Cryptocurrencies are a great deal for potential investors and traders to make huge sums in a shorter or longer period of time. It is because of the fact that crypto assets are highly volatile and act as per the market conditions.

In this guide, we’ll take you through how to trade crypto assets and make short/long-term gains, even if you are just starting out in the crypto world.

How to Trade Cryptocurrency – 5 Easy Steps

Below is a brief step-by-step guide on how you can start trading cryptocurrencies before we move on to the detailed version of it.

Step 1 – Choose a Crypto Trading Platform – Consider multiple factors like platform features, deposit and withdrawal methods, supported cryptocurrencies, security practices, and other necessary details while choosing a platform. We recommend OKX.

Step 2 – Deposit Funds – The next step is to deposit the amount so that you can start buying cryptocurrency. Choose the best suitable payment method to deposit your funds from your bank account to the trading platform.

Step 3 – Research the Market – Research the crypto market to be updated with the latest news, developments, and how the market is currently responding. This will help you know when to enter and exit the market.

Step 4 – Choose Which Crypto to Trade – The next step is to choose a cryptocurrency to trade. Start with whitepapers, the team behind the project, and other technical factors before choosing a cryptocurrency. Apply fundamental and technical analysis to take an informed decision.

Step 5 – Trade Crypto – Once you choose a cryptocurrency, the final step is to place an order to start trading. You can simply start with the minimum amount required to begin trading. For instance, the minimum deposit to purchase Bitcoin on OKX is $30.

Let’s move on to our in-depth guide on how you can start trading cryptocurrencies.

Where to Trade Cryptocurrency

Choosing a reliable, secure, and easy-to-use crypto platform is important for trading cryptocurrencies. As a crypto trader, it is also essential for you to consider multiple factors like platform features, transaction fees, deposit and withdrawal methods, security practices, and the supported cryptocurrency pairs before trading digital currencies through a particular platform.

We have reviewed a few crypto platforms below, which will help you seamlessly trade cryptocurrencies.

Join a Trading Signal Site – Learn2Trade

Learn2Trade is one of the world’s best forex trading platforms that provides trading signals to help its customers make the most of crypto trading. Being built by seasoned traders with more than 15 years of trading experience, the platform gives access to forex, cryptocurrency, indices, and commodity markets.

The forex signal service of the platform helps users execute stop-loss and limit orders at favorable times to make profits. Users can start with the free Learn2Trade service that provides three trading suggestions per week. To get more trading signals, users need to have a premium plan and join their Telegram group.

It also offers detailed trading guides on long-term investment goals, bid-ask spreads, market orders, leverage, and all the other concepts to help beginners. Moreover, it has two courses— F1 Strategy and Trading course in its “Education” section where it helps customers with forex and crypto trading.

What We Like

- Free forex and crypto trading courses

- Lifetime access to the educational courses

- Free trading signals service

- High success rate for its trading signals – 82%

- Access to various markets – forex, crypto, indices, and commodities

- 30-day money-back guarantee on paid services

- Immediate alerts to email

- Daily tips for trading and market analysis

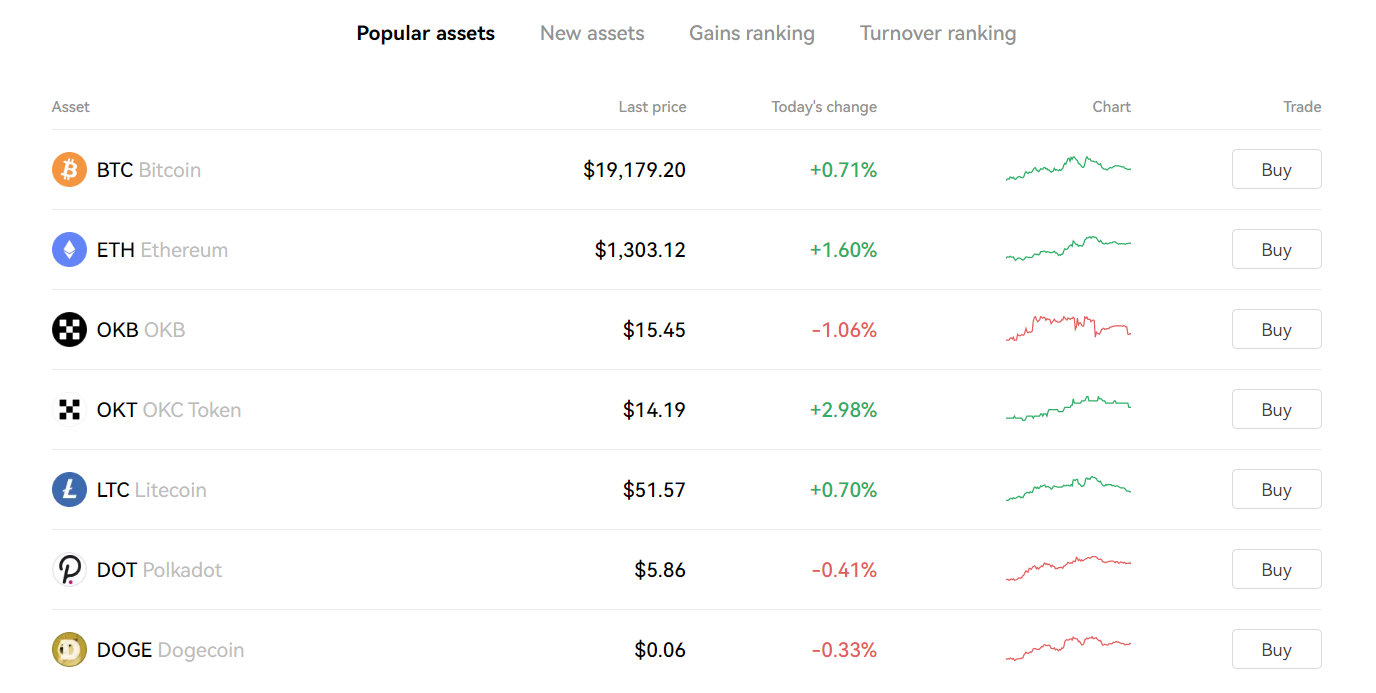

Trade on OKX

OKX crypto exchange offers advanced financial services for both beginners and experienced traders. Its services include spot trading, margin trading, options, DeFi liquidity, etc. Not just that, but it also offers crypto mining services to its customers.

One of the major advantages of using this platform is the low trading fees. Starting with just 0.10%, its trading fees decrease with higher trading volumes and larger stakes in its native currency, the OKB token. Another impressive feature is that OKX allows users to buy cryptocurrencies with multiple payment options— credit or debit cards, bank account transfers, and other digital payment methods like Apple Pay and Google Pay.

However, OKX does not provide any trading services for US-based customers. It is also known for its low liquidity levels for certain cryptocurrencies. OKX provides a wide range of crypto services and also supports more than 300 cryptocurrencies so that users do not have to search for other platforms to buy their preferred cryptocurrency.

Customers can register and open an account on the OKX platform by providing the required information. Completing KYC verification is essential for users to get access to all the features and benefits of the platform. Plus, KYC-verified users can also benefit from higher withdrawal limits when compared to other users.

OKX uses the best possible security features and stores most of the assets in cold storage. It also employs additional features like withdrawal passwords and anti-phishing codes. Overall, OKX offers a simple and easy-to-use interface to enable seamless navigation for beginners.

|

Number of Cryptos |

300+ |

|

Trading Commission |

0.10% |

|

Debit Card Fees |

Variable |

|

Minimum Deposit |

10 USDT |

What We Like

- Low trading fees

- Large no. of supported cryptocurrencies

- Staking feature with high-interest rates

- Multiple deposit and withdrawal methods

- Simple and easy-to-use platform

Cryptocurrency Trading Explained – Overview

The crypto market shares similar methods when compared with other markets like stocks, commodities, forex, etc. However, crypto trading is risky because of its volatile nature and extreme price swings. When you are just starting out in the crypto market, it is essential to DYOR regarding the assets as well as the trading platforms.

Having a clear understanding of the market and its sensitivity to market speculations helps you make better investment decisions. Choosing the best trading platform and cryptocurrencies with future potential combined with the implementation of trading strategies will help you gain sustainable profits. One of those strategies is finding the right crypto signals to help you assess the market situation before investing.

How Does Crypto Trading Work?

In order to understand how crypto trading works, let us look at the three major aspects of it.

Crypto Trading Pairs

Crypto trading pairs are the most important elements in the market. They enable traders to convert one currency into another for buying or selling. Each trading pair contains two currencies. They can either be two types of cryptocurrencies or one fiat and one crypto.

For example, BTC/USD trading pair allows users to buy or sell Bitcoin with US dollars. Most of the platforms support stablecoin pairs like BTC/USDT and ETH/USDT. Also, it is worth noting that crypto exchanges provide multiple crypto trading pairs with fiat currency.

Crypto Trading Orders

Crypto trading orders include market orders, limit orders, stop-loss orders, take-profit orders, etc. However, the market orders are more suitable for beginner traders as they allow them to buy the asset instantly at the current market price.

Once you get familiar with the market and trading platform and gain enough experience, you can set up stop-loss and take-profit orders as well. Traders need to specify the market price and the amount in order to set up these orders.

Crypto Trading vs Investing?

Even though the terms investing and trading are used synonymously, there is a clear difference. Investing means you buy an asset and store it in your wallet or exchange platform for a long period. Investing requires fundamental analysis and is suitable for assets that can appreciate in value over long periods.

On the other hand, trading involves buying and selling cryptocurrencies in short periods of time. Traders use technical analysis to estimate future price movements and change their trudging strategies based on that. This is where traders can leverage the volatility of cryptocurrencies to make profits.

Why Trade Cryptocurrency?

Trading cryptocurrencies can be highly profitable if it is done with proper research and analysis. When compared to other assets like stocks and commodities, cryptocurrencies are high-risk and high-reward assets. Let us discuss a few aspects to know why you should consider trading cryptocurrencies.

Market Diversity

The crypto market is diverse, which means you find a large number of cryptocurrencies to trade in the market. As a result, you can choose a cryptocurrency based on your preference, like risk appetite, trading strategies, and other investment goals. Because of its diversity, crypto provides huge opportunities for investors to enter the market and make significant profits.

Volatility

The crypto market is extremely volatile when compared to other trading markets. Even though the large price movements are risky, that is also a big opportunity for short-term traders and day traders. However, leveraging this opportunity is more suitable for experts and traders with several years of experience in trading.

Huge Growth Potential

The original cryptocurrency, Bitcoin, was valued at less than $1 when it was first developed in 2009. Today, one BTC is worth around $19,000, as per Coinmarketcap. Despite being more than 50% less than its all-time high value, there is still tremendous growth. Cryptocurrencies like Bitcoin and other altcoins have huge growth potential and are worth considering for investment.

How to Make Money from Crypto Trading?

In this section, we will discuss some of the methods here to help you make profits from crypto trading.

Cryptocurrency Trading Capital Gains

Capital gain is the profit earned from buying and selling an asset. When calculating capital gains, the buying price and other fees incurred in the trade are subtracted from the selling price. Capital gain is the most basic method of making money from crypto trading.

Liquidity Provision

The next method to make money from crypto trading platforms is by providing liquidity. Liquidity means the ease with which an asset can be bought and sold on a platform. By depositing the funds into a liquidity pool, investors can make passive income from their crypto holdings. In exchange for providing liquidity, the pool rewards users with LP tokens and a portion of trading fees.

Other Ways to Make Money

There are also other methods to make money from cryptocurrencies, like staking and storing crypto in interest-bearing accounts. Staking platforms require investors to lock the crypto holdings for a certain period, and in exchange for that, users can make passive income. Interest-bearing accounts pay interest for the stored crypto, similar to how banks pay interest on savings.

Cryptocurrency Trading Hours

Unlike traditional stock markets, crypto markets can be accessed anywhere and at any time with a digital device connected to the internet. Investors can buy and sell cryptocurrencies 24 hours a day and 7 days a week. They can leverage the market prices with full exposure and do not have to wait for trading hours to execute their trading strategy. However, it works best if you’ve researched and know the best cryptos for day trading.

Crypto Price Movements

Similar to any other financial instrument, the prices of cryptocurrencies vary based on demand and supply. The crypto market comprises a wide range of centralized and decentralized exchanges, unlike the traditional stock market.

It is essential to follow standard platforms like Coinmarketcap and Coingecko to track the crypto price movements. The price changes depending on various factors like demand, market speculation, news related to the industry, the latest innovations and developments in the space, etc.

Earning passive income through Crypto Interest Accounts

Earning interest on crypto is suitable for anyone who doesn’t want to deal with the volatility of the crypto markets. By opening crypto interest accounts, investors can earn regular APR (Annual Percentage Returns). Another method is staking through a liquidity pool. In this case, investors lock their assets for a certain period of time in order to earn regular APYs (Annual Percentage Yield).

Check out our guide about staking crypto.

What are the Best Cryptocurrencies to Trade?

Even though there are many cryptocurrencies, it is important to choose the coins that have future growth potential and better utility.

Let’s have a look at three of the best crypto tokens in terms of popularity and trading volume:

Bitcoin (BTC)

Bitcoin is the original cryptocurrency that gave rise to the entire crypto industry consisting of many coins today. Bitcoin reached an all-time value of around $68,000 in November 2021.

Traders who would like to choose a cryptocurrency with relatively long-term gains can opt for BTC. Bitcoin is also considered digital gold considering its ability to act as a hedge against inflation.

Ethereum (ETH)

Ethereum is the native cryptocurrency of Ethereum. It has opened up many possibilities for the crypto industry— from allowing dApps development to the creation of NFTs.

Ether reached an all-time high value of around $4,800 in November 2021, as per Coinmarketcap. It is considered to be the best investment for long-term gains and can be purchased at around $1,800 as of Q2 2023.

Shiba Inu (SHIB)

Shiba Inu is known as a meme coin in the crypto community. As a result, its price is sensitive to market speculations and can witness extreme price swings in a short period. SHIB reached an all-time value of $0.00007924 in October 2021, as per Coinmarketcap. Traders can consider this crypto to make significant profits in a short period.

Cryptocurrency Trading Strategies

Crypto trading strategies help you make the most out of your crypto trading journey. By implementing them, you can avoid acting based on FOMO and unfavorable results.

Let us look at some of the crypto trading strategies below.

Bankroll Management

A bankroll management trading strategy involves the maximum amount that you can risk on a single trade. Let us assume that you have $1,000 in your crypto exchange and you have a 3% bankroll strategy. In this case, you can only risk 3% of $1,000, i.e., $30 per single trade.

Stop-Loss Orders

Stop-loss is probably one of the most popular crypto trading strategies. With stop-loss orders, you can make sure to minimize the losses in a single trading position. When the price of crypto reduces, the stop-loss order gets executed as soon as it reaches the predefined market price.

Take-Profit Orders

Take-profit orders help you to maximize the chances of making profits in a trading position. For that, you would need to set a take-profit order for a particular market price. For instance, if you bought an asset at $10,000 and would like to take 20% profit, you can set take-profit order for $12,000.

Take Advantage of Market Dips

When there is a bearish trend in the crypto market, you can start buying blue chip cryptocurrencies with future growth potential. This way, you can buy cryptocurrencies at a discounted price and make profits in the next bull trend. Leveraging market dips is one of the best trading strategies for entering a buy position.

Trade Cryptocurrency Passively

Even though crypto trading requires active participation in gathering information and analyzing market trends, you can still automate this process. Different crypto platforms that offer crypto trading bot features and copy trading services will help you execute trading strategies automatically with less time and effort.

Crypto Day Trading

Day trading involves buying and selling a particular asset within 24 hours. Technical analysis plays a crucial part in day trading because traders target smaller gains that can be made in a few hours. Executing market orders like stop-loss and take-profit without fail is important in day trading to leverage the tight profit margins.

Is Cryptocurrency Trading Safe?

Cryptocurrencies are well-known for their volatility and instability. Though we cannot say that crypto trading is completely risk-free, you can ensure the safety of your funds by choosing reliable platforms and standard cryptocurrencies like BTC and ETH.

It is essential to choose trading platforms that are regulated and follow the best security practices to keep your funds safe. There are plenty of cryptocurrencies to choose from. However, if you are a beginner trader, choosing cryptocurrencies with max potential, such as Bitcoin, Ethereum, Lucky Block, and more, is recommended.

Once you gain sufficient experience, you can start using hardware wallets to provide additional security for your crypto holdings because they reduce the chances of online hacks. Overall, following security measures and utilizing trustworthy platforms are as important as buying potential tokens in the first place to help you keep your assets safe.

How to Trade Cryptocurrency

As we’ve delved into how you can trade cryptocurrencies in this guide, let’s quickly take you through the steps of how you can start trading tokens on OKX.

Step 1: Create and Verify an Account

Enter your full name, email, phone number, and other additional information on the official OKX website or by downloading the free OKX mobile app on iOS or Android.

Users will need to follow KYC steps to verify their account, this includes verifying the email address and phone number, as well as providing photo ID – some users may need to provide a proof of address.

Step 2: Deposit Funds

Depositing your funds with OKX is an easy process and doesn’t even require any fees. You can choose between a lot of payment methods for instant deposits like PayPal, debit/credit cards, e-wallets or bank transfers. The minimum deposit amount is $10.

Step 4: Search for Cryptocurrency

Once you feel that you are all set to start trading with your deposited money, you can simply start looking for digital assets over the search bar or check out the full list of supported cryptocurrencies on the platform.

Step 5: Trade Cryptocurrency

Some cryptos can be purchased directly with fiat currency – including Ethereum and Bitcoin. Simply click ‘Buy’ after selecting the desired crypto.

Alternatively, altcoins may need to be purchased and traded with a stablecoin. Purchase Tether (USDT) with your fiat currency and then find the desired crypto and trading pair – eg ATOM/USDT – and click ‘Trade’, entering the desired amount of USDT to convert to your selected token.

Conclusion

Undoubtedly, cryptocurrencies have opened up many lucrative opportunities for potential investors and traders. You can walk through our comprehensive guide to learn about how you can start cryptocurrency trading, even if you are a newbie.

Also, see our articles on the best crypto courses to learn to trade, and the best crypto Discord servers to join to meet other traders.

FAQs

You can make a profit by purchasing a cryptocurrency at a lower price and further selling it at a higher price when the market is up.

Crypto trading can come out as a lucrative choice. However, one must do the necessary due diligence before investing in any asset.

Yes, it is possible to trade crypto assets on your own with the help of a crypto exchange platform.

One of the best platforms to trade cryptocurrencies is OKX. This platform allows users to trade with a minimum deposit limit of just $10 and has excellent security features. How to successfully trade in crypto and make money?

Is crypto trading profitable?

Can you trade crypto by yourself?

What is the best place to trade cryptocurrency?