Best Mutual Funds UK to Watch

If you’re thinking about entering the world of stocks and shares for the very first time, you might be concerned about which companies to invest in.

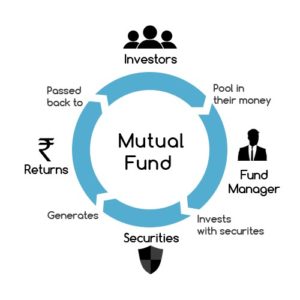

Mutual funds remove the need to choose individual shares – as the provider in question will buy and sell stocks on your behalf. In return, you will need to pay a small fee – which is usually less than 1% per year.

In this guide, we explore the ins and outs of how mutual funds work – and why they are highly sought after by newbie investors.

-

-

5 popular Mutual Funds UK List

Below you’ll find an overview of 5 popular mutual funds based on trading volumes.

- Vanguard U.S. Equity Index Fund

- OHCM UK Equity Income Fund

- Vanguard Global Balanced Fund

- Fidelity UK Smaller Companies

- Fundsmith Equity

What are Mutual Funds?

Mutual funds are offered by large financial institutions. They allow both retail and professional clients to invest money into the mutual fund, who in turn, will buy and sell shares on your behalf. Your money will be pooled together alongside thousands of other investors of all shapes and sizes – subsequently giving the mutual fund a multi-billion pound war chest.

This then allows the fund to access stock markets that would otherwise be difficult to reach. The main attraction of mutual funds for newbie investors is that the entire process is passive. That is to say, once you inject money into a mutual fund, nothing else needs to be done.

As we cover in more detail later, this ensures that you get access to the UK and international stock markets without needing to have a single inch of trading knowledge. More specifically, you will be entrusting your investment funds with a proven trading house that will have vast resources under its belt. As such, mutual funds will typically strive to outpace the wider stock markets.

This will, however, come at a fee – which is often less than 1% per year. In terms of making money, this can come in two forms. If the mutual fund holds dividend stocks, then you will be entitled to your share of payments. The mutual fund will also look to increase the value of your investment through capital gains. Put simply, this means that it will look to buy shares that it can then sell at a higher price in the future.

How do Mutual Funds Work in the UK?

You simply need to find a UK broker that gives you access to the mutual fund, decide how much you wish to invest, and that’s it – the rest is taken care of. In fact, you don’t need to do anything until you decide to cash your investment out.

As straightforward as the investment process is, we would still suggest that you brush up on your knowledge of how mutual funds work. After all, you are going to be investing your hard-earned money.

- Let’s suppose that you invest in a mutual fund that buys and sells UK shares

- As such, its portfolio might contain shares in Royal Mail, Tesco, BP, HSBC, Barclays, and many others

- You decide to invest £10,000 into the mutual fund

- The mutual fund will then actively manage its portfolio by buying and selling shares

- The value of your investment will go up and down depending on how the portfolio performs

It is important to note that the above process of buying and selling shares on your behalf is super-transparent. In fact, mutual funds are typically listed on public markets like the London Stock Exchange – which in itself ensures that the fund is required to release information on what shares it holds.

Net Asset Value (NAV) of a Mutual Fund

When you invest in shares in the traditional sense, it’s simple to figure out how much you are making or losing.

- For example, if you buy 100 shares in Facebook at $200 per stock – you have invested $20,000

- If the shares increase to $250, your investment is then worth $25,000

- As such, you’ve made a profit of $5,000

However, in the case of mutual funds, things are a bit more complex. At the forefront of this is the Net Asset Value (NAV) of the fund. In its most basic form, the NAV is the total value of the assets the mutual fund is holding on behalf of its investors. This figure is taken by adding all of the shares that the fund has in its portfolio, at the current market price.

For example:

- Let’s suppose that the mutual fund is holding 100 shares in IBM, Apple, and Amazon

- For the purpose of simplicity, we’ll say that each share is worth $50 at the start of 2020

- As such, the fund has $5,000 invested in IBM, $5,000 in Apple, and $5,000 in Amazon

- This means that the NAV of the mutual fund is $15,000

- If at the end of 2020 each of three shares were collectively worth $7,000 each – this would mean that the NAV would have increased to $21,000

Of course, this is a super basic example, as mutual funds typically hold billions of pounds worth of shares in their portfolio. But, the key point here is that the NAV is the most effective way of assessing how much your investment is worth.

Capital Gains

So now that you know how the NAV works, we can then explain how this translates into capital gains.

In simple terms:

- If the NAV of your chosen mutual fund increases, as will the value of your investment

- If the NAV of your chosen fund decreases, as will the value of your investment

For example, let’s supposed that you invest £10,000 into a mutual fund when its NAV is £2 billion. A few years year, the NAV is now worth £3 billion – representing a gain of 50%. On an initial investment of £10,000, your money is now worth £15,000. But, you will not be able to realize this 50% increase unless you exit your position. That is to say – and much like a traditional stocks and shares investment, you would need to sell your stake in the mutual fund before you can get your hands on the money.

When you do, your profits will be liable for capital gains tax. You can read our UK Tax on Shares Guide here.

Dividends

Once again, the process is slightly different in comparison to buying dividend shares in the traditional sense, as everything goes through the mutual fund. Crucially, if the mutual fund that you invest in does hold shares in companies that distribute dividends – you will be entitled to your share.

For example:

- Let’s suppose that your chosen mutual fund holds shares in Tesco, and it receives four quarterly dividends at an annualized yield of 4%

- Tesco makes up 10% of the mutual fund’s portfolio

- You have £20,000 invested at the mutual fund

- In effect, you have a £2,000 stake in Tesco shares via the mutual fund, as it makes up 10% of the portfolio (10% of £20,000)

- This means that 4% in dividends on a £2,000 stake amounts to an annual return of £80

Once again, the example above is somewhat arbitrary, as there are many variables that will dictate how much you can earn in dividends.

For example, while the mutual fund might buy and hold Barclays shares for many years, in other cases, it might hold on to GlaxoSmithKline shares for a few months before selling them on.

Either way, we should also note that you will not get the dividends on the same date that they are distributed by the company. Instead, you will likely receive a lump sum payment from the mutual fund once every three months.

This is because the fund itself will potentially receive dividends throughout the week, so it would be inefficient for it to constantly be forwarding on payments to all of its investors.

If you’ve read our guide up to this point, then you will know that mutual funds are 100% passive. That is to say, once you make an initial investment, there is nothing else for you to do – as the fund manager will determine which shares to buy and sell, and when. As you might have guessed, this will come at a cost. However, the fees associated with mutual funds are usually very competitive.

Nevertheless, let’s break down the main fees that you need to be aware of when using a mutual fund in the UK.

Annual Maintenance Fee

Irrespective of which mutual fund you decide to invest in, you will always pay an annual maintenance fee. This will be a percentage of the amount you have invested with the fund.

For example, if you have £15,000 invested in the fund and the annual maintenance fee amounts to 0.5%, then you will pay £75 per year.

Most mutual funds give you a more favourable rate if you invest larger amounts – but this often requires at least £100,000. Nevertheless, you will rarely find that the annual fee amounts to more than 1%.

No Share Dealing Charges

In all but a few cases, mutual funds will not charge you any share dealing fees. Ordinarily, when you buy and sell shares on a DIY basis, you are charged a flat fee. For example, whether you buy £50, £100, or £1,000 worth of shares at Hargreaves Lansdown – you will still pay a flat fee of £11.95. However, when you invest with a mutual fund, you rarely need to pay any fees when the provider buys and sells shares.

What is the ‘Redemption’ When Investing in Mutual Funds?

In a nutshell, ‘redemption’ in the context of mutual funds simply refers to the process of making a withdrawal. That is to say, you redeem the money you initially invested. There is no hard and fast rule when it comes to the redemption of mutual funds, so this is something that you must check before parting with your money.

- A minimum ‘redemption period’ is the number of months or years that you are unable to withdraw your money out of the mutual fund. For example, if the redemption period is 12 months, this means that your money is locked away until one year passes.

- A ‘redemption fee’ is the amount of money that you will be charged to take your money out. This is typically a percentage fee of the amount you decide to withdraw.

UK Mutual Fund Fundamentals

- FTSE 100: Some mutual funds will simply look to track the FTSE 100. In other words, they will buy shares in the 100 companies that make up the FTSE 100, these can include many markets including property funds.

- FTSE All-Shares: To obtain even more exposure to the UK economy, the mutual fund might choose to invest in the 600-ish companies that make up the FTSE All-Shares Index.

- International: Some UK mutual funds will target stocks and shares listed on international markets. Many will focus on the New York Stock Exchange and NASDAQ – so its portfolio will contain the likes of Disney, Apple, Facebook, IBM, and Amazon.

- Emerging Markets: Mutual funds might invest some, or all, of their capital into the emerging markets. This means that they will be buying and selling shares that are listed in South Africa, Brazil, Vietnam, and India – to name a few.

- Dividends: Some mutual funds such as the income funds will focus exclusively on shares that pay dividends.

- Sector-Specific: Some mutual funds will target specific sectors. For example, a tech-oriented mutual fund might buy shares in Apple, Microsoft, Netflix, IBM, and Uber.,

Crucially, you need to understand the type of marketplace, sector, and risk that your chosen mutual fund is targeting. As a side tip, it might be worth diversifying even further by backing several mutual funds – all of which target a different niche of the stocks and shares space!

Lump-Sum, Regular Payments, or Both?

Once you have assessed the type of mutual fund that you wish to invest in, not only do you need to assess how much to invest, but also the frequency. For example, some UK investors simply choose to invest a one-off lump-sum and then allow the mutual fund to do its thing for a number of years.

Others will instead choose to invest a bit at the end of each month, while some might opt for a combination of the two.

There isn’t a one-size-fits-all investment strategy when it comes to mutual funds, as it all depends on personal preference. With that being said, it is worth considering a re-investment strategy if and when you receive your dividends.

This is because in most cases, your chosen mutual fund will distribute your share of dividends on a quarterly basis. If you were to re-invest these dividends back into the fund (or any other asset class for that matter), your money can grow substantially faster.

A couple of quick points to note about payments:

- Most mutual funds (whether that’s direct with the provider or through a third-party broker) will have a minimum investment amount. This can be as low as £25 per month or £100 upfront.

- Most providers allow you to invest with a UK debit card or bank account and even set up a direct debit

- You do not normally need to pay any fees to deposit funds

How to Invest in a Mutual Fund

So now that you know the ins and outs of how mutual funds work, we are now going to explain how the investment process works.

Step 1: Choose a Mutual Fund

While the first step of the stocks and shares process typically centres on finding a UK stock broker, in this instance, it’s start with the asset itself. In other words, spend some time researching a mutual fund that meets your long-term investment goals.

Some of the questions that you need to ask of the mutual fund are:

- What niche does the mutual fund target (dividend stocks, international shares, emerging markets, etc.)?

- How has the mutual fund performed over the past 10 years?

- What annual maintenance fee does the mutual fund charge?

- What is the minimum investment amount?

- Is there a minimum redemption period or redemption fee?

If you need some inspiration, Yahoo Finance has a highly comprehensive research facility on mutual funds.

Step 2: Find a UK Broker That Offers Your Mutual Fund

Once you have found a mutual fund that meets your long-term investing goals, you then need to find a UK broker that allows you to invest in it. Although some mutual funds allow you to invest directly, we actually find that going through a third-party broker is often cheaper.

Brokers also ask for a much lower minimum investment amount, and typically support more payment methods. Just make sure that your chosen broker is regulated by the Financial Conduct Authority (FCA).

Step 3: Open an Account and Upload ID

Once you have chosen a broker, you will then need to open an account. This will require you to enter some personal information – such as your full name, home address, date of birth, and national insurance number.

If the broker is unable to verify your identity electronically, you’ll likely be asked to upload a copy of your passport or driver’s license, as well as a proof of address.

Step 4: Deposit Funds

If you’re using a third-party broker, you will first need to deposit some funds into your newly created account. Most platforms accept debit/credit cards and bank accounts, and some will also support e-wallets.

Step 5: Invest in a Mutual Fund

Once your brokerage account has been funded, you can then proceed to invest in a mutual fund. All you need to do is specify the amount that you wish to invest in pounds and pence, and confirm the order. The funds will then be taken from your cash balance, and allocated into the fund.

From then on, any dividend payments that the fund distributes will likely be reflected in your brokerage account every three months. When it comes to withdrawing your funds back out – you can do this at the click of a button. But, don’t forget that a redemption period/fee might apply.

Conclusion

In summary, mutual funds are okay if you want to invest in stocks and shares – but you have no idea where to start. They are also okay if you want to diversify across hundreds of different companies – and invest in a 100% passive manner. The most challenging part is knowing which mutual fund to invest in, as hundreds exist. Whether that’s a fund targeting dividends, emerging markets, growth, or sector-specific companies – there’s plenty to choose from.

FAQs

What is the difference between a mutual fund and an ETF?

Both are actually very similar, as they both allow you to invest in a basket of shares through a single trade – and they are 100% passive. The key difference is that ETFs are usually tasked with ‘tracking’ a specific market, while mutual funds will actively buy and sell assets. As such, mutual funds have much more flexibility in choosing what to invest in.

How are mutual funds traded?

Mutual funds are usually listed on a public exchange like the London Stock Exchange. This ensures that investors can enter and exit the market. The value of the mutual fund will go up and down in-line with its NAV.

Do mutual funds pay dividends?

If the mutual fund invests in companies that pay dividends, then you will be entitled to your share.

Kane Pepi

View all posts by Kane PepiKane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelor’s Degree in Finance, a Master’s Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy. Kane is also behind peer-reviewed publications - which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kane’s material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2024 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Mutual funds are offered by large financial institutions. They allow both retail and professional clients to invest money into the mutual fund, who in turn, will buy and sell shares on your behalf. Your money will be pooled together alongside thousands of other investors of all shapes and sizes – subsequently giving the mutual fund a multi-billion pound war chest.

Mutual funds are offered by large financial institutions. They allow both retail and professional clients to invest money into the mutual fund, who in turn, will buy and sell shares on your behalf. Your money will be pooled together alongside thousands of other investors of all shapes and sizes – subsequently giving the mutual fund a multi-billion pound war chest. Once again, the example above is somewhat arbitrary, as there are many variables that will dictate how much you can earn in dividends.

Once again, the example above is somewhat arbitrary, as there are many variables that will dictate how much you can earn in dividends. Once you have assessed the type of mutual fund that you wish to invest in, not only do you need to assess how much to invest, but also the frequency. For example, some UK investors simply choose to invest a one-off lump-sum and then allow the mutual fund to do its thing for a number of years.

Once you have assessed the type of mutual fund that you wish to invest in, not only do you need to assess how much to invest, but also the frequency. For example, some UK investors simply choose to invest a one-off lump-sum and then allow the mutual fund to do its thing for a number of years.