When Vitalik Buterin first envisioned Ethereum, it was to be designed in a way to be more than just an investment asset. Its purpose was to give way for decentralization through applications. And that’s what it did. Dapps (decentralized applications) have become part of the norm, and we are seeing more of them every day. However, Dapps only work as well as they do because of an interoperable environment.

Establishing such an ecosystem requires a connection between disparate blockchains by letting them communicate with each other flawlessly. And to establish that connection, blockchains must have a uniform standard. That uniformity should extend to cryptocurrency exchanges, too, to make exchange between different assets possible. In Ethererum’s case, that standard is ERC-20.

However, therein lies the problem. Ethereum is not a native ERC-20 token. Created years before ERC-20 first emerged, Ethereum has a different code base altogether. That is why, in order to make it compatible with exchanges and decentralization applications, a solution emerged, which is to “wrap” ETH inside an ERC-20 standard.

The act of “wrapping”, also known as tokenizing, transforms ETH into an ERC-20 token. Bridging the gap between ERC-20 and ETH, wrapping turns ETH into wETH, a tradable version of Ethereum.

What is Wrapped ETH?

Simply put, wETH is the wrapped version of Ethereum. Wrapped crypto assets are pegged to the original value of those assets by a 1:1 ratio. That’s the same case with wETH. Its value is equal to Ethereum, and the act of “wrapping” doesn’t cause any slippage or have any impact on its price.

Other examples of wrapped cryptocurrencies include wrapped BNB (wBNB) and wrapped Bitcoin (wBTC). To understand the working principle of a wrapped crypto asset, think of it as having the same approach as stablecoins. USDT, for instance, is a wrapped USD, which means it wraps – tokenizes – USD to make the US dollar blockchain compatible.

And similar to how unwrapping the USDT, or “de-tokenizing” it, redeems the original fiat value of USD, unwrapping wETH redeems the original value of Ethereum.

But why go through all this trouble of wrapping ETH? Can’t we use it as it is? The answer is no. It is because Ethereum is not an ERC-20 token. It must be tokenized with the ERC-20 standard for it to be accepted by ERC-20 compatible blockchain. For instance, using ETH on the Optimism blockchain would require one to transform ETH into wETH before transferring it to the chain.

In summary, here is the key takeaway to get from this introduction.

- Ethereum is not an ERC-20 asset.

- It has to be converted into wETH to be used on different blockchains.

- The value of which is equal to that of the underlying Ethereum token.

- While wrapped ethereum tokens slightly veer in terms of characteristics from the standard Ethereum token, they add a layer of compatibility to make them usable on different blockchains – making Ethereum a flexible crypto asset.

Also, check out our guide on how to buy Ethereum.

What Are the Benefits of WETH?

There are three major benefits to draw from using WETH:

Innovation and Advancement of Decentralized Finance

Ethereum blockchain is regarded as the most comprehensive DeFi ecosystem. This crypto asset was the one that paved the way for more flexibility in the blockchain space. Known for its compatibility, Ethereum’s functionality extends beyond registering and validating transactions.

However, while Ethereum is getting closer to becoming more interoperable, it is still a long way off. So, for now, transforming it into wETH is what people need to make Ethereum work consistently with other blockchains.

That transformation opens many venues for Ethereum. For instance, while wETH cannot be used to pay gas fees, its compatibility with different centralized applications allows users to enjoy staking opportunities with Ethereum. Platforms like OpenSea accept wETH as crypto assets to buy and sell NFTs.

Also, when’s compatibility with multiple blockchains makes ETH available across multiple centralized and decentralized exchanges, which exposes ETH to more buyers and sellers, stabilizing and even increasing its liquidity. And as ETH is the core of DeFi, factors like these help wETH innovate and advance decentralized finance.

Check out our list of the best DeFi cryptos to buy.

Increased Liquidity

Liquidity refers to the is the ability to buy or sell assets without impacting their unlying value by a high degree. High liquidity leads to stabilized crypto market, and when liquidity is low, the market is volatile.

One of the major parts of maintaining and increasing the liquidity of an asset requires that it should have exposure to a high number of buyers and sellers, which is only possible if it is available across multiple centralized and decentralized cryptocurrency exchanges. wETH makes it possible for Ethereum, making it easy for people to buy and sell ETH.

Offering Interoperability

The blockchain economy can only prosper through interoperability. That requires flawless interaction between multiple disparate blockchains so that there can be one core of a decentralized economy where people aren’t encumbered by the flaws of centralized institutions.

wETH, by making ETH compatible with ERC-20 blockchains, offers interoperability. Tokenized with the same standards as the blockchain, wETH reduces the chance of error when transacting in those chains.

But the perks of interoperability extend beyond that. Being available on different blockchains, Ethereum, by being tokenized with ERC-20 standards, can tap into the perks of those blockchains. For instance, when stored as wETH on the Avalanche chain, Ethereum can benefit from increased transaction fees and low transaction fees for its holders.

wETH is Highly Compatible

There are 450,000 ERC-20 tokens in total. The number goes up and down every day, depending on how long the new projects persist and how many of these projects are legitimate. This number indicates the number of blockchains that support ERC-20.

In addition to several chains adopting the ERC-20 standard, decentralized applications and wallets, too, have an ERC-20-first approach. With the transformation in wETH, Ethereum can interact with these disparate ecosystems without many issues.

Making Ethereum ERC-20 Compliant

The ultimate goal of wETH is to make an Ethereum ERC-20 complaint. It aims to evolve Ethereum’s code base and make it standardized into the ERC-20 format. When that happens, the world’s biggest altcoin will achieve full interoperability, slowly making wETH null and void.

But till that day, wETH remains a crucial part of ETH, helping it interact with different aspects of the decentralized economy, such as liquidity pools, crypto lending, NFT Trading, and more.

How Does Wrapped Ethereum Work?

Wrapping ETH requires sending it to a custodian that holds it for collateral. These custodians can be merchants, multi-signature wallets, or simply smart contracts.

To understand the basics of the wrapping mechanic, however, take the smart contract, for example. ETH is submitted to the smart contract, which has an inbuilt functionality of generating wETH and backing the deposited ETH inside a centralized reserve. So, the smart contract generates wETH while locking the pegged ETH.

Once the user applies to redeem the ETH from wETH, It gets ETH out of the reserve and burns the wETH out of circulation. Both of these acts must happen simultaneously. If it doesn’t, there can be a distortion with the ratio, which would depeg the value of wETH and devalue the Ethereum price.

How to Wrap ETH

We touched upon the need of custodians for wrapping ETH in the last section. They can be smart contracts, Decentralized exchange crypto wallets. Let us discuss the process of wrapping Ethereum using these custodians:

Decentralized Exchange

The most common way that people opt for is through a decentralized exchange. It has a simple wrap functionality, which makes the process of tokenization of Ethereum simpler. We are taking Uniswap as the DEX to demonstrate the process:

Step 1 – Go to Uniswap

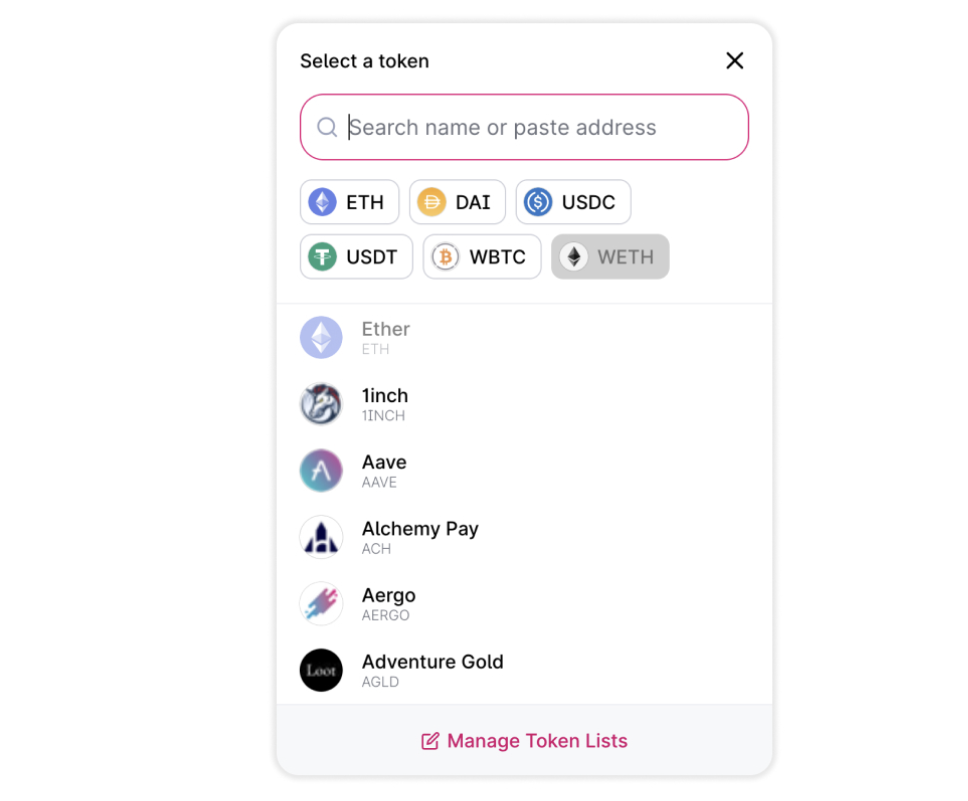

Connect your wallet to Uniswap. Proceed to select the token at the bottom. Among the options available, choose wETH.

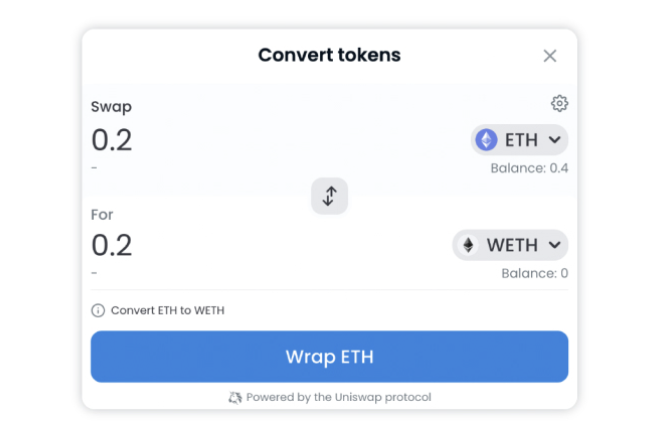

Step 2 – Enter the Number of ETH you want to Wrap

Proceed by entering the number of ETH you want to convert to wrapped ETH. and click on the “Wrap” button.

Step 3 – Confirm the Transaction

You will be asked to confirm the transaction. Do so and pay the gas fee to complete the process. Uniswap has the lowest gas fee among the three methods. But the gas fee also depends on timing. Once the transaction is complete, all you need to do is wait for the transaction to show up on the blockchain.

Using a wETH smart contract

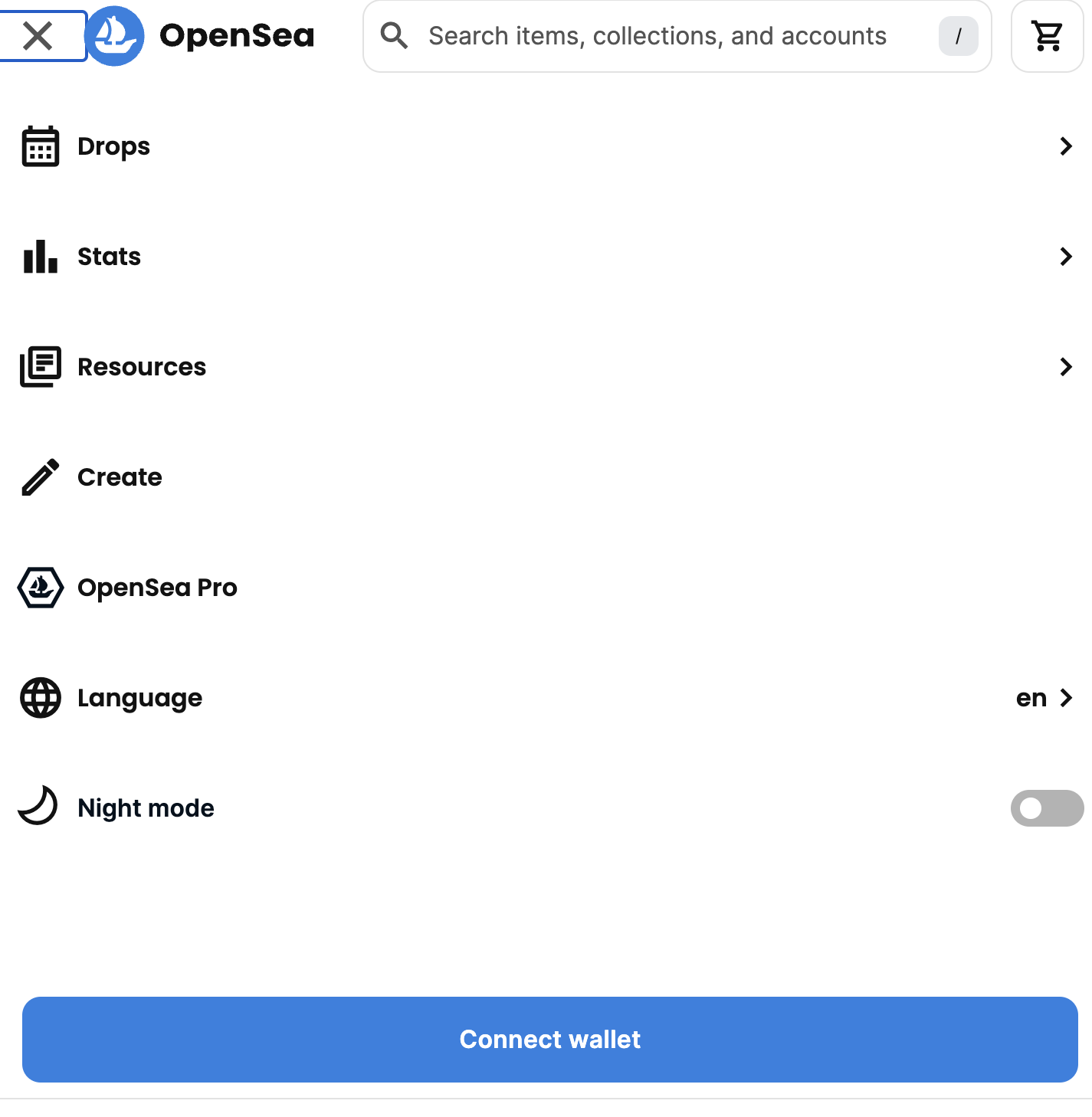

Smart contracts also offer an easy method to convert ETh into wETH. For the context of this guide, we are using Opensea. Here are the steps to follow:

Step 1 – Go to Opensea

First, you must navigate to Opensea.io. there you will find. There, click on the three bars on the top left of the page to get a dropdown menu. Click on the “Connect Wallet”.

Step 2 – Wrap Ethereum

You will get multiple wallet options to connect. Choose Metamask since it is marked the most “popular”. Once you have connected the wallet, click on the three dots next to Ethereum on your wallet and click on the “Wrap” button. Enter the value of the ETH you want to convert, and click on Wrap ETH.

Sign the transaction and confirm it, and wETH will show up once the process is complete. If the texts seem too small to be legible, wETH is marked with a pink logo that separates it from Ethereum.

Using a Crypto Wallet

You can use MetaMask to wrap ETH. However, keep in mind that the gas fee is the highest when using MetaMask. This may be largely due to MetaMask being one of the most popular Ethereum wallets, and it has been linked to nodes that often get too congested too often.

Here are the steps to wrap Ethereum using this process:

Step 1 – Open the wallet

Your first step must be to open the wallet. And then ensure that you have Ethereum mainnet selected. If not, you can add the network manually using the steps below:

- Go to settings

- Click on Add network

- Click on Add a Network Manually

- Enter the network name, RPC URL, Chain ID, and the currency symbol

- Network name – Ethereum Mainnet

- RPC URL – https://api.mycryptoapi.com/eth

- Chain ID – 1

- Currency Symbol – ETH

- Click on the “Save” button.

Step 2 – Swap to wETH

Once you have Ethereum Mainnet selected, click on “Swap”. Then, select WETH in the “Swap to” field. Enter the amount of ETH you want to swap. Click on “Review Swap,” and finally, click on the “Swap” button to finalize the process.

How to Unwrap Ethereum?

Manual unwrapping is possible, and its process is the same as above. The only difference is that instead of Wrap buttons, you will encounter “Unwrap” buttons. In Metamask’s case, however, you would need to swap your wETH for ETH.

What are the Risks of Wrapped ETH (wETH)?

The primary risk of wrapped Ethereum or wrapped cryptocurrencies, in general, is their reliance on a custodian.

While wrapped tokens are improving, having a custodian adds an element of centralization. In all the steps we discussed, there is a centralized body that provides wETH by backing its ETH value through a centrally controlled reserve.

Furthermore, minting a wrapped token does not happen on the blockchain; a central program is used instead. Even Vitalik Buterin, the originator of Ethereum, has his reservations about it. He has stated that since decisions about wrapped assets are centrally made, adding the risk of market consumption.

That issue stems from protocols like BTC and NXM that are used to wrap tokens not being Turing complete. It means that they cannot be tethered to a smart contract, which leads to the process of wrapping not being automated. That leaves the control of wrapping with a central program, leaving wrapped ETH susceptible to the risks associated with centralization.

Another issue with Wrapped ETH is Contagion. Since wrapped Ethereum is an interdependent cryptocurrency, it is at risk of financial contagion, which refers to the spread of financial crises from one cryptocurrency to another.

Conclusion

With wrapped ETH, users get the benefit of interoperability. It allows ETH to access non-compatible blockchains, which paves the way for DEFI expansion. That leads to increased liquidity for ETH, making more Ethereum available for dapp developers, which further bolsters innovation in the blockchain ecosystem.

However, there is a limitation stemming from centralization, and the problem lies with the current wrapping mechanism.

So, while wrapped ETH is good, and the perks outweigh the cons, if unchecked, the one con it does have can create issues for ETH’s development. However, there is more push towards changing Ethereum’s codebase to make it ERC-20 compatible without the need for wETH. Once that happens, wETH will be slowly moved out of the blockchain space. But till then, there is a need for a more decentralized wrapping mechanic.

Frequently Asked Questions

What is the difference between wrapped ETH and ETH?

Wrapped Ethereum and Ethereum are two different kinds of Ethereum tokens. Ethereum is a original token for the Ethereum blockchain. Wrapped Ethereum is its ERC-20 variant, created by tokenizing Ethereum with ERC-20 standards.

What does Wrapped ETH means?

Wrapped ETH means a tokenized version of Ethereum. By being wrapped with ERC-20 standards, Ethereum becomes compatible with other ERC-20 blockchains, DEXs and other decentralized applications.

What are the benefits of wrapped ETH?

Wrapped Ethereum make Ethereum compatible with other blockchains. It also makes the token interoperable, allowing it to have access to better liquidity since it can be active on different decentralized applications.

What are the limitations of wrapped Ethereum?

The main limitation of wrapped Ethereum is centralization since the process of wrapping the Ethereum token involves using a single centralized application.