The number of forex traders has been increasing considerably, now that financial knowledge is becoming mainstream due to social media. Due to this, a huge number of companies compete with each other today to position themselves as the number one broker within the sector. However, only a few entities have managed to create a name for themselves as reputed brokers.

One such broker is OANDA Corporation, which shall be reviewed thoroughly in this guide. It will cover every aspect right from the platform’s features, to the quality of customer service. Based on the details mentioned, we will determine if the broker is a recommended choice or not.

While the company does have its roots and caters to a global audience, this guide will be covering the broker and its services available specifically in the US. Thus, every factor mentioned within this article may or may not pertain to other geographical locations, except in the United States.

OANDA Corporation is regulated by the CFTC/NFA (Member ID: 0325821). CFDs are not available to residents in the United States.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Pros and Cons

Before learning about the OANDA platform and its variety of product offerings, let us take a quick look at the pros and cons that one may find insightful.

Pros:

Cons:

- Withdrawals may take up to 1-2 days

- No negative balance protection

- Less number of base currencies

- Limited funding methods

- Only Forex and Crypto trading instruments are available

- High withdrawal fees for certain methods

- GSLO (Guaranteed Stop Loss Orders) is not available

- CFD products not supported

About OANDA Brokerage

Founded by Dr Michael Stumm and Dr Richard Olsen, OANDA was launched way back in 1996. It was popularized soon after while being based out of Delaware. Within the first year of launch, OANDA was featured in TIME magazine for being the first platform to provide free exchange rate information on the internet.

Naturally, this gave the company a headstart as a huge number of people started recognizing the brand and becoming a part of it. By 2007, the company had grown to become a global entity, with its latest venture being focused on the Asia Pacific region.

Since a decade of its inception, OANDA has bagged a huge number of awards from some of the biggest authoritative organizations in the world. These include the Highest Overall Customer Satisfaction Award, Best Retail FX Platform Award etc from the US itself. It also rose to become the number-one FX broker in countries like Japan and Singapore for several years.

In 2018, the platform was acquired by CVC Capital Partners who currently run the company which is headed by Gavin Bambury as CEO. As of today, OANDA is one of the most preferred forex brokers in the US and is used by thousands of active traders.

What kind of broker is OANDA?

OANDA is; as mentioned above, one of the oldest and most reliable names in the industry when it comes to the currency domain. It features a high-frequency and filtered currency database that can be used by any type of trader for accurate information. It is a market maker and uses innovative computer and financial technology to ensure that the products are of the highest quality for users.

Products by OANDA Exchange

OANDA features two major product offerings in the US. While it originally does boast a huge variety of services, the US consists of forex trading and cryptocurrency trading. It is naturally one of the top choices by forex traders due to its reputation and excellent trading experience. Crypto trading is a feature that was recently added to OANDA exchange. Since it has grown rather quickly, this move was embraced by the wider audience, who have also started participating in the industry now.

Let us take a look at both products by OANDA in depth:

Forex Trading

Being one of the most liquid markets in the world, it is important that even a minute change in price gets reflected on any brokerage swiftly, so the users can benefit from it. This is something that OANDA claims to take very seriously. Voted as the Most Popular Broker and Best Forex and CBD Broker in 2021, OANDA already wins in terms of recognition and popularity.

OANDA provides a competitive spread of over 70 forex pairs, which includes majors and minors. Its two pricing models ensure that the spreads go as low as 0.0%, which can be beneficial for traders while generating profits. This is because it will capture even the smallest change in prices. Being a completely regulated broker, OANDA is yet to face even a single issue or major legal battle.

OANDA’s hours of operation coincide directly with global financial markets. In the US, trading is open between 5 pm Sunday to 5 pm Friday in the New York timezone. These timings may be subject to change depending on certain unforeseen issues and during daylight savings time.

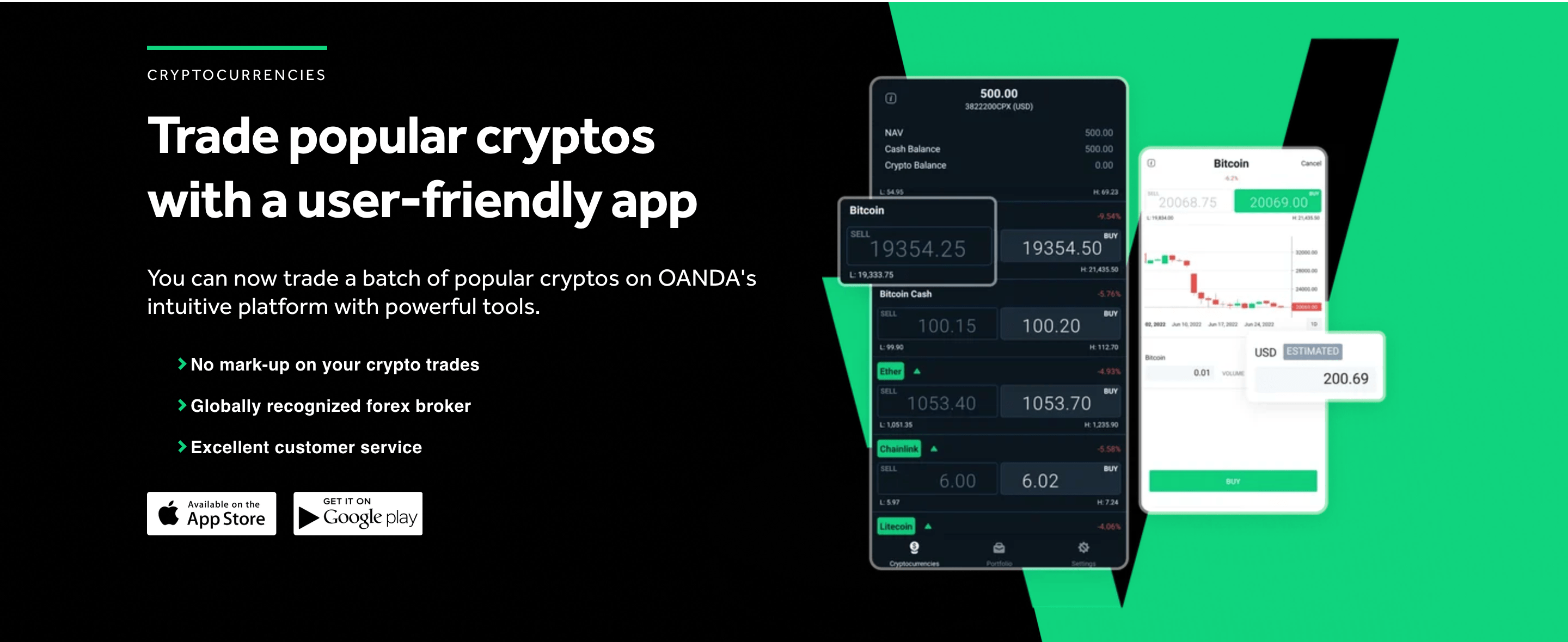

Crypto Trading

As the cryptocurrency industry has been growing at a drastic speed, it was a smart option by OANDA to add a crypto trading offering to its platform. To enable this, the brokerage partnered with Paxos, which is one of the most popular cryptocurrency companies in the space.

Due to the aforementioned growth, users generally have to access different applications or websites to trade in forex and crypto. OANDA makes it possible for investors to park their funds in crypto while also availing top-quality forex trading services in a single place. Users can open their account with the crypto services partner Paxos and access the product directly from Paxos’s iBit Exchange.

Crypto trades do not incur spread markups or custody fees. For all crypto orders, a 0.25% fee is applied, subject to a US$0.01 minimum. In case of any deposits or withdrawals, a daily statement will be sent to the user’s email address. Monthly statements will also be available for those who wish to acquire one. However, users can transfer or withdraw from their forex account only if the funds are fully settled. Instant ACH credits received in the user’s forex account can’t be transferred to the respective crypto account.

Currently, there are 10 cryptocurrencies that are supported on OANDA. These include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), PAx Gold (PAXG), Chainlink (LINK), Polygon (MATIC), AAVE (AAVE) and Uniswap (UNI).

OANDA Trading Platforms

As a company that deals with funds in large quantities and has to be updated every other second in terms of price and movements, OANDA’s Trading platform plays a huge role. This is the main medium that users will rely on to make strategic trading decisions which would impact their positions.

Currently, there are four major platforms that are available for trading on OANDA in the US. These include Desktop, Mobile, Web, Metatrader 4 and recently integrated Tradingview. Let us take a look at how all these platforms function within the brokerage and what their advantages are.

1. OANDA Trade desktop platform

For any trader to get the best out of their experience, it is important to have a layout that can give them real-time data in a convenient manner. One that has access to all important information and tracks the price accurately at all times. That is exactly what this platform is about. It features powerful charting, sophisticated trader analysis and a suite of high-efficiency trading tools.

This platform allows users to trade directly from the charts, which has over 10 layout types to suit one’s trading style. The chart types too have a wide variety, which features basic line charts for beginners and advanced options like Renki and Kegi for professional traders. It also allows users to access updated market news and insight at all times. The news comes from leading providers like Dow Jones International, 4CAST and OANDA MarketPulse

Widely used by a huge majority of OANDA’s user base, the desktop platform is available on Windows, Mac or Linux computers.

2. Mobile Trading App

Today, a huge chunk of the investing or trading citizenry prefers convenience over hefty features or offerings. This makes an app a crucial addition to the platforms available on OANDA. Fortunately, it features a mobile application since 2010. However, the current version of the application is a much more upgraded product which can be used with much more ease and speed than before.

The app hosts a customizable interface, where users can set their parameters. This includes the addition of data on the dashboard like units traded, bounds in pips or percentage price, risk and profitability levels for pending orders and favourite forex pairs. Surely, this will only enhance the trading experience, as the trader will have direct access to every data required as soon as the application interface opens up.

One can also opt to have alerts and signal notifications to further improve their timing in terms of taking positions and other important actions. The app is mobile-centric software by nature. This means that the application doesn’t simply copy the interface on the desktop website.

The application is available on android and IOS. However, there are certain specifications to be eligible for the application. The device must be iOS 11, 12 or above or Android Jelly Bean and above to function on iPhones or Android mobile phones respectively.

3. OANDA Trade web platform

While the desktop platform is downloadable and can be used right after, the OANDA Trade web platform makes it one step shorter. There is no need to download any software in this case. One can simply log in to their OANDA account and start trading right away. Needless to say, the web platform is also extremely optimized to ensure a smooth trading experience even on a browser.

It features a next-generation engine with superior trading technology that focuses on providing real-time data while factoring in even the slightest price changes. There is a wide variety of trader analytics and tools that can be taken advantage of as well. Infact, unbiased technical analysis and other such features can be accessed through Algo labs powered by Quant Connect, both of which are highly popular names in the trading space.

With other features like risk management and updated news, a web platform is also a great option for those who prefer not to install extra software on their desktops.

4. MetaTrader 4

MetaTrader 4, also known as MT4 is one of the most popular charting and analysis platforms available currently. MT4’s charting and analysis are integrated with OANDA’s pricing and execution through a custom-built bridge. Upgrades to MT4 Premium include additional indicators and expert advisors (EAs), such as mini charts, OCO orders, five-minute order book, tick-chart and keyboard trading, chart ladder order entry and alert trading.

With MetaTrader, a user has direct access to the following features-

- Trade using retail pricing sentiment

- Access cumulative order information

- View open orders directly on your MT4 charts

- View open positions directly on your MT4 charts

- Access net order information

- Increase Indicator data refresh frequency from once every 20 minutes to once every 5 minutes

For the users who trade more than $15 million in volume every quarter, a complimentary upgrade to MT4 may be available as per the company website. In order to avail this, one should add at least $10,000 and email the designated relationship manager once the $15 million mark is hit.

5. TradingView Platform Synergy

This is one of the latest features that OANDA has integrated into its ecosystem. As a part of the partnership between OANDA brokerage and TradingView, which is one of the best and most widely used analytical platforms in the world, users can have the best of both worlds. In short, a user can use the features that are exclusive to TradingView while enjoying an accurate chart by OANDA.

Users can also access world-class advanced charting solutions from OANDA’s web and desktop platforms via Advanced Charts, powered by TradingView. This partnership comes after OANDA was awarded ‘Best forex and CFD broker’ and ‘Most popular broker’ by the TradingView community in 2021.

The advanced trader program

OANDA has a special feature that can be taken advantage of by professional traders with a huge amount of funds. The Advanced Trader program allows users to earn cash rebates or commission markdowns from $5 up to $15 per million as they meet OANDA’s minimum volume and deposit requirements.

To become a part of this program users are initially required to fill out a form available on the platform itself. After depositing $10,000 and trading more than $10 million worth of volume, the respective user will be eligible to become a part of the platform. Perks of the program include access to dedicated relationship managers, access to third-party platforms and free wire transfers.

OANDA Exchange’s Security

There is no doubt that OANDA is a highly secure platform that can be trusted when it comes to forex or crypto trading in the US. It has a long-standing reputation built over 20 years and is one of the most used platforms in the country. Moreover, it is regulated by Financial Conduct Authority (FCA) and Commodity Futures Trading Commission (CFTC) in the United States itself.

However, it is a good idea to also review the regulators for OANDA in other countries where it conducts business. The exchange is regulated by highly reputed entities in almost every country that OANDA caters to. This ensures that the platform is secure and can be trusted since it also has no previous issues regarding payouts or loss of funds.

Deposit and withdrawals

Depositing on the OANDA platform is fairly easy, but is limited when it comes to funding options. In the US, deposits can be made through bank transfers, wire transfers, Visa and Mastercard Debit/Credit cards, Neteller and Skrill. While there is no such charge for depositing funds, a hefty charge is levied when it comes to withdrawing through bank transfers.

In other methods, there is no withdrawal fee. But as mentioned above, if a user wishes to withdraw through a bank, then a charge of around $20 is levied, which is quite high compared to several counterparts.

Customer Service and Languages supported

Customer Service is vital to any platform that deals with money. This has been considered with much gravity when it comes to OANDA. OANDA’s customer service is one of the best available currently, with a variety of options to get issues resolved swiftly. There is a contact number through which users can directly talk on call and get their issues sorted. Additionally, an email address is also provided if that is a preferred mode.

Users can also make use of the live chat feature. It is one of the best parts of customer service when it comes to OANDA. English, Spanish and Mandarin are the languages supported on OANDA’s chat support.

How to Open an OANDA Account

Registering on OANDA is easy, and will only take a couple of minutes.

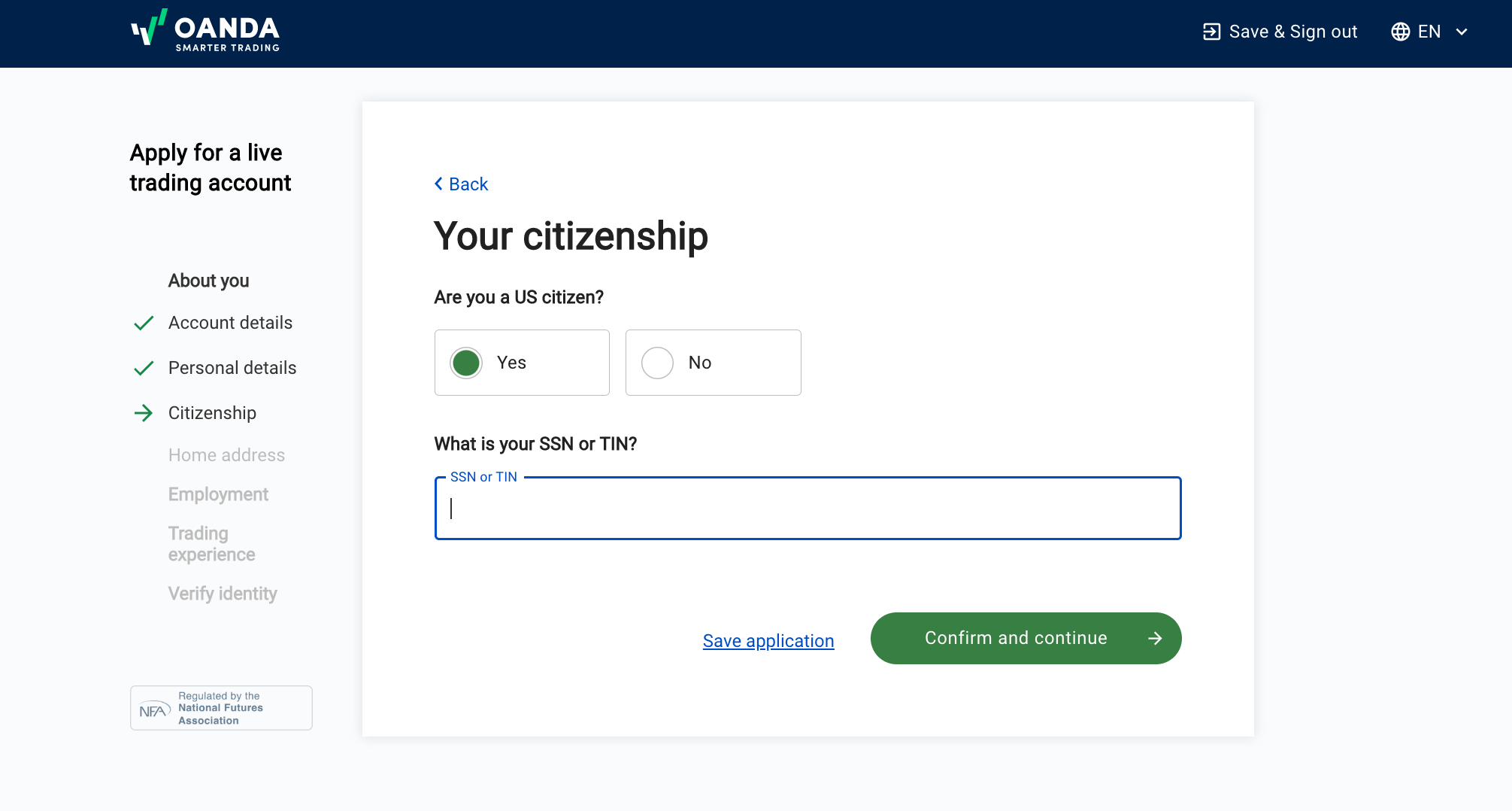

Step 1 – First visit the official OANDA website.

Step 2 – Click on the “Start Trading” button on the website

Step 3 – A question regarding the user’s country of residence will pop up. Select the right answer.

Step 4 – The user will be required to give an email ID and some personal details. Add these details as asked on the following screen.

Step 5 – After filling in the personal details, and some information about previous trading experience, the user will be expected to provide KYC verification documents

Step 6 – When this is done, the user can start trading on the OANDA Website

Conclusion

It is evident that OANDA succeeds in bringing about some of the best products, features and upgrades to the platform while maintaining the company’s reputation. Due to these factors, OANDA can be considered a great option for beginners and professional traders alike.

Naturally, there is a chance of losing funds due to the nature of forex trading and crypto. However, for those looking for an excellent brokerage with a wide variety of features, OANDA is surely one of the top picks.

OANDA Corporation is regulated by the CFTC/NFA (Member ID: 0325821). CFDs are not available to residents in the United States.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA’S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

Read more:

Frequently Asked Questions

Does OANDA have an inactivity fee?

Yes, OANDA does have an inactivity fee. It is levied on not having a single open position for more than 365 days. In that case, the platform deducts funds amounting to $10 every month.

Does OANDA have CFD products in the US?

No, OANDA does not feature a CFD product in the US. However, it is available in several other countries.

Can you short-sell crypto on OANDA?

No, this feature is not available on the OANDA exchange yet. A user can, however, buy or sell the 10 cryptocurrencies available on the platform.