Bitcoin, the leading cryptocurrency, has seen exponential growth in recent times. It has repeatedly toppled its previous all-time highs and towers above other cryptocurrencies. Bitcoin remains a favorite choice for investors and brokers alike. It isn’t your average digital asset, it holds a market cap in the hundreds of billions of USD. As investors are consistently capitalizing on its growth, understanding how to maximize its growth is essential.

Primarily, you use Bitcoin when you have units of it in your digital wallet. The first step to take is to buy Bitcoin. After that, you can decide to hold it for a while or sell it when you feel like in exchange for fiat. However, not everyone understands how to sell their Bitcoins and this is why we have created this guide to help you.

On this Page:

Best Platforms to Sell or Short Bitcoin

[fin_table id=”14125″]Selling your Bitcoin requires a few tools, majorly consisting of a good broker integrated with a withdrawal channel. To ensure you make the right decisions on the appropriate broker to facilitate your Bitcoin withdrawals, we are highlighting these brokers below. Like we’ve always done, these brokers have been carefully examined by industry experts and have been handpicked as the most suitable for any trader, notwithstanding the level of experience.

The above brokers share almost the same similarities. Analysts who have explored their functions have concluded that they comfortably satisfy the average requirements for any trader. Also, they comply with regulatory requirements and keep up the tempo with useful integrations that make trading crypto a joy ride.

Some of the basic requirements that are to be considered before selecting a crypto broker include ease of trading, active customer support, conformity to local regulations, attention to security, suitable trading desks for both amateur and professional traders, diverse cryptocurrencies and so many more features. Judging from the above requirements, experts have pinpointed the above exchanges as some of the best amongst all.

Aside from offering almost all the above requirements, these exchanges also incorporate impressive features peculiar to their platforms. They also provide stable liquidity and in some cases, leveraged trading. Their ratings are also exceptional with users attesting to their dedication to seamless trading and responsiveness to customer distress. A look into their history, one would discover that they are not frequently breached by hackers and can protect user identity to some extent. Therefore, the above brokers are your best bet to begin the process of buying and selling your Bitcoins as well as other digital assets.

How to Sell Bitcoin in 2025 Step by Step

Just as we mentioned before, selling your Bitcoins might appear a complex process but it is quite easy. Of course, the ease of liquidating any digital asset depends on the flexibility of the broker used as well. The fundamental process is to own a crypto asset you wish to sell. In this case, we are focused on Bitcoin. Do ensure that you have specified an acceptable withdrawal channel, then go ahead to withdraw your crypto.

You are open to using any of the brokers listed above to sell any amount of Bitcoin, so far you own some Bitcoin. However, for this tutorial, we’d be focusing on one of the most prominent crypto brokers – eToro.

For quite a while, we’ve emphasized this broker and recommended it to investors as one of the most efficient out there. The reason for this advocacy is not far-fetched, eToro is no doubt one of the most suitable brokers that offers a wide range of integrations that simplifies crypto trading. With a befitting user interface and concise attention to speed and ease, there are little or no chances of plunging into errors due to complexities.

Below are the five steps to sell your Bitcoin on eToro. If you carefully follow these steps you would easily get to sell your Bitcoins in exchange for fiat at any time.

Step 1: Buy Bitcoin

As you know, you can’t withdraw any digital assets if you don’t have them. Bitcoin is a cryptocurrency that is transferable from one wallet to another or can simply be purchased outrightly from a broker.

To purchase Bitcoin on eToro, you need to be a verified user of the platform. After verification, you can go ahead to deposit funds into your account. eToro simplifies this process as you can deposit using several channels including your credit/debit cards, your local bank account, or a third-party payment service like PayPal, Neteller, or Skrill.

After deposit, you can purchase your Bitcoin straight away on the platform – we’ve created a comprehensive guide on how to buy Bitcoin.

Buy Bitcoin on eToro

Step 2: Know When to Sell

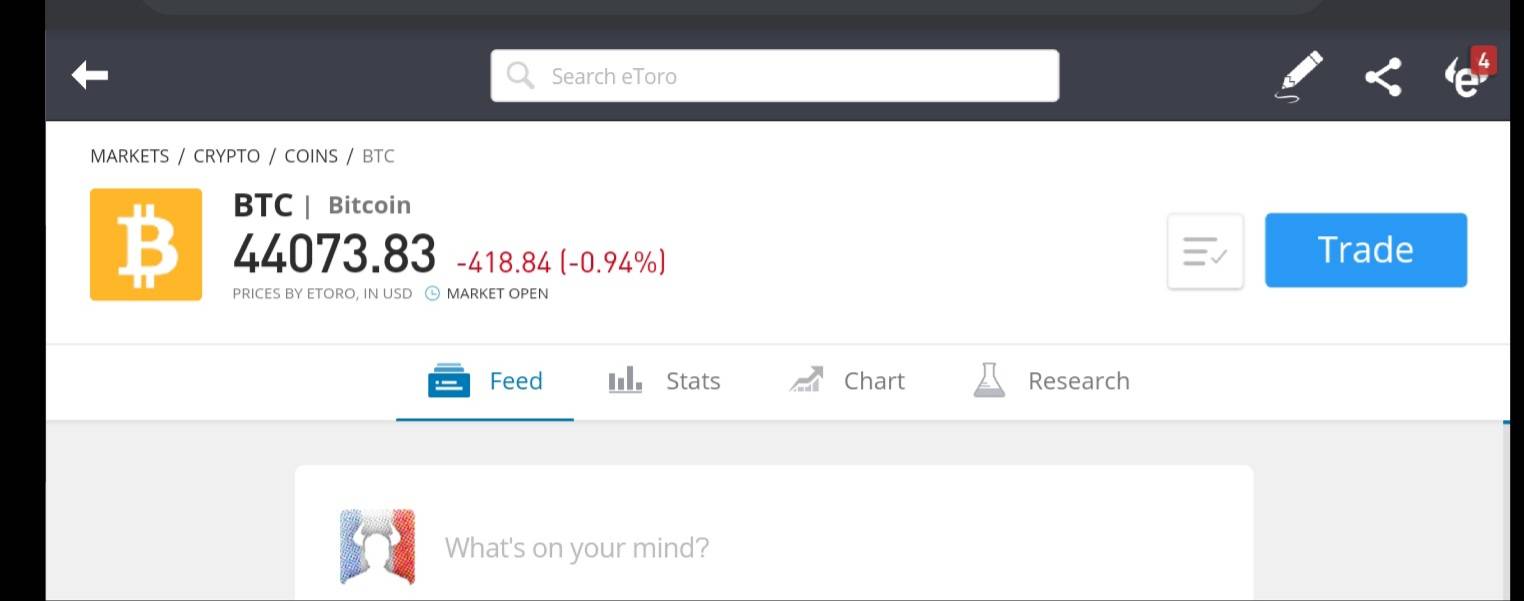

Knowing when to sell is the main motive behind crypto trading. The game revolves around buying a crypto asset at a low range and selling at a higher value to make some profits. Unlike other physical services where you find it difficult to track their past and present price actions, eToro offers a firm historical chart pattern of Bitcoin and other cryptocurrencies.

The chart patterns are divided into diverse time frames, making it easier to track your entry points and evaluate your intended profits. To explore the historic chart of Bitcoin, you can access it on eToro by simply clicking on Bitcoin on the cryptocurrency window.

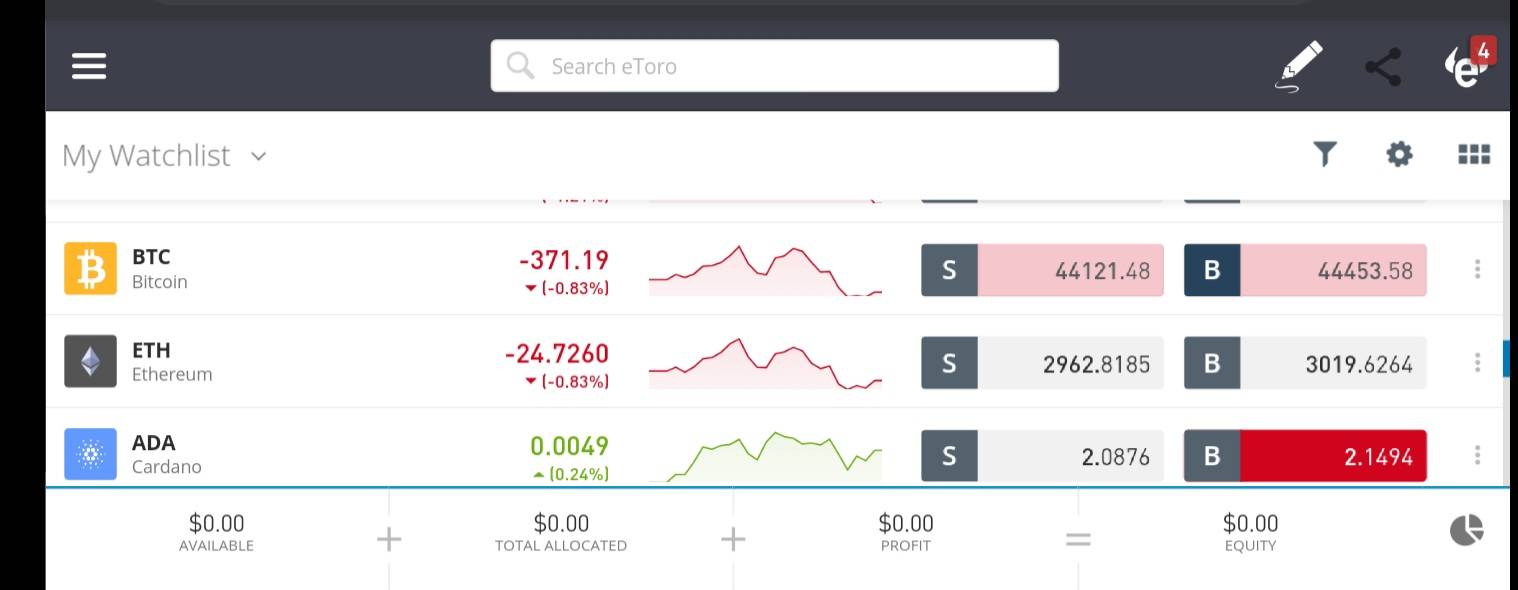

Step 3: Get an Overview of Your Crypto Holdings

If you’re a trader, you would likely have other digital assets on your list. eToro offers users access to trade multiple cryptocurrencies whenever they wish. As regards this guide, we’re concerned about Bitcoin, you can find your assets by taking a look at your crypto portfolio.

The listed assets can be sold on the platform. Any amount of Bitcoin can be sold on eToro but you need at least $30 to successfully withdraw to your local bank.

To access your crypto portfolio, you would find “portfolio” at the top left. When you click it, you’d be brought into a full view of your active positions. There you can click on the asset you want to sell and then proceed to close the active position.

Bitcoin Overview Source eToro

Step 4: Close Active Positions

Before you can sell your Bitcoin, you should have closed all your active trade which is another way of saying “selling your positions”. When you have a cryptocurrency like Bitcoin in your portfolio, they are still volatile and susceptible to varying actions in prices.

Withdrawals are not taken straight from the active crypto. You have to close out the position to convert the value of your Bitcoin to a dollar equivalent or any other currency pair of choice. The value reflects on your available balance where you get to withdraw to your local bank.

To close your active positions, click portfolio and then the crypto asset you want to sell. You would be propped with a box detailing your active positions and their values. There you can indicate the amount you wish to sell, whether a part or all of it. Click on “close trade” and the liquidated value reflects in your available balance, ready for withdrawal.

Bitcoin Closing Trade. Source: eToro

Withdrawal Requirements and Exchange Rates

Withdrawal of funds might not pose a challenge if you are using eToro. Users who have explored the process have all testified of the simplicity. However, there might be certain limitations that could deter one from withdrawing especially if your location is not covered by the platform. Being a verified user is often a presiding requirement for any user to withdraw. Secondly, you have to link an acceptable withdrawal channel that corresponds with your details on the platform.

eToro is focused on offering a useful trading platform and an easy means to sell your Bitcoin and convert them to fiat. However, direct withdrawals from exchanges aren’t always a joy ride especially when some exchanges have lofty requirements that might not favor small investors.

For merely $30, you can withdraw your funds on eToro with a fee of $5 notwithstanding the withdrawal amount. For withdrawals in USD, there are no conversion fees whatsoever aside from the initial withdrawal charge. Other currency pairs might have to pay conversion fees for a high-level exchange rate. This reemphasizes the reason this broker is a favorite of many crypto traders.

Storing Bitcoin with the Best Wallets

Just like other cryptocurrencies, Bitcoin is an asset. This implies that it is valuable and deserves to be protected and kept safe. To keep your Bitcoins safe and personal you don’t need to store them in a bank, you need a Bitcoin wallet. You can store your Bitcoins in a cold or hot wallet. The cold wallet is the physical equipment used to keep your Bitcoins while the hot wallet is virtually-based.

The advantage of using digital wallets to secure your Bitcoins is the flexibility that comes with them as you’re able to move them easily. We emphasize security, ease, confidentiality, and simplicity when choosing a Bitcoin wallet. To aid you in making the best choice, we’ve documented a professional guide for you to access the best crypto wallets here.

Crypto Taxation in the US

The United States in particular imposes tax returns on crypto trading and related activities. Although Bitcoin is also considered a “currency” by its proponents, the US Internal Revenue Service (IRS) classifies it as a property or an asset. In other words, it is a taxable concept and those who fail to file their tax returns might be sanctioned by the authorities.

To avoid such a scenario, it is necessary that you understand the fundamentals of crypto taxation in the United States. The regulatory body majorly divides crypto taxes into two as short-term capital gains and long-term capital gains. The former is in view when an individual holds an amount of crypto under a year while the latter refers to crypto holdings of more than a year. The ratio is split into a wide range of activities and even includes the accumulation of crypto through airdrops, mining, DeFi rewards, and transactions fees. In the case of using cryptocurrencies to purchase commodities, swapping, or converting them to fiat, these actions are taxable under capital gains tax events.

To have a better grasp of crypto taxation in the United States, it is suggested that you peep into the IRS crypto tax changes to make more informed decisions.

Best Crypto Exchanges to Sell Bitcoin

Crypto exchanges are the platforms that traders leverage to effectively buy and sell digital currencies. These exchanges are also equipped with a good number of tools and programs that ensure the average trader isn’t stuck on the way while trying to perform a job. While there are hundreds of exchanges out there, some of them are not yet clear enough to offer all that is needed to their users.

Majorly, an exchange is required to trade crypto, swap them or withdraw. They also include safe wallets for the storage of cryptocurrencies. Nevertheless, some of these exchanges go out of their way to integrate other cool features like copy trading or even offering trading bots. Trading with exchanges demands an exchange with a great level of security, support, and efficiency. Due to this, the exchanges below are considered some of the best in the industry as they offer the required integrations and also feature other native functions.

Compare Platforms to Sell or Short Cryptocurrency

[side_by_side_comparison id=”14147″ type=”Crypto”]When is the Best Time to Sell my Bitcoin?

When you buy a crypto asset, the major motive is often to sell at a higher value, especially if you are a crypto trader. The best way to ensure that you are up to speed in tracking the price of an asset is to analyze the historic chart pattern of the asset. For a crypto like Bitcoin, it’s price reacts to changes in market trends which ultimately reflect in altcoins.

Traders often have varying targets. In cryptocurrency trading, one can place targets in short-term, mid-term, and long-term ranges. Short-term targets are often hit Intra-day or within a week, mid-term targets might stretch up to weeks or even a few months, while long-term targets spread as long as a trader wants. A good instance of long-term trading applies in a scenario when a trader buys Bitcoin in 2010 and prepares to sell it off in a ten-year gap.

Therefore, it is better left to the discretion of the trader to determine the best time to drop their holdings in Bitcoin. Bitcoin is a crypto on a volatile market. Just as mentioned earlier, market trends can affect this volatility. A good way to observe the market trends is to monitor the chart patterns and stay abreast of happenings around the crypto market. For instance, a crypto asset might sink in value when rumors spread that a big holder often called a “Whale” wants to sell off his position. This scenario might trigger panic and send other traders to dump their holdings to escape the volatility.

This shouldn’t bother you. To ensure that you are ahead of the crowd in information about the actions and volatility of a crypto asset, we are documenting up-to-date reports to help you reach a decision easier. The cryptocurrency industry thrives on information to make the most out of it. Fortunately, you can make a culture to access trustworthy reports about the crypto market on this site at any time.

While it is best to dictate when to enter and exit a market by yourself, you can also rely on market predictions from renowned experts. These experts and analysts in our team have a reputation for leveraging the trending market and implementing it to maximize profits. Anyone can access the analysis that is frequently released by these professionals simply by navigating this site.

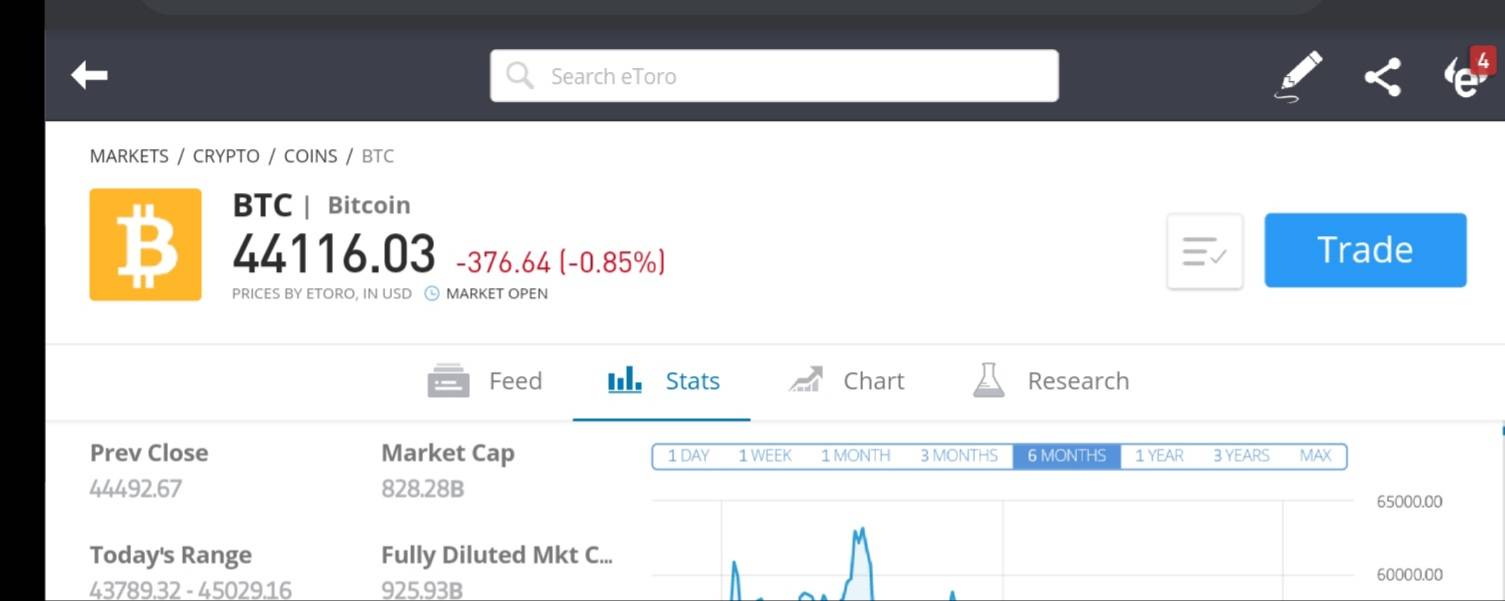

The Price of Bitcoin

You have heard the phrase “trendy market” being frequently used when discussing Bitcoin. A trending market simply implies that the price of an asset isn’t stable. The price of cryptocurrencies swings in an up-down momentum which plays out when money is inputted or taken away from the asset. This explains the constant changes in the pattern of a digital asset when you examine the charts.

Since Bitcoin was released in 2009, it has raked up bigger values. The cryptocurrency has surged many times over its initial prices. One Bitcoin even touched $63,000 sometime in April 2021 and looks even to attain higher levels. This does not mean that Bitcoin isn’t liable to downturns. Similar to most altcoins, Bitcoin has also had a fair share of bulls and bears. You can learn more about the price changes in Bitcoin on this site as well.

Guide to Automated Trading

If you are an active crypto trader, you would agree that trading often requires dedication to time. As is the culture of most professional traders, there is an entry point to trade and an exit point. If you are not focused on the timing you might miss entering a trade at the right time which would consequently lead to a late exit or a smaller profit. Timing and expertise are the two most important qualities a trader should employ to make the best of the market.

However, not everyone has the time or the expertise to focus on trade. Most traders might have a job or would prefer to focus on another venture or attend a function. In such a situation, the trader cannot trade the crypto market and might miss out on making profits. To counter this, automated trading was developed and is available to almost everyone.

With automated trading bots, you can maximize the crypto market even when you are absent. These trading bots use algorithms to purchase and sell cryptocurrency at the right time. A user can set them to execute trading commands based on a personal trading strategy, technical analysis, or the amount of money available in your portfolio. Trading bots are beneficial because they are structured to instantly respond to market movements much faster than a human would.

The ideology behind the creation of automated trading bots is the need for a system that can maximize the volatility of the crypto market beyond the limitations of humans. In other words, using a trading bot means you won’t have to monitor your computer at all times. This innovation is more promising than employing the help of individual trading experts, copy trading, or even investing in hedge funds. Primarily, a trading bot is designed to help you make the most of the crypto market while cutting off as much risk as possible.

Bot programs can involve risk – those interested should only deposit a small amount at first to test them out. These are some bots we’ve reviewed:

How to Invest Responsibly in Crypto

Have you ever wondered if buying some crypto is a great decision? You’re not alone. Investing in a volatile financial market like cryptocurrency requires a lot more than capital. Factors like expertise, patience, and a good digital asset matters a lot as well.

The cryptocurrency market is beset by uncertainties as anything might happen at any time. The market is relatively new and might witness tumbles at one time or another as it develops. To cushion the adverse effects of the crypto market, a trader should understand the philosophy of responsible investments.

Greed isn’t a good trait if you want to leverage the crypto market. Of course, you might have heard stories about investors that lost heavily while waiting for their investments to attain the biggest level. Most crypto analysts confirm that the industry is still governed by the emotions of the public. Thus, a popular perception of a crypto asset might affect its performance negatively or positively.

A key method to stay sane while exploring a speculative industry like crypto is to set a bankroll management strategy for yourself. A good bankroll strategy would save you from risking your entire income in the cryptocurrency market. You can set a limit for yourself by channeling a particular amount of your income to crypto investments and spreading percentages of the sum over time over a period of time. Because you can lose or gain at any time, don’t be swayed by the desire to keep putting funds into your portfolio even when you are losing. Of course, when it gets too difficult, it isn’t a shame to call it quits.

Most times, a particular cryptocurrency might be a challenge or a bad trading strategy. Instead of plunging into a losing streak, pause and re-strategize. Invest into understanding the market better then when you feel ready again, go ahead and invest.

Should I Sell Bitcoin in 2025?

Bitcoin has seen a massive downturn recently and it is speculated that it could climb to greater heights or even lose more. The reason is connected to the concerns about the energy consumption of Bitcoin and the ban imposed on it by China.

Here are some factors to consider if you want to sell Bitcoin:

- Ensure that you are not at the losing end, if you have purchased Bitcoin for a while now it is best to give it more time unless you are no longer comfortable holding it.

- Since it is not advisable to leave all your money in Bitcoin, you can sell a percentage or all of it off to retrieve your funds.

- If you are no longer bullish on Bitcoin and perceive another asset as more promising, you can sell your Bitcoins and proceed to the one you are optimistic about.

- You should sell your Bitcoin if you have achieved your targets and in profits.

- Bitcoin is a revolutionary venture, if you don’t understand how it works yet, sell off your holdings and study the concept first.

Summary

Bitcoin has evolved over the years and has maintained a lead over other digital currencies in both market cap and value. As a digital currency, you can buy and sell it whenever you wish. Buying Bitcoin isn’t much of a heavy task, you can purchase the crypto from several exchanges like the ones listed above. Aside from purchasing it from those brokers or exchanges, you can also trade them, hold them, or sell them in exchange for fiat.

To sell your Bitcoins, you first have to close your position. This means that you dispose of them in conversion to fiat. The fiat is then withdrawn to your local bank account or any other payment gateway. For investors that wish to hold their Bitcoin for some time before selling them off, they can hold them in Bitcoin wallets. Bitcoin wallets are encrypted with the security to hold a person’s digital currency without losing them unless the individual is careless with their private keys.

We often suggest that before you buy any cryptocurrency, you should only invest what you can afford to lose. The cryptocurrency market is undoubtedly volatile and a negative turn might exhaust your portfolio. This is why we are offering insights into the crypto market on this site to help you make informed decisions. Nevertheless, if you have Bitcoins and you are thinking of selling them, ensure it is done at the right time with you smiling from the profits.

Our recommended best exchange to sell Bitcoin in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

Read more:

FAQs

Where to Sell Bitcoin

Oftentimes, the best place to sell your Bitcoin is via an exchange. Although other methods like peer-to-peer exist, the safest is using the feature available on an exchange. We consider eToro as the best option for selling Bitcoins due to the ease of the process. However, you can also sell them on brokers like Coinbase, Binance, and many more.

How Easy it is to Sell Bitcoin

When you use an exchange like eToro, selling your Bitcoins can be concluded in minutes after a few clicks. The exchange features withdrawal options as well.

What are the Best Brokers for Selling Bitcoin?

Several brokers can be used to sell Bitcoins. However, the following are considered the best by expert traders that have explored other options. They are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

What are the Taxes for Selling Bitcoin?

Owning Bitcoin for more than a year makes you liable to pay a long-term capital gain tax which is between 0% to 15% depending on how much you made. However, if you hold Bitcoin for less than a year, you'd be charged as short-term capital gain which is between 10% to 37%.

Where to Sell Bitcoin for USD?

To sell your Bitcoin for USD, you need an exchange that permits payment to your local bank or third-party payment service. Some of the best choices are eToro, Coinbase, AvaTrade, and Binance.

What Exchanges Sell Bitcoin?

Some of the exchanges where Bitcoin can be sold include eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

How to Quickly Sell Bitcoin

To quickly sell your Bitcoin, you need an account with eToro or any other exchange-listed above. To set up your account doesn't take a lot of time. If you have your Bitcoins already, you can transfer them to the wallet on the exchange and sell them there instantly.

How to Sell Bitcoin for Cash

To sell Bitcoin for cash, you should integrate a withdrawal channel on eToro or any other exchange-listed above. Ensure that you've set your desired currency. When you withdraw, the exchange helps you convert the funds to cash and pays into the proper channel.

How to Sell Bitcoin for PayPal

PayPal is one of the leading fintech that accepts Bitcoin sales for PayPal funds. For US users, you can buy or sell Bitcoin on PayPal, as well you can transfer the funds you got from selling Bitcoin on eToro or any other exchange to PayPal.

How to Sell Bitcoin from Wallet

Some wallets help you sell your Bitcoin natively. To sell them on the wallets, you need to integrate a payment method and follow the necessary procedures to sell Bitcoins.

How to Sell Bitcoins for Other Cryptocurrencies

Often, you can swap your Bitcoins for other cryptocurrencies on brokers like eToro or Coinbase. Once you complete a swap, the actual value of Bitcoins sold reflects on the crypto you choose.