As one of the latest improvements in the decentralized finance industry, Arbitrum offers a novel solution to Ethereum’s scalability problem. It introduces a layer-2 network for the Ethereum blockchain to address the issues of transaction speed, high gas fees, and network congestion.

With this being said, cryptocurrencies that belong to the Arbitrum ecosystem can have good potential for investors. In this guide, we will introduce the best Arbitrum network coins you can buy in 2024 and discuss each in detail. We will also briefly introduce the Arbitrum network and discuss the benefits of investing in this ecosystem.

7 Best Arbitrum Network Coins To Buy In 2024

Here is our quick list of the best Arbitrum Network coins you can buy now. You can also find detailed information about each project in the next section.

- Uniswap – Largest Decentralized Exchange Crypto By Market Cap

- Chainlink – Timely Provision Of Data For Smart Contracts

- Arbitrum (ARB) – The Native and Governance Token of the Arbitrum Network

- The Graph – An Innovative Project That Focuses On Blockchain Data

- Sushiswap – Lower Fees And Faster Transactions

- Wrapped Bitcoin – Bitcoin In Ethereum Network

- Frax Share (FXS) – Fractional-algorithmic System

Best Arbitrum Network Coins To Buy – Full Review

With hundreds of Arbitrum tokens available in the market, finding the most suitable coins for your portfolio can sometimes be tricky. After all, you need to explore those projects and examine their features, safety, and other factors to decide whether they are worth investing.

In this session, we will thoroughly review each of the best Arbitrum coins that investors can buy this year. Read on to find out the tokens are best suited for you.

Uniswap – Largest Decentralized Exchange Crypto By Market Cap

There’s probably no one in the decentralized economy who has never heard of Uniswap. It is one of the first and most popular DEXs in the DeFi industry. Uniswap was the first exchange to use the idea of automated market makers and smart contracts to support trading.

The platform was launched in 2018 by Hayden Adams, a former mechanical engineer at Siemens. Since its inception, it has continued to grow in popularity, becoming one of the largest decentralized exchanges.

One of the major strengths of Uniswap is its ability to facilitate peer-to-peer trading without interference from any third party. It is built on the Ethereum blockchain and therefore supports swapping between ERC-20 tokens. Fees charged on Uniswap are quite low compared to many traditional exchanges. Those fees go to the liquidity providers.

To power its network, Uniswap also issues its native token – UNI which plays a vital role in the running of the ecosystem. As a utility token, UNI is used to provide liquidity to the Uniswap protocol. Outside that, it is also a governance token and thus enables its holders to vote on project-related decisions.

UNI token has over $3 billion market capitalization and has been rated among the best cryptocurrencies to buy right now. It is currently the largest decentralized exchange crypto by market cap.

Your capital is at risk.

Chainlink – Timely Provision Of Data For Smart Contracts

Chainlink is a fully Arbitrum-compatible network that plays a vital role within the DeFi ecosystem. Founded in 2017 by Sergey Nazarov and Steve Ellis, Chainlink has become quite a successful project in the DeFi space, and its native token, LINK is regarded as one of the largest cryptocurrencies by market capitalization.

The whole decentralized finance relies on the operation of smart contracts. However, to operate effectively, smart contracts should have the source for the information from the outside world. Chainlink has created the solution by providing a so-called oracle network to help smart contracts communicate and get real-world data from the off-blockchain sources.

Chainlink supports effective communication between smart contracts and the outside world and ensures that the blockchain’s security and reliability assurance is maintained. This data is provided by Oracles which get reputation scores for the data they provide to smart contracts. This motivates them to provide accurate data and be rewarded with Chainlink’s native token – LINK.

As the native token of the Chainlink blockchain, LINK has some important use cases. For instance, it is the only cryptocurrency that can be used for operational purposes, including paying node operators to retrieve data.

LINK tokens are also used to keep deposits from the smart contract creators, which is later paid to the oracles for providing the data. If the oracles fail to provide necessary services, the deposited LINK tokens are paid back to the smart contract creators. Additionally, the number of LINK tokens is limited which creates scarcity once the demand for the coin increases.

The maximum supply of LINK tokens provided by Chainlink is 1 billion tokens. There are 556,849,970 LINK in circulation and it has a market cap of over $7 billion as of press time. LINK has great potential, thus positioning it as one of the best Arbitrum coins to buy now.

Your capital is at risk.

Arbitrum (ARB) – The Native And Governance Token Of The Arbitrum Ecosystem

Since Arbitrum is a layer-2 protocol that enables the development of other dApps, it has a native governance token to power its ecosystem. First, its native token, ARB plays a governance role, meaning it grants voting power to its holders and ensures they can have a word in Arbitrum’s important decisions.

Every vital decision regarding the project is voted on by the DAO members, making Arbitrum a community-based project. Apart from it, ARB also has other utility use cases. It can be staked to generate rewards. Outside that, users can also leverage it to pay the transaction fees on Arbitrum’s network.

Hence, users must hold ARB tokens to be able to use Arbitrum’s services. This is crucially important for token holders as ARB’s value will depend on the success of the Arbitrum network, and it can gain huge demand once Arbitrum receives mass adoption.

Although the Arbitrum network was launched in 2017, its native token, ARB was not issued until March 2023. Read our guide to discover where to buy ARB this year.

Currently, it has a market capitalization of over $1 billion which puts it among the largest cryptocurrencies. It also comes with a limited supply of 1,275,000,000 coins.

Your capital is at risk.

The Graph – An Innovative Project That Focuses On Blockchain Data

The Graph is another popular DeFi product that specializes in blockchain information retrieval so as to enhance its efficiency. The project aims at provide valuable blockchain data to support dApp developers in building their decentralized applications more efficiently.

The Graph project was founded in 2018 by Yaniv Tal, Jannis Pohlmann, and Brandon Ramirez, who have a wealth of experience in building startups. In October 2020, the Graph conducted a public sale of its native token – GRT, during which it raised $10 million, selling more than 20% of the token’s maximum supply.

GRT is the main and most important token within the Graph’s ecosystem. To understand why GRT is crucial in Graph operations, let’s first discuss how Graph works. Notably, it focuses on providing efficient data. Meanwhile, there are different types of users who provide services and contribute to organizing data within Graph’s network.

To become a service provider for the Graph network, users must have Graph’s native token – GRT. Users are also rewarded for their role within the Graph’s ecosystem from the transaction fees, and these rewards are distributed in GRT tokens.

Apart from that, GRT also plays a governance role. Hence, users, holding GRT tokens have the right to vote on proposals that are geared towards developing the ecosystem. The current circulating supply of the GRT token is 9,281,758,241 GRT. The protocol burns 1% of the GRT tokens for every transaction, thus making GRT a deflationary coin.

Your capital is at risk.

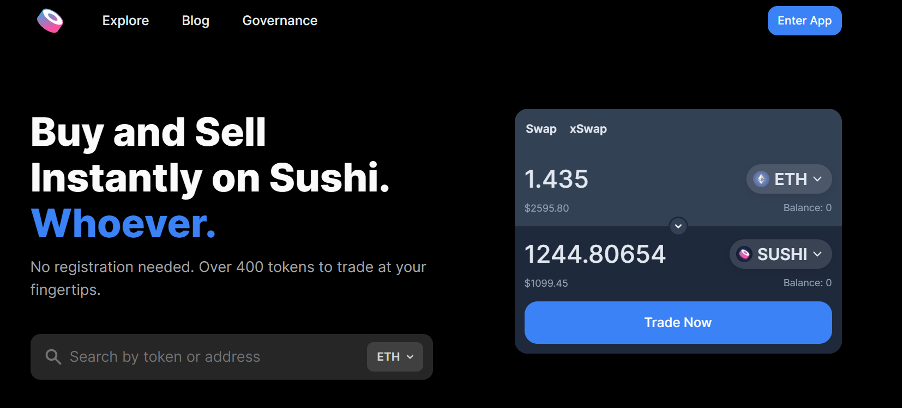

Sushiswap – Lower Fees And Faster Transactions

Similar to Uniswap, Sushiswap is a decentralized exchange that provides trading services for investors. It is popular among traders who look for different trading services, such as yield farming, swapping, and staking. Although Sushiswap is initially built on the Ethereum blockchain, it also bridges with the Arbitrum network for more efficient operation of its network.

Like Uniswap and many other DEXs, Sushiswap uses the mechanism of AMM, which enables users to lock cryptocurrencies in smart contracts. This creates liquidity and enables users to buy and sell assets. Sushiswap is also great when it comes to portfolio diversification, as this exchange supports buying and selling thousands of cryptocurrencies without browsing between multiple centralized exchanges.

Another attractive feature of Sushiswap is its yield farming feature. It enables traders to benefit from the pools by offering a lucrative APY. More so, its multiple functions also position Sushiswap as an attractive platform for traders who prefer decentralized finance services.

Meanwhile, Sushiswap’s native token, SUSHI is a good investment to consider if you believe in the future of the Arbitrum ecosystem. It serve both governance and utility purposes.

So, SUSHI holders can vote on proposals geared towards developing the Sushiswap ecosystem. Plus, SUSHI is used to incentivize liquidity providers. Additionally, SUSHI can also be staked to generate passive income.

Meanwhile, Sushi has a market cap of over $222 million. The current circulating supply of the token is 231,700,065 SUSHI coins, with a maximum supply of 250 million SUSHI tokens. Sushi’s value has suffered significantly from the recent crypto market crash, but the project has the potential for growth once the prices recover again. Hence, we consider it one of the best Arbitrum coins to buy this year.

Your capital is at risk.

Wrapped Bitcoin – Bitcoin In Ethereum Network

Wrapped Bitcoin is another DeFi product that bridges with the Arbitrum network. It is created to represent real Bitcoin on the Ethereum’s blockchain. Despite being an ERC-20 token, Wrapped Bitcoin is pegged with Bitcoin. It leverages the flexibility of the ERC-20 standard to bring BTC to the Ethereum network.

Don’t forget that Bitcoin can’t be used within this ecosystem as it has a token standard that is not compatible with Ethereum’s ecosystem. Wrapped Bitcoin aims to solve this problem by making Bitcoin usable on Ethereum’s blockchain and other ecosystems built on the network.

To do this, Wrapped Bitcoin locks up a certain amount of BTC to mint an ERC-20 token called WBTC. As WBTC uses ERC-20 token standard, it can be used within Ethereum. In other words, WBTC represents Bitcoin in Ethereum’s ecosystem: one WBTC is equal to one BTC, and it can be easily transferred back to BTC.

As it was initially created to mirror the price of Bitcoin, Wrapped Bitcoin isn’t usually used for gaining profits on price changes. But it can be a good investment for those who want to use DeFi applications built on the Ethereum blockchain while holding value in Bitcoin.

One of the benefits can be staking. However, BTC holders can swap them with WBTC and stake them to generate passive income with their idle Bitcoins. Another opportunity is to use WBTC tokens to swap them with other coins on decentralized exchanges.

Your capital is at risk.

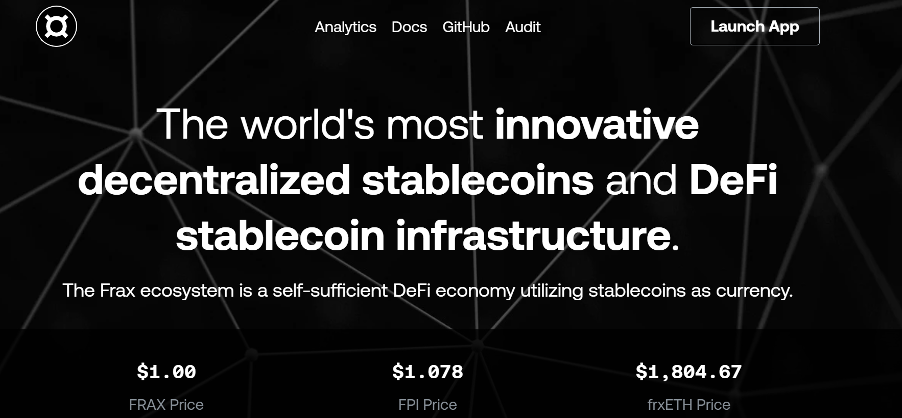

Frax Share – Fractional-algorithmic System

Frax Share is another Arbitrum coin with a huge potential. As a stablecoin project, FRAX relies on another asset to keep its value. It is pegged to USD, hence its value is always $1. Frax Share is unique because it is the first stablecoin to use the fractional-algorithmic system.

So, the project’s framework is based on two mechanisms – collateral and algorithmic, meaning that some part of the token’s supply is backed by collateral, and the other part is backed by algorithmic. The amount of tokens backed by collateral and algorithmic depends on the market value of the stablecoin.

Besides, Frax Share has another cryptocurrency – FXS, which serves as its governance token. FXS is not a stablecoin, like FRAX, and its value can change. It can increase or decrease in value depending on the situation in the market.

While FRAX serves as a stablecoin, FXS’s use case is governance, and it gives voting rights on Frax Share’s decisions. Launched in 2021, FXS has managed to gain value. In the first months of 2023, FXS hit the $10 mark for a short period. It has a market cap of $470,916,097 as of press time.

Your capital is at risk.

What Is Arbitrum Network And How Does It Work?

Arbitrum was launched in 2018, and it is being developed by a company known as Off-chain Labs. It is a layer-2 scaling solution added to the Ethereum blockchain. To understand why Arbitrum is a vital solution for the Ethereum blockchain, it is important to discuss the main problems of the network.

One major issue that is associated with Ethereum and the entire DeFi sector is scalability. Ethereum can only handle a small number of blockchains at a certain time. This significantly reduces the speed of the transaction and increases gas fees.

Although Ethereum recently incorporated the Proof-of-Stake consensus mechanism, which would handle this problem, it is not completely solved. High congestion also affects the number of transactions that can be conducted in a second and increases the gas fees developers pay to execute transactions.

Hence, as a Layer-2 protocol added to this blockchain, Arbitrum aims to handle 3 vital issues – congestion, high gas fees, and scalability. Arbitrum can currently handle 40,000 transactions in a second.

Transaction costs are also significantly low, and in many cases, they can even be in the cents. After launching its mainnet, Arbitrum has succeeded significantly and has become popular among developers. Hundreds of cryptocurrency projects have bridged to the Arbitrum network, with more expected in the future.

What Is The Purpose Of Arbitrum And What Makes It A Different Blockchain Network?

Arbitrum is a layer-2 scaling solution that helps developers to build dApps with low costs. Arbitrum has its native token – ARB, which grants governance rights to holders, allowing them to vote on significant decisions about the ecosystem.

As a layer-2 scaling solution, Arbitrum uses the roll-up technology to boost the validation of transactions. Like other side chains, it collects a bunch of transactions in a single transaction and verifies them parallelly. As all the transactions are verified simultaneously, this significantly reduces the time needed to verify each transaction.

The validators on the Arbitrum network verify all the transactions. To become a validator, one must stake a certain number of ETH tokens for safety purposes. If any bad action is noticed among the validators, they risk losing their locked ETH tokens.

More so, Arbitrum’s technology enables it to run up to 40,000 transactions and feed them to Ethereum’s blockchain. Currently, Arbitrum is integrated with a number of popular DeFi projects, including SushiSwap and Uniswap.

Are Arbitrum Network Tokens Good Investments?

In this session, we extensively analyze why Arbitrum network tokens are good investments. As a crypto trader, here are some of the reasons you need to buy Arbitrum coins:

Presale Tokens Can Be Bought At A Low Price

One of the main benefits of investing in newly launched Arbitrum tokens is their low prices, and the option to buy these coins during their presales. Hence, investing in Arbitrum coins in their presale stages is a way to benefit from them hugely.

Potential For Growth

All the projects that bridge with Arbitrum are quite popular within the DeFi space. For example, Sushiswap and Uniswap are decentralized exchanges that enable decentralized currencies’ lending, borrowing, swapping, and earning. Chainlink is used to facilitate smart contracts with valuable data.

So, the native tokens of these projects have valuable use cases with their ecosystems and have been able to get the attention of DeFi enthusiasts.

Along with the popularity of these projects, the demand for the coins will grow too, which will help trigger their prices.

But, it is recommended that you read our guide on how to buy cryptocurrency safely.

Arbitrum Network Solutions

Eventually, one of the major strengths of the Arbitrum network is its innovative solutions. It helps to improve network scalability, solve the high gas fee problem, and increase transaction speed in the world of decentralized finance.

There’s no doubt that scalability has been a major problem in decentralized finance. Arbitrum introduces a new layer-2 solution that aims to tackle this issue and increase the transaction speed without harming the security of the network.

Conclusion

To conclude, the Arbitrum network is a safe layer-2 solution on the Ethereum blockchain that is used to improve scalability, reduce gas fees and increase the speed of transactions. As the network is getting more popular, it could be a good time to invest in the coins bridging with the Arbitrum ecosystem.

In our guide, we have introduced and thoroughly discussed the best Arbitrum tokens to buy right now. Our top pick is Uniswap, the largest decentralized exchange crypto by market cap. It was the first exchange to leverage automated market makers and smart contracts to support trading. Meanwhile, you can buy Uniswap on eToro, one of the most reliable crypto exchanges around.

FAQs

What are the best Arbitrum coins to buy right now?

Overall, according to our research, some of the best Arbitrum coins you can buy are Chainlink, Uniswap, Sushiswap, Graph, Frax Share, Wrapped Bitcoin, and Abritrum’s native token - ARB.

Is Arbitrum network safe?

Yes, Arbitrum is a safe network as it relies on Ethereum’s layer-1 network. The aim of the Arbitrum network is to decrease gas fees and increase scalability without compromising security. Hence, Arbitrum requires the network's validators to lock ETH tokens which they can lose if they violate the rules.

Can I add Arbitrum tokens to MetaMask?

All the Arbitrum tokens are ERC-20 as as it is a layer-2 protocol built on the Ethereum blockchain. Since Metamask supports all the tokens with ERC-20 standard, Arbitrum coins can be added to Metamask.

How many coins are used within the Arbitrum ecosystem?

Hundreds of tokens and coins are used within the Arbitrum ecosystem. The most popular tokens include Wrapped Bitcoin, Chainlink, Sushiswap, Uniswap, etc. Arbitrum also has a native token - ARB, with a limited supply of 1,275,000,000 ARB tokens.

What are the most popular Arbitrum coins?

Some popular Arbitrum tokens include SUSHI and UNI, which are the native tokens of Sushiswap and Uniswap, respectively. Other popular tokens include LINK (Chainlink), FXS (Frax Share), GRT (The Graph), ARB (Arbitrum), and WBTC (Wrapped Bitcoin).