Coinfloor is a UK based cryptocurrency exchange that allows users to trade

In total, six cryptocurrencies are supported, notably Bitcoin, Bitcoin Cash, Ripple, Litecoin, Ethereum Cash, and Ethereum. If you’re thinking about opening an account at Coinfloor, but not too sure whether they’re the right exchange for you, then be sure to read our comprehensive guide.

eToro - Our Recommended Crypto Platform

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

On this Page:

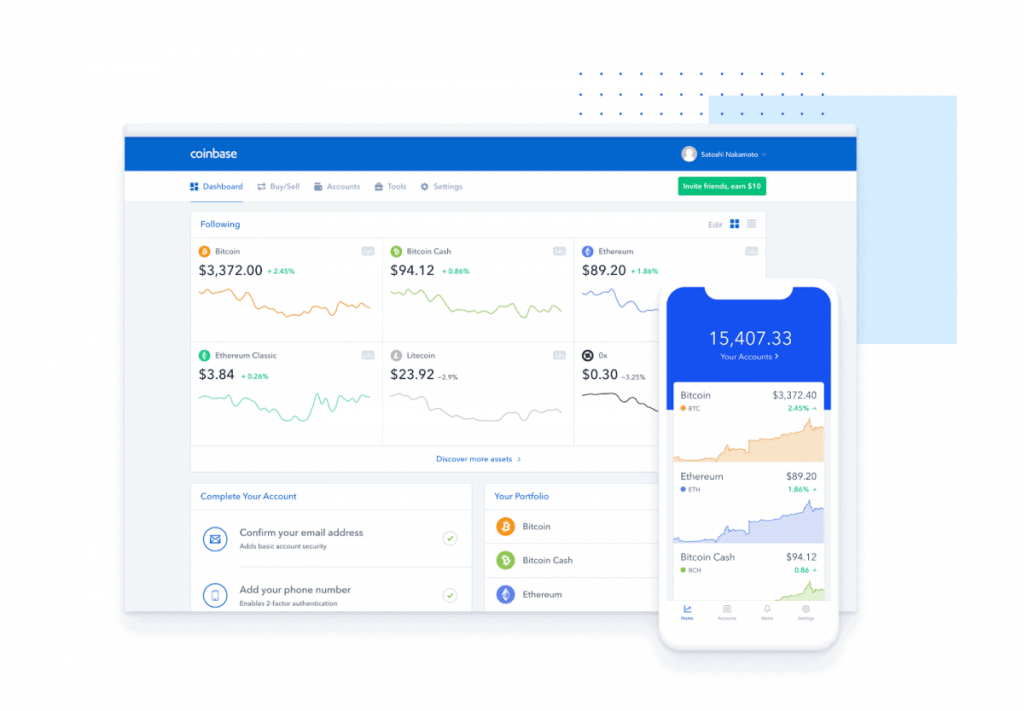

We’ll discuss everything from fees, user-friendliness, safety, and more. If you don’t have the capacity to read our guide in full, then we have summarized the review by concluding that we cannot endorse Coinfloor. The key reasons for this are that Coinfloor lists just six coins, they don’t support debit/credit card payments, and you don’t have the option of going short. We instead prefer the likes of Coinbase, who list more than 15 coins, hold multiple regulatory licenses, offer debit/credit card deposits, and they even allow you to short crypto.

What is Coinfloor?

Coinfloor is a London-based cryptocurrency exchange that was first launched in 2012. The platform was partly funded by Taavet Hinrikus, a co-founder of TransferWise. Coinflooor only allows users to trade crypto-to-fiat, meaning that there is no option to engage in crypto-to-crypto trading.

On the cryptocurrency side, this includes Bitcoin, Bitcoin Cash, Ripple, Ethereum, Ethereum Classic, and Litecoin. Depending on the specific pairing, these currencies can be traded against either GBP, USD or EUR.

Although Coinfloor services the retail markets, they also facilitate over-the-counter (OTC) trades. Moreover, they also serve corporate clients, subsequently providing quotes for large Bitcoin purchases or sales.

How does Coinfloor Work?

Coinfloor has a specific focus on crypto-to-fiat trading. As such, if you want to trade Bitcoin against real-world money, Coinfloor can facilitate this. The process works in a similar fashion to other well-known cryptocurrency exchanges, insofar that they make their money in trading fees.

When you first register an account and verify your identity, you’ll then be able to make a deposit. As soon as your account is funded, you can then begin trading one of eight crypto-to-fiat pairs. Once you’ve purchased your cryptocurrency of choosing, you can either keep your funds on the Coinfloor website or withdraw them to your private Bitcoin wallets.

Effectively, the main selling point of the Coinfloor exchange is that they have good liquidity levels on GBP trading. As most exchanges focus on USD pairs, this makes it a noteworthy exchange for those based in the UK. However, if you’re based in the U.S., then you’re better off using a global exchange like Coinbase, as their fees are much lower and they support more cryptocurrencies.

Best Cryptocurrency Exchange in October 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

What are Coinfloor alternatives?

Etoro-BTC-6

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Huobi

Visit SiteAs prices of digital assets are highly volatile, users could lose all or a substantial portion of the value of any digital asset they purchase....

What cryptocurrencies does Coinfloor support?

Although Coinfloor originally only supported Bitcoin, they’ve since increased the number of cryptocurrencies that they support. At the time of the writing, the platform is still limited to just six cryptocurrencies, which we’ve listed below.

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ethereum Classic (ECH)

- Bitcoin Cash (BCH)

- Ripple (XRP)

If you’re interested in trading fiat-to-crypto pairs, then there are eight pairs available at Coinfloor. This covers three fiat currencies, notably GBP, USD, and EUR. Take note, Coinfloor lists Bitcoin as ‘XBT’ instead of its more commonly used ‘BTC’ code. Nevertheless, we’ve listed the eight trading pairs below.

- BTC/GBP

- BTC/USD

- BTC/EUR

- BCH/GBP

- ETC/GBP

- LTC/GBP

- XRP/BTC

- ETH/GBP

As you’ll see from the above list, the only cryptocurrency that is paired with a non-GBP currency is BTC. Ultimately, this is extremely limited for those that do not want to use GBP as their primary currency.

Which countries does Coinfloor support?

Coinfloor places a significant emphasis on its UK customer base, with the vast majority of trading pairs listed against GBP.

However, Coinfloor supports most countries, making the platform a global exchange. Regardless of where the user is from, Coinfloor requires all traders to verify their identity before depositing funds.

Coinfloor supported currencies and minimum deposit

If you’re looking to deposit funds via a fiat currency gateway, then Coinfloor supports a total of four currencies. This includes Pound Sterling (GBP), Euro (EUR), US Dollar (USD) and the Polish Zloty. However, as noted above, only GBP, EUR and USD are included as trading pairs. As such, although you can deposit with the PLN, you can’t actually trade with it, which is strange.

When it comes to the minimum amount that you can deposit, this is actually one of the platform’s biggest flaws. Coinfloor recently increased its minimum deposit amounts on some of its currencies. At the time of writing, Coinfloor has a minimum deposit amount of 1,000 GBP/EUR/USD.

This is a significant minimum deposit threshold to meet. In effect, this completely alienates the average investor that is looking to start their day trading journey. Therefore, it appears that Coinfloor is looking to focus on its corporate and institutional clients.

If you are just starting out in the world of Bitcoin trading, then you should instead use a more inclusive exchange such as Coinbase. The platform allows you to get started with just $200, and you can buy Ethereum, Bitcoin, Bitcoin Cash, and 12 other cryptocurrencies.

Coinfloor fees

When it comes to fees at Coinfloor, you will be charged every time you make a deposit and withdrawal. You’ll also be charged trading fees, with the fees dependant on how much you trade. We’ve listed the main Coinfloor exchange fees below.

Deposit fees

Debit card deposits: Not supported

Credit card deposits: Not supported

SEPA (EUR only): €1.50

UK Faster Payments (GBP only): £2.50

UK CHAPS/BACS/SWIFT (GBP only): £30

U.S. wire transfer (USD only): $10

Bitcoin, Ethereum, and Bitcoin Cash: Free

Withdrawal fees

- Debit card withdrawals: Not supported

- Credit card withdrawals: Not supported

- SEPA (EUR only): €1.50

- UK Faster Payments (GBP only): £5

- UK CHAPS/BACS/SWIFT (GBP only): £30

- U.S. wire transfer (USD only): $75

- Bitcoin, Ethereum, and Bitcoin Cash: 0.0010 BTC / 0.0200 ETH / 0.0010 BCH

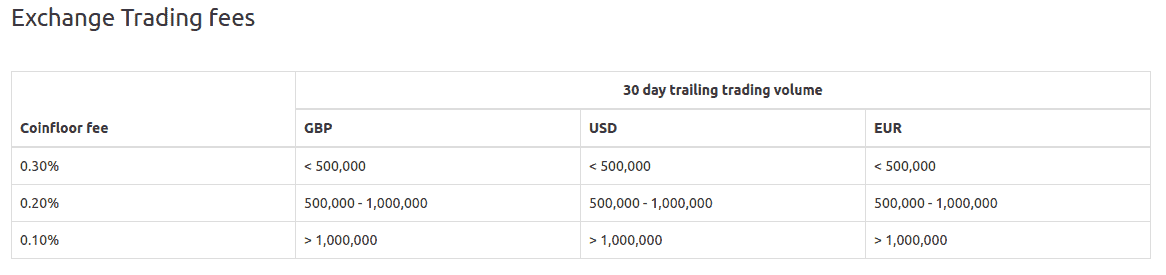

Trading fees

Coinfloor has a variable trading fee structure that depends on the volume that you trade. If you are trading less than 500,000 GBP/USD/EUR per month, then you will pay a trading fee of 0.30%. You can get this down to 0.20% if you trade between 500,000-1,000,000 GBP/USD/EUR. The lowest trading fee you can get is 0.10%, and that’s applied for trades of more than 1,000,000 GBP/USD/EUR per month.

Although much cheaper than the likes of VirWoX, these trading fees, especially the main charge at 0.30%, are extremely high. Don’t forget, you’ll need to pay this when you buy crypto, as well as when you sell it. Other exchanges such as Coinbase don’t charge trading fees. Instead, they make their money via the spread, which is much more cost effective for the trader.

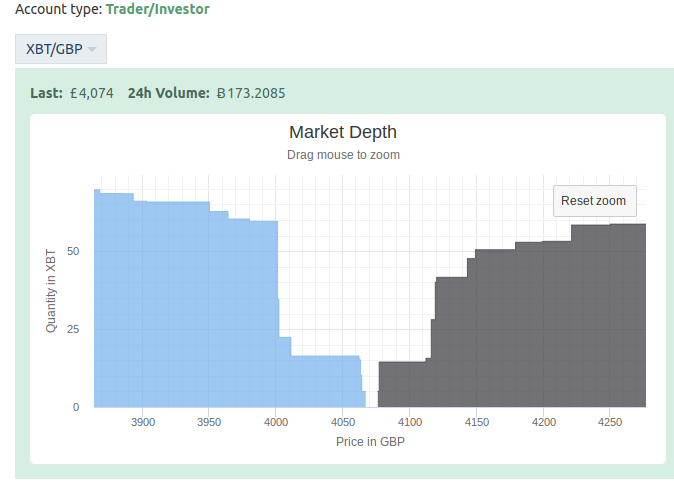

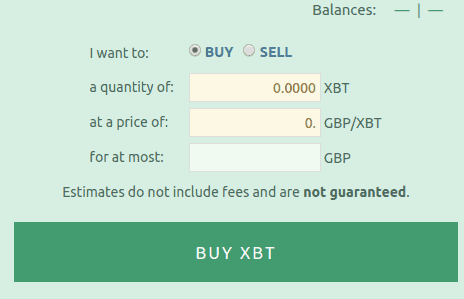

Coinfloor platform dashboard

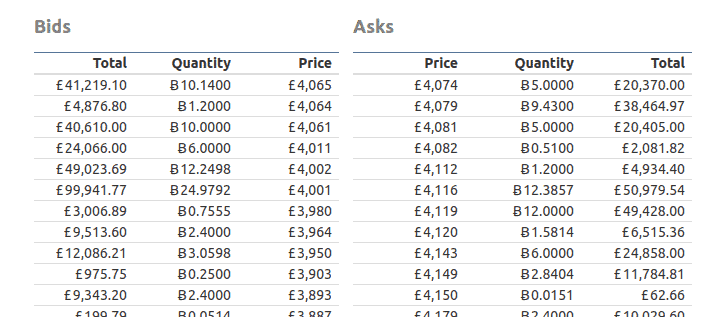

The actual Coinfloor platform dashboard is somewhat disappointing. Overall, some sections of the website seem a bit out-dated and basic. For example, as you’ll see from the screenshot below, the main trading area lacks any notable features.

We were unable to change the main trading chart view over to alternative metrics, such as candlesticks. This is crucial for many professional day traders, as it allows them to get a good view of the marketplace in real-time.

The bids/asks section of the trading area is also very basic. It makes it difficult to ascertain which way the market is moving, which again, is crucial for traders.

The help section of the Coinfloor platform is fairly extensive. We found that most frequently answered questions were taken care of. This is really handy if you are using Coinfloor for the first time.

How to sign up and trade on Coinfloor

Although we would suggest using Coinbase to buy and sell cryptocurrencies, if you do want to proceed with your Coinfloor account application, then we’ve provided a step-by-step guide below.

Step 1. Open an account with Coinfloor

You will first need to head over to the Coinfloor website and click on ‘SIGN UP’, which you’ll find at the top right-hand side of the homepage.

Step 2. Confirm your email address

Before proceeding to the next stage of your Coinfloor application, you will first need to confirm your email address. Head over to the email account that you provided in the previous step, and click on the confirmation link that Coinfloor sent you.

Once you’ve clicked the link, you’ll then need to sign in with your newly created account credentials.

Step 3. Set-up two-factor authentication (2FA)

The next stage of the Coinfloor account opening process will require you to set-up two-factor authentication (2FA). This increases the security on your account by forcing you to enter a unique code that is sent to your phone, every time you log in.

The easiest way to do this is to download the Authy App on your smartphone. If you don’t want to do this, you can instead connect a Yubikey device, which is just as secure. Whichever option you go for, setting up 2FA is mandatory. You won’t be able to use your Coinfloor account until you set it up.

Step 4. Verify your identity

Before you’ll be able to deposit funds and begin trading, you’ll need to verify your identity. You will need to enter your full legal name (as shown on your ID), your residential country, home address, nationality, and date of birth.

You’ll then need to upload a copy of your government issued ID. This either will need to be a passport or a driving license.

Coinfloor state that most accounts are verified within 60 seconds, however, this can take longer.

Step 5. Deposit funds

Once you receive an email from Coinfloor confirming that your identity has been verified, you can proceed to deposit funds. If you are looking to use fiat currency, you can only deposit by a bank transfer. As you are doing a bank transfer as opposed to a debit/credit card payment, you’ll need to wait a few days for Coinfloor to add the funds to your account.

Alternatively, you also deposit by Bitcoin, Ethereum, or Bitcoin Cash.

If this is too long for you and you want to get started today, Coinbase offers instant deposits with both debit/credit cards. You can even buy Bitcoin with PayPal.

Step 6. Trade

If you’ve got to this point of our step-by-step guide, you should now have a fully verified Coinfloor account that is funded. This means that you can now trade one of the eight crypto-to-fiat pairs listed on the platform.

To start trading, click on the ‘EXCHANGE’ Button at the top of the screen. You’ll then need to choose your preferred trading pair from the drop-down list.

Enter the amount that you want to trade, and choose whether you want to buy at the market rate, or set a limit order. Once you’re happy with the information entered, simply click on the green ‘BUY’ button.

Is Coinfloor regulated?

Although Coinfloor is a UK-centric cryptocurrency exchange, they are not regulated in the UK. Although some review platforms state that they are regulated by the UK’s FCA, this isn’t actually the case. On the contrary, the platform claims to have received “formal communication” from the FCA. Coinfloor is registered with HM Revenue & Customs – the UK’s taxation body.

In late 2018, it was reported that Coinfloor obtained a license from the Gibraltar Financial Services Commission.

If you’re looking for an exchange that is regulated by the FCA (as well as CySEC in Cyprus), then you should consider Coinbase.

Is Coinfloor safe?

Coinfloor has been trading since 2012, and as far as we know, the platform has not been accustomed to any major hacks. Here is an overview of some of the security measures that Coinfloor implements to keep user funds safe. The platform holds client funds (fiat) at LHV Bank in Estonia. It’s unclear why they don’t store the funds in the UK, as that is where they are based.

Coinfloor’s security measures

- Here’s a break down of security features available at Coinfloor.

- Mandatory set-up of two-factor authentication (2FA)

- 100% cold storage policy with cryptocurrency holdings. It remains unclear where liquidity comes from if nothing is stored online.

- Multi-Signature Pay 2 Script Hash (P2SH)

- Email confirmation when logging in

- Web application firewalls

Does Coinfloor have a wallet?

Coinfloor does not have a native cryptocurrency wallet. When you deposit or buy cryptocurrencies at the platform, you need to entrust Coinfloor to store them on your behalf. This is problematic for a number of reasons. Firstly, if the Coinfloor website was hacked, your funds could be at risk. While it’s notable that Coinfloor has installed a range of security safeguards to prevent hackers from gaining access to their servers, nothing is guaranteed.

The second issue with entrusting Coinfloor to store your coins is that they only permit withdrawals of more than 2 BTC at three intervals per day. If you need to access your coins urgently, this could be a problem.

We think that you’re always better off using a regulated cryptocurrency exchange that offers a secure wallet, such as Coinbase.

Does Coinfloor have an app?

Not only does Coinfloor not offer a native wallet, but the platform has not launched a mobile app. This is somewhat poor, as crypto trading on the move is now really popular.

If customers don’t have access to a dedicator app, trading on the go can be difficult. Although Coinfloor has fully optimized their mobile website, it’s not as responsive as the main desktop site. This was especially true when it came to loading market data.

Coinfloor customer service

Support is really poor at Coinfloor. The only option available to you is to send the team an email. As such, there is no phone support or live chat facility. When trading with your own money, you want a platform that is able to resolve urgent queries immediately. Some issues cannot wait hours, or even days, for an email response. However, as the platform has been operational since 2012, it is unlikely that this will change any time soon.

Email support: Other than offering a FAQ help section, the only option you have of contacting customer support is via email.

- No phone support

- No live chat

- No social media

If you want a cryptocurrency exchange that offers support in real-time, via both live chat and phone support, then you might want to consider Coinbase.

Coinfloor pros and cons

Pros:

Cons:

- Only 6 cryptocurrencies supported

- Trading fees at 0.30% are expensive

- No live chat or phone support

- No debit/credit card or e-wallet deposits/withdrawals

- A minimum deposit of 1,000 GBP/EUR/USD

- Basic trading area and no mobile app

Coinfloor vs Coinbase

To help you understand how Coinfloor compares to other cryptocurrency exchanges in the market, we decided to do a comparison with Coinbase. This way, you get to make an informed decision as to whether or not Coinfloor is worth joining.

If you are not using leverage with Coinbase, and you go-long, then you own the underlying cryptocurrency asset. Not only this, but the platform also allows you to buy stocks and shares, indices, and commodities, as well as being able to trade forex. The platform is also regulated by the FCA (and CySEC in Cyprus), and they allow you to deposit funds with a debit/credit card and e-wallet.

Why we recommend Coinbase wallet over Coinfloor:

- Coinbase allows you to choose from 15 different cryptocurrencies, as opposed to the 6 that Coinfloor lists.

- Coinbase allows you to deposit funds with a debit/credit card or e-wallet, as well as other popular payment methods. On the contrary, Coinfloor only accepts a bank transfer.

- Fees at Coinbase are significantly lower than Coinfloor. Deposits are free at Coinbase, while withdrawals cost just $25. Moreover, Coinbase does not charge trading fees, other than what you see in the spread.

- Coinfloor doesn’t allow you to short cryptocurrencies, while Coinbase does.

- Customer support at Coinfloor is only available via email. Coinbase offers email, live chat, and phone support.

- Coinbase allows you to get started with a deposit of just $200, while Coinfloor has a minimum deposit of $1,000.

Conclusion

When Coinfloor was first set up in 2012, its main purpose was to offer Bitcoin trading to those holding GBP. This was a specific niche in the market, and to a certain degree, it worked quite well. However, although the platform has been operational for more than seven years now, its capabilities are extremely limited.

The Coinfloor exchange still only hosts six cryptocurrencies, and there is no option to short the coins on offer. Moreover, with minimum deposits set at 1,000 GBP/USD/EUR, this essentially alienates those that want to make smaller short-term investments. If you’re looking to deposit with a traditional debit/credit card or e-wallet, you’re also out of luck at Coinfloor.

Finally, customer support is also really lacking, as the only way you can get hold of the team is to email them. All in, and for the reasons stated above, we cannot endorse Coinfloor as a notable cryptocurrency exchange.

If you are yet to commit to Coinfloor, then we would instead consider using Coinbase. The platform is regulated by top EU bodies such as the FCA, they offer debit/credit card and e-wallet deposits, you can get started with just $200, and security is top-notch. Furthermore, you can long and short 15 different cryptocurrencies, with ultra-low fees.

eToro - Our Recommended Crypto Platform

How many coins do Coinfloor list?

Across eight crypto-to-fiat pairs, Coinfloor lists just 6 different cryptocurrencies. Apart from Bitcoin, the only currency that the remaining five cryptocurrencies can be traded against is GBP.

Can you 'short' cryptocurrencies on Coinfloor?

If you're looking to profit when the crypto markets go down, you won't be able to do this with Coinfloor. To short cryptocurrencies, you'll need to use a platform like Coinbase.

How do I contact Coinfloor via live chat?

Coinfloor does not offer a live chat facility, nor can you contact them via the telephone. The only support option available at the platform is email. This means that you might need to wait hours, even days before you get a response.

How much are the Coinfloor trading fees?

Coinfloor trading fees start at 0.30% every time you buy or sell a trading pair. This can be reduced to 0.10%, but you will need to trade more than 1 million GBP/USD/EUR every 30 days. This is out of reach for the vast majority of everyday investors.

Do I need to verify my identity to use Coinfloor?

Regardless of where you are located, you won't be able to deposit funds or trade at Coinfloor until you verify your identity. You'll need to upload a copy of your government issued ID. This can be verified within 60 seconds, although sometimes this takes longer.

Bitcoin

Bitcoin