FinmaxFX is an online CFD broker that offers hundreds of financial instruments. It primarily focuses on forex but also offers everything from equities and indices to hard metals, energies and cryptocurrencies. With a wide range of assets and generous leverage, FinmaxFX is sure to appeal to many traders, but is it the right broker for you?

In this article, we explore the ins and outs of how FinmaxFX compares with its market competitors. This includes the platform’s tradable assets, fees, spreads, regulatory standing, supported payment methods and much more. Let’s get to it.

On this Page:

What is Finmax FX?

When it comes to regulation, this broker holds licenses from the Vanuatu Securities and Exchange Commission (VSEC) and the Financial Market Relations Regulation Center (FMRRC).

FinmaxFX comes with a number of stand-out selling points. For example, you will have access to hundreds of assets via the desktop, mobile, or web-browser platform. You will also be able to trade on a commission-free basis.

Furthermore, the broker gives you fully-fledged access to MT5. This is perfect if you’re planning to advanced trading tools or trading software such as forex EAs or automated robots. There’s also a wide range of analytical and educational resources available at FinmaxFX, including online webinars.

FinmaxFX Pros and Cons

Let us now consider the top CoinsBank Pros and Cons:

Pros:

- Hundreds of financial instruments to trade

- Supports MT5

- Useful trading tools

- Lots of educational resources

- Wide range of payment methods

- Up to 1:2,000 leverage

Cons:

- High fees for some withdrawal methods

- Only holds Vanatu licence

Regulation and Trust

FinmaxFX’s proprietary license issuer is that of the VFSC, which is facilitated through its parent company Max Capital Limited. While the Vanatu licence may not be as renowned as a UK licence, it still ensures that the platform complies with global anti-money laundering laws.

This CFD broker also holds a certificate from the International Financial Market Relations Resolution Centre (IFMRRC). This means that your consumer rights are protected, that you can file a claim in the event that there’s a disagreement, and that there’s a guaranteed payout of your funds should FinmaxFX ever close or go bankrupt.

Products and Markets

FinMaxFX is a specialist CFD platform, meaning that none of its financial instruments can be purchased in the traditional sense. Instead, you will be speculating on the future value of your chosen asset. You will have access to more 500 different instruments at the platform, which is great for creating a highly diversified portfolio of assets.

This includes:

- Forex: Over 50 currency pairs, including major, minor and exotic pairs.

- Stocks: The broker offers over 180 equities, most of which are listed on either the NASDAQ or New York Stock Exchange. This means you’ll have access to the likes of Apple, IBM, Microsoft, Disney, and Ford.

- Indices: You will also be able to trade indices CFDs. This includes the S&P 500, Dow Jones, NASDAQ 100, FTSE 100, and DAX 30. Less liquid markets include the MIB in Italy, ASX 200 of Australia, and the Hang Seng of Hong Kong.

- Cryptocurrencies: If you’ve got a slightly higher appetite for risk and wish to gain exposure to cryptocurrencies, FinmaxFX has you covered. Across 12 different digital currencies, you’ll get to trade Bitcoin, Litecoin, Ripple, Stella, Ethereum, and more.

- Commodities: FinmaxFX supports a number of commodities, including but not limited to gold, oil, and natural gas.

- Bonds: You will also have the capacity to trade five different bonds. This includes 10 and 30-year US T-Bills, Euro Bunds, and Japan G.Bonds.

All in all, FinmaxFX offers more than enough markets to suit most traders.

Leverage

On the one hand, you should always tread with caution when trading on overseas forex brokers. On the other, this does mean that you are able to bypass the leverage limits imposed by the European Securities and Markets Authority (ESMA). For those unaware, this places limits on UK and European traders, depending on the asset class. This starts from 2x on cryptocurrencies and a maximum of 30x on major forex pairs.

Below we have listed the leverage limits offered by FinmaxFX.

- Forex: Up to 200x (depending on currency pair)

- Stocks: 20x

- Indices: 200x

- Cryptocurrencies: 10x

- Non-Gold Commodities: 100x

- Gold: 200x

- Bonds: 100x

Make sure play it safe when trading on leverage and only trade what you can afford to lose. While it is true you can amplify your winnings, you can do the same with your losses.

Bonus

FinMaxFX offers a welcome package to new traders. The bonus amounts to 50% of your first deposit, up to a maximum of 500 USD/EUR. In order to qualify for the bonus, you will need to open an account and verify your identity.

You will also need to deposit at least $100. An additional bonus of 25% will be applied on your second deposit. With that being said, there are some terms and conditions that you need to be made aware before opting in for the bonus.

At the forefront of this is a requirement to trade $10,000 for each $1 that you wish to cash out. Moreover, you can only withdraw profits made from your trading endeavours, and not the actual bonus amount itself.

Education and Trading Tools

FinMaxFX offers a decent number of educational resources that are tailored to the newbie investor. This includes a fully-fledged e-book that aims to introduce you to the world of online trading. There is also a terms and definitions document that explains key trading jargon.

The broker also runs regular Webinars which again, is great for those of you that are looking to build your knowledge of how the online trading arena works.

FinaxFX also offers a comprehensive research department. This covers financial news and market reviews, which is ideal if you’re looking to employ fundamental analysis. Investment strategies and technical analysis guidance is also provided to help you read and understand charting patterns.

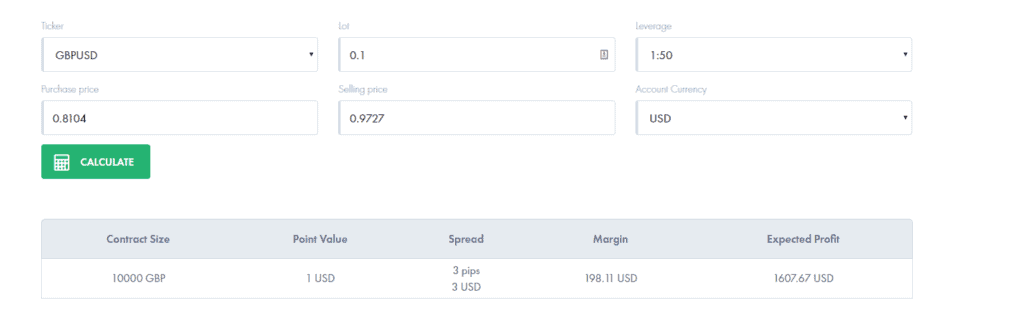

There’s also the forex trading calculator which presents an easy way to calculate how much you could potentially make from trades. Other tools include a pivot point calculator, live quotes, an economic calendar and a margin calculator.

Fees

The exact spread that you pay will ultimately depend on the type of account you have with the broker. For example, if you have a micro account your spreads will start at 3 pips. This is actually quite expensive, as there are a number of alternative brokers in the UK trading space that offers spreads from just 0.2 pips. Even if you have a VIP account – which requires a minimum deposit of $100,000 – you will pay spreads in the region of 1-2 pips.

Other fees include an inactivity fee and withdrawal fees, which range of 0.9% – 7% depending on your chosen method. If ou deposit and withdraw funds via a bank wire, as you will only need to pay a flat fee of $25 (about £20).There is no mention of trading commissions on the FinmaxFX site.

Banking

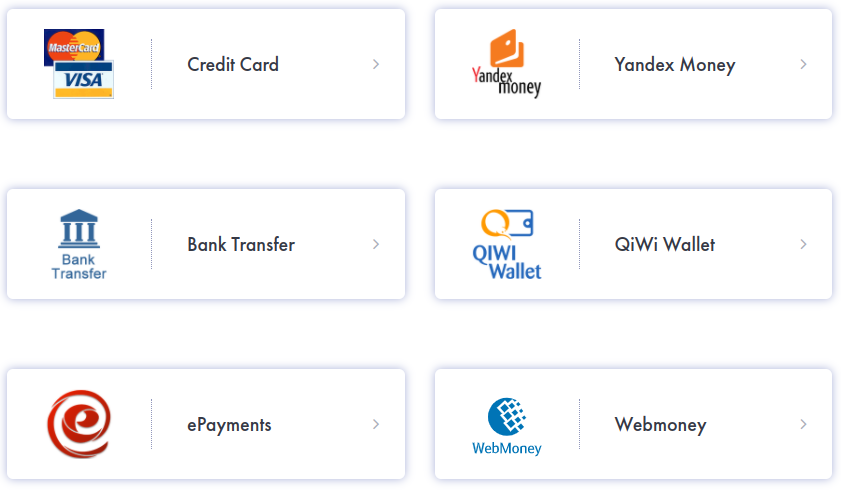

In terms of funding your account, FinMaxFX offers an impressive range of deposit and withdrawal methods.

This includes:

- Debit/Credit Cards

- Bank Transfer

- Neteller

- Skrill

- Yandex Money

- QiWi Wallet

- Webmoney

Bear in mind that you’ll have to complete a verification process before you request a withdrawal.

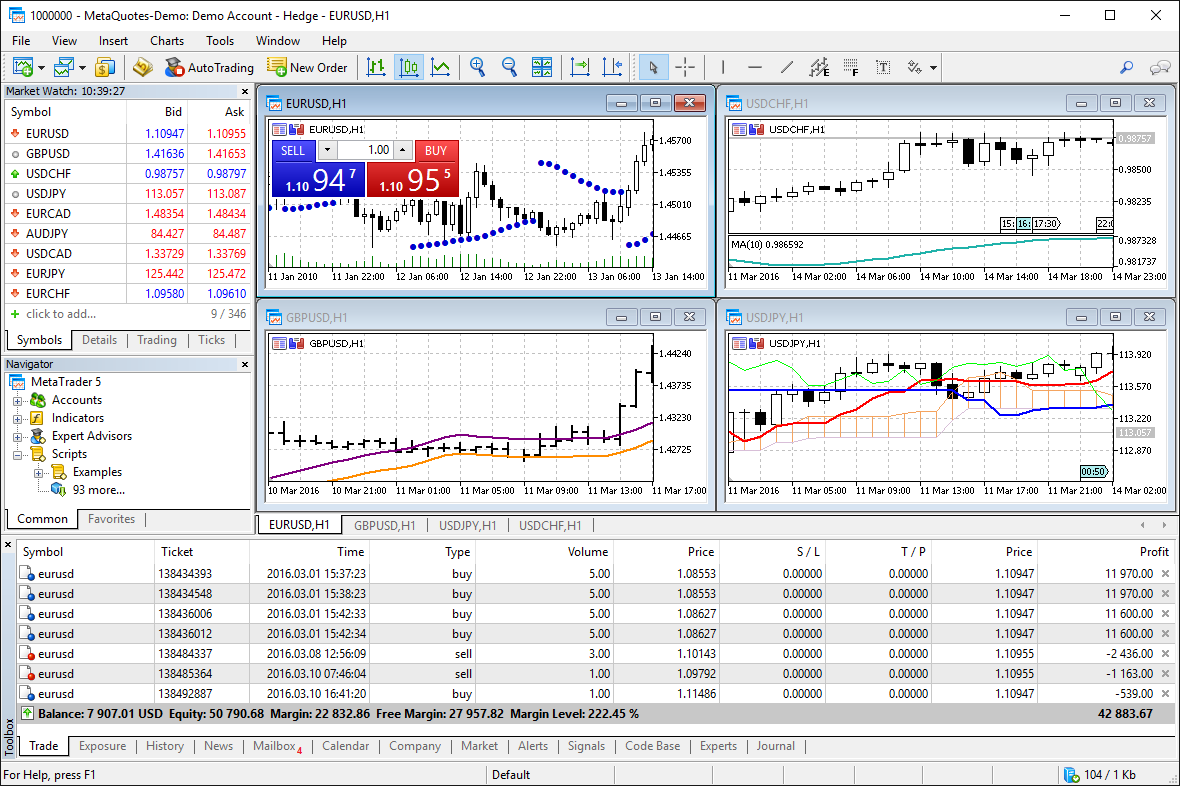

Desktop Platform

FinMaxFX offers one platform type – MetaTrader 5 (MT5). This is available to download to your desktop device, which is ideal if you are looking to deploy an automated trading robot or forex ea. For those of you that prefer to trade online, MT5 is also supported via the FinMaxFX browser-based site.

If you’re familiar with how MT5 works, then you’ll know that the platform is ideal for both newbie traders and seasoned investors. You will have access to heaps of technical indicators and advanced chart-reading tools. You will also have the option of customizing your trading screen, both on the desktop and online version.

Mobile Platform

If you’re the type of investor that likes to buy and sell financial instruments on the move, you’ll be pleased to know that FinMaxFX permits mobile trading. With that said, the broker does not offer a proprietary mobile trading app. Instead, you will be downloading the MT5 mobile app via Google Play or the Apple Store. Once you do, you will then need to link the app to your FinMaxFX account, which can be done at the click of a button.

Account Types

FinMaxFX offers five account types to choose from. The key differentiator is the minimum amount that you are required to deposit. At the lower end, the Micro account requires a minimum deposit of $250. For this, you will get spreads from 3 pips upwards. The account comes with a bonus of 30%.

The benefit of upgrading to the Mini account, which requires a minimum balance of $1,000, is that you will get access to two weekly webinars instead of one. The Standard account ,which requires a $5,000 account balance, also comes with spreads of 3 pips upwards.

You will, however, get one free withdrawal per month, alongside a 50% bonus. If you’re looking to trade larger volumes, FinMaxFX offers unlimited free withdrawals fee on both its Premium and VIP accounts.

This requires a minimum account balance of $25,000 and $100,000, respectively. The VIP account also offers a withdrawal timeframe of just 5 hours, while the other account types can take up to two days.

FinMaxFX Tutorial: How to Sign Up & Trade

If you like the sound of what FinMaxFX offers for your trading and investment goals, we are now going to show you how you can get started with an account today.

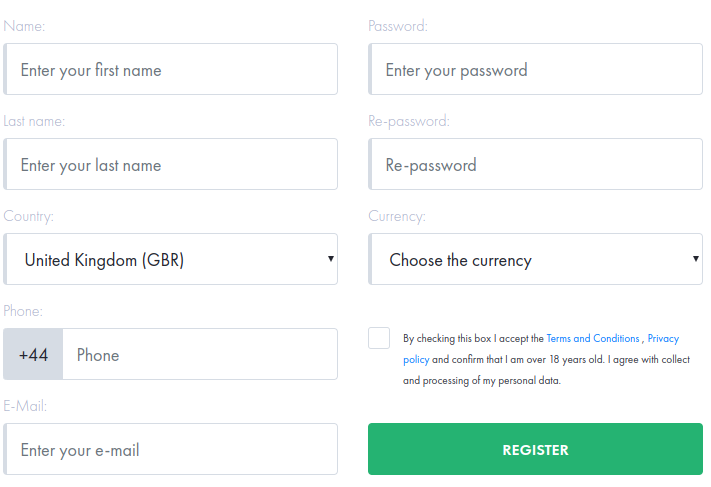

Step 1: Open an Account

To get the ball rolling, head over to the FinMaXFX website and elect to open an account. You’ll find the button at the top of the page.

You will then be asked to provide some personal information. This includes key metrics like your full name, home address, nationality, date of birth, and contact details.

Step 2: Verify Your Identity

In order to remain compliant with its license issuer, FinMaxFX will now ask you to upload some documents.

This includes:

- Government-Issued ID, such as a passport or driver’s license

- Proof of residential address, such as a bank account statement or utility bill

- If depositing with a debit/credit card, you’ll need to provide a copy of the front and back of the card

It’s best to upload the requested documents straight away, as you won’t be able to withdraw your funds out of the broker until your identity has been verified.

Step 3: Deposit Funds

You will now need to fund your FinMaxFX trading account. The minimum deposit will depend on the account type that you opt for. If you just want to start off with small amounts, the Basic account permits a minimum deposit of $250. After that, you will have the option of depositing smaller amounts.

Unless you are opting for a bank account transfer, all other payment methods are typically credited instantly.

Step 4: Choose Your Trading Platform

Once your account has been funded, you will then need to decide which trading platform you wish to use – the online, desktop software or mobile app version of MT5.

Step 5: Start Trading

And that’s it – you should now have a fully-funded FinMaxFX account and your chosen platform would be loaded-up on your screen! You can now trade your preferred financial instruments at the click of a button.

Customer Service

The customer service team at FinMaxFX works seven days per week, between the hours of 8 am and 8 pm. You can call the team directly at 0208 089-2575.

Alternatively, you can elect to have FinMaxFX call you by filling in an online contact request. The only other option that you have is to send an email to support@finmaxfx.com.

Supported Countries and Regions

It appears that most countries are supported by FinMaxFX, with a few exceptions. This includes traders from the United States, as well as countries that are listed on sanction lists.

FinxmaxFX vs Other Brokers

FinmaxFX weighs up well against other brokers in some regards, though not so well in other areas. In terms of where it could improve, fees are probably the main aspect.

While FinmaxFX offers spreads from 3 pips upwards on the basic account, the likes of IG start from 0.6 pips. In terms of withdrawals, eToro charges just $5 while FinMaxFX charges 3.5% on debit/credits and a whopping 7% on Bitcoin.

On the plus side, FinmaxFX offers an impressive range of asset classes that is one of the best on the market. There’s also the ability to trade with up to 1:200 leverage, which is far more than the limits imposed by European brokers.

While FinmaxFX may not yet be up there with the very best brokers, it’s still an attractive option and has plenty going for it. It’s also only been around since 2019, so there’s plenty of time for it to improve in the coming years.

Conclusion

In summary, FinmaxFX can be a good option if you’re looking to trade a wide range of asset classes as CFDs, if you want access to useful educational resources and trading tools, and if you don’t want to be restricted by the leverage limits imposed by European brokers. If it had lower withdrawal fees and tighter spreads than it would be up there as one of the best CFD brokers around, but it still has plenty to offer as it is.

FAQs

Can I transfer my FinmaxFX portfolio to another broker?

FinMaxFX is a specialist CFD broker, meaning that you never own the underlying asset. As such, you are unable to transfer your holdings to another broker. Instead, you will need to sell your positions, and then withdraw the cash back to your payment methods.

Can FinxmaxFX run my IRA or other retirement account?

No, FinMaxFX has no involvement with IRAs or retirement accounts. In fact, the platform does not accept US clients anyway!

Is FinmaxFX available in my country?

Apart from the US and countries that are sanctioned or deemed high-risk, FinMaxFX is available globally.

Is it cheaper to buy stocks rather than trade stock CFDs on FinmaxFX?

The only option that you have at FinMax is to trade stock CFDs, meaning that you can't purchase the underlying asset.

Can I access the same account through my phone and computer?

Yes, whether it's through the mobile, desktop, or web-based trading platform, all accounts are facilitated via MT5. This means that you can access the same account on all device types.