Many forex and CFD brokers have been accused of manipulating their clients and managing a dishonest service. According to a some user reviews, London Capital Group might be one of these brokers.

Founded in 1996, London Capital Group has succeeded to establish a financial operation with a large number of clients as a forex and CFD broker.

However, we have found many users online wondering whether this broker is legit and the broker’s reputation remains unclear and clients’ accusation of fraud and scam leave us no choice but to recommend other brokers in the industry such as eToro which we consider to be a much reliable broker. Read our full London Capital Group review to find out why you should stay away from this broker.

On this Page:

What is London Capital Group (LCG)?

Founded in 1996, London Capital Group, also known as LCG, is one of the first forex and CFD brokers in the industry. Based in the United Kingdom, the broker offers a range of financial products and markets on various trading platforms allowing traders to exchange forex and other CFD products with the ability to leverage their capital.

LCG was publicly listed at the London Stock Exchange up until 2017, transferring the company’s stocks to the New Securities Stocks Exchange (NEX) under the symbol LCG. London Capital Group is regulated by the Financial Conduct Authority (FCA)

London Capital Group Markets

Score: 8/10

London Capital Group offers a range broad of financial products that include 7000 assets across 9 asset classes. In terms of financial products and markets, LCG offers a wide list of instruments, those include:

- Forex – Over 60 currency pairs

- Indices – 15 global indices

- Commodities – 17 commodities.

- Cryptocurrencies – 6 crypto coins. BTC/USD, BTC/GBP, BTC/EUR, , ETH/USD, ETH/GBP and ETH/EUR.

- Stocks (shares) – 3500 shares across European, US and UK markets.

- Bonds (Fixed Income) – 9 bonds and interest rates.

- Exchange Traded Funds (ETF’s) – Over 500 ETF’s

- Vanilla options – LCG offers vanilla options on UK 100, Germany 30, EURUSD, GBPUSD, USDJPY as well as the UK, EU, and US equities.

London Capital Group Special Features

Score:5/10

LCG does not offer traders unique features compared to other forex brokers. Most of LCG available features are part of the popular trading platform MT4. Here are some of LCG special features:

➡️Vanilla Options

Trading vanilla options is a unique financial instrument to trade on and can provide high profit with relatively low investment. Trading vanilla options can reduce risk and offers an extremely volatile market.

➡️LCG Trader (cTrader) Trading platform features

LCG offers MT4 and a proprietary LCG trading platform. The LCG is not an advanced trading platform compared to MT4, however, it offers features such as one-click trading and guaranteed stop-loss order.

➡️ECN Account

The electronic communication network (ECN) is a communication network linking retail traders and investors with a liquidity provider through an ECN broker, providing traders lower spreads and a reliable connection to the markets. LCG offers ECN account with a minimum deposit requirement of $10,000.

Supported Countries

Score: 5/10

London Capital Group (LCG) offers online trading service mostly to European countries. The broker does not provide a full list of supported countries, however, the broker does not offer its services to the following countries:

- Australia

- Belgium

- Canada

- New Zealand

- Singapore

- United States

We recommend opening a trading account with other brokers like the one in our eToro review it’s authorised in many countries across the globe or checking with London Capital Group support their legal status in your country.

Languages

Score: 8/10

London Capital Group support is available in 18 different languages:

- English

- Swedish

- German

- Norwegian

- French

- Spanish

- Chinese

- Portuguese

- Turkish

- Indonesian

- Polish

- Russian

- Japanese

- Vietnamese

- Arabic

- Thai

- Italian

- Malaysian

London Capital Group Trading Platforms

Score: 7/10

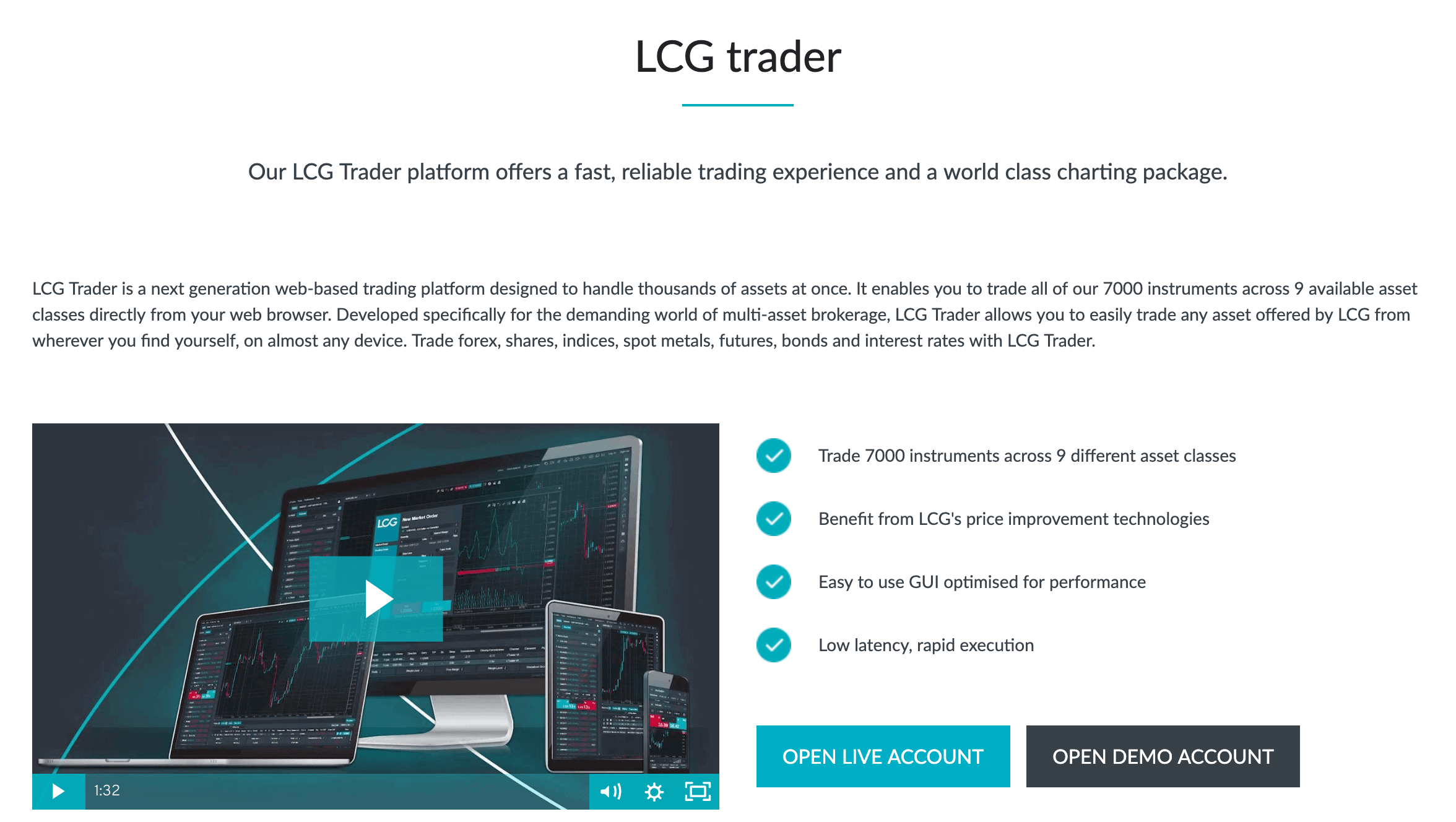

London Capital Group offers traders and investors two trading platform: The popular MetaTrader 4 and the entry level London Capital Group proprietary trading platform, the LCG trader (cTrader).

MetaTrader4

LCG provides the most popular trading platform for forex and CFD trading, the Meta Trader 4 which is available on desktop, mobile, and smartphone. LCG claims to provide an accurate pricing and rapid execution as well as price improvement technology feature as part of the ECN account.

LCG trader (cTrader)

London Capital Group also offers the LCG trader which is based on the cTrader platform and was designed to provide easy to use trading platform for entry-level traders. The LCG trader is a desktop web-based trading platform but available on the Apple store and Google Play as a mobile app.

Overall, LCG provides the advanced MT4 and the LCG proprietary trading platform. Both trading platform considered a great solution for traders, however, for traders who would like to interact and use the social/copy feature, we recommend eToro which connects more than 6 million users.

Fees and Limits

Score: 6/10

Spreads

London Capital Group spreads vary depending on the account type, with spreads on the classic (CFD) account are average compared to competitors in the industry and spreads on the ECN account are competitive.

Trading fees

Most of the fees at LCG are charged through spreads but there are additional fees for trading through the ECN account.

Guaranteed stop orders – LCG charges an additional fee in order to execute a guaranteed stop order.

Overnight fees – Overnight financing is charged at 0.04% admin fee per day and will be charged for each position open at 22:00 (UK time) each day

Deposit and Withdrawal fees

Deposit fee, Credit/Debit card– The broker states that an additional fee will be charged for deposit through credit/debit card. A 2% flat rate of the amount to be deposited will be charged.

Withdrawal fee – The broker charges a fixed commission of £20 for the withdrawal with the amount lower than £1,000

Minimum Deposit

Score: 6/10

LCG takes pride in not having a minimum deposit requirement for the Classic (CFD) account as long as there are enough funds to cover the margin requirements. The minimum deposit starts at $1 for the CFD account and $10,000 for the ECN account.

Note that no minimum deposit is not necessarily a positive requirement as you can wipe out your account easily.

Account Types

Score: 7/10

London Capital Group offers two types of account, the CFD trading account, and the ECN account. In addition, LCG offers and Islamic (no-swap) account which can the same as the classic or the ECN account but with no overnight (swap-free) charge. Here are some differences between the two accounts:

ECN Account

The ECN account is a premium account offering a much reliable connection and better trading terms and conditions.

- There is an additional commission – for example 0.2 average spread + 0.45 pip commission

CFD Trading Account

CFD trading account is the standard account and has no minimum deposit requirement. Take note that the CFD trading account cannot be offered as an ECN account, hence, the broker functions as a market maker.

- Spreads are relatively higher

As a conclusion, the ECN account offers a reliable connection and better spreads, however, the broker offers limited account types.

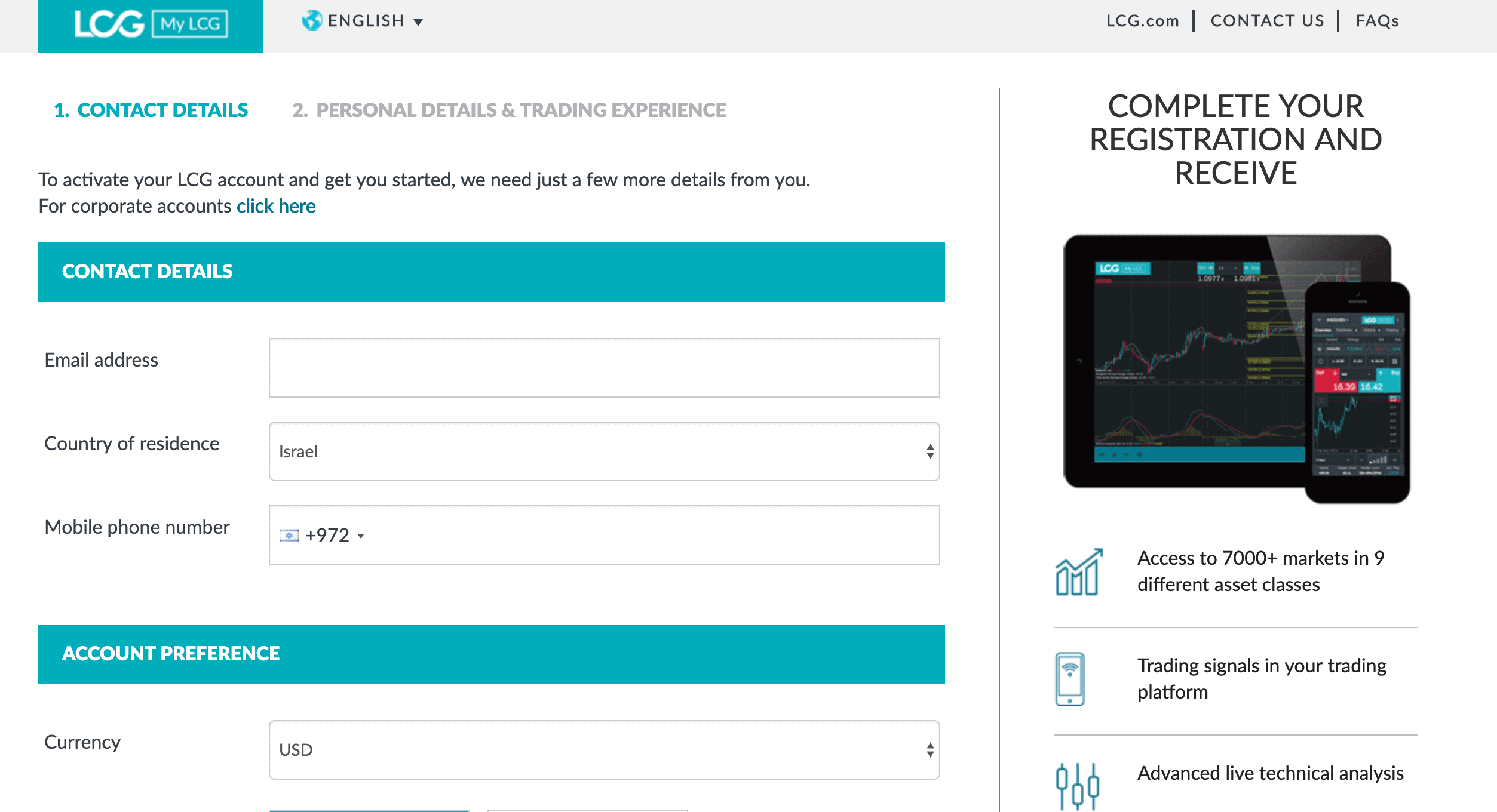

How to Sign Up and Trade on London Capital Group

Opening an account with LCG can be a simple process. Follow the next steps:

- Click the open account button at the top-right corner of your screen. Fill in your email, password and desired currency.

- Now complete all the details in this registration page. You can choose the currency and your preferred platform.

- Next, you have to fill in your personal details and trading experience.

- Now, you have to submit all the required documentation and fund your account via one of the payment methods.

- Start trading.

How to Configure Your London Capital Group Account

London Capital Group offers two trading platform, its in-house platform LCG Trader and the popular trading platform MT4. Once you registered and choose your preferred platform, you can start setting up all the necessary tools.

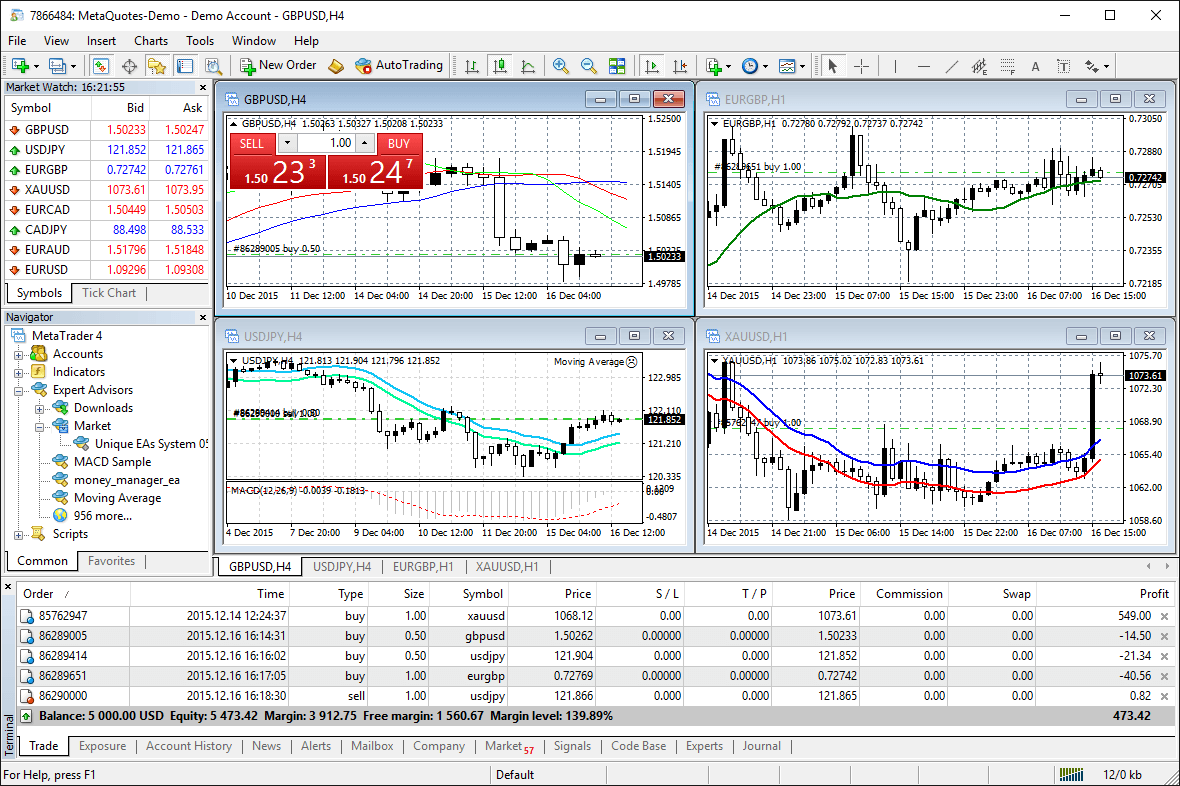

MetaTrader 4

MT4 offers advanced trading tools including more than 80 technical analysis indicators, web-based Platform, Expert Advisor (automated trading), MQL Programming and one-click trading.

Once you download the platform, you need to set up all the available trading tools: MarketWatch (instruments quotes), trading charts and the terminal (positions, orders, account balance) as you can see in the image below.

You can learn more about the MetaTrader 4 trading platform on this page and on videos and guides across the web.

LCG Trader

The LCG Trader is a user-friendly trading platform and was designed for multi-assets trading. The lCG is similar in its design to MT4 with the instruments window, charts, and account details.

Remember, you can use the demo account in order to test both trading platforms before opening a live trading account.

Security and Regulation

Score: 6/10

Regulation

London Capital Group is regulated by one regulator the United Kingdom, the Financial Conduct Authority (FCA) under the license number 182110 which means the broker can offer its services to EEA countries (EU + Iceland, Norway, and Lichtenstein). The broker is also regulated by the CySEC (the Cyprus Securities and Exchange Commission).

We would however recommend traders to choose a regulated broker like eToro which is regulated by top-tier several financial authorities including FCA, CySEC and ASIC and FinCEN.

Security

LCG offers the security of funds through its regulators and by being listed as a public company on the New Securities Stocks Exchange (NEX) under the symbol LCG.

LCG does not seem to possess any security feature that might protect traders accounts such as two-factor authentication. Take note that most brokers offer security tools to protect traders’ account.

Deposit and Withdrawal Process

Score: 7/10

Payment options

London Capital Group offers limited payment methods to fund your account. A deposit will be charged additional fees by LCG.

Here are the payment methods:

- Credit card – Visa (a fee of 2%) and MasterCard.

- Electronic payments – Neteller and Skrill.

- Union Pay

- Southeast Asia

- Bank Wire transfer

London Capital Group offers limited payment methods compared to other brokers in the industry such as Plus500 or eToro which provides a variety of payment methods including China Union Pay, Credit / Debit card, Giropay, Neteller, PayPal, Skrill Limited UK, WebMoney, Wire Transfer, Yandex, and Local Online Banking.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Withdrawal process

LCG traders can withdraw funds via email or phone and funds are deposited to your credit card or bank account. Payment methods for withdrawal are the same as deposit methods. There is a minimum withdrawal of $50 and the withdrawal process can take between 3-5 days.

Education and resources

Score: 7/10

London Capital group offers an educational section on the website that includes trading guides (introduction guide and how to guides), trading videos, glossary, and the LCG blog. London Capital Group also offers seminars and webinars as part of their education section.

LCG has additional market news, economic calendar, technical analysis, and video analysis. One of the disadvantages of LCG is the fact that they do not offer an education, news section as part of the trading platform which requires users to log in to the LCG website.

Customer Service

Score: 8/10

LCG support desk is available via email, phone, and live chat. The support desk is available Monday to Friday, and there is no support during the weekends. In addition, you can submit a form for the support team.

Overall, LCG customer support was good and provided answers to our questions.

Mobile App

Score: 6/10

LCG offers two trading platform mobile applications, the MetaTrader 4 and its in-house proprietary trading platform, the LCG Trader. Both trading platform can be downloaded on the Apple store and Google play and are compatible with iOS and Android operation-system. Our LCG Trader review concludes an averages mobile experience, in particular when comparing to other mobile trading platforms apps.

For those who are interested in a user-friendly mobile trading app, we recommend eToro which provides one of the best mobile stock trading apps these days with a social/copy feature.https://insidebitcoins.com/visit/etoro

Pros and Cons

Pros:

Cons:

- Offers only two crypto coins – Bitcoin (BTC) and Ethereum (ETH)

- London Capital Group is not available for US residents

- Low credibility among users

- Customer support is not available 24/7

- Long withdrawal process lasting between 3-5 days

- Limited payment methods

- No trading signals

- There are additional fees and commissions

London Capital Group vs eToro

We decided to evaluate LCG by conducting a comparison with one of the leading brokers in the industry, eToro. Although London Capital Group is an experienced forex and CFD broker offering two trading platforms and more than 7000 instruments, we recommend eToro as it is a highly regulated broker offering the most user-friendly and reputable online trading services. eToro offers a huge selection of trading products with an advanced web-based trading platform and a unique social/copy trading platform that allows you to interact, connect and copy other successful traders.

Why we recommend eToro over London Capital Group:

✅eToro offers a social/copy trading that allows to interact and copy successful traders

✅eToro trading platform is user-friendly, easy to use and is available on the mobile app

✅eToro is regulated by top-tier regulators and offers traders protection and reliability

66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion

London Capital Group managed to build an advanced technological operation offering a wide range of financial products across 9 assets classes via two trading platform and is regulated by only one regulator, the Financial Conduct Authority (FCA). Yet, the broker’s negative reputation prevent us from recommending this broker as we noticed many bad user reviews and complaints.

We recommend our readers to choose a reliable broker like eToro instead as this broker can significantly improve your trading experience.

FAQs

What is the leverage ratio offered by London Capital Group?

London Capital Group leverage varies depending on the asset type, the account type, and the clients' country. For example, forex leverage is limited to 1:30 in some countries which is in line with the requirements of the European Securities and Markets Authority(ESMA). Most shares' leverage starts at 1:5 and the maximum leverage offered by London Capital Group is 1:500.

What is the minimum deposit to open a forex/CFD account at London Capital Group?

LCG has no minimum deposit requirement for the Classic (CFD) account as long as there are enough funds to cover the margin requirements.

Is London Capital Group a regulated broker?

, the broker is regulated by the Financial Conduct Authority (FCA) and complies with the requirements of the European Securities and Markets Authority(ESMA) in some European countries.

LCG - Is it a scam broker?

LCG is regulated by the Financial Conduct Authority (FCA) and operates as a forex and CFD broker for more than two decades, however, following our in-depth review we discovered that LCG main flaw is the low credibility and reliability among users and other players in the industry.

How Many Instruments are available on LCG?

LCG offers a broad range of more than 7000 financial instruments categorized into 9 markets. Those include 60 currency pairs, 6 Cryptocurrencies pairs, 15 Global indices, 17 Commodities, 3500 stocks, 9 bonds and 500 ETF's.

Can I use Automated Trading with LCG?

Yes, LCG offers automated trading via Meta Trader4 EA (Expert Advisor). With MT4 EA you can backtest your trading strategy and set up automated trading that is based on statistics and algorithms.

Is London Capital Group available in the US?

No, LCG is not regulated in the United States and cannot accept US residents. A forex/CFD broker must be registered with the Securities and Exchange Commission (SEC) in order to offer clients forex trading.

Does London Capital Group support MetaTrader4?

Yes, LCG offers traders and investors the popular MetaTrader4 trading platform available on desktop, mobile, and tablet.