Founded in 2014, Core Spreads offers contract for difference (CFD) and spread betting online trading services for traders and investors. The company is based in the United Kingdom and is regulated by the Financial Conduct Authority (FCA) under the name Finsa Europe Ltd.

On this Page:

Core Spreads users enter the market through the STP (Straight Through Processing) model which transfers their trades directly into the global forex market and provides users a higher level of reliability. However, we have found many users online wondering whether this broker is legit, and it seems that the broker has major disadvantages and flaws compared to other brokers in the industry.

We have put it to the test by testing their platform, pros, cons, etc and have found it not be legit. Read our full review to find out why you should stay away from this broker.

What is Core Spreads?

Founded in 2014, Core Spreads is an online trading broker offering forex and CFD products through various trading platforms, allowing traders to exchange financial instruments with the ability to leverage their capital. The brokers execute all market orders according to the STP (Straight-Through Processing) model. Core Spreads also offers online trading through spread betting model which can be beneficial for those who are located in the UK due to tax exemptions.

Core Spreads is located in the United Kingdom and in Sydney, Australia and is regulated by the Financial Conduct Authority (FCA).

Core Spreads Markets and Products

Score: 7/10

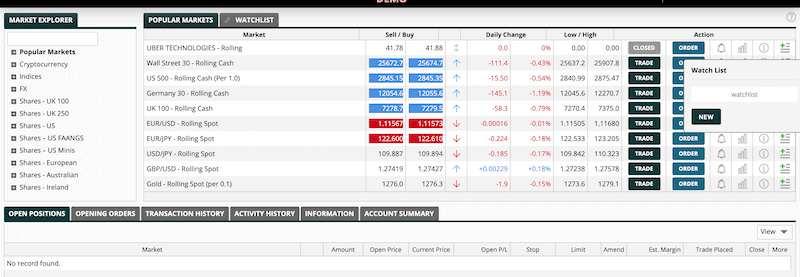

Core Spreads offers a wide selection of financial assets categorized and organized in a way that can help trading experience. The broker provides a broad range of financial assets across six different markets:

- Forex – EUR/GBP/USD and other pairs.

- Indices – Asian, Differentials, European, US, and World.

- Commodities – Energy, and Metals.

- Stocks (shares) – UK100, UK250, US, US FAANGS*, US minis, European shares, Australian, Ireland.

- Bonds

- Cryptocurrencies

*FAANGS – FAANGS refers to Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Facebook (FB), and Netflix stocks (NFLX).

Core Spreads Special Features

Score: 5/10

Core Spreads does not offer any special trading features and trading tools that can improve traders’ experience. The broker does not provide much information on their website and the only unique feature is the ability to trade spread betting which allows UK traders exempt from taxes.

Spread Betting

Spread betting allows traders to speculate derivatives prices, similarly to contract for difference, with profits are exempt from UK Capital Gains. Core Spreads offers fixed spreads on spread betting and traders have more flexibility than CFDs on choosing the size of the position.

Automated Trading

Core Spreads also offers automated trading via MetaTrader 4 Expert Advisor (EA). Automated trading allows you to create a computer program that automatically sends orders to the market. Note that you can backtest your strategy via Core Spreads MT4 demonstration account.

Supported Countries

Score: 6/10

Core Spreads offers online CFD and spread betting trading services to more than 150 countries around the world. Core Spreads, however, does not provide much information on their supported countries.

The broker, however, is not regulated by any US regulator and does not offer its services to residents from the United States.

Languages

Score: 3/10

Unfortunately, Core Spreads does not support any additional languages and does not provide much information regarding its supported languages. For those who feel more comfortable in their native language, we recommend other brokers likeCoinbase offering customer support and a trading platform in 21 different languages.

Core Spreads Trading Platforms

Score: 7/10

Core Spreads offers a selection of only two trading platform: the CoreTrader which is available as a web-based trading platform and as a mobile app. The second trading platform offered by Core Spreads is the popular MetaTrader4 which is available as a desktop trading platform, mobile app, and tablet. Note that MT4 can be used for CFD trading and CoreTrader is offered for spread betting.

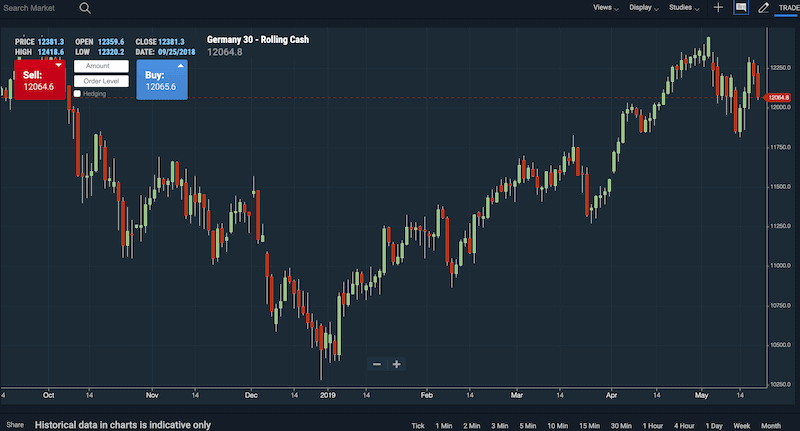

CoreTrader

CoreTrader is an easy-to-use web-based trading platform offering simple trading execution. The platform is more similar to a bank or investment banking trading platform than to a professional trading platform like the MT4 or NinjaTrader.

Overall, the CoreTrader trading platform can be adopted by inexperienced traders with a low number of transactions per month/year. For those who prefer scalping/day trading/swing trading, we recommend the MT4 or other CFD brokers like Coinbase that provide an innovative trading platform.

Meta Trader 4

In addition to the CoreTrader, Core Spreads also offers the popular MetaTrader 4 with some of the most well-known MT4 features including automated trading via the Expert Advisor (EA) and the lightning fast-execution. Note that the pricing model through MT4 is different and includes variable spreads with an additional commission of £1.25, €1.40 or $1.50 per lot.

Fees and Limits

Score: 6/10

Trading and Non-Trading Fees

Rollover/Overnight fees – Core Spreads charges overnight/rollover (swaps) fees for FX and CFDs at the end of the trading day. For the majority of GBP trades, the charge will be 2.5% ± 1 month LIBOR interest rate.

Deposit and Withdrawal fees

Core Spreads does not charge any deposit and withdrawal fees and you will be charged only by the bank or any other payment method.

Spreads

Core Spreads offers competitive spreads which vary depending on the account type. Core Spreads does not charge additional fees for the spread betting account, meaning you will have the pay the buy/sell spread only. For the CFD account, traders have to pay an additional commission of £1.25, €1.40 or $1.50 per lot.

Note that Core Spreads offers fixed spreads for the spread betting (CoreTrader) account and variable spreads for the CFDs (MT4) account.

Minimum Deposit

Score: 6/10

Core Spreads does not require a minimum deposit in order to open a trading account, which means you can open an account and fund your account anytime you wish and start trading. You do need a minimum of 10 USD in order to start trading. Take note that low or no minimum deposit is not necessarily positive as you can lose your funds faster with high leverage and high margin requirements.

Account Types

Score: 6/10

Core Spreads takes pride in offering a simple service, with no differentials between account types. The broker offers two account types, the CoreTrader account and the MT4 account which are basically the same in terms of conditions, trading terms, leverage ratio, etc. The only difference between the two accounts is that the CoreTrader account is a spread betting account (can be an advantage for those who are located in the UK) and the MT4 account is a contract for difference (CFD) account.

Apart from that, each account offers different spreads with the MT4 offers variable spreads plus a fixed commission per lot.

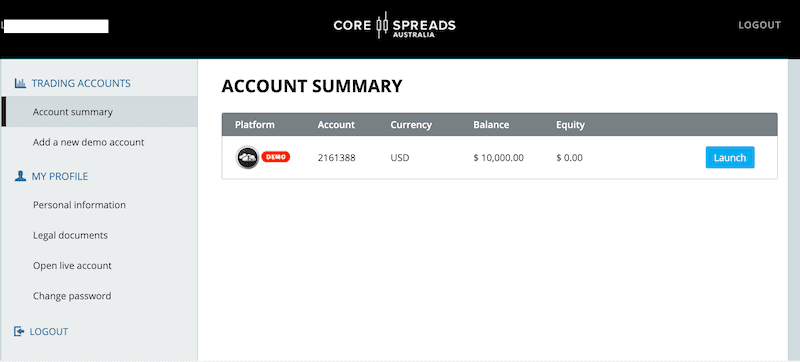

How to Sign Up and Trade on Core Spreads

Open a trading account at Core Spreads can be done in a few simple steps. Follow the next steps:

- Login to Core Spreads’ website and click the ‘Open an Account’ button on the top right corner or at the center of the homepage.

- Fill in your personal details, and contact details and then click Next.

- Then, you can log in to Core Spreads trading dashboard. Once you are ready to fund your account, click on open a live account, and the support will contact you to complete the process.

- Fund your account through one of the Core Spreads payment methods.

- Start trading.

How to Configure Your Core Spreads Account

Core Spreads offers only two trading platforms depending on the trading account you choose – The CoreTrader account and the MT4 account.

Take note that you can use a demonstration account before you risk real money. Here’s how to set up the basic configuration of each of the trading platforms.

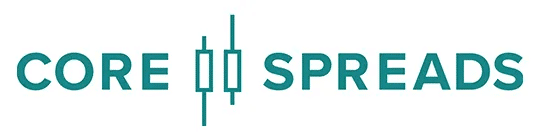

CoreTrader

Once you enter the CoreTrader trading platform, you can see the Market Explorer, Popular markets/Watch List and the account details at the bottom of the screen.

You can create your preferred Watch List by clicking the plus button and adding the instrument into your Watch List.

By clicking the chart button, you can open a separate browser chart window and trade from the chart.

Meta Trader 4

MetaTrader 4 is one of the most popular forex and CFD trading platforms. Once you download the platform, you can see the MarketWatch (instruments quotes), trading charts and the terminal (positions, orders, account balance). You can organize the MarketWatch based on your preferences and open a number of trading charts. The MT4 is an advanced trading platform with more than 80 technical indicators.

Overall, Core Spreads offers two trading platforms – The in house CoreTrader might be good enough for basic trading experience, however, the platform does not provide an innovative interface with advanced technical indicators and high-speed execution.

Security and Regulation

Score: 6/10

Regulation

Core Spreads is regulated by one regulator in the United Kingdom, The Financial Conduct Authority (FCA) under the name Finsa Europe Ltd. The broker also complies with the European Securities and Markets Authority (ESMA). Core Spreads offers customers protection by FSCS (UK’s Financial Services Compensation Scheme) which guarantees a return of funds up to £85,000 in the case of Finsa Europe Ltd fails to pay back your investment.

Security

Core Spreads has no security features like two-factor authentication, however, the broker states on their website of holding traders’ money in a fully separated segregated account with Barclays. The broker also offers traders additional protection of coverage by the UK’s Financial Services Compensation Scheme (FSCS), which guarantees a return of your funds up to £85,000.

Deposit and Withdrawal Process

Score: 7/10

Core Spreads does not charge a deposit and withdrawal fee and has no deposit minimum requirement.

Deposit

Core Spreads offers a limited selection of payment methods which include:

- Credit/Debit card

- Local Bank Transfer

- e-Wallet – Skrill

Withdrawal

Withdrawal can be made by the same deposit payment methods:

- Credit card

- eWallet

- Bank wire transfer

Overall, Core Spreads offers a limited selection of payment methods compared to other brokers in the industry like Pepperstone, however, the broker does not charge any deposit and withdrawal fee and offers traders a number of online fraud protection measures.

Education and Resources

Score: 6/10

Core Spreads offers traders daily market analysis and trading insights, however, compared to other brokers there is no educational materials, webinars, and an economic calendar. As every trader is looking to grow and expand his/her knowledge, one of the most essentials tools for traders, beginners, and professionals, is education resources available from the broker.

Forex brokers such as Coinbase put a lot of effort to maintain an educational section in order to help traders understand the markets and all the trading tools involved, including orders, trading terms, technical and fundamental analysis, etc.

☎️Customer Service

Score: 8/10

Core Spreads offers 24/5 customer service from Sunday 22:00 (GMT) to Friday 22:00 (GMT) via phone, email and live chat in English only. Overall, Core Spreads customer support is responsive and answer quickly although we have found several users complaints.

Mobile App

Score: 7/10

Core Spreads provides a mobile app for both trading platforms, the in-house CoreTrader available on AppStore only, and the popular MT4 mobile trading platform. While the MT4 mobile app is one of the best in the industry offering traders a great interface and trading tools, CoreTrader mobile app is an easy-to-use and user-friendly trading app but is not innovative and suitable for scalping/day/swing trading.

Pros and Cons

Pros:

Cons:

- Does not offer any special features

- No educational resources

- Core Spreads does not offer Exchange traded Funds (ETF’s)

- Limited selection of account types

- A low leverage ratio of 1:200

- Low reliability among users

- Customer support is not available 24/7

- Low regulation

- Not available for US residents

Conclusion

Founded in 2014, Core Spreads is a new broker in the industry and has not yet succeeded in offering an effective forex trading experience for its traders. The lack of information, selection of account types, relatively low leverage ratio, and low regulation compared to other brokers in the industry lead us to conclude that this broker is not recommended.

We do support brokers with an extensive list of regulators across different parts of the world and special trading features and tools like Coinbase, and Plus500. Coinbase provides a wider selection of financial instruments and offer one of the most innovative and advanced trading platforms.

FAQs

What is the leverage ratio offered by Core Spreads?

Core Spreads offers a maximum leverage ratio of 1:200 for CFDs and spread betting which is relatively low compared to other brokers in the industry like Plus500 and Coinbase.

What is the minimum deposit to open a forex/CFD account at Core Spreads?

Core Spreads does not have a minimum deposit requirement in order to open a live trading account. In order to start trading, you need to have enough funds to cover your margin requirements.

Is Core Spreads a regulated broker?

Yes, Core Spreads is regulated by The Financial Conduct Authority (FCA) under the name Finsa Europe Ltd and complies with the European Securities and Markets Authority (ESMA).

Core Spreads - Is it a scam broker?

Core Spreads is regulated by the Financial Conduct Authority (FCA) in the UK and by ASIC in Australia and complies with the ESMA. However, we have found many user reviews accusing the broker and asking whether it's a legit broker. We are able to conclude that Core Spreads is not transparent and reliable compared to other brokers in the industry.

Can I use Automated Trading with Core Spreads?

Yes, Core Spreads allows you to use automated trading via the popular MetaTrader 4 EA (Expert Advisor). Note that you can backtest your trading strategy before you open a live account on a demo account which is available on the CoreTrader website.

Is Core Spreads available in the US?

No, Core Spreads does not offer online trading services for US residents as the broker is not regulated and registered with the Commodity Futures Trading Commission (CFTC) or the U.S. Securities and Exchange Commission (SEC).

Does Core Spreads support MetaTrader4?

Yes, Core Spreads offers traders one of the most popular trading platform, the MetaTrader4 which is available on desktop, mobile, and tablet in addition to the CoreTrader trading platform.