Bitcoin cash has been affiliated with bitcoin for a long time perhaps due to the name and circumstances surrounding its creation. Bitcoin Cash was created in August 2017 by a group of anonymous developers with the aim of improving the memory and success potential of the coin. The coin came into existence after Bitcoin experienced a hard fork in August 2017.

Due to the tweaks made to this new currency, a lot of investors have freely given bitcoin cash a chance to display itself. There are many predictions that Bitcoin Cash could follow a similar growth trajectory as bitcoin but there are still loopholes with this prediction. The buzz around Bitcoin Cash since its creation has fueled a lot of buy decisions and influenced lots of investors. The liquidity for Bitcoin Cash simply cannot be compared with that of bitcoin as Bitcoin Cash’s liquidity is way lower. Bitcoin cash like other crypto currencies was created with the intention of using it as a medium of tender. It does not have any real popularity beyond the crypto world. This feature has affected the way investors view bitcoin cash. Just like with all forms of investments, there will be investors looking to go long term and some short term hence selling bitcoin cash for USD becomes mandatory along the way. More and more exchanges are being created on a daily basis and each has its own respective features. Every platform tends to exhibit some sort of bias for certain kinds of services. It is on this note that people looking to sell their Bitcoin Cash must exercise patience in deciding the broker or exchanger that would be used for the exchange. It has become an open secret that the exchanger plays a huge role in the quality of the exchange and how satisfied the trader will be afterwards. The exchanger performs a host of functions in the selling process like ensuring the process is safe, providing a smooth interface for traders to navigate and execute trade decisions as well as providing suitable channels for exchange and withdrawal to chosen fiat currencies. This guide covers the Bitcoin Cash selling process in detail. Anyone intending to sell bitcoin cash will be able to make a choice easily at the end of this guide. On this Page:

Best Exchange to Sell Crypto in June 2025

[fin_table id=”14251″]

Compare Exchanges & Brokers to Sell Crypto

[side_by_side_comparison id=”14147″ type=”Crypto”]

Before arriving at a list of top performing brokers for the exchange of Bitcoin Cash, the different brokers have been vetted by industry experts and popular choices among traders have been put into consideration. Their years in existence providing top notch brokerage services to traders, the efficiency and effectiveness of using the platform as a trader as well as a host of other features were properly analyzed.

The best exchanges available to sell cryptocurrency, including to selling Bitcoin cash to USD, other fiat currencies or stable coins include:

All of the above listed brokers are user centered and effective for selling Bitcoin cash. They have a simple interface, prompt security for the storing of Bitcoin Cash, numerous withdrawal methods to ease the exchange process and many more. Either of the above exchanges can be used for the exchange of bitcoin cash. Traders who have used these exchanges have said a lot of positive things about their experience so new time sellers can be rest assured that the process will be hassle free.

Tutorial On How To Sell Bitcoin Cash

All investors after making investments wait patiently for their investments to mature and then exchange them to gain profit. When the time for selling investments draws nearer, investors become saddled with the responsibility of finding a stress free way of selling.

Selling bitcoin cash should at most last only a few hours. Once the right platform has been chosen, the process can be concluded with a couple of steps and the seller will be credited with an equal amount of USD or other fiat currency.

This section of this guide will be looking at the main steps required to successfully exchange Bitcoin Cash for an equal amount of cash. However, our focus will be on eToro.

So far, eToro has been associated with ease of transactions and a smooth trading experience. First time sellers can handle the entire process all by themselves and everything is concluded in a timely manner.

Traders on eToro can sell their bitcoin cash for USD by taking the following steps. These main steps will be covered in detail to guide you on the selling process.

Step 1 – Fund Your eToro Wallet With Bitcoin Cash

Bitcoin cash is a popular cryptocurrency and there is every possibility that you probably have your coin stored in some external wallet or some other platform after purchase. To take off selling, you have to transfer all of your coins or the amount you wish to sell to the eToro platform. This is to fasten up the process and ensure your transaction is secured as everything will be done on the eToro platform.

As a first time seller, you would have to create an account with eToro to have access to the eToro wallet. The great thing here is that the account creation process on eToro is quick. You never have to worry about encountering gigantic paper work as the process has been completely streamlined.

To create an account, navigate to the eToro website sign up page and sign up. Next, you will have to provide your full name, email address and contact details. A verification link will be sent to your email which you have to click on to verify your email address. After that you will be asked to verify your identity. Identity verification on eToro is also very easy. All that is required is the submission of a valid government issued identity card and a proof of address like a utility bill receipt or bank statement.

The submitted documents will be duly verified and your account will be approved afterwards. At this point, all initial restrictions on your account will be lifted as you have become a verified member. Access to the wallet will also be granted and so you can move on to transfer your bitcoin cash.

There is a feature for wallet to wallet transfers. Here you can now state the amount of coins to be transferred from your previous wallet and within a maximum of five minutes, the coins will be reflected in your account dashboard.

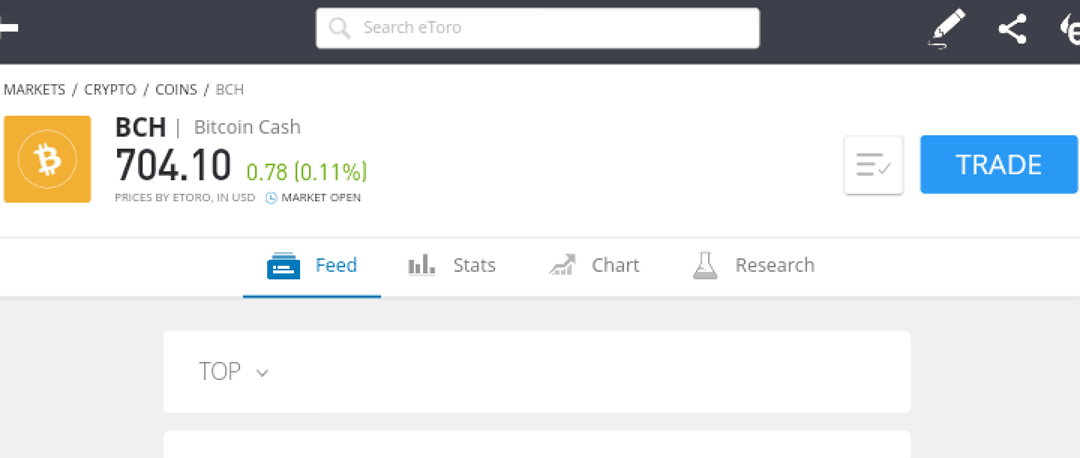

Bitcoin Cash price

Step 2 – Estimate The Best Time To Sell Your Bitcoin cash

Timing is the defining factor for how profitable a bitcoin cash investment can be. Before investing, investors have a time frame in mind for how long the Investment will last. As soon as the time elapses, investors start agitating to make sales as that is the calculated time. However, it is important to reassess the market when the investment time elapses to arrive at the perfect day and time to place a sell order.

Hasty sales have a proven track record of causing the trader loss. This is because the time was not given much consideration hence the execution time was wrong. The trader then has no choice but to make do with the lower amount of cash gotten from the exchange. In extreme cases, after waiting for the investment to mature, the coins are sold at a rate lower than it was bought initially.

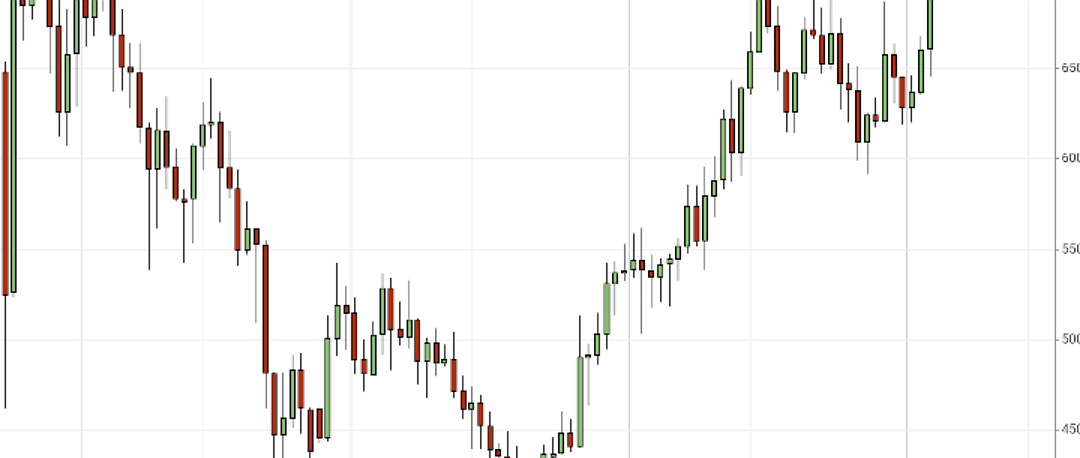

These scenarios are disturbing and to avoid such occurrences, estimate the best time to sell your bitcoin cash before selling. These estimates are obtained after thorough analysis of the price changes, liquidity level and a host of other factors. None of this can be done without the necessary tools for analysis. This is one of the reasons why eToro is one of our top recommended brokers. eToro has a wealth of analytical tools, charts and graphs at all traders’ disposal. Traders can make good use of these tools to decide the best time to part with their investment and yield the most profit.

Bitcoin Cash tools for analysis

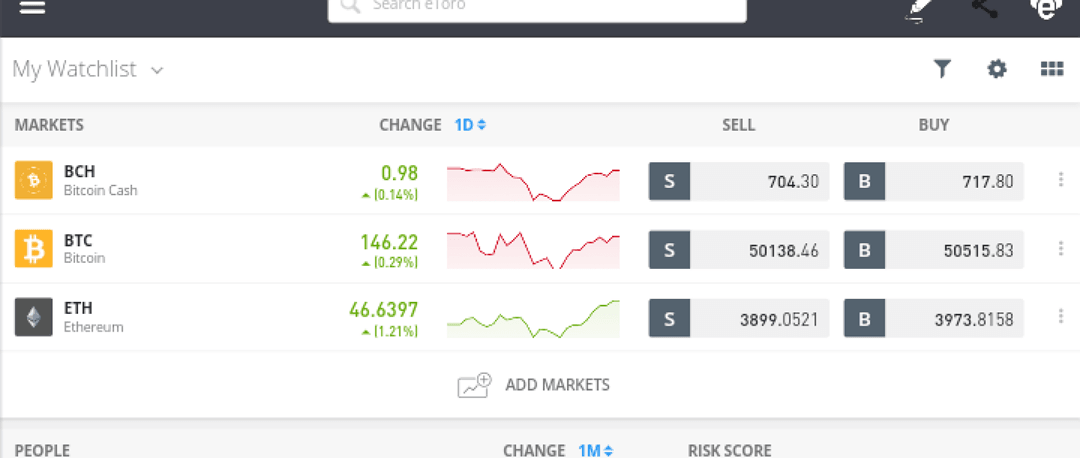

Step 3 – Estimate The Cash Sum Of Your Investment Before Selling

This step is more like an extension of step two. They are all part of the preparations required before the execution of a trade. A profitable trade is determined before execution and not at execution. The purpose of discovering the cash equivalent before selling is to help you calculate the best time to sell and to know how much to expect once the sale is completed.

Once you have determined the amount you will be getting after the sales, you can compare it with your initial investment and then decide if you are comfortable with the profit accrued.

Another reason why the exchange amount should be estimated is to guide you on the amount of bitcoin cash you would be exchanging. Different platforms have different withdrawal limits and the trader needs to confirm that his or her exchange surpasses the withdrawal limit so that the cash equivalent of the investment can be accessed after sales.

eToro for instance has its least withdrawal limit at $50. This is a really considerate amount. Traders who wish to sell very little of their investment or sell their coins in bits can still do that and access their funds. Before executing the sell order, the trader can check out the cash equivalent of their intended exchange before selling. To see the cash estimate, sign in to the platform and move to the portfolio icon at the top end of the screen. Afterwards, click on the asset and the cash equivalent will be displayed.

eToro overview

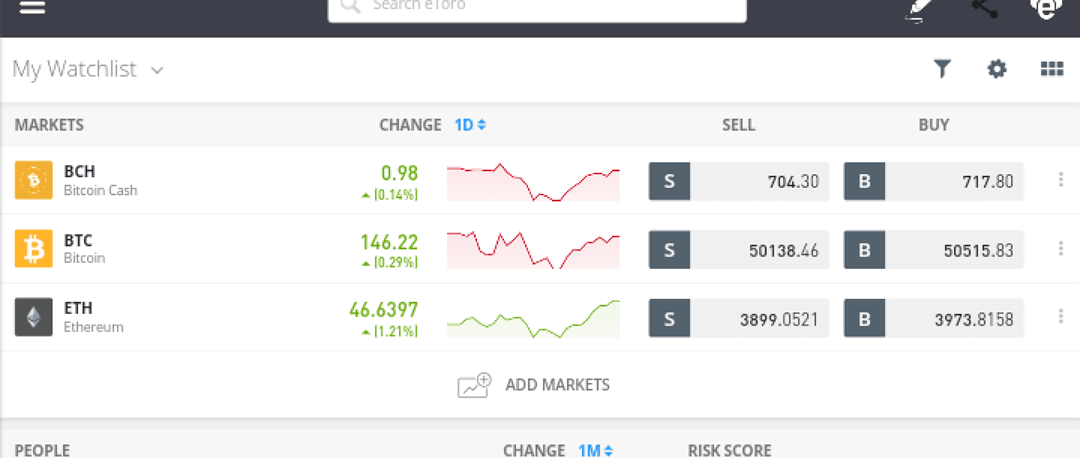

Step 4 – Placing The Trade Order

This is another step that needs to be done on time. After estimating the best time to place the sell order, it is important that there are no further delays. Delays would affect the outcome of the exchange so orders should be placed on time.

Placing trades on eToro

The trade process on eToro is easy. You need to click on the portfolio icon then select sell bitcoin cash and have your trade closed. The sell order will be executed and when that is done, the cash equivalent will be available on your dashboard.

Step 5 – Withdrawal Requirements And Exchange Rates

Withdrawal sometimes poses a challenge to first time investors. Most times, the problem is due to their choice of broker. We recommend eToro for first time sellers because withdrawal on eToro is straight forward. The trader is credited within a short while after requesting for withdrawal. So far, there have been no complaints about the withdrawal process on eToro. Withdrawal can be made via wire transfer, with credit cards or via other available payment channels.

Problems with withdrawal can only arise when the trader does not follow the right process. For instance, all unverified users will not have their withdrawal requests granted as eToro wants to ensure the safety of its platform and transactions. Hence, users must be verified to gain access to their funds. In other cases, the trader may have skipped a compulsory process along the line. eToro being an intuitive platform has an amazing customer service to guide clients when they encounter problems using the site.

eToro also offers a very fair exchange rate. Traders never have to worry about high transaction charges. Withdrawal requests are processed and completed within the period stipulated on the platform.

Crypto Taxation In The US

Cryptocurrencies though unregulated still fall under the finance section and businesses that operate in this industry are regulated by different finance commissions. Despite this, the manner in which taxes are to be charged for cryptocurrencies and how they are to be paid still has many confused.

The recent proposal by the United States government is of the view that all businesses that operate in the crypto industry pay their due taxes. These taxes are set to be calculated based on time frame. However the volatile nature of cryptocurrencies has been a big drawback for the implementation of this policy. Lately, the government has made a couple of moves to have this sphere of the economy regulated but all efforts have been futile.

Considering the line of events, there is a likelihood that the bill to pay taxes on crypto may be implemented in the nearest future. For now, there are no known taxes cryptocurrency holders and businesses are expected to pay.

Best Crypto Exchanges

To comfortably explore the world of cryptocurrencies, crypto exchanges are needed. This need has promoted the creation of so many crypto exchange businesses in the past few years. Like all industries, these exchanges are in an unspoken contest with each bother when it comes to service delivery. This, most times makes it difficult for crypto traders and investors to decide which of the currently existing exchanges are the most excellent.

Judging excellence when it comes to cryptocurrency exchanges may be subjective. What works best for one trader may not work well for another. Also, these exchanges differ in the way they offer their services. All exchanges tend to focus on a particular feature even though all the other basic features are well taken care of. It is left to the trader or investor to decide what their most basic requirements are and then go with the exchange that meets that need.

It is also important to keep in mind that the names some brokers have made for themselves is not due to effective service but marketing buzz. To save you the stress of trying to decide which crypto exchange is the best, we have curated a list of top crypto exchanges. This list is based on recommendations by industry experts and reviews from traders and investors.

Below is a list of some of the best crypto exchanges.

These brokers have common characteristics. All of the above exchanges ensure that account creation on their platform is easy, withdrawal is smooth, security is tight and above all that users are satisfied. They routinely carry out surveys to see user satisfaction levels and how best to improve.

Storing Bitcoin Cash In The Best Wallet

Bitcoin cash has a high level of liquidity which means that demand is high. This is a highly valuable asset that needs to be kept safely. Negligence on the part of bitcoin cash holders can lead to permanent loss. The increase in the levels of cyber crimes is something all investors should beware of.

There are so many kinds of wallets. Some wallets have top security features while others can be easily hacked. When storing something of high value as bitcoin cash, investors must go for the best kinds of wallets to ensure that their investments are safe and cannot be stolen.

Bitcoin cash can be stored safely in either a software wallet or a hardware wallet. A software wallet is a wallet that requires a pass code to get access. A hardware wallet on the other hand is backed on an external drive. They are both safe ways of storing bitcoin cash so long as precaution is taken.

Software wallets have no external source of recovering a pass code. This means that when an investor loses this pass code, they have lost their investment as well. Unless of course, the pass code is regained. Investors can avoid this by storing their pass code externally so they can access it in case they lose their pass code.

Hardware wallets are great but the storage medium is a drawback. Since storage is via physical drive like a flash drive, damage to the drive can result in loss of access to one’s investment. Again, this can be managed if the drive is kept safely and protected from damage.

When Is The Best Time To Sell My Bitcoin Cash?

All investors have one thing in common. It is the desire to make the most profit on their investment considering the time and money put into the process. This is why the question of ‘when is the best time to sell’ is mostly asked.

Cryptocurrencies in general are uncontrollable and choosing to go with the conventional method of investing may not be so beneficial. Sometimes, the price of a coin could rise very high and then fall to a very low point within a short period. There is no doubt that crypto investment requires so much patience.

Investors who make the most of their investment know when to shift from a long term strategy to a short term strategy as not all coins favor both styles. Traders who rush to selling when a commodity hits a particular high would lose out on the profit that the more patient traders would make. And in the case of a coin with little growth potential, long term strategies may seem less risky.

For a coin like Bitcoin Cash with a high growth potential, both short term and long term strategies may appear perfect. So when considering the best way to sell bitcoin cash, try to draft your expectations of the investment and how long you are willing to watch it grow.

The thing with selling Bitcoin Cash is that there is no perfect time for everyone. Rather, traders have to decide their own perfect time. This will require price analysis and studying the growth curve of the coin. Investors who stick to holding the coin long term would need to stay informed with happenings around the coin and try to predict what the coin could grow to be. Short term investors however, would be looking to target a particular high before selling. The strategy to be used is dependent on the investor.

All investors may need to learn some level of technical analysis so that their decisions are not based completely on the views presented by industry experts. On a platform like eToro, there are so many tools investors can make use of to monitor the direction Bitcoin Cash takes.

The views presented by industry experts may serve as a starting point in analysis but should not be relied on 100% as most views are subjective. Though, on this site, you will be constantly updated with unbiased information about bitcoin cash and the direction the coin seems to be taking from time to time.

There is no fixed best time to sell bitcoin cash. All an investor can do to ensure that their coins are sold at the best time is to personally monitor the growth curve while paying attention to the predictions experts share.

Price Of Bitcoin Cash

The value of bitcoin cash has increased steadily since its launch in 2017. It is currently ranked at number 14 in the crypto market. The price of bitcoin cash is currently fluctuating between $672 and $720 and it has a market capitalization of over three trillion.

Bitcoin Cash is quite successful and many experts are of the view that its price could surge to a new high after some time. Although it was built with the intention of improving the Bitcoin network, progress has been a bit slow. Moreover, it has managed to stand strong since its creation. Investors are advised to keep their eyes open for future changes that may come up.

Guide For Automated Trading

Automated trading is a high tech feature available on most great exchange platforms. This style of trading makes use of bots in executing trades. This feature is of great importance to traders who may not have the time to be present in executing all trades.

The bots are inputted with the configurations to carry out the trades. So when the time is due, this bots automatically place trade orders on behalf of the trader. When done effectively, traders can maximize their time in making the most profit from trades. It is important to note that the trader still has to be prompt in studying the market trends.

Bots are unable to study market trends to analyze it and know when it is best to stop a trade. This can lead to unforeseen losses if the trader does not constantly observe the market.

Automated trading is a great feature that busy or inexperienced traders can use to make profit off the market. This feature can be enjoyed without encountering losses if the trader frequently assesses the market.

Bot programs can involve risk – those interested should only deposit a small amount at first to test them out. These are some bots we’ve reviewed:

How To Invest Responsibly In Bitcoin Cash

There are no hard or fast rules when it comes to investing generally. However, with cryptocurrency investing, investors are usually told to play safe considering the volatility of the coins being invested in. Hence, there is this common believe that investors should only invest what they can afford to lose. This way, when the prices of a commodity falls very low, the investor’s finances would not suffer so much.

The right amount to be invested in Bitcoin Cash is up to every investor. Assessing one’s finances and properly weighing the risk involved are two important steps that should not be compromised. Also, investors should beware of being swayed by market emotions. All investments should be done with a clear mind.

Should I Sell Bitcoin Cash in 2025?

As stated earlier, there is no best time to sell a cryptocurrency. So long as all the necessary background checks have been done, selling Bitcoin Cash can be profitable. What traders should look out for is selling their coins at an unfavorable time where they end up losing.

If you intend to sell bitcoin cash, take note of the following points:

- Assess the period before selling. The price in which you sell your coins should be favorable to you and you should be getting extra profit from the investment.

- Select the right exchange when selling and leverage the analytical tools available to make the most of your trade.

- Be cautious of the market as it is very volatile and never be in a haste to place a sell order.

Summary

Bitcoin Cash is a very valuable investment. Investment time frames should be assessed regularly to ensure that profits are maximized. Sell orders should be well calculated before they are executed to reduce the incidence of loss. With adequate planning, investors can reap great profit from their investment.

Our recommended best exchange to sell Dogecoin in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

Read more:

FAQs

Where Do I sell Bitcoin Cash?

There are so many exchanges where Bitcoin Cash can be sold. It is best to sell bitcoin cash on an exchange platform because the trader is guaranteed security and the entire process is well taken care of.

How Easy Is It To Sell Bitcoin Cash?

Selling Bitcoin Cash is very easy and takes a very short period of time for a sell order to be completed. eToro is one of the best platforms a trader can use to sell bitcoin cash easily.

What Are The Best Brokers For Selling Bitcoin Cash?

The best brokers for selling Bitcoin Cash are selected based on assessment by traders, users and industry experts. The top brokers on the list are : eToro, Changelly, Libretex, AvaTrade, Coinbase, Binance, Revolut, Crypto rocket, Plus500, Capital.

What Are The Taxes Involved In Selling Bitcoin Cash?

At the moment, taxes are not charged for the selling of Bitcoin Cash.

Where Do I Sell Bitcoin Cash For USD?

Bitcoin cash can be exchanged for USD on top brokerage platforms like eToro, Avatrade, Binance, Coinbase.

What Exchanges Sell Bitcoin Cash?

Most exchanges support the sale of Bitcoin Cash on their platform. Some of the best among them include: eToro, Avatrade, Coinbase, Changelly, Capital, Libertex.

How To Quickly Sell Bitcoin Cash?

Selling Bitcoin Cash is a an easy process that does not consume time. Traders can be certain that the selling process will be concluded within a very short period if they make use of top brokers like eToro or Capital.

How To Sell Bitcoin Cash For Cash?

To exchange BCH for cash, the sell order should be placed. This should be done on a trusted brokerage platform like eToro. Once the sell order is completed, the cash equivalent will be credited to the user.

How To Sell Bitcoin Cash For PayPal?

Currently, PayPal does not support bitcoin cash. Hence, it is not possible to exchange Bitcoin Cash for PayPal.

How To Sell Bitcoin Cash From A Wallet?

Exchange of BCH from a wallet in which it is stored is very simple. All that is required is to enable the withdrawal method for a fiat currency or stable coin of choice. In the case where the wallet does not have such a feature, the bitcoin cash can be transferred to another wallet that allows such withdrawal.

How To Sell Bitcoin Cash For Other Cryptocurrencies?

Bitcoin Cash can be exchanged for another cryptocurrency on any reliable platform. The first step is placing an exchange order for the chosen cryptocurrency. After the order is completed, an equivalent of the desired cryptocurrency will be credited to the seller.