Crypto nodes are specialized computers that maintain blockchain networks by validating transactions. They store the distributed ledger and enforce consensus rules. Nodes are the critical infrastructure enabling decentralized networks to function without central authorities. In 2025, there are over 18,000 Bitcoin nodes and 9,000+ Ethereum nodes securing these networks worldwide.

In this article, we examine what crypto nodes are, how they work in blockchain systems, and why they’re essential for network security. You’ll discover the different types of nodes, their specific functions, and practical steps for running your own node to enhance privacy and contribute to blockchain decentralization.

Key Takeaways

What Is a Crypto Node?

A crypto node is any computer or device that connects to a blockchain network, maintaining an up-to-date copy of the ledger and ensuring network rules are followed. Each node independently stores identical copies of the blockchain while running validation protocols to verify incoming data against consensus rules. This creates a resilient system that remains synchronized without requiring trust between participants.

The term “node” comes from the network theory concept of connection points in distributed systems. In blockchain, nodes form a peer-to-peer network where each participant is equal; there is no hierarchical structure or central server. This architectural choice is fundamental to blockchain’s resistance to censorship and single points of failure.

From a technical perspective, a node consists of:

- Hardware components: Physical computing resources (CPU, RAM, storage, network interface)

- Blockchain client software: Protocol-specific implementation that defines the rules

- Network connectivity: Methods to discover and communicate with other nodes

- Cryptographic capabilities: Tools to verify digital signatures and transaction integrity

The combination of these elements allows nodes to independently validate the state of the network while remaining in consensus with other participants. We can say that this is a remarkable achievement in distributed systems design.

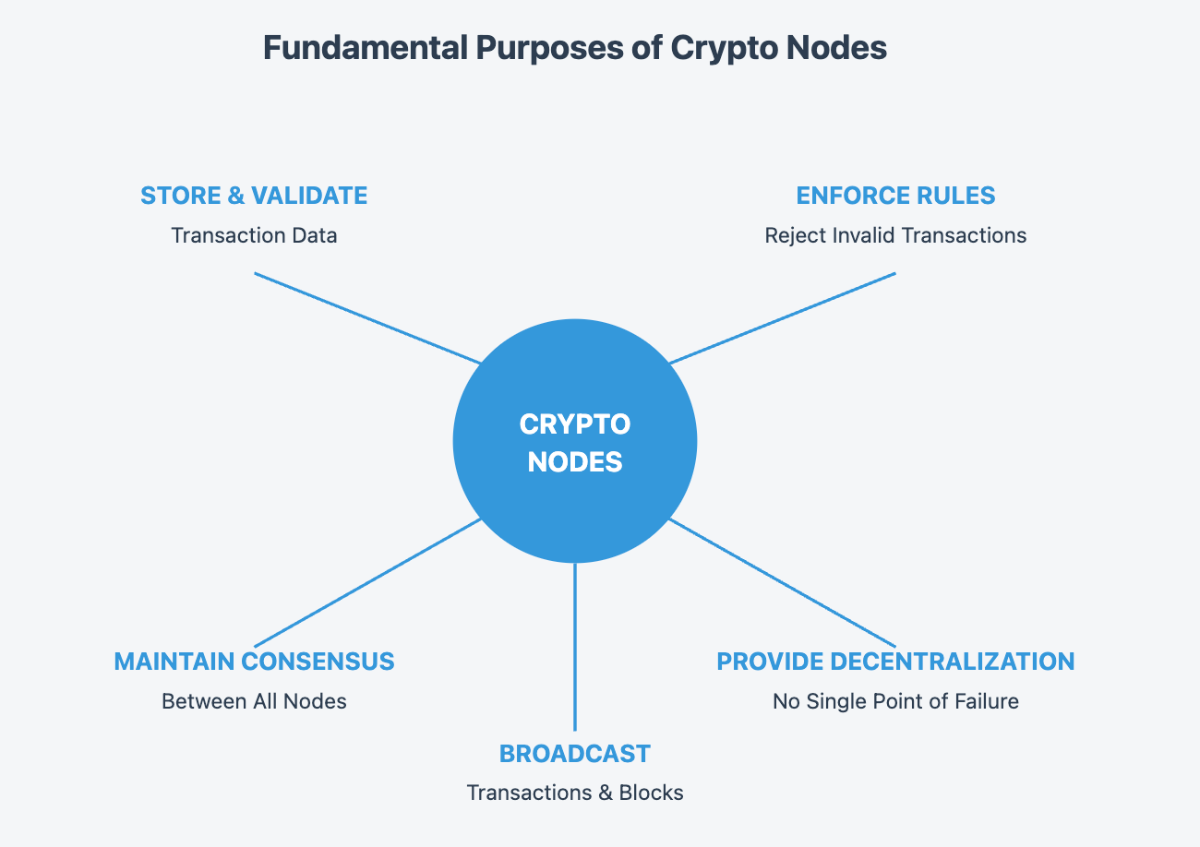

Crypto nodes have several fundamental purposes:

- They store and validate transaction data

- They communicate with other nodes to maintain network consensus

- They enforce protocol rules, rejecting invalid transactions

- They provide decentralization, preventing any single point of failure

- They broadcast new transactions and blocks throughout the network

Blockchains achieve results by distributing these responsibilities across thousands of independent devices. In this trustless system, transactions can occur without centralized intermediaries.

How Do Crypto Nodes Work In a Blockchain?

The functionality of crypto nodes revolves around maintaining the distributed ledger that forms the blockchain. When someone initiates a transaction, the following process unfolds:

- When you send cryptocurrency, your transaction is broadcast to nearby nodes on the network.

- Nodes check your transaction against established protocol rules, ensuring you have enough funds and that your digital signature is valid.

- Valid transactions enter the “mempool” (memory pool), where they await inclusion in the next block.

- Specialized nodes (miners or validators) bundle multiple transactions into blocks.

- Once created, new blocks are broadcast across the network from node to node.

- Nodes independently verify each new block, ensuring it follows network rules before adding it to their copy of the blockchain.

- After verification, nodes update their copy of the blockchain, maintaining synchronization across the entire network.

This distributed verification system makes blockchains remarkably resilient against tampering and fraud. With thousands of nodes all independently maintaining the same ledger, no single entity can alter transaction history without consensus from the majority of the network.

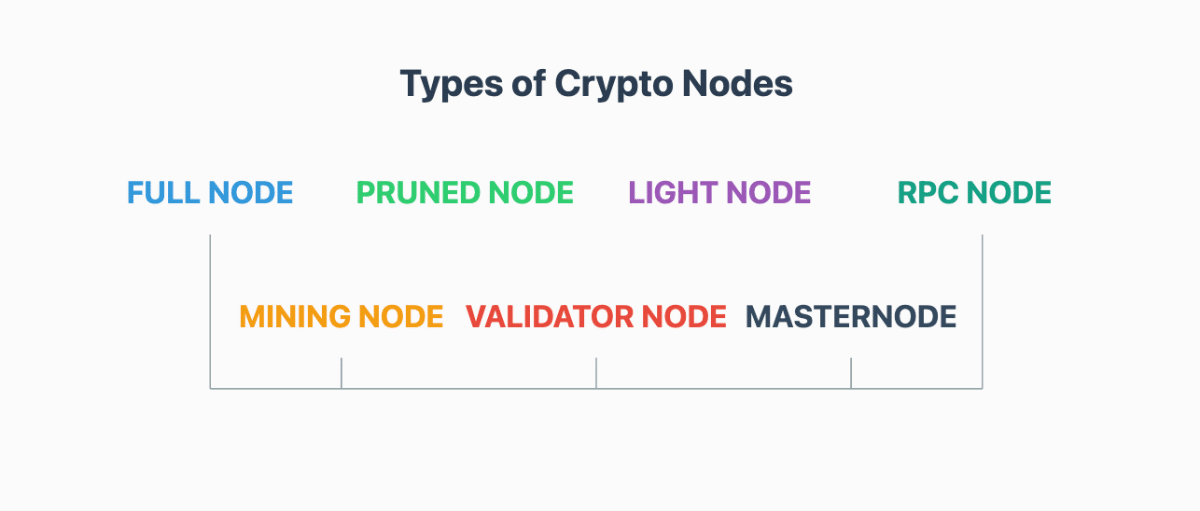

Types of Crypto Nodes

Blockchain networks use various types of nodes, each with specific functions. The architecture of node types varies between blockchain networks, as they are created with different design philosophies and technical requirements.

Bitcoin, Ethereum, Solana, and other major networks each implement their own node taxonomy based on their specific consensus mechanisms, throughput requirements, and security models.

Full Nodes

Full nodes store the entire blockchain from the genesis block to the present, making them the most comprehensive type of node. They:

- Independently verify every transaction using the network’s consensus rules

- Store a complete copy of the blockchain’s transaction history

- Relay valid transactions and blocks to other nodes

- Ensure the network remains decentralized and secure

Running a full node requires substantial storage space and processing power, but contributes to the network’s resilience.

Pruned Nodes

Pruned nodes offer a storage-efficient alternative to full nodes while maintaining essential validation capabilities. They begin by downloading the complete blockchain, then systematically delete older historical data while preserving critical metadata and block headers. By keeping only the most recent blocks based on user-defined storage capacity settings (typically 550MB-2GB), these nodes reduce disk requirements by 60-80% compared to full nodes.

Despite their lighter storage footprint, pruned nodes fully participate in transaction validation, consensus enforcement, and network security, making them ideal for users with limited storage who still want to contribute meaningfully to blockchain validation.

Light Nodes (SPV Clients)

Light nodes, also called Simplified Payment Verification (SPV) clients, make blockchain participation accessible on resource-constrained devices by dramatically reducing hardware demands. These efficient nodes download only block headers, typically less than 50MB compared to hundreds of gigabytes for full nodes, and rely on trusted full nodes for detailed transaction verification.

First described in Section 8 of the Bitcoin whitepaper, SPV technology enables mobile wallets and lightweight applications to interact with blockchains using just 1/1000th of the storage and bandwidth of full nodes. Though they sacrifice some verification independence, light nodes expand ecosystem participation by allowing everyday users to connect directly to blockchain networks through smartphones and low-powered computers.

The technical foundation for light nodes comes from Section 8 of the original Bitcoin whitepaper, where Satoshi Nakamoto described the SPV concept. The innovation lies in how light nodes verify transactions without downloading the entire blockchain:

- They download block headers (which are much smaller than full blocks)

- They verify the proof-of-work in each header to confirm the validity of the chain

- They request Merkle proofs from full nodes to verify that specific transactions are included in blocks

- They use these cryptographic proofs to establish transaction validity without downloading all transaction data

This elegant solution enables practical everyday use of cryptocurrencies on resource-constrained devices like smartphones while maintaining acceptable security trade-offs. Most mobile crypto wallets utilize this approach, which explains how they can function efficiently while connecting to blockchains that may contain hundreds of gigabytes of data.

Mining Nodes

Mining nodes form the backbone of proof-of-work blockchains like Bitcoin, converting electrical energy into network security through specialized hardware. These nodes compete to solve cryptographic puzzles requiring too much computational power, with Bitcoin’s mining network currently performing over 400 quintillion calculations per second.

When a mining node successfully solves the puzzle, it earns the right to create a new block, bundle waiting transactions, and receive rewards. Unlike lightweight nodes, miners must run full node software to validate transactions independently, ensuring they don’t waste resources on invalid blocks. This economic incentive system aligns miners’ profit motives with network security, making attacks prohibitively expensive.

Validator Nodes

Validator nodes power proof-of-stake networks like Ethereum with much less energy consumption than mining, using approximately 99.95% less electricity. Instead of competing through computational work, validators lock up (“stake“) significant cryptocurrency holdings as security deposits to participate in block creation.

The network randomly selects validators to propose and attest to new blocks based on their stake size, with larger stakeholders receiving proportionally more opportunities. Validators earn rewards of about 3-5% annually on their staked assets but face harsh penalties (“slashing”) for dishonest behavior, potentially losing up to 100% of their staked funds. This economic security model effectively replaces energy expenditure with capital commitment while maintaining robust protection against attacks.

Masternodes

Masternodes enhance blockchain functionality as they provide specialized services beyond basic transaction validation, enabling features like instant transactions, private sends, and enhanced governance. Originally pioneered by Dash in 2014, masternodes require operators to lock substantial cryptocurrency collateral, with requirements ranging from 1,000 DASH ($45,000) to 10,000 PIVX ($2,000) depending on the network.

This significant financial stake creates strong incentives for honest operation while funding annual returns between 5-25% for node operators. The masternode approach balances specialized service provision with decentralization principles, addressing advanced functionality needs without sacrificing network security. For cryptocurrencies like Dash, these second-layer nodes enable transaction speeds under two seconds, competing effectively with traditional payment processors.

RPC Nodes

Remote Procedure Call (RPC) nodes interface between blockchain networks and external applications. They:

- Expose API endpoints that applications can query

- Process requests for blockchain data

- Broadcast transactions to the network

- Enable functionality for wallets, exchanges, and dApps

Unlike consensus-participating nodes, RPC nodes focus on providing accessible interfaces for developers and applications. Major blockchain networks like Bitcoin and Ethereum designate specific communication protocols for RPC interactions, allowing developers to build applications without implementing low-level peer-to-peer network details.

Many blockchain service providers operate RPC infrastructure that developers can access through API keys, creating a critical layer of the web3 development stack. These services save developers from having to run their own infrastructure while potentially introducing centralization risks that users should be aware of.

Node Functions and Responsibilities

As we already mentioned, blockchain networks rely on nodes to maintain their integrity, security, and decentralization. Let’s examine the core functions these digital validators perform to keep cryptocurrency networks running smoothly.

Transaction Verification

When you send Bitcoin, Ethereum, or any cryptocurrency, your transaction doesn’t just appear in the recipient’s wallet. It first undergoes rigorous scrutiny by the network’s nodes.

Here’s how nodes validate transactions:

- Digital Signature Verification: Nodes first check that each transaction has been properly signed with the sender’s private key. This cryptographic verification ensures that only the rightful owner of funds can move them. Think of it as checking both the signature and ID on a check before cashing it.

- Balance Verification: Nodes confirm that the sender has enough funds to complete the transaction. By verifying against the sender’s transaction history, this prevents double-spending—the digital equivalent of bouncing a check.

- Protocol Compliance: Each transaction must conform to the blockchain’s specific ruleset. For Bitcoin, this means checking proper formatting, input and output values, and transaction size limits. Ethereum nodes additionally verify smart contract interactions and gas limitations.

A transaction only proceeds when it passes all these checks. This multi-layered verification process replaces traditional banking’s centralized authentication with a distributed trust model where thousands of independent nodes reach agreement on validity.

Block Propagation

Once transactions are verified, they don’t immediately become permanent. They must first be packaged into blocks and propagated throughout the network. This process follows several steps:

- Mining or validator nodes gather verified transactions from the mempool (transaction waiting area) and package them into a candidate block.

- When a new block is created, receiving nodes perform comprehensive checks. It confirms all included transactions are valid, then verifies the block header meets the network’s criteria (correct hash, appropriate difficulty level). And then ensures the block correctly references the previous block, maintaining the chain’s integrity

- Once validated, nodes relay the new block to their peer nodes. This creates a ripple effect as each node passes the block to its connections until the entire network receives it.

This propagation mechanism ensures every node maintains an identical copy of the blockchain. When your Bitcoin transaction gets included in a block and that block propagates to thousands of nodes worldwide, you can be confident your transaction is secure and irreversible.

Speed matters here; blocks typically propagate through the network in seconds. Bitcoin blocks reach 95% of nodes in under 40 seconds, while Ethereum’s faster block times result in propagation within 10-15 seconds.

Consensus Participation

The main aspect of any blockchain is its consensus mechanism. It allows decentralized participants to agree on the network’s state without a central authority. Nodes play crucial roles in these mechanisms:

Proof of Work Consensus

In Bitcoin and similar networks, mining nodes compete to solve complex cryptographic puzzles, broadcasting their solutions (proofs of work) to the network for verification. They simultaneously validate proofs submitted by other miners while rejecting invalid blocks or those that don’t follow the longest chain rule. This competition-based system creates a self-regulating security mechanism where computational power directly translates to network influence.

Proof of Stake Consensus

In networks like Ethereum 2.0, validator nodes stake cryptocurrency as collateral to participate in the consensus process. The network selects validators to propose new blocks based on their stake size – the more you’ve invested, the more often you’ll be chosen. These nodes also attest to blocks proposed by other validators and vote on which chain fork represents the canonical chain. This approach reduces energy consumption while maintaining security through economic incentives.

Alternative Consensus Mechanisms

Many blockchains use variations or entirely different approaches. In Delegated Proof of Stake (DPoS), nodes vote for a limited set of block producers who take turns creating blocks. Practical Byzantine Fault Tolerance (PBFT) involves nodes participating in multi-round voting protocols to achieve agreement. Proof of Authority (PoA) networks rely on pre-approved validator nodes taking turns producing blocks, sacrificing some decentralization for speed and efficiency.

Regardless of the mechanism, nodes collectively decide which transactions are valid and which blocks become permanent, enabling cryptocurrencies to operate without traditional financial intermediaries.

Incentives and Rewards for Node Operators

Running blockchain nodes requires investment in hardware, electricity, and technical know-how. To encourage this, blockchain networks offer various motivations to node operators. Let’s explore these reward mechanisms.

Mining Rewards

Mining nodes receive significant rewards for securing proof-of-work blockchains. Here’s how these incentives work:

Block Rewards: When miners successfully add a new block to the blockchain, they receive newly created cryptocurrency as a reward. For Bitcoin, this reward started at 50 BTC per block in 2009 and halves approximately every four years (known as “halving“).

Transaction Fees: In addition to block rewards, miners collect all transaction fees included in their blocks. As block rewards decrease over time, transaction fees become an increasingly important part of mining revenue.

Mining Economics: The competition among miners creates an efficient marketplace where:

- More miners join when mining is profitable

- Less efficient miners drop out when costs exceed rewards

- Difficulty adjusts automatically to maintain consistent block times

For example, a Bitcoin miner operating an Antminer S19 XP (140 TH/s) might earn approximately $15-20 per day at current difficulty levels, before electricity costs. This creates an economic incentive to secure the network while maintaining decentralization.

Staking Rewards

In proof-of-stake networks, validators earn rewards for locking up their cryptocurrency as collateral. This system offers several advantages:

Staking Yield: Validators earn returns on their staked cryptocurrency, typically ranging from 3-10% annually, depending on the network. For example, Ethereum staking yields approximately 3-5% APR, while smaller networks may offer significantly higher returns to attract stakers.

Risk-Adjusted Returns: Unlike mining, staking doesn’t require specialized hardware, so it becomes accessible to more participants. However, staking does carry risks: The first one can be a slashing penalty for validator misbehavior. The second risk might be the lockup periods that limit liquidity, and lastly, potential price volatility of staked assets can also be considered a risk.

Participation Options: Not everyone needs to run a validator node to earn staking rewards. Most networks offer:

- Solo staking (running your own validator)

- Pooled staking (joining with others)

- Delegated staking (assigning your stake to another validator)

- Liquid staking (receiving tradable tokens representing staked assets)

The economic incentives of staking help maintain network security while requiring significantly less energy than proof-of-work systems. For example, Ethereum’s shift from mining to staking reduced its energy consumption by over 99%.

Masternode Incentives

Masternodes offer better functionality to certain blockchain networks and receive substantial compensation for their specialized services. Operators typically collect a generous portion of block rewards (often 45-75%, depending on the network), plus transaction fees for special transactions they process and governance voting rights. Running these nodes isn’t cheap, though – you’ll need a significant collateral stake (like 1,000 DASH worth about $35,000), dedicated server hardware with high uptime, and technical know-how to keep everything running smoothly.

The payoff comes in enabling powerful network features such as InstantSend for near-instant confirmations, PrivateSend for enhanced privacy, decentralized governance systems, and treasury funding for ongoing development. These capabilities make masternodes worth the investment for committed crypto enthusiasts seeking both returns and network participation.

For example, a DASH masternode operator might earn approximately 5.5% annual return on their collateral while participating in network governance decisions. Similar systems exist in PIVX, Horizen, and several other cryptocurrency networks.

This three-tiered reward system, mining, staking, and masternode operation, creates diverse incentives that support blockchain networks at different levels of commitment and technical expertise.

Setting Up and Running a Crypto Node

Hardware and Software Requirements

The hardware and software needed to run a node are different depending on the node type and blockchain network. Here’s a table for comparison:

| Node Type | CPU | RAM | Storage | Network |

| Bitcoin Full Node | 2+ cores | 2-4 GB | 500+ GB SSD | 5+ Mbps |

| Ethereum Full Node | 4+ cores | 8-16 GB | 1+ TB SSD | 8+ Mbps |

| Ethereum Validator | 4+ cores | 16+ GB | 1+ TB SSD | 10+ Mbps |

| Light Node (most networks) | 1+ cores | 1-2 GB | 5-50 GB | 1+ Mbps |

| Masternode (e.g., DASH) | 2+ cores | 4+ GB | 100+ GB SSD | 5+ Mbps |

For storage, SSDs deliver essential performance advantages over HDDs for all node types, though you’ll face ever-growing space needs as blockchains continuously expand. While Ethereum archive nodes demand multi-terabyte capacity, pruned nodes can operate with less storage at the cost of limited historical access.

Processing demands vary widely – more CPU cores accelerate transaction validation, and faster clock speeds enhance block verification, but you won’t need GPUs except for mining operations. The hardware sweet spot depends on your node type, with Bitcoin full nodes running effectively on modest setups (2+ cores, 4GB RAM, 500GB SSD), while Ethereum validators need substantially more horsepower (4+ cores, 16GB RAM, 1TB+ SSD).

Popular Software Implementations

There are several well-maintained client software options for major blockchain networks:

| Bitcoin Node Software | Ethereum Node Software | Other Network Clients |

| Bitcoin Core: The reference implementation (C++) | Geth (Go Ethereum): Most widely used client | Solana: Solana Validator |

| BTC.Qore Node: User-friendly alternative with GUI | Erigon: Faster sync and lower storage requirements | Cardano: Cardano Node |

| Rustring Bitcoin: Rust implementation focused on performance | Nethermind: High-performance .NET implementation | Polkadot: Substrate Node |

Most client software is open-source, regularly updated, and offers detailed documentation to help you get started.

Steps to Deploy a Node

For the setup, you may follow these steps, although specifics vary by blockchain:

First of all, prepare your environment. Select a hardware based on the requirements for your chosen network. Then, set up your operating system (Linux distributions like Ubuntu are popular for stability). After that, configure firewall rules to allow necessary connections and consider using a UPS (uninterruptible power supply) to prevent downtime.

The next step is installing Node software:

- Download the client software from the official repository

- Verify the download using checksums to ensure security

- Install the dependencies required by the client

- Configure basic settings like data directory location

For example, to install Bitcoin Core on Ubuntu:

After installation, you’ll need to configure your node by modifying configuration files for customization, setting up port forwarding on your router, enabling automatic startup for consistent uptime, and establishing resource limits to prevent system overload.

The next challenge is blockchain synchronization – a process that can take several days for major networks like Bitcoin or Ethereum. You’ll want to monitor sync progress through client logs or dashboards, and might consider bootstrapping options to accelerate this initial download.

Be patient – Ethereum typically takes 1-3 days to sync even on powerful hardware, while Bitcoin often requires 2-4 days for the complete blockchain. This one-time setup investment pays off with a fully operational node that contributes to network security and possibly generates rewards.

And lastly, for the ongoing maintenance, follow these steps:

- Keep software updated to maintain security and compatibility

- Monitor performance through metrics and logs

- Back up key files like wallet data and validator keys

- Join community forums for troubleshooting and updates

Challenges and Considerations

Running a node comes with several practical difficulties you’ll need to deal with. Bandwidth consumption is significant – nodes constantly exchange 20-200 GB of data monthly with peers, while initial blockchain synchronization can devour over 1 TB. Your home internet’s upload limits might become a bottleneck. Storage demands never stop growing, with Bitcoin expanding by ~50 GB yearly and Ethereum by ~100 GB, likely requiring storage upgrades every couple of years.

Security threats loom large, from DDoS attacks and malware to private key vulnerabilities for validators. You’ll need basic command-line skills for troubleshooting, should budget $5-15 monthly for electricity, and understand that some nodes (validators, masternodes) penalize downtime.

To succeed, use dedicated hardware instead of your main computer, implement strong security measures with firewalls and regular updates, monitor for unusual behavior, and join community forums for support. Despite these challenges, many find the rewards worthwhile, whether supporting networks they believe in, earning financial incentives, or simply learning how blockchain infrastructure really works. With proper preparation, you can join the global community in keeping these systems running.

Conclusion

Crypto nodes are the foundational infrastructure that makes blockchain technology possible. By maintaining distributed copies of the ledger and enforcing consensus rules, nodes enable truly peer-to-peer transactions without centralized intermediaries.

The diversity of node types creates a rich ecosystem that balances security, accessibility, and functionality. This variety allows different participants, from individual hobbyists to enterprise infrastructure providers, to contribute according to their capabilities and needs.

Whether you’re looking to support your favorite cryptocurrency, enhance your privacy, or simply learn more about blockchain technology, understanding nodes will give you important insights into crypto technologies. While not everyone needs to run a node, the distributed network of those who do creates the secure, censorship-resistant foundation that gives cryptocurrency its unique value proposition.