There have been some user reviews indicating that GKFX might not be a genuine broker.

We’ve researched GKFX to find out what exactly this online trading platform is all about and due to the uncertainties surround this broker’s authenticity, we are inclined to recommend other better brokers like Coinbase.

We will explain why you should stay away from this broker in our full comprehensive GKFX review.

On this Page:

What Is GKFX?

GFKX is a company offering an online trading platform for customers. The company is regulated by the FCA (Financial Conduct Authority). The platform facilitates CFD trading, Forex trading, and spread betting. GKFX was established back in 2014 and is headquartered in London. The company also has presence in 14 countries across the world. It boasts an employee capacity of 400. Its main financial hubs are situated in Frankfurt (Germany), London (UK), Shanghai (China), and Paris (France).

GKFX Markets

Score: 6/10

GKFX offers a variety of products, each with its own market allocations. The products include:

Cryptocurrencies

The cryptos available on GKFX include Bitcoin, Litecoin, XRP, and Ethereum.

FX

The GKFX market is open between Sunday and Friday, 24 hours a day. The GKFX online trading platform facilitates Forex trading, with the most traded currency pairs being EUR/USD, USD/JPY, and GBP/USD.

Equities

Traders on GKFX can buy equities on the platform from companies that have listed their shares on the broker’s platform. If the share prices increase, the investors’ profits increase, and vice versa.

Indices

To initiate a trade on an Index (DAX) on GKFX, a buyer only needs to deposit 1% of the index price. They can also trade indices across multiple countries including US, UK, and Europe.

Commodities

GKFX offers trades on oil and precious metals.

CFD

GKFX facilitates CFD trading on a variety of markets, including indices, cryptocurrencies, commodities, and currency pairs. However, traders are urged to exercise extreme caution when trading CFDs on GKFX as sometimes losses can exceed deposits.

Below is a table representing the specifics of each market:

| Markets | Standard fixed | Corporate variable |

|---|---|---|

| FX | 50 | 50 |

| Commodities | 5 | 5 |

| Indices | 14 | 14 |

| Equities | 250+ | 300+ |

| Min.Deposit | N/A | $25,000 |

| Stop Out Level | 50% | 50% |

| Swap Fee | YES | YES |

| Commission | N/A | N/A |

GKFX Special Features

Score:5/10

GKFX doesn’t really offer any distinct features as compared to many other brokers in the market. The GKFX platform offers a number of trading models or features:

➡️Mobile

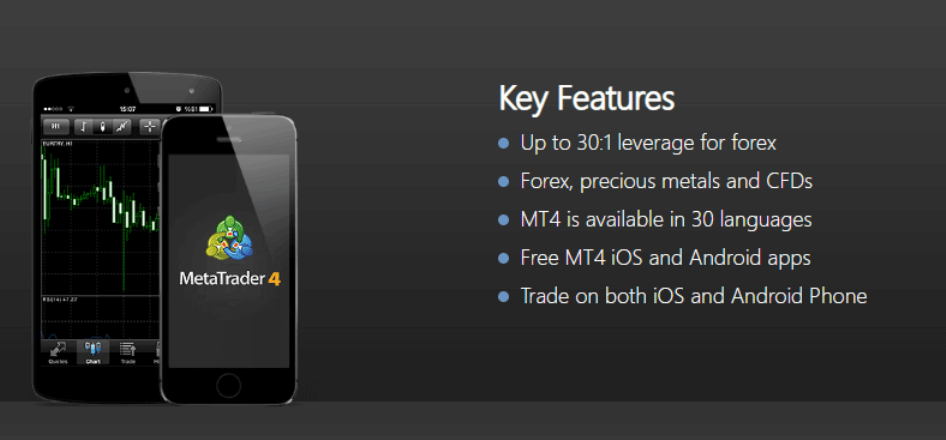

Allows users to access the trading platform via iphones, ipads, Android devices.

➡️Sirix WebTrader

Has similar functionality as MT4 except that it allows access to the trading platform from any web-enabled PC.

➡️Multi-Terminal

This is an extra added facility for the MT4. Allows traders to work with more than trading account at the same time.

➡️MT4

Offers sophisticated and customizable trading tools.

➡️WebTrader

Offers a customizable web trading environment.

GKFX provides gives traders with a variety of trading platforms. However, we would still recommend Coinbase over GKFX because it’s popular both in functionality and authenticity.

Supported Countries

Score: 5/10

GKFX operates in a number of countries around the world:

- Poland -Warsaw

- Spain – Madrid

- France – Paris

- Japan – Tokyo

- China – Hong Kong, Beijing, Shanghai

- UAE – Dubai

- Indonesia – Jakarta

- United Kingdon – London

- Egypt – Cairo.

- Germany – Frankfurt

- Slovakia – Bratslavia

- Czech Republic – Prague

As is evident in this review, the GKFX platform isn’t very popular or present in many parts of the world.

Languages

Score: 6/10

According to information that we have gathered, this broker supports 7 languages:

- English

- Arabic

- Chinese

- Russian

- French

- German

- Indonesian

Fees And Limits

Score: 4/10

GKFX offers spreads according to account types. Traders with a professional level aren’t affected by leverage restrictions or other regulation changes. Lower level traders have to submit applications to upgrade to professional client status.

Other Fees

According to information available on its website and included in this GKFX review, the broker doesn’t charge commissions on customer’s accounts unless otherwise specified with regard to account specifications like premium account services and MT4.

Trading On GKFX

Score: 6/10

Like many other online trading platforms, GKFX offers a variety of account types. GKFX allow traders to open a demo account before they start real trading. Just like with other platforms like Coinbase, a demo account helps traders to improve their trading skills as well as sharpen their decision-making instincts before trading for real money.

Account Types

Score: 5/10

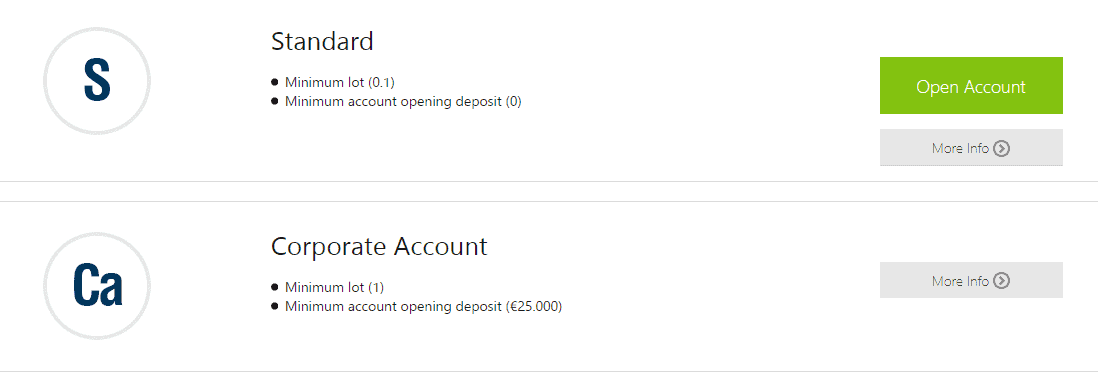

Choosing an account type depends on a few important factors like time available, risk tolerance, and amount of capital available. For a live trading account, GKFX offer two types: a standard/professional trading account, and a corporate/premium trading account.

Standard / Professional Trading Account

This type of trading account can be used by both novices and experienced traders and it is free.

Corporate/Premium Account

The premium account is a paid-for service that allows for MT4 account automation.

Below is a comparative representation of the two account types on offer at GKFX:

| Standard Account | Corporate Account | |

|---|---|---|

| Spread | From 1.2* | From 0.6* |

| Spread Types | Variable | Variable/Fixed |

| Max Open Trades* | X | X |

| Max Open Positions (Lot) | N/A | N/A |

| Max Trade Size (FX)** | 100 | 100 |

| Min Trade Size (FX)*** | 0.01 | 1 |

| Leverage**** | Up to 30:1 | Up to 30:1 |

| Account Base CCY | EUR,USD,GBP | EUR,USD,GBP |

| Trading Platform | MT4,WebTrader | MT4,WebTrader |

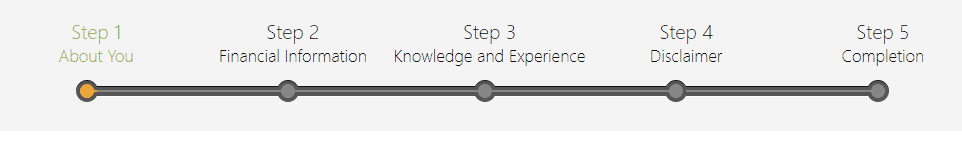

How To Sign Up And Trade On GKFX

To start trading on GKFX, you first need to click on LIVE ACCOUNT button on the website to start the process of creating a GKFX account. You can choose to open either a standard or corporate account.

- You enter your details and click “Next” to continue.

- From there, you follow the instructions given via email for verification.

Here’s a simple representation of the opening account process when you want to invest on GKFX:

Below are the steps involved when opening a trading account with gkfx:

Security And Regulation

Score: 4/10

Being an online trading platform, GKFX is obligated to secure its customers’ data with an effective data protection policy. However, GKFX’s website has a cookie policy. This means that the website tracks the users’ activity on the website. As a matter of fact, a lot of people are somewhat apathetic to such policies as they’re seen as compromising data protection.

Besides the cookie policy, GKFX also uses third party payment processors for deposits and withdrawals. That’s unlike other popular trading platforms like Coinbase. In the case of Coinbase, the platform has its own in-house e-wallet. However, much like various others, GKFX prohibits deposits or withdrawals to third parties, meaning that customers are not allowed to deposit or withdraw funds via contacts or wallets owned by friends or family members.

Customers on GKFX have to provide proof of their identity. The trading platform claims that this verification procedure is aimed at helping it rout out scammers and other bad characters. The verification procedures include Anti-Money Laundering (AML) and Know-Your-Customer (KYC) processes.

Deposit And Withdrawal Process

Score: 6/10

After GKFX account signup and login, the user is now ready to deposit capital on the broker. GKFX offers a number of options for depositing. For each, the broker has set rules like the accepted currencies, transfer limits, transaction time, and transfer costs.

Payment Options

Below is a snippet representing the related information:

| Description | Accepted Currencies | Transfer Limits | Transaction Time | Transfer Cost |

|---|---|---|---|---|

| Bank Transfer | USD,EUR,GBP | Min $50, No Max | 1-5 Business Days | No Fee* |

| Credit Card | USD,EUR,GBP | Min $20 Max $5,000 | Instantly | No Fee* |

| Debit Card | USD,EUR,GBP | Min $20 Max $5,000 | Instantly | No Fee* |

| E-Wallet | USD,EUR,GBP | Max $5,000 | Instantly | No Fee* |

After depositing capital, traders can then open order or place a buy order for products or assets of their choice.

Withdrawal Process

If the trades bring in profits, the user can then withdraw their profits or continue trading. There are several options on how to withdraw funds on GKFX.

| Description | Accepted Currencies | Transfer Limits | Transaction Time | Transfer Cost |

|---|---|---|---|---|

| Bank Transfer | USD,EUR,GBP | Min $50 | 1-5 Business Days (Depends on Country) | No Fee |

| Credit/Debit Card | USD,EUR,GBP | Min $50 | 3-5 Business Days | No Fee |

| E-Wallet | USD,EUR,GBP | Min $50 | 1-3 Business Days | No Fee |

Education And Resources

Score: 7/10

As a trading platform, GKFX has a plan in place to help out novice as well as established traders. The platform avails some learning materials like videos, economic glossaries, e-Books, webinars, and other tutorials related to online trading. The tutorials cover topics like CFD trading and Forex trading. They also try to help the learners up along the learning curve or improve their learning process.

Customer Service

Score: 8/10

GKFX operates a customer service desk that’s functional 24 hours a day between Sunday 10:00 pm and Friday 10:00 pm. The support includes a direct line to the help desk. Account opening support or services are accessible Monday to Friday between 8:00 am and 5:00 pm.

Customers can also place press inquiries from Monday to Friday anytime between 9:00 am and 5:00 pm. For payment processing involving deposits and withdrawals, customers can initiate the transactions between 9:00 am and 5:00 pm from Monday to Friday.

Mobile App

Score: 6/10

However, the Coinbase mobile app is much easier to use and is constantly updated with new, interactive features in order to provide a better experience to all traders.

Pros and Cons

Like everything else, trading on GKFX has its advantages and disadvantages. Also, it’s perfectly prudent to note that we’re providing this true information to help you, as a trader and our reader, to make the right decision in choosing the most suitable trading platform.

- GKFX is an FCA-regulated online trading platform, meaning that its operations are perfectly within the legal limits.

- GKFX allows very low minimum initial deposits of $20. You don’t have to have a lot of money to trade on the platform.

- On its website, GKFX makes it clear to traders that it’s possible to lose all your money on the broker especially when trading CFDs.

- Unfortunately, GKFX’s interface looks cluttered, making it very hard to access specific important information like account types products available.

- GKFX allows use of third-party wallets. Third party wallets have been known to introduce some level of insecurity and apathy on the part of the investors.

- Withdrawals can take even 5 days to process.

Conclusion

Granted, there are many online platforms just like GKFX trading platform, but the truth is that some are better than others. There are various factors that traders consider when choosing between trading platforms. In this case, Coinbase beats GKFX in many aspects including customer support, supported jurisdiction, and operating model. A simple look at this GKFX review stamps that.

FAQs

Is GKFX A regulated broker?

Yes, the broker is regulated by the Financial Conduct Authority (FCA). The FCA is the policy-maker and enforcer of laws governing the financial sector in the United Kingdom (UK).

Does GKFX charge any commissions?

Yes. Some products offered on GKFX are subject to a commission deduction. The fees charged are reflected in a daily or monthly statement according to the customer’s preference.

Are orders guaranteed?

No. GKFX offers no guarantee than an order placed will go through. Sometimes the order placed may be late, in which case the broker incurs no liability in the event that the market price for the product in question becomes volatile before the order is processed. In such cases, if the price falls, the loss is incurred by the customer rather than covered by the broker.

Can you lose more than you deposited on GKFX?

Yes. Losses on leveraged products may exceed the amount deposited by the trader. This is most prevalent in CFD trading on GKFX where more than 80% of traders are believed to incur losses. Another cause for this might be the huge 1:400 leverage margin offered by the broker. High margins increase risks of loss.

Does GKFX share customer information?

According to information on its website, the broker shares user information for purposes of marketing and market statistics. As such, anyone planning to sign up on GKFX should be willing and ready to share their personal information and allow the broker to use it for the mentioned purposes.