Whether you are new to cryptocurrency

The broker is adding a Visa credit card so you can easily spend your crypto money. We have reviewed the fees, features, and pros and cons to assess whether the CoinCorner multi-service wallet can meet the cryptocurrency needs of the non-trader.

While we found the CoinCorner to provide a cost-effective service for the UK-based customer, European and international investors pay high deposit and withdrawal fees on some payment methods.

eToro - Our Recommended Crypto Platform

On this Page:

What is CoinCorner?

If you want to buy cryptocurrency , and also send/receive, store and spend it, CoinCorner is worth a look. CoinCorner was a pioneer in 2014 when it became one of the first places to buy bitcoin with a credit card. The company, known as the European Bitcoin exchange, has added three alt coins – Ethereum, Ripple, and Litecoin. These coins can be bought, sold and stored but not withdrawn. The universe of coins is small at only four, but for many investors who want a small slice of cryptocurrency exposure in their portfolios, a few major coins will do fine. CoinCorner currently has 150,000 users.

CoinCorner Concierge is a service for investors who want to buy or sell more than USD 100,000 of Bitcoin, Ethereum, Ripple, or Litecoin. The service has been developed for high net worth individuals and institutional investors. To access this service, an investor needs to fill in the online form stating your name, email, coin you want to trade and how much you want to invest. A representative will get in touch with you.

How does the CoinCorner exchange work?

Cryptocurrency brokers can provide a cost and convenience advantage over exchanges. CoinCorner operates like a Changelly or Luno. Using CoinCorner is as simple as choosing the cryptocurrency coin or alt coin you want to buy, how you want to pay (GBP, EUR) and the amount. In a few clicks of a mouse, you can create a diversified crypto-fiat investment portfolio. The app displays your portfolio in a donut chart, providing a quick view of your holdings. Or stock up on crypto to send to family and friends, or spend. Soon, the new Visa card will make spending easier.

What cryptocurrencies does CoinCorner support?

CoinCorner offers crypto-fiat exchange in four of the largest coins by market capitalization. Europe’s Bitcoin exchange is also the place to buy ethereum, Ripple and Litecoin.

- BTC

- ETH

- XRP

- LTC

Best Cryptocurrency Exchange in April 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

What are the best CoinCorner Alternatives?

Etoro-BTC-6

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Huobi

Visit SiteAs prices of digital assets are highly volatile, users could lose all or a substantial portion of the value of any digital asset they purchase....

Supported countries

CoinCorner are cryptocurrency exchanges that are located on the Isle of Man in the United Kingdom. Its brokerage service is offered in the following countries:

- Andorra

- Argentina

- Australia

- Austria

- Belgium

- Brazil

- Bulgaria

- Canada

- Cayman Islands

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Faroe Islands

- Finland

- France

- Germany

- Gibralter

- Greece

- Greenland

- Guernsey

- Hungary

- Ireland

- Isle of Man

- Italy

- Jersey

- Kenya

- Luxembourg

- Malaysia

- Malta

- Mauritius

- Monaco

- Netherlands

- New Zealand

- Norway

- Philippines

- Poland

- Portugal

- Romania

- San Marino

- Singapore

- Slovakia

- Slovenia

- South Africa

- Spain

- Sweden

- Switzerland

- United Kingdom

Fees & limits

CoinCorner charges a 1 percent fee to buy or sell cryptocurrency. The fee is deducted from the final amount you receive. Deposits and withdrawals are available in fiat and bitcoin. As mentioned, you can

buy Ripple, Ethereum and Litecoin but cannot send and receive them.

| Method | Deposit Fee | Withdrawal Fee | Deposit/Withdrawal Limit (min-max) |

|---|---|---|---|

| Bank Transfer GBP (UK) | 1 GBP | 1 GBP | 5 GBP/5 GBP - No limits |

| Bank Transfer GBP (International) | 25 GBP | 25 GBP | 30 GBP/30 GBP - No limits |

| Bank Transfer EUR (SEPA) | Free | 35 EUR | 40GBP/5 EUR - No limits |

| Bank Transfer (SWIFT) | Service not offered | Service not offered | Service not offered |

| Debit/Credit Card | 2.5% | 0.80 GBP/1 EUR | 10 GBP/EUR - Variable/Up to value of previous deposit |

| Neteller | 3.2% | Service not offered | 20 GBP/EUR -5000 GBP/EUR/Service not offered |

| Bitcoin | Free | Variable | No limits/No limits |

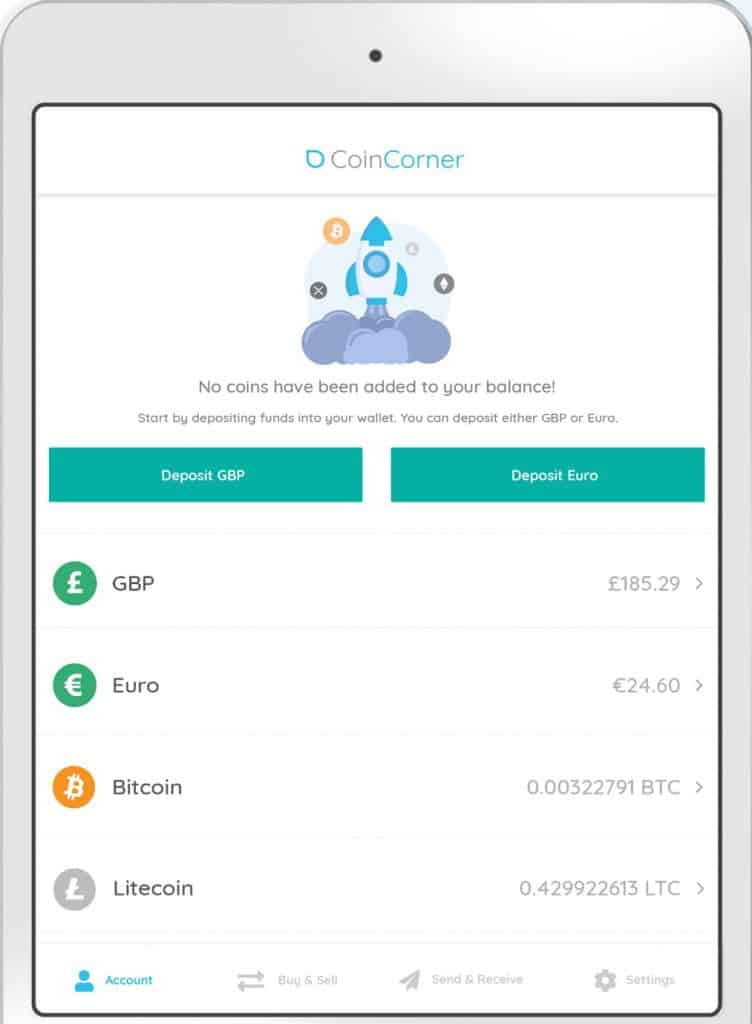

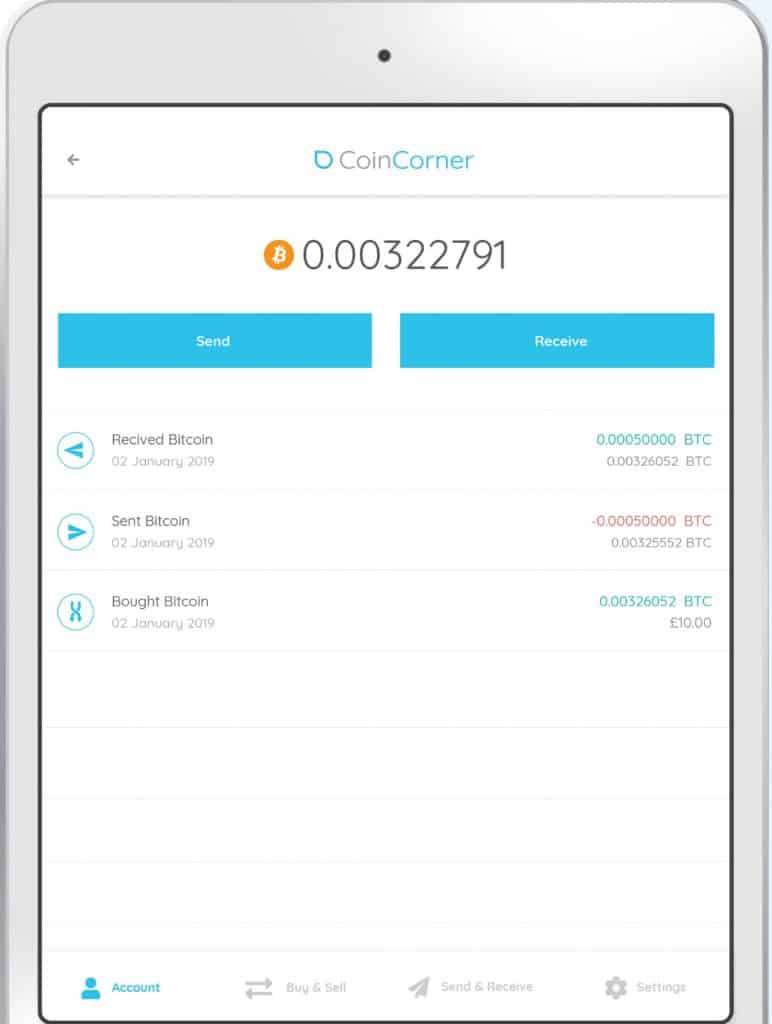

CoinCorner Dashboard

You can easily find your way around CoinCorner. All navigation is done from the menu on the left side – Deposit and Withdraw, Buy and Sell, Send and Receive and Transfer. The balance of all your wallets is displayed in the bottom half of the menu.

How to Buy Cryptocurrency on CoinCorner: Step-by-Step Tutorial

Trade cryptocurrency on CoinCorner

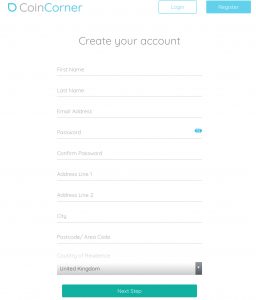

Step 1: Register your account

On the Register page, you will be asked to fill in an email, password, your name and address. A verification email will be sent to the address provided. Click on the link to confirm your email. You will then be asked to enter your mobile number and enter the code sent via SMS. The sign up process is complete! ID verification is not required to use CoinCorner.

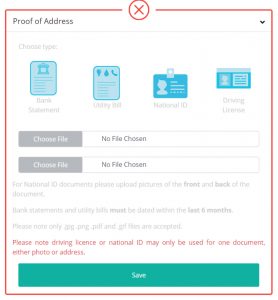

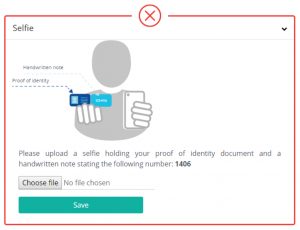

Step 2: Verify your account.

Once registered, a deposit limit will be placed on your account. Once you have reached the limit, you will be asked to verify your account. Your account could be flagged for ID verification before the limit is reached. The first two ID checks are mandatory – national ID, proof of address. You may also be asked to submit a selfie. The verification process is quick and often completed the same day.

Step 3: Fund your account

Before you can buy Bitcoin, you need to fund your account in EUR or GBP. Choose the Card, Bank or Neteller tab. Credit card and Neteller deposits are credited to your account immediately. To use a bank transfer in GPB or Neteller, your account must first be verified.

To do a bank deposit, select Bank and copy the bank details. Go to your bank online or in person and provide the CoinCorner bank details.

Step 4: Buy cryptocurrency

Select Buy & Sell from the left menu. Choose whether you are buying from your GBP or EUR wallet. Enter the amount you want to buy, and press Buy Bitcoin.

If you are selling, ensure you select the currency you want to withdraw. In the example below, ETH is being bought with GBP. If you sell in EUR, you can only withdraw EUR.

Step 5: Withdraw cryptocurrency

Withdraws are in GBP or Euro by bank transfer, or withdraw to a bitcoin address. Enter your wallet address where you want the funds sent.

Is CoinCorner regulated?

CoinCorner is regulated by the Isle of Man Financial Services Authority (IMFSA), where it is the first crypto company to have Designated Business status. CoinCorner has consulted on the developing regulation for crypto-related businesses in the Isle of Man. The company has hired a former banking regulator as its first Head of Compliance.

Is CoinCorner safe?

CoinCorner complies with Know your customer (KYC) and anti-money laundering (AML) checks and takes customer deposits. Since the centralized exchange acts as a custodian of your assets and personal information, how it protects your assets is important. Safeguards include:

Stores 90 percent of assets in multi-signature cold storage

Uses two-factor identification (2FA) with Google Authenticator

Transmits data over a secure HTTPS network

Recommends users store digital assets in cold storage with their private keys

Is the CoinCorner wallet safe?

Founded in 2014, CoinCorner is one of the oldest exchanges. The online site and wallet have never been hacked. Touch ID provides an added security measure.

Does CoinCorner have an app?

CoinCorner has an Android and IOS app. The wallet is integrated into the app. All the exchange features are available on the app – buy/sell, send/receive, transfer and store bitcoins. The app provides a fast, convenient way to send bitcoin to friends and family. Use the QR code to transmit your bitcoin address.

Is CoinCorner customer service reliable?

If you have a question or need guidance, you can contact CoinCorner by:

Live Chat – Agents are available Monday through Friday

Help Center – FAQs are provided on all aspects of how to buy and sell cryptocurrency on CoinCorner

Email support – Contact CoinCorner at support@CoinCorner.com

CoinCorner Pros and Cons

Pros:

Cons:

- Only four coins traded

- No crypto-to-crypto exchange

- High bank deposit fees outside UK

- High bank withdrawal fees outside UK (non-SEPA)

- Cryptocurrency prices set by CoinCorner

- Cannot send/receive ETH, XRP, LTC

Why We Recommend Coinbase Over CoinCorner

Whether your are experienced at bitcoin trading or buying your first bitcoins to invest and shop, CoinCorner provides everything you need to integrate bitcoin into your investment portfolio and lifestyle. If you want to invest beyond four major cryptocurrencies, Coinbase is a trusted exchange designed for novice traders who want to trade a wide selection of the majors and alt coins.

- Here is why we think Coinbase is the better exchange for many beginner traders.

- Regulated by multiple jurisdictions globally, including the UK FCA and CySec

- Leading social trading platform to develop trading skills

- Top performing traders easily copied with CopyTrader™️ and OneClick trading

- Top performing cryptocurrency portfolios by theme easily copied with CopyPortfolios™️

- Secure multi-currency wallet granted a Distributed Ledger Technology (DLT) licence from the Gibraltar Financial Services Commission (GFSC)

- Trading tips from social feeds

- Low fees

- Good educational resources for the beginner trader

CoinCorner VS Alvexo

There is no doubt that CoinCorner is a valid platform when it comes to online trading. However, we consider Alvexo to be a better option. The broker offers a user-friendly trading platforms, a great variety of assets ranging from cryptocurrencies and forex to stocks and indices. On top of this, we’ve found the broker to have significantly lower fees and spreads compared to CoinCorner.

These are just a few of the advantages offered by the exchange. To find out more about it, we recommend visit Alvexo. You will also find a step-by-step guide on how to get started with your trading experience on the platform.

Conclusion

CoinCorner has a lot of competition as a broker operating as an instant crypto-to-fiat digital money changer. For those transferring by one of the free methods, the one percent flat exchange fee is a good deal. The wallet stands out in a number of areas. Peer-to-peer crypto payment transfers can be easily facilitated. The new Visa card will make it easy to spend crypto anywhere Visa is accepted and withdraw from bank machines. Although CoinCorner is making it easier to use crypto, we would recommend cheaper alternatives for the non-UK customer. If you want to invest in cryptocurrencies directly, or CFDs and portfolios, Alvexo provides a great trading platform for beginners and experienced traders.

FAQs

Does CoinCorner have an affiliate program?

Yes, CoinCorner has an affiliate program. Once you register for the affiliate program, you will receive USD10 - or the Euro or cryptocurrency equivalent - each time you refer a friend or family to CoinCorner. Follow the Affiliate link from the main side menu to register.

What’s the difference between a hot and cold wallet?

Hot wallets store your crypto assets online and face a higher risk of cyber hacking. Cold storage involves storing your crypto assets offline on a USB drive or paper wallet, for example. CoinCorner cold storage wallet places crypto assets in a safety deposit box in a bank vault. The following risk measures should be taken to protect your hot and cold crypto assets:☑️ Generate and store your private keys offline☑️ Use two-factor authentication to access your wallet☑️ Use biometric identification

What is a decentralized exchange (DEX)?

A decentralized exchange does not use an intermediary to hold customer funds and accounts. Peers trade directly amongst each other (peer-to-peer) and funds are transferred between their cryptocurrency wallets. Trader money and ID are at lower risk of being hacked. A downside of DEXs is the current lack of liquidity.

What is a centralized exchange?

A centralized exchange accepts and holds users’ deposits. Most exchanges also conduct ID verification to comply with know your customer (KYC) and anti-money laundering (AML) rules. As a repository of client money and personal identification information, centralized exchanges have a higher risk of becoming a victim of cyber hacking and theft.

A-Z of Bitcoin Exchanges

Bitcoin

Bitcoin

Don't see the answer that you're looking for?