If you’re looking for a new cryptocurrency exchange to join, but not sure which one to go with, you might be thinking about using Cryptopia. The New Zealand platform makes it super easy to buy and sell a full range cryptocurrencies at the click of a button.

However, we would suggest treading with absolute caution, not least because Cryptopia were recently hit by a multi-million dollar hack. The hack resulted in New Zealand Police investigating the owners of the exchange, which is still ongoing. Although the platform is currently down for maintenance, a number of potential buyers are in the pipeline.

On this Page:

Nevertheless, if you’r thinking about using Cryptopia when the exchange is back up and running, then be sure to read our comprehensive review first. We’ve covered everything from the number of coins the platform supports, fees, regulation, and of course, its recent multi-million dollar hack.

What is Cryptopia?

Launched back in 2014 by Adam Clark and Rob Dawson, Cryptopia is a New Zealand-based cryptocurrency exchange. The platform is well known for hosting hundreds of cryptocurrency pairs – including popular coins like Bitcoin, Ethereum, and Bitcoin Cash, as well a full selection of lesser known ERC-20 tokens.

As Cryptopia is based in New Zealand, the platform only allows users to deposit and withdraw funds with real-world money using a New Zealand bank account. Nevertheless, the platform is offered on a global basis, meaning that if you’re not based in New Zealand, then you still use it, albeit you can only fund your account with cryptocurrencies.

How does Cryptopia Work?

Cryptopia is a cryptocurrency exchange in its purist form. In other words, unlike brokers such as Coinbase or Kraken, you cannot trade crypto with fiat currency pairs. As such, the platform is used to trade on a crypto-to-crypto basis. The exchange works much in the same way as other cryptocurrency exchanges in the online space.

You need to initially open an account, which takes no more than a couple of minutes. Once you do, you then need to fund your account by depositing cryptocurrency. Once you’ve funded your account, you can then exchange your coins with a different cryptocurrency. In doing so, you will pay the platform a trading fee, which you need to pay at both ends of the transaction. This is how the team at Cryptopia make their money.

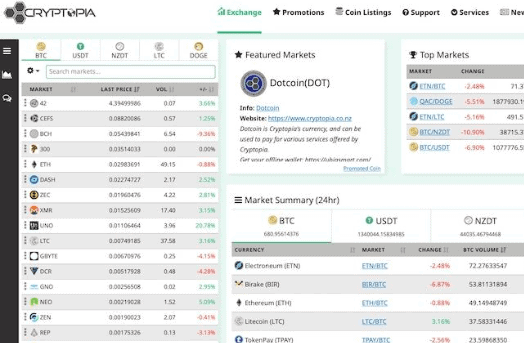

Due the large number of coins supported on Cryptopia, the platform is very popular with day trading professionals. The reason for this is that traders have access to a very large number of pairs, meaning there are plenty of opportunities to make quick profits.

What cryptocurrencies does Cryptopia support?

As noted above, Cryptopia has one of the most extensive lists of supported coins. At the time of writing, this exceeds over 500 different cryptocurrency pairings. Here’s a list of the coins that were supported before the platform went down for maintenance.

- 1337 (1337)

- 23skidoo (CHAO)

- 42 Coin(OLD) (42OLD)

- 42-coin (42)

- 808 (808)

- 8Bit (8BIT)

- ACoin (ACOIN)

- Aeon (AEON)

- AllSafe (ASAFE)

- AmberCoin (AMBER)

- AmigaCoin (AGA)

- AnarchistsPrime (ACP)

- AnimeCoin (ANI)

- AntiBitcoin (ANTI)

- AquariusCoin (ARCO)

- ArcticCoin (ARC)

- Argentum (ARG)

- Aricoin (ARI)

- Asiacoin (AC)

- Atomiccoin (ATOM)

- AudioCoin (ADC)

- AuroraCoin (AUR)

- AurumCoin (AU)

- B3 Coin (B3)

- BanksyCoin (BSY)

- BATA (BTA)

- BatCoin (BAT)

- BDSM-FETISH (WHIPPED)

- BeatCoin (XBTS)

- BeaverCoin (BVC)

- BeezerCoin (BEEZ)

- BenjiRolls (BENJI)

- BERNcash (BERN)

- BieberCoin (BRC)

- BikerCoin (BIC)

- BipCoin (BIP)

- BirdCoin (BIRD)

- BitBar (BTB)

- BitBean (BITB)

- Bitcedi (BXC)

- Bitcoal (COAL)

- Bitcoin (BTC)

- Bitcoin Scrypt (BTCS)

- BitcoinDark (BTCD)

- Bitcoinfast (BCF)

- BitcoinPlus (XBC)

- Bitgem (BTG)

- BitSend (BSD)

- Bitz (BITZ)

- BlackCoin (BLK)

- Blakecoin (BLC)

- BlazeCoin (BLZ)

- BnrtxCoin (BNX)

- BolivarCoin (BOLI)

- Bongger (BGR)

- Boolberry (BBR)

- BorgCoin (BRG)

- Boson (BOSON)

- BottleCaps (CAP)

- Bumbacoin (BUMBA)

- BunnyCoin (BUN)

- BVBCoin (BVB)

- ByteCoin (BCN)

- C-bit (XCT)

- CageCoin (CAGE)

- Canada eCoin (CDN)

- Cannabiscoin (CANN)

- CannabisIndustryCoin (XCI)

- CannaCoin (CCN)

- Caponecoin (CPNC)

- Capstone (CST)

- CaptCoin (CAPT)

- CareerCoin (CAR)

- CasinoCoin (CSC)

- Catcoin (CAT)

- CBDCrystals (CBD)

- ChainCoin (CHC)

- ChessCoin (CHESS)

- ChronosCoin (CRX)

- CircuitCoin (CIR)

- ClamCoin (CLAM)

- CloakCoin (CLOAK)

- CloudCoin (CDC)

- CoffeeCoin (CFC)

- Coin 66 (66)

- Coino (CNO)

- Colossuscoin (CV2)

- CometCoin (CMT)

- CompuCoin (CPN)

- ConquestCoin (CQST)

- CoolInDarkCoin (CC)

- CorgiCoin (CORG)

- Creatio (XCRE)

- Creditbit (CRBIT)

- CryptoBullion (CBX)

- CryptoClub (CCB)

- CryptoJacks (CJ)

- Cthulhu Offerings (OFF)

- Cubits (QBT)

- Cypherfunks (FUNK)

- DARK (DARK)

- Darsek (KED)

- DashCoin (DSH)

- Decred (DCR)

- Deutsche eMark (DEM)

- DigiByte (DGB)

- Digicube (CUBE)

- Digitalcoin (DGC)

- DimeCoin (DIME)

- DimeCoinDirty (DIRTY)

- DNotes (NOTE)

- DobbsCoin (BOB)

- Dogecoin (DOGE)

- DogeGore (DGORE)

- DonationCoin (DON)

- Dotcoin (DOT)

- Dubaicoin (DBIC)

- DuckDuckCoin (DUCK)

- E-Gulden (EFL)

- EDRcoin (EDRC)

- EducoinV (EDC)

- ElaCoin (ELC)

- ElephantCoin (ELP)

- EmbargoCoin (EBG)

- EmberCoin (EMB)

- Emerald Crypto (EMD)

- EmerCoin (EMC)

- Eryllium (ERY)

- Etheera(ETA)

- Ethereum Classic (ETC)

- Eurocoin (EUC)

- EverGreenCoin (EGC)

- Evilcoin (EVIL)

- Evotion (EVO)

- Expanse (EXP)

- ExperienceCoin (EPC)

- ExtremeCoin (EXC)

- FacileCoin (FCN)

- Factom (FCT)

- FameCoin (FAME)

- FastCoin (FST)

- Feathercoin (FTC)

- FeatherCoinClassic (FTCC)

- FireFlyCoin (FFC)

- Flaxscript (FLAX)

- FloripaCoin (FLN)

- FlutterCoin (FLT)

- FonzieCoin (FONZ)

- FootyCash (FOOT)

- Francs (FRN)

- FryCoin (FRY)

- FujiCoin (FJC)

- FuzzBalls (FUZZ)

- G3N (G3N)

- Gabencoin (GBN)

- GaiaCoin (GAIA)

- GameCredits (GAME)

- GameUnits (UNITS)

- Gapcoin (GAP)

- GayCoin (GAY)

- GCoin (GCN)

- GeoCoin (GEO)

- GlobalBoost-Y (BSTY)

- Globalcoin (GLC)

- GoldCoin (GLD)

- GoldPieces (GP)

- GoldPressedLatinum (GPL)

- GoldReserve (XGR)

- GPUCoin (GPU)

- GrandCoin (GDC)

- Granite (GRN)

- Groestlcoin (GRS)

- GroinCoin (GXG)

- GrowthCoin (GRW)

- Gulden (NLG)

- GunCoin (GUN)

- Halcyon (HAL)

- HamRadioCoin (HAM)

- HoboNickels (HBN)

- HundredCoin (HUN)

- HYPER (HYPER)

- HyperStake (HYP)

- I0Coin (I0C)

- IcebergCoin (ICB)

- ICOBid (ICOB)

- ImpeachCoin (IMPCH)

- ImperialCoin (IPC)

- Incakoin (NKA)

- InCoin (IN)

- Independent Money System (IMS)

- InfiniteCoin (IFC)

- Influxcoin (INFX)

- IrishCoin (IRL)

- IvugeoCoin (IEC)

- iWalletCoin (IW)

- IXCoin (IXC)

- JaneCoin (JANE)

- JinCoin (JIN)

- JouleCoin (XJO)

- Jumbucks (JBS)

- Jyn Erso (ERSO)

- Karbowanec (KRB)

- KarmaCoin (KARM)

- KashCoin (KASH)

- Kittehcoin (MEOW)

- KiwiCoin (KIWI)

- KlondikeCoin (KDC)

- KoboCoin (KOBO)

- Komodo (KMD)

- KumaCoin (KUMA)

- Kurrent (KURT)

- KushCoin (KUSH)

- LADACoin (LDC)

- LanaCoin (LANA)

- LBRY Credits (LBC)

- Le Pen Coin (LEPEN)

- LeaCoin (LEA)

- Leafcoin (LEAF)

- LemonCoin (LEMON)

- LeoCoin (LEO)

- LFTCCoin (LFTC)

- LiteBar (LTB)

- Litecoin (LTC)

- LiteDoge (LDOGE)

- Lithiumcoin (LIT)

- LookCoin (LOOK)

- Lottocoin (LOT)

- Lycancoin (LYC)

- MachineCoin (MAC)

- Magi (XMG)

- Mars (MARS)

- MarxCoin (MARX)

- MazaCoin (MZC)

- MedicCoin (MDC)

- MegaCoin (MEC)

- MetalMusicCoin (MTLMC)

- MileyCyrusCoin (MCC)

- Minerals (MIN)

- Mineum (MNM)

- Mintcoin (MINT)

- MiracleCoin (MCL)

- MOIN (MOIN)

- Monero (XMR)

- MonetaryUnit (MUE)

- Money ($$$)

- Mooncoin (MOON)

- MotoCoin (MOTO)

- MrsaCoin (MRSA)

- Murraycoin (MRY)

- Mustangcoin (MST)

- Myriad (XMY)

- NakamotoDark (NKT)

- NameCoin (NMC)

- NavCoin (NAV)

- NetCoin (NET)

- Neutron (NTRN)

- NevaCoin (NEVA)

- Nexus (NXS)

- NineElevenTruthCoin (NTC)

- NovaCoin (NVC)

- NyanCoin (NYAN)

- OctoCoin (888)

- OKCash (OK)

- Om (OOO)

- Opalcoin (OPAL)

- Open Source Coin (OSC)

- OrbitCoin (ORB)

- OroCoin (ORO)

- OzzieCoin (OZC)

- PacCoin (PAC)

- PakCoin (PAK)

- PandaCoin (PND)

- Parallelcoin (DUO)

- PascalCoin (PASC)

- PayCon (CON)

- PeerCoin (PPC)

- Penguin (PENG)

- PesetaCoin (PTC)

- Pesobit (PSB)

- PetroDollar (XPD)

- PhilosopherStone (PHS)

- PhoenixCoin (PXC)

- Photon (PHO)

- PiggyCoin (PIGGY)

- PIVX (PIVX)

- Platonic (XPL)

- Polcoin (PLC)

- PolishCoin (PCC)

- PopularCoin (POP)

- PostCoin (POST)

- PoSWallet (POSW)

- Potcoin (POT)

- Prime-XI (PXI)

- PrimeCoin (XPM)

- ProfitCoin (PFC)

- Prototanium (PR)

- PureVidz (VIDZ)

- Quark (QRK)

- Quatloo (QTL)

- Qubitcoin (Q2C)

- Rabbitcoin (RBBT)

- RateCoin (XRA)

- RedCoin (RED)

- Reddcoin (RDD)

- Revolvercoin (XRE)

- Rimbit (RBT)

- RonPaulCoin (RPC)

- RubyCoin (RBY)

- RussiaCoin (RC)

- SakuraCoin (SKR)

- Sativacoin (STV)

- SaveAndGain (SANDG)

- Selencoin (SEL)

- Sexcoin (SXC)

- SHACoin2 (SHA)

- ShadowCash (SDC)

- SharkCoin (SAK)

- SiaCoin (SC)

- SiberianChervonets (SIB)

- SJWCoin (SJW)

- SkeinCoin (SKC)

- SlothCoin (SLOTH)

- SmartCoin (SMC)

- Smileycoin (SMLY)

- SolarflareCoin (SFC)

- Songcoin (SONG)

- SoonCoin (SOON)

- SpaceCoin (SPACE)

- SpartanCoin (SPN)

- Spectre (XSPEC)

- Spots (SPT)

- Sprouts (SPRTS)

- SquallCoin (SQL)

- StableCoin (SBC)

- StartCoin (START)

- StaxCoin (STX)

- Sterlingcoin (SLG)

- StopTrumpCoin (STC)

- Stratis (STRAT)

- Stronghands (SHND)

- SuicideCoin (SCD)

- SwagBucks (BUCKS)

- Swingcoin (SWING)

- Swiscoin (SCN)

- Syndicate (SYNX)

- Tajcoin (TAJ)

- TEKcoin (TEK)

- TerraCoin (TRC)

- TeslaCoin (TES)

- TheChiefCoin (CHIEF)

- TigerCoin (TGC)

- TitCoin (TIT)

- TittieCoin (TTC)

- TopCoin (TOP)

- TradeCoin (TRADE)

- TransferCoin (TX)

- Triangles (TRI)

- Trinity (TTY)

- TruckCoin (TRK)

- Trumpcoin (TRUMP)

- TurboStake (TRBO)

- Unbreakablecoin (UNB)

- UniCoin (UNIC)

- Unitus (UIS)

- UniversalMolecule (UMO)

- Unobtanium (UNO)

- UR (UR)

- VaderCorpCoin (VCC)

- VapersCoin (VPRC)

- VegasCoin (VGC)

- Verge (XVG)

- VeriCoin (VRC)

- Verium (VRM)

- Version (V)

- Vibranium (XVI)

- WhiteCoin (XWC)

- WildBeastBitcoin (WBB)

- WorldCoin (WDC)

- XedosCoin (XDC)

- XtraCoin (CX)

- YobitCoin (YOVI)

- ZCash (ZEC)

- Zclassic (ZCL)

- ZCoin (XZC)

- Zdash (ZDASH)

- ZeitCoin (ZEIT)

- ZetaCoin (ZET)

- Zoin (ZOI)

Which countries does Cryptopia support?

Although Cryptopia is a New Zealand-based exchange that only accepts fiat currency deposits and withdrawals from New Zealand bank accounts, the platform allows traders from any country to join. This is because traders from outside of New Zealand are only allowed to fund their account using cryptocurrency.

However, this makes it challenging if you are not based in New Zealand, especially if you don’t currently have access to any cryptocurrencies to deposit. As such, you might be better off using a more inclusive platform like Coinbase, who allow multiple countries to deposit with a debit/credit card or e-wallet, including that of the U.S.

Cryptopia Payment Methods and Fees

As we have already discussed, fiat currency deposits are only available for New Zealand residents, via a New Zealand bank account. Alternatively, you’ll need to use cryptocurrency to deposit and withdraw funds.

- New Zealand Bank Transfer in NZ Dollars

- Cryptocurrencies

Trading fees

Cryptopia has a very simple trading fee structure. Unlike other platforms, which usually charge different rates depending on [1] the amount you trade every month and [2] whether you are a market maker or a market taker, the platform charges 0.2% for each trade you make. This is charged when you buy cryptocurrency, as well as when you sell it.

For example, if you bought $10,000 worth of cryptocurrency, you would pay a fee of $20. If the coins you bought were worth $20,000 at the time you decided to sell, then you would pay $40 in fees.

This is actually really expensive, especially if you are looking to trade on a frequent basis. Although the percentage rate might not seem like a lot, the fees would very quickly add up.

This is why we actually prefer Coinbase over Cryptopia, as the platform doesn’t charge any trading fees per-say. Instead, you are charged a really low rate, which is calculated by taking the difference between the buy and sell price, which is known as the spread.

How to sign up and trade on Cryptopia

We strongly suggest you re-think your plans to sign up and trade on Cryptopia, not least because the exchange was hacked for millions of dollars this year. Moreover, at the time of writing, the platform is still down for maintenance. However, if the rumours are true, then it’s likely the exchange will have a new owner soon, meaning it should be back up and running in the very near future. As such, if you still want to go ahead, here’s what you need to do.

Step 1. Open an account with Cryptopia

First you will need to head over to the Cryptopia homepage and register an account. Unless you are a New Zealand resident looking to deposit with fiat money, you’ll only need to provide some basic information. This will include your email address and country of residence.

Before you move onto the next step, you will need to verify your email address. Simply log in to your email account and click on the ‘Complete Registration’ link that Cryptopia send you.

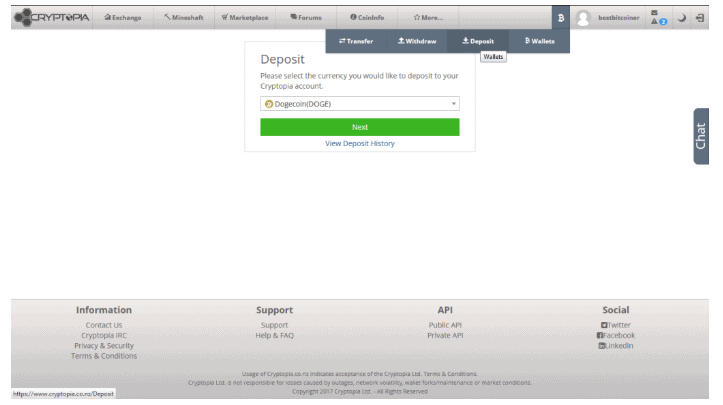

Step 2. Fund your account

As noted above, the account funding process will require you to deposit cryptocurrency unless you are from New Zealand. Head over to your account, and then find the ‘Deposit’ section. Once there, you will see a really long list of supported coins that runs in to the hundreds.

Once you’ve decided which coin you want to deposit with, click on the ‘deposit’ button placed next to it. You will then be presented with your unique deposit address. Copy it to your clipboard and then head over to your private wallet. Paste the address in, decide how much you want to deposit, and confirm the transfer.

Depending on the coin you are depositing with, it usually takes in the region of 10-20 minutes for the funds to show up in your Cryptopia account.

Step 3. Exchange Crypto

Once you’re all set-up with a fully funded account, you can then make your first trade. Head over to the trading area and search for the coin that you want to buy. If your coin isn’t paired with the coin you deposited with, you might need to make an additional trade.

Enter the amount that you want to exchange (in coins, not fiat), make sure you are comfortable with the current market rate, and confirm your trade. If there is enough liquidity to meet your desired volume, the trade should go through instantly.

Is Cryptopia regulated?

Cryptopia is not a regulated exchange. The platform operates in an unregulated manner, meaning that it does not hold any licenses. This also means that there is not a single regulatory watchdog keeping an eye on the platform.

We much prefer cryptocurrency exchanges that are heavily regulated like Coinbase.

Is Cryptopia safe?

This is without a doubt the most important part of our Cryptopia review. In a nutshell, Cryptopia is not a safe exchange to use. The platform was hacked recently, which resulted in a huge loss of funds for its users.

Here’s more information on the hack.

- In January 2019, the Cryptopia servers were hacked by a malicious third party. In total, the hacked coins resulted in a total loss believed to be in the region of $16 million.

- New Zealand Police raided the offices of Cryptopia, resulting in an investigation by its financial crimes unit

- As Cryptopia were unable to pay the stolen money back, liquidators were appointed to begin bankruptcy proceedings

- At the time of writing, the Cryptopia platform is “Down for Maintenance” while bankruptcy proceedings are ongoing

- It is believed that several buyers are interested in taking the exchange over

With that being said, you should only use Cryptopia at your peril. We cannot endorse an exchange that is responsible for losing millions of dollars worth of customer funds. This is further amplified by the fact that the Cryptopia owners are “unable” to pay the funds back.

We instead feel more comfortable recommending heavily regulated platforms that hold notable licences, such as Coinbase. After all, the safety of your funds should be your main priority.

Does Cryptopia have a wallet?

Cryptopia is a third party cryptocurrency exchange and thus, they only offer a web-based wallet. This is an extremely unsafe way to store your funds, as if (when in the case of Cryptopia) the exchange is hacked, you stand a chance of having your funds stolen. Moreover, you do not have access or control over your private keys.

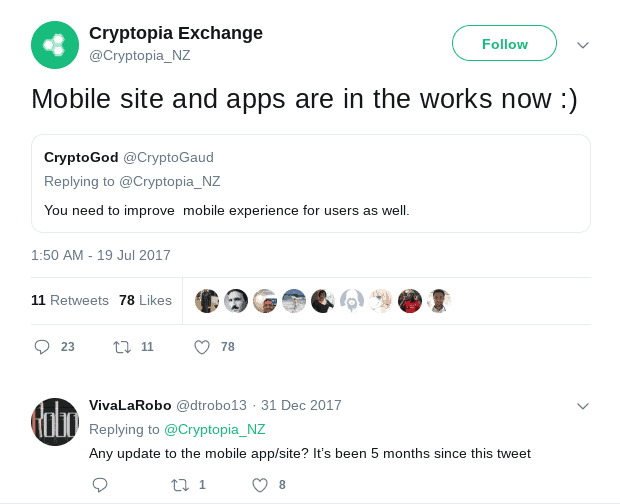

Does Cryptopia have an app?

On top of not having a wallet, Cryptopia does not have a native mobile app. This is somewhat strange for a cryptocurrency exchange that has been operational since 2014. The team at Cryptopia did Tweet in July 2017 that they were working on improving their mobile website, as well as working on a mobile application, although nothing ever surfaced.

In fact, attempting to trade on the move with Cryptopia via a mobile web browser is all-but impossible. The mobile version of the platform quite clearly wasn’t a top priority for the team, as it’s really cumbersome to move from section-to-section.

Cryptopia customer service

Customer support options at Cryptopia are also fairly limited. While no live chat or phone support facilities are available, you can send the team an email. The only other option that you have available to you is to raise a support ticket. Due to the small number of employees that Cryptopia have, response times can take days.

- Support Ticket

We should note that the FAQ section on the Cryptopia website is extensive. You should find the answer to most account queries on there.

Cryptopia pros and cons

Pros:

- One of the largest listings of supported coins

- Crypto-to-crypto trades available worldwide

- Established since 2014

Cons:

- Exchange has been liquidated pending bankruptcy

- Major hack resulted in $16 million of stolen funds

- Not paying back victims of hack

- Owners investigated by New Zealand Police for potential insider malpractice

- Very high fees

- Fiat deposit option only available to New Zealand residents

Conclusion

In summary, if you’ve read our comprehensive Cryptopia review all of the way through, then you should now know that opening an account with the exchange is a very unwise move. Among other factors, this mainly centres on the January 2019 hack, which saw the bad guys steal more than $16 million in user funds. This disregard for security ultimately means that victims of the hack will probably never see the funds again.

Even before the hack took place, Cryptopia was lacking in a range of key areas. Not only did the platform not offer a native app or wallet, but depositing funds with real-world cash was an option only available to New Zealand residents. That means that if you’re based in the U.S., Europe, or anywhere else outside of New Zealand, you’d only be able to deposit with cryptocurrency.

When we performed a like-for-like comparison with Coinbase, we found that the platform is a much better option. The platform is regulated by authorities in the UK and Cyprus, meaning that you have regulatory oversight on two fronts. Moreover, you can deposit with a debit/credit card or e-wallet with ease, the trading fees are much lower, and you even trade on-the-go via Coinbase.

How many coins do Cryptopia list?

Cryptopia supports in the region of 500+ different cryptocurrencies.

Can you 'short' Bitcoin on Cryptopia?

You can't short coins on Cryptopia. You'll need to use a more comprehensive platform like Coinbase for this.

How much are Cryptopia trading fees?

Trading fees at Cryptopia cost 0.2% per trade.

Do I need to verify my identity to use Cryptopia?

Only if you are depositing and withdrawing funds using fiat currency, which you can only do if you're from New Zealand.

Does Cryptopia offer leverage?

Cryptopia does not offer leverage on any of its cryptocurrencies.