Proof-of-Stake (PoS) is quickly becoming the dominant consensus mechanism for blockchains because it is fast, secure, and environmentally friendly. It also incentivizes users to play an active role in securing networks through staking by providing them with staking rewards.

Staking rewards are now a major source of passive income for many crypto investors, and PoS tokens are often more valuable because of the income they provide. In this guide, we’ll highlight the best Proof-of-Stake cryptocurrencies to buy now and explain everything investors need to know about PoS tokens and staking.

Ethereum BNB Solana TRON Cardano Avalanche Toncoin Polkadot Aptos NEAR Protocol Gate Cosmos Hub Algorand Celestia Injective The Graph

#

Coin

Price

24h %

Market Cap

Volume

24h Range

1

![]() Ethereum

ETH

Ethereum

ETH

$2,766.77

2.84%

$333,954,336,954

$31,590,203,499

2

![]() BNB

BNB

BNB

BNB

$669.11

1.29%

$97,604,127,323

$954,753,017

3

![]() Solana

SOL

Solana

SOL

$166.15

4.85%

$87,370,792,449

$5,119,700,161

4

![]() TRON

TRX

TRON

TRX

$0.29

1.47%

$27,554,078,081

$753,560,137

5

![]() Cardano

ADA

Cardano

ADA

$0.72

3.45%

$25,940,364,910

$805,901,251

6

![]() Avalanche

AVAX

Avalanche

AVAX

$22.04

1.62%

$9,287,031,487

$557,961,038

7

![]() Toncoin

TON

Toncoin

TON

$3.23

-2.02%

$7,951,395,524

$340,156,755

8

![]() Polkadot

DOT

Polkadot

DOT

$4.32

5.00%

$6,583,219,828

$330,516,899

9

![]() Aptos

APT

Aptos

APT

$5.16

5.09%

$3,253,934,259

$180,062,238

10

NEAR Protocol

NEAR

$2.62

3.74%

$3,202,031,442

$199,670,586

11

Gate

GT

$18.50

1.10%

$2,244,401,419

$6,260,208

12

Cosmos Hub

ATOM

$4.53

2.64%

$2,055,824,165

$143,477,314

13

Algorand

ALGO

$0.21

4.22%

$1,784,111,367

$74,042,354

14

Celestia

TIA

$2.18

2.53%

$1,458,175,526

$130,187,704

15

Injective

INJ

$13.37

-2.77%

$1,303,878,640

$131,725,187

16

The Graph

GRT

$0.10

4.74%

$964,215,685

$56,489,007

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Top Proof of Stake Coins to Invest In

Here are the 5 best PoS tokens to invest in today for passive income.

1. Ethereum ($ETH)

Ethereum Price Chart

(ETH)Ethereum (ETH)

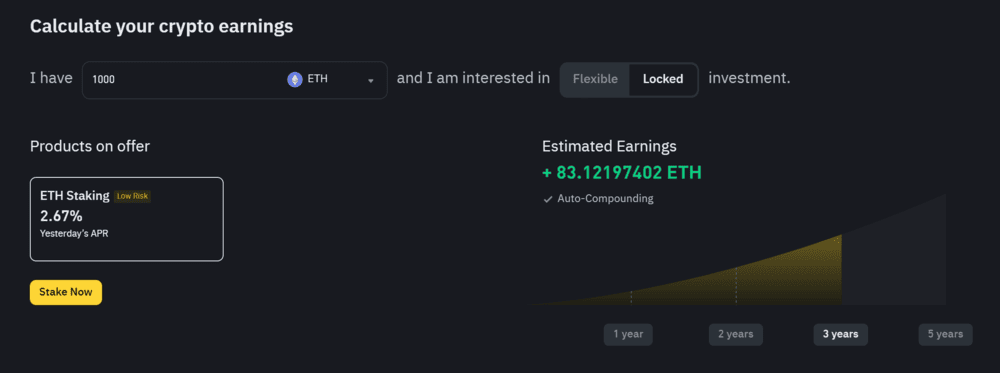

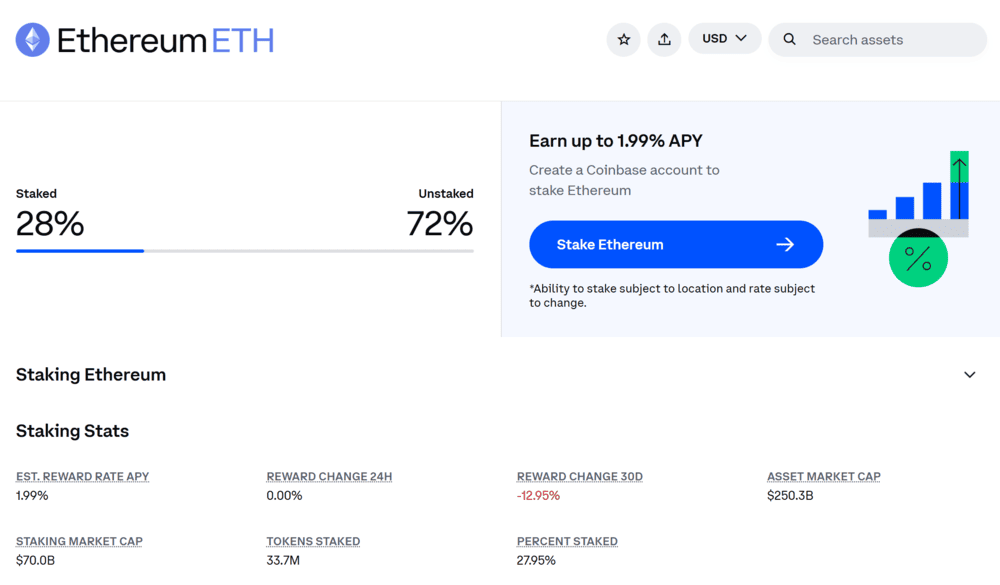

Ethereum ($ETH) is the largest PoS cryptocurrency on the market by a wide margin. While the Ethereum blockchain originally operated using the same Proof-of-Work security architecture as Bitcoin, it switched to the eco-friendly Proof-of-Stake and initiated staking rewards in 2022 in an event known as The Merge.

Individual investors can stake Ethereum in several ways. First, large $ETH token holders can establish a node on the network and become approved as a validator, thus reviewing transactions and collecting $ETH staking rewards directly. Alternatively, most decentralized finance (DeFi) platforms and major crypto exchanges offer $ETH staking pools. Investors can lock $ETH into these pools to be used for PoS transaction validation and receive a share of the staking rewards.

Ethereum’s large market capitalization — and its inclusion in traditional ETFs available to Wall Street investors — means that its price tends to be less volatile than many other PoS coins. This can be advantageous for investors looking primarily for staking income without the price volatility that normally accompanies cryptocurrencies. However, $ETH staking rewards typically range from only 2%–5% APY, much less than for alternative PoS tokens.

Find out more about Ethereum

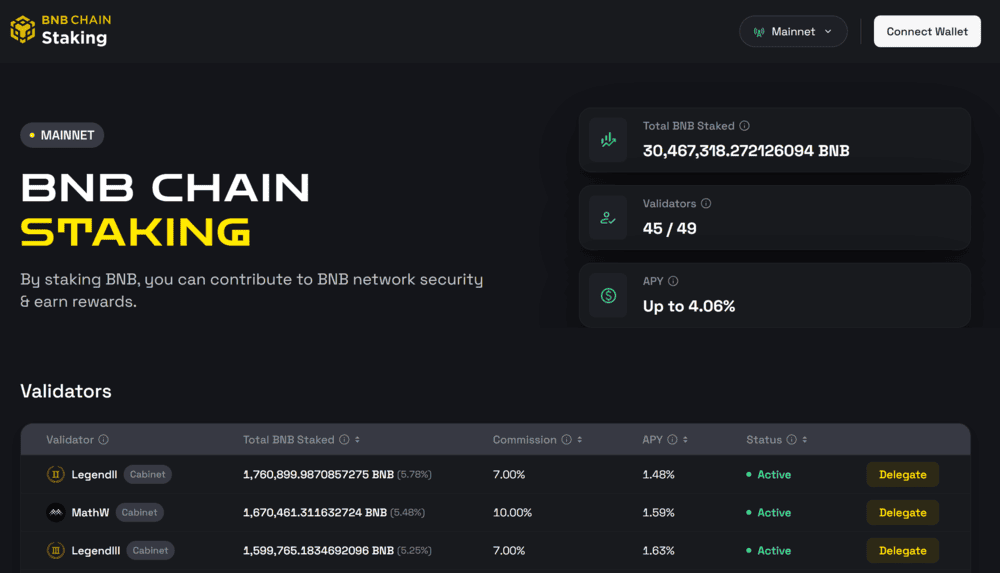

2. Binance Coin ($BNB)

BNB Price Chart

(BNB)BNB (BNB)

Binance Coin ($BNB) is the second-largest PoS token and is used to secure BNB Smart Chain. It typically offers rewards rates ranging from 4%–12% APY, making it a slightly more high-yield alternative to $ETH while still maintaining relatively low volatility compared to other tokens. However, $BNB staking isn’t supported by quite as large a range of crypto staking platforms as $ETH staking.

In addition to staking rewards, $BNB also confers benefits like discounts and early access to new tokens at Binance, the world’s largest crypto exchange. So, it can be a very worthwhile PoS token for investors who want to collect income while also trading other cryptocurrencies at Binance.

Notably, the price of $BNB is highly dependent on use of BNB Smart Chain and transaction volume at Binance. So, it can be very cyclical with crypto bull and bear cycles as well as sensitive to news about Binance.

Find out more about Binance Coin

3. Solana ($SOL)

Solana Price Chart

(SOL)Solana (SOL)

Solana ($SOL) is one of the hottest PoS blockchains and an up-and-coming competitor to Ethereum and BNB Smart Chain. The market capitalization of $SOL exceeded that of $BNB for much of 2023 and 2024, although Solana tends to be more volatile and more vulnerable during market downturns.

The upside of this increased volatility is that $SOL investors can earn relatively high staking rates for their tokens — generally between 5% and 15% APY. That’s in addition to potential gains in the value of the $SOL token itself. In 2024, the price of $SOL jumped more than 85%, far outpacing gains in the broader crypto market.

Solana is a hub for DeFi activity, so it’s straightforward to find staking pools that accept $SOL. In addition, the blockchain’s central role in meme coin trading means that $SOL tends to fare better than the rest of the market during bull cycles, which could be good news for investors looking to capitalize on the next upswing.

Find out more about Solana

4. Cardano ($ADA)

Cardano Price Chart

(ADA)Cardano (ADA)

Cardano ($ADA) is another PoS blockchain designed as an ultra-fast and scalable competitor to Ethereum. It launched in 2017 at the height of the crypto ICO boom and was one of the biggest winners of the 2021 bull cycle — but it has had a difficult time recovering since the crypto winter set in. Still, $ADA remains the 4th largest PoS token by market cap with a valuation of more than $26 billion.

Cardano’s staking rewards are somewhat low relative to the token’s volatility. Investors can expect to earn 2%–7% APY. However, this might reflect the token’s potential growth. With $ADA trading 75% below its all-time high, there’s plenty of room for price appreciation in the $ADA token itself to supplement staking income.

One interesting thing about Cardano is that its PoS transaction validation solution is slightly different from other blockchains. It uses a system called ‘Ouroboros,’ which is the first mathematically provable secure PoS system. Cardano is also more energy-efficient than other PoS blockchains, which could be an advantage in an energy-limited future.

Find out more about Cardano

5. Avalanche ($AVAX)

Avalanche Price Chart

(AVAX)Avalanche (AVAX)

Avalanche ($AVAX) is a PoS blockchain that offers high transaction speeds, better scalability than many competitors, and staking rewards ranging from 4%–14% APY. Many investors favor it as a more flexible blockchain than Ethereum or BNB Smart Chain, although its smaller market cap and user base also means that the price of the $AVAX token is more volatile.

An important thing for crypto income investors to note about $AVAX is that while it offers above-average rewards rates, staking pools for $AVAX are not available everywhere. Only some centralized exchanges and DeFi protocols offer staking on $AVAX. Investors may need to use DeFi platforms built on Avalanche to get the best rates.

On the bright side, it’s relatively easy to become a validator on the Avalanche blockchain. The hardware and $AVAX holding requirements are low, so even average investors can set up a node and begin validating transactions. This is a good way for investors to be involved directly in the validation process and maximize their staking income.

Find out more about Avalanche

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

What Is Proof-of-Stake and How Does It Work?

Proof-of-stake is a consensus mechanism that many blockchains use to validate transactions and ensure network security. It’s an alternative to Bitcoin’s mechanism, which involves ‘mining’ blocks through a computationally expensive process of guessing keys.

In PoS, participants can stake their cryptocurrency tokens to the blockchain as collateral. Then, several participants with staked tokens are randomly chosen to validate an upcoming set of blocks.

Validators are supposed to act faithfully to approve legitimate transactions and reject falsified or insecure transactions. If all validators do this, consensus on new blocks should be reached quickly.

In that case, each validator will receive new tokens from the blockchain as a reward. These new tokens are known as staking rewards. Validators will also have the ability to unstake their original tokens, taking back their collateral.

On the other hand, if validators act unfaithfully and fail to approve transactions or try to approve illegitimate transactions, their submission to the network will not reach consensus with the other (faithful) validators. In that case, the unfaithful validator will not receive rewards and will lose the tokens they staked as collateral. This system strongly incentivizes validators to act faithfully.

An important variation on this traditional PoS system is Delegated Proof-of-Stake (DPoS), which is used by networks like EOS, Tron, and Steem. In DPoS, validation works the same way, but validators are chosen through a vote by token holders rather than at random. This method is not as secure since malicious validators may be able to pay for votes. Still, it does enable token holders to steer additional staking rewards toward their favored validator and staking pool.

Another variation PoS token investors should be aware of is liquid staking. In liquid staking, participants who stake coins in the network receive tokens representing their staked tokens in return. These liquid staking tokens (LSTs) can be used to redeem the original tokens when they become available to be unstaked. In the meantime, LSTs can be traded or used to pay for digital goods and services, enabling staking participants to utilize the value they own even while taking part in PoS validation.

Benefits of Investing in PoS Coins

The main benefit to investing in PoS coins is that they offer the possibility of staking rewards, which are essentially passive income you get just for holding tokens. While a downside of staking has long been that it requires investors to lock up their tokens for long periods of time, that barrier has now been removed thanks to liquid staking. In effect, investors can earn passive income while still being able to utilize the value of their tokens.

Unlike crypto mining, earning income through PoS has a very low barrier to entry. Token holders don’t need expensive hardware to get involved — or even any hardware at all. Investors can start staking just by contributing tokens to a staking pool, which is connected to one or more validator nodes.

Importantly, thanks to the validation process, PoS chains are highly secure and decentralized. So, investors can feel confident in the underlying value of their tokens and build a sense of community by being involved in securing a network.

Proof of Stake vs Proof of Work

It’s worth taking a closer look at how PoS differs from Proof-of-Work (PoW) coins, the security validation mechanism used by the Bitcoin blockchain.

In PoW, ‘miners’ compete to guess the cryptographic hash key of a block. Correctly guessing this key validates the block, adds it to the blockchain, and unlocks token rewards for the miner who guessed correctly.

This process is incredibly energy-intensive because it requires computers worldwide to constantly guess hash keys. According to some estimates, the PoS validation mechanism uses 99% less energy than PoW. This is increasingly important since some countries and US states have limited the crypto industry’s ability to use large amounts of power for mining.

Another important difference involves who can participate in staking vs. mining. With PoS, anyone can stake tokens — either to a staking pool or through their own validator node — with no or relatively little hardware. This makes it easy for ordinary individuals to participate in staking and earn income.

Mining, on the other hand, is highly competitive and requires very expensive computational hardware. It costs tens of thousands of dollars in setup costs to assemble the infrastructure to mine Bitcoin, and then there are large ongoing costs for the energy required to run that infrastructure. This means that Bitcoin mining is largely inaccessible to ordinary investors and is limited to large companies with access to large amounts of capital.

Importantly, there are also some differences in how secure and decentralized PoS and PoW systems are. PoW is generally considered more secure because it’s more difficult for one person or group to assemble enough computational power to alter and validate an illegitimate block successfully.

A PoS blockchain consensus mechanism is more prone to manipulation if multiple unfaithful validators work in tandem. However, this is highly unlikely in large networks since validators are randomly chosen. There are no known instances of major PoS blockchains being manipulated in this way.

How to Stake Proof-of-Stake Coins

Staking PoS tokens can seem complex at first, but it’s actually relatively easy and flexible. We’ll take a closer look at several ways to stake tokens and explain some key terms investors need to know.

Best Ways to Stake PoS Cryptos

There are many different ways to stake PoS crypto tokens and start earning rewards. Let’s dive into the three most common approaches.

Staking on Centralized Exchanges

Many centralized crypto exchanges — like Binance, Coinbase, and Kraken — enable users to stake popular tokens like $ETH instantly. Users just need to own the token and then opt into staking.

Note that some exchanges offer different staking pools. Fixed staking pools are locked for a period of time, like 30 days. If investors withdraw their staked coins before this time ends, they will not receive rewards. Flexible staking pools allow investors to withdraw their staked tokens anytime with no lock-up periods. In general, flexible staking offers much lower rewards than fixed staking.

Staking Through Non-Custodial Wallets

Many non-custodial wallets or self-custody wallets — like Best Wallet, Ledger, MetaMask, and Trust Wallet — also offer built-in staking pools. Just like exchanges, these staking pools can be fixed or flexible.

Running a Validator Node

Individuals who want to participate in the validation process separately can set up a validator node on a blockchain. This typically requires a minimum amount of hardware and a large tranche of tokens to be staked. Running a validator node also involves long-term token locks, with few options for unstaking tokens before the lock period is up.

The benefit of running a validator node is that participants don’t have to share their staking rewards with others in a pool. If they are chosen as a validator and receive staking rewards, they keep all the tokens.

Staking Rewards and APY Explained

Most pools for staking rewards describe the returns investors can expect in APY, which is an easy way to estimate the number of tokens a user will receive. However, staking rewards are much more complex in practice, and APYs can fluctuate frequently.

The blockchain determines the rewards for successfully validating any given block. Most major PoS networks calculate the reward based on the total token supply in circulation and a predetermined inflation rate. However, with each new reward, the total supply changes, so the staking rewards change slightly, even if the inflation rate remains the same.

When using a staking pool, there’s another layer to navigate: the pool itself. A single participant’s staking rewards will depend on what fraction of tokens in the pool came from them. As more tokens are added to the pool, their fraction of staking rewards can shrink.

Given these variables, investors can use a few strategies to maximize their staking profits while minimizing risk. First, it’s a good idea to diversify a staking portfolio across multiple tokens. This protects investors against declining rates in any single blockchain due to a change in inflation rate or a large increase in the token supply.

Second, investors must choose their staking pool carefully. Consider the size of the pool and the commissions the validator is taking care of. Validators with more nodes can generally offer higher rates than validators with fewer nodes since they are more likely to be chosen to participate in consensus.

Liquid Staking vs. Traditional Staking

Liquid staking offers another way for investors to maximize the value they get from staking. It enables staking participants to continue to leverage the value of tokens even when they are locked to a staking pool or validator node. For example, with liquid staking, PoS token holders whose tokens are locked can leverage LSTs as collateral for a crypto loan or even re-stake those LSTs to another pool to boost their interest.

Liquid staking depends on DeFi platforms like Lido and Rocket Pool, which issue LSTs when users stake their PoS tokens in their pools. These platforms also have tools to help users use their LSTs, including crypto loan marketplaces and integrations with decentralized crypto exchanges for trading.

However, liquid staking does carry additional risks. LSTs can be redeemed for staked tokens when they become unlocked, but not until then. So, if a PoS coin’s price falls sharply, the value of an LST can plummet even faster since there’s no way to sell off the underlying PoS coin. In addition, LSTs for certain coins can have low liquidity, making them difficult to trade.

Another risk is that the staked tokens linked to an LST could be slashed. This happens when a validator acts unfaithfully and the network takes their stakes tokens as collateral. In the event that the tokens linked to an LST are slashed, the LST itself becomes worthless.

Latest Market News

Risks of Investing in PoS Coins

While PoS coins can be a valuable source of passive income and profits for investors, these tokens also come with risks. It’s important for investors to fully understand PoS token risks so they can make decisions about what’s right for their portfolio.

Validator Risks and Slashing Penalties

One key risk of staking is that if validators act unfaithfully, they will lose the tokens they staked as collateral. This is known as slashing.

Individuals who set up their own validation nodes stand to lose their own tokens through slashing. However, staking pool participants can also lose tokens to slashing since their staked tokens are used by validators as collateral.

The best way to mitigate this risk is to choose a reliable validator. Only stake tokens to well-known staking pools with a long track record of providing returns without slashing penalties.

Staking Lock-Up Periods

Lock-up periods on staked tokens can also present a risk to investors, especially if the PoS tokens they are staking are volatile. A token’s price can drop while it is staked, resulting in an overall negative return, even if the investor’s token holdings increase thanks to staking rewards.

Think carefully about the risk of locking up tokens for an extended period when comparing APYs across different staking pools with different lock-up periods. Some blockchains, including Solana and Cardano, offer fully flexible staking even for validators. PoS tokens for these chains never have lock-up periods.

Comparing PoS to PoW for Investors

It’s also worth considering how long-term returns for PoS tokens could compare to PoW tokens. PoS is slightly less secure than PoW because validators could potentially coordinate to act maliciously. An attack on one PoS blockchain could send a shockwave through the crypto market since all other PoS networks would likely be vulnerable.

However, PoW’s extremely high energy consumption also poses risks. Regulators have cracked down on energy use for crypto mining, which could pose a long-term threat to PoW returns if the cost of mining becomes too onerous. In addition, the increasing exclusivity of crypto mining means that networks are less decentralized than they once were.

Ultimately, it’s impossible to say with certainty whether PoS or PoW tokens offer more potential. Investors may want to consider building a diversified portfolio that includes both types of cryptocurrencies.

What’s Next for Proof-of-Stake Crypto?

PoS cryptocurrencies have grown tremendously in popularity in recent years, and staking is now a major part of the crypto market. So, what’s next for PoS tokens? We’ll cover a few key trends.

How Ethereum’s PoS Shift Impacts the Market

Ethereum switched from PoW to PoS in a major transition known as The Merge in 2022. Since then, $ETH has been the largest PoS cryptocurrency and has encouraged the widespread adoption of staking. Virtually all major crypto exchanges and DeFi platforms are now $ETH staking platforms, and there have been discussions about how Ethereum ETFs could offer staking in the future.

Ethereum’s transition to PoS created a lot of competition for other PoS blockchains like BNB Smart Chain and Solana, which had seemed positioned to outgrow Ethereum as the largest smart contract networks. However, Ethereum now seems likely to maintain its dominance and could gain more interest from traditional financial institutions.

Sustainability and Regulatory Factors

One of the major advantages of PoS blockchains over PoW is that they require far less energy to maintain. After Ethereum switched from PoW to PoS, the network’s energy consumption was estimated to have declined by more than 99%.

That’s a big deal since PoW blockchains — and particularly Bitcoin — are in the sights of energy regulators. While some crypto industry experts argue that energy demand for PoW mining has spurred green energy development, regulators frequently see PoW as an energy hog that is taking away power from more ‘productive’ industries.

This is a major reason why nearly all new blockchains use PoS or similar consensus mechanisms rather than PoW. PoS could ultimately be adopted as a standard for the crypto industry as a way for this sector to reduce energy consumption and improve sustainability.

Innovations in PoS and Staking Technology

PoS transaction validation remains relatively new, and many improvements are still being made to the technology. For example, a number of projects have recently introduced cross-chain staking solutions that enable investors to stake tokens on one blockchain and receive staking rewards on another. This can increase liquidity and get more participants involved in staking, increasing decentralization.

Another technological improvement is the incorporation of artificial intelligence (AI) into staking. AI can help investors optimize staking rewards and better detect malicious activity by validators.

Variations on PoS are also being explored. We discussed DPoS, which involves token holders voting for specific validators rather than validators being chosen at random. Other variations include Pure Proof of Stake (PPoS), in which validator requirements are so low that anyone can be selected as a validator, and Hybrid Proof of Stake (HPoS), which combines elements of PoS and PoW.

Proof-of-Stake FAQs

What are the best Proof-of-Stake coins to invest in?

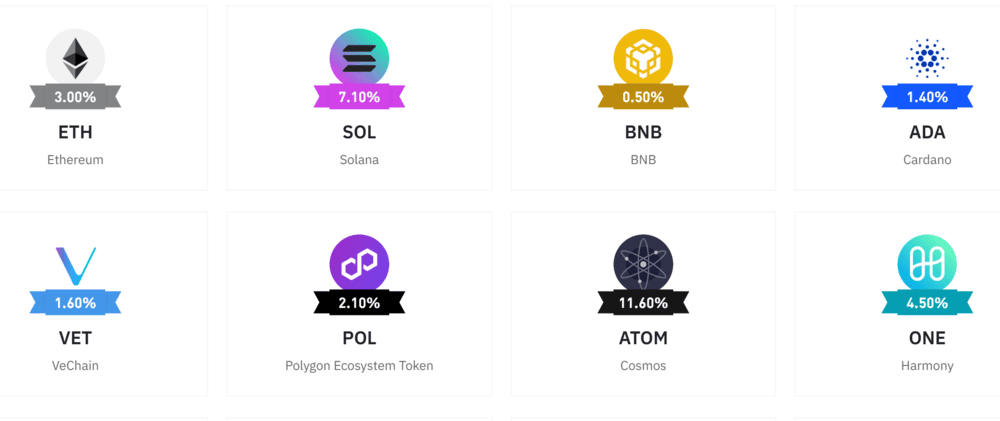

The best Proof-of-Stake (PoS) cryptocurrencies to invest in now are Ethereum ($ETH), Binance Coin ($BNB), Solana ($SOL), Cardano ($ADA), and Avalanche ($AVAX). These tokens can be staked through most major exchanges or crypto wallets and offer staking rates ranging from 2%-15% APY.

How does staking work in PoS cryptocurrencies?

Staking a Proof-of-Stake (PoS) cryptocurrency involves putting it up as collateral to validate transactions on the blockchain. Validators receive staking rewards if they come to consensus, but lose their staked tokens if they act unfaithfully or try to manipulate transactions. Individuals can participate in staking by setting up their own validator node or contributing to a staking pool run by another validator.

Which PoS coins offer the highest staking rewards?

New and emerging PoS tokens typically offer the highest staking rewards due to low circulating supply and high inflation. Among major PoS blockchains, Solana and Avalanche stand out with staking returns ranging from 4% to 15% APY.

Is staking PoS crypto safe?

Staking PoS cryptocurrencies can be safe if you choose a trusted validator, such as a major exchange. However, risks still exist — tokens may lose value, and slashing penalties can occur if a validator acts dishonestly.

What is the difference between staking and mining?

Staking is used in PoS blockchains like Ethereum, where validators lock up tokens to help validate transactions. Mining is used in PoW blockchains like Bitcoin, where miners use computing power to solve complex puzzles and earn rewards. Staking requires collateral; mining requires electricity and hardware.

Can I unstake my PoS coins anytime?

It depends on the blockchain. Solana and Cardano allow flexible unstaking, but Ethereum and others may require lock-up periods. Some staking pools offer more flexible terms, usually with lower returns.

What happens if a validator gets slashed?

If a validator gets slashed, their staked tokens may be lost due to misbehavior or negligence. If you’ve staked through their pool, you could share in that loss. Slashed tokens are usually burned or redistributed to honest validators.

Are PoS coins more secure than PoW coins?

PoS and PoW blockchains offer similar security, both relying on decentralization to prevent manipulation. Security depends more on network size and validator/miner integrity than the consensus mechanism alone.

What are the risks of staking cryptocurrencies?

Key risks include slashing penalties, which can cause token loss, and lock-up periods, which can prevent you from selling if the market turns. Price drops can also outweigh staking gains.

Can you lose money staking PoS coins?

Yes. If a validator gets slashed or the token’s market price drops significantly while it is locked up, you could lose money. Always weigh potential rewards against these risks.

References

- Understanding Ethereum’s Major ‘Merge’ Upgrade (Reuters)

- What is liquid staking and why does it matter? (CNBC)

- Shaping the future of Ethereum: exploring energy consumption in Proof-of-Work and Proof-of-Stake consensus (Frontiers in Blockchain)

- Can Bitcoin mining increase renewable electricity capacity? (Resource and Energy Economics)