Through yield farming, investors can put their idle crypto assets to work and make passive gains. While there are risks with yield farming, recent issues with traditional finance have made people stay glued to this aspect of the decentralized economy.

Meanwhile, finding the right yield farming platforms matters a lot. So, in this guide, we cover the best yield farming platforms where you can put your crypto assets in 2024. We also explore how yield farming works and its benefits and inherent risks.

13 Best Crypto Yield Farming Platforms – Ranked

Here are the 13 best crypto yield farming platforms in which you can park your funds to make impressive passive gains:

- Bitcoin Minetrix – Overall best yield farming platform with 168% APY. It functions as a stake-to-earn ecosystem where you can stake $BTCMTX tokens and receive Bitcoin cloud mining credits. Currently, it has raised over $1.5 million in its ongoing presale.

- Wall Street Memes – Wall Street Memes is another top yield farming platform with an active buyback and burning program that’s targeted at rewarding users. The platform has a vast community which to an extent contributed to the popularity and success of its presale.

- Meme Kombat – Meme Kombat is a reliable yield farming platform that offers 112% APY. The platform combines staking and betting to position itself as one of the high-rewarding outlets. Meme Kombat stands tall among its peers due to its heavy emphasis on user safety and high rewards.

- OKX – The second biggest cryptocurrency exchange by market capitalization. With no KYC requirements, and a high level of versatility, this exchange offers multiple ways to generate passive gains using idle crypto. It offers yield farming across multiple blockchains for low-cap altcoins and stablecoins.

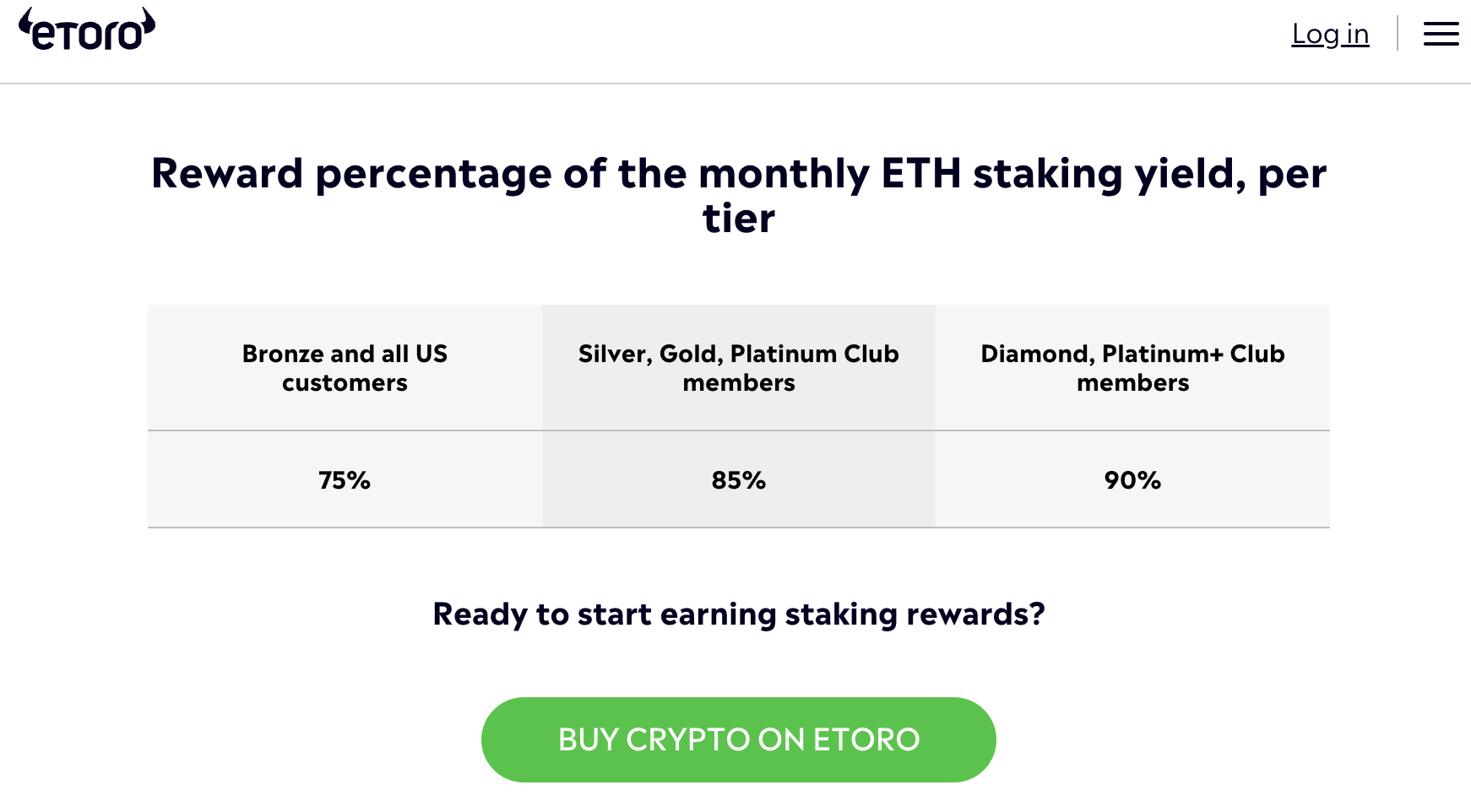

- eToro – A CySEC and FCA-regulated cryptocurrency broker with no yield farming feature but offers an alternative way to generate passive gains through staking. Although supporting staking for three cryptocurrencies, eToro offers yields in double digits.

- Binance – The largest cryptocurrency exchange by market capitalization. Offers many options when it comes to yield farming. Also, it offers a Simple Earn program to generate APR (Annual Percentage Returns) for customers.

- Huobi – Offers multiple passive income opportunities via the Huobi Earn program. Offers up to 50% APY on stored assets.

- YieldFlow – A decentralized and anonymous platform offering yield farming services for various ERC-20 tokens. It also provides staking, lending, and liquidity mining.

- PancakeSwap – A decentralized exchange based on Binance smart chain that offers high yields for BNB (Binance Coin) and BUSD (Binance’s stablecoin). Also, it offers high yields for pairs with CAKE tokens.

- Yearn.Finance – Defi platform offering yield farming based on Curve protocol. Offers high CRV yields in the industry.

- AAVE – Offers yield farming for a range of networks, including Ethereum, Avalanche, Polygon, Optimism, and Arbitrum. Also, it supports crypto staking.

- Uniswap – World’s largest decentralized exchange offering high-quality yields for assets created on the Ethereum blockchain.

- CropperFinance – Solana-based yield farming platform offering high yields for tokens built on the top of the Solana blockchain.

Review Of The Best Crypto Yield Farming Platforms Of 2024

Reviewed here are the best crypto yields farming platforms we have listed. We have ranked them based on their UI, the assets they support, and the yield farming APYs they provide.

Bitcoin Minetrix – Overall Best Yield Farming Platform

We recommend Bitcoin Minetrix ($BTCMTX) as a reliable yield platform. Technically, Bitcoin Minetrix isn’t a yield farm, instead, the platform functions as a stake-to-earn ecosystem where you can stake $BTCMTX tokens and receive Bitcoin cloud mining credits. Consequently, you can turn the mining credits into money by burning them in exchange for BTC. So, the higher your mining credits, the more BTC you earn.

Also, the platform through the presale of its $BTCMTX token offers early investors the opportunity to earn 168% APY when they stake the coin. At one point, the APY for the token stood at a gigantic 100,000%. However, the lucrative offer is gradually declining as the presale is heading towards its closing stage.

Nonetheless, the extra token investors are bound to net through the presale will offer them a larger chunk of mining power. Basically, more mining power implies more money for investors.

Since making its market debut, $BTCMTX has been the talk of the crypto town, netting over $1.5 million in presale investment as of November 2023. With the real excitement around it, there’s no doubt that $BTCMTX will be the next cryptocurrency to fly to the moon.

Check out our Bitcoin Minetrix Price Prediction guide for more information.

Meanwhile, Bitcoin Minetrix is flying high on this list because it offers investors both staking and mining rewards. We rate this innovative feature highly because it offers investors a robust medium of earning passively. More so, the outlet through its innovative approach provides a dynamic route to Bitcoin mining.

Meanwhile, Bitcoin Minetrix is gaining significant recognition among investors because its mining process is eco-friendly and works within the Ethereum network. The eco-friendly approach has helped Bitcoin Minetrix eliminate every negative impact of mining activities on the climate.

Unlike orthodox Bitcoin mining platforms, Bitcoin Minetrix activities are not environmentally destructive and are less expensive to operate. You can get started on Bitcoin Minetrix with as little as $10 which offers a cheaper pathway to Bitcoin mining, unlike traditional platforms that require high investment.

Additionally, we also rate Bitcoin Minetrix highly because of its low-risk feature. Unlike traditional outlets, Bitcoin Minetrix doesn’t require long-term commitment as investments are controlled by users. This simply means users can withdraw their funds anytime they wish.

Above all, Bitcoin Minetrix has a friendly interface that allows investors to seamlessly explore the platform. In addition, the project has a well-detailed roadmap, providing users with a clear-cut explanation and insights about its plans. Getting started with Bitcoin Minetrix is easy as you only need a Web3 wallet to enjoy the innovative platform.

Wall Street Memes – Too Yield Farming Platgltm With A Vast Social Media Community

Wall Street Memes is a top-yield farming platform that has continued to fascinate investors. Its native token, $WSM caught the eyes of investors earlier, attracting more than $25 million worth of sales during its presale. The significant attention it enjoyed during the presale led to its listing on top exchanges like Huobi, KuCoin, Bitmart, Gate.io, CoinDCX, and OKX among many others.

As a prominent project, Wall Street Memes has also attracted investors with its amazing reward system. The platform offers investors a 39% staking APY. In addition, Wall Street Memes is planning to launch a buyback program that will support the value of $WSM. As revealed, the platform is willing to commit 10% of its Net Gaming Revenue to acquire the token in the open market.

The beauty of the buyback program is that it will offer investors of $WSM another avenue to earn passively. Wall Street Memes intends to add tokens acquired through the buyback program to the staking reward pool. The launch of the buyback program implies that investors will get more rewards.

However, the higher you stake, the more you earn from the staking reward pool. There are strong pointers that Wall Street Memes will only get better with time. The platform has a vast community that keeps increasing daily. Wall Street Memes’s community spread across some of the popular social media platforms like Twitter and Instagram.

The acceptance of this project by such a vast community has highlighted how investors are coming to terms with Wall Street Memes. Aside from its staking reward pool, $WSM also has an active burning initiative. The feature is an avenue for investors to earn more rewards for their commitment to the program. Likewise, the burning exercise helps ensure that the $WSM is less volatile, offering it a launchpad for a good price rally.

Meme Kombat – Lucrative APY

Meme Kombat ($MK) is another highly rewarding platform that offers investors a lucrative 112% APY. Meme Kombat remains one of the foremost platforms that provide investors with a two-way earning system. On the prominent outlet, you can earn awesomely through its staking and betting features.

This ingenious platform allows users to bet on meme vs meme combat. The betting options come in three (3) dimensions which permit players to wage on Player vs Player, Player vs AI, and Game. More so, each meme is controlled by AI, and the outcome is processed on the blockchain. With the support of blockchain, Meme Kombat ensures that the outcome of each battle is fair and difficult to manipulate.

Meanwhile, the platform is running its Season One which features some of the famous memes from around the globe. Meme Kombat is expected to get far better with time, suiting the demands of gamers and investors more. At the end of the first season, Meme Kombat intends to take users’ reviews into consideration and introduce new battle options, memes and a reward system.

The present yield system on Meme Kombat offers investors a steady APY and a lucrative ROI on winning bets. To ensure a good winning chance, the AI-driven platform is equipped with a feature that provides users with statistics that can aid them to make a research on upcoming fights and odds. Similarly, all fights are randomly selected.

The project is presently running the presale of its token $MK. Likewise, 50% of the 12 million total supply has been committed to the presale exercise. Without a doubt, Meme Kombat prioritizes rewarding investors awesomely. It allocated 30% of its total supply to staking returns while 10% each is shared between DEX liquidity and community rewards.

At the moment, Meme Kombat ($MK) has seen more than $1.2 million in early investments, becoming one of the biggest crypto presales ever. Hence, we consider it as one of the best cryptocurrencies to buy now.

Meme Kombat has proven to be one of the most reliable yield platforms on this list. The project employed the service of Coinsult to audit its advanced smart contract. With that, Meme Kombat ensured that the code didn’t contain medium or high-risk bugs. This exercise further confirms the reliability of the platform.

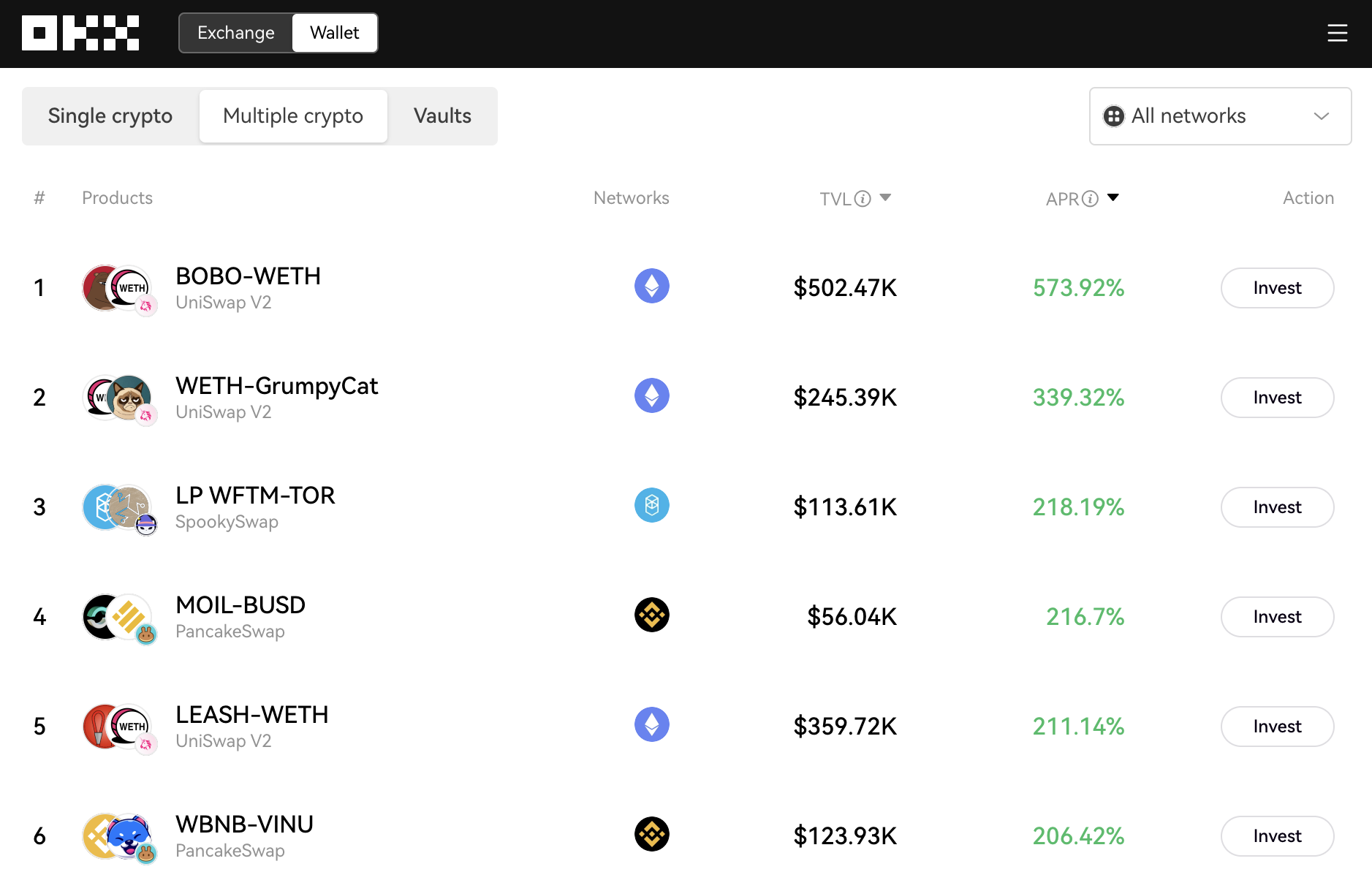

OKX – A No KYC Cryptocurrency Exchange Offering Up To 29.92% Via Its DeFi Aggregator

Launched in 2017, OKX is a cryptocurrency exchange that doesn’t require users to provide any KYC details to participate in crypto trading. And in addition to providing trading facilities to its 20 million user base, OKX also offers staking and yield farming opportunities via its DeFi Aggregator System.

OKX is a DeFi aggregator system that is part of its Web3 Earn program that we found to be effective in generating passive gains for beginners as well as veterans. According to OKX, it is a way to converge the utilities of multiple DeFi protocols, allowing users to pick liquidity pools on platforms such as AAVE, Yearn.Finance, and PancakeSwap.

You can pick between three options in this DeFi aggregator – Single crypto, multiple crypto, and vaults.

With the Single Crypto option, one can invest in investment products with a single token. These products are free from impermanent loss and can be used for lending, staking, and borrowing protocols. They offer up to double-digit gains. For instance, putting up APE will return an APY of 29.92%. With yCRV, investors can earn 28.82%, and BeQi will give a return of 9.53%. Other products in this single crypto option include QUICK, WAVAX, USDT, DAI, SNX, and more.

For riskier and more rewarding investment opportunities, investors can switch to the multiple-crypto option as they provide triple-digit gains. For instance, choosing a WETH pair with BOBO, LEASH, and VINU will offer an APY of 573%, 211%, and 206%, respectively.

The third option is a Vault. Vault is an earning aggregator that will adopt an earning strategy automatically as soon as investors park their funds. Here, users can earn up to 29.92% APY. For further details, check out our OKX review.

Overall, we like the level of versatility provided by OKX when it comes to yield farming. The earning opportunities are many, and OKX is transparent about the risks. For instance, choosing the multi-crypto option may make an asset vulnerable to impermanent loss, which is due to multi-crypto being an option that allows one to buy products that are available in liquidity pools, which fluctuates depending on the price of the underlying asset.

eToro – A CySEC and FCA-Regulated Crypto Broker Offering Staking Opportunities

eToro is a 2007-launched crypto trading broker that is most suitable for beginners that want to earn money through staking. Being a fiat-first broker, it has no decentralized aspects. But that makes it even simpler for investors to earn passive income.

As one of the best crypto exchanges, eToro offers staking rewards for three tokens – Cardano, Tron, and Ethereum. The yield rewards are divided based on the level attained by users. For instance, Bronze members will earn up to 75% APY on Cardano. Leveling up will net these users up to 85% APY. The highest APY they can acquire is 90%. Check out our eToro review for additional information.

Tron and Ethereum have similar reward structures. That said, staking rewards don’t start coming in as soon as an investor decides to park an asset on eToro. They need to wait for at least 9 days in the case of Cardano and 7 days in the case of Tron.

Ethereum staking is a different story. There was a time when ETH 2.0 staking was available on eToro. But it has been discontinued since April 2023.

In addition to staking facilities, eToro also offers uses with a simple way to buy crypto. It only charges a 1% fee on each transaction, and it also offers social trading utilities like copy trading to get beginners primed up for the volatile world of crypto. Also, eToro offers instant, reliable, and safe wallet services. In fact, it is considered one of the best crypto wallets for beginners.

These factors make eToro an enticing option for beginners who want to make gains through their crypto assets. While there should be more options, the high APY rewarded for Cardano, Tron, and Ethereum makes up for them.

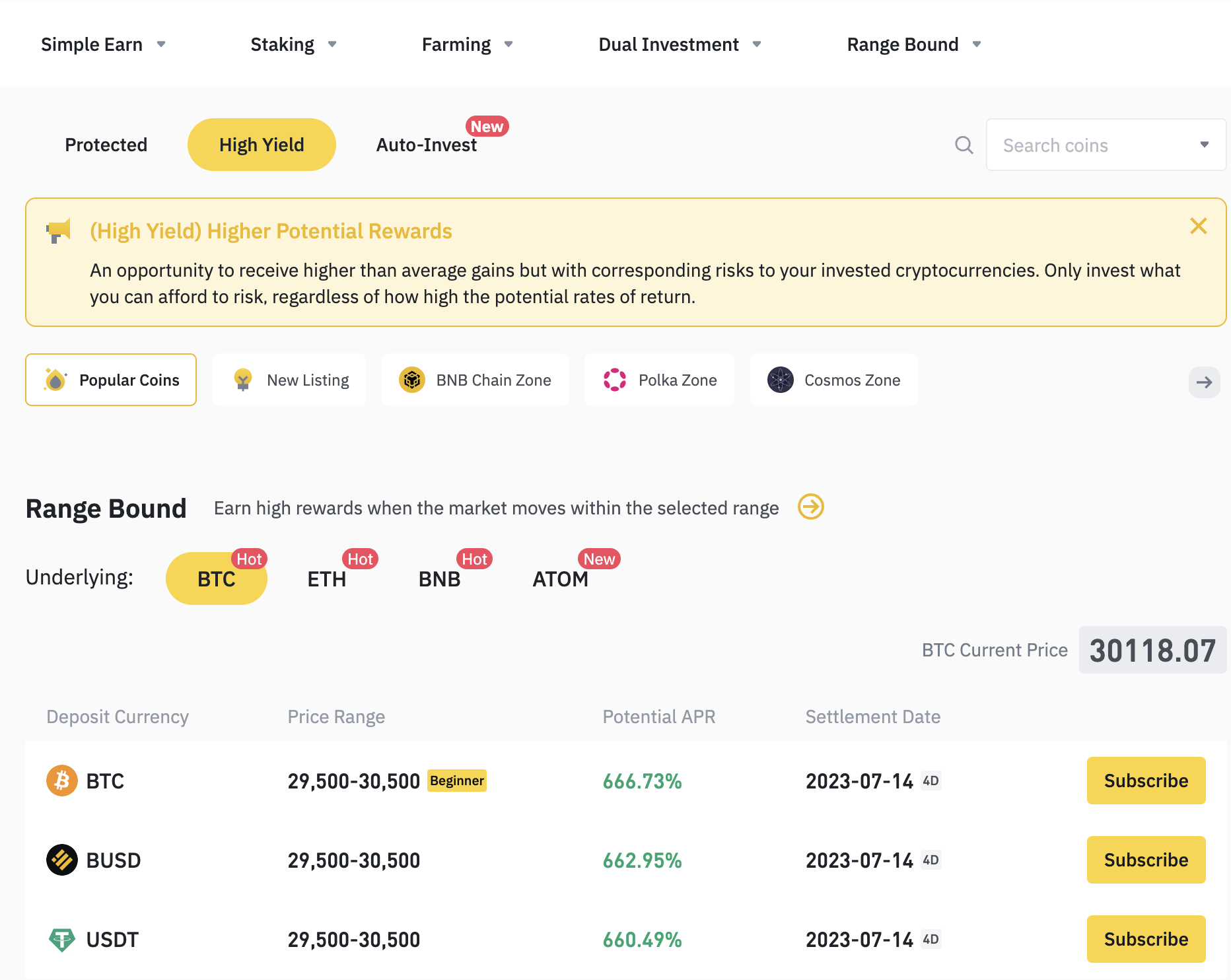

Binance – World’s Biggest Crypto Exchange Offering Multiple Venues For Yield Farming

Binance is known for its wide array of yield farming facilities. Its high-yield facilities alone don’t limit itself to just sharing a portion of a transaction fee when it comes to providing APR. The world’s leading cryptocurrency exchange also offers dual investments and range-bound options under its High-Yield umbrella.

The riskiest among them is range bound, where users are rewarded with APR when the price of an asset lands between a pre-determined range.

For instance, beginners might want to choose BTC, which states that if Bitcoin reaches between the $29.5k and $30.5k mark, the potential APR rewarded is 666.73%. For USDT, the range is the same, and the APR is up to 310%.

And as always, the wider the range, the lesser the risk. For BTC, if investors choose to invest in the high-yield pool with a range between 28.5k and 31.5k, they can earn up to 13.53% APR. For more information, we recommend that you read our Binance review.

Other high-yield offering options include dual investment, with APR up to 86.82%. Liquidity swap, where one conventionally earns a portion of the transaction fee, offers up to 26.90% APY. If you are a beginner, our guide on how to earn interest in crypto will help you understand better.

Meanwhile, that’s not all on Binance. It also offers DeFi staking. With DeFi staking, investors can lock their ETH tokens for up to 120 days to earn up to 5.4% APY. BNB staking is also available in this category, offering an APY of up to 0.90%. The lower Annual Percentage Yield is the result of flexible holding terms.

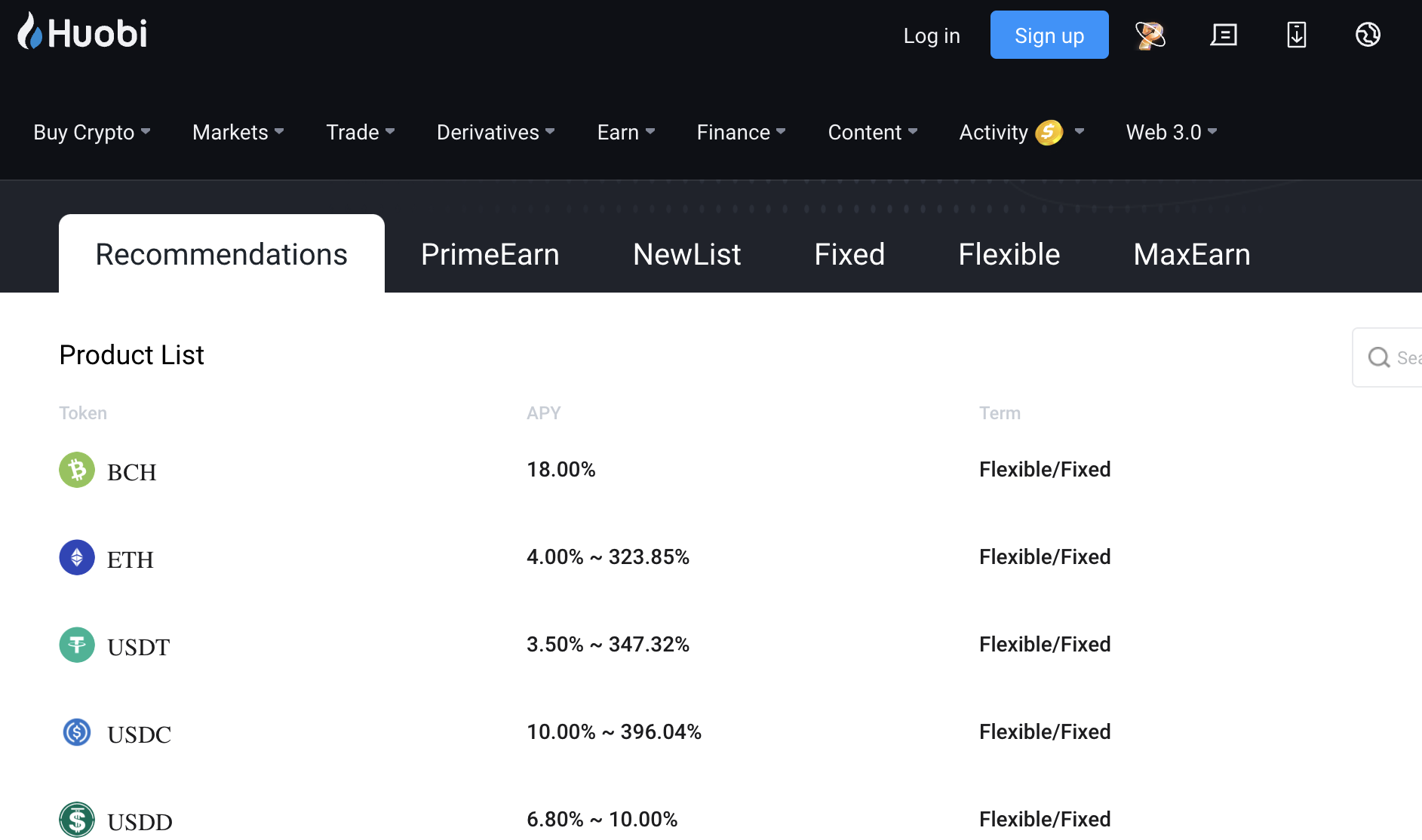

Huobi Global – Offers Multiple Passive Income Opportunities Via The Huobi Earn Program

Another centralized exchange that has earned our recognition for this list is Huobi. As a generous crypto trading platform, Huobi offers up to 50% APY for holding funds.

Choosing the fixed term, however, will allow investors to earn up to 100% APY. For instance, depositing USDT to the pool and holding it for 7 days attracts 100% APY.

But those who want to go with flexible terms won’t have a bad deal either. Investors can earn up to 18% APY this way.

The earn program is subdivided into PrimeEarn and MaxEarn, giving users other opportunities to earn. For instance, users can earn up to 322.88% APY for holding Ethereum via the PrimeEarn program. For additional information about this program, read our Huobi review.

The other element of Huobi’s Earn program is dual investment. With dual investment, users can deposit two cryptocurrencies, and the APY they earn will depend on the daily closing price of one of the paired assets. For instance, if an investor has bought a BTC/USDT pair, and BTC closes on $28k, the investor will make up to a 123% APY.

That said, the dual investment option has been closed for now. Navigating to this option opens the window to Huobi Options trading. But it is likely that this feature will return with time.

YieldFlow – A Decentralized And Anonymous Platform Offering Yield Farming Services

YieldFlow is right up the alley for those looking for a simple platform that offers anonymity and security. This platform supports liquidity mining, allowing investors to lend their tokens and earn interest in the form of other tokens.

However, this process is not wholly suitable for beginners due to the complexities surrounding it. Nevertheless, it does offer substantial returns by letting investors maximize their idle. Also, due to the presence of the standard staking and lending system, using this platform is far less risky than the alternative.

With YieldFLow, investors are necessarily providing digital assets to enhance the infrastructure of specific and preselected projects, which, according to YieldFlow’s whitepaper, are handpicked by crypto trading and blockchain experts. Since the projects are preselected, a lot of risks are removed, allowing users to have stable returns over a period of time.

In terms of security, YieldFlow has taken a decentralized approach. Users can interact with the platform using a Web3 login, and their accounts remain anonymous. The platform only interacts with smart contracts that are third-party verified, further mitigating any risks of fraudulent projects.

At press time, there are more than 20 assets available on YielfFlow that are used for yield farming, lending, and staking by over 10k active users. The average APY offered by this yield-farming platform stands at 15%.

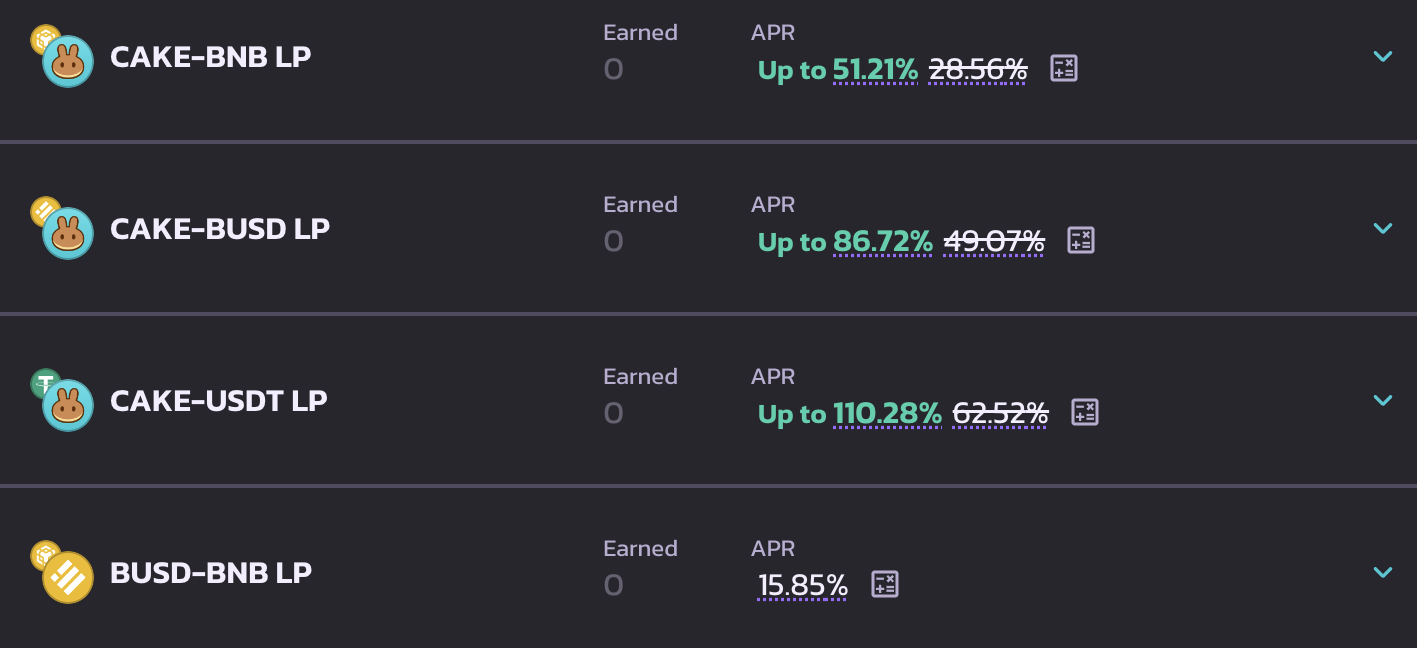

PancakeSwap – A decentralized Exchange Based On Binance Smart Chain

Pancakeswap is a decentralized exchange offering multiple staking pools. Under the Farms section of PancakeSwap, users can earn high APY for staking LP tokens. The best returns are provided by crypto pairs that involve CAKE – the native crypto of PancakeSwap. For instance, staking a CAKE-BNB LP will net investors an APY of 51.21% at press time.

Investors can also enhance their earnings from yield farming by leveraging yield boosters. Yield boosters “boost” the farm’s leads for those who stake their CAKE tokens inside the pools.

Those seeking low-risk gains can interact with Syrup pools. They offer high APY and let users lock their assets for fixed and flexible terms.

The third option is liquid staking, but it allows investors to stake only one pair – ETH WBETH. WBETH is Wrapped Beacon Ethereum, a liquid staking derivative token.

Overall, PancakeSwap is a good yield farming platform, but only for veterans. It does not support fiat, and unless syrup pools are selected, the risks are high. Furthermore, the staking rewards vary rapidly, which requires investors to act quickly in order to get their desired APY.

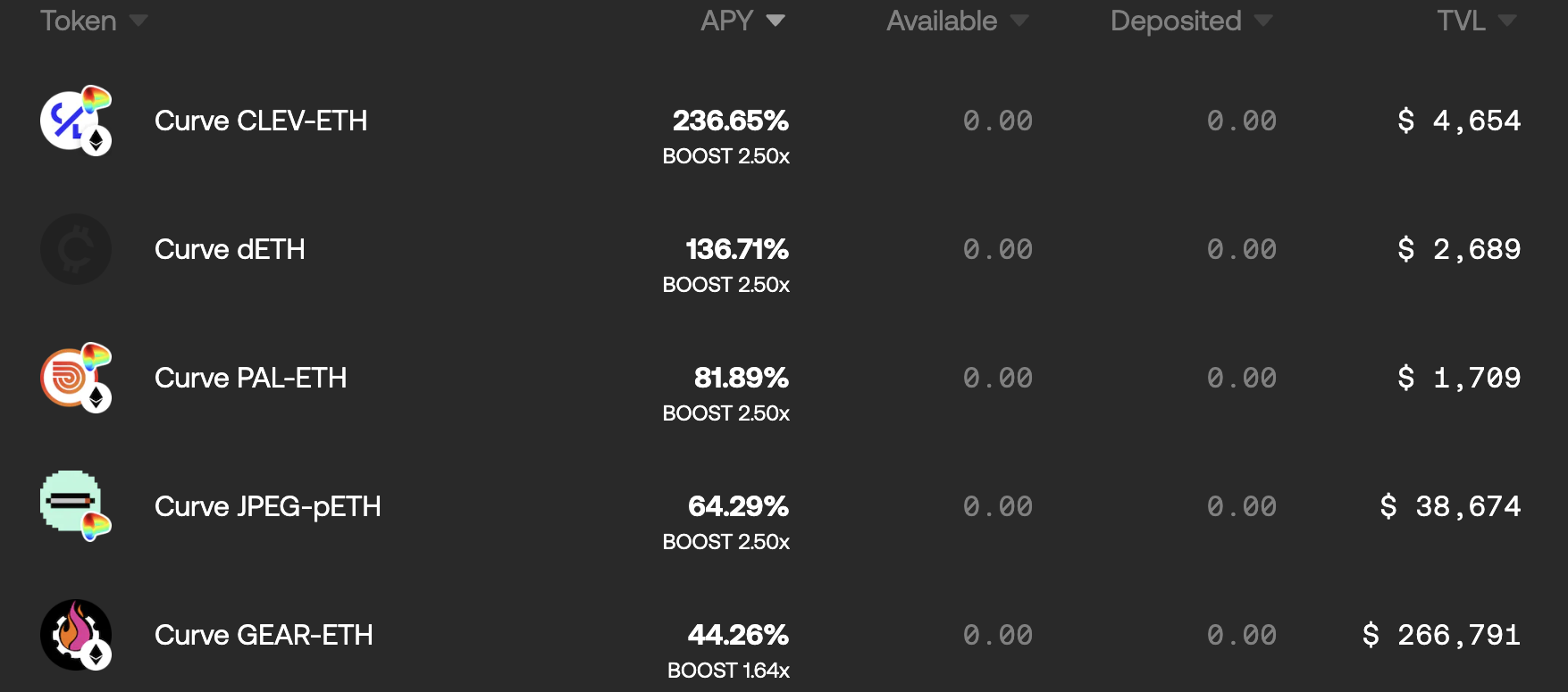

Yearn.Finance – Defi Platform Offering Yield Farming Based On Curve Protocol

Yearn.Finance is a decentralized DeFi platform offering multiple types of yield farms across different blockchains. These include Ethereum, Arbitrum, Fantom, and Optimism.

The yield farming rewards from this yield farming platform are based on curved finance. Staking Curve will yield an APY of 36.01% while providing CRV as liquidity will yield 32.04% APY, with a 2.5x boost.

Like OKX, Yearn.Finance also offers Vaults, which require users to stake only one token. Stablecoins are also supported, such as DAI, LUSD, USDC, USDT, and TUSD. These offer yields of 2.83%, 2.11%, 1.83%, 1.27%, and 0%, respectively.

Users can also deposit ETH on Yearn.Finance, and get an APY of around 2.86%. Other cryptos, like LINK, can also be deposited on the DeFi platform, and they return an APY of around 0.72%.

The highest-yielding token, however, is Curve CLEV-ETH, with an APY of 236.65% and a 2.50x boost.

Yearn.Finance also has a native crypto YFI, which you can learn about in our how-to-buy Yearn.Finance guide.

AAVE – Offers Yield Farming For A Range Of Networks

With its cross-chain functionality, AAVE is an open-source liquidity protocol that should be on the radar of those looking for a good yield farming platform to pick. It supports multiple networks, including Optimism, Ethereum, Avalanche, Polygon, and Arbitrum. And at press time, it has over $8.5 billion worth of liquidity locked in over 11 markets.

AAVE allows yield farming for multiple assets, including stablecoins such as DAI, for which it offers a 2.59% APY. For LUSD, which is another stablecoin, AAVE offers 1.97% APY. Other crypto assets that it supports include FRAX, Tether, USDC, 1inch Network, Balancer, Curve DAO Token, ENS, Lido DAO Token, Maker, ChainLink, Rocket Pool ETH, and more.

To get a higher APY, users must switch to the Fantom Network. Fantom offers up to 103% APY for DAI holdings. The other high-yield AAVE market is Metis V3. However, that, too, only offers up to 3.23% APY.

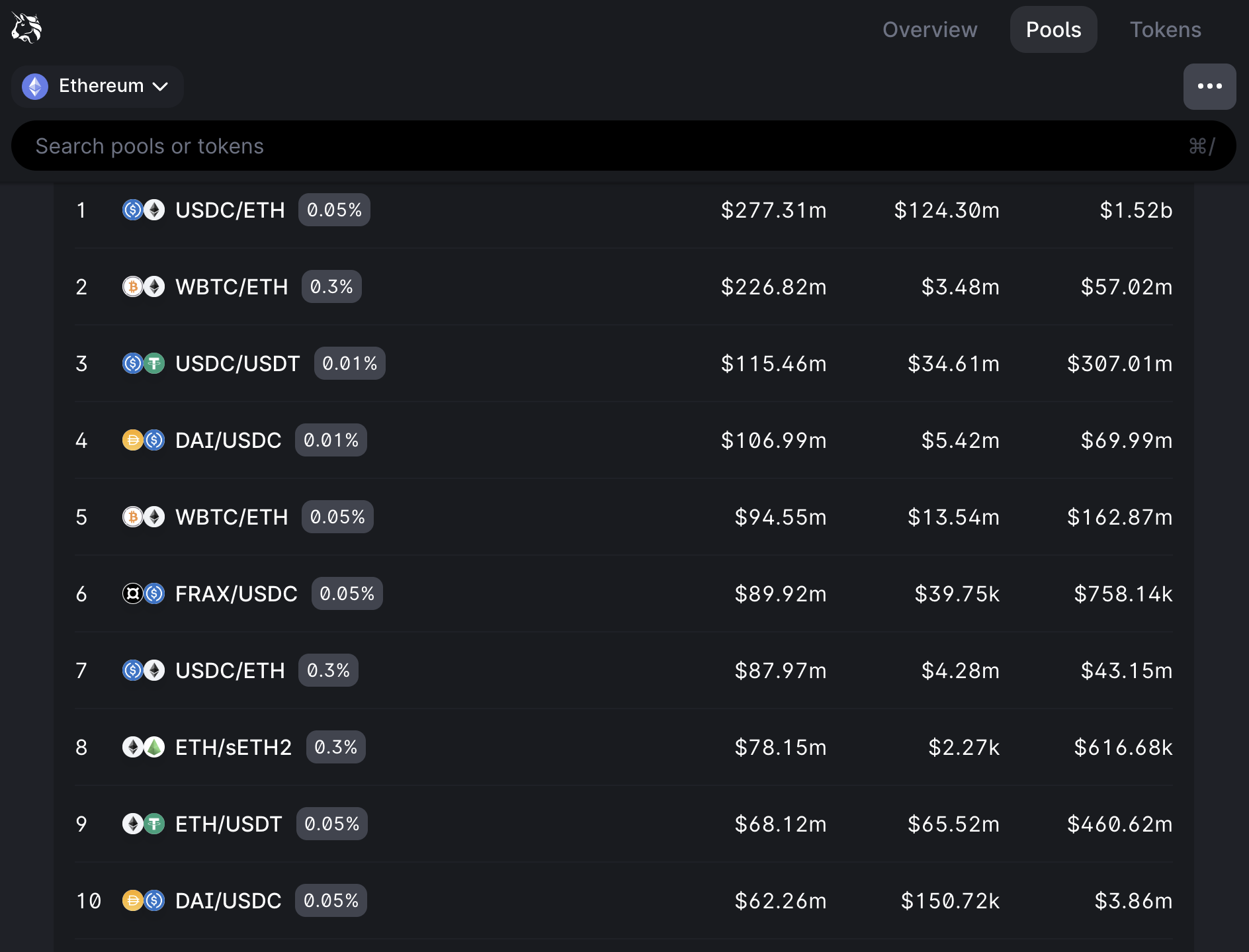

Uniswap – World’s Largest Decentralized Exchange Offering High-quality Yields

Uniswap is the world’s biggest decentralized exchange that supports assets on the Ethereum network. It started in 2018 and supports multiple ERC-20 tokens for trading and yield farming. That is, it has listed popular pairs such as USDC/ETH, DAI/USDC, and more.

Uniswap is also one of the best places to find new cryptocurrencies. As a decentralized exchange, Uniswap allows users to be anonymous. In addition to its farming and trading utilities, Uniswap also allows users to interact with over 300 DeFi applications.

In order to find tokens to farm, one needs to navigate to the pools and pick the tokens there. There are multiple token pairs available for investors to generate yields from, including ETH/sETH2, ETH/USDT, and more.

The only flaw with this cryptocurrency exchange is that it is not beginner-friendly. While the app is accessible to all, a fair bit of crypto knowledge is a must if one has to interact with the crypto space using Uniswap.

Meanwhile, check out our list of the best DEX cryptos to buy.

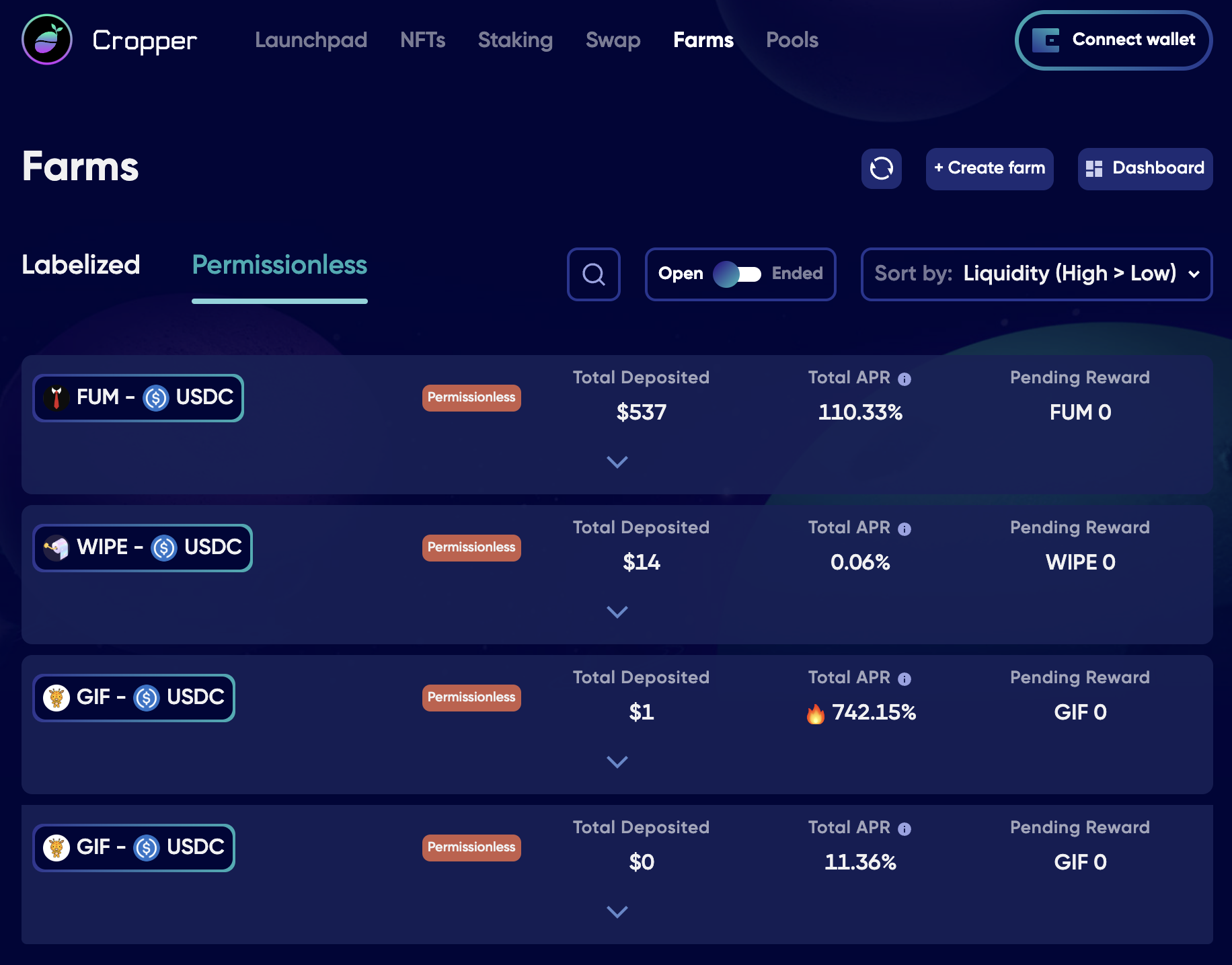

CropperFinance – Solana-Based Yield Farming Platform

Our final entry on this list is about CropperFinance. CropperFinance is a yield farming platform based on the Solana Blockchain. That is, it is a DeFi platform that exclusively supports SOL and Solana-based tokens. Users will also get access to token swaps on this platform, as well as staking, liquidity pools, and more.

Investors can earn up to 371.84% APR on CropperFinance. It is also essential to note that there is no fee involved with the farming rewards.

There are two categories of farms available on CropperFinance. One is Labelized, and the other is Permissionless.

Only two options are available on labelized at the time of writing – CRP/SOL and CRP/USDC. With permissionless, however, investors get three options, FUM/USDC, WIPE/USDC, and GIF/USDC, offering 110%, 0.06%, and 742.15% APR, respectively.

Alongside its yield farming, lending, and staking features, Cropper Finance also offers a good crypto IDO.

Check out our list of the best crypto IDOs to invest in.

What Is Yield Farming?

In simple terms, yield farming is the process of depositing cryptocurrencies into decentralized applications in return for earning rewards, which are generally in the form of APY.

Yield farming, in simple terms, is analogous to earning interest from banks. Here, instead of fiat currencies, crypto assets are involved. And instead of centralized banks, cryptocurrency exchanges (centralized or decentralized) offer rewards.

Much like banks provide interest to depositors to provide liquidity to the banking infrastructure, cryptocurrency exchanges reward users with yields. These yields are essentially portions of trading fees on these cryptocurrency exchanges.

Is yield farming the same as staking? No. Staking involves only a single crypto asset, but with yield farming, two cryptocurrencies, essentially a liquidity pair, are deposited. The interest generated through yield farming is determined by the current status of the market, which makes this way to earn passive income riskier but more rewarding.

If you wish to engage in staking, we have also listed some of the platforms you can consider. Check out our guide on the best staking platforms to pick one.

What Is The Difference Between Yield Farming And Staking?

There are quite a few similarities between yield farming and staking. Both require investors to park their crypto assets in decentralized or centralized exchanges, and both offer rewards in return.

However, there are two differences between these two terms:

Crypto Assets Used

With staking, users only need to park one cryptocurrency. But with yield farming, a cryptocurrency trading pair is parked instead. Having two cryptocurrencies reduces the impermanent loss – as the loss of one could be offset by the gains of another.

Check out our guide on how to buy cryptocurrency safely this year.

Income Generation

With crypto staking, exchanges generate passive income by giving crypto loans. The interest generated from these loans is divided among those who were staking the prevailing asset.

With yield farming, users deposit cryptocurrency pairs to provide liquidity to exchanges so that they can facilitate crypto trading services. In return, these exchanges reward users with a portion of the trading fee.

What Are The Risks Associated With Yield Farming?

Listed below are the risks associated with yield farming:

Volatility

New cryptocurrencies generally have low liquidity, which makes them subject to market fluctuations. The market’s volatility is reflected in the massive fluctuations that these assets go through in terms of value, which makes it easy to yield farmers to lose a lot of money quickly. That is why it is often recommended that investors farm only those crypto assets that have high liquidity in the market.

Impermanent Loss

Impermanent loss refers to unrealized profit. In terms of liquidity pools, here is a simple explanation for it.

- Suppose there is a liquidity pool that allows users to trade ETH to USDT.

- If a user buys ETH from this pool, they need to deposit USDT and remove the equivalent amount of ETH from the pool.

- Now, because the ratio between ETH and USDT has changed in the pool – the number of ETH tokens are fewer, and the number of USDT coins are more – the value of ETH increase by virtue of its low supply.

- That means those who added USDT to the liquidity pool now have Tether, whose value is less as compared to what they would have if they hadn’t deposited their tokens into the pool.

Impermanent loss isn’t a big issue if one can stay patient about withdrawing their assets from the pool. An asset’s price can return to the initial value with time. Granted that the volatile market conditions can make that return take late, but waiting is still better than a rushed withdrawal.

Rug Pulls

Rug Pulls are getting increasingly common in the cryptocurrency space. They happen when a bunch of individuals come together to hype a project up to inflate the value of its crypto asset, and then the devs sell all of those assets into the liquidity pools, making the token worthless.

They are getting more prevalent in the DeFi space, which is why we recommend that users only farm cryptos that have proven their worth in the past.

Drying Up Liquidity Pools

Liquidity can be affected negatively if multiple people pull their tokens from the pool at the same time. That has happened since the arrival of crypto winter, as FUD led many to sell off their assets after removing them from the liquidity pools. That leads to higher slippage, reducing the money people can make from selling these assets.

That is why many liquidity pools that offer a higher APY often locks tokens for a fixed period.

Inability To Keep Up With The Shifting Market Conditions

Yield farming doesn’t often have the same payout daily. It shifts dramatically as the number of tokens in the pool comes and goes. There have been cases when people have locked their tokens in a pool with a high APY, only to find out a day later that the triple-digit gains have now reduced to a single-digit annual percentage yield.

This problem is twofold because unstaking tokens from the liquidity pools also take a lot of time. There can be a gradual shift in the APY while one is unstaking their assets. Factors like this make it challenging for investors to make a significant amount of passive income from yield farming.

Is Crypto Yield Farming Legit?

Crypto yield farming is legit in most countries, especially the ones that are more receptive towards the crypto economy. Most countries, however, have taken a different stance toward staking or any method that could help people generate passive income through crypto.

However, the legality differs from farm to farm. That is why investors must invest their time in researching the right farms and the right assets before leveraging this great opportunity.

The first course of action must be to assess the smart contract. If the contract is faulty, the funds could be at risk. The solution is to look for assets with audited smart contracts.

That said, yield farming is still risky since the value of the tokens is still determined by macroeconomic activity. It means that investors can witness a sizable devaluation of their farmed tokens.

That is why we recommend sticking with regulated cryptocurrency exchanges. While the yield farming reward they offer is now high, they do offer some security, which is necessary for navigating the current volatile waters of crypto trading.

Conclusion

We have reviewed the best yield farming platforms in this guide and have highlighted their APY rewards. Yield farming is not without its risks, but the rewards are equally bigger.

However, beginners should still consider a secure option, which, in our opinion, is Bitcoin Minetrix. It functions as a stake-to-earn ecosystem where you can stake $BTCMTX tokens and receive Bitcoin cloud mining credits. Currently, it offers a tantalizing 168% APY.

New Crypto Mining Platform - Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now - BTCMTX

- Staking Rewards - Over 50% APY

FAQs

What is the best yield farming app?

We have listed Bitcoin Minetrix as the best yield farming platform for this year. It offers at least 168% APY for now. Others include Meme Kombat, Wall Street Memes, OKX, eToro, Binance, Huobi, and many more.

Can you do yield farming on Coinbase?

No, Coinbase does not offer yield farming services anywhere. However, it does have staking services.

Is yield farming profitable?

Yield farming can be profitable depending on the market conditions. For instance, during the bull season, yield farming can generate massive gains for investors. However, the risk of loss is always high since the cryptocurrency market is inherently volatile.

Does Binance provide yield farming?

Yes, Binance does offer yield farming through its High Yield program under Binance earn. This program offers range bound, liquidity swap, DeFi staking, and dual investments to generate yields from the current market.

Is yield farming risky?

Yes, yield farming is inherently risky. Most of the risks are associated with impermanent loss, and the inability to react quickly to market changes. Rug pulls are also a major risk with yield farming.