Stellar is a cryptocurrency that allows for quick, secure, and inexpensive cross-border money transfers to a large number of transacting parties. Stellar, like Ripple Labs, aspires to make international payments easy and cost-effective.

Stellar is a cryptocurrency that was established to compete with Ripple. However, unlike Ripple, Stellar is decentralized and aims to serve the common public, not large banks. The goal of Stellar is to make financial services available to everyone. Because of its high position, Stellar Lumens (XLM) is regarded as a valuable investment option for investors.

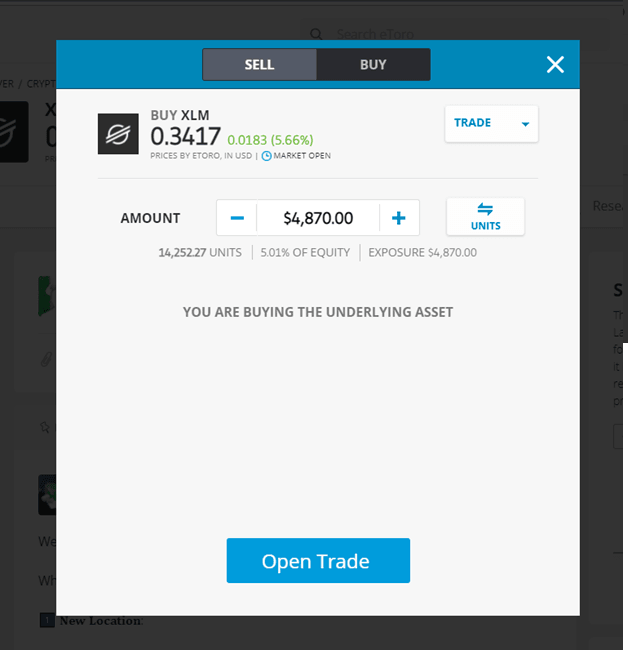

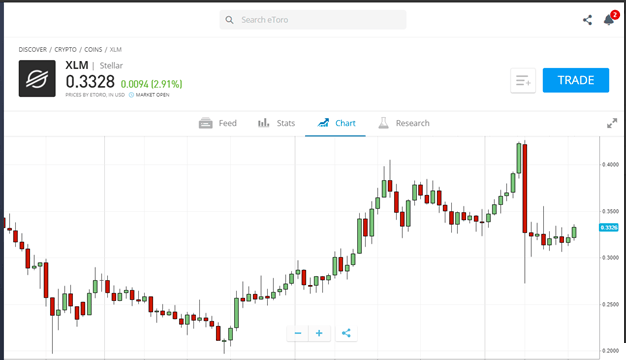

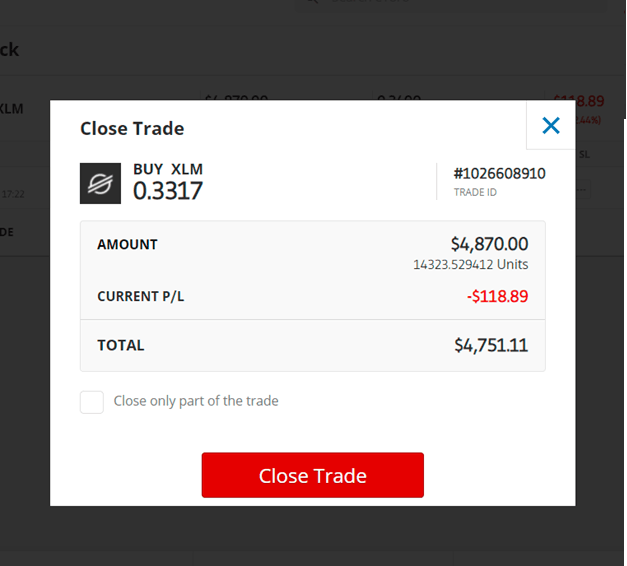

Despite understanding how to acquire the cryptocurrency to hold for a long time as an investment approach, the majority of them are frequently at a loss when it comes to selling after achieving their targets. Investors will typically want to sell their Stellar Lumens (XLM) against USDT, a popular stablecoin, more often than not. As a result, this article was created to assist Ripple investors to maximize their profits. It is not possible to sell Stellar Lumens without the assistance of a broker. Brokers, in a sense, provide liquidity for crypto assets. As a result, we’ve compiled a list of brokers that you may always rely on if you wish to sell your Stellar Lumens. These brokers have been thoroughly reviewed by industry experts and deemed safe for both novice and experienced crypto investors to sell cryptocurrency. The aforementioned brokers share a crucial feature in common: they enable customers to trade Stellar Lumens for USDT or any other pair available on their platforms. These brokers, in addition to their country-specific licenses, have a global presence and are acknowledged by the market. They also follow recent legislation from regulatory authorities while simultaneously improving their platform’s features to make trading simpler for clients. Before selecting a broker, it is critical to keep certain standards in mind. If no broker has met any of these criteria, it casts doubt on the broker’s reputation. A number of these standards include a simple and pleasant user interface, quick customer service, compliance with laws, security, many trading pairs, and so on. Experts have deemed the brokers listed above to be secure. Some of these firms also offer features such as staking, borrowing, and even allowing customers to pay for services using their accounts on the brokers’ platforms, which is something to keep in mind. Even though this asset has one of the largest daily trading volumes on record, it is still extremely simple to locate liquidity for it. Users are occasionally permitted to trade futures. In reality, all of these brokers have become renowned not just among investors and traders, but also in the cryptocurrency industry as a whole. They’ve been able to develop a reputation for honesty over time as firms that sell Stellar Lumens. It’s just as simple to sell Stellar Lumens as it is to acquire them. Trading off the asset or any other cryptocurrency, on the other hand, always depends on whether there is adequate liquidity for it. This decides whether the asset will be bought. Because of its position among cryptocurrencies, Stellar Lumens has a lot of liquidity. When attempting to sell your Stellar Lumens asset, make sure there is a suitable withdrawal method available. It is feasible to sell Stellar Lumens on all of the brokers described above, however, for this post, our attention will be on eToro, which is at the top of our list. eToro has been a part of all of our Bitcoin trading guides, including the ‘How to Sell Bitcoin’ as a reliable broker for both buying and selling any cryptocurrency asset. You won’t come across eToro among the top 10 crypto brokers in the world. The eToro platform was developed with both new and seasoned traders in mind. Every element of the site is designed to make crypto trading easier. As a result, new investors should have no trouble using eToro to trade Stellar Lumens or any other cryptocurrency asset since there will be no room for errors. Here’s how to sell Stellar Lumens (XLM) on eToro, according to the five stages outlined below. If these procedures are followed precisely, selling on the site will be as simple as can be. Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum. Buying Stellar Lumens is the first stage in any selling process since you can’t sell an asset you don’t own. You may buy Stellar Lumens on eToro or from another broker, then send it to eToro to sell. Our specialists have successfully completed hundreds of cryptocurrency trades. We are aware of the risks associated with cryptocurrency and can help you navigate your way through them. Only verified users are permitted by eToro to acquire Stellar Lumens. As a result, you’ll need to complete verification processes after signing up. You may then move on to depositing money into your account. However, eToro offers a variety of ways to deposit funds into your account. You can send fiat to your eToro account using your credit or debit card, as well as local bank accounts and third-party payment services such as PayPal, Skrill, or Neteller. When the funds have been credited to your account, you may either buy Stellar Lumens in the manner in which you received them or USDT and then XRP. It all comes down to personal preference. The objective of acquiring a tradeable asset is to make money. Unless you intend to lose money, it’s crucial to know when to buy and sell an asset. Nobody wants to make mistakes, even long-term holders who acquire cryptocurrency assets in the hopes of holding them for a long period. Nobody would want to err. In addition, the price volatility of cryptocurrencies is well documented. In addition, nobody has control over the price of these assets. It is critical that you establish a selling price before you sell your coins. Not doing so may lead to serious consequences and might even result in the loss of your money. To assist traders in making good trading judgments, eToro provided Stellar Lumens trading charts. Candlesticks and patterns are used in these charts to illustrate both past and present price changes on different timeframes. These graphs might also be used to determine when it’s the best time to acquire Stellar Lumens or other cryptocurrencies. If you click on Stellar Lumens, you’ll be taken to the chart for the asset right away. XLM price chart on eToro Aside from Stellar Lumens, there may be other assets in your portfolio because eToro supports a variety of digital currencies and trading pairs. Our attention is on the asset, Stellar Lumens, in this tutorial. As a result, knowing the overall value of your portfolio can assist you in determining whether the quantity of XRP you wish to sell is sufficient. eToro has a minimum withdrawable amount of $30. So before you can sell, you’ll need at least that many Stellar Lumens. eToro XLM overview If you wish to see the value of your portfolio, go to the top left corner where you’ll find ‘Portfolio.’ After clicking on the symbol, you’ll be able to see all of your crypto assets and their value. You may select any other asset in addition to Stellar Lumens to sell. Make a mental note that you must have a sufficient withdrawable amount before you can actually sell the item. Closing open positions are necessary in order to sell your XRP holdings. We use the term selling the asset to refer to closing active positions. You may not be able to do this if the asset is still in its original form. Cryptocurrencies are undoubtedly volatile. You could lose your XRP gains if you leave your XRP holdings untouched and wait to sell them against USDT or any other currency pair. There’s a high chance that the price will retrace shortly after it rises, so you should act fast to preserve your gains. Closing your position entails trading XRP against USDT or some other cryptocurrency, as previously said. The equivalent balance is reflected in your portfolio after conversion. Slippage occurs when an asset settles for a price that is lower than the initial price target. Slippage happens when security settles for a price that is different from the planned selling rate. This can happen positively or negatively. When a negative slippage occurs, the asset settles for a lesser price than expected; whereas positive slippage occurs when an asset sells at a higher price. Closing trade on eToro To close a purchased Stellar Lumens position on your eToro account, go to the portfolio icon and select all of your assets. Go to the trading area and click on Stellar Lumens. Then you’ll be sent to the trade section. You may sell all of your Stellar Lumens (XLM) or just a portion of them in this part. Alternatively, search for a pair of Stellar Lumens (XLM) that you want using the search button, and you’ll still be brought to the trade area. The equivalent value of the conversion is refundable when the position on the asset closes. You may withdraw the rest to your local bank account or credit card after closing the position. On eToro, withdrawing funds is simple as long as the necessary conditions have been satisfied. The withdrawal procedure on eToro has generally received positive reviews from other customers. Most of the feedback focused on how easy the withdrawal process was. There may be times when withdrawal difficulties occur, but they are extremely uncommon. It’s quite possible that the user is a citizen of a country blacklisted by the platform. Other common problems include verification failure, missing withdrawal routes, and incorrect deposit channels. Intraday trading on eToro is free. There are two types of accounts: free and premium. The latter costs more, allows you to trade in a greater variety of currencies, and provides higher leverage than the standard account. Every cryptocurrency offered on eToro can be sold. When you trade Stellar Lumens, they make sure the exchange is liquidated so that you may convert it to fiat at any moment. While other exchanges set a higher minimum withdrawable amount, eToro accomplished this while maintaining the same high standards of service. The minimum withdrawal amount for XLM is 17.7 XLM, with a 0.5 percent fee levied on each withdrawal. The minimum withdrawal cost at eToro is $1, while the maximum is $50. This shows that eToro is both user-friendly and inexpensive when it comes to all activities carried out on the exchange. In the United States, there are taxes on cryptocurrencies. In reality, a new Infrastructure bill is being prepared by the US government that would impose reporting obligations on crypto firms operating in the country. However, the legislation may signal the end to the legal dispute between the US SEC and Stellar Lumens Laboratories. The law would also exempt XLM tokens from being labeled unregistered securities, as claimed by the Securities and Exchange Commission. It’s been estimated that investors and holders of the XRP token will be taxed on the asset since the case is still pending (still in court). According to new crypto tax standards released by the US Internal Revenue Service, Bitcoin investors will have to pay taxes on both short-term and long-term gains. The taxes on short and long-term gains refer to profits made in a year or more and are applied based on when the money was accumulated. Short term refers to gains earned within a year, while long term implies earnings made for longer than a year. the following are taxed: Airdrops, Defi yields, mining, and transaction. Enforcing tax obligations on their owners may be challenging due to the shady nature of cryptocurrencies. The US government has been concerned about cryptocurrencies being used for illicit activities since day one. Thus, they are looking to enact regulations that will encapsulate and safeguard against such acts. There are over 100 exchanges around the world. Some are in different countries. In the past, most people had a hard time buying and selling cryptocurrency. Now, most people can trade on crypto exchanges. Many of these platforms provide a home for crypto investors to buy and sell assets. Despite their shared goal, you may discover various services on these platforms. This implies that aside from trading cryptocurrency, these exchanges may also offer unique services. As a result of this, the exchange that best meets your needs is determined by your demands. Some crypto exchanges have been able to stand out and appeal to a broad audience. This is not due to the fact that their services are unique from those of others, but rather because they go above and beyond in protecting client interests. There are a number of criteria used to distinguish the top crypto exchanges. These factors include security, user-friendly interface, efficient customer service, instructions on how to use the exchange, and a burgeoning community. On the eToro, you will find complete information about selling or trading XLM tokens. The platform is clean and easy to navigate. Using this platform, you can make deposits using fiat currencies, bank accounts, cryptocurrencies, wire transfers, credit cards among others. You can purchase cryptocurrency either by choosing a dollar or EURO value of the desired asset or the percentage of your XLM holdings that must be traded for it. This implies that users are allowed to trade with as little as 0.5 percent of their entire portfolio. In light of what you have read, some exchanges have been able to do this by passing these rules. Some exchanges have not met these requirements and don’t have as many people signing up or trading their coins. A handful of exchanges, on the other hand, provide their clients with premium services by allowing them to utilize copy trading or trading bots tools. Traders who are unsuited to manually executing trades might instead replicate trades from more experienced traders or automate the trade process using bot trading. Below, we have a list of high-ranking and industry-recognized cryptocurrency exchanges: Stellar Lumens is a cryptocurrency that, like all other cryptocurrencies, needs to be stored. Digital wallets are used to store cryptocurrencies like Stellar Lumens. The methods for storing digital assets vary depending on whether you’re a crypto investor or holder. Some keep their money in hot and software wallets, while others move it to hardware wallets (also known as cold wallets). There are many types of wallets. Each one has its advantages and disadvantages. Software wallets, for example, are based on private keys. These credentials allow you to access any wallet from which they were copied on any device. However, it is rather simple to lose the private keys to such a wallet, especially if they are kept in writing. Private keys are sequences of numbers, usually consisting of 12 to 24 digits. If your private keys are lost, it’s practically impossible to get your Stellar Lumens back. Cold storage wallets, on the other hand, are tangible wallets with no need for private keys and just require passwords. The disadvantages of a physical crypto wallet include being destroyed by fire or other calamities. You may, nevertheless, choose to keep your Stellar Lumens in any wallet of your choosing as long as you take appropriate measures to safeguard your funds. You must also be prepared to accept the consequences of any unforeseen events. Here we’ve compiled a list of some of the best crypto wallets for storing your XLM assets. If you’re following the invest-and-sit-back method, you’ll almost certainly have to keep an eye on the price of Stellar Lumens, especially if your goal isn’t set. Keeping track of trends in the cryptocurrency market can be really time-consuming because you must stay up to date on what’s going on around the crypto space to know whether or not you should sell off your Stellar Lumens holdings. Investors tend to adopt various strategies in their investments. Some people choose the quick route, only staying within the range of a day to a week before taking a selling position. Those who buy Stellar Lumens for themselves, as well as those who are looking to buy and sell on the market at some later date, need not be concerned. Individuals with their own funds could purchase Stellar Lumens and store them for a mid-term time period, meaning they’ll return to check if they’ve made any profits on their investments in weeks or months. A long-term investment strategy involves years of holding on before selling off. Essentially, the right to sell your Stellar Lumens holdings is determined by how you invested. If you use a short-term investment strategy, you must wait until that time comes before trading your Stellar Lumens. As a result, there is no such thing as an appropriate moment to sell. When your investing technique indicates so, it’s the right time to sell. Given that the crypto market is volatile, a lot of things can happen during the period when your investment has yet to reach its goal. Bearish reports may have an impact on your open position or holdings. This is why it’s important to analyze whatever you intend to invest in-between times. The analysis keeps you in control even if the trade is going against you. You may have to wait longer than necessary before reaching your goal at times. If your forecast is correct, a minor departure from that pattern you anticipated in the charts shouldn’t worry you. If you invested in Stellar Lumens or other crypto assets early on, discovering an upcoming bearish movement might help you avoid losing your money. There are many ways to stay up to speed on the latest market developments. The cryptocurrency market is dependent on useful information. You may receive them by relying on reliable sources and updates. You can also profit from the market views of industry experts as an investor. However, don’t rely only on them or follow their recommendations without doing your homework. These experts are people, and they are fallible as well. You may read the latest updates provided by professionals on this website. This is a common question among many people who would prefer to keep their XLM in an online wallet. Online wallets are quick and easy to use, but they have one major flaw-they’re vulnerable to cyber attacks. As a result, you might lose your tokens if hackers find their way into your account. That’s why most crypto investors keep the bulk of their assets in cold storage wallets with private keys that stay offline until one chooses to bring them online when checking on the current market trends. Although cryptocurrencies, such as Stellar, are volatile, they rise and fall in a 24-hour timeframe. Later it can jump 10% and fall 25%. This allows us to see a few things: If the price of Stellar is rising because of strong market sentiment and more people are wanting to invest, it will go up. In January 2018, when Stellar rose $0.329 to $0.875563, this was apparent. The stellar currency is traded against the USD. However, it can also be bought and sold in euros or Korean won on cryptocurrency exchanges around the world giving traders more options when they need a different fiat pairing than what’s available through trading platforms like eToro. Since its inception, Stellar Lumens (XLM) has fluctuated significantly. Because the market is volatile, the asset’s value isn’t consistent. When the market swings up and down, this indicates that prices will go up at times before plummeting as investors sell-off. Price changes are generally revealed on a chart via candlesticks and other patterns. In April, when Stellar Lumens was trading around $1, the cryptocurrency staged a rally that generally drove prices upwards. The price of Stellar Lumens is expected to rise even further in the coming months. Since December 2020, Stellar Lumens has been embroiled in a lawsuit with US regulators alleging fraud against executives. According to the suit, top executives had sold unregistered securities to investors worth $1.3 billion. In light of the planned infrastructure bill, which defines digital assets and digital asset securities, Stellar Lumens may well win. Aside from financial efforts, cryptocurrency trading necessitates a significant amount of input and dedication from traders. Traders must check the charts frequently in order to stay up to date. All of these activities might take time. It’s worse if a trader has to work a 9-to-5 job and divide his attention between work and the charts. He may commit costly trading mistakes or get questions from his bosses at work if he doesn’t manage both tasks simultaneously. A trader’s attention might be lost at any moment, especially while dealing with a large number of transactions. Focus is vital when it comes to trading, just as it is in life. Trading without paying attention may result in financial or emotional catastrophe. Accuracy and mental equilibrium are required for traders to maintain their mental states and emotional balance while trading according to industry standards. Trading bots automate the trading process to the extent that traders may spend more time on other pursuits. Cryptocurrency trading algorithms are used by trading bots. Nonetheless, they need some human input in order to operate correctly. They are unable to function on their own; a trader must activate a trading range based on his personal strategy for them to operate effectively. One of the primary reasons why trading bots are beneficial is because they are designed to react faster than people to market opportunities. The major objective of automated trading is to take advantage of price rises. Traders may be preoccupied because of their frantic schedules on occasion. Trading bots keep an eye on every market movement, allowing traders to make more money than they would if they traded manually. At the same time, robots may not work in all situations. Trading bots have disadvantages, one of which is that if the market is declining and the trader isn’t there to see it, huge losses may result. As a consequence, trading bots aren’t entirely trustworthy. Automated trading is another name for robot trading. Bot programs can involve risk – those interested should only deposit a small amount at first to test them out. These are some bots we’ve reviewed: Everyone is proclaiming that they have invested in cryptocurrency these days. Who wouldn’t want to? I mean, many individuals have made huge profits by investing in cryptocurrencies. Of course, you may be feeling the strain to do the same thing, but you are concerned about how it will turn out. The problem is that crypto is not a good idea to get into without first gaining knowledge. It’s beyond the realm of possibility for new investors to have money to invest. A volatile market should be a flashing neon sign for any would-be investor. In addition, there are several other qualities that a crypto investing candidate must have. Patience, risk management, good trading psychology, emotional stability, technical and fundamental analysis skills all come together to form a competent trader in the end. The market is not under anyone’s control; as a result, it must be well-traveled. Most traders have difficulty controlling their desires for riches. Greed is one of the biggest hurdles that most traders face. Once a trader has overcome his desire to get rich, he is one step closer on his way to becoming an expert. A non-trading approach is, in fact, a trading method. Traders must learn how to stay away from the market when it is extremely volatile and unpredictable, as it was during the 2008 financial crisis. You should also never revenge trade as a trader. This involves attempting to recover losses incurred after suffering a loss. While seeking to recoup damages caused after being subjected to one. Stellar Lumens (XLM) has promise, but the controversy between its parent company and the US SEC has kept it from reaching even higher heights. We have seen a price surge for most cryptocurrencies as they edge closer to the end of 2025. It is still very difficult to predict where Stellar will move to after this year. The crypto market has witnessed several fluctuations over the years and those who have been trading it from early on have become experts at predicting trends. While there are some analysts who believe that XLM might hit new highs in 2025, there are others who believe that it can breach three digits once more before the end of the year. This brings us back to our original question – should you sell Stellar Lumens? Before selling your XLM in 2025, keep the following information in mind: The spectacular gains these blockchain-based assets have provided have been one of the main draws to the crypto market. With growing institutional adoption and increased investor interest, many individuals have entered the early stage. However, we must emphasize that digital assets are extremely volatile, which means your profits may be erased in a matter of seconds after a market downturn. The crypto market has had to endure the rigors of rallies and volatilities, which have both endeared and frightened away several investors. You might still be undecided as to whether or not you should invest in Stellar. This is anticipated, however, these wild price fluctuations are not expected to continue for long. Experts believe that as the sector matures, there will be less volatility and more stability compared to traditional markets. Additionally, with Stellar predicted to become one of the top remittance blockchains in the future, this may be an excellent moment to acquire Stellar. To sell XLM on eToro and other brokers’ platforms, you must first close positions. You may trade the asset against USDT or your country’s fiat currency before withdrawing to your normal bank account. Stellar Lumens can be kept in a wallet, which is either physical or digital. It is secure as long as the owner takes precautions and uses good judgment. If you have the intention of buying any cryptocurrency, you should do so from an informed standpoint and not because the asset looks profitable. As they say, invest what you can afford to lose. The crypto market is a volatile one and cannot be traded on from the viewpoint of hope and mere speculations. This guide can suffice as a handbook you can revert to whenever you want to make investments in XLM. Our recommended best exchange to sell Stellar Lumens in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

In this article, we propose selling Stellar Lumens (XLM) through an exchange because you are certain of protection and get real money. There are alternative methods for selling your coins. P2P trading is another option, albeit one with some dangers.

To sell your Stellar Lumens (XLM) for dollars, you'll need an exchange that allows you to send money directly to your bank. The most popular alternatives are eToro, Coinbase, AvaTrade, and Binance.

With a broker such as eToro, selling your Stellar Lumens (XLM) may be finished in minutes after only a few clicks. The exchange also offers withdrawal choices.

Stellar Lumens (XLM) can be sold by a number of brokers. However, expert traders consider the options below to be the finest. eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly are among the most popular brokers for trading Stellar Lumens (XLM).

This varies by country, consult you local government's official website for taxes related to selling cryptocurrencies.

You must have an exchange that supports payments to your local bank or third-party payment service in order to sell your Ripple for USD. eToro, Coinbase, AvaTrade, and Binance are some of the finest options.

Stellar Lumens (XLM) can be purchased on eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

To sell your Stellar Lumens (XLM) as quickly as possible, you'll need to create an account with eToro or one of the other exchanges listed above. It only takes a few minutes to set up an account. You may send your Stellar Lumens (XLM)s to the exchange's wallet and sell them right away if you have them already.

You'll need a withdrawal channel on eToro or another exchange listed above in order to sell Stellar Lumens (XLM) for cash. Choose your preferred currency. After your withdrawal, the exchange converts the money to money and delivers it to the correct sender.

Only four cryptocurrencies are supported by PayPal: Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and Litecoin (LTC).

Some wallets enable you to sell your Stellar Lumens (XLM) straight from the app. You must connect a payment method and follow the necessary selling Stellar Lumens (XLM) procedures in order to sell them on the wallets.

On eToro and Coinbase, you may exchange your BTC for other cryptocurrencies. The actual value of BTC sold will be revealed in the cryptocurrency you pick after you've completed the trade. On this Page:

How to Sell Stellar Lumens in June 2025

Step 1: Buy Stellar Lumens

Step 2: Always Know When to Sell

Step 3: Know the Total Value of Your Portfolio

Step 4: Close All Active Positions

Step 5: Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges to Sell XLM

Storing Stellar Lumens in the Best Wallets

When is the Best Time to Sell my Stellar Lumens?

What are the Risks of Keeping my Stellar Lumens in an Exchange?

Stellar Lumens Price

Guide to Automated Trading

How to Invest Responsibility in Crypto

Should I Sell Stellar Lumens in 2025?

The Importance of Responsible Stellar Investment

Summary

FAQs

How to Sell Stellar Lumens (XLM)

Where to Sell Stellar Lumens (XLM)

How Easy is it to Sell Stellar Lumens (XLM)?

What Are The Best Brokers For Selling Stellar Lumens (XLM)?

What Are The Taxes For Selling Stellar Lumens (XLM)?

Where to Sell Stellar Lumens (XLM) For USD

What Are The Best Stellar Lumens (XLM) Exchanges

How to quickly Sell Stellar Lumens (XLM)

How to Sell Stellar Lumens (XLM) For Cash

How to Sell Stellar Lumens (XLM) For Paypal

How to Sell Stellar Lumens (XLM) From the Wallet

How to Sell Stellar Lumens (XLM) For Other Cryptocurrencies