Founded by 2002, XTB is an online forex and CFD broker located in Poland. XTB is a subsidiary of XXZW Investment Group and listed on Warsaw Stock Exchange (WSE) under the symbol XTB. Although the broker has been in the industry since 2002, users reviews present two sides of a coin so we decided to conduct an in-depth broker review for XTB.

If you’re looking to find a reliable review about XTB, then read this guide. We’ll cover who the broker is, account types, trading platforms, fees and spreads, regulation and security, customer service, languages, and more.

What is XTB?

XTB is an online forex and CFD broker operating as a market maker and STP (Straight Through Processing). The broker offering financial instruments trading in various markets including forex, indices, commodities, stocks, ETF’s and cryptocurrencies. The broker operates offices in 11 countries including the United Kingdom, Poland, Spain, France, Turkey, Portugal, and Germany.

XTB is regulated by the Financial Conduct Authority (FCA) and by more than 10 top-tier regulators across the globe.

75% of retail CFD accounts lose money.

Markets

Score: 9/10

XTB offers a wide variety of financial products with a total list of 1908 assets categorized into six markets: Forex, indices, stocks, commodities, ETF’s and Cryptocurrencies. Take note that stocks trading is not allowed for all countries so make sure you find out with XTB before opening an account.

Although XTB offers a broad range of financial products, the broker does not allow traders to control your leverage unlike other forex brokers in the industry.

- Forex – 49 currency pairs

- Indices – 36 global indices

- Stocks (shares) – 1675 stocks

- Commodities – 21 commodities

- ETF’s – 102 Exchange Traded Funds

- Cryptocurrencies – 25 crypto coins

Special Features

Score: 7/10

XTB offers traders and investors features to improve the trading experience. Those include:

➡️Alerts and notification

Traders can register for SMS, email or desktop push notification for economic events and important market news.

➡️Security Pin

You can set up a security pin for the XTB application.

➡️MetaTrader available on Mac

XTB allows traders and investors to trade via MT4 on iOS operating system.

➡️Stop-loss/Take-profit Percentage of balance

The xStation offers a unique feature that allows traders to insert a stop-loss or take-profit order as a percentage of the balance in the account.

➡️Negative Balance Protection

XTB offers traders to use negative balance protection which ensures that your account will never be below zero and you will receive a margin call before it reaches a certain amount in your account.

Supported Countries

Score : 6/10

XTB offers online trading services mostly in Europe. Some of the main countries of XTB’s operation include:

- Poland

- Poland

- Germany

- The Czech Republic

- France

- Portugal

- Spain

XTB does not offer online trading services in the following countries:

- USA

- Canada

- India

- Pakistan

- Singapore

- Japan

- South-Korea

- North-Korea

- Bosnia and Herzegovina

- Afghanistan

- Libya

- Iran

- Iraq

- Syria

Languages supported

Score: 8/10

XTB support is available in 15 different languages:

- English

- Spanish

- Italian

- French

- Turkish

- Portuguese

- Arabic

- Polish

- German

- Hungarian

- Czech

- Slovenian

- Chinese

- Romanian

- Greek

Trading Platforms

Score: 9/10

XTB offers trading and investors a selection of two trading platform: The popular MetaTrader 4 and the award-winning xStation. Trading platforms are available on Windows and Mac as a desktop/web-based platform and available also on a mobile device.

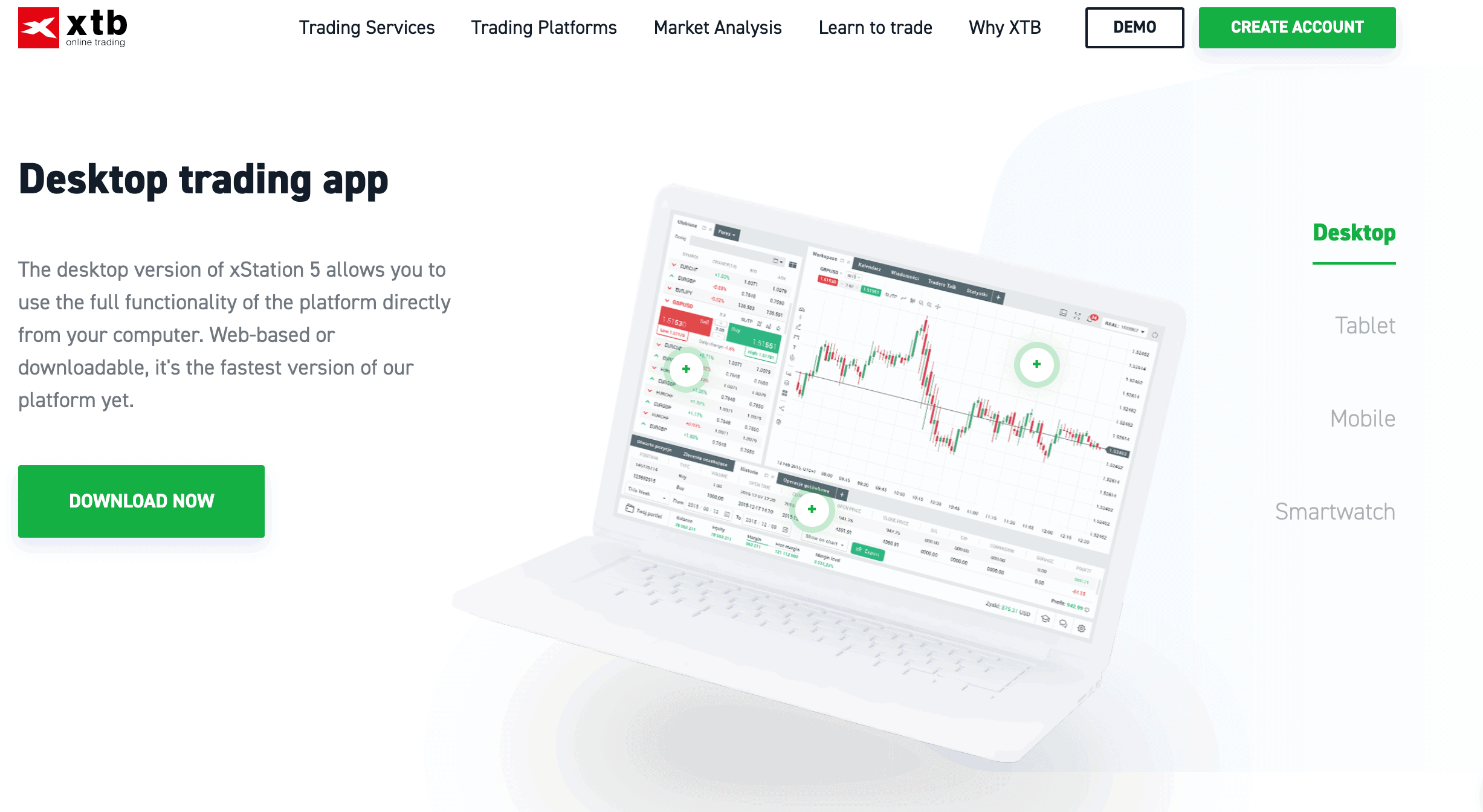

xStation

The xStation is a web-based user-friendly platform which can be a great solution for beginners. The desktop version is similar to the web-based platform, however, connection and advanced tools are available on the desktop version.

MetaTrader 4

The second available trading platform by XTB, MetaTrader 4 is one of the most popular trading platforms for traders and investors. Traders at XTB can trader through desktop, mobile, or a tablet and use the MT4 advanced trading tools such as more than 80 technical analysis indicators, web-based Platform, Expert Advisor (automated trading), MQL Programming and one-click trading.

Fees and Limits

Score: 6/10

Although XTB spreads are mostly competitive, the broker charges trading and non-trading fees. Those include:

Trading fees

Equity (stocks) CFDs and ETFs fees: From 0.08% charged per lot (0.16% per round turn). A minimum fee applies (see instrument specification). All other markets: Basic and Standard accounts: No commission charged for PRO accounts.

Commission charged per lot – The fee applies for the PRO account, an additional commission not including the instruments spread – 2.50 GBP / 3.50 EUR / 4 USD / 1100 HUF per closed lot 2.50 GBP / 3.50 EUR / 4 USD / 1100 HUF per open lot For transaction on crypto-currencies for the volume of 1 Lot of BITCOIN, 10 Lots of ETHEREUM, 10000 Lots of RIPPLE, 100 Lots of LITECOIN and 10 Lots of DASH

Overnight fees – XTB charges a swap/overnight fee for holding a position overnight. The cost depends on the market and instrument you trade, as well as whether you went long or short the asset.

Penalty Interest

Deposit and Withdrawal fees

XTB charges deposit and withdrawal fees:

Credit/debit card funding – To deposit into a trading account currency: GBP – free of charge. EUR – free of charge. USD – the cost of 2% of the amount to be deposited. HUF – the cost of 5% of the amount to be deposited.

Small withdrawals fees – There is a withdrawal fee below 100 USD/80 EUR/60 GBP/12000 HUF. Withdrawal fees at XTB are listed at the table below:

| Amount | Fee |

| 100 USD | 20 USD |

| 80 EUR | 16 EUR |

| 60 GBP | 12 GBP |

| 12000 HUF | 3000 HUF |

PayPal fee – When depositing through PayPal: A 2% flat rate of the amount to be deposited will be charged.

PaySafe (Skrill) – A 2% flat rate of the amount to be deposited will be charged.

Neteller – A 4% flat rate of the amount to be deposited will be charged.

XTB Spreads

Spreads at XTB differ depending on the account type. The Standard account offers traders and investors floating/variable spreads while the Pro account offers floating spreads but also market execution, meaning there is an extra commission to get an STP market execution.

The Pro account offers tighter spreads with an additional commission for stock indices, forex, and commodities.

Overall, XTB offers average spreads compared to other brokers in the industry. For example, the EUR/USD spread is 0.08 pips while other brokers offer EUR/USD with spreads as low as zero pips.

XTB Minimum Deposit

Score: 8/10

The required initial minimum deposit to open an account at XTB starts at £250, €250 or $250. The Pro account offers lower spreads than the Standard account but traders will be charged £2.5, €3.5, or $4 per side on 1 lot transaction.

Take note that XTB minimum requirement differs from country to country so make sure to check with the broker your minimum deposit requirements.

XTB Account Types

Score: 7/10

XTB offers two types of account, the Standard account, and the Pro account. Here are some of the differences between the two accounts:

| STANDARD | PRO | |

| Execution type | Market | Market |

| Available Instruments | Forex, Commodities, Indices, Cryptos, Stock CFDs, ETF CFDs | Forex, Commodities, Indices, Cryptos, Stock CFDs, ETF CFDs |

| Instruments | 1500+ | 1500+ |

| Maximum Leverage: | 30:1 | 30:1 |

| Minimum spread | 0.35 | 0.28 |

| Negative Balance Protection | Yes | Yes |

| Minimal Order | 0.01 lot* | 0.01 lot* |

| Automated trading | Yes | Yes |

| Account setup | Free | Free |

| Trading platforms | xStation & MT4 | xStation & MT4 |

| Account setup & management | Free | Free |

| Forex, Indices, Commodities | No commission | Commission from 2.50 GBP per lot |

| Stocks | N/A | Commission from 0.08% per lotN/A |

| Stock CFDs and ETF CFDs | Commission from 0.08% per lot | Commission from 0.08% per lot |

| Cryptocurrencies | No commission | Commission from 2.50 GBP |

| Minimum Deposit | £250, €250 or $250 | £250, €250 or $250 |

XTB standard and pro accounts offer traders basic trading accounts, however, the broker does not provide clients other accounts with attractive features such as zero spread account and high leverage ratio.

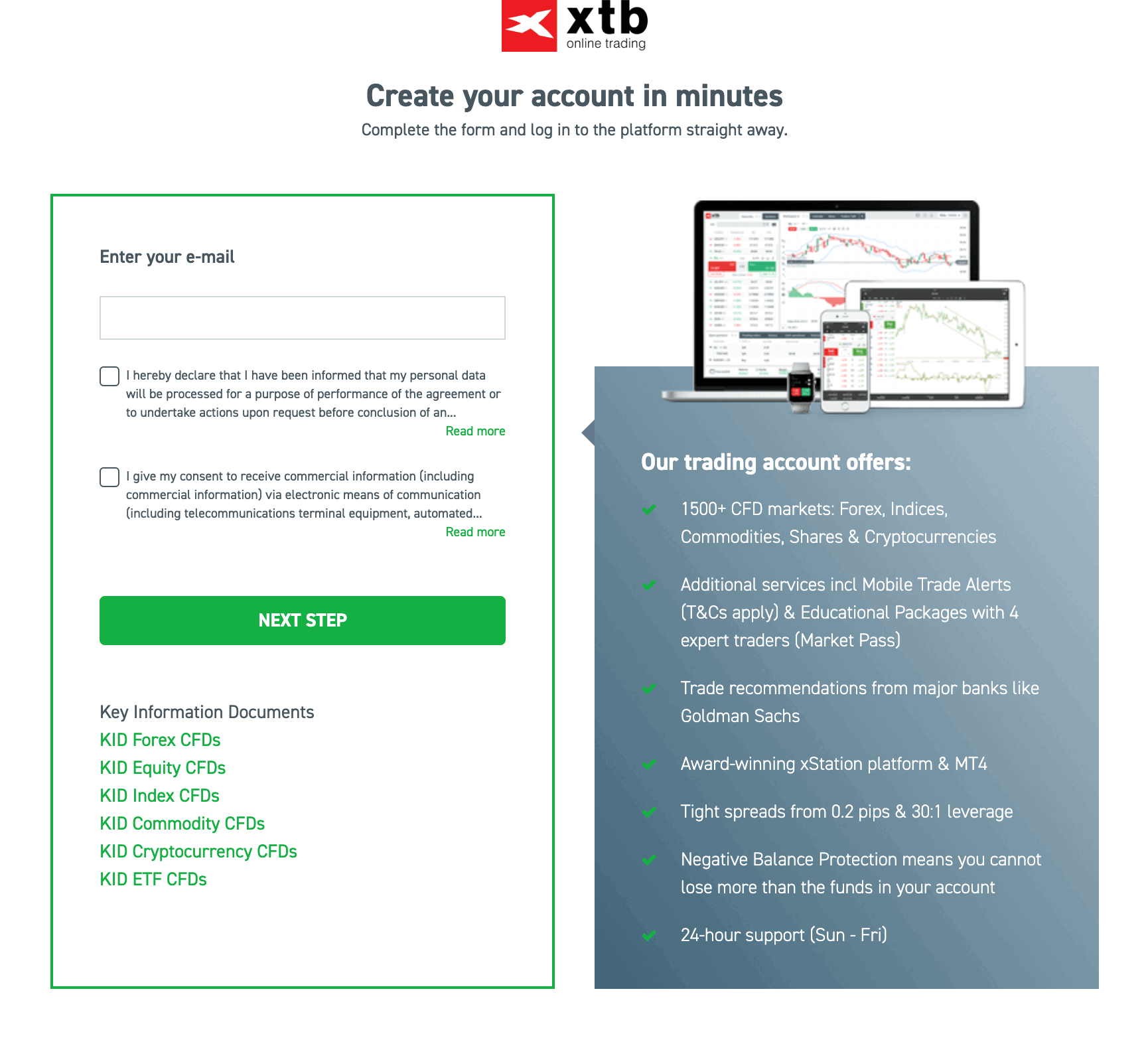

How to Sign Up and Trade on XTB

Opening a trading account with XTB is a simple and quick process. In order to open a real account and start trading with XTB, follow the next steps:

- Visit xtb.com, enter your email address on the signup page and check the two boxes.

Update – the appearance of the signup page may have changed since writing this review.

-

- Fill in all the details in the online form and submit all the required documentation (proof of identity, bank statement, etc).

- Once you finished the online form, a representative will contact you to approve the account.

- Deposit funds through one of XTB payment methods.

- Download one of the trading platform – MetaTrader 4 or xStation.

- Start trading

75% of retail CFD accounts lose money.

How to Configure Your Account

XTB offers one of the most popular forex and CFD trading platform, the MetaTrader 4. The MetaTrader4 was designed specifically for forex and CFD trading and therefore those instruments are most suitable for the MT4.

MT4 offers advanced trading tools including more than 80 technical analysis indicators, Web Based Platform, Expert Advisor (automated trading), MQL Programming and one-click trading.

Once you download the platform, you need to set up all the available trading tools: MarketWatch (instruments quotes), trading charts and the terminal (positions, orders, account balance).

Remember that you can use XTB demonstration account to master your trading techniques and set up your trading account including all the necessary tools to elevated your trading.

Security and Regulation

Regulation

XTB is regulated by more than 10 top-tier regulators including the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (‘CySEC’), International Financial Services Commission of Belize (IFSC), Polish Financial Supervision Authority (KNF), BaFIN, Czech National Bank (CNB), Autorite Des Marches Fianciers (AMF), Autorité de contrôle prudentiel et de résolution ACPR.

The broker is regulated in different regions and countries across the globe including the United Kingdom, Cyprus, Italy, Poland, Turkey, Hungary, and other European and non-European countries. In addition, the broker is listed on the Warsaw Stock Exchange (WSE) under the symbol XTB.

XTB is highly regulated, however, you must check the regulator in your area and the protection liability for traders. If you are a trader who feels confident with a broker that is regulated with the most strict and protective terms for traders.

Other brokers like eToro are regulated by FCA, CySEC and ASIC can be a better solution.

Security

In terms of security features, XTB offers two main security tools: the first is a pin for the XTB mobile application, which can prevent an entrance to the mobile without the pin. The other security feature is a set up of two-factor authentication for the desktop and mobile platform.

Deposit and Withdrawal Process

Score: 7/10

Deposit

Funding your account at XTB can be made through the XTB website. There is a limited number of payment methods at XTB, those include:

- Bank wire transfer – No fees, available only for the following currencies: EUR, USD, GBP, HUF.

- Credit Cards – MasterCard, Visa, and Maestro. No fees, available for the following currencies: EUR, USD, GBP.

- eWallets – PayPal and Skrill. Available for the following currencies: EUR, USD, GBP, HUF. There is an additional fee of 2% of the deposited amount.

Withdrawal

Withdrawal will be sent automatically to your bank account and money withdrawal is free above 100 USD. Withdrawals can take up to 2 days, however, some user reviews mentioned a longer period of the withdrawal process.

Education

Score: 6/10

XTB educational section includes a trading academy and live webinars. The broker also offers market news and an economic calendar. In terms of trader’s education tools, eToro offers wider educational tools including live webinars, interactive trading courses, trading videos and a social trading platform that includes markets news and interaction with other traders. eToro’s trading platform allow traders to maintain a trading operation without the need of other news /forums sites.

Customer Service

Score:9/10

XTB customer support is available via email, phone, and live chat. The live chat is a great tool to communicate quickly, however, XTB supports only on workdays and are not available 24/7. Overall, XTB customer support has been reliable and fast and the web site’s navigation is easy to use.

Mobile App

Score: 8/10

XTB offers trading from your mobile device (Android, Windows and iOs devices) through their trading platform, the MetaTrader4 and xStation provide traders and investors a trading mobile app. You can download the XTB mobile app on AppStore and Google Play.

For those who are in need of a solid mobile trading app, we recommend the MetaTrader 4 over the xStation trading app which has a limited interface and order types. The MetaTrader 4 mobile app is a success due to its simplicity and functionality.

Take note that eToro mobile app provides traders one of the most advanced mobile trading platform with a user-friendly user interface.

Moreover, the MT4 offers automated trading and backtesting of your trading strategy with advanced technical analysis tools and easy-to-use trading platform.

For those who would like to analyze their trading statistics and can get a benefit of features such as traders’ talk, market sentiment, trading calculator and trader statistics, then the xStation can be a good trading platform for you. Take note that the xStation is available on desktop, web-based, mobile, tablet and smartwatch.

Pros and Cons

Pros:

Cons:

- No ECN account

- Limited payment methods

- Charges additional fees such as deposit and withdrawal fees

- XTB offers a low leverage ratio of 1:30

- XTB is not available for US residents

- No guaranteed stop-loss order

- XTB does offer trading signals

- Offers only two trading platforms

Conclusion

Overall score : 7/10

XTB has been in the forex industry since 2002 and succeeded to implement a broad range of products and advanced technological tools. The broker also offers solid customer support and is regulated by the FCA and other regulators. Yet, for a broker that has been in the industry for this extent of time, the reputation and reviews are not perfect and some brokers such as eToro and IG Group might offer the additional feature or service that can make a big difference.

75% of retail CFD accounts lose money.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

FAQs

What is the leverage ratio offered by XTB?

XTB offers different leverage ratio depending on the country or region you are located in. For the UK or some European countries, the maximum leverage ratio offered is 1:30. For other countries, the maximum leverage is 1:200. You need to check with XTB customer support the leverage ratio regulation in your country/region.

What is the minimum deposit to open a forex/CFD account at XTB?

The initial deposit requirement at XTB starts at £250, €250 or $250. Take note that the minimum deposit requirement at XTB differs from different countries and regions.

Is XTB a regulated broker?

XTB is highly regulated by various regulators across the globe. Those include: Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (‘CySEC’), International Financial Services Commission of Belize (IFSC), Polish Financial Supervision Authority (KNF), BaFIN, Czech National Bank (CNB), Autorite Des Marches Fianciers (AMF), Autorité de contrôle prudentiel et de résolution ACPR.

XTB - Is it a scam broker?

No, XTB is not a scam broker, it is a legitimate regulated broker in the industry operates since 2002 and is publicly listed in the Warsaw Stock Exchange (WSE).

How Many Instruments are available on XTB?

XTB offers a wide selection of more than 2000 financial instruments. Those include 1675 Stocks on various exchanges and regions, 102 Exchange Traded Funds (ETF’s), 25 Cryptocurrencies pairs, 36 Global indices, 21 Commodities, 49 Forex currency pairs.

Can I use Automated Trading with XTB?

Yes, XTB offers MT4 trading platform which allows traders to implement trading strategies and automate trading through the Expert Advisor (EA) feature.

Is XTB available in the US?

No, trading forex and CFDs with XTB in the United States is not available as of 2019. In order to accept US traders, XTB must be registered with the Securities and Exchange Commission (SEC).