Best Investment Platforms UK

Did you know there are tons of investment platforms UK that offer low-cost trading on heaps of markets? With such a wide range of popular UK investment platforms to choose from, making the right choice is easier said than done.

At the same time, it also means that with the right type of research you can find the most popular investment platform that suits your trading needs and goals. We’ve reviewed some popular investment platforms UK in 2022.

Key Points on the most popular Investment Platforms UK

- The most popular investment platforms UK give you access to a wide range of markets on a low-cost basis.

- Trading fees are one of the key metrics to consider when choosing the most popular investment platforms UK

Popular Investment Platforms UK

- Fineco

- Plus500

- Pepperstone

- AvaTrade

- IG

- Hargreaves Lansdown

- Interactive Investor

- AJ Bell

Popular Investment Platforms UK Reviewed

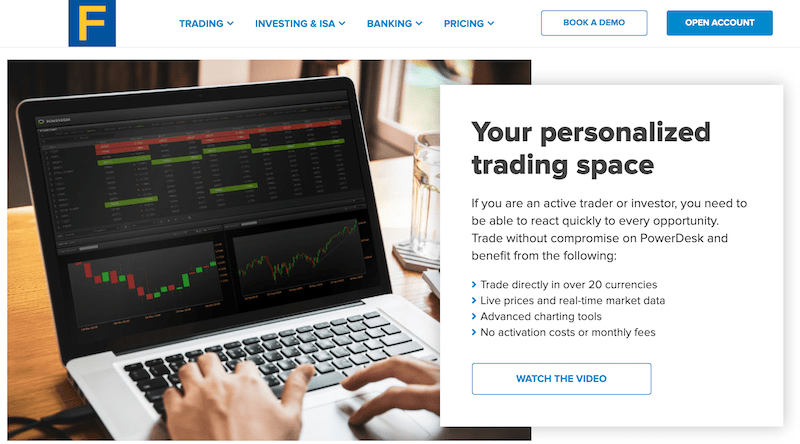

1. FinecoBank

Crucially, Fineco has online trading services for all levels of traders. As such, users can use the bank’s web trading platform, mobile app, or a professional trading platform known as PowerDesk. Plus, the broker gives you access to real-time stock screeners and plenty of trading tools and features.

Sponsored ad. 65.69% of retail investor accounts lose money due to CFD trading with this provider.

| Assets Available | Pricing Structure | Price for Amazon | Investment Tools |

| Shares, ETFs, currencies, CFDs, futures, options, indices, commodities, and bonds | Depending on the asset – commission for buying outright. CFDs – no commission, only spreads | £2.95 per trade | PowerDesk trading platform, stock trading screeners |

2. Plus500

Another investment platform UK that has gained popularity among traders and investors across the world is Plus500.

In terms of regulation and the safety of funds, Plus500 is regulated by the FCA and by other regulators. Further, it is a public listed company on the London Stock Exchanges and one of the most reputable brokers in the world.

| Assets Available | Pricing Structure | Price for Amazon | Investment Tools |

| Over 2000 assets – stocks, FX currency pairs, commodities, indices, ETFs, and cryptocurrencies | Only spreads | No commission. Only spread of 24.01 | A mobile app, negative balance protection, email and push notifications |

3. Pepperstone

Most important of all, Pepperstone is a no-dealing desk investment platform that operates through straight-through processing (STP) and electronic communication network (ECN) networks. This means that this online broker is able to offer zero spreads and charge low fixed trading fees by connecting users to liquidity providers.

Overall, Pepperstone is one of the most popular investment platforms UK due to the selection of trading platforms, trading tools, and the trading terms it provides. This includes a high leverage ratio, fast market execution, zero spreads, and more. To get started, the broker maintains a minimum deposit requirement of 200 GBP.

Sponsored ad. 76.6% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

| Assets Available | Pricing Structure | Price for Amazon | Investment Tools |

| Over 1000 instruments – stocks, FX currency pairs, commodities, indices, ETFs, and cryptocurrencies | Zero spreads and commissions/ only spreads | $7 round turn per lot | CopyTrade, CopyPortfolios, unlimited demo account |

Most Popular UK Investment Platforms Comparison

Below, we compare the most popular investment platforms UK showing the key strengths of each platform and the most important factors you need to consider when you choose the most popular investment platform UK. With this convenient comparison table, you’ll be able to compare the most popular investment platforms UK against one another.

| Most Popular Investment Platforms UK | Investment Assets | Pricing Structure | Price for Investing in Amazon | Yearly Platform Fee | Investment Tools |

| Fineco | Shares, ETFs, currencies, CFDs, futures, options, indices, commodities, and bonds | Spreads and fixed fees (depending on the type of asset – CFDs or outright) | Outright – £2.95 per trade

CFDs – only spreads |

PowerDesk, stock screeners. | |

| Plus500 | Over 2000 – stocks, forex, indices, commodities, cryptos, ETFs, and options | Spreads | 24.01 spread | None | A mobile app, negative balance protection, email and push notifications |

| Pepperstone | Over 1000 assets – forex, indices, commodities, ETFs, and equities. | Zero spreads and commissions/only spreads | $7 round turn per lot | None | Fast execution, ECN online brokerage firm, social trading, MT4/MT4, and cTrader |

| AvaTrade | Over 1250 assets – forex, stock, bonds, cryptos, ETFs, indices, commodities, FX options | Spreads | 0.13% spread | None | Automated trading tools, social trading tools, MT4/MT5 |

| IG | Over 17,000 markets – forex, indices, shares, commodities, cryptocurrencies, bonds, ETFs, interest rates, and options | Spreads and commissions | $0.02 per share | None | Trading alerts, algorithmic trading tools, spread bet |

| Hargreaves Lansdown | Over 8000 shares, 3000 funds, spread betting, CFDs, ISAs, investment trusts, mutual funds | Between £5.95 to £11.95 per trade | £11.95 per trade | 0.45% per annum on the first £250,000 of funds,

0.25% per annum between £250,000 and £1m, 0.1% per annum above £1m |

Ready-made portfolios, Spread betting, and CFDs |

| Interactive Investor | 40,000 assets | A fixed monthly platform fee that starts from £9.99 per month | £7.99 for the investor plan. £4.99 for the super investor plan | Depending on the plan. | Quick start funds, mobile trading app |

| AJ Bell | Self Invested Personal Pension (SIPP), ISAs, Lifetime ISAs, Junior ISAs, shares and funds, ETFs | Starts from £1.50 with a maximum charge of £9.95 | £9.95 | None | Managed portfolios and funds, IPOs, share dealing account |

Important Features of Investment Platforms in the UK

Before you sign up for an online trading account at one of the most popular investment platforms UK on our list, there are essential factors that some investors take into account.

Range of Investment Assets

In this sense, some traders prefer to focus on 1-3 instruments while others like to explore the markets and constantly find new opportunities. As such, you need to decide how you want to trade the markets and based on that, choose the right investment platform for you.

Fees

Generally, when you register for one of the investment platforms listed in this guide, you need to pay fees for executing your trades as well as management fees. To ensure you’ll be able to focus on trading rather than on the costs you pay for your brokerage firm, it is crucial to find the cheapest investment platform.

With this in mind, you need to understand the difference in each type of investment platform.

Investment Resources & Tools

As we previously mentioned, each stock broker offers different investment platforms, features, and investment options.

Customer Service

At last, having customer support service can be really helpful, especially when you are dealing with money. As such, you want to ensure that the investment platform you choose has 24/7 customer support and investment advisors. Also, you need to ensure that the response time is short and the broker offers several communication channels like email, phone number, and live chat.

Most Popular Investment Platforms UK – Conclusion

To sum up, choosing the most popular investment platforms UK for your needs is an important decision that may have a long-term impact on your investment success. Very often, investors sign up to more than one investment platform to explore the key features of each platform and eventually, if necessary, transferring all the funds to the most popular investment platform of all.