Your Forex trading experience relies heavily on the broker you choose. When it comes to the type of Forex platform you choose, extended due diligence is required: This is so that you can make sure you answer any questions of whether brokers are actually legitimate. In the case of Admiral Markets, many users may wonder is Admiral Markets a scam? Can I trust this broker and is Admiral Markets legit if I’m looking to trade the markets? In this Admiral Markets review, we’ll answer these questions.

Within this review, we’ve dived straight in and conducted thorough research to determine whether or not Admiral Markets is a good choice for our readers. In conclusion, we’ve compiled extensive data and due diligence to conclude that Admiral Markets has maintained as a functional broker for over 18 years now, offering clients a reliable and stable connection to FX and CFD markets.

On this Page:

Within this review, we’ll go over the ins and outs of Admiral Markets from an outsider looking in’s perspective. We’ll go over in the most applicable, analytical way possible and go over exactly why or why not you shouldn’t use Admiral Markets.

What is Admiral Markets?

Founded in 2001, Admiral Markets is a multi-asset online broker that offers the trading of a variety of markets via multiple financial products including CFDs and general account leverage. Admiral Markets maintains an edge within the general markets because it was instantiated in 2001, which makes it one of the longest lasting Forex and CFD brokers in the world.

Admiral Markets demonstrates a global presence, operating 10 offices worldwide and offers its products in a range of different jurisdictions, which definitely gives it a favorable placement in the list of Forex brokers and CFD brokers. The broker authorized and regulated by top regulators including FCA, ASIC, MiFID, CySEC, and EFSA.

Admiral Markets Assets

Score: 8/10

Admiral Markets maintains a healthy number of tradeable assets and global markets. On Admiral Markets, currently the trading of the following assets is offered:

- Forex – As of 2019, a total of 55 different currency trading pairs

- Commodities – Trading of CFDs for basic 16 commodities including oil, gold, and silver

- Indices – Admiral Markets allows for the trading of 6 major stock market indices only with CFDs

- Cryptocurrencies – Allows the trading of CFDs for 32 cryptocurrencies, but not actual underlying assets.

- ETFs – CFD trading for 379 ETFs, no underlying purchases enabled

- Bonds – Offers an alternative of bond trading, which includes the Bund and US 10-Year T-Note

- Stocks – A huge selection of 3394 stocks.

Admiral Markets – Exclusive or Unique Features

Score: 8/10

Admiral Markets shows an extensive arsenal of exclusive features and trading tools. Many online CFD brokers like AvaTrade and Plus500 will find their success in offering exclusive features or platforms, and Admiral Markets is one of these brokers. Some of the unique features offered by Admiral Markets include the Admiral.Invest, Pro.Cashback and volatility protection.

➡️Admiral.Invest

For those looking to trade and invest in the stock market via Admiral Markets, you’re in luck; Admiral Markets offers its product called Admiral.Invest which offers the trading of ETFs and stock shares from 15 global stock exchanges including the US, EU and UK stock exchanges with real-time market data.

➡️Pro.Cashback

Admiral Markets does, in fact, offer a unique approach to incentivizing traders. Through their Admiral Markets Pro.Cashback program, you can actually be rewarded through the more you trade. This functions similar to a loyalty program in that the more you use the platform, the more bonus you are given. Note that this program is only available for professional clients.

Volatility Protection

Admiral Markets also offer the Volatility Protection tool that helps you to minimize volatility risk by setting a number of key features such as limit maximum price slippage on market and stop orders, limit or fully avoid losses on pending orders falling into price gaps, get filled on larger orders and more. The volatility protection is a great tool that can help you to avoid unnecessary trading losses.

Supported Countries

Score: 7.5/10

Admiral Markets does, in fact, find some redemption in its ability to offer its services to a wide number of different jurisdictions. Compared to other providers, Admiral Markets does possess an edge; unless you live in a jurisdiction that explicitly forbids the use of online Forex services, online trading, or Forex trading in general, then you probably won’t find much of a roadblock when it comes to using Admiral Markets. Admiral Markets, however, does not provide its services to US traders.

Languages

Admiral Markets has succeeded to an extent in providing their services for a large number of different languages. The broker offers the ability to filter between languages which it will then autonomously translate for you (Upon selection). Admiral Markets does offer a comparatively decent amount of 29 different languages, making its website accessible for all users. As a result, we give Admiral Markets the following score in regards to languages:

Score: 9/10

As indicated, Admiral Markets does do a fairly reputable job in its ability to offer services and appeal to quite a wide variety of global clients. As it currently stands, Admiral Markets offers some of the most supported languages on any Forex broker at this time. Among them are as follows:

Admiral Markets Trading Platforms

Score: 7/10

Admiral Markets is one of the first forex and CFD brokers to offer the legendary MetaTrader 4. The broker remains loyal to the most popular trading platform and its developing company, the MetaQuotes, offering MetaTrader in all the existing forms – MetaTrader 4, MetaTrader 5, the MetaTrader Supreme Edition, and the MetaTrader Web Trader.

MetaTrader 4

Admiral Markets offers MetaTrader 4, the most popular forex and CFD trading platform which is available on desktop, iOS, and Android. Another way to use MT4 is to log in to MetaTrader Web Trader, a web-based trading platform that does not require an installation.

Meta Trader 5

Although the MT5 has not gained the same success as the MT4, it is an improved version of MT4. The MT5 offers enhanced order management capabilities, real volume-traded data, multiple features, a wider list of technical indicators, a faster and secure connection and more.

Admiral Markets provide traders MetaTrader 5 with unique trading features such as level II pricing, VPS support, robot (automated) trading, economic calendar, etc. One of the advantages offered by Admiral Markets is the ability to install MT5 for Mac users.

MetaTrader Supreme Edition

In addition to MT4 and MT5, Admiral Markets supports the MetaTrader Supreme Edition, a unique plugin that can be installed on MT4 and MT5. Some of the Supreme Edition features and tools include Advanced Technical Analysis Indicators and Analyst Opinion, market sentiment, mini terminal, trader terminal, tick-chart trading, and real-time news.

Admiral Markets Fees & Limits

Score: 8/10

Spreads

Admiral Markets maintains some competitive spreads within the broker industry. Some of the more popular and major volume trading pairs on Admiral Markets have spreads that compete directly with the majority of Forex brokers. Generally, however, the broker implies wavering spreads, which depend based upon the type of account you open. While some of Admiral Markets’ asset listings imply higher spreads, this is many times in return for eliminating any commission based fees.

Trading and non-trading fees

Rollover/Overnight fees – Like most forex brokers, Admiral Markets charges overnight/rollover (swaps) fees for FX and CFDs at the end of the trading day.

Inactivity fee – Admiral Markets does not charge inactivity fee.

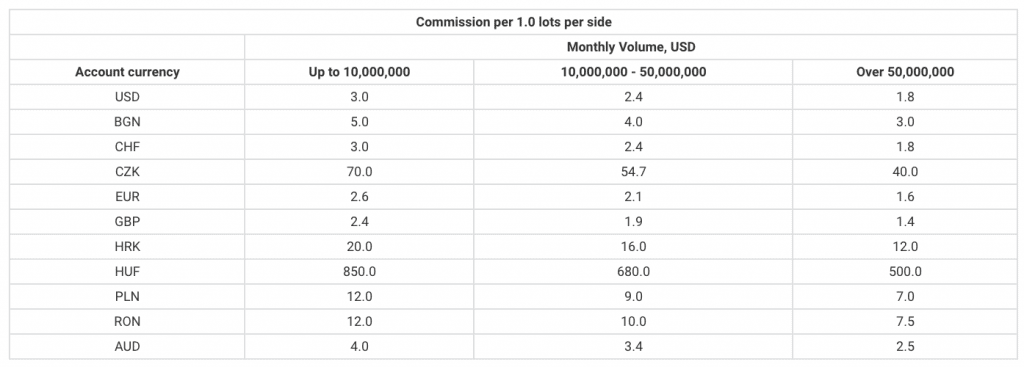

Commission per lot

Admiral Markets imposes a custom/unique type of fee and commission basis. This is dependent on a few factors: namely, the amount of volume that you generate on your account per month, as well as the type of trading pair you operate. Admiral Markets additionally doesn’t enable static fee structures either; some account types can be maneuvered to tailor to deduct fees from the spreads that are traded.

The following table demonstrates the commission rates at which Admiral Markets places certain trading processes at on a per 1.0 lot basis:

In this case, when running upon a flat commission basis, if you maintain for example $15M in monthly volume and trade the USD/JPY currency pair, you’ll be given a 2.4 / lot commission basis. This can also be calculated via the following formula:

Commission (in the deposit currency) = Contract size * Commission rate in account`s deposit currency * 2

Deposit and Withdrawal fees

Admiral Markets does not charge its clients any deposit and withdrawal fees.

Bank Transfer – Admiral Markets imposes no fees for depositing to the platform via bank transfer. For withdrawals, the broker enables 2 free withdrawal requests to your bank of choice per month. For those wondering how to withdraw money from Admiral Markets, you’ll find it can be very simply by heading to your account and finding the ‘Withdraw’ section and selecting your bank account.

Credit/Debit Card – As long as the credit/debit card you’re using is Visa or MasterCard, you will not be given any fees for card deposits. This makes Admiral Markets very competitive for card deposits.

In conclusion, Admiral Markets fees are relatively low compared to other brokers in the industry. The broker offers competitive spreads and has no hidden fees.

Minimum Deposit

Score: 8/10

Admiral Markets maintains a competitive stance within the industry when it comes to minimum deposits. Minimum deposits should not be near zero (Otherwise it would be fairly suspicious as to why the broker isn’t imposing minimum collateral for its margin offerings depending on the deposit type), however, it should not be absurdly high for retail brokers as to enable people to move at their own pace.

Consequently, Admiral Markets imposes a general minimum of 200 USD/EUR/GBP to open a live account.

Account Types

Score: 7/10

Admiral Markets offers, as we specified prior, a fairly reasonable amount of account type offerings. They include the following:

Admiral Markets MT4 Account

The MT4 trading account is often regarded as the most basic and preliminary account type. The following parameters are implied for MT4 trading accounts:

- MetaTrader4 incorporated, Web Trader and Mobile integration.

Admiral MarketsMetaTrader5 Account

This account type is relatively similar to the MT4 account, except it includes 2 additional markets. The parameters include:

- All parameters included in the MT4 account type, except MT5 is the main platform integration.

Admiral.Invest

This account is suited for those who wish to extract the best out of the global stock markets. This requires $500 minimum deposit and includes stock trading for over 5,000 stocks.

How to Sign Up and Trade on Admiral Markets

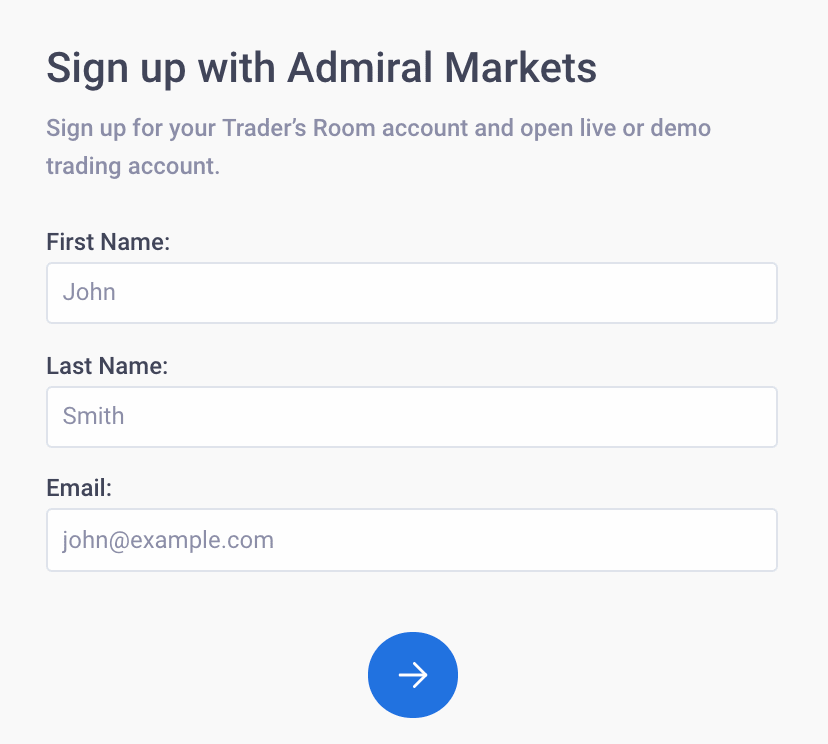

Getting started on Admiral Markets is fast and easy; follow the following steps:

- Go to the Admiral Markets trading platform homepage, click the ‘Account’ icon and select the “Create Account” button.

- On the newly loaded account page, enter in your name and email:

- Once entered, confirm your email and provide the necessary Admiral Markets verification information/documentation that is required.

- Your account will be reviewed; once done, you’ll then go to your account tab and click ‘Deposit’ –> Select a payment and method and add your funds.

- Wait for funds to process, and then begin trading.

Configuring Your Admiral Markets Account

Let’s overview the process of configuration for your Admiral Markets trading accounts.

MetaTrader4 and MetaTrader5

MetaTrader is, arguably, the most well-known platform for Forex trading. To set up Admiral Markets on MT4, first download MT4/ MT5 or launch the platform as a web-based platform.

Once you are connected, you can see the MarketWatch (instruments quotes), trading charts and the terminal (positions, orders, account balance).

MetaTrader Supreme Edition

The MetaTrade Supreme Edition was designed as a plugin for MT4 and MT5, offering useful features and tools such as Advanced Technical Analysis Indicators and Analyst, market sentiment, risk management widget, trade terminal, tick-chart trading, real-time news, additional indicator package, trading simulator and mini-chart.

In order to install the plugin, you need to sign up/sign in and download the plugin.

Security and Regulation

Score: 8/10

Regulation

Having the correct regulation and registration amongst the broker that you choose is absolutely pivotal; Admiral Markets is a highly regulated broker. The broker is authorized and regulated by the Financial Conduct Authority (FCA) for trade/use in the U.K., as well as other major hubs including the Estonian Financial Supervision Authority, the Markets in Financial Instruments (MiFID) within the European Economic Area (EEA), CySEC in Cyprus and ASIC in Australia.

Admiral Markets is also authorized to hold client money under the FCA CASS rules, which can provide clients protections and safety.

Score: 8/10

Security

Admiral Markets maintains a significant stance within the industry as far as security goes. First, the Admiral Markets’ website employs basic site encryption and multiple factor authorisation methods such as 2FA via your mobile phone. Then, the broker provides a segregation of client funds In accordance with FCA rules, and a protection for all clients in the case the company cannot pay back investors’ funds, a compensation amount of up to £50,000.

Admiral Markets has been around for over 18 years now, and there have not been any major security breaches. This track record alone gives us some confidence in the security aspect.

Deposit and Withdrawal Process

Score: 8/10

Admiral Markets does not charge any deposit and withdrawal fees and you will be charged by your payment issuer if you deposit funds via Skrill or Neteller. As a whole, Admiral Markets offers a fair selection of payment methods.

Payment options

The following methods are supported for deposits and withdrawals:

- Bank/Wire Transfer

- Skrill

- MasterCard or Visa credit/debit card

- Neteller

- TrustPay

- Klarna

Withdrawal process

Admiral Markets enables the withdrawing of user funds using any of the above methods. Withdrawal via Skrill and Neteller is instantaneous while bank wire transfer withdrawal takes up to 3 business days.

Education and resources

Score: 9/10

One of the additional sectors that Admiral Markets excels is in its education section, surpassing other broker education sections such as ThinkMarkets by multiple amounts.

Their entire education section maintains in-depth guides as well as a comprehensive glossary. Admiral Markets provides traders with webinars, seminars, trading tutorial and articles, and a trading course of ‘Learn How to Trade in 21 Days’.

Customer Service

Score: 8/10

Admiral Markets has a fairly promising customer service section. From our own personal reviews, customer service reps seem to know what they are doing and answer times are fairly quick. Admiral Market customer support is available 24/5 via phone, chatbot, email and live chat.

Mobile Trading

Score: 8/10

Admiral Markets offers mobile trading for both trading platforms, the MetaTrader 4 as well as MetaTrader 5 available on App Store and Google Play.

Pros and Cons

Pros:

Cons:

- Not available for US traders

- A small selection of FX pairs

- Low leverage ratio for retail clients of 1:30.

Conclusion

Admiral Markets is one of the leading brokers in the industry, offering all the necessary tools, platforms, and services for you to maintain a profitable account. The broker is also well reputed and highly regulated in various jurisdictions including FCA, ASIC, MiFID, CySEC, and EFSA. As one of the first forex and CFD brokers in the industry, Admiral Markets have the knowledge and the tools to offer the most trendy tools and develop with the markets.

Following our review, we recommend our users Admiral Markets as it is a reliable and safe forex and CFD broker.

FAQs

Admiral Markets has been around for 18 years, does this mean I can trust it?

Yes, Admiral Markets is a reliable broker, regulated by top regulators around the world.

I'm a beginner and would like some guidance, would the Admiral Markets broker be a good option in this case?

Admiral Markets is also a beginner friendly as a platform itself - they offer a great education section is fairly reputable and impressive and the MT4 is a trading platform for beginners and experienced traders.

Are my funds insured on Admiral Markets?

Yes, the broker holds investors' funds in a segregated account and offers clients a compensation of up to £50,000 under the Financial Services Compensation Scheme (FSCS) in case something goes wrong.

Can I link my own trading platform with Admiral Markets?

Unfortunately, Admiral Markets only offers integration with the MetaTrader platforms.

Can I trade cryptocurrency using Admiral Markets?

You can trade a selection of 32 different cryptocurrency pairs on the Admiral Markets.

What is the absolute minimum deposit for Admiral Markets?

Admiral Markets has set a minimum requirement of 200 USD/EUR/GBP in order to open a live account.

How fast can I trade on Admiral Markets?

Admiral Markets enables an average of around 0.067 seconds to execute the most liquid pair on the broker, which is EUR/USD.