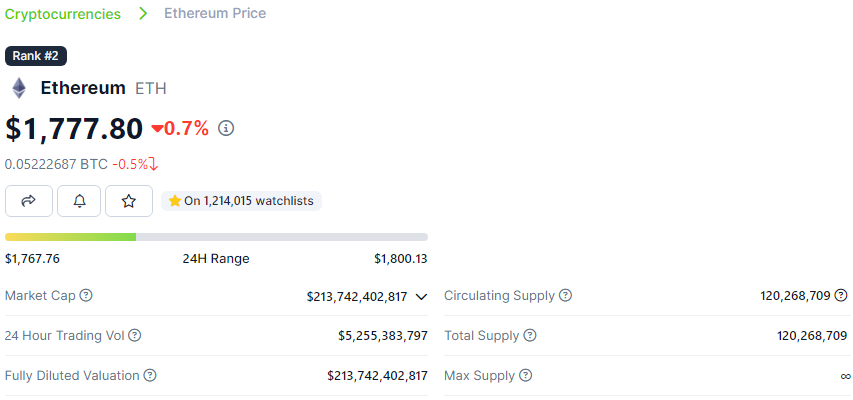

Ethereum is the second-largest cryptocurrency by market cap and the most popular smart contract-based blockchain in the world. Ethereum hit its all-time high during the bull market in November 2021, reaching over $4800. But it lost over 50% of its value as a result of the following crypto market crash, and for a short period, ETH was even traded at below $1000. Ethereum’s current price is close to $1800, which is 2.5 times lower compared to its all-time high.

With this being said, you may ask yourself, “Should I buy Ethereum Now” or not? To help you make a more reasonable decision, we have made this guide which introduces 8 reasons you should invest in ETH in 2024. Read on to find out everything about Ethereum and what features of this crypto project can make it a good asset for your crypto portfolio.

On this Page:

Ethereum Market Update – What Happened to ETH So Far This Year?

As in the case of many other cryptocurrencies, Ethereum’s price suffered hugely as a result of the deep bear market, which was a result of multiple events – from crypto regulations to major project crashes. For the second part of the year 2021, Ethereum was mostly traded above $2000, but in 2022, its price dropped below $2000, and the coin never hit that price again.

However, if we look at this from the long-term perspective, Ethereum is traded several times higher compared to its price before the 2021 bull market. The coin’s value kept fluctuating between $100-$300 during that period before starting a rally at the end of 2020. Ethereum started the year 2023 with a price of $1300, but it managed to recover significantly and has a quite profitable YTD return rate.

The coin’s value started to increase during the first month of 2023, and by the end of the month, Ethereum was already traded at above $1500. ETH even managed to hit $1600 from time to time. The coin kept its price above $1500 up until March, when it dropped to $1400 for a short time. This was followed by a drastic growth which peaked at $2120, bringing investors over 75% YTD return.

Another attempt to break the $2000 mark was made in May; however, Ethereum couldn’t manage to do that, and the prices started to decrease after the coin reached $1995. Ethereum was back to the $1700-1800 mark for the next 15 days after it finally dropped $1650 in a month. This was the lowest price for Ethereum for the next 5 months.

On July 13, new details were released about the SEC’s lawsuit against Ripple, which affected not only XRP but also the whole market, including also Ethereum. The judge has published a decision that stated that cryptocurrencies are not considered security when they are sold to investors on exchanges. This was regarded as a victory for Ripple and led to many investments in popular cryptocurrencies.

As expected, Ethereum benefited from the uptrend in the market and managed to hit $2000 again, peaking at $2005. Around July 19, the second largest crypto by market cap traded at over $1800 according to CoinMarketCap’s chart.

Heading into August, Ethereum maintained a positive price level of $1,856. However, the value of the token dipped slightly compared to what it enjoyed in the previous month. Its lowest price during the month was $1,652 as the token hovered around $1,700 for most of August.

Meanwhile, it ended the month staying up around $1,705 and started September on a low note, recording a slight dip to $1,645. More so, toward the end of the month, Ethereum dropped further to $1,584. At the beginning of October, Ethereum rallied to $1,732 and almost attained $1,900 in the last days of the month as speculations over a possible approval of an exchange-traded Bitcoin fund greeted the crypto landscape. Nevertheless, as of October 29, it traded around $1,777, according to CoinGecho

Will Ethereum Go Up Before The End of 2024?

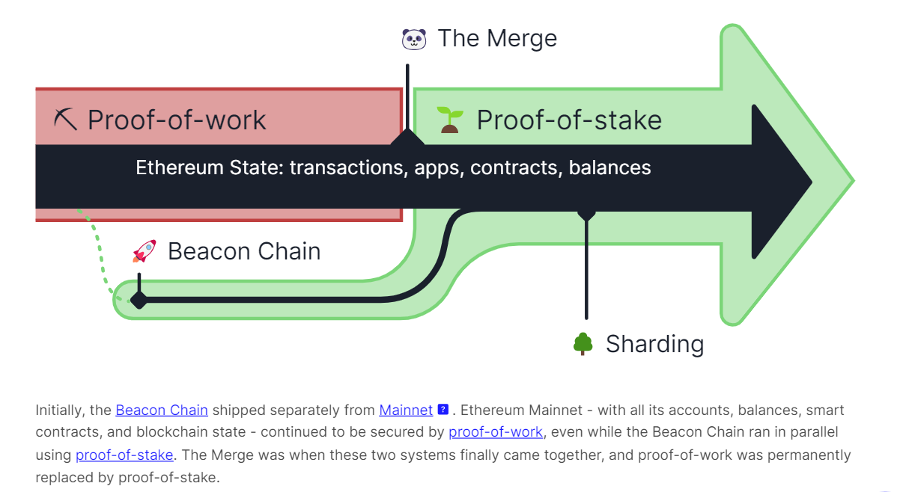

Ethereum price is down compared to its all-time high; however, it’s over 6 times higher if we consider its price before the 2021 bull market. It seems that Ethereum’s Merge, which was its transition to the Proof of Stake consensus mechanism from Proof of Work that took place in 2022, did not leave too much impact on the cryptocurrency’s price.

However, the fact that Ethereum’s price hasn’t experienced any significant growth after the Merge is also connected with the bearish condition of the general crypto market. The whole market has been down since November 2021 because of some negative events in the crypto market. Ethereum is the backbone of the whole DeFi sector as well as the best DeFi coins in the market, and is widely used to build decentralized apps, NFTs, DAO tokens, etc.

Taking into account the use cases of the Ethereum token, we can say that Ethereum has the potential for growth if the crypto market shows recovery signs. If the market takes a bullish direction in the next few years, Ethereum is expected to hit its previous all-time high and, according to some predictions, even reach $6500 in 2025.

As for the short-term perspective, the predictions differ depending on the platform. According to Cryptonewsz technical analyses, Ethereum can have a minimum price of $1600 and a maximum price of $3900 before the end of the 2023. Meanwhile, Changelly predicts that Ethereum’s average price for 2023 will be $2140, with the possibility of hitting as high as $2335.

However attractive these predictions may seem, it is important to remember that the crypto market is highly volatile as it is controlled only by demand and supply forces. So, any unpredictable event can happen and result in massive sales or buying among investors. Meanwhile, Ethereum is one of the most valuable altcoins, which means that the coin is less risky than most of the other cryptocurrencies.

Should You Buy ETH – 8 Reasons Why You Should Consider Investing in Ethereum

If you want to follow the trend and invest in Ethereum but still have some second thoughts about it, this section will help you make up your mind. Ethereum is one of the most popular cryptocurrencies not only as an asset to speculate on its price changes but also for the value it brings to the DeFi sector. But why is Ethereum so reputable? Here are 8 good reasons why you should invest in Ethereum now.

1. Ethereum is the World’s Largest Ecosystem for Decentralised Applications

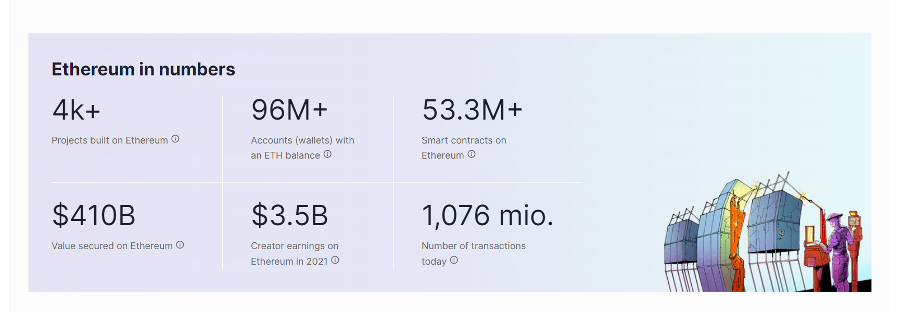

There are almost 3000 decentralized applications running on Ethereum’s blockchain, making Ethereum the largest ecosystem for dApps. What are those applications created for, and what is their benefit? When Bitcoin launched its decentralized technology and offered an alternative to the traditional payment method, Ethereum’s co-founder Vitalik Buterin understood that blockchain technology could be used for broader purposes.

Buterin realized that blockchain has more potential and it can have many more applications. This is how Ethereum was created, which enables developers to build their own decentralized applications on top of its blockchain. Ethereum was the first blockchain project to use the idea of smart contracts, which is the underlying principle for dApps. Smart contracts are contracts that are executed automatically once the predetermined terms and conditions are met.

There are different kinds of decentralized applications built on the Ethereum blockchain. Among the most popular ones are DeFi games that enable users not only to enjoy the game on a secure network but also to earn real-world value from their in-game activities. In another way, these games are known as play-to-earn games.

Decentralized exchanges are another popular type of dApps. These are crypto exchanges where token swaps occur through code without the interference of any financial institution. DEXs aren’t regulated, and they don’t require too many activities to get started. All you need to do is to link your wallet and start swapping tokens. Meanwhile, they stand out with high security as they rely on blockchain technology.

Among the other popular dApps are browsers, NFT platforms, applications to lend and borrow cryptocurrencies, the decentralized versions of many traditional apps, scaling solutions, etc. Ethereum is still the leader in the decentralized apps sector, and the number of these applications is growing steadily. With its long history, secure technology, and reliability Ethereum has built a good reputation as a dApps blockchain.

Ethereum’s native token, ETH, plays a vital role in this process as the token is used to fuel the whole ecosystem. When developers use Ethereum’s blockchain to build their apps, they need to process transactions for which they pay gas fees. These fees are paid in ETH tokens. Hence, ETH’s demand grows if more users use Ethereum’s technology to build their applications.

2. Ethereum Merge is Complete

If you pay attention to the news in the cryptocurrency sector, you may have probably heard about such an event as Ethereum Merge. This is one of the latest and most important upgrades from Ethereum, which transformed it into a greener and more scalable blockchain platform. The Merge was the joining of Ethereum’s initial blockchain with the new Proof-of-Stake protocol to make the blockchain more sustainable and secure.

To understand this better, let’s first find out what are Proof-of-Work and Proof-of-Stake consensus mechanisms. Bitcoin was the first to use the Proof-of-Work consensus mechanism to operate its blockchain. As blockchain is decentralized, it relies on miners to verify transactions and mine a new block for the network. To become a miner, you must solve complex equations, and when the equation is solved, a new block is added to the network.

However, miners don’t solve these tasks by themselves, and they use computational power for that. This requires powerful technologies and huge electricity usage to run the computer continuously and solve the equation. Consequently, this consumes a lot of electricity and increases the amount of carbon dioxide harming the environment.

Meanwhile, the increase in the number of transactions increases network congestion, thus slowing the transaction speed and increasing fees. This is why cryptocurrencies using PoW-based blockchain are not considered environmentally friendly. In contrast, the Proof of Stake mechanism does not require using high computation power to run its network. Instead, users can stake their tokens in the pool and become a network validator.

In return, network validators earn a portion from the transaction fees for their service, which differs depending on the number of tokens and the period they are staked. This makes the PoS consensus mechanism more eco-friendly than Proof-of-Work. As this impact of cryptocurrencies on the environment has been noticed, more and more crypto projects are trying to create greener tokens and reduce the damage to nature.

Ethereum has also followed the trend and changed its consensus mechanism to Proof-of-Stake. Ethereum’s Merge took palace in September 2022, which not only made it a greener token but also improved its security, scalability, and efficiency. Ethereum claims to be able to conduct up to 100,000 transactions per second after the Merge, while this number was less than 100 before the Merge.

Less network congestion also means less gas cost, so using Ethereum’s blockchain platform will be much more affordable than with the Proof-of-Work consensus mechanism. This can attract more developers to build their dApps on Ethereum and consequently increase the demand for the ETH token. Meanwhile, Ethereum’s Merge builds more trust around this cryptocurrency and its future, leading to more investments in it.

3. Ethereum is Vital for NFTs and DeFi Applications

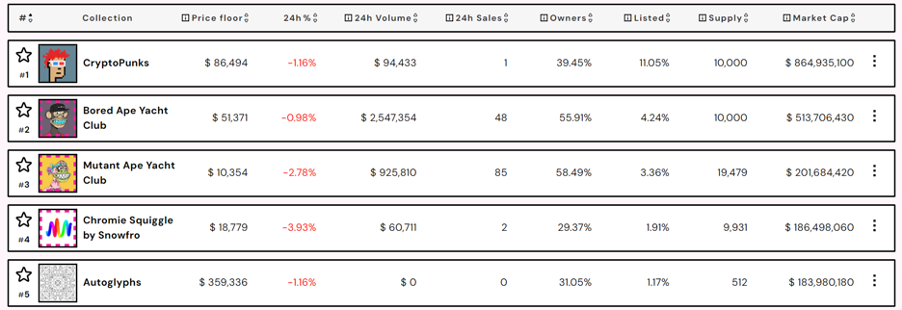

NFTs are getting more popular in the last years bringing new trends in the art sector. The abbreviation stands for non-fungible tokens, which means that NFTs are unique and can’t be replaced by another asset having similar value. NFTs are also strongly associated with Ethereum, as its blockchain is widely used to create, launch, trade, and store NFT collections.

Ethereum’s smart contract technology enables the creation of unique digital assets, which can be a piece of video, music, art, and other creative work. Ethereum not only provides a platform for NFT creation but also provides a secure and transparent way of claiming its ownership, making it easier for creators to sell and claim their creations. NFTs are one of the fast-developing sectors in the DeFi, and while their popularity grows, Ethereum is likely to remain the key player in the NFT market.

Here are a number of ways Ethereum’s smart contract technology is used for NFTs. Ethereum provides a platform where artists can securely and easily create NFTs representing their artwork. Ethereum’s blockchain helps to easily claim ownership of your work and keep the record that you own this or that digital asset. Due to Ethereum’s blockchain, NFT distribution also becomes easier and more secure, as it automatically changes royalty when NFTs are sold or bought.

Ethereum also helps to digitalize your real-world assets and trade them as an NFT. NFT trading also becomes easier as Ethereum provides decentralized marketplaces where your NFTs can be traded, sold, and bought without the interference of any other party other than the seller and the buyer.

Decentralized games based on the Ethereum blockchain can tokenize in-game items and introduce them in the form of NFTs. Later, these items can be traded on in-game marketplaces as real-world values. This enables to launch of play-to-earn games and gives a chance to players to generate rewards while playing and enjoying the games.

Ethereum plays a vital role not only in the NFT sector but also in the world of decentralized applications. Today dApps are getting more and more popular, with Ethereum being the most significant dApp platform provider. Ethereum’s blockchain technology provides a more transparent and secure way of launching applications due to its decentralized nature.

4. The Ethereum Development Project is Huge and Revolutionary

Another reason to invest in Ethereum is its overall impact globally and its revolutionary role in the financial sector. Ethereum has introduced cutting-edge technology that has reshaped online financial practices, trade, and communication. While Bitcoin’s influence is on the payment system, and its main use case is being a digital currency, Ethereum introduces a programmable platform that anyone can use to build their own decentralized applications.

One of the most revolutionary components of Ethereum is the technology underlying its blockchain – smart contracts. These contracts are programmed to self-execute once the conditions provided to them are met. Due to the way smart contracts operate, there is no need for an intermediate party which significantly reduces costs and increases security and transparency.

Ethereum already houses thousands of decentralized applications which use the benefits of its smart contract technology. These dApps have altered different industries, including games, healthcare, finance, etc. Ethereum gave rise to a whole new world of Decentralized finance known as DeFi. DeFi enables users to effortlessly lend, borrow, exchange, and earn interest with their digital assets, directly interacting with the second party without any middleman.

NFTs are another rapidly developing sector that relies on Ethereum’s blockchain technology. Some of the best NFTs have transformed the entertainment sector, making it easier for artists to create and prove the ownership of their assets. Decentralized exchanges came to replace traditional exchanges enabling them to trade and swap tokens quickly, with low fees and cutting the need for the third party.

Ether is another product launched by the Ethereum project, which is also called ETH and fuels the whole ecosystem as its native token. ETH is used as a means of exchange on the Ethereum network and to pay for gas fees. ETH can also be staked, and users can lock up their tokens to earn interest by becoming a validator.

Eventually, Ethereum is constantly developing and incorporating changes to make its blockchain more secure, scalable, and transparent and to reduce transaction costs meanwhile increasing its speed. One of the fundamental changes that Ethereum has brought to its blockchain was the integration of the Proof-of-Stake consensus mechanism. This event which is already described in our guide in detail, became known as The Merge.

In fact, Ethereum is the only blockchain platform so far that has changed the consensus mechanism of its blockchain. It means that Ethereum always seeks new ways to constantly develop its technology and make it easier and more efficient for its users to use its platform. Ethereum’s plans for improving blockchain technology go far, and ETH being its native token, can grow in value if these changes attract more people to Ethereum’s platform.

5. Ethereum Has a Secure Blockchain Network

One of the key features of blockchain technology is its security and transparency, which become a reality due to its decentralized nature. Decentralization means that no single person or authority has control over it. Instead, it belongs to everyone, and the blockchain is governed through collective control. But how this happens?

Every time when a transaction is executed, the data about it is added to the network. It means that everyone can add data to the blockchain; however, data on the blockchain can never be deleted, meaning that it’s irreversible. Another key factor is the transparency of the blockchain. When a piece of data is added to the blockchain, it can be viewed by anyone. Moreover, several copies of it are created and saved on different machines.

For the transaction to be executed, all of these copies should be valid and match. This is why it is almost near impossible to hack blockchain networks. To be able to fool the blockchain, one must change the information on most of these copies, which is extremely hard to do and will consume a huge amount of resources and time.

Both Proof-of-Work and Proof-of-Stake consensus mechanisms have a high level of security. However, apart from being secure, Proof-of-Stake also operates the blockchain in a way that is less harmful to the environment. The transactions are verified by the network validators who, instead of using electricity to run their devices, just lock up their ETH tokens in the pool. Randomly selected validators confirm the transactions and add a new block to the blockchain.

6. Ethereum’s Price is Heading Upwards

Another indicator of Ethereum being a good investment is the positive performance of its price. Ethereum has been around since 2015, and it has managed to go through two bull markets, each time setting a new all-time high. Ethereum was launched in July 2015 – at a time when cryptocurrencies were not so popular. Bitcoin had already managed to grow significantly and hit $200 by the time Ethereum was introduced.

However, altcoins were just getting popular, and Ethereum started its journey with a price of $0.7. In 2016 ETH already got listed on popular crypto exchanges and was traded between $8-$10. Ethereum’s first significant growth happened in 2017 when the coin increased by hundreds of times compared to its listing value and peaked at $370. After slightly dropping to below the $200 market, Ethereum entered the bull cycle.

At the time when Bitcoin first exceeded $10,000 and hit its new time-high in January 2018, ETH peaked at new highs too. It exceeded $1000 and, after hitting an all-time high of $1200, started to lose value. Ethereum mostly kept its value above $100 during its first bear market. And at the beginning of 2021, it was again traded at above $1000.

The second bull market brought new peaks for Ethereum, like for many other cryptocurrencies. The first wave took place in May 2021 when Ethereum exceeded $4000 and then dropped $1700 because of some issues happening in the general crypto market. The second wave took place in November 2021 when Ethereum hit its highest all-time high, peaking at $4600.

After that, the crypto market entered into a deep bear cycle, but Ethereum managed to keep its resistance level at $1000. The coin never dropped below that price during the bear market. It means that the coin’s value keeps hitting new records with every bull cycle following Bitcoin. Hence, Ethereum is expected to hit a new all-time high, with the next bull market expected by the end of 2024. Even more, ChatGPT Ethereum price predictions suggest that the coin is likely to experience bullish trend in 2023.

7. Regulatory Framework Can Be Beneficial for Ethereum

Cryptocurrencies have been around for more than 14 years, with Bitcoin being the first one that launched in 2009. However, there have been no serious steps to bring regulations into this market. While regulations are sometimes seen to bring a negative impact on the crypto market, they can be quite useful for Ethereum.

One of the main outcomes of the regulations can be the stabilization of the prices. Cryptocurrencies are now considered the most volatile type of asset because their price is only regulated by supply and demand forces. Regulations can help decrease speculations in the crypto market and bring more stability, reducing crypto volatility. This can make the crypto industry less risky and can attract many new investors.

Ethereum isn’t a speculative asset, it has real-world use cases, and its main aim is to fuel an innovative industry of decentralized applications. Hence, it seems that a regulatory framework can be beneficial for this cryptocurrency and increase many investors’ confidence to trust Ethereum. Though the market may still be risky, investors will have more protection than without regulations.

8. Ethereum is Still Among the Most Attractive Cryptocurrencies in the Market

Finally, Ethereum is still one of the favorite cryptocurrencies for crypto investors. The coin has managed to build a good reputation in the crypto sector due to its valuable features and innovative ideas. Ethereum is popular for many things among DeFi enthusiasts, developers, and crypto enthusiasts. One of the main things that make Ethereum popular is the smart contract technology which is the backbone of the whole Ethereum ecosystem.

Another thing is that Ethereum ignites a whole new industry with DeFi applications, financial platforms, games, NFT platforms, and many other applications. Its ETH token has many use cases and is not only the fuel for the whole Ethereum ecosystem but is also widely used for trading purposes. ETH can also be staked to help keep the network secure, meanwhile bringing passive income to the validators.

Ethereum is considered one of the best cryptocurrencies to buy now. It is the second largest cryptocurrency with a market cap exceeding $214 billion. ETH is also preferred by many investors as a long-term investment and as a store of value. With so much trust in this coin, it is highly likely that Ethereum is going to become one of the key players in the future of DeFi and cryptocurrencies.

Is Now the Time to Buy Ethereum?

Ethereum’s functionality and exciting features have been attracting several developers who chose this blockchain to build decentralized apps, launch NFT collections, and create DeFi games. There are many popular decentralized exchanges using Ethereum’s smart contract solution to enable swapping tokens without the need for any third party. Hundreds of crypto projects use Ethereum’s ERC-20 token standard to launch tokens for their DAOs.

All these functions prove that Ethereum is a valuable project and is one of the main underlying elements for the whole DeFi sector. Ethereum has disadvantages too; for example, network congestion is one trouble for Ethereum as it slows down the transaction time and increases gas fees paid to use the network.

However, Ethereum tries to solve these problems to provide faster transaction speed. One of the steps was its Merge which helped Ethereum to transform into a greener blockchain solution – called Proof of Stake. This also means that Ethereum significantly improved its transaction speed, upgrading it from 30 transactions per second to 100,000 transactions per second.

Ethereum also has a lot of competitors in the market that provide similar services and try to introduce solutions for network congestion. However, the project still remains the favorite coding platform among DeFi enthusiasts. Its native token, ETH, is one of the most widely traded crypto assets available on several crypto exchanges.

ETH is considerably down to its last all-time high, but everything can change if the crypto market takes a positive direction. If Ether continues to attract DeFi enthusiasts and crypto investors, the demand for the coin will obviously grow. Hence, investing in Ethereum right now can be a good choice as Ethereum can grow up to $3000 this year, according to some predictions.

How to Buy Ethereum – The Easiest Way

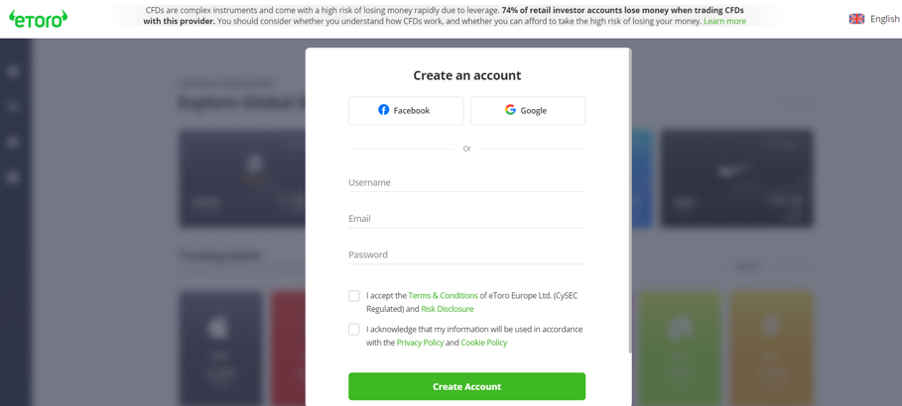

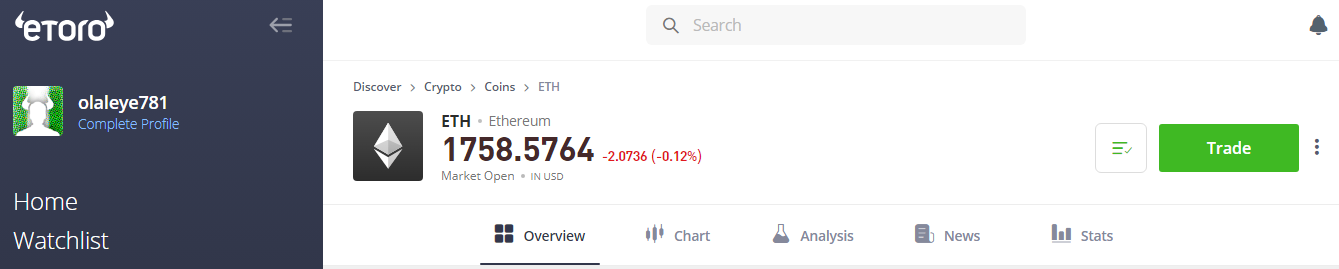

When it comes to buying Ethereum tokens, the first crucial step is to select a reputable cryptocurrency broker. This may seem quite hard with so many options available in the market and offering different services. As looking for a good broker may consume a lot of time, we have already done the research and chose eToro as the best broker to buy Ethereum. eToro supports Ethereum tokens and offers services in more than a hundred countries.

Additionally, the broker has a lot of features that can be quite helpful for novice traders. First, eToro provides a user-friendly platform that is easy to navigate and simple to understand. Creating an account with this broker takes a few minutes, and you can easily get started with eToro. When it comes to funds, safety is the most important factor, and eToro integrates advanced features to keep its users away from fraud.

Additionally, eToro is heavily regulated and registered with several tier-2 institutions, which makes the broker trustworthy and safe. Another advantage is eToro’s pricing structure with affordable trading and non-trading fees. The broker charges only a 1% transaction fee every time you buy and sell cryptocurrencies. Also, the minimum deposit is quite low for cryptocurrencies, and you can get started with $20.

Finally, eToro provides and wide selection of social trading tools that beginners can use to their benefit. Its CopyTrader and CopyPortfolio tools are quite popular as they allow beginners to save time on research and copy the trades of experts without doing their own research. Below you will find the step-by-step process to start buying Ethereum with eToro.

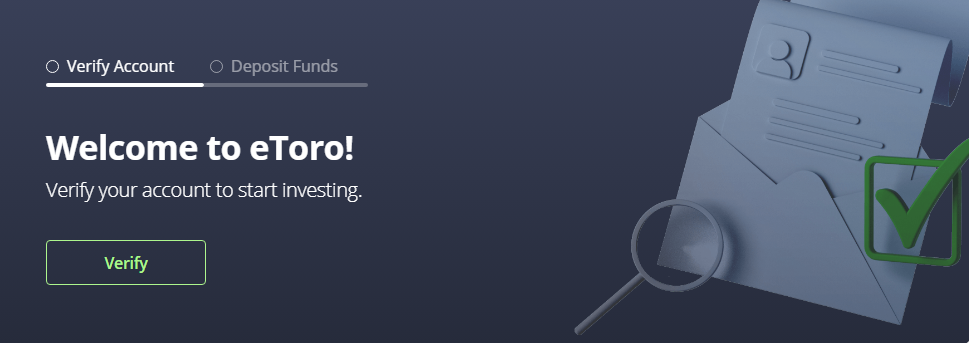

Step 1 – Open an Account

Visit eToro and click on the Join button to open your account. In this stage, write down your email, create a password and username for you, and you will have an account. Other steps include verifying your account with your email and phone number and finishing your account creation process.

After this, you will need to go through the KYC procedure, as it is required to trade on eToro’s platform. Provide proof of your identity and proof of your address, and eToro will quickly review and verify your account upon providing the correct documents.

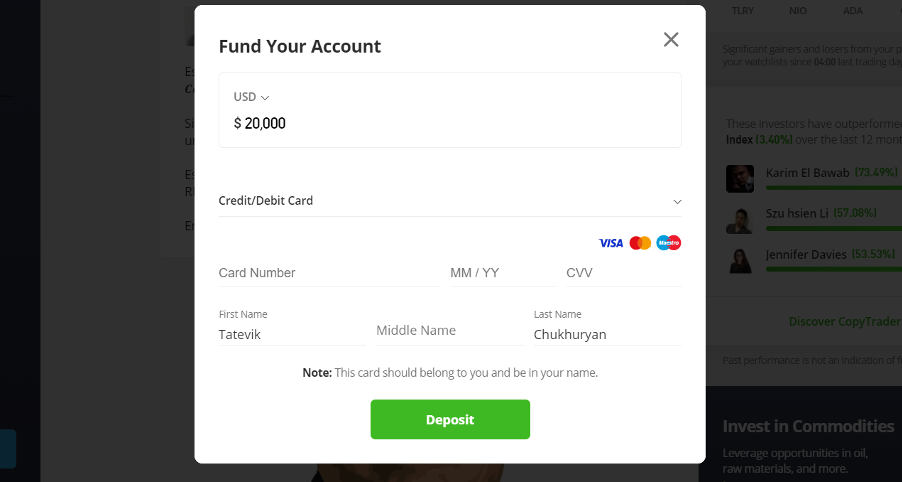

Step 2 – Deposit Funds

After having your account verified, it’s time to charge your account to start trading. eToro offers a few options to transfer funds, but the deposit speed may differ depending on the payment option. You can use credit or debit card options, bank or wire transfers, and even e-wallets, such as PayPal, Skrill, etc. Select the most suitable payment method for you and fill in the necessary details to make the transaction.

Step 3 – Search for Ethereum

Once eToro confirms that your funds are transferred to your account, you can start buying Ethereum. The coin’s ticker symbol is ETH, so write that in the search area to easily find the coin and click on the first result. eToro will lead you to a separate page where you can not only use the charts to track Ethereum’s price performance but can also read the latest news, write comments and participate in discussions.

Step 4 – Buy Ethereum

When you are ready to make the purchase, click on the “Trade” button next to Ethereum’s name, and you will see the buying section. Here you need to write how much Ethereum you want to purchase. You can also select your order type as eToro supports options of standard order and limit order. Finalize the transaction to make the purchase, and if it is successful, your coins will appear on your eToro account in a few minutes.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

For further details, check out our guide on where to buy Ethereum.

Ethereum Alternative – Could Wall Street Memes Token Be the Next ETH?

Wall Street Memes token is backed by an already popular community known as Wall Street Memes. The latter is popular for its entertaining and funny memes, which it constantly posts on Instagram, X, and other social media accounts. This is why there was already a huge community of supporters when WSM launched in May 2023. Due to the fact that Wall Street Memes project has already established its brand, the coin got over $25 million worth of investment before the conclusion of its presale.

As for the intrinsic value, Wall Street Memes token is not a means of exchange, nor does it support any blockchain network and plays a role in its operations. The coin is only for entertaining purposes, which is the main value of the meme coins. While meme cryptocurrencies are rather risky, they can also bring huge rewards, provided that you invest in them on time. Our guide on how to buy cryptocurrency safely will help you make an informed decision.

Wall Street Memes token has a maximum supply of 2 billion tokens, 50% of which will be used for marketing purposes. 30% will be distributed as rewards for the most active community members. The other 20% will be listed on centralized and decentralized exchanges. The token ended its presale, raising over $25 million and has been listed on prominent exchanges like OKX.

Summary – Should You Invest in ETH Now?

With all the benefits Ethereum can bring to the DeFi sector, this cryptocurrency still has the potential to become a well-established project in the future. This can have a huge impact on the coin’s popularity and help the coin increase in value. There are multiple reasons to buy Ethereum, and in this guide, we have introduced 8 reasons why you should invest in Ethereum now.

We also explained that to get started; you will need to pick a crypto broker that will provide you with a good trading experience. Our top recommended broker is eToro which is safe and easy to use as it is suited to all the tools beginners will need.

As an alternative to Ethereum or as an additional cryptocurrency to your crypto portfolio , we have discussed the Wall Street Memes token, which can be a good choice for those who think it is already late for them to buy ETH. Following a successful presale, $WSM has now been listed on well-known crypto exchanges, like OKX and many more.

FAQs

Will ETH go up in 2023?

Crypto experts are overall positive about Ethereum’s price, and the technical analyses made by different platforms indicate that Ethereum can go up in 2023 if the broader crypto market takes a bullish direction. According to some predictions, Ethereum has also the chance to hit $3000 and even higher.

Will Ethereum reach $4000 again?

It is highly possible for Ethereum to reach $4000 and hit its previous all-time high. However, the technical analyses show that this won’t happen in 2023. According to Cryptonewsz, ETH can reach $4000 and even hit $5000 in 2024, while Changelly's predictions indicate that this can happen only in 2025.

What will ETH be worth in 2025?

As Ethereum is one of the most widely traded and valuable cryptocurrencies, it is highly likely that the coin’s value will keep growing if there is an uptrend in the broader market. According to predictions, Ethereum can hit a new all-time high in 2025 with the possibility of increasing as high as $6500.

Should I buy Bitcoin or Ethereum right now?

Both Bitcoin and Ethereum are very successful crypto projects with great potential for growth and hitting new peaks. However, they have different features, with Bitcoin trying to replace the traditional payment system and giving people more freedom over their money and Ethereum trying to build a decentralized ecosystem of apps, games, and NFTs. You need to do your own research to understand which one suits your interests more and which one can prove the usability of its technology. The ideal option would be to diversify your portfolio with both coins, as each of them has good potential for success.

How much should I invest in ETH to make money?

It depends on your investment goals and budget. Meanwhile, you will need to be cautious and not put at risk the money you can’t afford to lose. Also, don’t put all your money in a single cryptocurrency and use only some percentage of the budget for one coin.

Does Ethereum have a future?

Ethereum has quite a promising future due to the valuable features it offers. Ethereum’s blockchain is the first smart-contract-based blockchain that is widely used among developers to build decentralized apps and games. Decentralized autonomous organizations use Ethereum’s token standard to launch their native governance tokens. Several layer-2 protocols are created to solve the problem of Ethereum’s network congestion and foster faster transactions. With all this being said, it is without a doubt that Ethereum is the backbone of the DeFi sector, and its Ether token is the main currency that can be used to pay for gas fees on the network.