Decentralized exchanges are becoming more and more popular in the crypto community. They differ from traditional crypto exchanges in different features with the most crucial being a peer-to-peer marketplace where the trades are executed without the interference of a third party. In contrast, centralized exchanges are governed by a single party and are often regulated meaning that you have less anonymity than trading on the DEXs.

The speed of the transactions is another reason why decentralized exchanges are getting widely accepted. Most of the exchanges also issued their native tokens that grant this or that priority within the DEX ecosystem. Apart from that, DEX coins are widely traded among investors as the popularity of the DEXs can increase decentralized exchange coins’ value too.

In this guide, we will introduce to you top DEX coins to buy in 2024, explain the importance of DEX coins and guide you on buying DEX coins online.

Best DEX Coins to Buy in November 2024

- Uniswap – The Largest DEX Coin by Market Capitalisation

- Compound – Best DEX Coin for Long-Term Investment

- SushiSwap – Best DEX Coin for Earning Passive Revenue

- PancakeSwap– Best DEX Platform to Trade BEP-20 Tokens

- YearnFinance – Popular DEX Coin with Multiple Earning Tools

- AAVE – DEX Coin that Grants Discounts and Free Transaction Fees

Best Exchange to Buy DEX Coins

If you are curious about investing in decentralized exchange coins, you must find an online broker to make the purchase. Among the essential metrics, you need to consider when selecting a trading platform are safety, privacy policy, trading fees, the versatility of coins, payment methods, etc. But the number of cryptocurrency exchanges makes it a bit of a daunting and time-consuming process to analyze several platforms and select the most suitable for you.

Our research team found the best broker to buy dex coins is eToro which stands out with a number of unique features. It’s a cost-effective, trustworthy, and highly functional trading platform.

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Top DEX Coins to Buy Now – Full List

Now when you have already learned what the DEXs are and how they work, let’s take a look at the best-decentralized crypto exchange coins. Below you will find detailed reviews for the top DEX coins in the market.

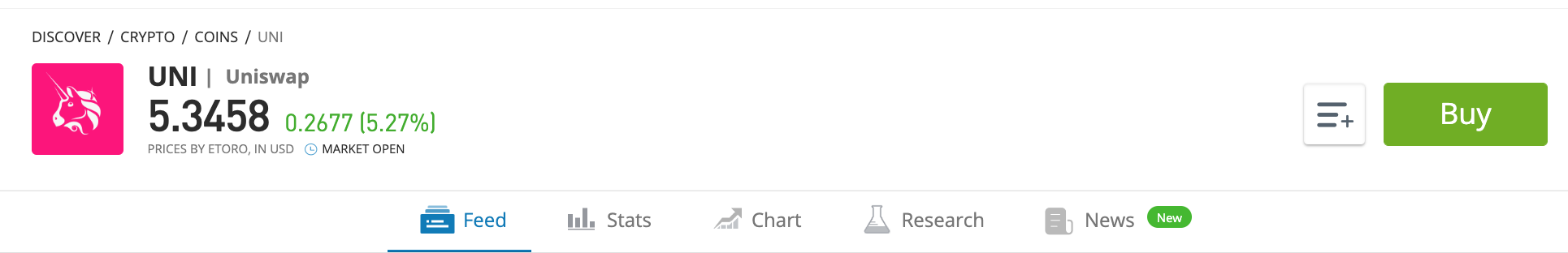

Uniswap – The Largest DEX Coin by Market Cap

Uniswap is one of the leading decentralized exchanges in the industry with more than 1.5 million users. Being the first automated market maker trading platform, Uniswap offers peer-to-peer trading without any third party or middlemen involvement. The platform is based on the Ethereum blockchain and enables swapping between all the ERC20 tokens.

To buy or sell a certain ERC-20 token on Uniswap, the token must have its own smart contract and liquidity pool. But even if it does not have them yet it is very straightforward to create if you hold some ETH tokens. As ETH is the fuel token of the platform it is used to pay for transaction fees and create smart contracts. Apart from ETH, Uniswap has its native token, UNI, which is a governance token and grants voting rights to the holders.

The UNI token was launched in September 2020, and the team airdropped 400 UNI to every wallet that showed any activity with the Uniswap platform till September. The DEX coin value has grown rapidly and soon it became the largest crypto asset by market capitalization which was also due to the popularity of the DEX Uniswap. In fact, it is the most successful DEX platform that became the first decentralized exchange to have a $100 billion trading volume.

Your capital is at risk.

Compound – Best DEX Coin for Long-Term Investment

Compound was founded in 2018 by entrepreneurs Robert Leshner and Geoffrey Hays and aims to become an automated market that enables lending or borrowing cryptocurrencies. The company has managed to raise capital through 2018 and 2019 being funded by such popular venture capital firms as Andreessen Horowitz, Paradigm Capital, etc. Compound is a popular name in the DEX industry and its DEX coin COMP is among the most widely traded crypto assets.

On the whole, Compound consists of two parties – lenders and borrowers. The first group can lend its idle assets to the Compound protocol, locking them in smart contracts and they get ctokens that represent the deposit. In contrast, borrowers can borrow cryptocurrencies and give collaterals for them. Both processes happen automatically through the Compound’s special code. All users who interact with the protocol are rewarded with Compound’s native token COMP. Additionally, lenders are rewarded for locking their assets in the pool based on the cTokens they hold and other factors.

COMP acts as a governance token for the ecosystem and everyone holding a COMP token can participate in the decision-making process referring to the protocol. COMP is also a tradable DEX coin and has a circulating supply of 7 million tokens. The maximum supply of the coin is 10 million tokens and it is currently the #95 largest crypto by its market capitalization.

Your capital is at risk.

SushiSwap – Best DEX Coin for Earning Passive Revenue

SushiSwap is a fork from Uniswap that was founded in 2020 by a group or a person under the pseudonym Chef Nomi. It is currently in the process of rebranding and soon will be rammed to Sushi. Like most decentralized exchanges it is based on the Ethereum blockchain and uses AMM to provide liquidity pools. SushiSwap is aimed to be better than Uniswap, therefore it works on adding more tools and passive revenue earning possibilities for the users. They can swap, earn, stake, borrow, lend, leverage, and stack yield on the SushiSwaps platform.

SushiSwap is a great place to earn passive income by locking your idle assets in smart contracts. The lenders will be rewarded with SUSHI tokens which are generated from the transaction fees that the users on the SushiSwap platform pay. As SUSHI is the governance token of the ecosystem, Sushi holders also can actively take part in the decisions and vote on changes regarding the project.

People who lend tokens to SushiSwap’s liquidity tools can take out their tokens and earnings whenever they want. Apart from it, they can also stake their SUSHI governance tokens and generate rewards in the form of xSUSHI tokens. SUSHI is currently ranked #144 largest crypto asset by its market cap and has a circulating supply of 250 million tokens.

Your capital is at risk.

PancakeSwap – DEX Platform to Trade BEP-20 Tokens with Native DEX Coin

PancakeSwap is a BNB Chain-based automated market maker and DEX that enables to trade BEP-20 tokens without the need for intermediaries. The BEP20 tokens are the ones that originated on the Binance Smart Chain, and PancakeSwap aims to provide a decentralized platform for swapping between these tokens.

PancakeSwap has a native token called CAKE which is a trading pair for multiple tokens listed on the platform. CAKE is also used to reward the lenders who provide their tokens to the PancakeSwap liquidity pools. After locking your coins in the liquidity pool you will get an LP (liquidity provider) ticket which you can later use for farming purposes. You can farm these LP tokens and generate rewards in the form of CAKE tokens or you can stake them and again generate rewards.

PancakeSwap is also quite a versatile platform and besides being a decentralized exchange it also has a free-to-use lottery platform. The latter enables you to gamble by registering a combination of four numbers. If you fill in the winning combination you will receive 50% of the winning pool. If you are not successful enough to guess all the numbers correctly and in the correct order, you can still receive a prize if two or more numbers match the winning combination.

Your capital is at risk.

YearnFinance – Popular DEX Coin with Multiple Earning Tools

YearnFinance’s YFI token is another popular decentralized exchange coin to consider purchasing. It was created as a native token of Yearn Finance decentralized exchange which was built on Ethereum’s network by an independent developer Andre Cronje. The main purpose of YearnFinance is to create a platform where buyers and sellers can directly interact with each other without any third-party participation.

Besides being a DEX where people can lend or borrow tokens, YearnFinance also provides a couple of earning tools to help users generate passive income. For instance, the platform allows traders to lock their YFI tokens in smart contracts and generate rewards for that. Earn is another tool that automatically finds the best lending interest rates on different protocols and users can lend their assets to generate those interest rates.

YearnFinance’s YFI token is quite expensive though it has lost a significant value in the last year. The cryptocurrency has a very low supply – the maximum supply of YFI is 36,666 tokens and more than 99.9% of coins are already in circulation. As long as Yearn Finance is quite popular and there is enough demand for the coin it is traded at high prices following the supply and demand low. The crypto even hit $82,000 in 2021 but the prices dropped significantly and now one YFI is worth $7500.

Your capital is at risk.

AAVE – DEX Coin that Grants Discounts and Free Transaction Fees

Founded in 2017, the Aave project was initially known as ETHLend and its native token was called LEND. Having 1 billion LEND tokens originally, Aave founders soon transformed it into AAEV at the value of 100 LEND for 1 AAVE. In this way, they decreased the supply of the Aave coins by 18 million tokens.

Today Aave is among the most popular decentralized exchanges in the market and the AAVE token is widely traded among investors, which is due to the popularity of the Aave protocol. Based on the Ethereum blockchain, Aave works pretty much similar to the previous DEX platforms. It enables borrowing, lending, and earning almost 20 different cryptocurrencies only through the code and without any middlemen.

The platform issued two types of tokens – aToken and AAVE. The first one is created and granted to the lenders every time they lock their assets in the pools and enables them to generate rewards through pooling. The second one is Aave’s governance token which not only grants voting rights within the ecosystem but gives some advantages too. For example, AAVE holding lenders do not pay transaction fees for taking out the loans. Additionally, borrowers giving AAVE tokens as collateral get discounts on transaction fees.

Your capital is at risk.

What are Decentralized Exchange Coins (DEX)?

It is crucial that you know what you are investing in, hence in this section, we will explain what decentralized exchange coins are and how they work. If you have ever traded before you may know that the centralized, traditional exchanges are platforms where you can buy, sell or trade a certain asset that is supported by it. Centralized means that they are governed by a single party who manages all the processes and takes care that your trades are executed.

In contrast to them, decentralized exchanges are built on blockchain technology which means that the trades are executed automatically. These exchanges are also known as peer-to-peer marketplaces because the contracts are solely between the buyer and the seller. No other third party is involved in the process.

But how do these exchanges work? To accomplish this process DEXs use smart contracts which bear certain conditions about trading one cryptocurrency asset against another and automatically execute the trade if the conditions are met. DEXs also have so-called liquidity pools where token holders can lock their holdings and be rewarded for that. Later on, buyers can purchase the assets locked in the liquidity pools meaning that such pools have a core role in the whole process.

With all these features decentralized exchanges have some advantages over traditional exchanges which is why they are growing so rapidly. First and foremost, they provide more anonymity to the traders than the centralized ones. The latter often requires that users verify their identities through some documents and execute the trades via bank card, wire transfer, etc. But DEXs do not require verification and to buy a coin on the DEX platform you simply need to link your crypto wallet.

The reason that verifications are mandatory with centralized exchanges is that it is the way to keep your account safe and away from fraud. As long as DEXs are built on blockchains that are highly secure and almost impossible to hack, they do not need details about your identity. Another advantage is the variety of tokens as long as holders can lock all the ERC-20 tokens in the smart contracts, buyers have a huge trading selection.

DEXs also issue native tokens to fuel their network. These tokens can be utility tokens and governance tokens. DEXs coins can be used for paying transaction or gas fees, trading NFTs, and can also grant governing rights to the holders. Some DEXs also will provide their native token holders several advantages or discounts when trading on the platform.

How We Reviewed the Best DEX Coins to Invest in

As the cryptocurrency market is growing rapidly more and more decentralized exchange coins sprung up in the market. Definitely, you can not invest in all of them which means you will need to narrow down your selection list and include the best dex coins to build a diversified portfolio. But how to decide which coins are the best dex-based coins? Here are what metrics we use to create the best dex coin list.

Security

First of all, we consider how secure the crypto asset is. It is crucial that the project is backed by a team of professionals and offers trustworthy and effective technology. If the project has several weaknesses it is likely to fail shortly which means that its value can crash and you will not benefit from your investment.

Coin’s Use Case

Another vital factor to consider is the use cases of the DEX coin you want to buy. It is better if the token has multiple use cases and not only be used for training purposes. The good thing with this is that if it has a lot of use cases within the ecosystem that it fuels, more people will purchase it to use it on its network. Consequently, there will be more demand for the coin which will increase its value. All the DEX coins picked by us have additional purposes apart from being an asset to trade. For example, they can be staked, used for paying fees, can grant governing rights, etc.

Potential Growth

Potential growth is another indicator of investing in a crypto asset. You need to do a lot of market analyses and combine them with the coin’s fundamental analysis to understand what upgrades or projects the DEX coin project has for the future and if that can affect its price positively in the future.

These are the main metrics we use to evaluate if this or that digital asset is a good investment or not but there are multiple others you can use. In any case, spend some time doing your own research and invest only what you can afford to lose as cryptocurrencies are rather risky.

Are Decentralized Exchange Coins a Good Investment?

There are some reasons why DEX coins can be considered a good investment. First of all, they intend to offer more sophisticated technology that will replace the traditional exchanges and solve some basic problems. DEXs want to build a decentralized platform with no intermediary between the buyers and sellers. Additionally, they aim to offer lower transaction fees and higher transaction speed.

Another great factor to consider is that DEXs are still new and have a lot of room for growth. Some DEXs already have millions of users and this fact makes them attractive and successful projects. But they still have a lot of developments to undergo and if they succeed in bringing their goals into reality they can win a huge amount of attention and become widely used.

Where to Buy and Trade DEX coins?

Decentralized exchange coins are available to buy on many cryptocurrency trading platforms. To buy DEX coins you need to find an appropriate platform for you as there will be multiple options in the market. Our top recommended platform is eToro which supports trading more than 70 coins and tokens, including Uniswap, SushiSwap, Aave, YearnFinance, etc. Another trusted option with over 20 DeFi tokens listed is Bitstamp.

eToro is a brokerage platform that lists several types of assets – stocks, commodities, cryptocurrencies, etc. It is a highly secure broker regulated by ASIC, FCA, FinCEN, and CySEC which means that the platform will do its best to keep your account away from fraudulent logins and attacks. eToro is also an excellent platform in terms of trading fees as it offers cost-effective trading with competitive prices.

But eToro’s greatness is not only about being a safe and cost-effective trading platform – the broker also has a great user experience, a simple and beginner-friendly platform. eToro is also an excellent social trading platform with great tools that allow you to mirror the trades of an expert trader with a few simple steps. eToro also provides a combination of good trading tools, graphs, charts, news, and analyses that will help you make a better training strategy.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

How to buy DEX Coins Step by Step with eToro

You can buy decentralized exchange coins through brokerage platforms through a few simple steps. Here is a detailed guide that explains how to buy DEX coins with eToro.

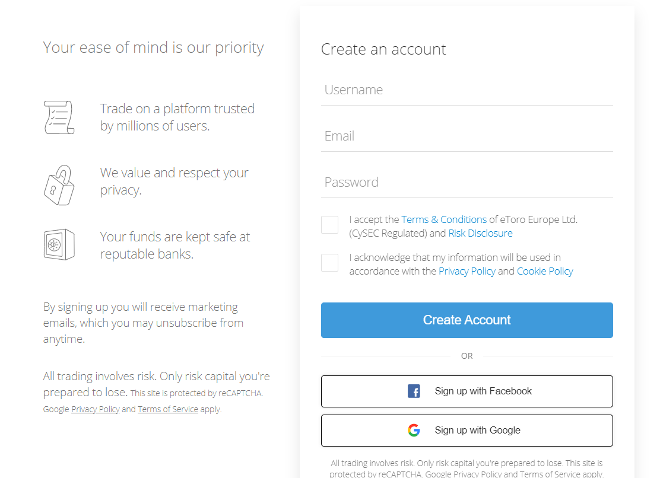

Step 1. Register for an Online Exchange Account

Start by creating an account with eToro for which you must provide some necessary details about your identity – name, surname, email, phone number, etc. To finish the registration process, you need to verify your account as eToro will not let you trade with an unverified account for your own safety. It is an ID and address verification that you can undergo quickly if you provide the correct documents.

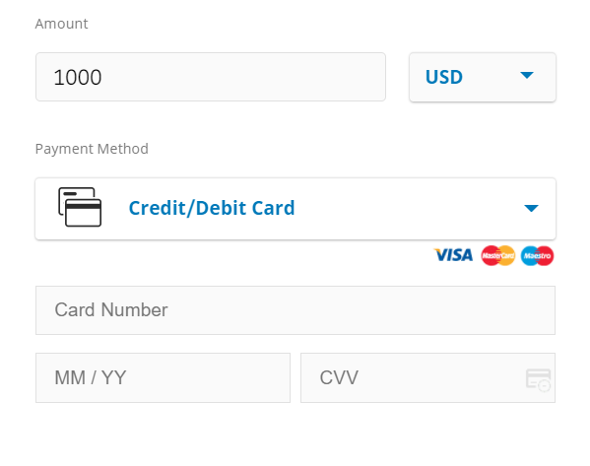

Step 2. Fund Your Account

Before you invest in any DEX coin, you must have money in your brokerage account. eToro supports several billing options – bank card, speed transfers, wire transfers, Skrill, PayPal, etc. To fund your account select the suitable payment method and register the details to link it to your account.

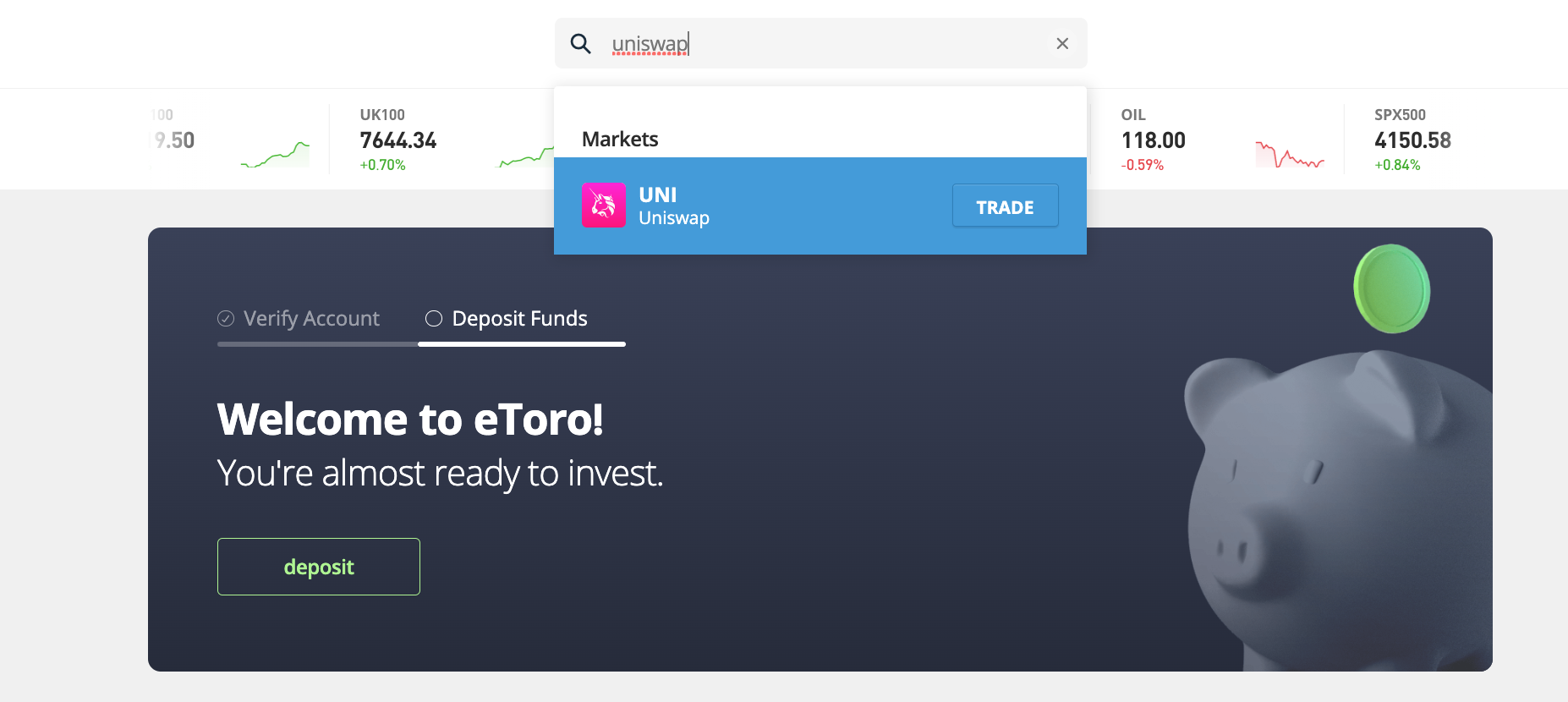

Step 3. Find DEX Coins

Once the money is deposited into your eToro account, you can get into the trading process. Visit the eToro’s cryptocurrency market section and browse to find the coins you want to buy. Or you can simply type the coin’s name in the search toolbar and click on the first results.

Step 4. Buy DEX Coins

Eventually, you can start the purchase by clicking on the “Trade” button next to the asset name you want to buy. A trading window will spring up on your screen on which you must select the buying window. Now fill in the amount you want to purchase and open the buying order.

Where to Trade DEX coins?

If you want to trade decentralized exchange coins, first you should take care of finding an appropriate trading platform that can ensure safe and effective trading. Below you will find our recommendation list with the best brokers to trade DEX coins with.

Conclusion

If you are looking for a good long-term investment DEX coins can be your best choice. The DEX industry is growing rapidly and many of them try to offer versatile services apart from simply lending or borrowing assets. Hence, if you believe that this technology can prove itself and DEXs can win public attention in the future, you can invest in DEX coins.

As the market is filled with hundreds of options, in our guide we have already reviewed the best DEX coins to buy in 2024, so you can save your time and select your favorite coins from our recommendation list and visit a brokerage platform to make purchases.

Related

Most Searched Crypto Launch - Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards - pepeunchained.com

- $10+ Million Raised at ICO - Ends Soon

Bitcoin

Bitcoin