The brokerage firm has made a name with its revolutionary market-making approach as well as other unique features. As a result, the platform has spread over the globe and continues to grow its trading volume to unprecedented levels.

On this Page:

In our Pepperstone review, we will offer a step-by-step tutorial for creating an account and trading on the platform. By the end of it all, you should be able to establish whether it is the right exchange broker for your trading needs. Let’s dive right in!

What is Pepperstone?

Founded in 2010 by Owen Kerr and Joe Davenport, Pepperstone is an online Forex and CFD broker that provides traders across the globe with cutting edge technology to trade the world’s markets. Since 2010, Pepperstone focus has been to change the way people trade forex.

They are driven to provide traders with incredibly low-cost pricing across all FX, CFDs and Commodities with the security of financial regulation and industry leading customer support. Pepperstone offers the best trading platforms including MetaTrader 4/5, cTrader, WebTrader and mobile apps for iPhone, Android and tablets.

Markets

Score: 9/10

Pepperstone is a forex broker with some CFDs. The largest retail foreign exchange brokers sell themselves as an ‘all-in-one trading solution’. This includes IG and CMC Markets who offer a wide range of mainstream products including:

• Share Trading

• Bonds Trading

• IPOs

Pepperstone only focuses on core award-winning products that are:

- Cryptocurrency trading: There are four cryptocurrency trading options available through Pepperstone. You will be able to trade Bitcoin, Ethereum, Dash (Digital cash), Litecoin.

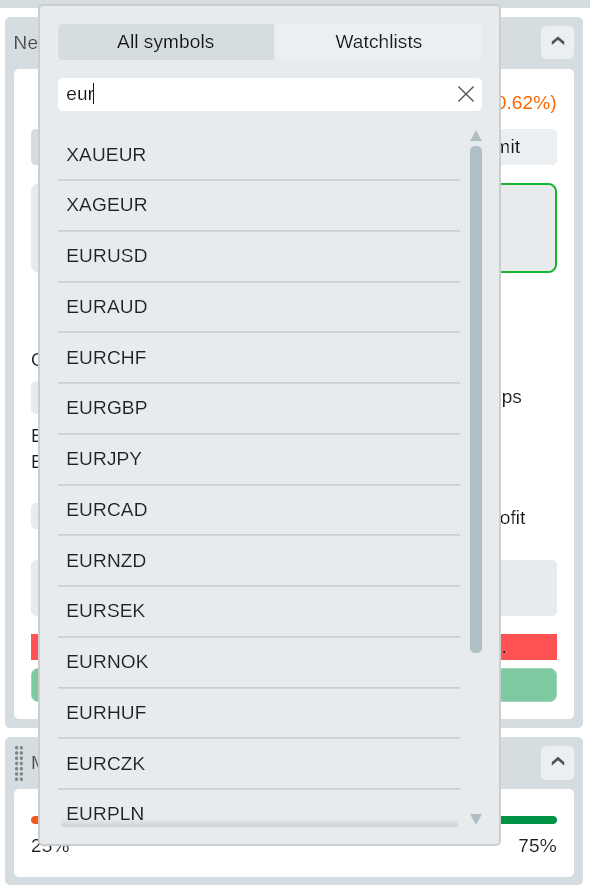

- FX Trading: There are 59 currency pairs available including the most popular currency including the United States Dollar. Other currencies include the Euro, Japanese Yen, Great Britain Pound and the Australian Dollar. Over $1.5 trillion a day worldwide is traded on Australian share trading platforms. The leverage on FXtrading is 500:1 with low spreads

- CFD Trading, Stocks, Indices: CFD trading (Contract For Difference) also known as derivative trading allows traders to speculate on the movements of financial markets. Pepperstone offer 14 indices CFD trading including the Australian 200 Index, EU Stocks 50 Index and US Tech 100 Index. CFDs are complex instruments recommended for advanced traders.

- Commodity Trading: Commodity, Energy & Precious Metal Trading. Pepperstone offer 500:1 leverage on precious metals such as Gold, Silver, Platinum and Palladium. The same leverage levels is offered across both oil and gas markets. Soft commodity markets have a 50:1 leverage and include coffee, sugar, cocoa cotton and even orange juice.

Special Features

Score: 8/10

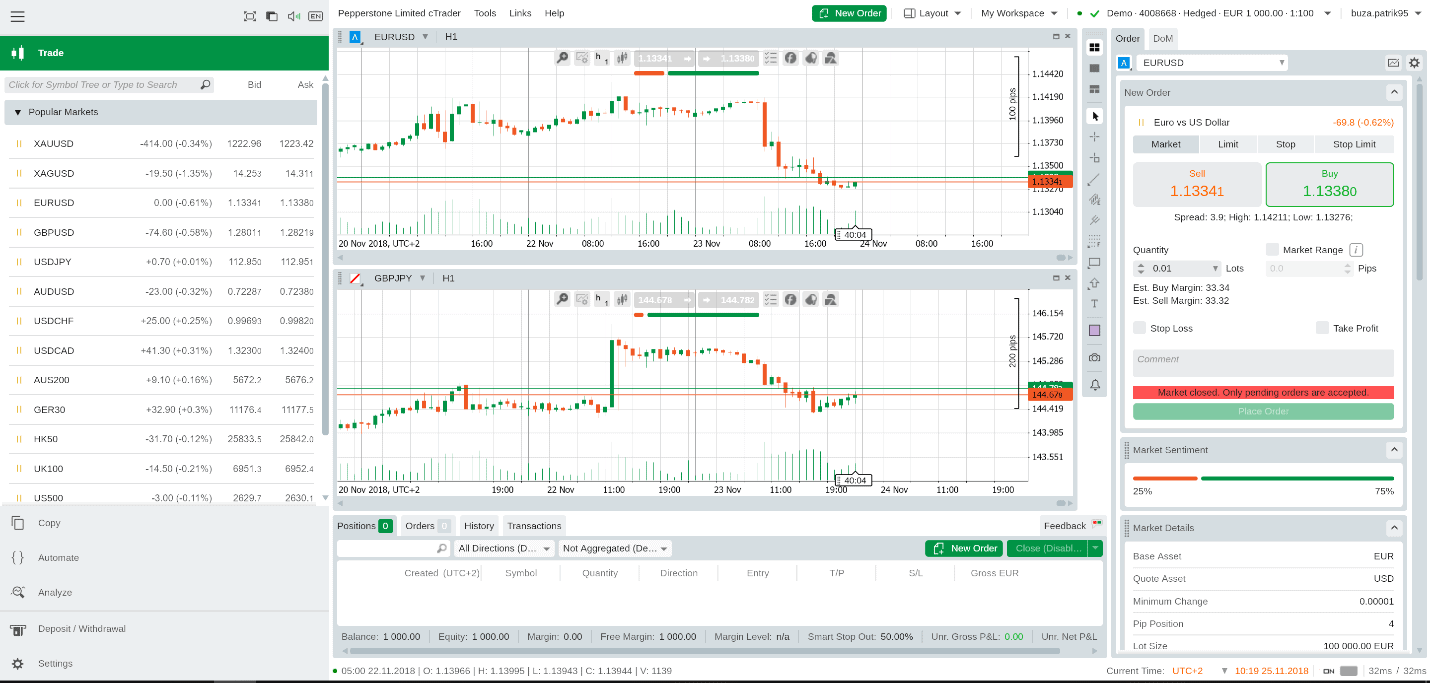

Pepperstone trading platform is user-friendly and looks nice. You will easily find the features. We also liked the customizability. You can change the panels’ size and position easily.

Pepperstone offers traders and investors features to improve theit trading experience. Those include:

➡️ Login and security

The login process is a one-step login. A two-step authentication isn’t available at the moment.

➡️ Search function

Pepperstone search function works as you would expect. There is a drop-down list on the left and you can search by typing or searching among the categorized products. It gives relevant results.

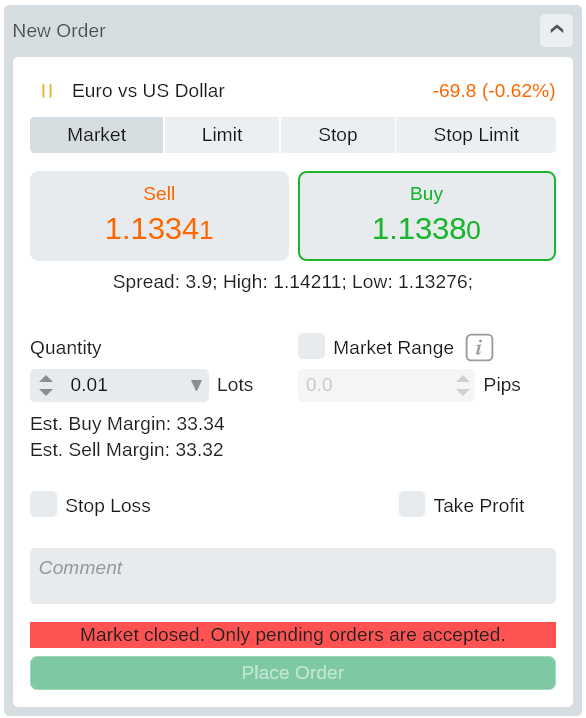

➡️ Placing orders

You can use four order types. But, you will not find very sophisticated ones, like a “one cancels the other”.

• Market

• Limit

• Stop

• Stop trailing

You can set only one order term, the good ’till date.

➡️ Alerts and notifications

You can set only price alerts and only in the form of a platform pop-up message. Order confirmation notification through SMS or push message would be useful.

➡️ Portfolio and fee reports

You can find very detailed performance report. You can see many statistics about your trades, e.g. the largest profit or the number of winning or losing trades. Also, you can see the fees you paid to the broker.

Supported Countries

Score : 5/10

Pepperstone are worldwide Australian forex brokers but due to regulatory and other local laws, there are some country where residents can’t open an account, including:

- USA

- Japan

- New Zeland

- Canada

- Zimbabwe

Languages supported

Score: 7/10

Pepperstone support is available in 8 different languages:

- English

- Spanish

- Polish

- Chinese

- Japanese

- Korean

- Vietnamese

- Arabic

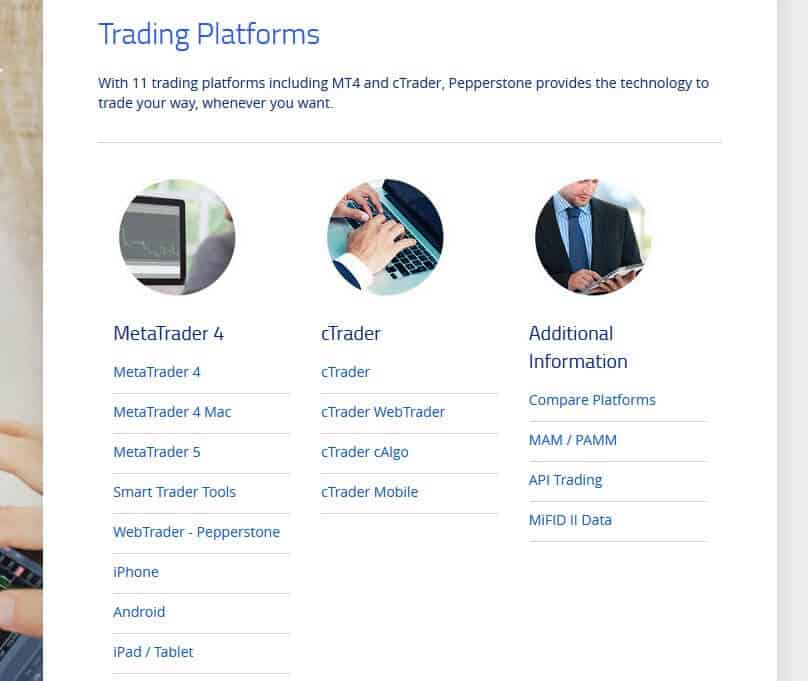

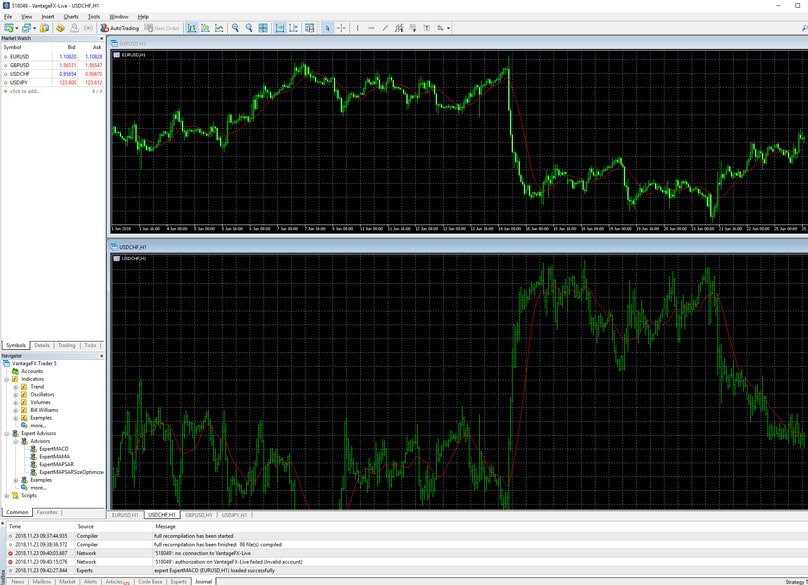

Trading Platforms

Score: 9/10

Traders with Pepperstone accounts can choose to trade using either MetaTrader 4 or cTrader. MetaTrader 4 is compatible with Windows, Mac, the Web Trader via your choice of browser, iPhone, Android, and tablets (both Android and iOS). cTrader is compatible as a WebTrader, cAlgo, or mobile. MetaTrader 4 is user-friendly and filled with features, such as enhanced charting functionality, Expert Advisors and other automated trading strategies, a Market Watch Window, a Navigator Window, your choice of order types, 85 preinstalled indicators, order execution capabilities, multiple chart setups, and analysis tools. It delivers first-class charting with unlimited charts, real-time data export, and secure trading. There is also support for MetaTrader 5, which has optimized processing speeds, 38 built-in indicators, 21 time frames, a built-in economic calendar, advanced pending orders, and the ability to hedge positions.

For trading platforms, Pepperstone offers a choice of two different types of trading platforms. They include the popular MetaTrader4 platform and the intuitive cTrader platform.

cTrader

With cTrader, you get robust trading infrastructure, lightning-fast speed, and top-tier liquidity. cTrader was designed by and for traders and has a highly customizable user-friendly interface with order management systems and enhanced charting abilities. It includes detachable charts, level II pricing, extensive backtesting facilities, automated trading via a dedicated platform, and next-generation charting techniques and user interface.

MetaTrader 4

Money Managers who use the MetaTrader 4 platform can also use Pepperstone with Multi Account Manager and Percent Allocation Management Module software via MT4. You just need to apply for access to use the system. There is also API Trading available.

Pepperstone Mobile Trading

To cater to an increasingly mobile capable population, Pepperstone has also made the MT4 and cTrader trading platforms available as mobile stock trading apps which can be downloaded from Google Play store and Apple App Store. Both these platforms have been optimized for the small trading screen of the smartphones and are fully capable of supporting many of the advanced trading features found on their desktop counterpart.

Desktop Trading Platform

Pepperstone’s cTrader platform has a desktop version. It is the same as the web trading platform.

Those who choose to trade on MetaTrader can opt for the Smart Trader Tools from Pepperstone. This package includes 10 smart trading apps that help deliver an edge. The tools help with advanced trade management and execution, sophisticated alarms, decision assistance, up-to-date market data, and more. The tools include Connect, Alarm Manager, Correlation Matrix, Correlation Trader, Excel RTD, Market Manager, Mini Terminal, Sentiment Trader, Stealth Orders, Session Map, Trade Simulator, Tick Chart Trader, Indicators, and Trade Terminal.

Pepperstone also has a section dedicated to forex news with multiple new articles every day, an economic calendar, and Technical Analysis Software powered by Autochartist.

Currency Trading Orders Types

Pepperstone offers three order types of currency trading orders. This includes a limit order and a stop loss order exits a trader after a price is reached. This can be set by price or the maximum a trader is looking to gain/lose in a trade. The final currency trading order is a trailing stop which moves with the market as price fluctuates. The trailing stop activates only when a designated level is reached.

The only type that Pepperstone doesn’t offer is guaranteed stop loss orders. This is similar are the same as a ‘stop-loss’ order but the maximum loss is guaranteed at the designate level. A stop-loss order on the other hand can lead to losses exceeding the designated level is high volatile markets leading to slippage. While guaranteed stop loss orders have increased fees, they can be an effective risk management tool for those with a low risk appetite or new to currency trading.

Fees and Limits

Score: 7/10

You can view the current spreads at any time via the Pepperstone website on the Spreads page within the section for “Forex Trading.” This is also where you will find more detailed information about commissions, when applicable. To view the swap rates, right-click on “Market Watch” from the MT4 trading platform and choose “symbols.” Select your currency pair and then “Properties.” Pepperstone has low trading fees and average non-trading fees.

Those include:

Pepperstone Fees snapshot

Equity (stocks) CFDs and ETFs fees: The fee terms for US stocks are not available. There is no inactivity fee.

Commission charged per lot: For the EUR/USD currency pair the fees are built into spread, 1.16 pips is the spread cost. The benchmark fee for EUR/USD is $17.6, while the benchmark fee for the EUR/GBP is $14.1

Financing rates. Pepperstone’s financing rates are average. EURUSD is quite high almost same as Oanda, while EURGBP is the lowest financing rate. The EUR/USD financing rate is 4.2%, and the EUR/GBP financing rate is 3.0%.

Non-trading fees and deposit, withdrawal fees. Pepperstone non-trading fees are average. There is no inactivity fee, but the withdrawal fee is quite high, especially the bank withdrawals, $20. Pepperstone do not charge any internal fees for deposits or withdrawals.

Pepperstone Spreads

During liquid times the spreads can go as low as 0 pips on the EURUSD. Spreads at Pepperstone differ depending on the financial asset. The average spreads are low, 0.5 for the West Texas Intermediate / US Dollar (XTIUSD) or high 16.76 pips for Cotton.

For Indices, there are different points for in-market hours versus outside-market hours. Also, the commissions are different for cTrader and MT4 accounts.

Overall, Pepperstone offers average spreads compared to other brokers in the industry.

Pepperstone Minimum Deposit

Score: 10/10

There is no minimum deposit on Pepperstone. Users can deposit any amount they wish.

Pepperstone Account Types

Score: 8/10

There are four main types of accounts from Pepperstone, including the Edge Standard Account, Edge Razor Account, Edge Swap-Free Account, and Edge Active Traders Account. Edge Standard Accounts have institutional grade STP spreads and $0 commissions. With this account, you get to enjoy the liquidity from 22 banks, trading via MetaTrader 4, and negative balance protection, all from an Australian-regulated firm. The interbank spreads start at just 1 pip.

Moving to an Edge Razor Account gives you $3.50 commissions and spreads from 0 pips. The spreads for this type of account are raw interbank direct pricing. The average EUR/USD spread is between 0 and 0.8 pips. The commission of $3.50 AUD is per 100,000 traded. This type of account has a minimum trade size of 0.01 lots, a maximum trade size of 100 lots, and leverage of up to 500:1. These accounts require an opening balance of $200 AUD or the equivalent with the ability to choose the following base currencies: AUD, USD, GBP, JPY, EUR, CAD, NZD, CHF, SGD, and HKD. Edge Razor Accounts also allow scalping, EAs, and hedging.

Edge Swap-Free Accounts are interest-free, have $0 commissions, and feature STP spreads. This type of account is specifically designed for traders who are unable to pay or receive swaps. The spreads are straight through processing with no swaps. There is no commission and the minimum account opening balance is $200 USD or the equivalent. Base currencies can include USD, AUD, EUR, and SGD. The average EUR/USD spread is 1 to 1.2 pips with a minimum trade size of 0.01 lots and a maximum trade size of 100 lots. It also allows EAs, scalping, and hedging. It is worth noting that if you hold a trade on this type of account for two days, Pepperstone does make an admin charge, according to the clear table of commissions on the page dedicated to this account type.

Finally, Edge Active Traders Accounts are for high volume or institutional traders. Spreads start at 0 pips, and you have to contact Pepperstone for pricing. Those who qualify for the Active Trader Program can earn cash rebates for their forex trades and save as much as 43 percent on trading commissions. The rebates depend on the volume of standard lots you trade monthly, with higher rebates for higher trading volumes. To stand out from the competition, rebates from Pepperstone are paid daily and right into your account on the day after you close the position. You can then use the rebate right away.

Active Traders also earn Qantas Points via the Qantas Frequent Flyer program, get priority client support with a dedicated account manager, enjoy complimentary VPS hosting that makes it possible to run automated strategies, and get exclusive access to various reports and insights, such as daily Autochartist signals and market analysis from Pepperstone.

There is also a demo account available from Pepperstone.

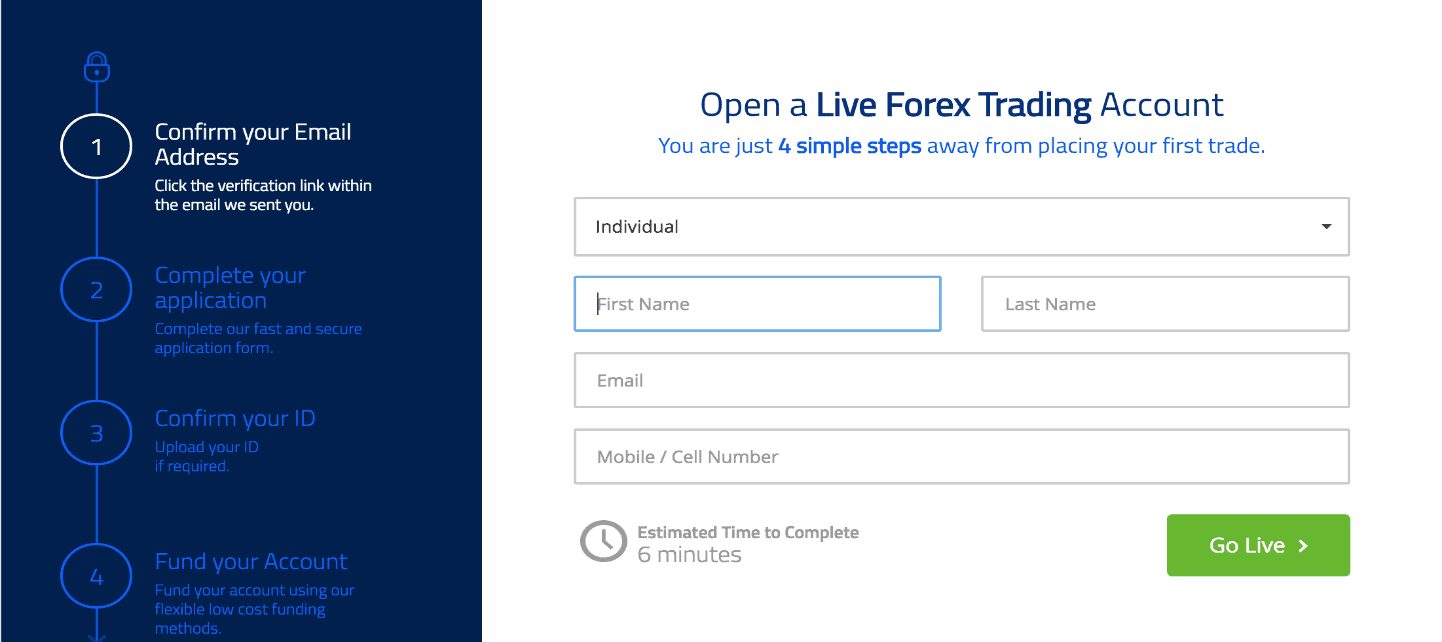

How to Sign Up and Trade on Pepperstone

<span style=”font-weight: 400;” Opening an account is straightforward after you click on the ‘visit website’ button below. You should set aside 6 minutes to complete the application assuming you have the right documentation in-front of you.

- Complete the online form that includes stating what the application type is (Individual, Company, Trust etc), name, country, phone number and provide your e-mail address.

- The following section requires more detailed personal information and the forex broker can set the limit of the leverage they want (up to 500:1). As part of this process a short survey is given to gauge the expertise of the trader.

- At this stage the forex trader needs to verify their identity your ID (most individuals use their password) and proof of address (often a utility bill). Notarised passport helps avoid the requirements of the proof of address requirements.

- Download the forex trading platform and start trading after the paperwork is processed (between a day to a week).

The live-chat, e-mail and call centre support can be of great assistance if you encounter problems especially with verification of the process.

How to Configure Your Account

Pepperstone offers one of the most popular forex and CFD trading platform, the MetaTrader 4. The MetaTrader4 was designed specifically for forex and CFD trading and therefore those instruments are most suitable for the MT4.

MT4 offers advanced trading tools including more than 80 technical analysis indicators, Web Based Platform, Expert Advisor (automated trading), MQL Programming and one-click trading.

Once you download the platform, you need to set up all the available trading tools: MarketWatch (instruments quotes), trading charts and the terminal (positions, orders, account balance).

Security and Regulation

Regulation

Pepperstone prides itself on its strong culture of compliance and regulation. To keep client funds secure, the broker keeps client accounts segregated. In Australia, this is done with the National Australia Bank. In the UK, this is with Barclays. Pepperstone also has additional professional indemnity insurance with Lloyds of London and maintains independent auditing to provide peace of mind. Pepperstone is regulated by top-tiers regulators, like the FCA in the UK.

How you are protected?

Pepperstone has two major entities. This is important for you because investor protection amount and the regulator differ from entity to entity.

For Europe the Legal Entity is Pepperstone Limited, it is regulated by FCA and the investor protection amount is GBP 50,000. Outside Europe there is no protection, the Regulator is ASIC and the Legal Entity is Pepperstone Group Limited.

XTB is highly regulated, however, you must check the regulator in your area and the protection liability for traders. If you are a trader who feels confident with a broker that is regulated with the most strict and protective terms for traders.

In terms of regulatory oversight, Pepperstone is regulated by the UK’s Financial Conduct Authority (FCA) under the FCA registration number FRN: 684312 in the UK. In Australia, it is regulated by the Australian Securities and Investment Commission (ASIC) under the registration (AFSL #414530). Both regulatory bodies are renowned for their strict enforcement of regulatory requirements as well as vigilance over the players in the financial industry. For clients based in the UK and the European Economic Area (EEA), they fall under the regulatory oversight of the FCA. Their funds are insured with Lloyds of London and are kept in tier 1 banks such as Barclays. For traders in Australia and the rest of the world, their legal interests are looked after by ASIC. Funds are also insured with Lloyds of London and are kept in leading banks in Australia such as the National Australia Bank. auditing from Ernst & Young. The client accounts are maintained with National Australia Bank. There is no compensation scheme like the FSCS in Australia.

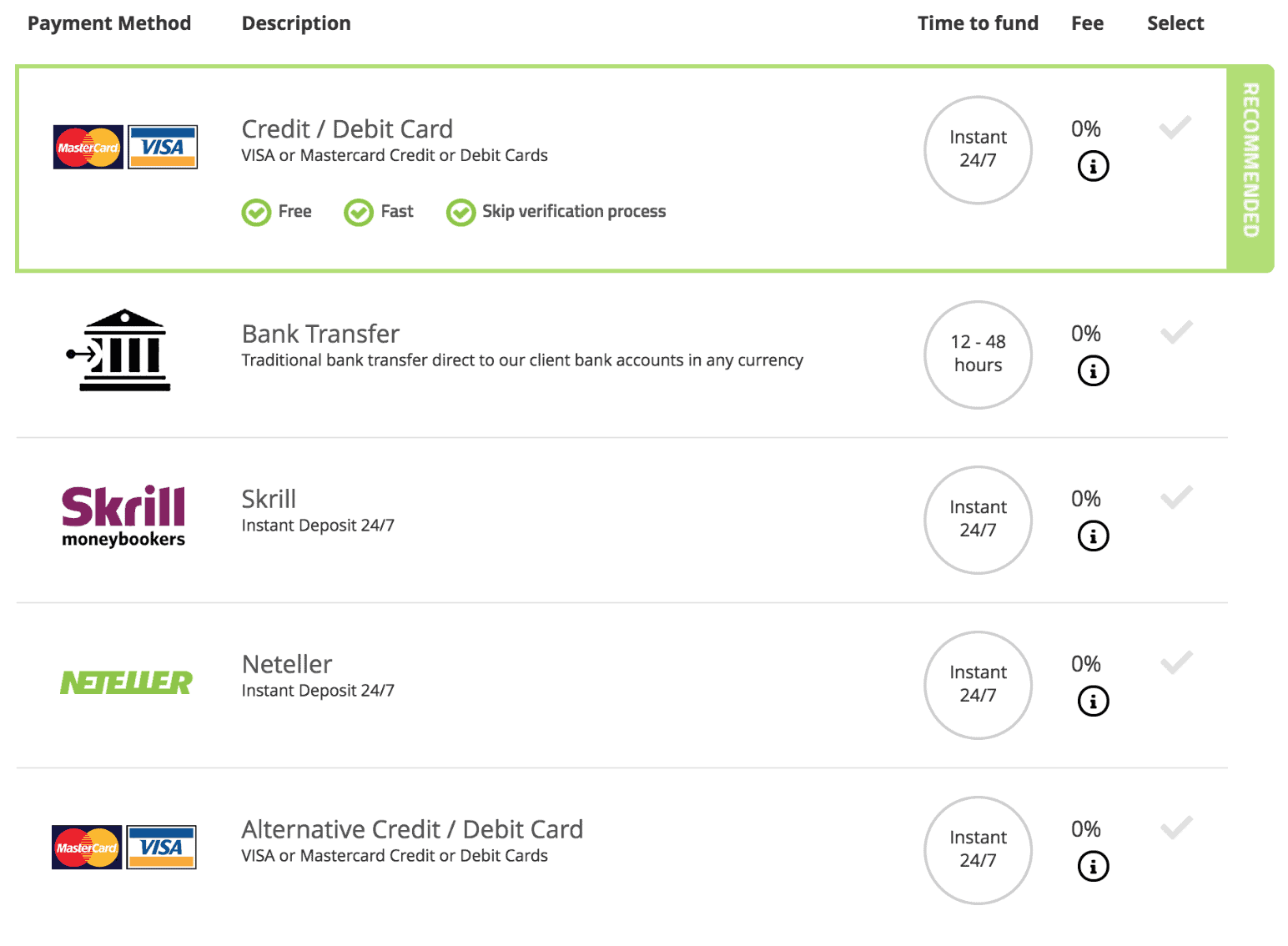

Deposit and Withdrawal Process

Score: 7/10

Deposit

You can choose among various base currencies. The base currency is the currency of your account as well as the one you use for deposits. Options include the Australian dollar (AUD), British pound sterling (GBP), United States dollar (USD), euro (EUR), Japanese yen (JPY), Canadian dollar (CAD), New Zealand dollar (NZD), Singapore dollar (SGD), Hong Kong dollar (HKD), and Swiss franc (CHF).

There is an extensive list of funding methods for Pepperstone accounts, including e-wallets and credit and debit cards. You can use Verified by Visa, MasterCard Secure Code, Visa or Mastercard, traditional domestic or international bank transfers, Skrill (Moneybookers), Neteller, Qiwi, other local funding methods, and broker-to-broker transfers. Many of these methods allow for instant funding 24/7.

Pepperstone will not charge you any fees for a deposit or withdrawal. However, your payment provider might charge you a transfer fee or a conversion fee.

Withdrawal

You can only return funds to a bank account that bears the same name as your Pepperstone account, as with deposits, due to the third-party transaction regulations. Pepperstone does not charge fees with withdrawals, but your financial institution could. If this happens, Pepperstone will pass the fee onto you in most cases, including in the case of an international telegraphic transfer fee that Pepperstone’s banking institution charges, which is usually about AUD 20. Any suggested time frames for withdrawals from Pepperstone may be lengthened by unforeseen circumstances.

Education

Score: 7/10

Pepperstone has a nice section for education, including FAQ and a glossary. You will also find informative Trading Guides on a range of topics, free webinars for all skill levels, and a section dedicated to learning to trade forex.

You can use the following tools for education:

• Demo account

• Webinars

• Educational texts

• Trading glossary

You can use demo accounts for getting familiar with the platforms. We think this is the best way to learn how Pepperstone trading platforms work. In addition, you can participate webinars and read texts from trend lines to fundamental analysis. There is even a trading glossary which helps you to understand the unfamiliar words, expressions, acronyms.

Customer Service

Score:9/10

Pepperstone customer service is great. You can reach them in many ways and you will get fast and relevant answers.

You can contact Pepperstone via:

• live chat

• phone

• email

Pepperstone customer service is available in more languages, like English, Spanish, French, and Arabic. The support person told us that often other languages may be available, but could not provide a list. Live chat works as you would expect. We did not have to wait for an operator, and we always got relevant answers. After the conversation, you can rate and comment the chat, it is easy and efficient to give feedback. Phone support is also great. An agent was connected within seconds and answered my questions in a professional and kind manner. We also liked that Pepperstone customer service is available 24 hours a day from Sunday to Friday.

The customer support team was very fast and relevant to emails as well. They replied within a few hours. Their answers were clear with relevant links attached.

Mobile App

Score: 8/10

To cater to an increasingly mobile capable population, Pepperstone has also made the MT4 and cTrader trading platforms available as mobile trading apps which can be downloaded from Google Play store and Apple App Store. Both these platforms have been optimized for the small trading screen of the smartphones and are fully capable of supporting many of the advanced trading features found on their desktop counterpart.

Is Pepperstone safe?

Pepperstone has numerous safety features in place that reinforce user confidence in the platform. Here are some of them:

Regulation

As mentioned earlier, the exchange is regulated by the FCA and ASIC and as such has the following benefits:

- Capital Reserves – in order to be in a position to handle liquidity events, regulators require that a have substantial funds in reserve. (1m GBP according to the FCA and AUD$ 1m according to ASIC)

- Segregated Bank Accounts – regulators require that a broker hold most client funds in accounts separate from those of their main operations to protect client funds in case the broker goes under.

- Background Checks for Directors – before licensing, directors and owners with any significant interest undergo stringent background checks to eliminate nefarious characters.

Other Safety Measures

- Keeping funds in top-tier banks such as National Australia Bank

- Liability insurance from Lloyds of London to cover the broker for liquidity in case of an unforeseen liability

- Independent auditing by Ernst & Young for transparency

- No dealing desk policy ensures that there are no front-runners for client orders and no one is privy to any user’s orders

Pros and Cons

- Great customer support

- Extensive opportunities to learn and trade with multiple respected trading platforms.

- Regulated platform

- Commission free trading with highly competitive spreads.

- A low-minimum deposit required to get started.

- Advanced execution technology

- Supports numerous payment options

Cons:

- Slightly limited range of trading pairs available when compared with other brokers.

- Educational materials are adequate but not as extensive as other brokers for new traders.

Why We Recommend Pepperstone

We recommend Pepperstone for a number of worthwhile reasons. For starters, the exchange was founded by experienced and trustworthy industry players. In its years of existence, it has gradually expanded its services and performance to cover users’ needs better. It is a regulated platform and therefore offers considerable safety. Furthermore, it has a wide array of trading features for both novices and pros. Though it still supports a limited number of cryptocurrencies and only offers CFD trading, it is a reliable choice thanks to fast and flawless performance. Its customer service is also exceptional and its user resource base comprehensive.

Conclusion

Overall score : 9/10

Over the years since its inception, Pepperstone has won numerous awards from various industry bodies, and it is easy to see why. The broker has put a lot of effort into facilitating user satisfaction in every conceivable way. Both its performance and quality of services are top-notch and it is versatile enough to cater to the needs of its global user base.

FAQs

Is Pepperstone regulated?

Yes. Pepperstone is regulated by 2 regulatory bodies, the FCA and ASIC.

Where is Pepperstone based?

Pepperstone is based in Melbourne Australia. Its head office is located at Level 5, 530 Collins Street, Melbourne Victoria, Australia.

How does Pepperstone make money?

Pepperstone makes its money by charging its clients a small commission or spreads on the traded executed by its clients.

Pepperstone- Is it a scam broker?

No, Pepperstone is not a scam, It is regulated by the FCA and ASIC.

How do I deposit money, withdraw money in Pepperstone?

You can deposit your funds through bank wire, credit cards and major online payment provider. You can withdraw your funds from Pepperstone though bank wire transfer, credit cards and e-wallets. Normally the method of withdrawals is through the same methods used in depositing the funds.

Is Pepperstone reliable?

Yes, Pepperstone is a reliable broker. The broker has won several awards bearing testimonials to its reliability. Pepperstone is a safe broker that abide with all the strict regulatory requirements imposed by the FCA and ASIC.

How do I open an account with Peppesrstone?

To open an account with Pepperstone, you need to fill up the registration form and submit it with all the necessary documentation used for verifying your identity.