Trade.com is designed for those with interest in the US market. Trade.com came into existence in 2013. It is a platform of Lead Capital Markets Ltd. The Trade.com broker platform enjoys the regulation of Cyprus financial authorities at the countries Securities and Exchange Commission. Trade.com provides a market for the trading in Cryptocurrency, FOREX index, shares and commodities.

If you’re looking to find a reliable review about Trade.com, then read this guide. We’ll cover who the broker is, account types, trading platforms, fees and spreads, regulation and security, customer service, languages, and more.

On this Page:

What is Trade.com?

Trade.com is a CFD and forex broker designed for trading in precious metals, commodities, stocks, bonds, CFDs and major indices. The trading platform also supports trading in more than 45 currency pairs. The trading platform is a brand name developed and managed by lead capital Market Limited.

Trade.com is under the regulation of Cyprus Security and Exchange Commission (CySEC). The role of CySEC is to ensure that license holders enjoy some level of security as regards the provision of financial services. Some of the measures taken by CySEC is, ensuring that customers funds are kept in segregated accounts. It also ensures that investment firms in Cyprus have a minimum of €1,000,000 in reserves. This is to ensure that they are financially stable.

Markets

Score: 9/10

Trade.com offers a wide variety of financial products with main assets categorized into six markets. You will be able to trade Forex, indices, stocks, commodities, ETF’s and Cryptocurrencies. Take note that trading of all financial assets mentioned above is not allowed for all countries so make sure you find out with Trade.com before opening an account.

- Forex – 55 currency pairs

- Indices – 26 global indices

- Stocks (shares) – Over 2000 stocks

- Commodities – 19 commodities

- ETF’s – 37 Exchange Traded Funds

- Cryptocurrencies – Several crypto coins

Special Features

Score: 7/10

Trade.com offers traders and investors features to improve the trading experience. Those include:

➡️There are four types of account available for live trading on Trade.com website.

When you sign up on Trade.com, there are security questions you need to answer. This security verification, however, is for first-time users only. You also receive £10,000 in a demo account for demo account trading.

➡️On Trade.com, clients can trade in a variety of instruments including commodities.

Some of the commodities you can trade on the platform include Precious metals – Gold and Silver, Foodstuff – wheat and sugar

➡️Clients can also trade on oil and a variety of major indices such as NIKKEI, NASDAQ or FTSE.

Trading on different types of international stocks, CFDs and bonds is also a part of the Trade.com platform. Trade.com offers a no commission charge on trading CFDs. The required margin for CFD trading is also very low standing at 2-5%.

➡️When you sign up to Trade.com, you can enjoy the rollover feature.

This is applicable to overnight trades. It involves the interest deducted or paid from open locations. At Trade.com, traders can expand their portfolio on the international bond market. There is no commission. You can also enjoy the leverage of up to 1:100.

➡️Customers who trade on Forex can choose to either trade with the account or floating spreads.

Supported Countries

Score : 8/10

Trade.com’s platform is supported in the following 30 countries listed below:

- Austria

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg/span>

- Malta

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- The Netherlands

- United Kingdom

Languages supported

Score: 9/10

Invest on Trade.com platform to enjoy trading in one of the following supported 23 languages:

- Albanian

- Arabic

- Bulgarian

- Chinese

- Czech

- Danish

- Dutch

- English

- Finnish

- French

- German

- Greek

- Hungarian

- Italian

- Italian

- Norwegian

- Polish

- Portuguese

- Romanian

- Russian

- Slovenian

- Slovak

- Spanish

- Swedish

Trading Platforms

Score: 9/10

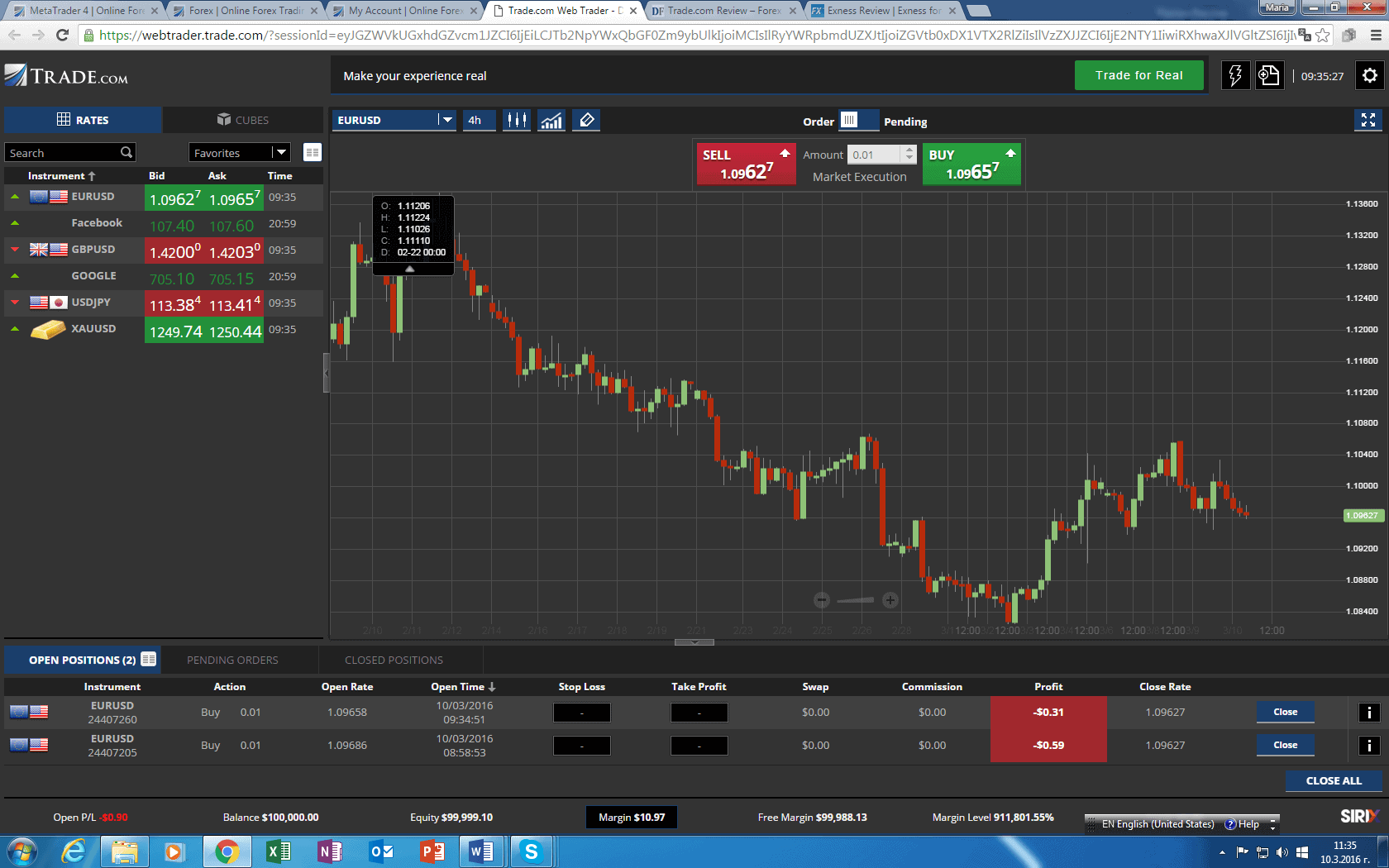

Trade.com’s trading platform utilizes two trading platforms which are MT4 and WebTrader, powered by Sirix.

MT4

MT4 is very popular and internationally accepted when it comes to online trading. It offers a full array of trading tools and assets. There a range of technical indicators available on the trading terminal. It provides the user with the opportunity to run a comprehensive back-testing. MT4 comes with an innovative charting package and a variety of EAs. MT4 enables traders to download a ready-made EAs or create customized EAs.

The trade ticket is a cool feature of Trade.com platform. It makes it easy to open order and place a buy order on the platform.

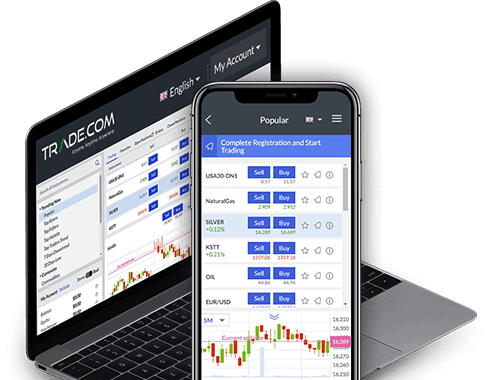

Mobile Experience

Trade.com also offers a customized mobile experience of the MT4. The mobile version offers the same experience as the desktop version. However, it is designed to adapt to the mobile phone experience better.

It is designed to enable traders to access their trading tools and innovative order types. Trade.com makes it possible for users to track their favorite watch list. Users can also access their account information from their mobile device. Access to charts is also available on the mobile device, however, it has limited functions.

Getting acquainted with the mobile device is very easy. It offers minimum functionalities for execution and analysis of trade. It is designed to help users find asset classes with ease. Asset classes can also be added on a preferred list.

Installing the mobile app is very easy. However, there are some security issues associated with the mobile app. This can pose a lot of security risks for traders who access sensitive account information.

The mobile app is also not available to traders in certain regions. This makes it not the best app for all traders.

Fees and Limits

Score: 8/10

What fees does Trade.com have? Although Trade spreads are mostly competitive, the broker charges trading and non-trading fees. Those include:

Trading fees

Equity (stocks) CFDs and ETFs fees: To get the latest information, it is important to visit Trade.com website. There are more than 2,000 companies open for trading with individual minimum spreads listed.

Commission charged per lot: Trade.com does not charge commission fees which is excellent for countering the high spreads. Well, it is not something new to Trade.com. There are quite several brokers that are commission free.

Overnight fees: These are fees charged for positions that remain open after the close of market hours.

Withdrawal fees: fees charged on funds withdrawal.

Inactivity fees: fees charged after a month of inactivity.

Deposit and Withdrawal fees

Trade.com has no Deposit/Withdrawal fees.

Trade.com Spreads

Spreads at trade differ depending on the financial asset.The following tables show the spreads for Indices, Forex, Commodities, Cryptocurrencies, ETFs and Bonds.

Spreads and trading hours

| Instrument | Spreads (as low as) | Leverage (up to) | Trading hours (GMT) |

|---|---|---|---|

| EURO-BUND-10Y EU | 0.06 (EUR) | 1:100 | 07:00 - 21:00 |

| TBOND-30Y (US30YBond) | 0.06 (USD) | 1:100 | 23:01 - 21:59 |

| GILT-LONG UK (Gilt10Y) | 0.06 (GBP) | 1:100 | 08:10 - 18:00 |

| Japan G. Bonds | 0.08 (JPY) | 1:100 | 00:05 - 01:59, 03:35 - 05:59, 06:35 - 14:24 |

| TNOTE-10Y (US10YNote) | 0.06 (USD) | 1:100 | 23:01 - 21:59 |

N.B. Spread is likely to widen during daily break or in major news.

Stock fees

To get the latest information, it is important to visit Trade.com website. There are more than 2,000 companies open for trading with individual minimum spreads listed.

Indices spreads

Trade.com indices spreads are as follows:

| Instrument | Spreads (as low as) |

|---|---|

| S&P 500 (USA500) | 1 (USD) |

| DJ 30 (USA30) | 3 (USD |

| NASDAQ 100 (USTECH100) | 1.50 (USD) |

| CAC 40 (France40 | 2 (EUR) |

| DAX 30 (Germany30) | 2 (EUR) |

| FTSE 100 (UK100) | 2 (GBP) |

| NIKKEI 225 (Japan225) | 15 (JPY) |

| Hang Seng (HongKong45) | 10 (HKD) |

| S&P / ASX 200 (Sydney200) | 4 (AUD) |

| DJ EURO STOXX50 (Europe50) | 2 (EUR) |

| FTSE / MIB (Italy40) | 16 (EUR) |

| India50 | 5 (USD) |

| RUSSEL2000 -US small cap 2000 (USA2000) | 0.4 (USD) |

| S&P/IBEX (Spain35) | 7 (EUR |

| WIG20 (Poland20) | 4(PLN) |

| OMXS30 (Sweden30) | 0.5 (SEK) |

| AEX (Amsterdam25) | 0.25 (EUR) |

| SMI (Swiss20) | 6.00 (CHF) |

| MSCI (MSCI Taiwan) | 0.20 (USD) |

| JSE (SAfrica40 | 40 (ZAR) |

| VIX (VIXX) | 0.1 (USD) |

| MICEX (Moscow50) | 1 (RUB |

| USDX (Dollar Index) | 0.05 (USD) |

| FTSE/Athex 20 (Greece20 | 15.00 (EUR) |

| FTSE China A50 Index Futures (China50) | 20 (USD) |

| ChinaAMC CSI 300 Index ETF (China300 ETF) | 0.10 (HKD) |

| Norway25 | 2 (NOK) |

Forex spreads

| Instrument | Spreads (as low as) |

|---|---|

| TBOND-30Y (US30YBond) | 0.06 (USD |

| TNOTE-10Y (US10YNote) | 0.06 (USD |

| EURO-BUND-10Y EU | 0.06 (EUR) |

| GILT-LONG UK (Gilt10Y) | 0.06 (GBP) |

| Japan G. Bonds | 0.08 (JPY) |

Cryptocurrencies spread

| Instrument | Spreads in Pips (as low as) |

|---|---|

| BCHUSD | 50.00 (USD) |

| Bitcoin | 240.00 (USD) |

| BITCOINEUR | 80.00 (EUR |

| Dash | 20.00 (USD) |

| DASHEUR | 6.00 (USD) |

| ETHCLASSIC | 1.00 (USD) |

| Ethereum | 12.00 (USD) |

| ETHEREUMEUR | 12.00 (EUR) |

| Litecoin | 8 (USD) |

| LITECOINEUR | 0.5 (USD) |

Commodities spread

| Instrument | Spreads (as low as) |

|---|---|

| Crude Oil | 0.05 (USD) |

| Gold | 0.70 (USD) |

| Silver | 0.07 (USD) |

| Corn | 0.70 (USD) |

| Wheat | 2.5 (USD) |

| Coffee C | 0.65 (USD) |

| Sugar no.11 | 0.1 (USD) |

| Soybean | 2 (USD) |

| Cotton no.2 | 1 (USD) |

| Natural Gas | 0.005 (USD) |

| Rice | 0.06 (USD) |

| Copper | 0.0060 (USD) |

| Palladium | 2 (USD) |

| Platinum | 1.50 (USD) |

| Cocoa | 10 (USD) |

| Brent Oil | 0.05 (USD) |

| Aluminium | 10.00 (USD) |

| Zinc | 10.00 (USD |

Bonds spread

| INSTRUMENT | SPREADS (AS LOW AS) |

|---|---|

| TBOND-30Y (US30YBOND) | 0.06 (USD) |

| TNOTE-10Y (US10YNOTE) | 0.06 (USD) |

| EURO-BUND-10Y EU | 0.06 (EUR) |

| GILT-LONG UK (GILT10Y) | 0.06 (GBP) |

| JAPAN G. BONDS | 0.08 (JPY) |

ETFs

| Instrument | Spreads (as low as) |

|---|---|

| ACWI | 0.20 (USD) |

| AGQ | 0.09 (USD) |

| ChinaCSI300 | 0.10 (HKD) |

| DBC | 0.03 (USD) |

| DIA | 0.60 (USD) |

| EWT | 0.06 (USD) |

| EWY | 0.25 (USD) |

| FAS | 0.11 (USD) |

| FAZ | 0.10 (USD) |

| FXE | 0.20 (USD) |

| IWM | 0.35 (USD) |

| IWO | 0.50 (USD) |

| LIT | 0.10 (USD) |

| MDY | 0.90 (USD) |

| MSCIMexico | 0.20 (USD) |

| QID | 0.06 (USD |

| QLD | 0.25 (USD |

| SDS | 0.04 (USD |

| SFYAX | 0.20 (USD) |

| SLV | 0.03 (USD) |

| SPXU | 0.05 (USD) |

| SPY | 0.40 (USD) |

| SSO | 0.20 (USD) |

| TBT | 0.07 (USD) |

| TWM | 0.07 (USD) |

| TZA | 0.15 (USD) |

| USO | 0.02 (USD) |

| VTI | 0.35 (USD) |

| XLB | 0.20 (USD) |

| XLE | 0.35 (USD) |

| XLF | 0.10 (USD) |

| XLI | 0.20 (USD) |

| XLK | 0.15 (USD) |

| XLP | 0.20 (USD) |

| XLU | 0.15 (USD) |

| XLV | 0.20 (USD) |

| XLY | 0.25 (USD) |

Minimum Deposit

Score: 8/10

The minimum deposit amount required to start trading is 100 USD. This amount, however, depends on your account type.

Account Types

Score: 8/10

There are 5 account types on Trade.com. Micro, Silver, Gold, Platinum and Exclusive.

| MICRO | SILVER | GOLD | PLATINUM | EXCLUSIVE |

|---|---|---|---|---|

| Account Size $100 | Account Size $1,000 | Account Size $10,000 | Account Size $50,000 | Account Size $100,000 |

| Daily Analysis: Morning Review No | Daily Analysis: Morning Review Yes | Daily Analysis: Morning Review Yes | Daily Analysis: Morning Review Yes | Daily Analysis: Morning Review Yes |

| Desktop & Mobile Trading Yes | Desktop & Mobile Trading Yes | Desktop & Mobile Trading Yes | Desktop & Mobile Trading Yes | Desktop & Mobile Trading Yes |

| 24 Hour Customer Service Yes | 24 Hour Customer Service Yes | 24 Hour Customer Service Yes | 24 Hour Customer Service Yes | 24 Hour Customer Service Yes |

| Events & Trade Yes | Events & Trade Yes | Events & Trade Yes | Events & Trade Yes | Events & Trade Yes |

| Dedicated Account Manager No | Dedicated Account Manager Yes | Dedicated Account Manager Yes | Dedicated Account Manager Yes | Dedicated Account Manager Yes |

| Premium Daily Analysis No | Premium Daily Analysis No | Premium Daily Analysis Yes | Premium Daily Analysis Yes | Premium Daily Analysis Yes |

| Premium Customer Support No | Premium Customer Support No | Premium Customer Support No | Premium Customer Support Yes | Premium Customer Support Yes |

| Trading Central No | Trading Central No | Trading Central Yes | Trading Central Yes | Trading Central Yes |

The Exclusive Trade.com account offers the lowest spreads compared to other types of accounts.

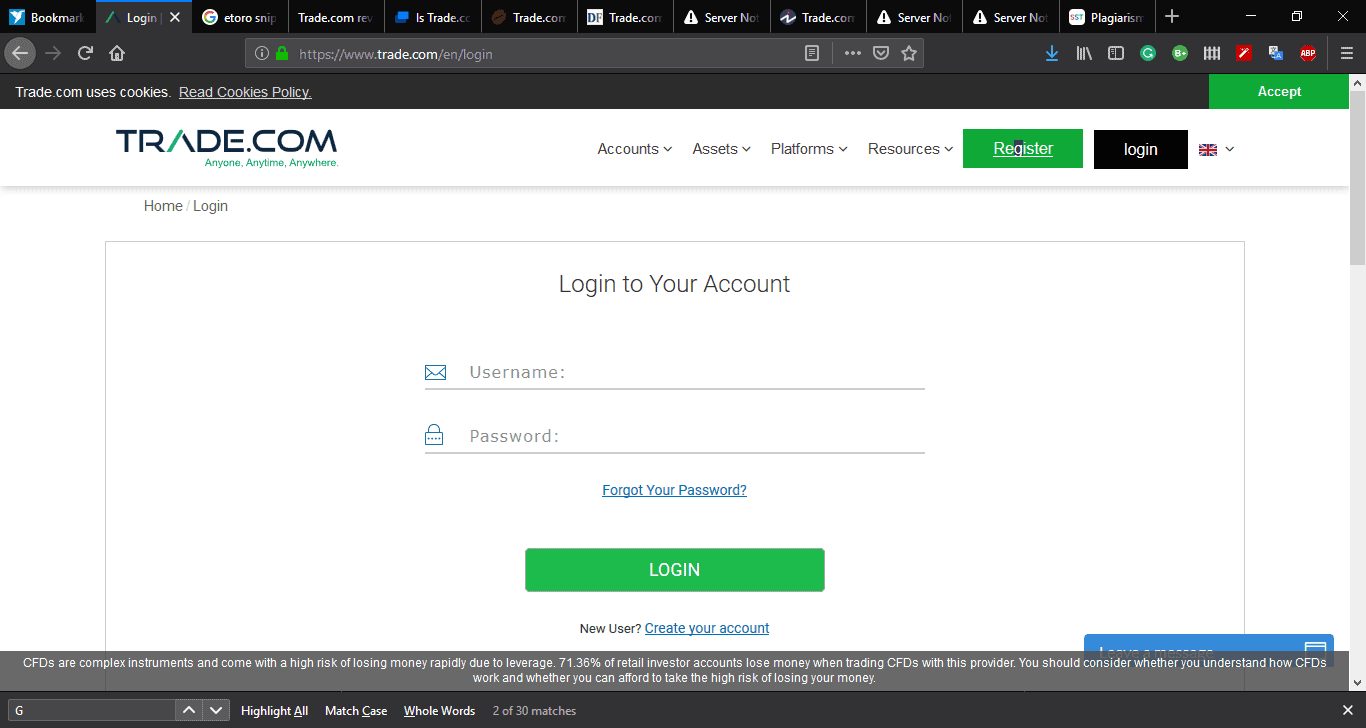

How to Sign Up and Trade on Trade.com

Opening a trading account with Trade.com is a simple and quick process. When trading for the first time, you are required to create a Trade.com account. The account creation process requires that you answer a few questions. The typical account opening on Trade.com takes about 10 minutes to complete. In order to open a real account and start trading with Trade.com follow the next steps:

- Choose a username (email address) and enter your preferred password to open an account on Trade.com. Select your default trading currency and click create an account. A pop-up window comes up requesting you complete your registration to receive £10,000 demo account funds.

- Here you are required to fill out your personal details: Full name, Phone number, Date of birth.

. - You are required to enter your financial information which includes the source of trading funds: Gross income estimate, Net worth, Expected annual turnover.

- Final stage. At this stage, you are required to enter your basic education background and trading experience.

You are requested to select your leverage amount (1:300, 1:200, 1:100, 1:50). You are then directed to the deposit screen to select your funding method.

You can proceed to make your deposit at this point or wait for identity verification. Trade.com verification may last up to 24 hours. Any funds deposited before the verification will be kept safe by Trade.com.

How to Configure Your Account

Trade.com offers one of the most popular forex and CFD trading platform, the MetaTrader 4. The MetaTrader4 was designed specifically for forex and CFD trading and therefore those instruments are most suitable for the MT4.

The MT4 is available on Trade.com platform in both desktop format and mobile formats. There are a lot of online traders who rely on MT4 to carry out their online trading.

How to reset your Trade.com password

In case a trader forgets his password, there is a password reset button on the landing page. Enter your valid email (the same one used to open the account). A secure link will be sent to your email. This link is used to reset the password. You can go ahead and create a new password for your account. The MT4 patform is very easy to use with amny indicators available.

Remember that you can use Trade.com demonstration account to master your trading technique, try trading ideas before deciding to trade with a live account.

Trade.com’s website also offers a web-based trading platform powered by Sirix. This platform is known as WebTrader. This platform is coded in HTML and is supported by most of the available browsers. Incorporated within the platform is a social trading function. This function enables you to have an insight into the performance of other traders on the platform. It, however, does not give a full analysis of their trading activities. WebTrader is designed to make online trading activities easy even for first-timers on the platform.

Trade.com is different from other trading platforms in some aspects. It lacks a VPS which are present in other trading platforms. VPS provides extra security for hosting your MT4 EAs during Forex trading.

Trading on Trade.com also gives you the opportunity of trying out the MT5 platform. MT4 is good and secure but MT5 is more secure with better features.

Security and Regulation

Regulation

Trade.com is regulated by Cyprus Securities and Exchange Commission (‘CySEC’), and is authorized by the FSCA, South Africa.

Trade.com is highly regulated, however, you must check the regulator in your area and the protection liability for traders. If you are a trader who feels confident with a broker that is regulated with the most strict and protective terms for traders.

eToro which is regulated by FCA, CySEC and ASIC is a better solution.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Deposit and Withdrawal Process

Score: 7/10

Deposit

There are various acceptable ways to deposit funds on Trade.com. users of the platform can deposit and withdraw their funds via the following channels:

Debit and Visa cards

- Pay.com

- Qiwi

- Skrill

- Wire transfer

- Neteller or PaySafe Card

The process of depositing money is not a complex one. There is a one-click button that allows you to deposit funds and start trading. The next action is to select your method of deposit. Fill in the mandatory information and proceed to make a deposit. The minimum deposit amount for trading is 100 USD depending on your account type. There are also different leverages to select from. Trade.com is a good choice for trading, however, eToro is our recommended option. eToro offers a broader range of payment options such as:

- PayPal

- Neteller

- Yandex

- WebMoney

It also provides traders with a secure wallet that helps enhance trading security.

Withdrawal

How to withdraw money from Trade.com:

Funds withdrawal requires that submit a withdrawal request. Withdrawal requests can be processed the same day provided it is submitted within trading hours. The minimum withdrawal request that can be submitted is 20 USD for other methods and 50 USD for wire transfer. The minimum withdrawal for wire transfer is 100 USD. In case fund request withdrawals are delayed, Trade.com will inform trader and provide a timeframe for funds withdrawal.

Education

Score: 7/10

There are a lot of educational materials available on Trade.com. However, when compared to eToro, they are a bit superficial. When it comes to educational materials, it is not new to the platform. Most trading platforms use educational materials to reduce the learning process for new users. While the educational style on the Trade.com platform seems okay. However, if you’re looking for a site with more elaborate educational features, we recommend eToro. There is a range of educational materials to take advantage of on eToro platform and you can learn from successful traders with their unique CopyPortfolio technology.

Customer Service

Score:7/10

The quality of customer support you get on Trade.com depends on your account. When a trader invests over 2,500, he is entitled to a dedicated account manager. To get a premium treatment, you need to invest over 50,000USD.

Trade.com have an elaborate customer service with different ways of reaching the support center.

Customer service can be reached via the following channels:

- Customer care lines and

- Via Chat app

Mobile App

Score: 7/10

Trade.com has a mobile which can be downloaded from the site homepage. If you’re a mobile user, you will notice the green “download app” button at the bottom of the homepage. Trade.com app is also available on the play store and the IOS app store. For traders who wish to trade on-the-go, the app is certainly a good choice. However, the mobile app is not as elaborate as the desktop version. It still has all the required features to enable traders to trade successfully. It is very easy to get acquainted with the mobile app. Depending on your region, the app may not be available.

Take note that eToro mobile app provides traders one of the most advanced mobile trading platform with a user-friendly user interface.

Tools

There is a wide range of research and intuitive tools available on Trade.com. You can find technical reports and stock analyst reports on Trade.com. The platform also makes available economic calendars. However, some of these tools are only available to a certain class of investors with a minimum deposit. Take for instance technical alerts from Trading Central which is only made available for gold members with a minimum deposit of 10,000 USD.

The best tool we often recommend on Trade.com platform is the charting application. This app is contained on the MT4 and web-based platform. There is also the MT5 platform to work with for those who like to keep up with the trend.

There are daily update videos on Trade.com however, they are of very low quality and less useful. If you’re a serious-minded trader that wants access to quality tools, you might want to try eToro.

Pros and Cons

- A lot of markets to trade in (shares are available in over 2,000+ companies.

- Available features to enable traders to see what other traders are selling/buying.

- Supports up to 20 languages.

- Gives traders the opportunity to switch from live to a demo account.

- Very high spreads on some of the largest currency pairs.

- Lack of attractive tools that can give it an edge over other brokers.

- Not available for traders in some regions and countries.

- Very difficult to add stop loss.

- Extra charges for minimum withdrawals and lesser amounts.

- Lack of concrete information about the broker

- Not all cryptocurrencies are available for trading

- Some security issues associated with the mobile app.

Trade.com vs eToro

In order to evaluate Trade.com as online forex and CFD broker, we decided to compare Trade.com with eToro, one of the most reputable brokers in the industry.

Overall, we believe that eToro is a better choice as it offers traders and investors better trading tools, products, protection and security, and lower fees.

Why we recommend eToro over Trade.com

✅eToro trading platform is user-friendly and easy to use

✅eToro offers a social/copy trading that allows to interact and copy successful traders.

✅Fees at Trade.com are relatively higher compared to eToro

✅eToro is regulated by top-tier regulators and offers traders protection and reliability compared to other brokers in the industry. eToro is regulated by the FCA and CySEC.

66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion

Overall score : 7/10

Trade.com experiences are very exceptional. However, it is important to compare it with eToro to decide if it’s really what you need. When it comes to trading extensive trading in cryptocurrency, eToro offers trading activities on a wider range of currency pairs. There is also the mobile wallet that ensures that you enjoy extra trading security.

While Trade.com may offer a good trading experience, you need to take your trading to a whole new level with eToro. It offers you the opportunity to trade on more cryptocurrency pairs. Enjoys improved security on your cryptocurrencies and general trading activities with eToro.

FAQs

Trade.com belongs to who?

Trade.com is owned and run by Lead Capital Market Ltd.

How does Trade.com make a profit?

They make a profit through small charges and spreads on transactions.

Can I trust Trade.com?

Yes. This broker is guaranteed and a legitimate broker. You shouldn’t be afraid of dealing with Trade.com.

How is the verification method of Trade.com?

It’s the same with other online brokerage platforms. You are required to provide 2 documents that verify your identity.

Is there a demo account available on Trade.com?

Yes. You can use the demo account to test the trading platform before proceeding with the real-time transaction.

How will I fund my account to start trading?

You can utilize one of our payment portals/method to fund your account. the Expert Advisor (EA) feature.

it possible to trade cryptocurrencies on Trade.com?

Yes. There are a lot of cryptocurrencies you can trade on. However, it is not possible to purchase the actual assets.