We have put it to the test by testing their platform, pros, cons, etc. Read our full review to find out all you need to know about this broker.

On this Page:

What is Markets.com?

Markets.com is a forex and CFD broker operated by Tradetech Markets (Australia) Pty Ltd, which is owned by TradeTech Markets Limited and is a subsidiary of Playtech PLC, a company traded on the London Stock Exchange’s Main Market under the symbol PTEC and a constituent of the FTSE 250 index.

Markets.com was founded in 2010 in the United Kingdom and is one of the fastest growing CFD providers in the world. The broker has achieved the necessary technology, service, and regulation to offer top-notch online trading environment.

Markets.com has offices in Europe, Australia, and Africa and is regulated by CySEC, FSCA, and ASIC.

Markets.com Financial Assets and Products

Score: 10/10

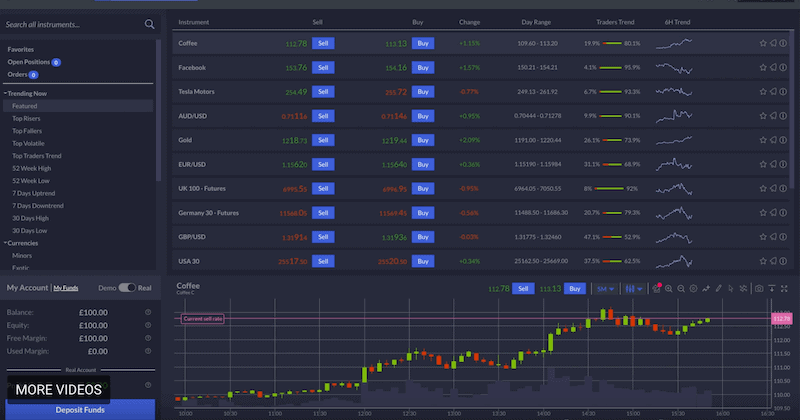

Markets.com offers traders an overall selection of more than 2200 instruments across 9 markets. The broker provides and the essential products as well as unique products such as Blends and IPOs. Among some of their products, you can find such as the cannabis blend, the Warren Buffet blend, and the Brexit losers blend.

- Forex – 67 currency pairs.

- Indices – 20+ global indices.

- Commodities – 25 global commodities.

- Stocks (shares) – 2,000 stocks in different exchanges across the globe.

- Cryptocurrencies – 6 crypto coins. Bitcoin, Ethereum, DASH, Bitcoin Cash, Litecoin, and Ripple.

- Bonds – 4 basic income assets

- Exchange Traded Funds (ETF’s) – 40+

- Blends (baskets similar to EFTs and Indices) – 17 blends

- IPOs

Markets.com Special Features

Score: 9/10

There are some unique trading features offered by Markets.com. Those include the market consensus, Markets.com traders trend, the trading central, and events and trade.

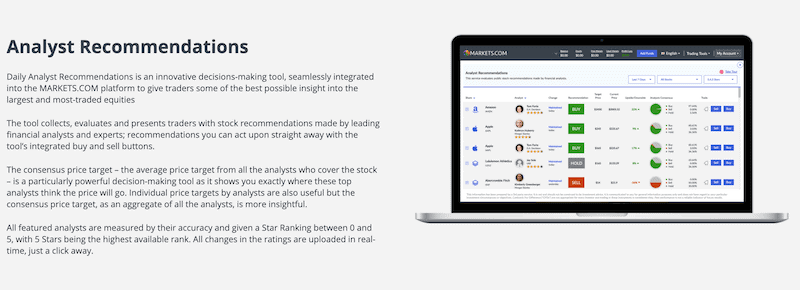

Markets Consensus – Sentiment Analysis

The market consensus and sentiment analysis offers you a financial insight for other traders’ positions and is a great decision-making tool. This Daily Analyst recommendation (DAR) tool presents traders’ and top financial analysts market sentiment in real time.

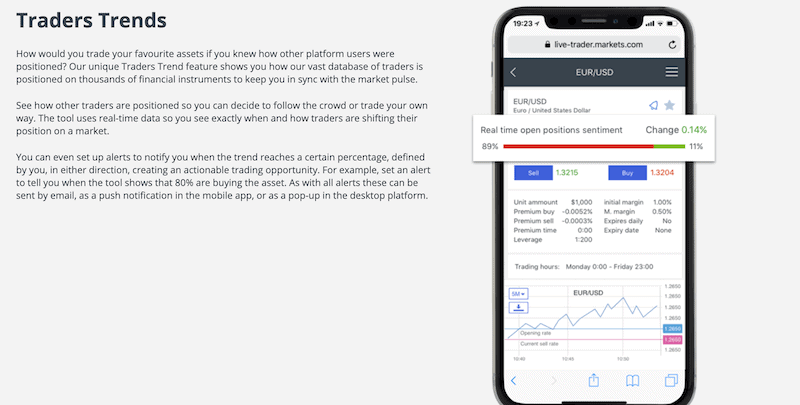

Traders Trend

The Traders Trend is a social/copy trading feature that allows you to know other traders positions and the general sentiment on a certain instrument. You can also set up alerts when a trend reaches a certain percentage. The Traders Trend uses real-time data and is a great tool to take direction at the time of trading.

Trading Central

No many forex and CFD brokers offer the Trading Central, however, for those who are keen to use technical analysis indicators to make trading decisions in the market, the Trading Central is one of the best additional features a broker can offer you.

Events and Trade

The events and trader is a unique trading tool to transact at the time of economic events and releases. Events & Trade looks much like a traditional economic calendar, with the main difference being that it automatically filters upcoming events, displaying only those that have exhibited significant statistical trends. You can get an instant analysis of the event and a certain currency pair or any other instrument.

Markest.com focuses on trading features that can help traders maximize their profit rather than useless features and tools. Overall, the broker offers excellent and unique trading tools and features.

Supported Countries

Score: 7/10

Markets.com offers its online trading services to many countries around the globe. The broker, however, does not offer its services to some of the following countries:

- United States

- Canada

- Israel

- Belgium

- Brazil

- Turkey

- Russia

- South Korea

Languages

Score: 9/10

Markets.com acknowledges the importance of supported languages, offering support in multiple languages for its website as well as for the web trading platform.

Markets.com website is available in the following languages:

- English

- Spanish

- Arabic

- Thai

- Vietnamese

Market.com web trading platform is available in 15 languages:

- English

- French

- Arabic

- Italian

- Spanish

- Dutch

- German

- Greek

- Norwegian

- Russian

- Polish

- Czech

- Danish

- Finish

- Swedish

Markets.com Trading Platforms

Score: 8/10

Markets.com offers traders a selection of three trading platform – The Markets.com award-winning trading platform which was recognized by users and professional traders as a great trading platform, the MetaTrader4, and the MetaTrader5.

Markets.com Trading Platform

Markets.com has invested thought and effort to provide one of the best web-based trading platforms. The platform is an award-winning with mostly positive user reviews and feedbacks.

Markets.com trading platform is an innovative platform with the integration of unique trading features including the daily analyst recommendation, traders trend and events, and trade. The platform is available on web browsers as well as on mobile phones. Note that you can use Markets.com ‘platform tips’ section on the website in order to understand how to use the platform, and how to use trading tools and features.

MetaTrader4 &5

In addition to the in-house Markets.com platform, the brokers also provide the option to use the MT4 and the MT5. The MetaTrader 5 is available for Mac and Windows users on desktop and can be downloaded as a mobile application.

Overall, Markets.com offers a solid selection of trading platforms with the user-friendly in-house Markets.com trading platform and the M4 and MT5 for traders who need a desktop trading platform.

Fees and Limits

Score: 8/10

Trading and Non-Trading Fees

???? Rollover/Overnight fees – Markets.com charges overnight/rollover (swaps) fees for FX and CFDs at the end of the trading day.

???? Conversion fee – Conversion fee is a small charge of 0.3% deducted for FX conversion when there is a discrepancy between the trading account currency and the quoted currency of the underlying asset.

Note that Markets.com does not charge an inactivity fee, unlike other forex brokers in the industry like Libertex and Oanda.

Deposit and Withdrawal fees

Markets.com does not charge any deposit and withdrawal fees and requires a low minimum withdrawal of 5 USD/EUR/GBP for Skrill/Neteller, 10 USD/EUR/GBP for a credit card or PayPal and 100 USD/EUR/GBP and 20 EUR within EU for bank wire transfer.

Spreads

Markets.com offers average to competitive spreads compared to other brokers in the industry like Alvexo, however, the broker does not charge any additional commission for any of the instruments.

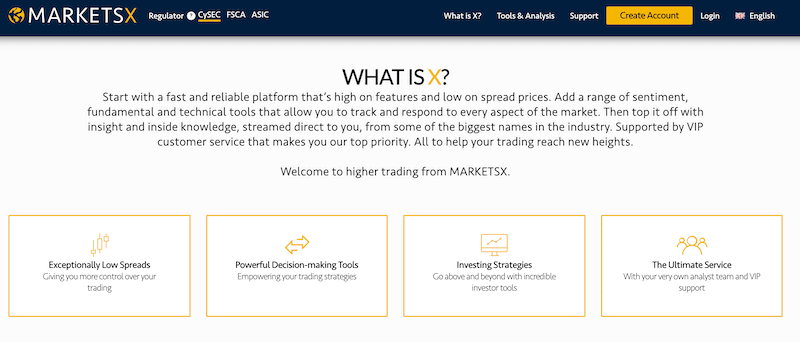

The broker also offers MarketsX targeting the high end of the retail client spectrum which provides traders extremely low spreads in addition to other great forex trading tools.

Minimum Deposit

Score: 8/10

Markets.com minimum deposit requirement is $/€/£ 100 which is an average deposit requirement compared to other brokers in the industry.

Account Types

Score: 7/10

Markets.com keeps it simple when it comes to account types. The broker offers a standard account, the GoPro account, MarketsX account, and the Islamic (swap-free) account for traders that must comply with the Sharia law.

The Standard account has a minimum deposit requirement of 100 EUR/USD/GBP through one of the trading platforms – Markets.com in house trading platform, MT4 or MT5. This is the main trading account offered by Markets.com

The GoPro suits traders with a financial portfolio of over €500k, relevant work experience in the financial sector, and traded CFDs in each of the last 4 quarters. Those are eligible for the GoPro account will not be subject to the new European leverage restrictions.

The MarketsX is an external account offered by Markets.com for high net worth traders, offering an advanced trading platform, additional features, and lower spreads.

How to Sign Up and Trade on Markets.com

Open a trading account with Markets.com can be done easily and quickly. Follow the next steps:

- Login to Markets.com website and click the ‘Register’ button on the top right corner of the screen.

- Fill in you personal or log in with your Google/Facebook account.

- Then, you can log in to to Markets.com web-based platform.

- Once you are ready to fund your account through one of the Markets.com payment methods, click the deposit fund button.

- Start trading.

How to Configure Your Markets.com Account

Markets.com provides a selection of three trading platforms – The in-house Markets.com web-based trading platform, the MetaTrader 4 and MetaTrader 5.

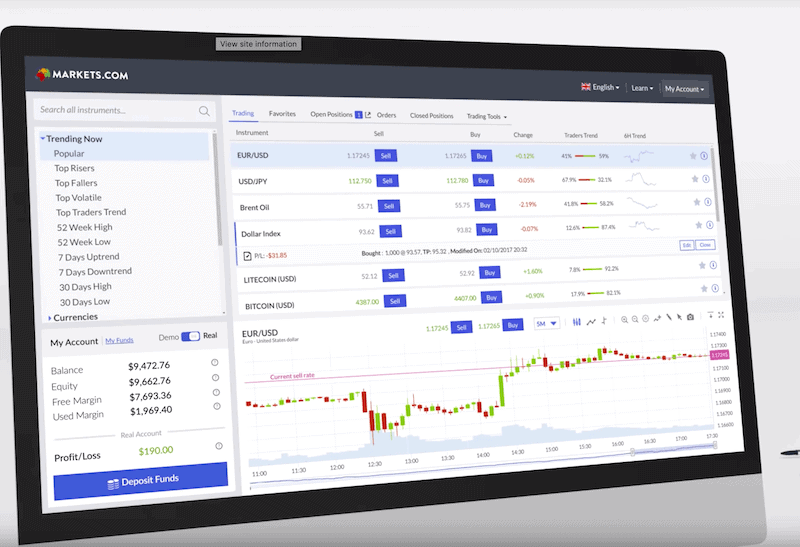

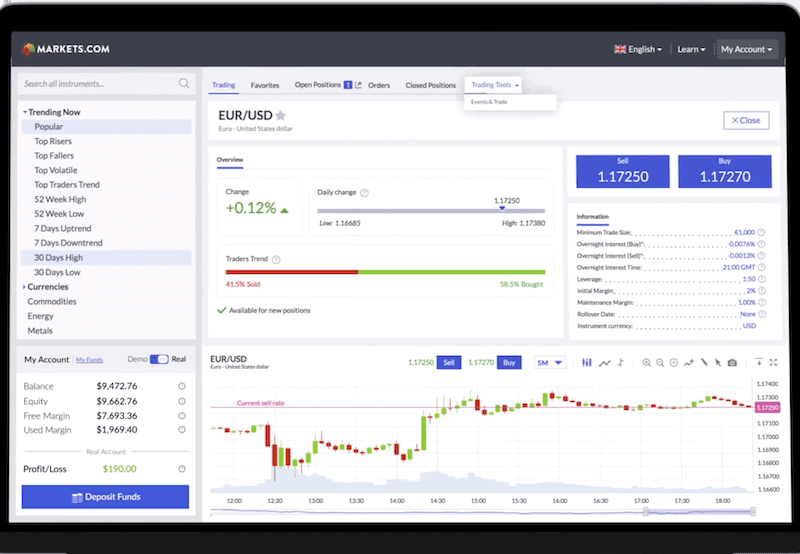

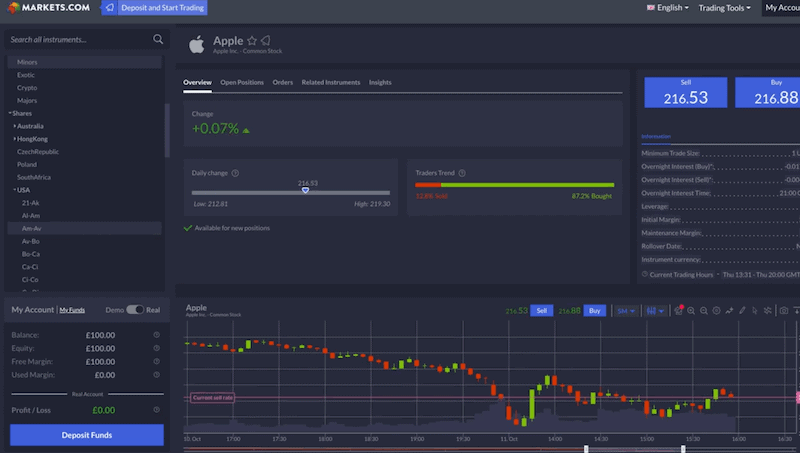

Markets.com We-Based Trading Platform

The Markets.com is a user-friendly trading platform with unique trading features and tools. Once you log in, you can see the ‘trending now’ feature on the left side of the screen that can help you analyze the market and choose an instrument to trade on. If you scroll down you can choose your preferred markets and instruments.

When you choose one of the assets, you will see the chose instrument at the center of the screen. As you can see in the image below, you have a range of information including the daily change, traders trend, open positions and orders, related instruments and insight.

Take note that you can change the platform’s color which for some people can improve the platform’s interface.

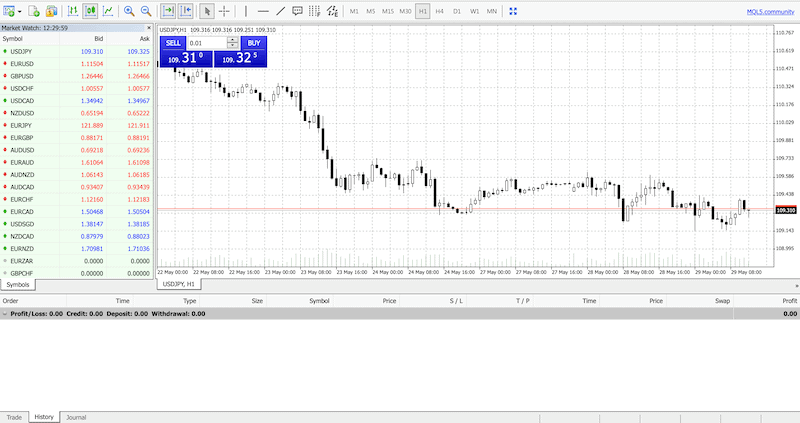

Meta Trader 4 and MetaTrader 5

MetaTrader 4 and the new version MetaTrader 5 are two of the most popular trading platforms designed especially for forex and CFD traders. Both platforms are easy to use and configure. Overall, the platforms are similar, however, the MT5 is the evolution of MT4 with additional features including more technical indicators, graphical objects, and a built-in economic calendar.

After you download the platform, you can see the MarketWatch (instruments quotes), trading charts and the terminal (positions, orders, account balance). MT4 configuration is an easy process – You can organize the MarketWatch based on your preferences and open a number of trading charts with more than 80 technical indicators.

Security and Regulation

Score: 8/10

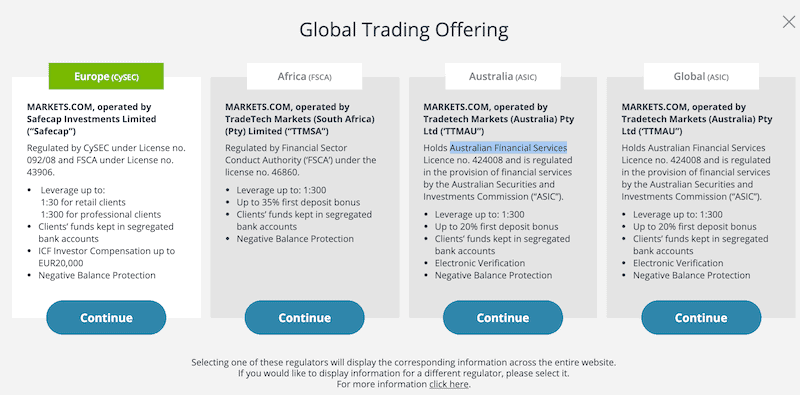

Regulation

Markets.com is operated by Safecap Investments Limited which is regulated by top regulators including the Cyprus Securities and Exchange Commission (CySEC) in Europe under License no. 092/08, by the Financial Sector Conduct Authority (‘FSCA’) under the license no. 46860 in Africa, and by the Australian Financial Services (ASIC) in Australia and globally.

Markets.com also complies with the European Securities and Markets Authority (ESMA) which limits leverage ratio to up to 1:30 for retail clients in Europe.

Security

Forex and CFD brokers like Markets.com are aware of the risk involved with cybercrime and clients’ safety of funds. Markets.com is one of the brokers offering high-technology security measurements and safety of funds. In terms of security measurements, the broker offers:

- Rigorous firewalls and Secure Sockets Layer (SSL) software is used to protect information during transmission

- All data transfers between server machines are transmitted using SSL encryption

- All financial transactions are handled by Level 1 PCI certified international payment service providers

- All trading servers are located in SAS 70 certified data centers

- All communication between Safecap Investments Limited clients and data servers is encrypted

The broker also provides traders the necessary funds’ protection by holding client funds in segregated accounts, and the investor compensation fund which provides clients to be covered by the Investor Compensation Fund for Customers of Cypriot Investment Firms (up to €20,000 per client).

Deposit and Withdrawal Process

Score: 8/10

Markets.com does not charge any deposit and withdrawal fees. The broker offers a video tutorial explaining how to fund your account.

Deposit

Market.com offers the following payment methods to fund your trading account:

- Credit card

- Wire transfer

- PayPal

- Neteller

- Skrill

- Fast Bank Transfers (Envoy/WorldPay)

- Ideal, Sofort

- Giropay

- Multibanco

Withdrawal

Markets.com also does not charge any withdrawal fees and requires a low minimum withdrawal amount:

- Credit/Debit card: minimum 10 USD/EUR/GBP

- Paypal: minimum 10 USD/EUR/GBP

- Wire Transfer: minimum

- Skrill/Neteller: minimum 5 USD/EUR/GBP

The withdrawal process can take between 2-8 days via credit card withdrawal, 2-5 days for bank wire transfer, and 2 days for an alternative payment method.

Education and Resources

Score: 9/10

Markets.com provides a great education section on the website which includes the knowledge center and the platform tips. The broker offer traders seminars, video tutorials and detailed explanation of how to use the trading platform, how to set market orders and additional tips to help traders improve their trading experience.

Markets.com also provides traders with daily news and analysis (fundamental and technical), sentiment analysis and economic calendar and an education tab in the Markets.com trading platform.

☎️Customer Service

Score: 9/10

Markets.com offers a support center that includes popular queries on various topics. The customer support is available 24-hour support 5 days a week. The broker was awarded several times for ‘best customer service’.

In addition to easily contacting the broker, Markets.com offers answers, tutorial, and webinars on relevant topics in order to help traders to set up their account, trading platform, and all the necessary trading tools.

Mobile App

Score: 9/10

Markets.com offers a mobile trading app for all trading platforms – the Markets.com in-house trading platform is available on iOS and Android and for the popular MetaTrader 4 and MetaTrader 5 is also available on the App Store and Google Play.

The Markets.com in house proprietary trading platform is easy-to-use and is one of the most advanced and innovative mobile trading applications with special trading features such as the daily analyst recommendation, traders trend and events, and trade.

Pros and Cons

Pros

- An advanced and innovative in-house trading platform

- Over 2,200 financial instruments

- Special trading tools and features such as the market consensus, Markets.com traders trend, the trading central, and events and trade.

- Good customer service

- Offers security measurements and safety of funds

- Highly regulated broker

- Offers MetaTrader 4 including automated trading and additional trading features

- No deposit/withdrawal fees and no inactivity fee

- Provides market news, analysis, and education material.

Cons

- Not available for US traders

- A low leverage ratio for the UK and European traders

- A limited selection of account types

- Average spreads

Conclusion

There are many online forex and CFD brokers offering an online trading platform, however, some are more advanced, innovative and safe than the others. Markets.com was founded in 2010 and these days is operated by Tradetech Markets (Australia) Pty Ltd, which is owned by TradeTech Markets Limited and is a subsidiary of Playtech PLC. The broker developed an innovative trading platform that includes useful trading tools and features. Markets.com fees are relatively low and the broker provides traders the necessary protection and safety of funds. In addition, the broker acquired since its foundation licenses from CySEC, FSCA, and ASIC.

Based on the result of our test of the broker, we recommend our users choose Markets.com. We also recommend eToro for both forex and cryptocurrency trading.

FAQs

What is the leverage ratio offered by Markets.com?

Markets.com leverage ratio varies depending on the region as well as the market and instrument. The maximum leverage ratio for currency pairs is 1:300 in Africa, Australia and globally. For traders in Europe and the UK, the maximum leverage is 1:30.

What is the minimum deposit to open a forex/CFD account at Markets.com?

Markets.com requires a minimum deposit of 100 USD/GBP/EUR in order to open a trading account.

Is Markets.com a regulated broker?

Markets.com is a regulated broker by the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (‘FSCA’), and by the Australian Financial Services (ASIC).

Markets.com - Is it a scam broker?

No, Markets.com was founded in 2010 and is a well-known and reputable forex and CFD broker in the industry. The broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA), and by the Australian Financial Services (ASIC). The broker also provides traders protection by offering safety of funds including investor compensation fund.

Can I use Automated Trading with Markets.com?

Yes, you can. Markets.com offers MetaTrader 4 as well as MetaTrader 5 which includes automated trading via the Expert Advisor (EA).

Is Markets.com available in the US?

No, Markets.com is not available for US traders. The broker is not regulated by the Securities and Exchange Commission (SEC).

Does Markets.com support MetaTrader4?

Yes. In addition to the in house proprietary trading platform, Markets.com supports MetaTrader 4 and MetaTrader 5 available on Mac and Windows.