5 Popular UK REITs Among Investors

Real Estate Investment Trusts (REITs) allow you to invest in a group of properties through a single investment. The REIT will be managed by a large-scale ETF provider that will invest in several property types on behalf of its investors. This can include anything from residential apartments and retail parks, to office blocks and commercial warehouses.

You will, of course, still benefit from the same revenue streams as a traditional real estate investment yields – notably appreciation and rental income.

In this guide, we explain the basics of REITs in the UK. On top of discussing the most popular Real Estate Investment Trusts of 2022, we also walk you through the process of getting started with an FCA-regulated broker.

Key Takeaways on REITs

- Investing in real estate through REITs can help you diversify your investment portfolio, but not all REITs are the same.

- Certain REITs make direct investments in real estate, receiving rental income and maintenance fees.

- On the other hand some REITs give you exposure to mortgages. In other words you’ll gain exposure to real estate debt.

- Finally, you can buy the most popular REIT ETFs using an FCA-regulated broker.

5 Popular UK REITS List

Here is a list of the most popular UK REITs for 2022.

- SPDR Dow Jones REIT ETF

- iShares UK Property UCITS ETF

- Sabra Health Care REIT

- Tritax Big Box REIT

- NewRiver REIT

UK REITs Reviewed

With so many REITs available to UK investors, finding one that suits your long-term investing goals can be difficult. For example, you’ll need to consider what real estate market you wish to target – such as the UK, US, or Germany. You then need to assess which type of REIT you wish to invest in – such as office space, retail, or residential units.

To help point you in the right direction, below you will find a broad selection of the most popular REITs in the UK.

1. SPDR Dow Jones REIT ETF

The US real estate market has performed extremely well over the past century. As such, UK investors will often look to gain exposure by investing in a REIT. If this is something you’re interested in, it might be worth considering the SPDR Dow Jones REIT ETF. In doing so, you will be investing in a highly diversified basket of US-based REITs.

This includes REITs from most sectors of the US real estate space. For example, there are providers that are specialists in residential properties, commercial office blocks, retail space, and even healthcare facilities. The SPDR Dow Jones REIT ETF is weighted to take into account the size of each respective provider.

For example, the largest holding is allocated to Prologis at 10.40%. After that, you’ve got Digitial Realty Trust and Public Storage at 5.57% and 4.66%, respectively. In terms of how the REIT is weighted by industry, industrial/office contributes 35.33%, while residential stands at 21%. Retail and healthcare are weighted at 13.54% and 11.52%, respectively.

All in all, if you’re looking to create a diversified portfolio of US properties from several sectors – this REIT will likely be of interest. When it comes to fees, SPDR charges an expense ratio of 0.25% per year. As such, a £10,000 would cost you £25 annually. You can, however, invest in this UK REIT ETF via a third-party broker.

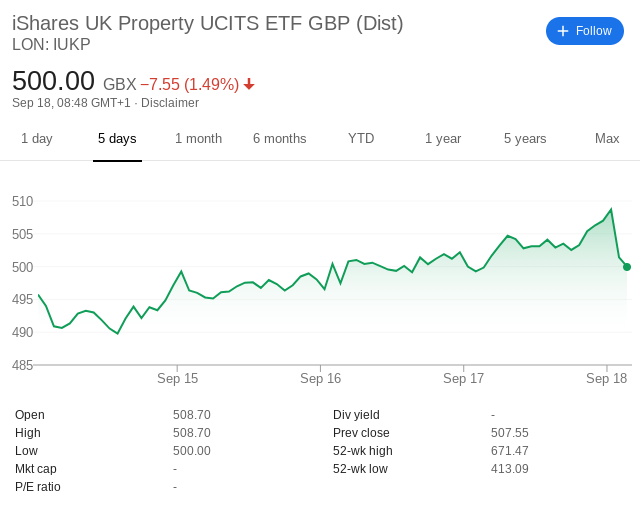

2. iShares UK Property UCITS ETF

If you’ve got your heart set on the domestic real estate industry, then you might want to consider the iShares UK Property UCITS ETF. For those unaware, iShares is a market leader in this particular scene – The provider offers over 700 ETFs globally and is responsible for over $1 trillion in investor assets.

What we like about the iShares UK Property UCITS ETF is that it offers a good blend of individual UK real estate investment trusts and blue-chip stocks. Regarding the latter, this will include a selection of UK companies that are actively involved in the domestic real estate scene. For example, there is a 5.76% holding in UNITE Group plc, which is listed on the London Stock Exchange with a market capitalization of £3.75 billion.

This company is a market leader in the student accommodation arena. At the other end of the spectrum, the iShares UK Property UCITS ETF also holds a basket of UK-based REITs. This includes everything from the Assura REIT, Tritax Big Box REIT, Primary Health Properties REIT, and Land Securities Group REIT.

Much like the previously discussed SPDR Dow Jones REIT ETF, you will be well-diversified across most sectors of the REIT arena. The expense ratio charged by iShares on this REIT is 0.40%. Dividends – which will cover your share of rental payments are distributed on a quarterly basis.

3. Sabra Health Care REIT

In a nutshell, the Sabra Health Care REIT is a US-based investment house that purchases small and large-scale properties that serve the North American healthcare arena.

At the time of writing, its diversified portfolio consists of 427 properties. While most of its holdings are situated in the US, it also has investments in Canada. Most of the properties are linked to skilled nursing and transitional care centres. There are also holdings in senior housing and specialty hospitals.

Some of the properties held by the Sabra Health Care REIT are fully managed, while others are simply leased out. But, the key feature of this REIT is that returns are typically easy to predict. This is because most of the tenants renting from Sabra Health Care sign long-term agreements.

This means that the provider does not need to constantly waste resources finding and vetting suitable tenants. The REIT ETF itself is listed on the US-based NASDAQ exchange. This isn’t a problem if you’re based in the UK, as most FCA brokers give you access to the American markets.

4. Tritax Big Box REIT

The logistics real estate arena covers a variety of commercial property types. In particular, this includes supply chain units, warehouses, and distribution centres. As you can likely guess, those behind the aforementioned property types will likely have large-scale storage requirements.

In turn, this means that companies will sign long-term lease agreements that will keep them at the respective unit for many years. As an investor, this provides you with an element of security, as you’ll know exactly what to expect in terms of rental yield. Additionally, longer-term agreements remove the need to constantly vet new tenants.

If this sounds of interest, then you might want to consider the Tritax Big Box REIT. This REIT – which is an ETF listed on the London Stock Exchange, has a diverse portfolio of reputable tenants. This includes Rolls-Royce, DHL Supply Chain, and Next. Tritax Big Box also has long-term lease agreements with most UK supermarket giants.

This includes Tesco, Morrisons, and Marks and Spencer. Crucially, the aforementioned firms are multi-billion pound organizations. – so there should be no concerns when it comes to meeting their rental obligations. As this ETF is publicly listed in the UK, you can easily make an investment with an online stock broker.

5. NewRiver REIT

Launched in 2009, the NewRiver REIT specializes in UK-based commercial properties. At the time of writing, its basket of properties includes high street shops, pubs, shopping centres, and retail warehouses. This translates into a diversified homegrown portfolio of over £1.4 billion worth in real estate.

The NewRiver REIT, as per its most recent report, notes occupancy rates at a whopping 97%. This is huge, as it ensures that the REIT has a constant flow of incoming cash flows. It is important to note that this REIT had a somewhat turbulent time in 2020. Crucially, the UK lockdown resulted in most of its occupants being forced to close its doors.

In turn, this led to a reduction or delay in rental payments. As a result, some would argue that at current prices – the NewRiver REIT can be purchased at a major discount. For example, as of September 2020 – the ETF is priced at just under 50p per share. Rewind to February 2020 and the very same share would have cost 190p.

In terms of dividend payments, this is typically distributed every three months. You can invest in this ETF with a number of FCA brokers.

What Are REITs?

Real Estate Investment Trust (REITs) are financial instruments that allow you to invest in a basket of properties. This is achieved by investing with an ETF provider. iShares, for example, is a market leader in the REIT ETF space, with several means to access your preferred real estate arena. The key difference here is that you are investing in exchange-traded funds, whereas if you were to invest in property funds, that is a mutual fund.

As the provider behind the ETF will likely have thousands of individual investors under its belt, it will have the financial capacity to purchase billions of pounds worth of property. In turn, you will have a stake in these properties at an amount proportional to what you invest.

For example, if the REIT purchases a residential unit worth £200,000 and you invest £10,000 into the ETF, then, in theory, you own a 5% stake in the respective property. Similarly, if your chosen ETF provider purchases a large-scale student housing unit for £1 million, then your stake would amount to 1%.

By investing in a REIT, you will be entitled to your share of rental payments. Once again, the amount you receive is proportionate to the size of your investment. In most cases, your dividends will be distributed every three months. In addition to your share of rental income, UK real estate investment trusts also allow you to grow your investment when its portfolio of properties increases in value.

How do REITs Work in the UK?

A lot of newbie investors in the UK are unaware of REITs. Even those that have heard of UK REITs stay away as they simply do not understand how the underlying mechanisms work. With that said, the investment process is actually fairly straightforward once you have a grasp of the basics.

With this in mind, below we explain the basics of how REITs work.

You Will be Investing in an ETF

Exchange-Traded Funds (ETFs) are hugely popular with investors both in the UK and abroad. In its most basic form, ETFs allow you to invest in a group of assets through a single transaction. This covers everything from dividend stocks, FTSE 100 shares, commodity trading instruments like gold, oil, and wheat – and of course – real estate.

Each ETF will be managed by a large-scale financial institution like iShares or Vanguard. In the case of a REIT, the ETF provider will pool investor funds together, which then gives it the financial capacity to purchase millions, if not billions of pounds worth of real estate. You as an investor will then be entitled to dividends (via rental payments – which is typically paid every three months.

REIT ETFs are convenient to invest in, as they are listed on public exchanges. For example, the iShares UK Property UCITS ETF is listed on the London Stock Exchange, meaning that you can invest at the click of a button. Even more importantly, this also means that you can exit your position at any given time.

REIT Net Asset Value (NAV)

Yet another acronym that you need to understand when investing in UK REITs is that of the NAV (Net Asset Value). Put simply, the NAV of a REIT illustrates the net value of its holdings. The simplest way to assess this is to look at the total value of all properties held by the REIT – at the current market rate. You also need to factor in outstanding debts – such as those linked to mortgages.

- For example, let’s say that the REIT provider held £1 billion worth of property

- It also holds £400 million in mortgage debt

- This means that the NAV is £600 million

Understanding the NAV of a REIT investment is important, as this will dictate the rate at which your capital can grow. For example, if over the course of the year the NAV on your chosen REIT is 10% higher, then in theory – your investment would have grown by the same rate.

There are, of course, many other factors to consider – such as occupancy rates, fees, non-mortgage-related debt, and the health of the wider property market. Nevertheless, the NAV is normally reflected in the share price of the respective ETF.

Quarterly Dividends

All REITs pay dividends. In fact, this is a legal requirement in the UK – as REITs must distribute at least 90% of all taxable profits. This not only includes your share of rental payments but capital gains from the sale of a property, too.

The dividend yield on UK real estate investment trusts will vary widely. With that said, some REITs will yield much more, albeit, the risks will follow suit.

Here’s a basic example of how you can earn quarterly dividends by investing in a UK REIT:

- You invest £5,000 into a REIT that invests in commercial properties

- At the end of the first quarter, the REIT receives rental payments with an equivalent annualized yield of 4%

- This means that you will receive a dividend at a quarterly yield of 1%

- On an investment of £5,000 – you will receive a dividend of £50

The dividend will then be distributed to the FCA broker that you used to invest in the REIT ETF. In turn, the funds will be reflected in your brokerage cash account.

Cashing Out a REIT Investment

Much like the traditional real estate arena, REITs should be viewed as a long-term investment. However, there might come a time where you need to raise funds and thus – seek to exit your REIT position. The good news is that this can be achieved at the click of a button during standard market hours.

After all, the ETF is listed on a public stock exchange, so the process works much the same as selling shares. The price that you get on cashing out will be reflected in the current stock price of the ETF. As we noted earlier, this is derived from the NAV of the REIT.

Types of UK REITs

Most UK REITs will specialise in a particular area of the real estate industry.

This includes:

- Single and Multi-Complex Residential Units

- Student Accommodation

- Healthcare Facilities

- Retail Parks and Shopping Centres

- Commercial Warehouses and Supply Chain Units

- High Street Shops, Restaurants, and Pubs

- Office Blocks

If you want to diversify across several REIT markets, there are two ways to achieve this. Firstly, there are a number of ETFs that invest in a basket of REITs. This is essentially a portfolio of individual REITs that come from a variety of sectors. Alternatively, you can easily create a diversified portfolio of REITs yourself by using an FCA broker.

UK REITs Dividend Yield

As we covered earlier, dividend yields on REITs will vary widely.

Some of the main factors that will determine your yield are as follows:

- The state of the wider property market

- The health of the local economy

- The types of real estate that the REIT invests in

- The level of weighting attributed to each holding

- The rental yield charges to tenants

With that said, most REITs in the UK will strive to make at least 2-3% per year – often more. Crucially, it all depends on the factors listed above. This is why you need to do lots of homework before choosing a REIT to invest in.

Why do People Invest in UK REITs

Just like index funds, mutual funds, and Vanguard funds, REIT investments come with many benefits, such as those listed below.

- Passive Income: UK REITs are suitable for those of you that want to invest in a passive income stream. This is because once the investment is made, the REIT takes care of the rest. In the meantime, you will receive dividend payments – typically on a quarterly basis.

- No Experience Needed: By choosing a REIT, you do not need to have any knowledge of how the real estate market functions. This is because the REIT provider will determine which properties to invest in, and when to sell.

- Diversification: By making a single investment into a REIT, you will be diversified across dozens, if not hundreds of properties. This might include several real estate sectors too, such as commercial, commercial, retail, or healthcare.

- Regular Income: UK REITs are legally required to distribute a minimum of 90% of earned income. This means that you will receive your share of rental payments every three months.

- Appreciation: On top of regular dividends, you will also benefit from a portfolio that can appreciate over time. In other words, as and when the REIT’s portfolio of properties increases in value, as should your investment.

- Affordability: REITs are popular because you are not required to purchase a property outright., Instead, brokers allow you to invest using smaller amounts.

- International Markets: Investing in properties overseas can be a stressful and cumbersome process. You need to have an understanding of local customs, and a firm grasp of the respective housing market. You also need to factor in the complexities of foreign exchange. But, by investing in a REIT, you can gain exposure to international properties in an accessible manner.

Risks of REITs

While there are many benefits of investing in REITs, there are also some risks and drawbacks that you need to factor in.

- Economic Woes: When the wider economy performs badly, this can have a direct impact on the value of your REIT investment. This became evident in the wake of the coronavirus pandemic, whereby the UK lockdown forced businesses to close their doors for months on end. In turn, this saw the value of many REITs to go down.

- Local Housing Markets: Property prices are typically dictated on a regional basis as opposed to nationally. For example, while property prices might increase by 5% in the North West of England, they might only increase by 2% in London. As such, there will be a direct correlation between individual housing markets and the value of your REIT investment.

- No Investment Input: By investing in a REIT, the ETF provider will make all investment decisions. While this will suffice for those of you that seek a passive flow of income, it does mean that you might be missing out on specific investment opportunities.

As always, you need to consider both the risks and rewards of an investment before taking the plunge.

Popular REIT Brokers in the UK

If you want to invest in a REIT broker today, your first port of call will bed to find a reliable broker. This is because your chosen REIT will be represented by an ETF instrument, which in turn, you’ll need to purchase from an FCA-regulated trading platform. Not only do you need to ensure that your chosen broker offers your preferred REIT ETF, but you also need to look at commissions, ongoing fees, supported payment methods, and customer support.

With this in mind, below you will find three popular UK brokers that allow you to invest or trade UK REITs:

1. IG

IG is an online broker that gives access to numerous markets. This is because you’ll get to choose from a traditional REIT investment via ETFs, or trade them through CFD instruments. Regarding the former, the platform offers over 10,000 traditional assets – meaning that you can diversify across dozens of different UK REITs with ease.

Fees payable in this department of the IG website are £8 per trade, or £3 per trade when you place three positions per month. If you decide to engage in short-term trading via CFDs, IG does not charge any commissions (other than stock CFDs). This is also the case if trading REITs through the IG spread betting platform.

When it comes to reputation, this FCA-licensed broker was first launched in 1974. The broker has grown to such heights that it is now publicly listed on the London Stock Exchange. Minimum deposits start at £250. The platform supports debit and credit cards, as well as a UK bank transfer. No fees apply on deposits unless you opt for a credit card. If you do, you’ll pay 1% when using Visa and 0.5% on MasterCard.

IG fees:

| Commission | 0% commission on all CFD instruments. £8 or £3 per trade on traditional REIT ETFs |

| Deposit Fee | Free (0.5%-1% fee on credit cards) |

| Withdrawal fee | Free |

| Inactivity fees | £12 a month after 2 years of inactivity |

Sponsored ad. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

3. Plus500

Although most investors will choose to invest in REITs via a traditional ETF, CFD platforms like Plus500 allow you to engage in short-term ‘trading’. Put simply, this means that you will need to decide whether you think the REIT will increase (buy order) or decrease (sell order) in value.

In other words, not only do you have the capacity to profit from rising markets, but falling markets, too. Trading REITs in the UK at Plus500 via CFD instruments also gives you the option of applying leverage. This means that you can enter buy and sell positions with more than you have in your trading account.

This can be as much as 1:30 at Plus500 – meaning that a £100 account balancer would permit a trade value of £3,000. When it comes to trading fees, you won’t pay any commissions at Plus500, and spreads are competitive. You will, however, need to factor in overnight financing fees for each day that you keep your position open.

You’ll need to meet a £100 minimum deposit with Plus500. There are no fees to deposit or withdraw funds, and you can opt for a debit/credit card, Paypal, or bank transfer. Plus500UK Ltd is authorised & regulated by the FCA (#509909). Its parent company is listed on the UK stock market.

Plus500 fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | $10 per quarter after 3 months inactivity |

How to Invest in UK REITs

If you’re keen to inject some capital into a Real Estate Investment Trust, we are now going to walk you through the investment process. The guidelines outlined below will show you how to open a brokerage account and invest in REITs online.

Open an Online Trading Account

Head over to your broker’s website. Looking out for the ‘Create Account’ button and begin the registration process. You simply need to provide the broker with some personal information, your national insurance number, and your email address and mobile number.

You will then be asked to provide some verification documents. This includes your government-issued ID (passport or driver’s license) and a proof of address (utility bill or bank account statement).

Deposit Funds

Once you open an account and confirm your mobile number, you will then be asked to make a deposit.

Most brokers support a wide variety of payment methods, such as:

- Debit Card

- Credit Card

- Bank Transfer

- Paypal

- Skrill

- Neteller

Invest in a REIT ETF

To view what REITs you have available to you, you can browse the selection of ETFs. Or, if you already know which REIT you want to invest in, search for it. When the respective REIT pops up (like the below), opt to trade it.

You will then be presented with an order box. If you simply want to invest in the REIT without applying leverage or short-selling, all you need to do is enter your stake.

Once you confirm the investment, the REIT will be allocated to your portfolio. You can sell your holdings at any given time during standard market hours.

Conclusion

REITs solve a lot of issues for the everyday investor. There is no requirement to purchase a property outright, nor do you need to marginalize yourself to a single housing unit. You don’t need to focus on residential units either, as REITs also invest in warehouses, commercial offices, retail parks, shopping malls, and more.

Additionally, REITs allow you to access lucrative international; real estate markets at the click of a button. You will, however, need to find a reliable broker that is FCA-regulated, to ensure you can invest effectively.