When trading Forex and CFDs, you always want to ensure that whichever broker you’re using is running at the best capacity possible. It determines the speed of your trades, the profit margin you’re able to attain, and the safety/security of your funds. Choosing the right one is absolutely imperative, especially if you’re looking to make sizable money from trading Forex.

FXCM demonstrates a large presence in the Forex trading scene – it’s a licensed broker that has, for quite some time, provided retail brokerage, trading, and settlement services for users. While FXCM started out small, once it found traction, it began to grow at rapid paces never seen before in the industry serving as an industry darling for beginner retail traders.

On this Page:

This review will give an overview of FXCM (Forex Capital Markets) and assess whether or not we believe it to be the optimal choice for Forex traders in 2019. Through our in-depth research and personal testing, we did the due diligence that many would have overlooked in coming up with a conclusion on whether or not the long-time brokerage should be your provider of choice.

In general, while FXCM has maintained an avid advertising presence, due to the number of historic legal troubles, broker limitations, technical bugs, and unanswered account/fund-related issues, we’ve concluded that FXCM is not an optimal broker, and does not offer reasoning to choose it over provably efficient brokers such as Coinbase.

Within our review, we’ll assess exactly why we’ve come to this decision, how FXCM compares to our brokers of choice in multiple fields, and get into the process for not only opening an account but also linking it to the supported platforms. In this way, we’ll be able to provide a non-biased report of the broker, in which ways it can be utilized, but primarily, why we’re not convinced in using FXCM.

What is FXCM? A Brief History

FXCM (Forex Capital Markets) is an online multi-asset broker, which offers the trading of different financial products in a plethora of markets. These markets primarily include Forex, however, also delve into other areas such as cryptocurrencies and equities. FXCM offers the trading of CFDs (Contracts for differences), which serves as its primary trading instrument where larger amounts of margin can be implied.

FXCM was established in 1999 and was originally intended as a global Forex broker; however, around the time of 2011, FXCM was charged by the CFTC and other legal authorities for illegal market malpractice and negligence in offering certain trading products in districts without proper registration. As a result, their brokerage was permanently banned in the U.S., and their parent company filed for bankruptcy. It wasn’t until a primary financial group acquired a majority interest in the company that FXCM was able to offer services again.

FXCM is U.K. based now and has since its legal woes, claimed complete registration and licensing for the areas of offering that it currently delves in.

FXCM Assets and Markets

Score: 5/10

FXCM lacks a wide range of assets for trading and in comparison to the majority of other Forex brokers, fails to offer a significant amount of assets. With consideration to the fact that FXCM has been around for 20 years now, we’d expect a large variety of assets to be available. Amongst these assets, only the following are offered:

- Forex – At this time, only 39 Forex pairs are available

- Commodities – Use CFDs to trade 9 commodity pairs via FXCM

- Indices – Trade between a limited number of major global index CFDs

- Cryptocurrencies – CFD trading for only 2 pairs (Bitcoin and Ether)

FXCM offers a total of (As of May 2019) 63 tradeable securities. Comparatively, this is among the smallest amount in the industry.

FXCM – Exclusive or Unique Features

Score: 7/10

FXCM does, in fact, show a bit of strength in the exclusivity of products that it offers, however, that benefactor is quickly shut down due to its inability to offer unique markets. This is many times argued to be because of regulatory imposition. Nonetheless, FXCM offers the following exclusive features:

➡️Custom Education Section

While almost all brokers provide some sort of educational section, FXCM finds solace in its broker through its custom and rather impressive education section. FXCM provides interactive tutorials through its platform and also offers live tutorial sessions, a large library of up-to-date educational videos (Ranging from platform usage to fundamental market and trading knowledge), as well as a range of text-based guides.

➡️ Unique API Integration

API integrations are not new to the Forex industry – however, FXCM offers a competitive total of 4 customizable APIs. This includes a REST API, an FIX API, a Java API, and a ForexConnect API. What’s interesting about these APIs as well is that users can establish negotiations with FXCM themselves that enable custom commissions to be configured via the APIs, something we haven’t seen done with other brokers.

Supported Countries

Score: 4.5/10

Countries and jurisdictional support is an area we find very concerning as far as FXCM goes – as stated, it’s not that FXCM doesn’t choose to offer investment products and markets in a limited number of continents, it’s that it is banned from operating in these areas. As a result, FXCM is banned from the United States and does not offer clear guidance on registration for other jurisdictions other than the U.K. If FXCM simply opted to offer U.K.-exclusive trading, we’d be much more comfortable with it, however, it is banned from a number of these areas and doesn’t provide clarity regarding legality on registration in any country other than the U.K.

Languages

Global support does not seem to be the area FXCM wants to emphasize; FXCM even states themselves on their website that they provide “limited support” for any languages excluding English. Their support teams do, in fact, uphold to some primary languages other than English which is a plus.

Score: 5.5/10

FXCM provides primary support for the following languages: Spanish, French, German, Arabic, Chinese-Mandarin, Italian, and Greek.

Additionally, FXCM provides secondary support for these languages: Malay, Vietnamese, Chinese-Cantonese, Urdu, Tamil, Hindi, Farsi, Bulgarian, Slovak, Czech, Portuguese, Thai, and Russian. What is meant by ‘secondary’ is essentially the idea that if you sign up via a primary language, you’re guaranteed support, however, if you sign up via a secondary language, FXCM cannot guarantee they’ll be able to communicate with you, which is a bit concerning for new users.

FXCM Trading Platforms and Support

Score: 8/10

While FXCM fails to live up to industry standards in terms of jurisdictional and language-based integration, the broker does offer a bit of favorability in terms of supported platforms. FXCM offers support for the following trading platforms, separating it from a number of brokers who take the safe route and opt for singular MetaTrader integration.

Trading Station

FXCM has a proprietary trading platform, which is a very big plus; the technology, named ‘Trading Station’, gives FXCM an edge in that other brokers can integration with Trading Station. This can be compared to an instance where, for example, MetaTrader was not only a trading platform but also a broker. Trading Station was developed all internally and offers multiple capabilities for traders.

MetaTrader

FXCM additionally offers support for MetaTrader4 (MT4), the industry standard for trading platforms. MT4 has served as an intuitive trading platform for many years now in the Forex trading sector due to its speed, multi-faceted trading tools, and track record.

FXCM does not directly offer support for MT5, and in most cases, this would be considered negative, however, MT4 has been regarded by the majority of most Forex professionals, traders, and institutions as the optimal MetaTrader platform. MT5 has been considered relatively unstable, and despite the launch of MT5, MT4 has still remained the standard; making it a plus that FXCM has chosen to focus on one stable legacy platform and perfect integration as opposed to jumping all over the place.

FXCM Fees & Limits

Score: 6/10

Spreads

Spreads that are offered on FXCM, when compared to most industry competitors, are not exactly noteworthy. In fact, they’re a bit underwhelming. All standard accounts on FXCM start off at the preliminary amount of 1.3 pips, placing it at one of the more pricier options in terms of spread. We’ve found the more competitive spreads to start at .6-.8 at standard account tiers, and then decreasing from there. Through account tiers, FXCM enables lower spreads if you deposit a larger initial amount. For example, if you deposit $25,000 or equivalent to FXCM, you’re awarded ‘Active Trader’ status; in this tier, your spreads start at a mere .2 pips.

Trading fees

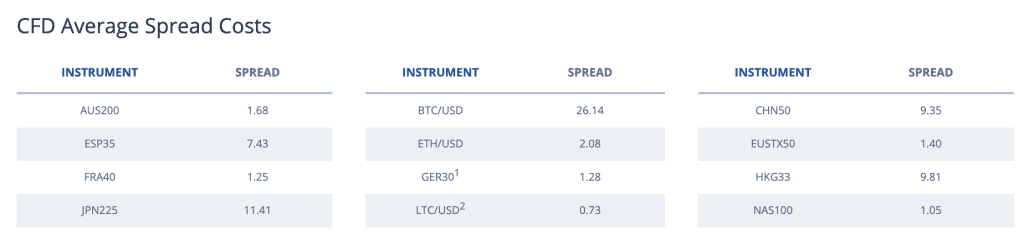

Standard trading fees on FXCM start out relatively low, however, they are not zero, even in the top-tier account status. This is disheartening as many forex brokers offer zero commissions in exchange for relatively larger spreads; not only does FXCM impose larger than normal spreads, it also imposes fees associated. This makes the cost of using the outlet more expensive than most industry standards. While spreads are drastically reduced when trading via ‘Active Trader’ account tier, additional fees are still imposed. When comparing asset spreads as well, we notice that FXCM implies a larger than normal spread to almost all its assets, especially tradeable CFDs, as shown below, to which it additionally adds flat fees:

While the spreads of an ‘active trader’ account tier are attractive, most users won’t ever reach that level. As a result, we’re not entirely ecstatic about the fees imposed by FXCM.

Deposit and Withdrawal fees

Bank Transfer – FXCM offers bank transfers as a main source of funding; however, we don’t recommend it. Every transfer has a mandatory flat fee of $40 – Bank transfers also take 3-5 days in the case of FXCM. Many, if not most brokers, have now implied zero bank transfer fees, so this ends up being a huge negative for the broker.

Credit/Debit Card – FXCM offers the linking of credit/debit card for all new users on the platform. All that’s required is the card information. Thankfully, there are no withdrawal or deposit fees associated with cards.

Minimum Deposit

Score: 6/10

FXCM doesn’t maintain a static amount for a minimum deposit required to get started. Theoretically, you can get started with $1 – but watch for hidden fees; for example, if you turn $1 into $10, you’ll actually end up in debt trying to withdraw via bank because $40 fees are imposed on bank withdrawals. You need minimum deposits to open separate account types (Which we specify below), however, to get started, you don’t need any more than $1.

Account Types

Score: 6.5/10

FXCM does a fairly reputable job in enabling different account types; their structure is fairly similar to that of ThinkMarkets. They do offer you the ability to establish the most basic account type with a close to zero minimum investment, however, you are then subject to much wider spreads, higher fees, and lower profit margins.

Mini Account

The most basic account on FXCM is the Mini Account. This account type can be opened with as little as a recommended $50. Mini accounts are not recommended since fees and additional spreads bite heavily into profits, however, they are still possible to open. With a Mini account you are granted:

- A total of 21 Forex pairs

- Up to 400:1 leverage

- Trade executions done via a dealing desk

- Significant spreads and fees (Spreads start at 1.3 pips for most liquid pairs)

Standard Account

The next FXCM account tier is the standard account – widely considered to be the step above the most beginner account type. Standard accounts can only be opened with a minimum of $2,000 in deposits, and offer the following features:

- Trade executions are done directly, not via a dealing desk

- Exclusive trading tools/charting

- Lower spreads, but not the lowest

Active Trader Account

The active trader account is the highest level account on FXCM – these accounts are tailored for those who are dealing with large amounts of capital, institutions, funds, and proprietary firms. Active Trader tiers can be accessed by depositing a minimum of $25,000. They grant the following:

- 39 total Forex pairs

- Direct trade execution

- Top-tier charting and trading tools

- Lowest spreads on the broker – start at .2 pips

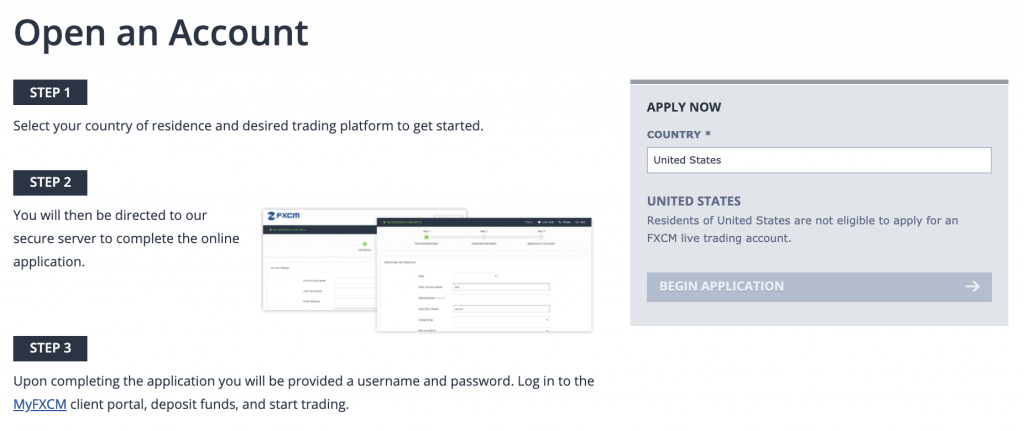

How to Sign Up and Trade on FXCM

Opening an account and getting started on FXCM is fairly quick:

- Navigate to main FXCM broker homepage

- Click the ‘Open Account’ button that is highlighted in teal towards the top right of the page. This will load a new page:

- Here, enter in the information necessary and complete your application; this will include providing identification docs.

- Once sent, wait for approval, then login to your new account. Fund your account via your choice.

- Once funds complete processing and are completely settled, begin trading.

Configuring Your FXCM Trading Account

FXCM configuration is simple; let’s walk through it.

Trade Station

Simply download Trade Station for your operating system of choice from the FXCM downloads page:

Once downloaded, specify FXCM as your broker, and log in – then you’re done!

MetaTrader4

Although considered the ‘outdated’ version of MetaTrader, most major brokers and institutions still adhere only to MetaTrader4. To configure FXCM on MetaTrader, download MT4 for the operating system of your choice.

Security and Regulation

Score: 4/10

Regulation

Regulation and security is FXCM’s downfall – since its public banning in the United States and recurring user issues that have failed to be answered, FXCM’s regulatory status is not secure. Based upon a plethora of public online user reports, regulation is not entirely settled, as many accounts are still being closed despite the broker claiming things have been solved.

Score: 6/10

Security

The login process for FXCM is a one-step process. This means that if their database is ever breached, if anything awry happens with your account info, or if your account info is stolen, there is no way to have secondary authorization. FXCM is amongst one of the only brokers in today’s atmosphere that doesn’t offer 2FA or additional security measures. No phone number link, no email confirmation ability, and no authenticator.

This is extremely concerning, especially for a broker with as much volume and activity as FXCM. There are institutional client options, however, even at that level, we’re relatively unsure if we’d move forward with those products if given the chance. 2FA is a basic online security measure, pivotal in today’s technological society, and there seems to be a limited amount of security with FXCM.

Deposit and Withdrawal Process

Score: 5/10

FXCM doesn’t enable any necessarily exclusive deposit methods such as via cryptocurrency or other digital deposits compared to other brokers. Additionally, fees implied with these processes are much higher (Relatively).

Payment options

FXCM enables the following payment methods:

- Bank Wire Transfer

- Credit/Debit Card

- Skrill

- Neteller

Withdrawal Process

FXCM requires a flat fee of $40 for any bank wire transfer withdrawal – it is non-negotiable, even if you only have $25 in your account.

Education and resources

Score: 8.5/10

FXCM thrives in the education and resources section. You can find their educational/guide-based section here – they offer new up to date guides, that are more advanced than most brokers.

Customer Service

Score: 8/10

While FXCM doesn’t offer 24/7 customer service, it does offer professional and fairly helpful advice and assistance. It’s amongst some of the more knowledgable customer service wings that we’ve seen.

Mobile Trading

Score: 7.5/10

FXCM not only offers its own proprietary mobile trading platform, Think Station, it also offers direct integration with MetaTrader4, an industry mobile trading standard.

Pros and Cons

Pros:

- Proprietary mobile trading platform

- Very in-depth and helpful education section

- Customer service is obviously knowledgable in the sector

- 20-year track record

Cons:

- Unclear regulatory stance, fairly unsafe from a legal perspective

- Exorbitant fees and commissions on both trading and account processes

- Limited trading pairs

- Weak security

Conclusion

Due to FXCM’s regulatory bans, lack of overall broker security, and underwhelming tradeable markets, we do not believe FXCM is the best choice in terms of brokers.

FXCM shows some strengths, such as their education section and customer service- however, when placed in general comparison and in a market with competitive brokers such as Coinbase, and because of the risks imposed because of regulatory uncertainty, we can’t find a finite reason to choose FXCM.

FAQs

What exactly happened to FXCM in 2011?

FXCM was charged for illegal broker practices in 2011 and was banned in 2011. They declared bankruptcy and were purchased by a third party financial group.

I'm in the U.S., but I can still sign up on FXCM, why is this?

The broker undergoes certain bugs such as this, delete the application and avoid it, however, as this can place you in legal troubles.

How secure is FXCM?

Our analysis of FXCM's security ended up proving extremely negative. The broker doesn't provide any extended account security, which raises some serious red flags.

What is the minimum deposit for FXCM?

There is no set minimum deposit for FXCM, however, $50 is required for the first account tier, and $2,000 is required for the standard account tier.

Is mobile trading with FXCM recommended?

As a whole, FXCM is generally not recommended, however, it does offer proprietary mobile trading technology via Trade Station. FXCM definitely outperforms mobility comapred to other brokers such as Admiral Markets.