IronFX is a leading forex and CFD broker brokerage firm that offers a wide array of assets like forex, metals, indices, commodities, futures, and shares. This trading platform has gained widespread popularity due to a flexible leverage ratio, competitive spreads, and a useful set of trading tools for professional traders. The broker is also regulated in Europe by the Cyprus Securities and Exchange Commission (CySEC), the FCA in the United Kingdom, and ASIC in Australia.

If you’re keen to find out whether it is the right broker for you, we would highly recommend reading our in-depth IronFX review before taking the plunge. In this review, we explore the platform’s range of assets, fees, spreads, regulatory framework, features, trading platforms and much more.

On this Page:

What is IronFX?

As of 2020, IronFX serves more than 1.2M retail clients globally and is is one of the leading brokers working in the retail FX and CFD market. IronFX executes investors’ orders via the ECN/STP or market maker execution model, which makes it one of the few brokers in the industry using both methods.

This broker supports a range of 200 CFDs assets from 6 asset classes on one single platform, the popular MetaTrader4.

IronFX Pros and Cons

Pros:

- Supports MetaTrader4

- Regulated by FCA, CySEC, and ASIC

- Low trading fees and competitive spreads

- Offers ECN/STP trading account

- A high leverage ratio of up to 1:1000

- Features a free VPS hosting

- Offers a Negative Balance Protection

- A diversified range of 7 account types

- Offers an AutoTrade solution that allows you to copy trades of other investors

- IronFX offers live trading competitions and trading bonuses

- Deep and diverse liquidity

Cons:

- No cryptocurrency trading

- Does not accept US clients

Regulation and Trust

When it comes to regulation and the safety of your funds, IronFX is one of the most regulated and safe brokerage firms in the world of online trading. This FX and CFD broker is regulated and authorized by some of the most well-known regulating agencies across the world and its regulatory licenses include the following:

- In the United Kingdom, IronFX is authorized and regulated by the Financial Conduct Authority (FCA) under Registration No 585561.

- IronFX’s parent company, IronFX Global Limited, is regulated by CySEC under license number 125/10.

- In Australia, IronFX is regulated by the Australian Securities and Investment Commission (ASIC) under AFSL number 417482.

Furthermore, IronFX complies with the Markets in Financial Instruments Directive (MiFID) and is a member of the Financial Ombudsman Service (UK) and the Financial Services Compensation Scheme (FSCS). This means that clients of IronFX may be eligible to have a payment in case of the inability of the broker to fulfill its financial obligations.

Products and Markets

Overall, IronFX offers clients the ability to trade on more than 200 financial instruments across six multiple asset classes that include:

- Forex: Over 80 forex trading pairs with a leverage ratio of up to 1:1000.

- Metals: IronFX offers investors to trade on Gold, Silver, Platinum, and Palladium. Spot Metals can be traded with the most competitive spreads in the industry.

- Indices: 16 indices including the DAX30, S&P500, FTSE100, NASDAQ100, etc. (margin requirement of %1-%3).

- Commodities: Crude/Brent Oil, natural gas, coffee, and sugar.

- Futures: IronFX also offers trading on CFDs on futures. This includes major share indices, grains, softs, and currency futures.

- Shares: The broker offers over 150 shares, most of which are listed on US stock exchange, UK, France, Germany, Spain, and the Czech Republic. This means you’ll have access to some of the most popular shares in the world including Facebook, Netflix, Volkswagen, BNP Paribas, and more.

Leverage

On the IronFX platform, every asset class available can be traded on margin. For those unaware, a margin trading is a form of leveraging the capital of investors by borrowing funds from the broker. The leverage ratio provided by IronFX is among the highest in the industry and can reach up to 1:1000 on some assets such as currency pairs and 10:1 on shares.

Below we have listed the maximum leverage ratio offered by IronFX for each asset class.

- Forex: Up to 1:1000 for live floating/live fixed account. Up to 200:1 for STP/ECN accounts

- Metals: Up to 10:1 , 10% X 5000 X Silver Mkt Price (in USD) for retail clients

- Indices: Up to 100:1

- Futures: Up to 100:1

- Commodities: Up to 50:1

- Shares: Up to 10:1

You should note, however, that you can limit the level of the leverage ratio you wish to employ. At this point, we must inform you that leverages as high as 1:1000 carries a high level of risk and therefore, we recommend you start with a lower level of leverage.

Bonus

IronFX offers a great selection of different bonuses and promotional offers to its clients:

- A unique live trading competitions that allows participants a chance to win exceptional prizes or a cash reward

- 100% unlimited sharing bonus

- 40% power bonus up to $4,000

- 20% iron bonus up to $2,000

During the account creation process, you can choose to type of bonus plan to be implemented. Bear in mind, however, that you can only withdraw profits made from your trading, but the amount of the bonus cannot be withdrawn unless you meet certain trading conditions.

Education and Trading Tools

IronFX gives investors access to a wealth of educational resources that are very useful to those who wish to improve and sharpen their trading skills. The broker offers the IronFX Trading Academy that includes plenty of educational tools such as a wide range of e-Books, webinars, live economic news, forex glossary, educational videos, and an economic calendar. The broker also offers a market insights section that covers financial news, market updates, and technical analysis forecasts.

Fees and Spreads

Like most CFD brokers, IronFX makes their money by charging a spread, which is the difference between the buy and sell price of an asset. With IronFX, the spread that you pay depends on the type of account you have with the broker. But overall, IronFX offers extremely competitive spreads and efficient execution speed. The four execution models include:

- Live Floating Spreads – EURUSD starts from 0.5 pips for the VIP account

- Live Fixed Spreads – EURUSD starts from 1.6 pips for the VIP account

- Live Zero Fixed Spreads – 0 pips for the EURUSD

- STP/ECN – Spread ranges between 0-1.7 pips depending on the type of the account

As IronFX offers ECN/STP execution, investors can expect tight spreads with more transparency. Essentially, the broker provides traders with direct access to interbank prices and top-tier liquidity providers such as Bank of America, Barclays, Goldman Sachs, UBS, etc.

IronFX does not charge any deposit fees and withdrawal fees. However, the broker does charge a $50 fee after one year of account inactivity.

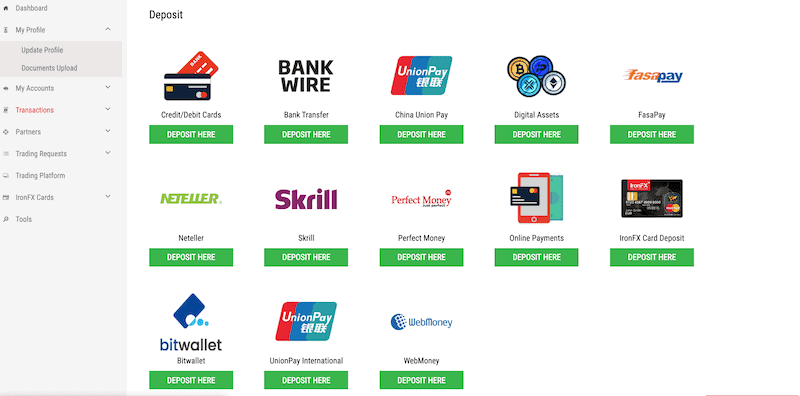

Banking

IronFX allows you to deposit and withdraw funds with an impressive range of payment methods. Neither payment method attracts any deposit fees though you may have to pay a fee to your bank or payment provider. Minimum deposits start at $100, and accounts at IronFX can be opened in USD, EUR, GBP, AUD, JPY, CHF, PLN, RUB and HUF. Any Deposit in a different currency than the above will be converted into the base currency of your trading account.

The following are the available deposit methods at IronFX:

- Credit/Debit cards

- Bank Wire Transfer

- China Union Pay

- Digital Assets

- FasaPay

- Neteller

- Skrill

- Perfect Money

- Online Payments

- IronFX Card Deposit

- Bit Wallet

- Union Pay International

- WebMoney

Trading Platform

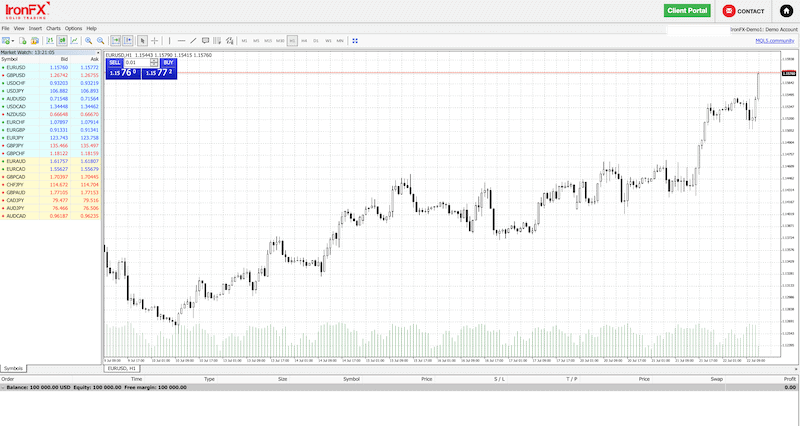

IronFX offers the popular MetaTrader4 trading platform that is available as a desktop version, WebTrader (web-browser version), and on mobile devices. Additionally, IronFX offers the Personal Multi-Account Manager (PMAM) feature that was specifically designed for professional money managers.

The MT4 platform is considered by many as the leading forex and CFD trading platform for retail customers due to the variety of technical indicators, the range technical charting tools, and the user-friendly interface. IronFX also offers clients to use a Virtual Private Server (VPS) hosting, which helps traders to deploy their trading strategies on an external server that will be running 24/7 without interruptions.

For those of you that want to use the AutoTrade feature, IronFX allows you to choose one of the top-performing traders on its network and copy all the trades the trader executes. This feature can be integrated into the MT4 trading platform.

Account Types

IronFX offers a variety of seven trading account types that suit different investment and trading styles. The broker allows you to choose between Live and STP/ECN trading account with the main difference between the two is in execution. Unlike the ECN execution model, which feeds orders through a number of liquidity providers offering the best price, a market maker may be more involved in-market execution. Either way, IronFX enables you to choose your preferred execution model.

Overall, the broker offers the Micro, Premium, VIP, and Zero Fixed Accounts on the live floating/fixed spread accounts. STP/ECN trading accounts include the No Commission, Zero Spread, and Absolute Zero Accounts. In addition, users can sign up for a free forex demo account.

The Micro account requires a minimum deposit of $100. As for the spreads, it’s advisable to consult with the IronFX support team to find out about the account that meets your trading needs.

IronFX Tutorial: How to Sign Up & Trade

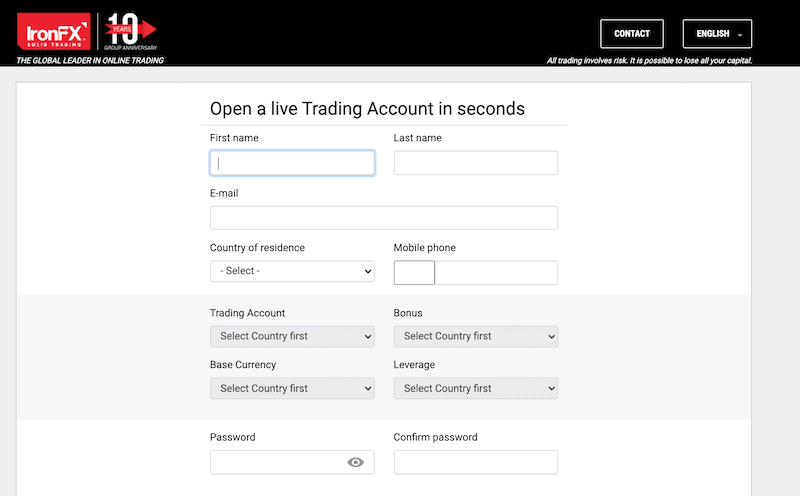

Opening an account with IronFX is pretty straightforward. Below, we’ll walk you through the process of how you can get started in four simple steps.

Step 1: Open an Account

On the IronFX’s homepage, click on the ‘Register’ button that directs you to the account creation page. On this page, you will need to fill in personal details such as your name, email address, country, phone number, the currency of the account, the account type, the bonus, and then create a password.

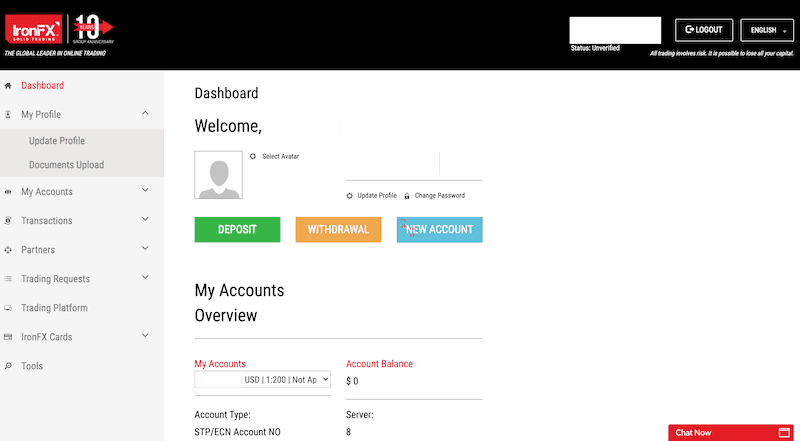

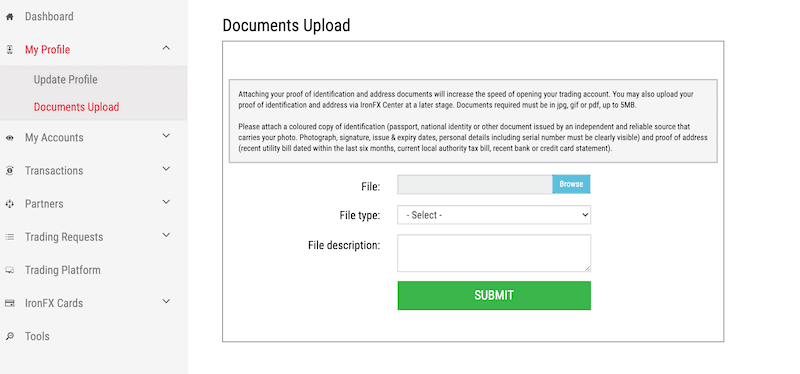

Step 2: Verify Your Identity

As IronFX is a heavily regulated broker, you will then need to upload documents that verify your identity. Once you have been transferred to the trading dashboard, navigate to ‘My Profile’ and then ‘Documents Upload’.

You will then need to upload a colored copy of identification (passport, national identity, or another Government-Issued ID, and proof of address (recent utility bill dated within the last six months, current local authority tax bill, recent bank or credit card statement).

Step 3: Deposit Funds

There are plenty of ways of making your initial deposit into your IronFX account. The minimum deposit depends on the account type that you opt for, but you can start with a minimum deposit of $100.

Take note that deposits can take up to 24 hours to be processed depending on the payment method you choose and up to 3 working days if you decide to fund your account via bank wire transfer.

Step 4: Demo and Live Trading

Once your account has been funded, you will then have to choose the platform version. As you can see in the image below, IronFX allows you to choose to trade on the online, desktop software or mobile app version. If you do not wish to download the software to your desktop, choose the WebTrader platform, and click on the ‘Launch’ button.

On the login screen, you will need to insert the credentials sent to you via email in order to connect to the real live account or you can create a free demo account.

Customer Service

IronFX maintains a highly skilled and professional support team. You can access them online 24/5 via email, phone, and live chat in over 180 countries and in 30 different languages. Further, it also provides a comprehensive FAQ section about trading, account opening, trading platform, and client funding.

Supported Countries and Regions

IronFX offers financial services in more than 180 countries around the globe, however, the broker does not offer its services to residents of the following countries:

- United States

- Iran

- Cuba

- Sudan

- Syria

- North Korea

IronFX vs Other Brokers

In terms of spreads and account types, you’re unlikely to find many forex brokers in the market that offer the same as IronFX. The variety of six accounts on two different execution models make IronFX a good choice for any type of trader. Also, if you’re looking to trade with high leverage, IronFX is an ideal broker as it offers a leverage ratio of up to 1:1000.

Other aspects in which IronFX measures up well against other brokers in the industry is that it supports the MetaTrader4, and allows users to easily facilitate automated trading.

On the negative side, one of the main things that might be causing problems for some traders is the limited range of assets. IronFX offers around 200 financial instruments, which is limited compared to other platforms. For those who are looking for a platform that offers a wide range of assets, eToro has more than 2000 financial instruments that include shares, forex, cryptocurrencies, Exchange Traded Funds (ETFs), commodities, and built-in CopyPortfolios.

Conclusion

In summary, it is obvious why IronFX has become a key player in the brokerage arena. With more than ten years in the industry, IronFX has since attracted more than 1.2 million clients worldwide.

This can be attributed to the fact that the broker takes into account the trading needs of the different classes of investors and traders, offering seven account types through market-maker and ECN/STP execution models. On top of that, investors on IronFX’s platform can be confident that funds are completely secure and safe as it is regulated by top-tier regulators.

Want to try IronFX out for yourself? Simply click the link below to open an account today!

FAQs

What is an ECN broker?

An ECN broker is a financial brokerage that uses electronic communications networks (ECNs) to give its clients direct access to other participants in markets by using a number of liquidity providers. ECN brokers are non-dealing desk brokers, meaning they remove the conflict of interest between the investor and the broker.

Can IronFX run my IRA or other retirement accounts?

No. IronFX is a CFD and FX third party broker with no authorization to manage retirement accounts.

Is IronFX available in my country?

IronFX accepts clients from most countries around the world, except the United States, Iran, Cuba, Sudan, Syria, and North Korea.

Does IronFX offer account protection?

Yes. As a member of the Financial Services Compensation Scheme (FSCS), investors have protections for their assets. The protection covers up to £85,000 if the authorised financial services firm fails.