The decentralized finance (DeFi) space has seen a significant surge in value, with almost $37.697 billion in total value locked. One of the standout protocols has been Yearn. With its YFI governance token, finance sees a significant value rise. Below, we’ll examine everything you need to know before about how to buy Yearn. Finance coin, how it works, and where to store them.

On this Page:

How to Buy Yearn.Finance Coin – Quick Guide

If you are pressed for time and need to get started quickly, we have taken the time to streamline the process for you.

- Choose a cryptocurrency exchange – we recommend Binance

- Create an account

- Search for ‘Yearn.Finance’ in the platform

- Select your payment method

- Enter how much YFI you want to buy

- Confirm your trade

Where to Buy Yearn.Finance Coin

You can buy YFI from several crypto exchanges, but here we focus on one of the best in the industry.

Binance – Largest Cryptocurrency Exchange in the World in Terms of Volume

Binance was started in 2017 by Changpeng Zhao and has grown tremendously since then. Today, the exchange handles billions in daily trades and has millions of customers spread across the globe. Binance houses more than 100 coins, including Yearn. Finance, Bitcoin, Binance Coin, and Ether.

Traders on Binance can check for Yearn. Finance price, set alerts, and trade the token with a leverage of 5x. Traders also get access to an advanced platform with all the bells and whistles. This includes professional charting tools, including Bollinger Bands, Relative Strength Index, and others.

Binance also makes it easy to trade YFI against other pairs. You can trade the yearning token against the USDT, BUSD, BNB, EUR, and BNB. You can trade pairs such as YFI/BNB and YFI/EUR. Concerning costs, Binance doesn’t use a spread model. It charges a trading fee of 0.1%, considered the lowest in the industry. Besides its trading capabilities, Binance offers intuitive features such as staking, crypto loans, a Binance wallet, and a cool.

Pros

- The largest exchange in terms of liquidity and volume

- Affordable trading fee

- Supports bank transfers and credit card payments

- Offers leverage and derivatives market

- Ideal for both newbies and sophisticated traders

Cons

- Requires a learning curve at the beginning

- Charges a 1.8% on debit/credit card deposits

Your Capital is at risk.

What is Yearn.Finance?

With Yearn. Finance, DeFi users can maximize their yields on trading and lending. The protocol acts as a gateway to other DeFi protocols, allowing users to gain access to the most profitable around.

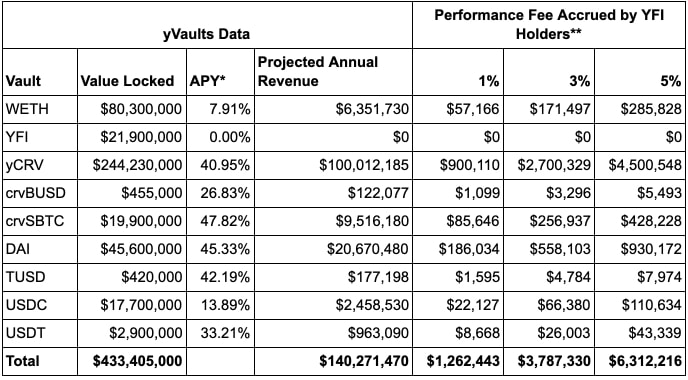

Yearn. Finance’s top feature is known as Vaults. The feature lets users deposit their digital assets and earn a specified percentage yield. Vaults run via a predetermined code, managing all deposited funds with a strategy to minimize risk and maximize earnings.

Essentially, vaults work to provide Yearn. Finance users with custom investment strategies. These strategies are expressed in the Solidity programming language, so users interested in increasing their own vaults will need to understand coding. However, investing in a vault is easy. Simply select a specific vault and deposit stablecoins into it. You already know the ROI, so you can operate as you please.

Beyond the opportunity to maximize yields, vaults are also critical because they help users reduce the cost of transacting on the Ethereum blockchain. Vaults are more critical now because the blockchain is notorious for significantly high gas fees. To save costs, vaults pool funds together and send them to a yield farm in one transaction. Thus, only one account – the vault controller – can pay the transaction fees. Beyond Vaults, Yearn. Finance also has some additional services. These include:

1. APY:

The APY feature is essentially a table that highlights the different interest rates across several lending DeFi protocols.

2. Earn:

The feature helps to identify the highest percentage rates you can earn while lending an asset. It also functions as a version of vaults that only supports tokenized Bitcoin and stablecoins.

3. Zap:

A feature that aggregates several trades into one, thus saving effort and cost. Zap also allows you to swap traditional stablecoins for liquidity provider tokens.

The YFI Token

YFI is the governance token for Yearn. Finance. It’s an ERC-20 token created in July 2020 to allow YFI users to gain voting rights and decision power on different developments that come to the protocol. Users could buy YFI through different methods, including providing liquidity to a decentralized exchange Balancer or depositing capital into Yearn. Finance products directly.

This way, Yearn. Finance capitalized on “yield farming” – a practice where users lock their digital assets in a DeFi protocol to gain more cryptocurrencies. The more the assets are locked, the more tokens the user gets. When Cronje announced YFI, he explained that the token had no intrinsic value. However, users soon jumped on the bandwagon, farming all 30,000 available tokens. The limited supply has made each token scarcer and rarer, increasing its value.

Why Buy YFI? YFI Analysis

Yearn. Finance has the singular vision of simplifying investments in DeFi and other related activities to improve accessibility to investors. With custom-built tools, the product acts as an aggregator for DeFi protocols and allows investors and users to access the highest possible investment yields.

For-profit, Yearn. Finance charges a reasonable 0.5 percent in withdrawal fees. There is also a gas subsidization fee, which could vary based on congestion on the Ethereum network. Since the protocol is decentralized, rates can be changed at any time through a consensus of users.

The YFI price increase comes primarily from incentives in the protocol. Holders of YFI can vote on rules governing Yearn. Finance. For a resolution to pass on the Yearn. The finance codebase must secure over 50 percent of the total votes. Regardless of whether they hold YFI tokens, anyone can raise a proposal. However, only YFI holders can vote to determine whether the proposal passes.

Yearn. Finance is already one of the most influential DeFi protocols available. With the prospect of voting on proposals concerning the platform, it is easy to see why many people want to buy Yearn. Finance coin.

Beyond the voting power, YFI holders can also receive revenue collected by the protocol in fees. Yearn. Finance charges a 0.5% withdrawal fee and a 5% performance fee “on subsidized gas.” These fees are redistributed to holders staking on the platform. These figures are relatively cheap for people using the features, and YFI holders can also get impressive revenues as a result.

Suppose you don’t want to buy YFI on exchange. You can earn the token by providing liquidity to the protocol and participating in the Yearn ecosystem. The number of tokens a holder has will determine their level of voting power on resolutions that affect the protocol.

Source: IntoTheBlock, Stats.Finance

In general, Yearn. Finance has become a DeFi behemoth. It has built a solid reputation since it launched last year, with its vaults helping many investors maximize their returns while also cutting risk. Yearn, thanks to interactions with other DeFi protocols (including dy/dx, Compound, and Aave). Finance has become a broader ecosystem that touches pretty much every facet of the DeFi space.

YFI is the backbone of Yearn. Finance, making it a DeFi blue-chip asset. The Yearn. Finance coin price has also increased, making it a safe investment.

Yearn. Finance Coin Price

Yearn.Finance Coin is a decentralized finance (DeFi) platform that allows users to earn interest on their crypto assets by lending them to various protocols. The platform also has its own governance token, YFI, which gives holders voting rights and a share of the fees generated by the platform.

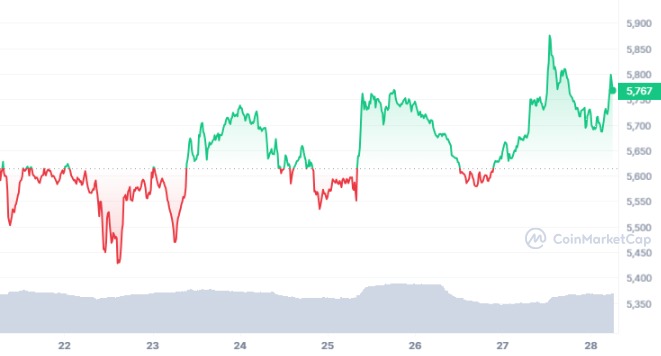

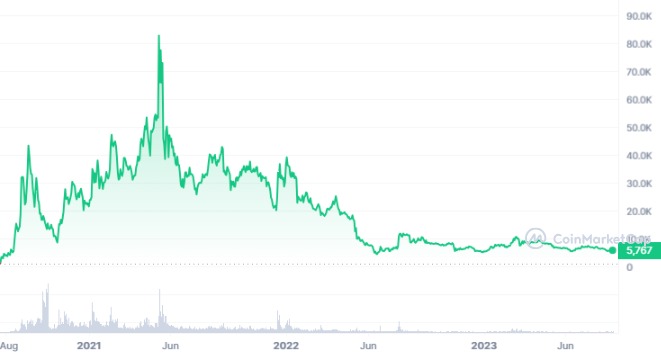

The price of YFI has fluctuated significantly since its launch in July 2020, reaching highs and lows that reflect the volatility of the DeFi sector. YFI started 2021 with a price of $21,566. It reached its all-time high of $82,835 on May 12th, 2021, following a strong rally that coincided with the launch of Yearn v2, a major upgrade that introduced new features and improvements to the platform. However, the price soon dropped sharply as the DeFi sector faced regulatory uncertainty and market corrections. YFI ended 2021 with a price of $30,225.

In 2022, YFI experienced another surge in price as the DeFi sector regained momentum and Yearn launched new products and partnerships. The price then entered a consolidation phase, trading between $40,000 and $20,000 for most of the year. However, the bear market hit hard, and YFI marked a yearly low of about $4,000; YFI closed 2022 with a price of $5,088.

In 2023, YFI continued to show resilience and growth as Yearn expanded its ecosystem and user base. YFI reached a yearly high of $10,560 on March 2nd, 2023. The price then corrected slightly but remained above $4,000. As of August 27th, 2023, YFI is trading at $5,785.65, according to Coinmarketcap, representing a 34.47% decrease over the year.

The historical price data of YFI shows that the token has been one of the best performers in the DeFi space despite facing challenges and competition from other platforms. The price of YFI reflects the innovation and value proposition of Yearn.Finance Coin, as well as the demand and sentiment of the DeFi sector. YFI is likely to continue to be a leading DeFi token in the future as Yearn strives to offer more services and solutions to its users.

Yearn. Finance Coin Prediction

In recent years, Yearn Finance (YFI) has consistently advanced within its ecosystem, and the year 2023 has marked notable milestones in its journey of recovery. As reported in the 68th edition of the Yearn Newsletter.

Latest Key Developments

- yETH Bootstrapping Competition: The yETH Bootstrapping initiative has gained momentum, with the first round of deposits concluded. Eight whitelisted Lending Service Tokens (LSTs) compete for the five available spots in yETH. Voting with staked yETH tokens is essential to receive a share of the approximately $9,484 in incentives. The top LST in the first round can represent up to 40% of yETH’s composition, adding to the stakes.

- V3 Vault Hacking Challenge: Yearn Finance is inviting participants to attempt hacking its V3 Vault for a reward of $20,000. This challenge underscores Yearn’s commitment to security, especially in light of recent exploits in the DeFi space. The community is encouraged to participate responsibly, with the reminder that security remains a priority.

- Updates on Velodrome Vaults: Velodrome Vaults, including Wido Zap support, are gaining attention. Users are encouraged to optimize their OP Velodrome Vault deposits to maximize boosted yields and explore the new capabilities offered by integrating Wido Zap.

- New Pools and Vaults: A new lp-yCRV pool has been introduced, facilitating continued CRV emissions and yield earning. New vaults featuring tokens such as yLQTY, Sonne, and MAI have also been unveiled. These developments provide users with opportunities for boosted rewards and yield.

- Yearn’s Presence at ETHCC Paris: Yearn Finance participated actively in events such as the War Room Games and the Smash Bros Tourney at ETHCC Paris. These engagements demonstrated Yearn’s involvement in the broader crypto community and its commitment to fostering growth and collaboration.

- Security and Audits: Yearn’s v3 Vaults was audited by yAuditDAO, resulting in a comprehensive report highlighting the codebase’s quality and innovative design. Further insights into Web3 security audits were shared at BlockSplit 2023, emphasizing the importance of context and variability in auditing.

- OATH Foundation Collaboration: Yearn engaged in discussions with the OATH Foundation, exploring ways to empower the DeFi ecosystem through collaboration and technology.

- Yearn’s Stats and Community Engagement: Yearn’s statistics, including Total Value Locked (TVL) and commitments to Vaults V3, were shared transparently on Yearn’s Budget Request GitHub. Community engagement extended to podcasts, interviews, and collaborations with projects such as StaFi, Messari, Synthetix, and Inverse Finance.

However, Yearn Finance’s progress in 2023 showcases its commitment to innovation, security, and collaboration within the DeFi ecosystem. From bootstrapping competitions to security challenges and ecosystem expansion, Yearn’s multifaceted approach continues to shape its growth and impact. These developments will lead the FYI price to a significant recovery in the near future.

By the end of 2023, it is predicted that the price of yearning. Finance will be $7,929, which will increase to $8,680 by the end of this year. Almost the same momentum would be carried forward by this cryptocurrency in 2024, where it would reach $7,816 by the middle of 2024. Afterward, it will close the year with a huge price of $9,575.

2025 is expected to be a promising year for this cryptocurrency as it will surpass $11,000 on its price charts. It is expected to be $11,192 by the middle of 2025 and $11,850 by the end of the year. Going by similar growth, the token would go beyond $12,500 by the middle of 2026. It is expected to close that year with a value of $12,628.

Considering all these projections, it can be reasonably concluded that yearn. Finance would have a great run in the crypto market in the upcoming years. Finance is set to catapult the finance sector into a whole new sphere, and with this, its governance token’s value may become the virtual currency of the decentralized market.

Buying Yearn Finance As A CFD Product

A contract for difference (CFD) is an agreement made in financial derivatives trading. The differences between the opening and closing trade prices are settled in cash at the contract’s expiration. CFDs do not require the presence of any physical goods or securities as trades are made on the underlying asset.

CFDs are primarily applied in traditional financial instruments like FX currency pairs, commodities, stocks, bonds, etc. However, the practice has filtered into the crypto space, with a growing number of brokerage firms offering CFD services.

The Importance of Responsible Yearn Finance Investment

Cryptocurrencies have become a major hit in the last year, with institutional adoption growing daily. It is the only industry to hit a trillion-dollar valuation in just a dozen years. However, cryptocurrencies have been plagued by volatility, with repeated wild price swings. Even though many have benefited from the industry’s volatility, several others have also lost large chunks of money. Given this, we highlight some measures you need to take to protect your capital and increase your chances of profit from trading cryptocurrencies.

1. Make Research Your Bedrock

The crypto market may be a novel innovation, but it is one of the widest spaces, with several crypto protocols coming onboard daily. At press time, there are 11,602 crypto projects listed on the popular crypto website Coinmarketcap. This shows the diverse nature of the market. To help you minimize risk and maximize returns, you will need to research a project’s value proposition to understand its possible future outcome. You can turn to dedicated social media channels covering crypto assets, listen to the news, and follow expert review websites to get the inside scope of the crypto market.

2. Start Small

Many are drawn in by the phenomenal returns digital assets have posted, and it is only expected. However, do not make large bets on any protocol. As they say, never put your eggs in one basket. Only invest what you can afford to lose. Maintain your regular savings plan and only increase your stake in cryptocurrencies when you are familiar with the workings of the crypto market.

Should You Mine Yearn Finance?

Another way you can get YFI tokens is through mining. Mining occurs when validator nodes can solve complex mathematical puzzles. This process is energy-intensive and slow, which means verifying transactions on the network takes time.

Yearn Finance can be mined through two means. Unlike large-cap assets like Bitcoin, which require specialized hardware, you can mine YFI tokens on your regulator computer or laptop. However, this can yield little returns compared to the electricity needed to validate the YFI network transactions. You can utilize application-specific integrated circuits (ASICs) to ensure efficiency, favored by large Bitcoin mining firms. This increases efficiency and the probability of getting block rewards.

Minimizing Risk with Yearn Finance Investment

Throughout the entirety of this article, we have stressed two key points:

- Yearn Finance is profitable

- It also comes with a huge risk

To minimize losses from trading Yearn Finance, we recommend following these steps:

1. Research Before Investing

Conducting research will help you understand a project’s use case and help in making an informed decision. Always look out for a protocol’s real-world use case and fundamental adoption.

2. Fraudsters Are Rampant In Crypto

Like several commercial ventures, bad actors are also in the crypto scene. They profit from the industry’s novelty and the knowledge gap between investors. Always vet every offer you come across online before parting with your money.

3. Hedge your bets

Although cryptocurrencies have tremendous growth potential, they are also highly volatile. This means an uptrend of 20% can easily swing sideways following major market news. Keep an eye out for this possibility, and always invest what you can afford to shrug your shoulders and move on.

4. Monitor your investment

Always know how much you have per time. This will help you decide which asset is seeing major growth to invest more in and which one you should sell off.

5. Resist FOMO

FOMO is short for fear of missing out and is a real issue. It occurs when many people enter a position because an asset is rising only to dump after. Do your research before you invest.

Yearn. Finance And Other Top Cryptocurrencies

Although Yearn. Finance was once the most valuable crypto asset; it is not the only top digital asset in the market. We compare Yearn. Finance with some other leading cryptocurrencies in the market:

Yearn. Finance vs. Bitcoin

Bitcoin is the largest crypto asset by market cap and controls more than 45% of the emerging market, even though Yearn. Finance was once the most valuable digital asset rising to $93,000; Bitcoin is seeing major adoption, with several countries looking to add it as a legal tender.

Yearn.Finance vs Ethereum

The Ethereum network is the official home of decentralized applications (dapps) and controls almost 20% of the crypto market share. With decentralized finance (DeFi) expected to become the new norm of transacting business, the Ethereum blockchain will assume more importance as the industry matures.

Yearn.Finance vs. ADA

ADA is the native token of the Cardano network and is seeing remarkable adoption. The Cardano network is also on the hunt for DeFi and NFTs and is the third-largest crypto protocol. The popular ‘Ethereum killer’ is growing by the day and is already onboarding several dapp platforms.

Yearn.Finance vs Litecoin

Litecoin is a Bitcoin fork and is a popular crypto asset. However, the project claims to be faster than the premier digital asset in validating transactions. Meanwhile, its reliance on PoW protocol means it has not addressed the underlying issue and could experience slow block finality in the event of high network traffic.

Yearn.Finance vs. Polkadot

Polkadot is another popular ‘Ethereum killer’ and aims to create an interconnected blockchain platform. Founded by a former co-founder of Ethereum, Polkadot uses sharding technology to build permissionless bridges between private and public blockchains. The project is still under development but sits in the eighth spot on the most valuable crypto chart.

Binance – Best Exchange to Buy Yearn.finance Coin

Yearn. Finance has spent little more than a year and has grown exponentially in such a short time. With the world gradually shifting to a more digital approach in dealing with financial services, Yearn. Finance might just be the ticket you need to gain your desired financial freedom.

In this guide, we have explained what the Yearn protocol is all about and the best way you can buy Yearn. Finance coin. That said, buying the yearning token is not an easy process. Binance offers up a feature rich platform with cheap trading fees for traders to buy YFI.

Your Capital is at Risk

FAQs

Should I Buy Yearn. Finance Coin?

If you are looking for the best performing DeFi token in the market right now, Yearn. The finance coin is the one. With its YFI token being the most expensive cryptocurrency, the price is still expected to rise. Also, its hard-cap limit of 36,000 utility tokens can make it a better store of value than your fiat currency.

Where can I Buy Yearn. Finance Coin?

You can buy Yearn. Finance coin from many crypto exchanges, we recommend Binance as the best place to buy Yearn.Finance as it offers low fees and a feature rich platform.

How much Yearn. Finance Coin Should I Buy?

Well, this entirely depends on your budget. You can get whatever quantity you want. But be aware that these crypto-assets are volatile and can lose value as quickly as they rise. A rule of thumb to follow is never to invest more than you're willing to lose.

How much is Yearn. Finance Coin Worth?

According to crypto data aggregator Coinmarketcap, 1 YFI token goes for as much as $7,449.68.

Will Yearn. Finance Coin go up?

Just like every crypto asset in the market now, Yearn. Finance coins will rise and fall from time to time. But from the outlook and market sentiment surrounding the broader crypto market, DeFi tokens like Yearn. Finance coins will possibly rise and continue to rise with the larger crypto market. The YFI price is expected to rise to $100K by the end of 2021, according to several market analysts.