Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum network is the second most valuable decentralized blockchain protocol in the world right now. With its utility token Ether (ETH) currently serving as the de facto currency for the rapidly growing decentralized finance (DeFi) and non-fungible token (NFT) sub-sector, ETH is one of the most sought-after digital currencies globally.

Crypto staking has boomed in the last couple of months, and ETH’s growing use case has seen several investors looking to pile up on the token. Meant to secure a blockchain network, crypto staking has really taken off, and more investors are on the lookout for platforms where they can stake ETH. This article covers some of the best Ethereum staking platforms you can use to generate passive ETH easily.

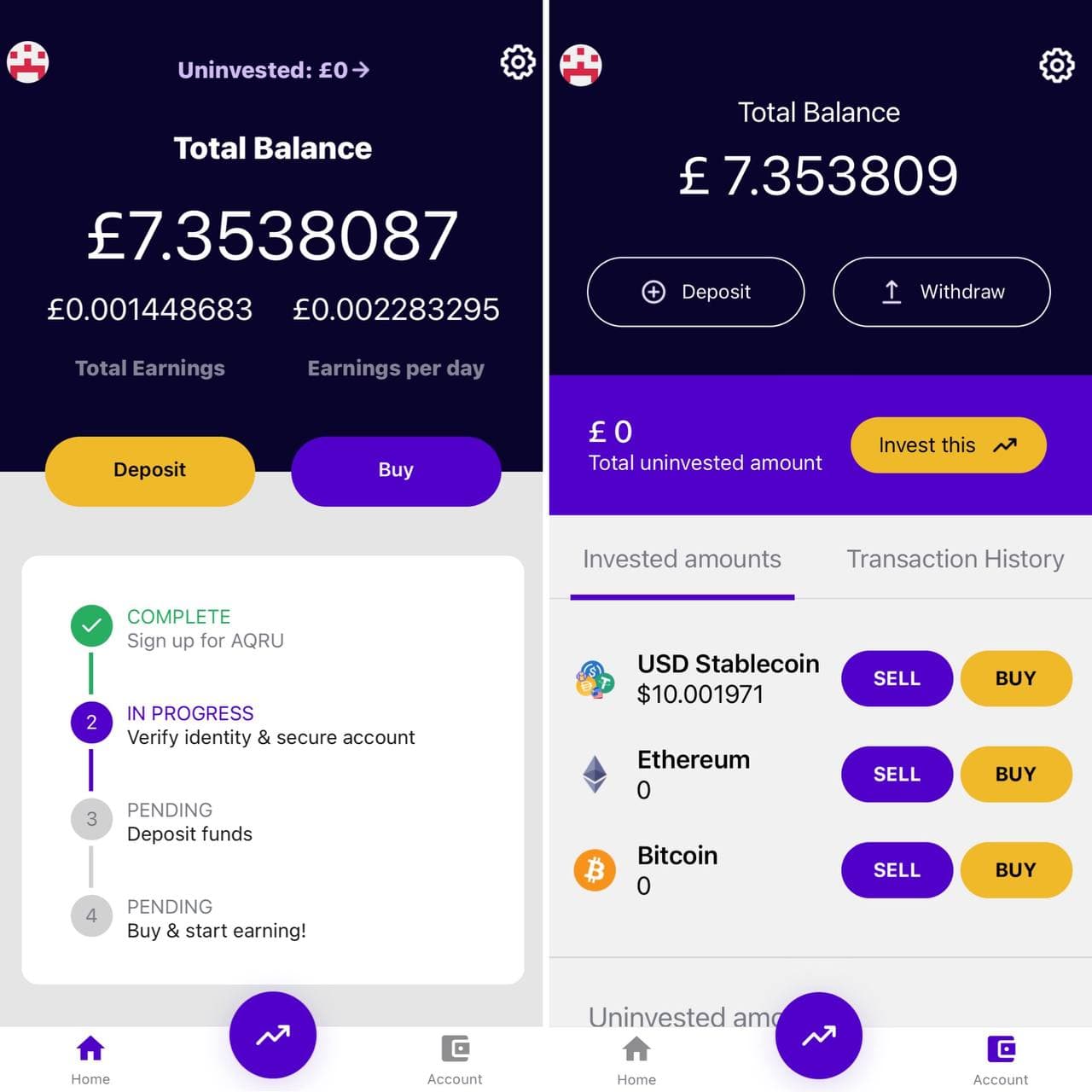

1. Aqru – Overall Best Ethereum Staking Platform in 2025

The Aqru mobile app platform

Aqru pay out 7% daily interest on Ethereum holdings in your balance allowing you to earn compound interest – rather than waiting to apply interest to your balance until the end of the month like some other Ethereum staking platforms.

A technical point is that on Aqru you aren’t staking Ethereum in the sense of your Ether (ETH) tokens being used to validate transactions on the Ethereum blockchain, and it isn’t related to ETH 2.0. How it works is Aqru are a crypto lending platform, and when they give out crypto loans you are paid interest from the revenue.

This is similar to what banks do with fractional reserve banking system only instead of the 0.05% interest high street banks pay savings account holders, Aqru pay you 7% (or 12% on stablecoins). This allows you to grow your wealth much faster than traditional bank accounts.

Aqru are a regulatory compliant company with their licensing information listed on the website. They also use industry-leading Fireblocks encryption software to protect user funds and have an insurance policy in place. They’re a relatively new platform compared to others but have a growing Reddit presence and positive feedback on Trustpilot.

They offer a risk-free way of testing out the platform – all users instantly receive a free $10 USDT bonus on signup with no deposit required (as shown above), which allows you to see how and when Ethereum interest payments are made into your account.

Pros

- Free $10 USDT bonus to test out the platform

- Other cryptos alongside ETH – Bitcoin and stablecoin interest

- Fireblocks security

- Daily interest, compounding gains

- Support for both mobile and desktop

Cons

- Not yet available in USA

Invest responsibly.

2. eToro – Best Exchange Platform for Ethereum Staking

The social trading platform eToro is a popular choice for over 20 million users. Traditionally a stock trading app, eToro has quickly evolved and transitioned into the crypto niche. Barring more conventional investment vehicles like commodities, stocks, bonds, CFDs, and ETFs, eToro supports large and small-cap cryptocurrencies.

Recently, eToro launched its staking-as-a-service offering called eToro Staking. Currently supporting only three cryptocurrencies, eToro lets you lock your ETH tokens for a period while rewarding you with more ETH tokens as compensation for securing the Ethereum network.

Update – As of 2025, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Ethereum 2.0 staking is currently the third most staked network with over $26 billion total value locked (TVL), according to Staking Rewards. This has largely been due to the network’s plans to transition to a proof-of-stake (PoS) consensus algorithm in the coming months.

To serve its global customers, eToro Staking offers users rewards upwards from 75% to 90% based on the platform’s monthly ETH yields. This reward percentage is based on a user’s membership choice on the tier system.

eToro also guarantees a potential earnings ratio between 5 and 6.25%, making it one of the best Ethereum staking platforms to tap into the staking frenzy.

Note – Staking reward is not available for UK/FCA users.

Pros

- eToro handles all the technicalities of staking

- Generate high-yield returns on ETH staked

- A secure and safe platform

Cons

- Limited repository of crypto assets up for staking

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

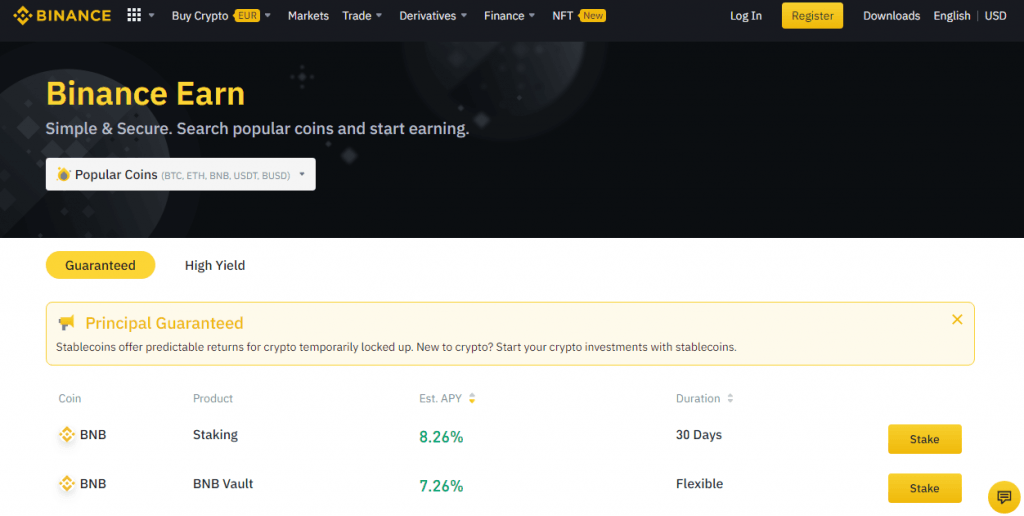

3. Binance

Binance has established itself as the top destination for the global thriving crypto community in a short period. Averaging a minimum of $50 billion worth of transactions on its Bitcoin exchange, Binance is the largest crypto-focused exchange in the world.

However, it has not relied solely on only buying and selling cryptocurrencies.

Launched late last year, Binance Earn has quickly become a popular choice for investors looking to generate passive income for staked tokens. Ethereum 2.0 staking has quickly carved a space in the large Binance Earn pool, and you get Binance’s version of ETH called BETH on a 1:1 staking ratio. Rewards are paid daily to users’ spot account. The annual percentage yield (APY) is largely out of Binance’s hands and largely depends on the number of ETH staked in the network. That means the more

ETH staked in Binance pools, the lesser the APY you get in return and vice-versa. However, Binance promises low-risk, meaning there is a high possibility of receiving your ETH rewards. Based on the popularity of Binance, ETH staking is a bit hard to come by as several investors are queuing to stake their ETH. Rewards are shared a day after staking your ETH. Binance also redistributes 100% of all on-chain rewards to customers.

Pros

- Large pool of crypto assets to stake

- Highly popular destination for crypto staking

- Low holding period

Cons

- First-come-first-serve staking structure

Your Capital is at risk.

4. Coinbase

Coinbase is a popular choice for cryptocurrency in the US. This long-standing and reputable brand has a great user interface and is the first port users in the United States and other neighboring countries call when they want to trade cryptocurrencies. Its highly intuitive and easy-to-understand exchange makes Coinbase one of the best Ethereum staking platforms in the world.

Just like other several Bitcoin exchanges, Coinbase offers Ethereum staking. Users get a fixed rate of 5% APR on the amount of ETH staked at any particular point in time. Coinbase handles all the technical issues surrounding staking. You can start with as little as $1. Aside from Ethereum, Coinbase offers staking rewards for popular coins like ALGO, ATOM, XTZ, DAI, and USDC with varying reward ratios. However, Coinbase charges a whopping 25% commission on your staking rewards. But if you don’t mind that, Coinbase is a top choice for Ethereum staking opportunities due to its less technical staking process.

Pros

- User-friendly

- Publicly listed, which makes it safe

- Attractive crypto-asset range

Cons

- High commission

- Limited crypto range for staking

Your Capital is at risk.

5. Kraken

On the global crypto exchange chart, Kraken is the fourth-largest, with a 24-hour trading volume in excess of $1 billion. This shows that Kraken is a top destination for several crypto enthusiasts. Although based in the US, Kraken mainly focuses on the European market generating crypto adoption in the largely laid-back region.

Also, Kraken supports crypto staking with notable services for Ethereum. Staking rewards are pegged at 5 to 7% per annum after commission, which is variable. Payouts occur every two weeks and are available on your spot wallet. Once you stake your ETH token, Kraken issues you a derivative token, ETH 2, that covers your investment on a 1:1 basis. You can also trade your new ETH on the exchange. Kraken has attractive crypto staking range with notable additions like Polkadot, Kusama promising 12% APY.

Kraken supports twelve digital assets, and you can also earn on your Euro stablecoin. The exchange’s large repository makes it one of the best Ethereum staking platforms for generating passive revenue.

Pros

- Easy-to-use platform

- High yields

- Large repository of crypto assets for staking

Cons

- Commission-based

Your Capital is at risk.

Join Our Telegram channel to stay up to date on breaking news coverage