The introduction of cryptocurrency exchanges has increased drastically in the past two years. Naturally, this is the effect of the growing popularity of the blockchain sector. Instead of a simple platform where crypto can be stored, the exchanges introduced today have so many features, that participating in the blockchain sector can now be done in a single place. This article will review Kraken, which is a crypto exchange that has managed to deliver every aforementioned development within its own platform to a large audience.

Kraken exchange has already managed to grow considerably since its inception. However, with several competitors around, investors could need clarification as to which exchange one should go for. This guide will explore information about the exchange, its pros and cons, features, customer service and more in-depth. We will also compare it to top exchanges to get an idea of its standing against the competitors.

Pros and Cons

Like any other exchange, Kraken has a set of strengths and weaknesses. While all of this is mentioned in detail further along in the guide, this can serve as a quick summary of what to expect.

Pros

Cons

- Can be difficult to navigate for beginners

- Some high fees if not using the pro version

What is Kraken Exchange?

Based in San Francisco, Kraken is one of the most popular cryptocurrency exchanges used by many on a global level. The company was initially created in 2011 and was launched officially in 2013. The founder Jesse Powell, currently serves as the CEO of the company and is a highly influential name in the cryptocurrency space. He has been prominent on social media platforms, and for increasing awareness about the blockchain industry.

Powell initially was a part of the now-collapsed exchange Mt. Gox and had speculated the exchange to crash while working on a security issue. Kraken was the brainchild which was born in order to replace the former exchange if the organization indeed went bust. As expected, Mt. Gox died out in 2014, a year after Kraken was launched by Powell and his team.

Initially, the exchange only focused on providing trading or investing options for Bitcoin, Litecoin and some other limited digital assets. However, the platform has since grown into a full-blown centre of participation in the blockchain industry. It currently employs more than 3200 professionals and caters to a massive audience upward of 4 million. The company is backed by investors from the financial space itself and has managed to be affiliated with some of the biggest names in the blockchain industry.

Currently, Kraken is owned by its parent company Payward Inc. and is available in various locations across the globe. The Kraken exchange platform can be considered to be split into two parts. One is the basic Kraken exchange, which features investment options and a basic interface, Another is Kraken Pro, which is suitable for more advanced traders, and provides a plethora of features for users.

How does Kraken work?

Kraken describes itself as nothing but a cryptocurrency exchange. It states that the platform merely facilitates the trade of digital assets i.e cryptocurrencies between two parties. It does not feature a personal wallet service, which is something that many exchanges have started doing recently.

Many people in the space mistake some services or features provided by Kraken to be a part of their “bank”. This should make sense since the exchange had gained the appreciation of many for getting their application for a bank charter approved by the state of Wyoming. The company confirms that the website doesn’t host any banking services for businesses or individuals. In case this was to happen in the upcoming years, then the bank would function as an entirely different entity.

Kraken does, however, feature an OTC desk which can be utilized by major investors or institutions. This component of the organization works differently from the official Kraken exchange website and comes with all risks involved. Naturally, this is not a point of concern for retail investors for the most part.

Who are the backers of Kraken Exchange?

A simple method to analyse the quality of not only an exchange, but any major organization in the blockchain space is to take a look at their investors. Huge and reputed organizations only park their funds in companies that are considered extremely promising. This is surely something that Kraken has managed to achieve, which is directly evidenced by the kind of investors it boasts of.

The major stakeholders of Kraken Exchange constitute some of the most popular VC Funds, Individuals as well as blockchain companies in the space currently. While many of these investors would be names that one may be wary of, some of them might catch investors’ attention. A few investors, however, can be identified by investors due to their reputation and popularity in the finance sector. These investors include individuals like Roger Ver, Jimmy Furland, Kevin Bombino, Trace Mayer, Meni Rosenfeld etc. and companies like Blockchain Capital, Hummingbird Ventures, Digital Currency Group, Digital Horizon, RIT Capital Partners, Andra Capital, Skyvision Capital, 2bgc etc.

Products and Services by Kraken

Listed below are some services by Kraken that have been curated keeping in mind, the ease of use and comfort for investors. Many of the mentioned components may also be a part of several major exchanges. However, Kraken manages to marry the common components with some unique and innovative upgrades. Some of these services that can be thoroughly utilized by investors include-

Margin Trading

This feature is available on only a few major exchanges. Margin Trading is a high-risk trading method, and can end up with the user losing all their funds. However, for those who have experience in trading and have the knowledge to speculate the next move of the markets with accuracy, margin trading can prove to be highly profitable. Kraken introduced margin trading to its exchange website in 2018.

The use of margin trading allows users to leverage their positions using funds they don’t actually possess. A user can open a position that is leveraged compared to their current balance. Kraken advances the user’s account funds beyond what’s in it. On Kraken, users can margin trade by choosing various order types based on where they think the market will go. Long and short positions can be opened and closed using opposite orders or the settling command. Margin trading is, however, limited to individuals who meet certain criteria.

On Kraken, margin allowances are a total per currency, not a total per position. A user can create a 1,000,000 USD long position in BTC/USD, or ten 100,000 USD long positions in BTC/USD. Kraken automatically repays margin funds when positions are closed, so the margin allowance limits are reset.

Futures

The market for crypto futures involves two counterparties trading a specified amount of an underlying crypto for a specific price on a specific date. Cryptocurrency owners can hedge market exposure using futures contracts. On its robust, low latency, high-performance trading platform, Kraken Futures offers a wide range of products. Naturally, this feature too, similar to margin trading, requires users to pass a certain verification level and also needs them to have a history on the exchange for trading assets. This is generally done to ensure that the user does infact, know the risks involved while participating in futures trading.

Kraken also consists of a multi-collateral wallet, which can serve to be highly beneficial for users. With this, users can manage all their positions without having to move their funds around. It offers up to 50X leverage for several assets in future trading.

OTC Service

Kraken offers an excellent Over-The-Counter desk for traders who need to execute large orders. This is made possible through over-the-counter asset exchanges, just like the name suggests. In simple words, Kraken facilitates the execution of personalized trades which are essentially off the open exchange website. This is a very useful product for high-net-worth parties or institutional organizations who have their funds in the exchange.

The Kraken OTC desk does not charge any fees and boasts 24/7 access. As a popular exchange, it also mitigates the liquidity crunch issue or those concerning security.

Indices

Kraken is one of the very few exchanges to offer indices as an investment or trading option. The exchange boasts extremely precise and accurate cryptocurrency indices data powered by CF benchmarks. This data is not just extracted from Kraken. Infact, it managed to act as an aggregator and gather real-time data from a variety of major exchanges all around the world to provide accurate rates.

The prices here can hugely impact one’s position. Thus, Kraken ensures that they are updated every single second to give the trader a seamless and pleasant experience. Kraken provides world-class trading indices options for BTC, ETH, XRP, BCH and LTC at the moment. This can be an excellent tool for traders since it assures security as well as accuracy which are the only two major factors one needs to consider while trading in assets as volatile as cryptocurrencies.

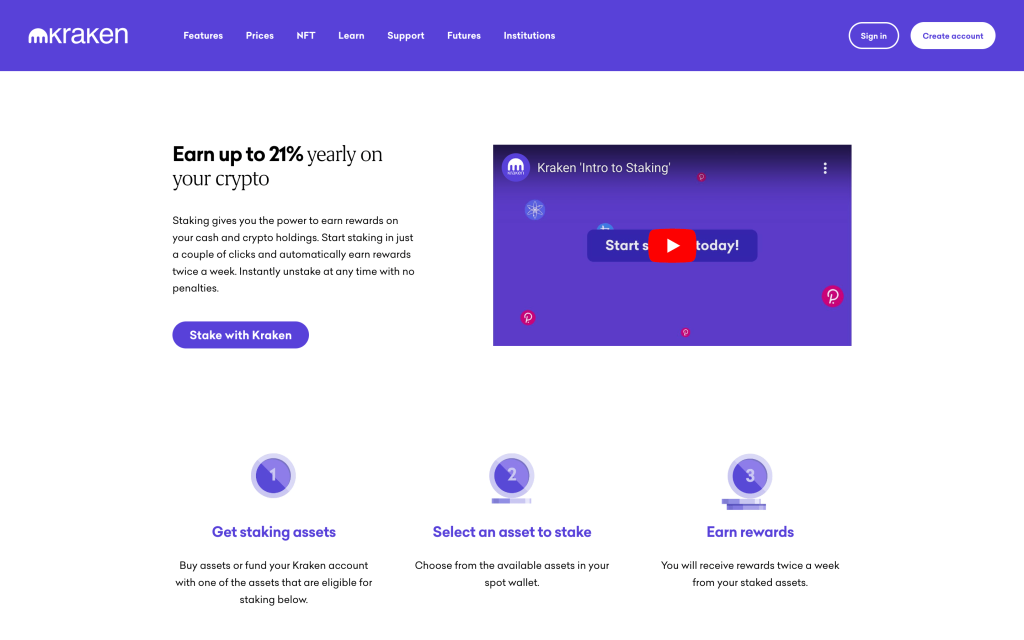

Staking

If a user locks their cryptocurrencies or fiat for a particular amount of time in the exchange, they are rewarded with more of the same token as an incentive for holding on to the asset. This is common and is a technique used by a huge number of investors to earn passive income with ease. Kraken also provides staking options for several cryptocurrencies and fiat. One can earn up to 21% by staking crypto on Kraken on a yearly basis. Kraken has no penalties for instant unstaking, which is a much-loved feature for investors. This is because even the major platforms that facilitate staking may charge a fee for unstaking before a particular period.

At the moment, Kraken allows staking for cryptos like ALGO, ADA, ATOM, ETH, FLOW, KAVA, KSM, MINA, DOT, MATIC, SCRT, SOL, XTZ, GRT, TRX and BTC. It has an excellent staking platform and can be used by beginners as well as advanced traders. BTC is an asset that is available for off-chain staking only. This, however, is only available in select countries and may be restricted in some nations.

Account Management Service

Kraken already has a customer service section set up for traders and investors to clear their doubts and solve any issues they face. But it happens very often that advanced traders may not be able to solve their issues easily as the problems may be more complex, or might require special assistance of some sort. Kraken launched its Account Management Service to tackle this exact issue.

This product by Kraken allows dedicated traders and investors to get access to a personal account representative. Kraken states that the account representative will take care of any account-related queries or issues and solve them with ease, helping traders to focus on their next strategies and not get a headache worrying about the problems they face between trading.

Events and Promotions

Top crypto exchanges with a strong hold in the industry have the capacity to get affiliated with huge organizations, or partner with crypto companies to help users as well as the respective companies. For such companies, this is in the form of marketing. Kraken mentions the project or holds events under the banner of those particular companies, helping them gain exposure to its massive audience without them having to search for it in the first place. This is very common since Kraken already has a dedicated section for such events or promotions and is engaged by a huge number of investors.

For the users, it comes as an easy way to earn rebates, coupons, cashbacks or even airdrops that could be worth a lot of money. Availing of this is simple too. Users simply need to have their account verified, and follow simple steps as mentioned on the website of applications. Rewards may also be in the form of cryptocurrencies or NFTs. Either way, being on Kraken and taking advantage of promos or events is a win-win situation for both parties.

Supported Cryptocurrencies

The number of cryptocurrencies on Kraken exchange at the time of writing is around 215. The exchange has made sure to list the top cryptocurrencies that have gotten high engagement and have proved to be strong tokens since their inception. It is one of those exchanges that doesn’t let any token get listed on the platform since this could simply help the token gain more exposure and thereby more investors.

The type of cryptocurrencies Kraken hosts can be divided into four parts. These include payment cryptocurrencies, infrastructure cryptocurrencies, financial cryptocurrencies, service cryptocurrencies and media & entertainment cryptocurrencies. All assets listed on the exchange have high liquidity, which means that users can always buy or sell their tokens without any hitch.

Where is Kraken available?

Kraken is a global exchange and is easily accessible from almost every part of the world. It has a huge user base and caters to the audience in every nation where cryptocurrencies are legal. Essentially, it is available in 190+ countries and has very limited restrictions in most of these nations. However, barring the restricted countries too, there are some locations where some services may be limited.

For instance, the Kraken mobile app is not available for users in countries like Crimea, Luhansk, Cuba, Iran, Japan, Donetsk, North Korea and Syria. This, however, is not a problem as users can access the platform through the website as well.

How does Kraken fare against its competitors?

Kraken is currently the third largest cryptocurrency exchange in the world in terms of volume traded. The only two exchanges above Kraken currently are Binance and Coinbase. While Binance and Coinbase both have a considerable advantage in terms of volume traded over Kraken, the exchange is still one of the best options available in the industry at the moment.

As a platform that had started off way before most of its contenders, simply staying in the top leagues is a hard feat for any exchange to achieve. Kraken has managed to do this by consistently bringing forward features, additions and improvements to its product. It was behind the FTX exchange previously, which has now collapsed.

While it may be difficult for Kraken to overtake Coinbase or Binance in the near future, it is evident that it can retain its current position, since it may be the best alternative to the first two options.

Fees and Limits

Kraken terms its fees to be “as low as 0%”. This is partially true, as the platform does feature a very low fee for trading cryptocurrencies. The fees for the exchange can be divided into two parts. One is for the normal Kraken exchange, while the other is for the pro version of Kraken.

For the basic version of Kraken exchange, the fee structure is as follows –

- 0.9% fee for any stablecoins and 1.5% fee for any other crypto or FX pair

- Payments Card Processing Fee of 3.75% + 0.25c

- Digital Wallet Payments Processing Fee of 3.75% + 0.25c

- Online Banking/ACH Processing Fee of 0.5%

Kraken’s Pro version is a better fit for advanced traders, as it features lower fees and better optics. It follows a maker-taker fee schedule with volume incentives based on the user’s activity in the past 30 days. These fee schedules are usually built to encourage traders and investors to engage with assets more and to drive maximum liquidity. In short, trading with higher amounts will allow users to participate in the exchange for a lesser fee.

Limits on depositing and withdrawing crypto are divided into three parts- Starter, Intermediate and Pro. The 24-hour limit on deposits for all three categories is unlimited. However, there is a withdrawal limit of assets worth $5000 for starters. This number goes higher to $500K for intermediate users and $10+ million for pro users. Monthly limits don’t have a cap and can be made on an unlimited basis. This is enjoyed by users belonging to all three categories.

How to buy crypto on Kraken

Buying crypto on Kraken is quite easy, and is similar to buying crypto on major exchanges like eToro or Binance. In order to get started, follow the mentioned steps as it is-

Step 1- Create an account

Start by downloading the app or visiting the official Kraken website where links to the official Kraken app can also be found. Make sure that the website name is correctly entered, as there are imitators to whom you could end up losing funds to.

Once in, fill in all the necessary details and complete KYC(Know Your Customer). This will help the exchange safeguard you as well as themselves and allow you to navigate through the exchange easily. Make sure to set up 2FA, as this could secure your account even further. Also, note to take down any important credentials somewhere safe.

Step 2- Fund your account

This can be done using two methods. One is to buy stablecoins using P2P or bank transfer. There are various ways to fund your account. Choose whichever way you prefer and add funds. Once this is done, you can navigate to the trading page to buy crypto.

Step 3- Enter the necessary details

Once you have funded your account, move on to the next step. Here, get to the cryptocurrency you wish to purchase and enter all the necessary details. Three types of orders are available for investors which include simple, intermediate and advanced. You can make use of these three forms to your preference and comfort. The advanced order allows users to trade in assets using high-level features.

Step 4- Check the details and buy tokens

After checking the details thoroughly, click on the buy button. If it is a market order, then your cryptocurrency will be bought at the latest price. Limit orders will be executed as soon as the mentioned price is reached. Right after, the newly bought crypto will be deposited into your Kraken wallet.

Is Kraken Safe?

Kraken has positioned itself to be a highly secure platform from the day of its inception. However, there have been some instances where users have lost funds to an extent. While this isn’t a common occurrence, it is something that users should keep in mind while going forward with the exchange.

The exchange stores all its digital assets in safe coin storage, with 95% of deposits held offline in cold storage units spread across the world. It also promises platform security. The servers for the exchange are kept in secure cages under 24/7 surveillance by video monitors and armed personnel.

Does Kraken exchange have an app?

Kraken exchange has an app that is available on both android and IOS devices. The application, however, was a rather recent upgrade, since the exchange functioned through the website only till 2021. After witnessing the massive surge of demand in the crypto industry Kraken officially launched its app in June 2021.

This app is used by most Kraken users and consists of every feature that the website processes.

Customer Service

Kraken has a very strong customer service support team, which is appreciated by not just the users, but also by several major crypto companies. It has three major forms of reaching out through which problems can be solved easily. One is through the live chat, which is available for users on the app as well as on the website. This can be accessed directly and is available 24/7.

The second method to get help is through calling. Kraken is one of the few exchanges to offer this. As an exchange with users all over the world, it can be difficult for the organization to help users on call. However, Kraken still provides this option and is also available on a 24/7 basis.

The third method is to send an email. Kraken ensures to revert to emails quickly and help the users on a priority basis. Fortunately for non-english speakers, there is a variety of languages that are supported by the platform. Alternatively, users can also go to the support centre, which has all the necessary resources for investors to figure out solutions for some easy issues themselves.

Conclusion

Kraken exchange is one of the best options for investors looking to park their funds in, at the moment. It is an easy pick for beginners as well as advanced traders and features high-quality products that can be relied on. Due to its security, features and reputation, it becomes a highly recommended exchange to buy, sell or trade cryptocurrencies.

Does Kraken Pro charge lesser fees?

Yes, Kraken Pro charges a lesser fee as compared to the normal version of Kraken. This is because Kraken Pro is more suitable for experienced traders who generally carry out larger trades often.

Is Kraken available in the US?

Kraken exchange is available globally. It caters to the audience of US as well. There are only a few countries where the company is restricted from offering its services.

Does Kraken exchange provide insurance on investors' assets?

No. Kraken is a highly secure platform that has been popular for safeguarding users' funds for several years. However, it does not feature an insurance fund like Binance that investors can rely on in case the platform gets hacked.

Is Kraken customer service bad?

While there have been some discrepencies when it comes to Kraken's customer service in the past, it is a very functional support system overall. Barring a few incident, Kraken has provided excellent customer service to all of their users.

Does Kraken feature tax support?

This is not a feature that is supported by Kraken exchange yet. Users have access to a huge number of features and options on the official website. However, tax support is yet to be added by the developers. Although, there have been claims from developers that this is something the team has been working on at the moment.