Your trading experience depends heavily on the features, trading platform, leverage ratio, fees, customer support and all the additional services offered by your forex broker.

Founded in 1983, City Index is one of the first CFD and forex brokers in the industry, offering traders spread-betting, contract for difference (CFDs), and forex trading through a selection of three trading platforms.

City Index is regulated by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and Monetary Authority of Singapore (MAS). The broker was acquired by GAIN Capital Holdings in 2015, a US-based investment company, trading on NYSE under GCAP ticker symbol.

On this Page:

We have put it to the test by testing their platform, pros, cons, etc and have found it not be legit. Read our full review to find out why you should stay away from this broker.

What is City Index?

Founded in 1983, City Index is one of the first online forex brokers in the industry offering forex, spread betting, and CFD trading, and allowing traders to buy and sell leveraged financial assets. City Index has over 150,000 retail traders worldwide and $978 million client assets as of 2018.

Like most European brokers, the broker executes all traders’ orders based on the market maker model rather than ECN or STP. City Index also offers online trading through the spread betting model which can be beneficial for those who are located in the UK due to tax exemptions.

City Index is based in the United Kingdom and operates additional offices in Dubai, Sydney, Shanghai, Hong Kong, and Singapore. City Index is regulated by the FCA in the United Kingdom, ASIC in Australia, and MAS in Singapore.

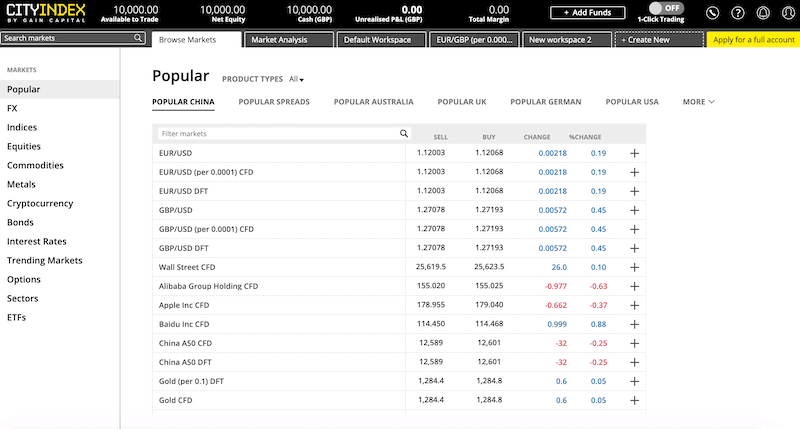

City Index Markets and Products

Score: 8/10

One of City Index’s advantages is the selection of products and markets. The broker provides more than 12,000 financial instruments in a broad range of markets although most of the offered products are shares in the UK, Australia, and Singapore.

- Forex – 84 currency pairs.

- Indices – 21 global indices.

- Commodities – 25 global commodities.

- Stocks (shares) – More than 4500 shares (stocks), mainly in the United Kingdom, Australia, and Singapore.

- Cryptocurrencies – 5 crypto coins. Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ripple.

- Bonds and interest rates – 14 bonds and interest rates.

- Options

Overall, City Index offers a wide selection of financial products divided to spread betting, CFD’s, options and futures.

City Index Special Features

Score: 6/10

Forex brokers must get the attention of traders and investors, offering the extra feature that might improve trading experience. Coinbase, for example, offers perhaps the best social/copy trading platform.

City Index provides trading features and tools for its clients including spread betting, automated trading, and real-time news from Reuters.

Automated Trading

Automated trading allows you to create a computer program that automatically sends orders to the market. Once you find a successful algorithm, following backtesting your strategy, you can operate an automatic program that creates a constant profit for you.

City Index offers traders automated trading through two of its trading platforms: The popular Meta Trader 4 and the desktop AT Pro platform.

Spread Betting

Spread betting, similarly to contract for difference, allows traders to speculate derivatives prices, with a major advantage of tax exemption for UK Capital Gains.

Market News, Technical Analysis Portal and Trading Signals

City Index offers market real-time news, the technical and fundamental analysis portal (available on AT Pro), and trading signals available on AT Pro and the Web Trader.

Supported Countries

Score: 6/10

City Index offers online CFD, spread betting, forex, and futures trading services to many countries around the world. The broker is regulated in three different jurisdictions but the main operation of City Index takes place in the United Kingdom and Australia. Take note that City Index’s services are not available for US and Canadian residents as the broker is not regulated in the United States and Canada.

Languages

Score: 5/10

Compared to other brokers in the industry City Index provides a limited selection of languages available on their site on platforms. The broker offers customer service in the following languages:

- English

- Spanish

- German

- Polish

- Arabic

- Chinese

In addition, City Index’s in-house desktop trading platform is available in the following languages: English, Arabic, German, Hungarian, Polish, Chinese, and Japanese.

For those who feel more comfortable in their native language, we recommend other brokers like Coinbase offering customer support and a trading platform in 21 different languages.

City Index Trading Platforms

Score: 7/10

City Index offers traders and investors a selection of three trading platforms: Web Trader, a web-based trading platform and as a mobile app, and the downloadable desktop trading platforms – the AT Pro and the MetaTrader4.

Web Trader

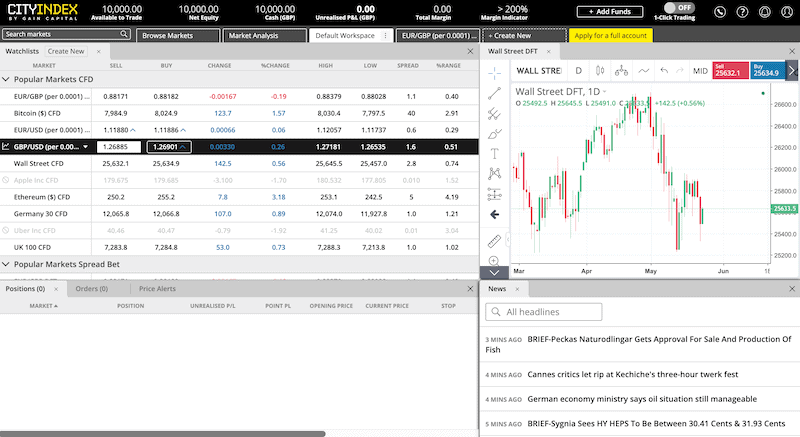

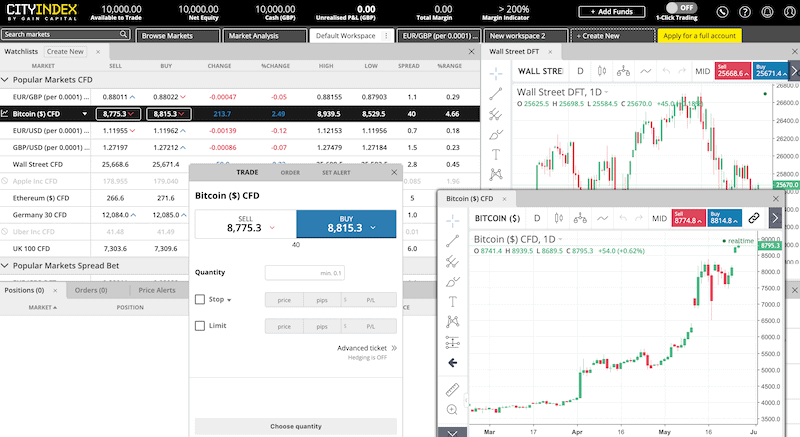

Web Trader is a web-based trading platform designed to provide traders an easy-to-use trading experience with a simple trading execution. Following our review, the first connection to City Index’s Web Trader platform is a simple process and the platform navigation is intuitive and lear. The platform provides four important windows – the Watchlist (financial instruments prices), charts, account details, and news.

On the negative side, the platform is outdated and the interface is not nice looking and modern. You will need time to master all the platform’s functions.

Overall, we do not recommend the Web Trader trading platform. For those who prefer an innovative web-based trading platform, we recommend the MT4 or other CFD brokers like Coinbase that provide one of the best web-based trading platforms.

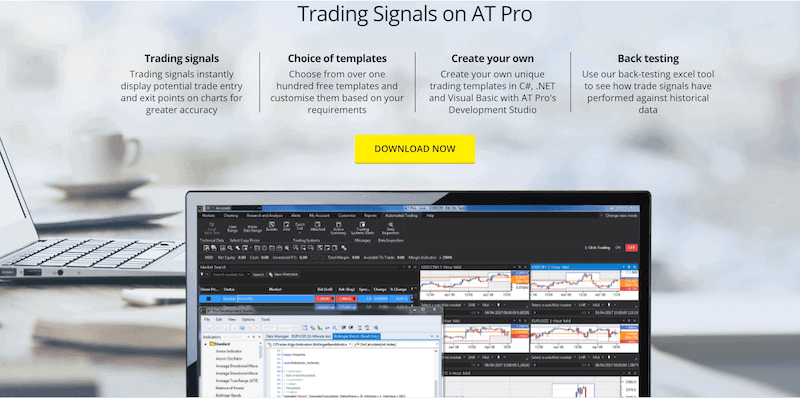

AT Pro

AT Pro is a downloadable trading platform designed for experienced traders and includes automated trading, built-in trading signals, and more than 100 technical indicators. Moreover, the AT Pro also includes an economic calendar, Real-time news from Reuters, and technical and fundamental analysis portal.

Meta Trader 4

In addition to the Web Trader and AT Pro, City Index offers the popular MetaTrader 4 trading platform. The MT4 is one of the best forex and CFD trading platforms, offering to trade with special features such as automated trading with Expert Advisors (EA), economic calendar, advanced charting package, and 80+ technical indicators.

Note that the AT Pro and Meta Trader 4 are available for traders who choose the Professional Trader account which requires financial instrument portfolio or cash deposits exceeding €500,000.

Fees and Limits

Score: 5/10

Trading and Non-Trading Fees

Rollover/Overnight fees – City Index charges overnight/rollover (swaps) fees for FX and CFDs at the end of the trading day.

Inactivity fee – City Index charges a monthly inactivity fee of £12.

Equity fee – For the UK and most European equities the charge is 0.08%, for most US equities it is 1.8CPS and for most Asian equities it is 0.2%.

Guaranteed stop loss orders – There is a charge for placing guaranteed stop loss orders upon execution.

Deposit and Withdrawal fees

City Index does not charge any deposit and withdrawal fees. You will be charged for credit card deposits by your card issuer.

Spreads

City Index offers fixed and variable spreads depending on the market you trade. City Index spreads are average compared to other brokers with spreads on MT4 are higher than other trading platforms offered by the broker and are relatively higher than the industry norm.

Overall, City Index charges high fees compared to other brokers in the industry, in particular, CFD fees, stocks fees, and inactivity fees. Spreads are competitive on the Web Trader and AT Pro but are quite high on MT4.

Minimum Deposit

Score: 7/10

City Index has no minimum deposit requirement in order to open a trading account, however, the broker recommends a minimum deposit of £100 or equivalent to cover the margin requirement of your position. Note that City Index minimum deposit can change depending on your location.

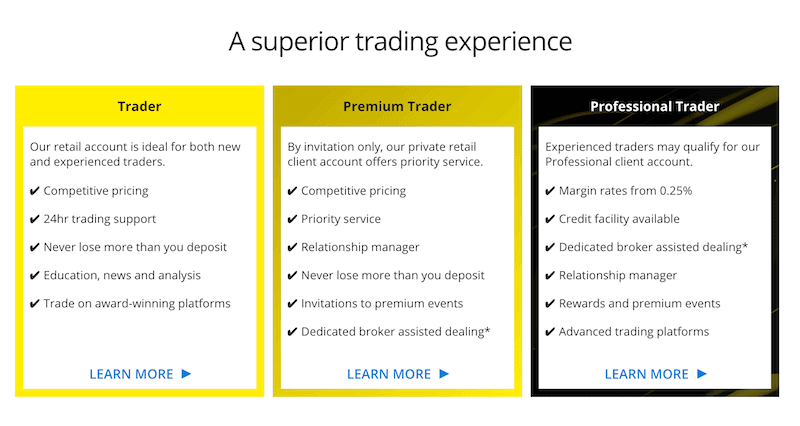

Account Types

Score: 6/10

City Index offers a selection of three account types – the Trader account, the Premium Trader account, and the Professional Trader account.

There are some difference among the three types of account, those include:

| Trader | Premium Trader | Professional Trader | |

| Negative balance protection | ✔ | ✔ | |

| Best execution | ✔ | ✔ | ✔ |

| 50% margin close out | ✔ | ✔ | ✔ |

| Dedicated relationship manager | ✔ | ✔ | |

| Priority service | ✔ | ✔ | |

| Broker assisted trading* | ✔ | ✔ | |

| Loyalty rewards | ✔ | ✔ | |

| Hospitality events | ✔ | ✔ | |

| Credit facility for qualified clients | ✔ | ||

| Increased leverage | ✔ | ||

| Minimum Deposit | £100 | £10,000 | €500,000 |

| Market access | 12,000+ markets | 12,000+ markets | 12,000+ markets |

| Platforms | Desktop & Mobile | Desktop & Mobile | Desktop & Mobile; Advanced |

| Charts | 16 HTML5 chart types | 16 HTML5 chart types | 16 HTML5 chart types |

| Trading Tools | Multiple Tools | Multiple Tools | Multiple Tools |

How to Sign Up and Trade on City Index

Open a trading account with City Index can be done in a few simple steps. Follow the next steps:

- Login to City Index’ website and click the ‘Create Account’ button on the top right corner of the screen.

- Fill in your personal details, and contact details and then click Next.

- Then, you can log in to City Index dashboard. Configure your trading platform and practice your trading strategy. Note that you can open a demo account first and fund your account once you are ready to trade.

- Fund your account through one of the City Index payment methods.

- Start trading.

How to Configure Your City Index Account

City Index offers three trading platforms – The in-house Web Trader which is a web-based trading platform, the popular MT4, and the desktop AT Pro trading platform.

Take note that you can use a demonstration account before you risk real money. Here’s how to set up the basic configuration of each of the trading platforms.

Web Trader

Once you enter the Web Trader, you can see the watchlist, account details, news, and chart. At the top, you have a choice of different tabs – browse markets, market analysis, default workspace, instrument tab, and a new workspace.

Once you enter one of the instruments, a separate chart window will pop up and as you enter the buy or sell, a new market order window will open up.

Under the browse market tab, you can add instruments into a new watchlist. Note that you can turn on the one-click trading at the top of the screen.

Meta Trader 4

MetaTrader 4 is one of the most popular and easy to use forex and CFD trading platforms. After you download the platform, you can see the MarketWatch (instruments quotes), trading charts and the terminal (positions, orders, account balance). Setting up MT4 is a simple process – You can organize the MarketWatch based on your preferences and open a number of trading charts. Note that the MT4 is an advanced trading platform with more than 80 technical indicators.

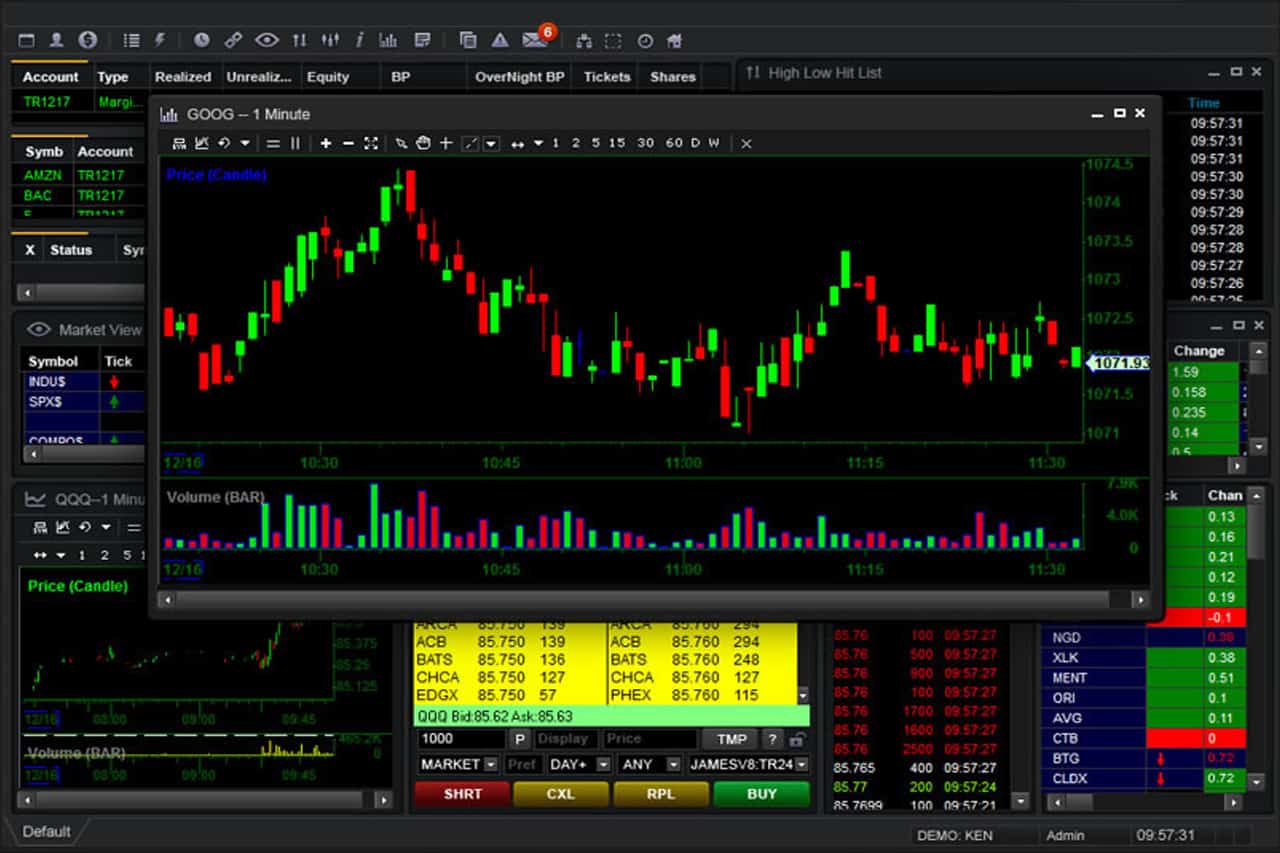

AT Pro

At Pro is an advanced trading platform suitable for experienced traders that execute a high number of daily trades. It might take you a few days to master the platform, but once you do master it, the AT Pro offers an advanced charting package including more than 100 technical indicators and high-speed execution.

As you can see in the image above, the AT Pro provide level 2 window which can be used if you choose to trade futures.

Security and Regulation

Score: 6/10

Regulation

City Index is a trading name of GAIN Capital UK Limited. The broker is regulated by the Financial Conduct Authority under the registered number 113942, by the Australian Securities and Investments Commission (ASIC) and Monetary Authority of Singapore (MAS). City Index is also regulated by the UASE Central Bank in Dubai.

Security

With the increasing concern over user security and cybercrime, forex and CFD brokers take seriously security measurements. City Index holds customer funds in a segregated account and offers clients protection of up to £50,000 by the FSCS (applies only in the United Kingdom and in the Middle East).

In terms of technological security measurements against hacking, the broker does not provide any tools and feature to protect clients.

Deposit and Withdrawal Process

Score: 7/10

City Index does not charge a deposit and withdrawal fee and has set an initial deposit recommendation of £100 or an amount which is enough to substantially cover the margin requirement of your first trade.

Deposit

Unlike other brokers in the industry, City Index offers a limited selection of payment methods which include:

- Debit card: Visa, MasterCard, Maestro and Electron

- Credit card: Visa, MasterCard,

- Bank transfer

City Index does not charge any fee for any of the deposit methods, however, you will be charged for credit card deposits by your card issuer.

Withdrawal

City Index does not charge a withdrawal fee, however, the withdrawal process can take 3–5 working days. Withdrawal can be made by the same deposit payment methods:

- Credit card/Debit card

- Bank wire transfer

In conclusion, City Index offers a limited selection of payment methods compared to other brokers in the industry such as Coinbase and Pepperstone.

Education and Resources

Score: 8/10

City Index offers traders an informative education section on the website that includes three sections: Introduction to trading, enhance your trading skills, and trading strategies. In addition, City Index offers a market news section that includes news and analysis, trading ideas and alerts, and educational webinars.

Overall, City Index provides useful educational material for traders and investors.

☎️Customer Service

Score: 8/10

City Index offers 24/5 customer service from Sunday to Friday via phone, chatbot, email and live chat in English only. In addition, City Index provides informative FAQ pages for different topics on their website.

All in all, the broker have a fairly good customer service reputation, including response time and a number of communication possibilities.

Mobile App

Score: 7/10

City Index provides a mobile app for two of its trading platforms, the in-house City Index Web Trader which is available on iOS and Android, and the popular MT4 mobile trading app. City Index does not offer a mobile app for the AT Pro.

While the MT4 mobile app is one of the best in the industry offering traders a user-friendly interface and trading tools, the in-house Web Trader mobile app is not well organized and might create confusion at the time of trading.

Pros and Cons

Pros:

- Good customer service

- City Index offers spread betting

- Offers MetaTrader 4 including an automated trading

- City Index offers live chat

- No deposit and withdrawal fees

- A selection of three trading platforms

Cons:

- City Index charges high fees, including inactivity fee

- A low leverage ratio of 1:200

- Low reliability among users

- Customer support is not available 24/7

- Not available for US residents

- No security tools

- Low selection of payment methods

Conclusion

City Index was established in 1983 and is one of the most well-known forex brokers in the world. The broker offers a wide selection of financial assets, three trading platforms, and a selection of account types and trading features. City Index is also regulated by different regulators around the world. However, following our review, we were not convinced that City Index should be the first choice as they charge high trading and non-trading fees, and lack the extra features to provide the best trading interface and service.

Although City Index offers great trading services, brokers like Coinbase which is regulated by top regulators around the globe is a better choice in terms of cost, speed, trading platform, and more.

FAQs

What is the leverage ratio offered by City Index?

City Index leverage ratio varies depending on the account type, traded product, and the trader's geographic location. The maximum leverage ratio offered by City Index is 1:200 for global indices in the UK and Australia. The maximum leverage ratio for forex trading is 1:30.

What is the minimum deposit to open a forex/CFD account at City Index?

City Index minimum deposit requirement for the Trader account is £100 or equivalent in order to cover the margin requirement of your position.

Is City Index a regulated broker?

Yes, City Index is regulated by The Financial Conduct Authority (FCA) under the name of GAIN Capital UK Limited, by the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS) and by the UASE Central Bank in Dubai.

City Index - Is it a scam broker?

No, City Index was established in 1983 and is a well-known forex broker. The broker is regulated by the Financial Conduct Authority (FCA) in the UK, by ASIC in Australia and MAS in Singapore. However, we have found many negative user reviews asking whether it's a legit broker.

Can I use Automated Trading with City Index?

Yes, City Index allows traders to automate trading via the popular MetaTrader 4 EA (Expert Advisor) as well as through the AT Pro. Note that you can backtest your trading strategy before you open a live account on a demo account which is available both MT4 and AT Pro.

Is City Index available in the US?

No, City Index is not available for US residents as the broker is not registered with any US regulator, the Commodity Futures Trading Commission (CFTC) or the U.S. Securities and Exchange Commission (SEC).

Has City Index got a mobile app?

Yes, City Index offers a mobile app for the popular MetaTrader 4 and the in-house Web Trader which is available on iOS and Android operating system.