As a member of the Ally Bank family, it’s among the leading investment brokerages around, especially when you consider all the services it has for just about every area of your financial life. With zero commissions and no required minimum plus a robust selection of trading features, Ally Invest stands outs as an excellent stockbroker for both new and experienced traders.

Continue reading to learn more about Ally Invest’s features, fees, pros and cons, and whether we recommend it.

On this Page:

Ally Invest Review

We have examined Ally Invest in detail and we do not recommend it. There are other options such as the broker below which provider a better stock trading experience with the added bonus of social trading and an easy-to-use stock trading platform.

What is Ally Invest?

Ally Invest is an investment service provided by Ally Bank. The stockbroker was previously known as TradeKing before Ally Bank acquired it. Ally Invest offers an extensive selection of self-directed and managed investment products. The stockbroker serves over 250,000 customer accounts, with $4.7 billion in assets under management.

Ally Invest aims to offer all its users highly competitive fees, high-end customer service and a seamless trading experience. The platform can be accessed via most of your devices, including your laptop, desktop computer or mobile application, allowing you to trade on the go.

One significant advantage of using Ally Invest stock brokerage is that it offers a lower trading fee compared to the other best trading platforms.

Read on to learn more about Ally Invest, how it works as well as its pros and cons.

Tradable Securities

Ally Invest gives its users access to: The biggest shortfall for a majority of the long-term investors is the platform’s selection of funds with no trading fees. There are around 100 no-fee ETFs and no fee-free mutual funds. A lot of its competitors with similar commissions only offer specific funds or even their own funds with no trading costs. This puts Ally Invest customers at a slight disadvantage if funds are a huge part of their investment plan.

Stocks Offered

If your main objective in this investment space is to focus on stocks, then you’re in luck. Ally Invest lists thousands of publicly listed brands, subsequently offering you the opportunity to build a diversified portfolio of investments.

This stockbroker primarily focuses on the major United States stock exchanges, notably the NASDAQ and the New York Stock Exchange.

Special Features

Like a majority of other online stock brokers, Ally Invest got rid of commissions on most United States exchange-listed options, ETF trades and options in 2019. Ally Invest user accounts are SIPC protected for amounts getting up to $500, 000 with $250,000 for cash claims. Additional coverage is available for an amount up to $37.5 million, with up to $900, 000 in cash with an aggregate cap of $150 million (Forex & Futures accounts are not covered). If you prefer to have some help in creating and maintaining your investment portfolio, Ally Invest also includes a fee-free managed portfolio akin as well as a Robo-advisory service. It’s known as the Cash-Enhanced Managed Portfolio. Ally Invest services brokerage accounts as well as advisory client account assets are stored in custody with Apex Clearing Corp. Ally Invest provides its users with a full suite of robust trading tools to help them become more successful investors. These include the following:Commission-free trading

Account protection

Managed portfolio options

Clearing agency

Trading tools

Account Fees, Commissions and Limits

Ally Invest used to have one of the lowest trading fees around. The good news is it announced that it would get rid of commissions on a major of the U.S exchange-listed options, stocks and EFT trades. This stockbroker was one of the several that opted to offer fee-free trades just after an escalating pricing war. All new Ally Invest accounts, regardless of the opening amount, will have commission-free stock trading. But keep in mind that options trades still go for 50 cents per contract.

Account Minimum

Ally Invest doesn’t impose any minimum deposit requirement. Your account will remain active even if you don’t have funds in the account.

Promotions

New Ally Invest account holders who deposit not less than $10,000 within 60 days of the account opening will receive 90 days of commission-free trades up to $500. Cash bonuses are also available but they should follow a certain deposit schedule.

Account Types

Ally Invest provides two primary types of accounts. The first one is a semi-managed account where users choose all their own investments and enter their own trades.

The second account is a managed portfolio account, also known as Robo-advisor, where Ally Invest chooses investments for users based on the questions they answer when opening their accounts. Forex trading is available via a separate account as well.

Taxable accounts available on Ally Invest include custodial, joint and individual. A few types of IRAs are available including Traditional, SIMPLE, SEP, Rollover, Roth and beneficiary IRAs. You can also choose to open a Coverdell education account, trust as well as entity accounts.

Note that there are no minimum balances or recurring fees for your self-directed account. Managed portfolio accounts on Ally charge 0.30 percent per year and have a minimum starting balance of at least $2,500.

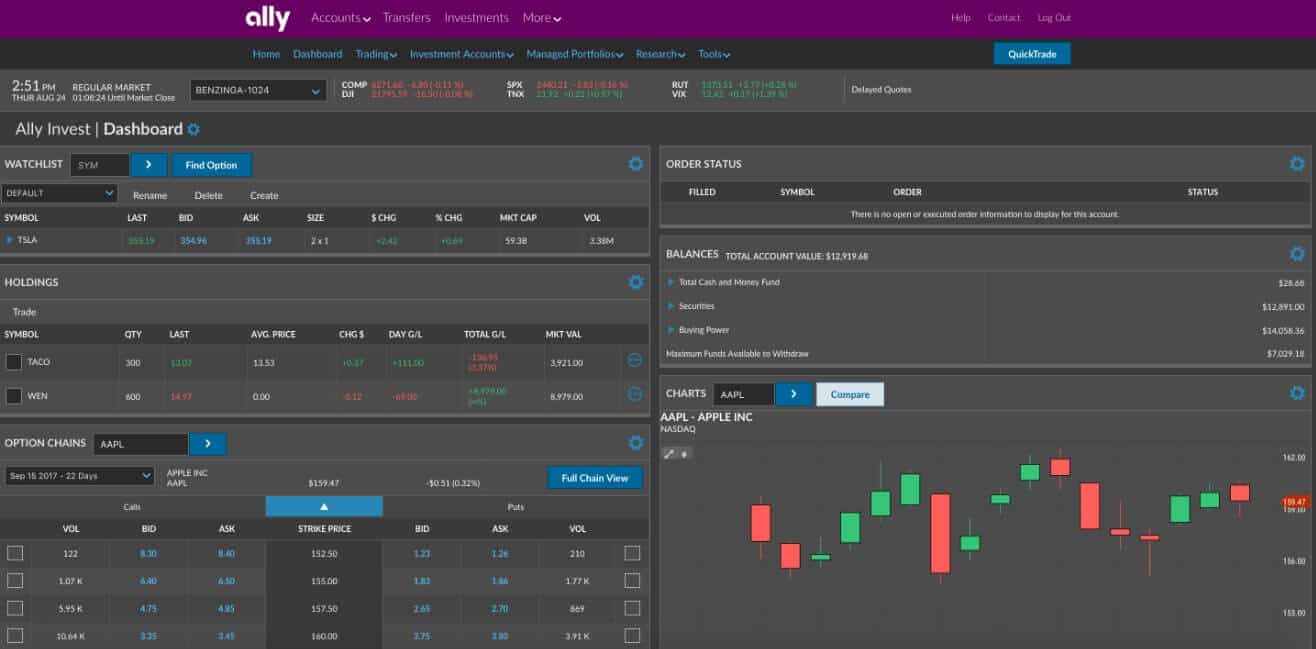

Trading Platform and Technical Features

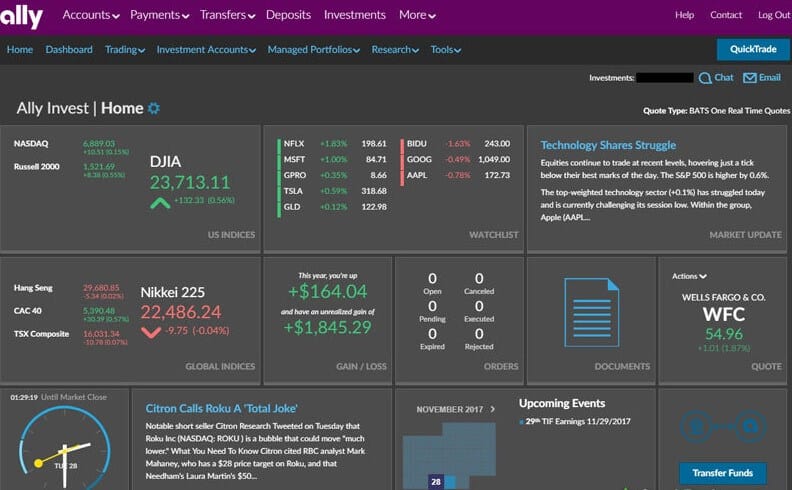

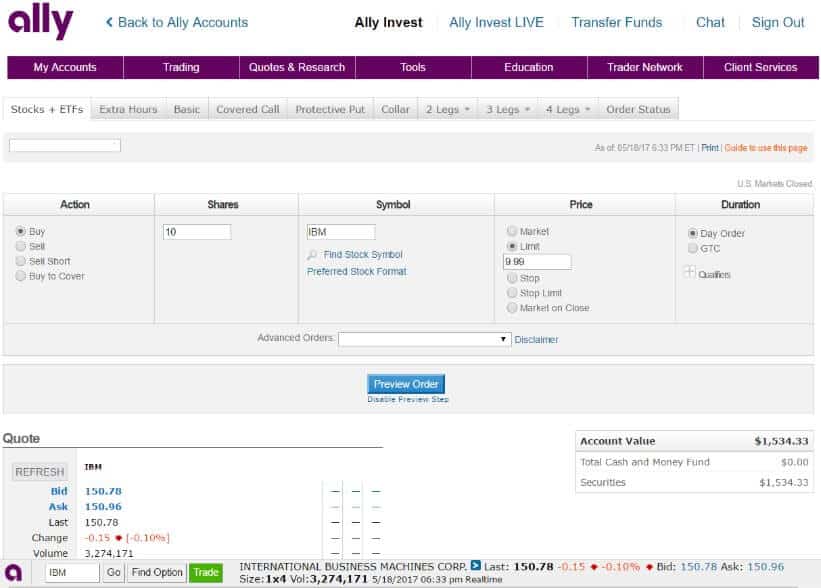

Ally Invest offers a discrete platform for users to trade on. Users are given access to Ally Invest Live, which is fast and easy to use. Any level traders will find it useful. It is easy to learn for beginners and includes almost everything experienced traders would need.

However, if you’re a Mac user, you’ll have this as your only option as the Ally Invest Live only supports PC platforms. Nevertheless, you can opt for some Mac apps that can run Windows-based applications that you can work-around if you are an Apple user.

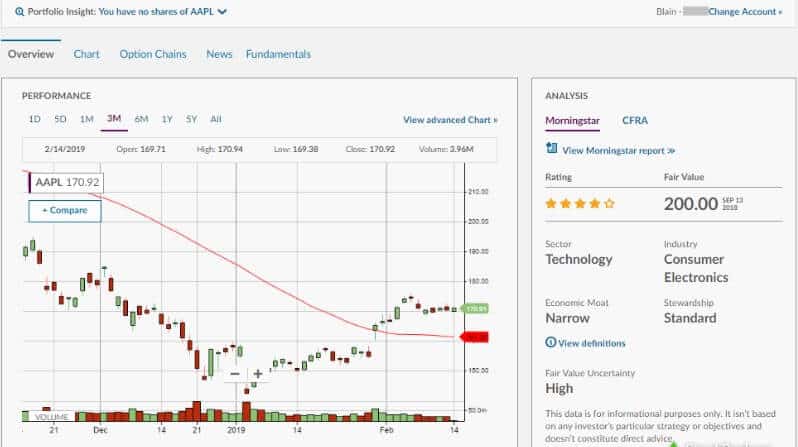

Research and Data

Ally Invest boasts one of the best research libraries in the business when compared to a majority of its competitors. The library has an extensive archive of information and date and brings both visual slides as well as interactive media to the user experience. Here, you can analyze everything ranging from your earnings to transactions, study graphs and more. It gives you an overview of a huge selection of market data. A majority of other stock brokers just give you a rundown of items and boring data.

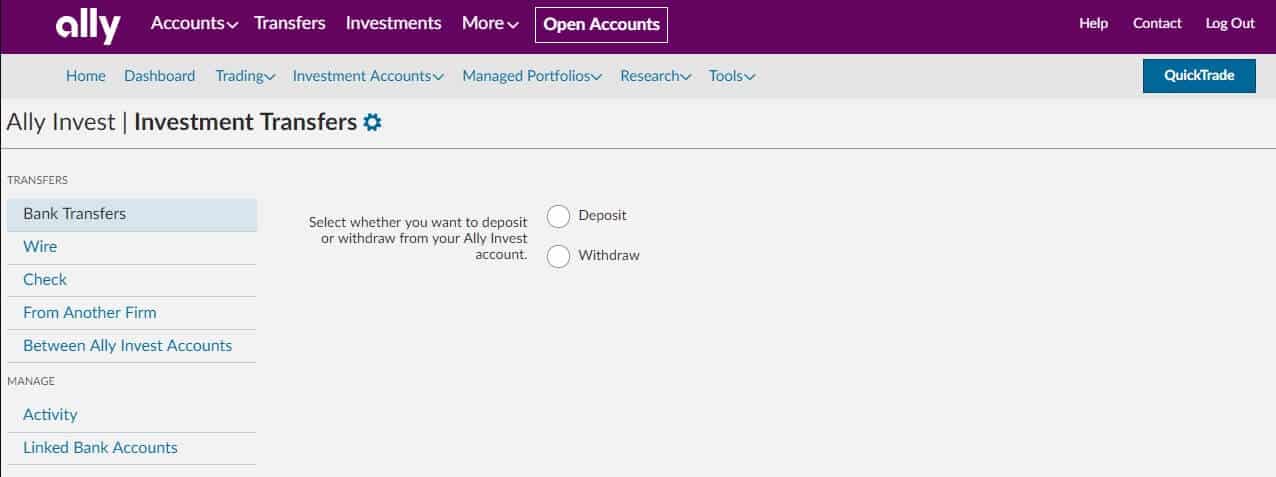

Cashier Options

You can fund your account using ACH transfer, debit card, wire transfer and check.

The use of debit cards is highly recommended if you want to immediately see your funds in your Ally Invest account. The other payment options can only complete the deposit and withdrawal transactions after 1-3 days.

How to Trade on Ally Invest

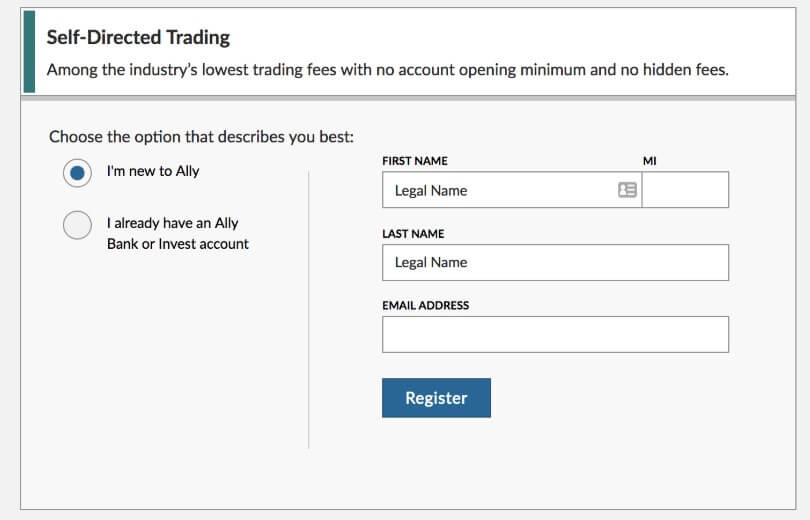

Step 1: Create your account.

For you to start trading on Ally Invest, you first need to open an account. To do that, go to the Ally Invest platform registration page and click on Start Trading. Fill in the required information that is designed to help the platform recognize you. This information includes your name and email address. Next, specify the account you wish to open.

Step 2: Complete your profile.

You’ll need to confirm your social security number. Fill in your phone number and set up your security question. You also need to provide your employment details and current financial standing.

Step 3: Submit your Ally Invest application.

Once your account is approved, you can deposit funds and start trading.

Ease of Use

New and experienced stock traders find it easy to navigate the Ally Invest platform. They can easily see the different account types they can choose from as well as the specific features of each one.

Aside from the user-friendly website, the account creation is also simple and will only take a few minutes to complete.

Customer Service

The customer support provided by Ally Invest includes live chat, telephone and email. The platform also includes a help section that is sufficient for most inquiries for the brokerage account. You can get customer support through the live chat option 24/7. Phone support, however, isn’t that active. Agents are available Monday to Friday from 8 am to 6 pm.

If you choose email support, you should receive a response to your email within 24 hours.

Security & Regulation

Ally Bank belongs to the FDIC family and Ally Invest is a member of the SIPC and the FINRA. These give the stockbroker the standard regulatory coverage and insurance coverage as required for any US brokerage.

Additionally, Ally Invest is a member of the NFS (National Futures Association).

Supported Countries and Regions

As a result of regulatory restrictions, Ally Invest only supports users from the U.S. Also, foreign citizens legally living in the country and have a valid social security number are eligible to become Ally members.

The platform does not offer its services to certain restricted countries like Iran to open an account whether they legally reside in the United States or not.

Education and Resources

Ally Invest offers educational resources related to the latest market news and events. CFRA and Morningstar reports can also be accessed by its users.

Similar to other trading platforms, it also has video tutorials and articles about trading, investing and personal finance.

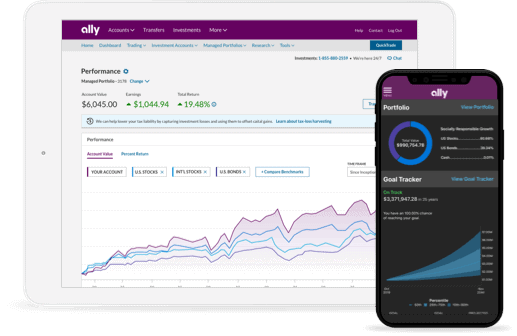

Mobile Trading

Ally Invest enables its users to trade on-the-go thanks to its iPhone and Android applications Ally Mobile. The stock trading apps has an average rating of 4.8 on the app store which is pretty good.

The app provides you with single access to your banking as well as investing life. The mobile app actually offers a simplified version of the Ally Invest’s desktop platform.

Pros and Cons

Pros:

Cons:

- No transaction-fee-free mutual funds

- No local branches

- Does not offer a demo account

Conclusion

Ally Invest is a great trading platform for all kinds of investors.

It is a simple and easy-to-use platform that allows investors to buy stocks in thousands of companies, options, over 800 ETFs and 8000 mutual funds. Its competitive fee structure and a lower fee for active traders are some of its best features. Additionally, the platform is reliable, licensed and regulated by government authorities. However, we find eToro to be a better option due to its usability, social trading platform and regulation. Click the link below to get started with eToro today.

FAQs

Is Ally Invest licensed?

Yes. The brokerage is licensed and regulated by government authorities.

How can I deposit money to my Ally Invest account?

You can deposit money in many ways, including wire, check and AHC.

Where is Ally Invest stockbroker based?

The brokerage is based in Detroit, Michigan. However, it doesn’t have a physical branch location.

What is the minimum account balance required at Ally Invest?

The platform does not impose a minimum account balance requirement.

Does Ally Invest offer a demo trading account?

Unfortunately, Ally Invest doesn’t offer a demo account. However, the platform permits users to test it without depositing money.