Augur is a trustless decentralized platform created for the prediction market. The decentralized protocol is built on Ethereum and leverages the wisdom of the crowd which participates in the prediction market using a native and primary token known as REP.

Users of the protocol are allowed to create a prediction market or bet on the likely outcome of an event. Such events could range from the performance of a company to the outcome of an election or even a natural event, perhaps the weather condition.

The REP token can be purchased on crypto exchanges. Investors now consider REP as valuable enough to invest in. REP is the only token that can be used to report the outcomes of events on the Augur network. It derives its value from its ability to successfully execute smart contracts built on the network.

Reporters on Augur are also known as nodes and to participate in reporting the outcome of events and earn a share of fees collated from users, they have to stake the REP token in a special contract. The continuous activity on the network contributes to the value of Augur’s REP.

Therefore, in this guide, we are going to consider why REP is a must-have and how to buy REP on an exchange as well as sell the tokens.

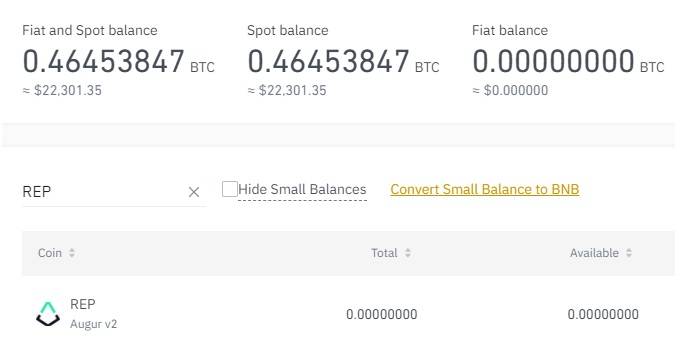

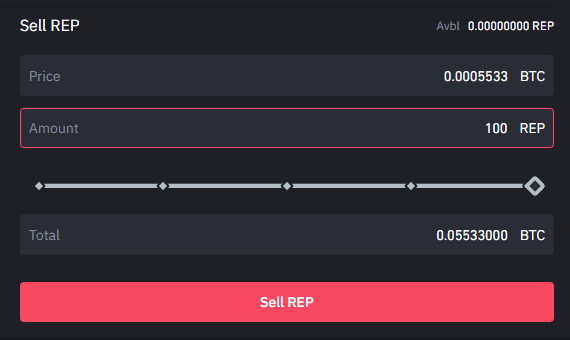

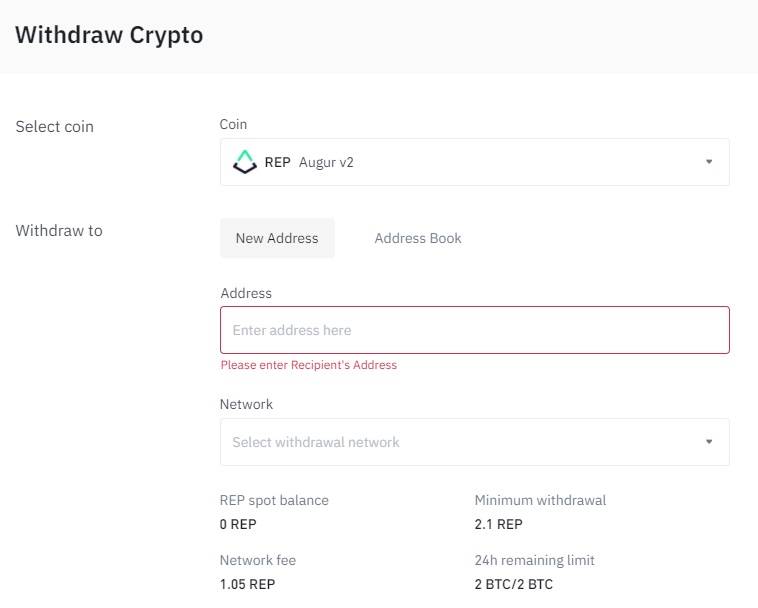

Augur aims to be a decentralized platform in the prediction markets. The Ethereum-based decentralized protocol allows users to create specific questions they may have around important events and profit from them by buying positive or negative shares regarding the outcome of such an event. Events could also include sporting events and everything within the prediction market. The online gambling industry is a huge one valued at $52 billion and Augur intends to tap into the lucrative market. Augur is the first decentralized application to launch on the Ethereum blockchain. The platform was founded by Forecast Foundation created in 2014 by Joey Krug, Jack Peterson and Jeremy Gardner. According to the founders, they had wanted Augur to launch on the Bitcoin blockchain before Ethereum creator, Vitalik Buterin approached them to launch on Ethereum which was still an emerging blockchain at the time. Augur launched in 2015 with an ICO, becoming one of the first projects to raise funding through that process. At the ICO, Forecast Foundation sold 8.8 million tokens garnering $5.5 million. Augur launched in 2018 with the first version of its protocol. Within the first month, Augur had pooled $1.53 million in staking and across over 800 outcome bets. You can only sell REP with the help of a broker. Brokers or crypto exchanges provide liquidity to cryptocurrencies including REP. This guide is aimed at guaranteeing that you settle for the right choice on a broker. We featured a few brokers below that you can always resort to whenever you need to sell your REP. Note that these brokers have fulfilled de facto parameters recognized by industry experts, and are considered suitable platforms for both newbies and investors with some experience. The list above consists of brokers that engage in a similar business and belong to the same industry- they allow thousands of investors to buy and sell crypto assets or even trade them to make profitable returns. They have markets in different parts of the world. In addition, they consent to existing regulations in countries where they operate while also scaling their services for users in these countries to enjoy more. Before settling for a broker, it is important to look out for specific benchmarks. Where a broker fails to satisfy these benchmarks, it calls its integrity to question. A handful of these benchmarks include a simple and understandable user interface, premium customer service, consistency with guidelines, security, various trading desks, and many more. It is in the light of meeting the listed benchmarks that the aforementioned exchanges are highly recommended by major stakeholders in the industry. Moreover, these brokers boast of other great features they offer their millions of customers. Some of these features include staking crypto assets, lending and borrowing or in any event, permitting clients to pay for services via their accounts on the exchanges. These brokers record billions of daily exchanging volume which implies that it is truly simple to get liquidity for that asset you are holding, or REP. At times, clients can take part in futures trading accessing benefits like higher leverages. Truly, this list of brokers has become commonly recognized names among investors and crypto enthusiasts as they are committed to giving the best of crypto services to their clients. Therefore, the trust and assurance reposed in them is an indication that you can always sell your REP on their platforms. Selling REP is pretty much as simple as purchasing. In any case, trading off the asset or some other crypto asset is equally dependent on whether there is liquidity for it. By liquidity, we mean demand. This determines whether the crypto asset will be sold. REP has a lot of liquidity, because of its position among cryptocurrencies. While attempting to sell your REP asset, ensure that there is an appropriate withdrawal channel. Currently not all of the exchanges listed above have trading pairs sell REP on their platforms – Binance is one that does. Since first you’ll need REP before you can sell REP, purchasing Augur is the initial step before any selling activity can occur. Binance permits clients to purchase REP with USDT, BTC or ETH, and sell REP to the same pairs. You can buy Augur spot (just buying the underlying asset), or on isolated 5x margin. This refers to borrowing funds on leverage from Binance – this is only recommended for experienced traders as a correction of 20% could result in liquidation – losing the Augur amount you bought, before you have a chance to sell it at a profit. After entering your details for Binance verification like country of residence, date of birth, name and email, you’ll be able to make withdrawals once you sell Augur. Unlike Coinbase, Binance does not require you to send them a selfie. REP/BTC trading pair on Binance Every investor purchases a tradeable asset intending to make gains. Despite knowing the right time to buy a crypto asset like REP, it is likewise important to know when to sell, except if you want to record unintended losses. Indeed, even investors who purchase crypto assets for the long haul consistently know when they are in profit so they can sell. You can avoid registering losses on your investments if you know what you’re doing. Moreover, the prices of digital assets can be profoundly unpredictable. So it is possible to be in profit on your investments today and the next few days, the price of the asset invested on has tumbled. Additionally, no one controls the prices of these assets. It is fitting to have a selling target for your REP investment. Not doing so could spell doom for your investments and you may ultimately lose funds. For this, Binance, in a bid to help traders make savvy investment decisions, integrated charts for each crypto asset including REP. These charts consist of candlesticks and patterns that help you study the historical data of an asset including REP. Similarly, you can study these charts to realize when to make a purchasing choice on REP or other cryptocurrencies. On Binance, you can click on REP and it takes you to a price chart where you can get an idea of the recent price action and trading volume. Augur price chart on Binance Aside from REP, there might be different assets you are holding in your portfolio because Binance offers many cryptocurrencies and trading pairs. Here in this guide, our attention is on the asset, REP. Along these lines, knowing the complete worth of your portfolio will assist you with deciding whether the measure of REP you wish to sell is up to the necessary sum. To know the worth your portfolio holds, click the ‘Wallet’ option then ‘Fiat and Spot’, ‘Margin’ or ‘Overview’ depending on if you’re spot trading or on leverage, or both. Augur (REP) balance on Binance To sell your REP asset, you would need to close active positions. Selling the asset is what is meant by closing your active positions. What’s more, you can’t do this if the asset is still in its original form. The volatile nature of cryptocurrencies is something to be concerned about. Leaving your REP investment without going on to sell for your preferred currency- could be fiat or USDT- is a risky move as you are likely to lose your funds. Due to how volatile prices can get, not selling at your target price after it has been hit or waiting for a while after then, you could return and see that prices have retraced. To secure your profits, you need to make a quick move. Closing your active positions requires exchanging the REP for USDT or some other digital currency. After closing these positions or selling, the equivalent or less reflects in your portfolio – if you are selling via what is known as ‘market price,’ the actual amount of REP sold may not be the exact amount that reflects in USDT due to what is referred to as ‘Slippage.’ Slippage happens when an asset settles at a cost lower than the intended target price. With slippage, there can be a positive or negative angle to it. When a negative slippage occurs, a trade is executed at a lower price than the proposed target; while positive slippage happens when an asset settles for a higher price than the intended price. Enter the amount you wish to sell in Binance, or drag the slider all the way to the right to sell 100% of your holdings. Enter the price you want to sell at for a limit order, or use a market order to sell at whatever the current market rate is. Sell REP on Binance Assets withdrawal on Binance is easy as long as the withdrawal prerequisites have been satisfied. Reviews about the withdrawal process on Binance are mostly positive. Withdrawals on the exchange can be easily navigated, even for newbies. There are occasions when withdrawal difficulties could emerge, yet these seldom occur. It could either be that a client is operating an account from a blacklisted country. Different instances include incomplete verification, errors while initiating withdrawals or failure to add withdrawal channels. Binance is focused on making withdrawals on its foundation as smooth as could be expected. This makes it simple for you as a user to sell your REP without inconveniences. Binance ensures that each crypto asset stored on its foundation can be sold. Currently the minimum withdrawal on Binance is 2.1 REP. Ensure you only enter a REP network address when withdrawing REP elsewhere, or a BTC address if you first sold REP to Bitcoin, or a USDT address if you sold REP to Tether. Binance should also automatically verify that the right type of address is entered. It’s not currently possible to sell REP for USD, GBP, EUR etc. or make a withdrawal via bank transfer. For that, we recommend withdrawing from Binance over to eToro, which has the widest range of cashout options to fiat. It’s also possible eToro will list Augur and make it possible to sell REP to fiat at some point. Augur (REP) withdrawal on Binance Crypto taxes do not yet exist in the US. A new Infrastructure bill is being proposed by the US that will impose tax reporting obligations on crypto businesses operating within the US. Cryptocurrencies are decentralized, as such enforcing tax obligations on their owners may not be possible. US authorities have continually expressed concerns over cryptocurrencies being used for illegal activities. Thus, they are looking to enact regulations that will encapsulate and safeguard against such acts. There are several exchanges both centralized and decentralized around the globe. Usually, crypto exchanges are meant to make cryptocurrencies accessible to investors and crypto enthusiasts. They also provide platforms for such asset classes to be traded by crypto traders. Despite being bound by one aim, you may find different services on these platforms. This means that apart from buying and selling crypto, these exchanges may have services peculiar to them. So your needs dictate which exchange will suit you. Of all the crypto exchanges that exist, some have been able to stand out and resonate with thousands of people around the globe. This is not because the services they offer are entirely different from those of others but because they go the extra mile in securing their users’ interest. There are some identifiable parameters used to mark out the best crypto exchanges. These parameters include security, user-friendly interface, efficient customer support, a guide on how to use the exchange, and a growing community. In light of the above, some exchanges have been able to pass these parameters to offer the best to their users. Other exchanges have fallen short of these parameters and do not enjoy so many signups or daily trading volume as the former. Giving their users nothing less than premium services, a handful of exchanges allow their customers to use copy trading or trading bots services. Traders who are not cut out for manual trading can copy trades from other experienced traders or automate the trading process via bot trading. Here, we have identified some of the best crypto exchanges in the industry. Storing REP is a must. Cryptocurrencies like REP are stored in digital wallets. Crypto investors and holders have different ways of storing their digital assets. Some store theirs in hot and software wallets while others transfer the asset to hardware wallets, also known as cold wallets. Alternatively, they leave their tokens on the exchange when they purchase them. However, this is not advisable as these tokens could be stolen. There have been several incidents in the past where the crypto holdings of investors were hacked and stolen on centralized exchanges. This does not mean that decentralized exchanges are safe too. Notwithstanding, you can decide to store your REP in any wallet of your choice as long as you will take the necessary measures to protect your assets. You must also be ready to bear the losses in case anything happens. Here, in another guide, we have identified some of the best crypto wallets you can store your REP holdings in. If you are taking the invest-and-sit-back approach, you will likely have to actively monitor the price of REP, especially if you don’t have a target price. Monitoring the price of an asset can be tasking since you have to keep yourself abreast of goings-on around the crypto market to know whether to sell off your REP holdings or keep maintaining the same position. Essentially, the right to sell your REP holdings is determined by the investment strategy you adopted. If you adopt a short-term strategy, then you have to wait until that time is right before exchanging your REP. So there is no specific right time to sell. The time is right when your investment strategy says so. In between that period when your investment is yet to attain the target you set, a lot of things might happen given that the crypto market is volatile. A piece of bearish news could affect your open position or holdings. This is why it is advisable to always do analysis whenever you want to invest. The analysis keeps your actions in check even when the trade is going the wrong way. Sometimes, you might have to wait longer than necessary before hitting your target. The price of Augur (REP) has been volatile. Given that the market is unpredictable, the cost of the crypto asset isn’t steady. When the market changes, it implies that prices will go up on specific occasions, then, at one point experience a downtrend following a negative report or when investors begin selling. REP’s price movements can be observed on the charts with the help of candlesticks and identifiable patterns. REP has a supply cap of 6.6 million all of which have been completely created which means that its circulating supply is also 6.6 million. The native token attained a high of $341 in 2016, which is currently its all-time high. Since 2016, the price has dropped to $25. Notwithstanding, REP is a valuable cryptocurrency; most native tokens are like that, especially when they facilitate transactions on the network they belong to. Crypto trading is an activity that requires devotion from traders themselves, aside from the capital they usually have to commit. Apart from studying charts, traders would normally stay abreast of important events in the market through news reports. Combining that workload can be tedious. Dividing his devotion between other engagements and the charts could make one or both suffer. Sometimes, he is likely to commit costly trading mistakes. Automated trading has come to the rescue of these traders, making trading easy for them with the use of trading bots. So they don’t have to be actively involved in the trading process. Trading bots automate the trading process such that traders can have time for other engagements. Trading bots utilize algorithms to trade cryptocurrencies. Nonetheless, they require a bit of human involvement to function effectively. They cannot function on their own, a trader has to activate a trading range based on his strategy, which these bots rely on. One reason trading bots are important is that they are designed to respond to opportunities in the market faster than humans. Bot programs can involve risk – those interested should only deposit a small amount at first to test them out and avoid bots we’ve blacklisted on our trading robot page. These are some bots we’ve reviewed: Suddenly, everyone has picked interest in cryptocurrency. Of course, you might have developed the same interest, but you are afraid of how it will turn out. One has to be careful when investing in cryptocurrencies. There are a whole lot of other qualities a crypto investor is expected to possess. One must understand that the market is not controlled by anybody. Hence, it must be skillfully manoeuvred. Greed is a major challenge most traders battle with. Once a trader can overcome the lure to be greedy, he is one step closer to becoming an expert. There are times when the market is very volatile and highly unpredictable- a trader should learn to avoid the market during those periods. Also, as a trader, never revenge trade. This means trying to recover from loss after suffering one. While trying to revenge-trade, it could lead to more losses. The best thing to do at such a point is to sit back and restrategize and head back to the market not with a mindset to recover from that loss. You can sell your REP tokens when you are in profit. Here are some key things to note before you sell Augur: REP has a market capitalization of $166 million and an average daily trading volume of $32.7 million. It is a digital asset, so it can be bought, stored and sold with ease. REP can be found on most exchanges apart from the brokers listed above. To sell REP on eToro and other brokers’ platforms, you need to close positions. You can trade the asset against USDT or the fiat currency of your residing country and then withdraw to your local bank account. REP can be stored in a wallet, whether hardware or software. If you have the intention of buying any cryptocurrency, you should do so from an informed standpoint and not because the asset looks profitable. As they say, invest what you can afford to lose. The crypto market is a volatile one and cannot be traded on from the viewpoint of hope and mere speculations. This guide can suffice as a handbook you can revert to whenever you want to make investments in REP. Currently eToro doesn’t allow users to sell Augur but it may be listed in the future. It is possible to sell Augur on Binance. Update – As of 2025, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

In this guide, we recommend selling REP via an exchange as you are guaranteed safety and received your fiat. There are other means through which you can sell. P2P is an alternative, but this is somewhat risky.

When you use a broker like eToro, selling your REP can be concluded in minutes after a few clicks. The exchange features withdrawal options as well.

Several brokers can be used to sell REP. However, the following are considered the best by expert traders that have explored other options. They are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

Consult your local govt webpages as cryptocurrency taxes for those selling vary by territory.

To sell your REP for USD, you need an exchange that permits payment to your local bank or third-party payment service. Some of the best choices are eToro, Coinbase, AvaTrade, and Binance.

Some of the exchanges where REP can be sold include eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

To quickly sell your REP, you need an account with eToro or any other exchange listed above. Setting up your account doesn't take a lot of time. If you have your REP already, you can transfer them to the wallet on the exchange and sell them there instantly.

To sell REP for cash, you should integrate a withdrawal channel on eToro or any other exchange-listed above. Ensure that you've set your desired currency. When you withdraw, the exchange helps you convert the funds to cash and pays into the proper channel.

PayPal only supports four cryptocurrencies, which include Bitcoin, Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC).

Some wallets help you sell your REP natively. To sell them on the wallets, you need to integrate a payment method and follow the necessary procedures to sell REP.

Often, you can swap your REP for other cryptocurrencies on brokers like eToro or Coinbase. Once you complete a swap, the actual value of REP sold reflects on the crypto you choose. On this Page:

Best Brokers to Sell Augur in 2025

Tutorial on How to Sell REP

Step 1: Buy REP

Step 2: Always Know When to Sell

Step 3: Know the Total Value of Your Portfolio

Step 4: Close All Active Positions

Step 5: Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges

Storing REP in the Best Wallets

When is the Best Time to Sell my REP?

Price of REP

Guide for Automated Trading

How to Invest Responsibly in Crypto

Should I Sell Augur in 2025?

Summary

FAQs

Where to Sell REP

How Easy it is to Sell REP

What are the Best Brokers for Selling REP?

What are the Taxes for Selling REP?

Where to Sell REP for USD?

What Exchanges Sell REP?

How to Quickly Sell REP

How to Sell REP for Cash

How to Sell REP for PayPal

How to Sell REP from Wallet

How to Sell REP for Other Cryptocurrencies