Coinspot pros and cons

Pros:

Cons:

- Fiat currency deposits and withdrawals only for Australians

- No ability to short coins or apply leverage

- No phone support

- Security features are lacking

Coinspot is an Australian based exchange that allows users to buy and sell more than 100 different cryptocurrencies. Although the platform accepts real-world fiat deposits, this is only available to those based in Australia. If you’re a non-Australian resident, then you’ll be forced to fund your Bitcoin account.

If you’re thinking about opening an account with Coinspot, we’d suggest you read our comprehensive review first. We’ll discuss everything from fees, supported coins, payment methods, security, regulation, and more.

On this Page:

What is Coinspot?

Launched in 2013, Coinspot is a third-party cryptocurrency exchange based in Australia. The platform has an extensive range of supported coins, with more than 100 cryptocurrencies available to buy and sell.

This includes crypto-to-crypto trading pairs, as well as crypto-to-AUD.

The Coinspot platform is rather simple to use, with a clean and crisp interface. The main drawback to using Coinspot for your cryptocurrency needs is that the exchange only accepts fiat deposits and withdrawals from Australian residents. This means that you’ll need to deposit funds with cryptocurrency if you’re based elsewhere.

How does Coinspot Work?

Coinspot works much in the same way as any other cryptocurrency exchange. The platform matches buyers and sellers, and charges trading fees for its efforts. When you first register an account with Coinspot, you’ll need to deposit some funds. Once your account is funded, you can then begin trading at Coinspot.

Some users like to use the platform for their day trading needs, while others use it just to buy crypto. If you’re looking to use Coinspot for your long-term investment needs, then you are best off withdrawing your coins to private Bitcoin wallets.

Coinspot is also involved in the OTC (over-the-counter) space. This means that they can facilitate direct cryptocurrency trades for institutional investors. However, if you’re only trading small amounts, you won’t be able to use this facility.

Best Cryptocurrency Exchange in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Coinspot Alternatives

Etoro-BTC-6

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Huobi

Visit SiteAs prices of digital assets are highly volatile, users could lose all or a substantial portion of the value of any digital asset they purchase....

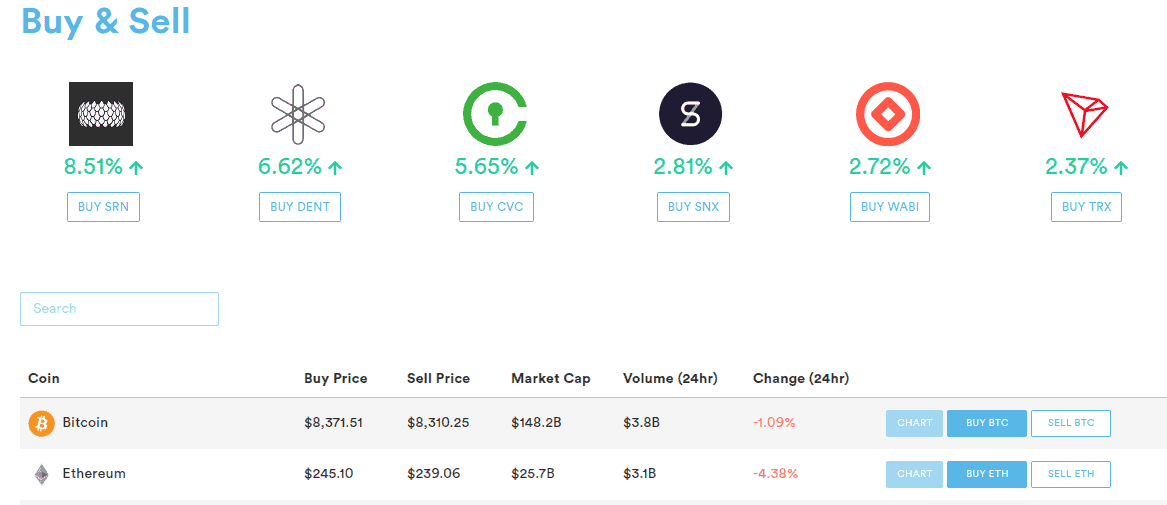

What cryptocurrencies does Coinspot support?

- AdEx ADX

- Aelf ELF

- Aeron ARN

- Aeternity AE

- Augur REP

- Bancor BNT

- Basic Attention Token BAT

- CanYa CAN

- ChainLink LINK

- Cindicator CND

- Civic CVC

- Decentraland MANA

- Dent DENT

- District0x DNT

- Dogecoin DOGE

- Dragonchain DRGN

- Enigma ENG

- Enjin ENJ

- Eos EOS

- Ethereum ETH

- ETHLend LEND

- Ethos BQX/ETHOS

- Fetch FET

- FunFair FUN

- Gas GAS

- Gifto GTO

- Golem GNT

- Havven HAV

- Holo HOT

- Horizon State HST

- Iconomi ICN

- IExec RLC

- IOSToken IOST

- Kyber Network KNC

- Litecoin LTC

- Loopring LRC

- Metal MTL

- Modum MOD

- Monaco MCO

- Neo NEO

- Nucleus.Vision NCASH

- Odyssey OCN

- OmiseGO OMG

- Ox ZRX

- Po.et POE

- Populous PPT

- Power Ledger POWR

- Pundi X NPXS

- Quantstamp QSP

- QuarkChain QKC

- Raiden Network Token RDN

- Rchain RHOC

- Request Network REQ

- Revain R

- Ripio Credit Network RCN

- Ripple XRP

- SALT SALT

- SelfKey KEY

- Simple Token OST

- SingularityNet AGI

- Sirin Labs SRN

- Status SNT

- Stellar XLM

- Storj STORJ

- Storm STORM

- Substratum SUB

- Tael WABI

- TenX PAY

- Theta THETA

- Tron TRX

- Walton WTC

- Wanchain WAN

- Wax WAX

- WePower WPR

- Wings WINGS

- Zilliqua ZIL

Which countries does Coinspot support?

Although Coinspot is an Australian exchange with a strong focus on Australian residents, users from other countries can deposit and withdraw funds in the form of cryptocurrencies. The platform does not specifically make any mention regarding prohibited countries, which indicates that the exchange is accessible on a global basis.

Coinspot Payment Methods and Fees

As noted earlier, Coinspot offers fiat currency deposits and withdrawals only to those based in Australia. If you’re not an Australian resident, then you will need to fund your account via cryptocurrency. Below is a list of payment methods available to Australians.

Online bank transfer (POLi payments)

Cash deposits (Blueshyft)

BPAY

There are no deposit fees to pay if you are funding your account with a bank transfer. If you use either BPAY or a cash deposit, you will pay fees of 0.9% and 2%, respectively.

Ultimately, if you’re a non-Australian resident and you need to deposit funds with an everyday debit/credit card or e-wallet, then you’re best off using a more inclusive exchange like Coinbase.

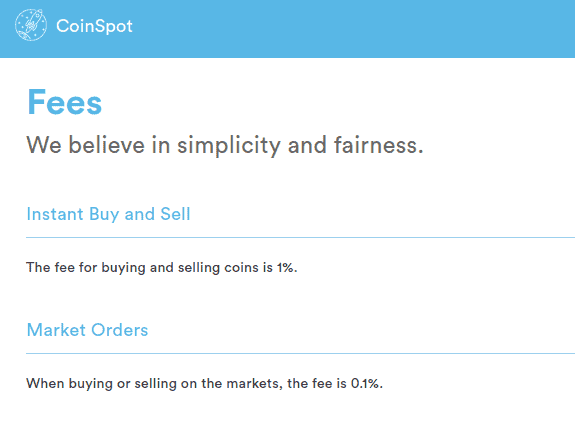

Trading fees

Coinspot offers a very simple trading fee pricing structure. Every time you buy or sell a cryptocurrency, you will pay a trading fee of just 0.1%

For example, if you buy $1,000 worth of crypto at Coinspot, you’d pay just $1.

Alternatively, if you use the Instant Buy/Sell/Swap service, which allows you to buy a cryptocurrency directly from Coinspot without needing to use the exchange, then you’ll pay 1%. It is best that you avoid using this feature, as a 1% trading fee is very expensive.

Other charges as under:

Deposit/Withdrawal fees

How to sign up and trade on Coinspot

Unless you are based in Australia, we would suggest re-thinking your plans to open an account at Coinspot. This is because you are severely limited when it comes to depositing and withdrawing real-world funds. However, if you do want to proceed, then check out our comprehensive step-by-step guide below.

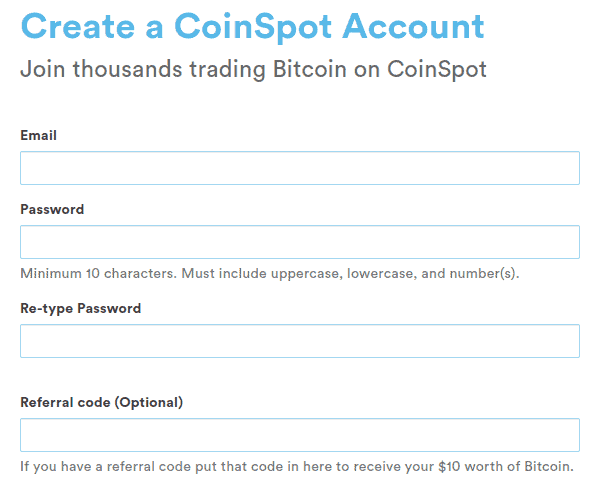

Step 1. Open an account with Coinspot

Head over to the Coinspot website and click on ‘REGISTER’. You’ll find the button at the top right-hand corner of the homepage.

On the next page, you will be asked to enter your email address and to choose a strong password.

Step 2. Set-up two-factor authentication

Although this step is not compulsory, you are advised to set-up two-factor authentication (2FA). This will add an extra layer of security on your account, and help to keep your funds safe.

Once you’re on your main account dashboard, click on the orange text that says “ENABLE 2FA”. You then need to link up the Authenticator app on your mobile phone with the Coinspot platform. Moving forward, you’ll need to enter the unique code from your mobile phone every time you log in.

Step 3. Deposit funds

Once you’ve set up 2FA, you’re now ready to deposit funds. If you’re an Australian resident, click on the ‘DEPOSIT AUD” button. If not, scroll down to the wallets section.

If you see the cryptocurrency that you want to deposit with, click on the “OPEN WALLET” button. If not, click on “SEE ALL WALLETS” to see the complete list of supported coins.

Once you do, click on the “RECEIVE” button. This will then display your unique Coinspot deposit address for the cryptocurrency you want to fund your account with.

Copy the code, head over to your private wallet, and then transfer the funds across.

Step 4. Start trading

Once you have funded your account, you can then begin trading. Click on the “BUY/SELL” button at the top of the screen to be taken to the main trading area.

Once you find the cryptocurrency that you want to buy, click on the “BUY” button. You will then be presented with an order box. Choose whether you want to place a market order or limit order, enter the amount you want to buy, and then execute the trade.

Is Coinspot regulated?

It is a Certified Digital Currency Business and a member of Blockchain Australia since 2014. It is accredited with ISO 27001 and is regulated by AUSTRAC.

Is Coinsafe safe?

Coinbase has not reported any cryptocurrency hacks since its inception in 2013, which is great. It is also now a regulated crypto exchange. We do like the fact that Coinspot verifies the identity of all of its users – regardless of what payment method is used. This at the very least keeps fraud away from the exchange.

The only security features that we were able to identify are as follows.

- Two-factor authentication (not enforced)

- Customers identified when using fiat currency

- SSL Encryption

When taking into account the lack of security features (such as multi-sig or cold storage of customer funds), we cannot say it is fully unsafe. However, safer options are there which are better in many other aspects.

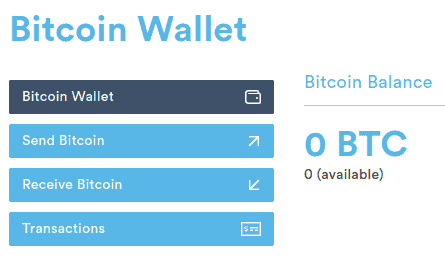

Does Coinspot have a wallet?

Although the platform advertises its ‘Coinspot Multicoin Wallet’, the wallet is actually nothing more than a web wallet. This means that you do not have access to your private keys. If the Coinspot servers were hacked, your funds could be at risk.

Moreover, although the Coinspot wallet offers 2FA, it doesn’t offer multi-sig logins. If you are determined to use Coinspot to buy coins, we would strongly recommend that you store them in a secure private wallet.

Does Coinspot have an app?

Coinspot does not offer a native mobile app. If you want to trade at Coinspot on the move, then you will need to access the platform via your mobile web browser. We found the mobile version of the site more difficult to navigate through in comparison to the main desktop website.

If trading remotely is your main priority, you’re best off using a platform like Coinbase, who now offers a dedicated Android and iOS application.

Coinspot customer service

Coinspot has a live chat facility that is available Melbourne time between 9am-10pm weekdays, and 10am-8pm on weekends. Alternatively, you can raise a support ticket from within your account. Coinspot does not offer phone support.

- Live Chat

- Support Ticket

Conclusion

In summary, Coinbase does have some notable features and a regulated exchange. We really like how clean and crisp the platform is, which makes it super simple for those that don’t have much experience in using cryptocurrency exchanges. We also like the fact that Coinspot lists more than 350 cryptocurrencies.

However, the main problem with Coinspot is that they are too focused on Australia. If you are not based in Australia, you won’t be able to deposit funds with fiat money, which makes it difficult to get money into the exchange.

How many coins do Coinspot list?

Coinspot supports more than 100 different cryptocurrencies.

Can you 'short' Bitcoin on Coinspot?

You can't short coins on Coinspot.

How do I contact Coinspot via live chat?

You can contact Coinspot via live chat through your account portal.

How much are Coinspot trading fees?

Coinspot charges a trading fee of 0.1%. If you want to access the 'Instant Buy' feature, you'll pay 1%.

Does Coinspot offer leverage?

Coinspot does not offer leverage on any of its crypto products.

Bitcoin

Bitcoin