Charles Schwab is a full-service investment brand that offers services and technology to everyone, ranging from self-directed active traders to individuals who want the help of a financial advisor.

Charles Schwab is a full-service investment brand that offers services and technology to everyone, ranging from self-directed active traders to individuals who want the help of a financial advisor.

The stockbroker has a collection of numerous platforms that are coupled with full banking capabilities. It caters to investors of all types. Beginner traders will appreciate its $0 account minimum while the $0 commission for options and stock will appeal to active traders.

Continue reading to get an in-depth look at Charles Schwab.

On this Page:

Charles Schwab Review

We have examined Charles Schwab in detail and we do not recommend it. There are other options such as the broker below which provider a better stock trading experience with the added bonus of social trading and an easy-to-use stock trading platform.

What is Charles Schwab?

Often regarded as the pioneer of today’s discount brokerage model, Charles Schwab has been in the business longer than most. It was launched in 1975 by its namesake chairman, Charles Schwab.

The stock broker is headquartered in San Francisco, California and has more than 300 locations in the United States. It is in these locations where you can meet with an advisor face to face.

According to its official website, the company runs with the aim of helping ‘People achieve better financial outcomes.’ To achieve this, Charles Schwab offers traders a full-service approach to investment, coupling the best of what technology and investors have to offer.

As a reputable brand in the business, Charles Schwab currently boasts more than $3.5 million in total client assets. The brand caters to at least 11 million active brokerage accounts, around 1.7 million participants in retirement plans as well as 1.3 million in banking accounts.

The brokerage came into existence not long after the deregulation of commission prices. At the time, the main aim was to offer much lower commissions than other brokerages in the industry. Over the years, Charles Schwab has sought to uphold this strategy.

As such, it has always regularly slashed fees on mutual funds, account fees, ETFs and lowered base commission to become one of the cheapest options in the industry.

Tradable Securities

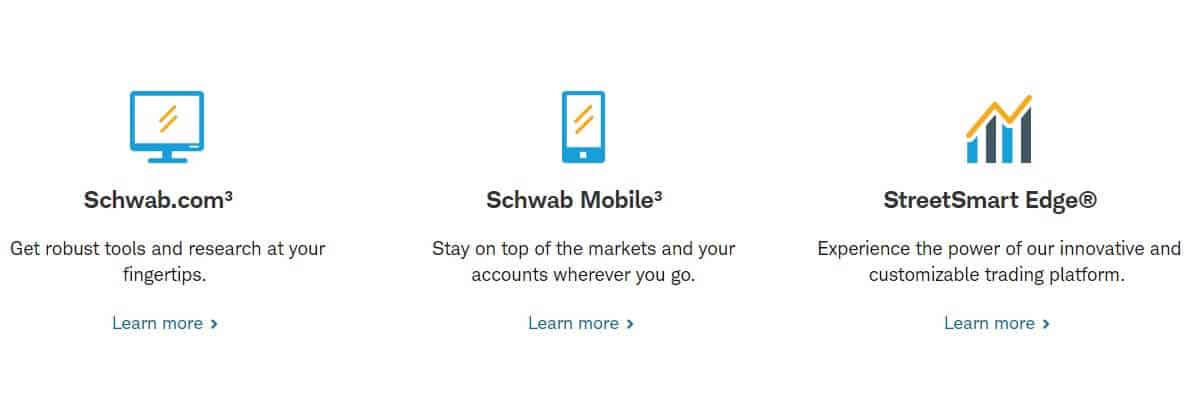

Being a full-service provider, Charles Schwab offers a wide range of services and products. These include the following: Currently, there is no support for forex trading as well as for futures trading and members must conduct trades on Charles Schwab’s StreetSmart Central platform. That means that members cannot place futures on the main site or the StreetSmart Edge platform. Through the Schwab Equity Ratings feature, you’ll get an overview of how the 3,000 US-traded stocks are performing. When checking these stocks, you’ll also see commentaries and independent analysis for each one of these stocks. Charles Schwab rubs over 300 local branch offices across the US. This is an excellent option to have in case you require face-to-face consulting with your investing needs. With this brokerage, you can find just about any asset type you think of, including options. It also offers over 300, 000 no-load, no-transaction-fee mutual funds. It offers banking that goes along with its customer’s investment account. Through its bank, you can have both checking and savings accounts as well as get home financing. This feature includes a Charles Schwab High Yield Investor account, which has no monthly fees, pays interest, has no minimum account balance and has unlimited fee rebates from ATM across the world. The bank works with Schwab’s Stock trading apps, can be linked to Apple Pay and offers mobile deposits. This is one reason why Charles Schwab is considered safe and secure. Cash on deposit with this brokerage is FDIC insured for up to $250, 000 per depositor. Investment accounts on this platform are secured by SIPC for accounts up to $500, 000 in cash and securities. If your account has at least $25,000, then you’re eligible for a face-to-face consultation, even if you are not taking part in the Schwa Intelligent Portfolios Robo advisor. This is the brokerage’s best trading platforms. Its interface is very customizable and you can set up the interface and optimize your trading plan.

Keep in mind that even though the transaction fee mutual funds on the platform is $49.965, the charge only applies for the first purchase. You’ll not incur any additional charges for selling. When it comes to its trading commissions and fees, the miscellaneous account fees on Charles Schwab are transparent and competitively priced. They are actually the lowest compare to other industry players.

Stocks Offered

Special Features

Nationwide branches

Numerous investments available

Charles Schwab Bank

Account protection

Face-to-face portfolio consultation

StreetSmart Edge

Account Fees, Commissions and Limits

Account Minimum

Charles Schwab stockbroker does not impose any account minimum amount. Your account will remain active whether you have funds or not. You can open an account with $0.

Promotions

Charles Schwab does include some offers for various user activities. These include:

- 500 trades commission-free for your first two years on the platform with a qualifying deposit of $100,000

- Referral award for any first-time member

- Receive up to $500 Charles Schwab bonus with a qualifying deposit

Account Types

Charles Schwab features five major types of accounts currently. They include the following:

- Banking - This is its High-yield Investor Checking account which is linked to your brokerage account.

- Estate and charitable planning - This account allows you to choose between a Schwab Charitable account and a Trust account.

- Retirement account- These can include the Traditional IRA, Rollover IRA and ROTH IRA.

- Automated and managed portfolios - These accounts include the Schwab Intelligent Portfolios as well as the Schwab Intelligent Portfolios Premium

- The Charles Schwab stockbroker account – This is the usual stockbroker account.

Other Charles Schwab accounts include:

- Education and custodial accounts

- Corporate brokerage account

- Joint brokerage account

Trading Platform and Technical Features

Alongside the Charles Schwab website, the brokerage offers its customer access to two primary platforms: StreetSmart Central (web-based: futures trading) and StreetSmart Edge (desktop:-based: active traders). Though each of these platforms has its pros and cons, all in all, the brokerage will satisfy most investors.

Research and Data

Charles Schwab’s research offerings are quite hard to beat and are arguably the best available from an online stockbroker. The platform offers its own equity rating, coupled with reports from Market Edge, Morningstar, Ned Davis, Credit Suisse, etc. In addition to real-time earnings reports and research reports, the brokerage offers a couple of research reports and market commentary authored by its in-house experts. It also offers a quarterly magazine free of charge.

Its investment screeners are simple to use and enable you to save your screens. Select Lists, like those of ETFs, are analyzed and compiled by the brand’s experts and released quarterly to offer you a pre-screened selection of ETFs and mutual funds. The funds on this list are divided by category. As such, you can easily view the brand’s pick, for example, the best large-cap stock mutual funds.

The brokerage is also integrated with Google's assistant. This means you can ask Google for stock quotes, general market news and much more. Charles Schwab has an Amazon Alexa skill that offers similar information and data, including the ability to build and get updates on a watch list.

Cashier Options

The options you’ll have to fund your account include:

How to Trade on Charles Schwab

1. Open an account

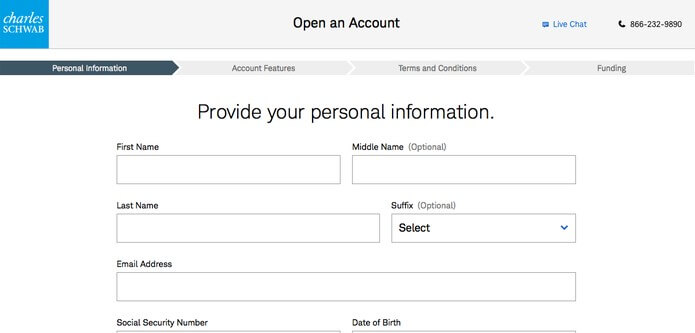

Charles Schwab signup is easy and straightforward and can be completed on phone on the Schwab app, online or in one of the physical branches. After this, choose your account type.

2. Complete your profile

You’ll need to provide basic information such as your full name, country of residence and email. After completing your profile, you’ll need to select your preferred account type.

3. Fund your account

Once you’re done with the application process, you can fund your account and begin investing.

Ease of Use

The platform is good for both newbies as it is for experienced and active investors. The standard site is very easy to use, and navigation has been cleaned up considerably. Getting started with the StreetSmart platforms might need some additional education, but these tools are easy to use once you’re familiar with their potential.

Customer Service

Discount brokers can give cutthroat commission prices because they get rid of the expenses associated with traditional brokerages. But top-notch brokerages still offer all the customer support you may need, whether online, via a branch office or over the phone.

Charles Schwab offers 24/7 customer service over the phone and a majority of discount brokers do. But thanks to the platform’s vast brick-and-mortar branch network, users can also get help in person at branches scattered across the U.S. The brokerage has over 340 offices in 46 states, so the vast majority of Americans live within a short distance of one of its branches.

Security & Regulation

For security purposes, Charles Schwab employs 2FA. During your initial login, you’ll be asked to register the device. You will receive a code via email, text or phone. From here onwards, you’ll only need your login ID and password to access your account.

Schwab is under SIPC and FDIC, both of which protect funds from any unauthorized access. They limit the number of employees who can access any individual user’s information.

The brokerage is also regulated by the FCA and SEC. Therefore, you can be assured that your funds and information are safe and secure. This is because the platform has the security of regulatory oversight.

Supported Countries and Languages

Charles Schwab stockbroker is available internationally for people who want to buy stocks on foreign markets. Currently, the brokerage supports stock trading in more than 30 global markets.

For you to access this functionality, you need to register for a Schwab Global account. Once you do that, you’ll be able to access online stocks trading in 12 of the leading foreign markets. Each of these will include real-time quotes when trading during market hours. This service is available in countries like:

When it comes to languages supported, Charles Schwab supports English and Chinese at the moment and also provides some documentation in Spanish.

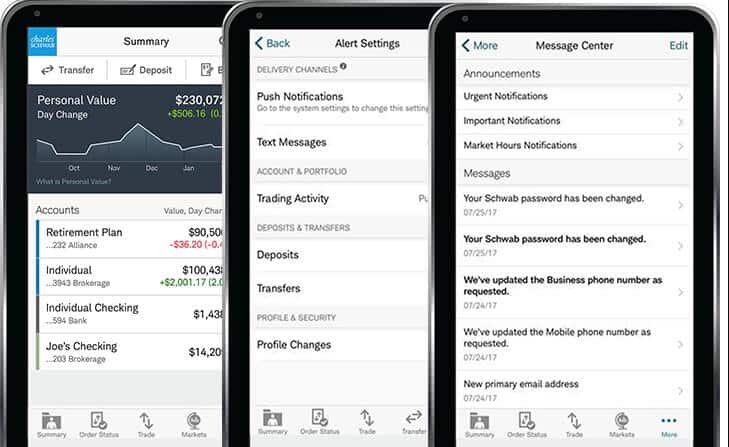

Mobile Trading

Investors using Charles Schwab can perform all of their transactions on the brand’s mobile app. This well-designed and easy to use app can be installed on iPhones, Android, iPads and Apple watch devices. In addition to making transactions, the app provides real-time information as well as updated research data on everything investors in the platform need to know.

Pros and Cons

Pros:

- Large fund section

- Mobile web platforms, as well as the mobile native app, offer the same functionality

- Advanced options tools

- Extensive research

Cons:

- Some features are divided among different platforms

- Low default cash sweep rate

Conclusion

Charles Schwab is an excellent and reliable stockbroker. But like other discount brokerage brands, it has its strengths and weaknesses.

Among its most significant highlights are its $0 minimum balance and low account fee. Charles Schwab is a versatile option for newbies and active traders alike and has the extensive research facilities they need.

FAQs

Is Charles Schwab licensed?

Yes. The brokerage is licensed and regulated by government authorities.

How can I deposit money to my Schwab account?

You can deposit money in two ways. You can do a bank transfer or transfer from another brokerage account.

Where is Charles Schwab based?

The brokerage is based in San Francisco, California. It also has over 340 physical branches across the US.

What is the minimum account balance required at Charles Schwab?

The brokerage does not impose a minimum account balance requirement.

Does Charles Schwab offer a demo trading account?

Unfortunately, Charles Schwab doesn’t offer a demo account.