We have carried out an in-depth review of Worldmarkets.com and found that this broker is recommendable and legit. This brokerage firm has made a name for itself with its essential bullion trading service as well as other unique trading operations and features. As a result, the broker provides a great variety of markets and products.

In this review, we will offer a concise overview of World Markets including markets and products, trading features, trading platforms, account types, pros and cons and more.

What is World Markets?

Founded in 2003, World Markets is an industry-leading brokerage specializing in the Bullion (Gold/Silver) and digital gold trading. Though the company was initially launched as a precious metals dealer, Worldmarkets.com has expanded its business to provide online trading services that include currency pairs, stocks, indices, commodities, and cryptocurrencies. World Markets has more than 50,000 clients worldwide and more than 30M assets under management. The broker also takes pride in its AI trading system that has an average monthly performance of 21.67%.

Worldmarkets.com provides a selection of online products through its partnerships with HYCM, a regulated broker since 1977 and Bitmex, one of the largest cryptocurrency exchanges in the world. The broker is also offering Artificial Intelligence managed account that allows traders to connect with top algorithms and trading of Security Tokens same as other brokers such as UFX.

The broker has registered offices in Norway, China, Switzerland, Iceland and additional representative offices in Bahrain and Panama.

Markets and Products

Worldmarkets.com offers a unique selection of markets and products that differentiate its services from competitors in the industry. The broker offers the Artificial Intelligence (AI) managed account powered by Microsoft AI software and also offers a diverse variety of bullion products including gold, silver, platinum, palladium, copper, and rhodium. Furthermore, the broker provides the option to trade gold digitally.

When it comes to online trading, Worldmarkets.com directs its traders to HYCM, highly regulated broker by FCA, CySEC, and CIMA that is operating since 1977. This partnership allows traders to trade a variety of products through HYCM’s platform including currency pairs, stocks, indices, commodities (CFDs), and cryptocurrencies.

The broker also provides cryptocurrency trading through BitMex, one of the largest cryptocurrency exchanges in the world, and the ability to trade Security Tokens (STOs) through DX.Exchange.

Trading Features

World Markets efforts to provide clients with the most robust set of trading features and tools. The broker offers traders trading features to improve their trading experience. Those include:

➡️ Automated Trading Account

The Artificial Managed account is the top feature offered by World Markets, offering an automated trading account utilized by advanced algorithms that allegedly scan the market and identify successful trading opportunities.

➡️ Safety Measurements

With the increasing risk of hacking attacks, World Markets offers 2-Factor Authentication, and military-grade encryption to prevent any account access breaches. The company also follows all security measures when it comes to clients’ safety of funds – All funds are held with Tier-1 Liquidity Providers and Banks to ensure the highest levels of security for clients.

➡️ Performance Statistics and Data

It seems that World Markets’ model includes an analysis of its AI managed account performance. The broker uses strict risk management settings to ensure only the trades with the highest win percentage likelihood are executed and provides clients with relevant data.

Trading Platforms

As previously mentioned, traders with World Markets can choose to trade on multiple platforms. The broker offers the in-house MQL Copy Trader for traders who choose to trade through the AI managed trading account and the MetaTrader 4 and MetaTrader 5 for traders who prefer the self-trading account via HYCM.

Take note that MetaTrader 4 and MetaTrader 5 are compatible with Windows, Mac, and on any web-browser. With these platforms, you can also activate your trading account from a mobile trading application that is available on the App Store and Google Play. MetaTrader 4 is one of the most popular online trading platforms in the market, equipped with features, such as enhanced charting package, automated trading (Expert Advisors) and a selection of 85 trading indicators. The broker also supports the MetaTrader 5, which is the new version of MT4 and has optimized trading tools including built-in indicators, a built-in economic calendar, and advanced trading features.

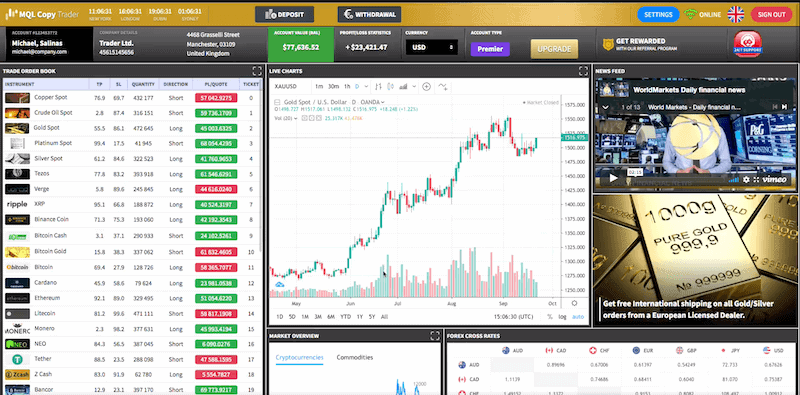

World Markets Trading Dashboard – MQL Copy Trader

For clients who choose to trade through the AI Managed account, World Markets provides the MQL Copy Trader that allows you to view and track your trading account anytime you wish. The AI managed account claims to use high-frequency algorithms that automatically scan the market and identify trading opportunities.

The MQL Copy Trader is a solid trading platform where you can get real-time and quick access to all sorts of data including your account balance, live charts, market data, and news feed.

To take advantage of the self-trading account on the platform, traders are being directed to HYCM, one of the leading CFD and forex brokers in the industry. Similarly to other CFD brokers such as Markets.com, HYCM provides the MetaTrader 4 and MetaTrader5, two of the most widely used electronic trading platforms in the online trading market.

Supported Countries

World Markets accepts clients from any country except the following: the United States of America, Austria, Belgium, Cuba, North Korea, Syria, Iran, Libya, Somalia, Sudan, Myanmar, Yemen, or Russia.

Fees and Commissions

The broker states on its website that there are no upfront fees associated with any World Markets trading accounts, including AI Managed Accounts, as well as Digital Gold and other advanced trading instruments.

The broker, however, does disclose the pricing structure for the AI managed account:

Standard Accounts are charged a 20% performance fee and a 1% Annual Management Fee.

Gold Premier Accounts ($25,000+) are charged 10% Performance Fee and 1% Annual Management Fee.

The broker operates also the High Watermark principle to ensure that traders do not pay performance-based fees repeatedly and the accounts are only subject to fees on net profits.

Minimum Deposit

The minimum deposit at World Markets varies depending on your account type and the plan you choose. The minimum deposit for the AI managed account is $2500. For the HYCM online trading account, the minimum deposit requirement is as low as $100.

Account Types

World Markets platform offers different types of trading accounts including:

AI Managed account

The AI Managed Account allows traders to connect with top algorithms used to trade millions of dollars while being directly supervised by World Markets’ analysts. The broker claims to have generated impressive trading profits for its clients. Traders can track the trading performance through the MQL trading dashboard.

Self-Trading account (HYCM)

Unlike the AI managed account, for traders who would like to take control of their trading activity, World Markets provides a self-trading account through HYCM that offers three types of trading accounts: Fixed, Classic Raw and VIP account.

Cryptocurrency account (BitMex)

Another option is to trade through BitMex, one of the leading cryptocurrency exchanges in the world. BitMex allows traders to trade cryptocurrencies with leverage including exotics crypto coins.

Regulation

Though World Markets regulatory framework is unclear, the company is transparent about the risks involved with online trading and ensures traders’ safety measurements. All funds are being held with Tier-1 liquidity providers and Banks to ensure traders’ safety of funds. For the self-trading account, World Markets allows traders to connect with HYCM, which is regulated by Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC) and, CIMA.

Deposits and Withdrawals

There is an extensive list of payment methods for World Markets accounts. Those include:

- Wire Transfer

- Visa

- MasterCard

- Bitcoin

- Ethereum

- Skrill

- WebMoney

World Markets does not charge any deposit and withdrawals fees besides credit card transactions and traders are eligible for six withdrawals per 12 months period.

Note that you can view your account balance in in EUR, USD, AUD, CAD, SGD, HKD, or BTC.

Education

Worldmarkets.com has a useful section for educational resources that includes a huge VOD library categorized into the following topics: Basic Forex Education, Fibonacci, Understanding Candlesticks, Chart Formation Patterns, Forex Indicators, Timing in Forex, MetaTrader4, and Cryptocurrencies.

In addition, the broker provides traders with daily financial news videos from the World Market analyst team on the brokers’ website and the MQL Copy trading dashboard.

Customer Service

Worldmarkets.com customer service is great. You can reach them in several ways including email, submit a ticket form, and phone. The broker provides phone numbers worldwide in 43 countries.

Worldmarkets.com customer service is available 24 hours a day from Sunday 21:00 GMT to Friday 21:00 GMT.

World Markets Pros and Cons

Pros:

Cons:

- No mobile Apple/Android app available for AI trading

- Cannot accept credit card deposits/ withdrawals

- No demo account

Conclusion

Over the years, World Markets has won numerous awards from various industry agencies. The company offers unusual products including the AI managed account and the physical bullion trading, making it one of the most diverse brokers in the industry. The partnership with industry-leading brokers, exchanges and data providers also makes this broker a legitimate choice for all types of traders. The broker has put a lot of effort into developing a great trading system along with excellent customer service.

World Markets is an excellent platform for traders who wish to use the automated trading system as well as for DIY investors who just need a reliable connection to the online trading market. Following our investigation, we can conclude that this broker is a legitimate choice for all types of traders.

FAQs

Where is World Markets based?

World Markets has registered offices in Norway, China, Switzerland, Iceland and additional representative offices in Bahrain and Panama. The broker has vault metals storage in Bangkok, Hong Kong, London, New York, Singapore, Toronto, and Zurich.

World Markets - Is it a scam broker?

No, World Markets is not a scam broker. Following our review, it appears to be a legit and reliable online trading broker. The broker is the winner of multiple global financial awards and is transparent about its trading and financial operation.

Does World Markets provide a mobile app?

Yes, World Markets offers its in house MQL trading dashboard that is compatible for all mobile devices and tablets including Apple and Android. The broker also provides MetaTrader4 and MetaTrader5 which is available as a desktop and mobile application.

How do I open an account with World Markets?

There are several ways to open an account with World Markets. In order to open an AI managed trading account, you can simply visit the broker's website and click the Open Account button on the top right corner of the screen. Then, you'll have to choose one of the selected accounts: Trial, Standard, or Gold Premium. You need to fill up the registration form and submit the necessary documentation used to verify your identity.