An index functions as a guide that helps to find things more quickly, it provides references that assist in locating a particular piece of information. This is what The Graph is used for in networks like Ethereum and Inter Planetary File System(IPFS). The Graph is a tool to sift through blockchain data.

The Graph, which aims to provide a truly decentralized solution, is an indexing protocol used by blockchains. This protocol allows for people to build subgraphs known as APIs, that make blockchain data easy to access. The Graph builds decentralized applications(dApps). It uses GraphQL, which is a query language originally used by Facebook to gather data for a user’s news feed.

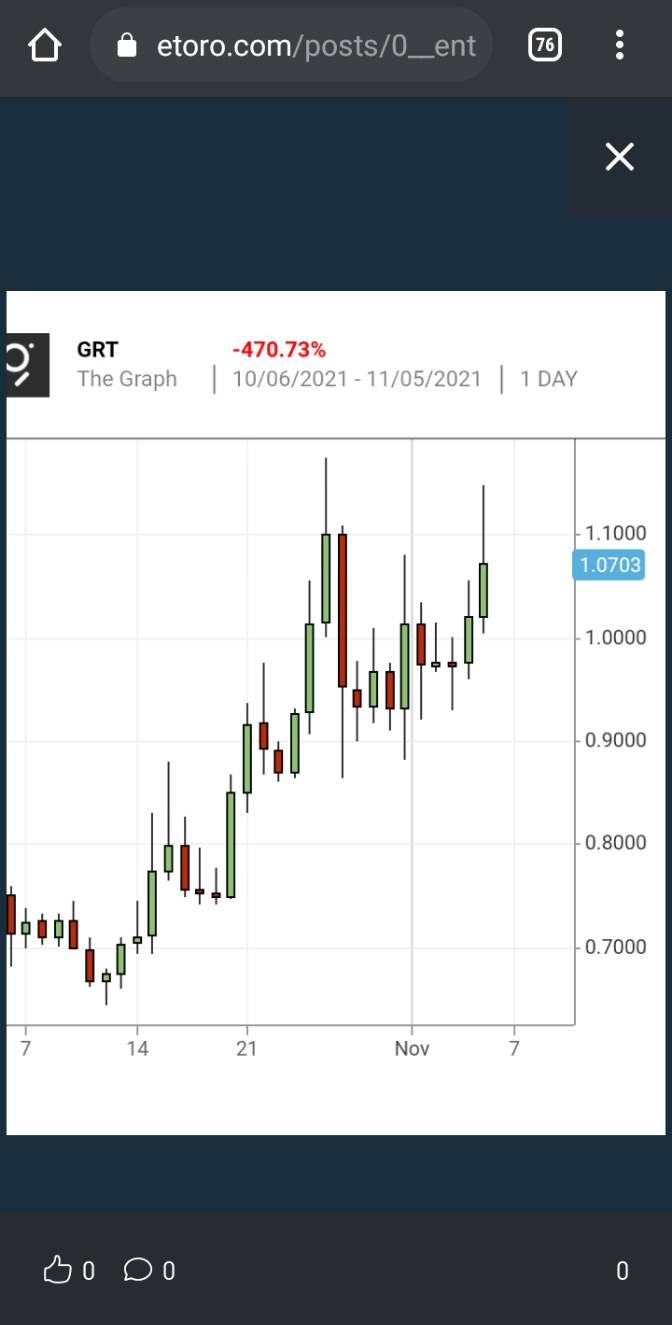

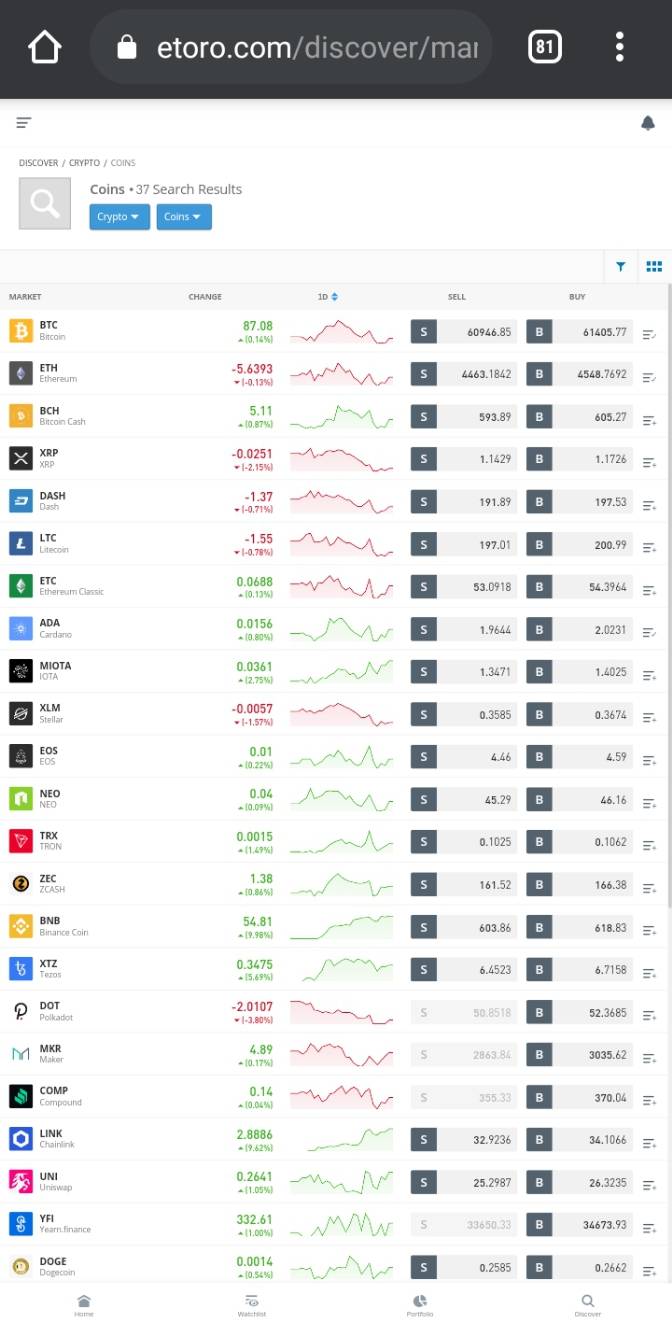

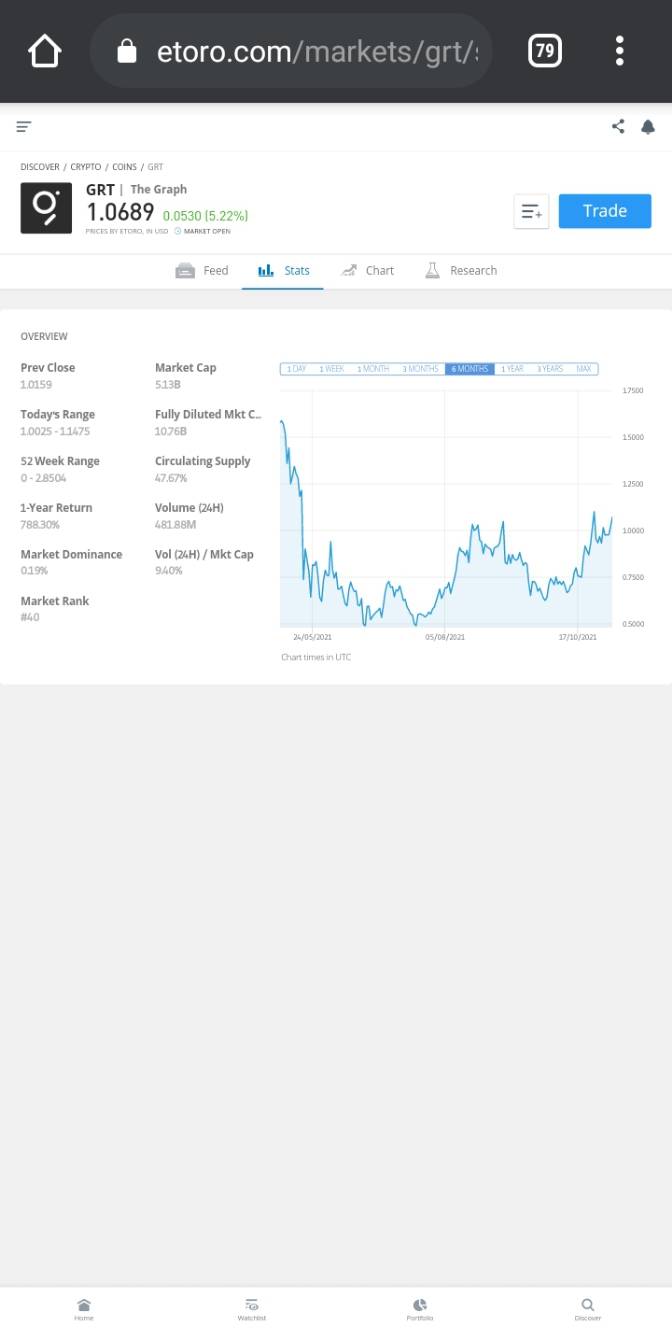

The crypto industry is steadily looking for ways to improve its technology and so, the Graph was born. Essentially, the Graph analyzes and gathers blockchain data, then proceeds to classify it into various indices, known as subgraphs. This allows any application to send a query to its protocol and receive an immediate response. Instead of going through the rigorous process of querying using other means, the Graph makes it faster, more secure, and more reliable even while allowing anyone to build and publish APIs. Application Programming Interfaces(APIs) are referred to as subgraphs which act as intermediaries between two applications, allowing them to communicate with each other. This attracted the likes of Uniswap, Synthetix Exchange, and more decentralized exchanges. The Graph was founded in 2018 by Yaniv Tal as the project lead, Brandon Ramirez as the Head of Research, and Jannis Pohlmann as the Tech Lead. These three previously worked together on several startups that focused on creating developer tools. The co-founders employed the assistance of other professionals from the Ethereum Foundation, OpenZeppelon, Puppet, and Barclays Plc, to name some. The Graph is one of the largest financing rounds along with NEAR and Avalanche, for example. This protocol has been up and running as a mainnet since 17, December 2020. The Initial Coin Offering(ICO) took place sometime in October 2020, raising $12 million, 400 million GRT were sold to over 4,000 investors. However, even before the public ICO, private investors had made their moves. These investors include Multicoin, Coinbase Venture, and Digital Currency Group. $5 million and $2.5 million were invested by Coinbase Venture and Multicoin Capital, respectively. The Graph seeks to expand, as it is in a non-committal relationship with layer-one blockchains. In other words, it is exploring, providing support for additional layer-one blockchains like Bitcoin(BTC). The Graph Token (GRT) is a native cryptocurrency of the Graph; it is an ERC-20 token that powers the Graph, through the Ethereum blockchain. Most times, a token is created to be used with dApps(decentralized apps) such as Uniswap, Aave, and more; it allows for seamless interactions between dApps and other blockchains. The GRT is involved in every stage of the Graph economy, which comprises Indexers, Curators, and Delegators. Indexers are node operators in the Graph Network, tasked with providing indexing and querying services, but to do this they have to stake GRT. What is in it for indexes are query fees, indexing rewards, and Rebate Pool(this is shared with all network contributors proportionate to their work done) following the Cobbs-Douglas Rebate Function. Consequently, indexers must provide correct information at all times, if not they will be penalized and lose a part of their deposit. Curators are essential to the Graph economy. They are usually very informed in the aspect of decentralized apps, and they use this knowledge to signal to indexers the subgraph that should be indexed, by depositing GRT in the respective subgraph. Essentially, they address which subgraphs are of high quality and need to be indexed through Explorer. Curation is risky as just anyone can create a subgraph and name it whatever. So, a curator must decide whether a source is reliable and furnishes valuable data. It is in the best interest (financially) of a curator to signal indexers early, as these signals are valuable to indexers. The reward for curators is that they receive a share of the query fees generated by subgraphs. Delegators are parties who deposit GRT to indexers as their contribution to the running of the network, without having to install a node. The tricky part is that to maximize profit, delegators must choose indexers that will do a good job, if not they may be left with low rewards. As a relatively new token, GRT is doing well as it has firm technological fundamentals, but it still has room for growth. You may be wondering if GRT is a good investment, if it is worth it. Indeed, it is. First off, the Graph(GRT) has solved a major problem; it has eliminated the technical barriers to querying. You may be skeptical about investing in the GRT because of the token’s price dip. However, that is a common feature of cryptocurrencies, and GRT has risen from that and strengthened its position as an important element of the DeFi ecosystem. Recently, GRT has been getting a lot of price support at its current levels; the possibility of this token reaching its all-time high again, before the end of the year, cannot be ruled out. It has been established that GRT is a good investment. To be active on the Graph Network is to put graph tokens, as it is what powers the protocol. Users, from indexers to curators have to stake GRT in the process. Now, how to purchase this token. This is a guide on how to sell GRT, but you cannot sell what you do not have. So, we will be looking at how to purchase GRT. The first step to buying this token is to find yourself a reliable and efficient exchange, it is essential. An exchange acts as an intermediary between the buyers and the crypto market. Here is a list of credible exchanges you can purchase GRT from. These exchanges are all in the business of trading crypto assets, some even go beyond that and allow for the trading of other assets. However, it is advisable to not hop on just any exchange which is why we provided a list of reliable ones. If you get it wrong, trading, and understanding the crypto market in general, may be a herculean task. Exchanges exist to bring together buyers and sellers and assist the trade to benefit both parties. Nevertheless, there are certain standards an exchange must live up to allow for efficient trading. Security and speed. A good exchange should be encrypted and follow certain regulations to guarantee the security of its trades. It could be the Know Your Customer(KYC) policy that mandates the identification of traders through personal documents like national ID. Also, nobody enjoys using a slow platform; the speed at which transactions can take place and even which the platform can be accessed is important. Trading tools and techniques are also important services a good exchange should offer. Materials that help clients understand trading better be it tutorials, eBooks and the likes should be provided. A welcoming interface and great customer service. An interface that is not intimidating to its users, especially beginners; an interface easy to understand and navigate. Having great customer service is an essential feature, a means through which investors or traders can easily reach out, to sort out issues and get clarity on some things. Again, an exchange should be innovative, to accommodate new measures to improve their company, new coins and tokens that seem reliable, based on adequate research. A good exchange always has room for growth and improvement. These are a few qualities a good exchange should possess, things the exchanges listed above are characterized by. You can see for yourself that these exchanges are reliable, reliable to purchase from and to sell on. The Graph (GRT) is a very promising token due to the importance of the position held by the Graph in the blockchain system. Currently, the Graph has a market cap of about 5.5 billion, and a circulating supply of 47.91%. The Graph is available for purchase on several exchanges, inclusive of the ones listed above. Now, the first step to selling the Graph is to purchase it, as you cannot sell what you do not have. To purchase Graph, you have to set up an account with an exchange of your choice. For this section, we will be using eToro as the subject, because it is among the top ten exchanges in the world. On eToro, after opening an account, you have to go through the verification process; verifying your account and the details you entered like your date of birth, name, occupation, among other things. The next step is to deposit funds into your account using the credit/debit option, through online payment platforms like PayPal or even through your local bank account. After this, proceed to buy GRT using fiat currency, or USDT. Buy GRT on eToro Timing can make or break your investments. Some investors know when to buy, but miss their timing when it comes to selling. Investors have to keep their eyes peeled to make sure their investments do not go down the drain. It is no easy feat as a major characteristic of crypto is its volatility. People invest in crypto to sometimes diversify their portfolios, but definitely to make profit. What is investing when all you are getting are losses? To avoid this, it is advisable to have a selling target for your GRT investments. A good exchange will make it easier for you to sell, which is why eToro, living up to the title, has provided charts that simplify the selling process for investors. These charts are very useful as they help you study the historical data of assets like GRT which could help with making good predictions. Also, adequate study and understanding of the charts can help you realize when to make that move as regards your investment. Locate GRT on the eToro platform and check out the features mentioned. GRT chart on eToro Your portfolio may be diverse because eToro, as well as some other exchanges offer several crypto assets and their trading pairs. Knowing the total value of your portfolio can influence your decision regarding what to sell and what not to. With our focus on GRT, knowing the total value will make you know if you can sell. On eToro, the minimum withdrawable amount is $30. eToro overview Another term for closing a position is known as position squaring. This differs based on the position an investor decided to take, whether long or short. In a short position, it would mean buying back units, while in a long position it would mean selling the units. In this case, it would mean selling your GRT assets. However, this cannot be done if the token is still in its original form. You can sell your GRT asset for your preferred fiat money or USDT. The volatility of crypto is something to be wary of. So, a person must close all active positions when the time is right, to secure profits. After selling, you may not get the exact amount of GRT you sold, and it could be one of two things. It could be that eToro, or any other exchange, charged withdrawal fees, or it could be as a result of slippage. When slippage occurs, a trader has to settle for a different price from what they requested due to a fluctuation in prices, between the time of order and the time of execution of the trade. It could be positive or negative. closing trade on eToro Making withdrawals on eToro is easy, and you can get it done any time, as long as you meet the verification requirements. If you are conversant with the platform, you are less likely to have issues. As you would be able to avoid operating an account from a country that is not open to your country, incomplete verification, among other things. Even with the variety of crypto available on eToro, it has made sure that every single one of them can be liquidated. Meaning, you can convert your GRT to fiat money at any time. The amount you can withdraw is based on the balance of your eToro account, minus the amount of margin used. The minimum amount for withdrawal is $30, and withdrawal fees are subject to withdrawal processing fees. However, the minimum withdrawal fee is $1, the maximum, $50. This fee is low in comparison to others, another perk of using eToro. Just because crypto is not regulated by the government does not mean it’s free from taxation. The Internal Revenue Service(IRS) has classified cryptocurrencies as assets similar to properties, like traditional stocks, for example, and they are taxed as such. In the US, crypto exchanges must report user activity on gains and losses to the Internal Revenue Service (IRS) which then treats it as a capital asset. The taxes you pay are the same as taxes you may owe when realizing a gain or loss on the sale of a capital asset. Making sure your crypto assets are secure is very important, as it cannot be recovered once it is lost, unlike fiat currency. You can store your crypto in a digital wallet, a supported exchange like eToro and Binance. There’s a variety of crypto wallets, for different needs; they all have their pros and cons. You could use hardware wallets like Trezor or Ledger, these use extremely high end encryption techniques. You could also use a trust wallet(this is supported by Binance), a multi-platform wallet like atomic wallet (available on Android, iOS, and several desktop versions), among others. To an extent, this depends on the investor. Some investments are short-term, where the investors sell in days, some medium-term, and some long-term, lasting for years. To know the best time to sell GRT, you could follow the opinion of industry experts, ones that have studied the crypto markets so well, and can make more or less accurate predictions. Nonetheless, it is important to note that these experts are also humans, so their predictions are not infallible. It is advised that you conduct extensive research too, before selling. Again, some factors that can influence you into selling are if you want to exchange your GRT for other crypto or fiat currency, to adjust your crypto strategy, to avoid losses in time of fluctuation, among others. The Graph started out well. Initially, the token was trading for $0.03 per token, but rose to $1.96 in a matter of five months, with an all-time high of $2.87. However, the price has been fluctuating because of its volatility. Experts have said that it is a very promising token, as it plays an important role in the blockchain system. Currently, the Graph goes for $1.12. It also has a circulating supply of almost 5 billion and a market cap of about 5.5 billion. This is a guide on how to sell GRT. The Graph, the Google of blockhains is powered by GRT. The Graph is a decentralized indexing protocol used by blockchain to query networks like Ethereum. The Graph, playing a very important role in the blockchain system, and gaining wide exposure to different exchanges triggered the mass adoption of the token. It also serves as a form of assurance that the Graph is a good investment, and that there is every possibility that it can surpass its previous all-time high before the year runs out. There are hundreds of exchanges and several of them allow for trading of the Graph on their platforms. However, this guide selected the best exchange for you to sell your token, the list includes eToro and Binance. Again, it includes the taxation stance of the GRT, requirements for making withdrawals, how best to store and secure your tokens, the best time to sell, using computer software to trade, and how best to invest.On this Page:

Tutorials On How to Sell GRT

Step 1: Buy the Graph (GRT)

Step 2: Sell At The Right Time

Step 3: Know the Total Value Of Your Portfolio

Step 4: Close All Active Positions

Withdrawal Requirements And Exchange Rates

Crypto Taxation In The US

Storing GRT In The Best Wallets

Best Time To Sell GRT

The Price Of GRT

Summary