Bittylicious is a third party exchange that allows users to buy cryptocurrency with fiat money.

The exchange targets the UK market, meaning that Pound Sterling is the default currency.

If you’re from the UK and thinking about buying cryptocurrencies with Bittylicious, be sure to read our comprehensive review. We’ll discuss everything from payment methods, fees, supported coins, and more.

eToro - Our Recommended Crypto Platform

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

On this Page:

If you’re in a rush and don’t quite have the time to read our review in full, then we concluded by noting that we cannot endorse Bittylicious. The main reason for this is that Bittylicious exchange rates are really bad, they operate in an unregulated manner, and there is no ability to short coins or apply leverage. Instead, we prefer heavily regulated exchanges like Coinbase, who allow you to long and short 15 cryptocurrencies, fees are super low, and the platform is really easy to use.

What is Bittylicious?

Bittylicious is a UK-based cryptocurrency exchange that allows users to buy and sell a small range of digital coins. Although the platform was first launched in 2013, Bittylicious is still not regulated by any notable bodies.

The Bittylicious website is very basic, which makes it super easy to buy coins if you’re a beginner. Although Bittylicious focus heavily on the UK market, they also accept payments from other countries too.

Bittylicious makes their money by adding their fees within the offered exchange rate.

How does Bittylicious Work?

Bittylicious is quite different from other leading exchanges such as Coinbase, as they act more like a third-party escrow provider. When you buy crypto at Bittylicious, you enter the amount that you want to purchase, and the rate is pre-defined for you.

Bittylicious then matches you with a registered broker, who will then deposit the coins into the Bittylicious escrow wallet. Once the broker confirms that you have deposited funds directly into their account, Bittylicious will then release the coins into private Bitcoin wallets.

This is actually a really inefficient process, as you need to wait for the broker to confirm that your payment has been received. Obviously, if you are using a bank wire, you might need to wait up to 5 working days before the funds actually arrive. Some brokers do allow you to use a debit or credit card, however, this is only available in certain countries.

As soon as the purchase is complete and the coins have been released, that’s the end of the transaction. This means that you cannot actually engage in day trading at Bittylicious, meaning that the platform is best suited for long-term investments.

Best Cryptocurrency Exchange in November 2024

What are Bittylicious Alternatives?

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

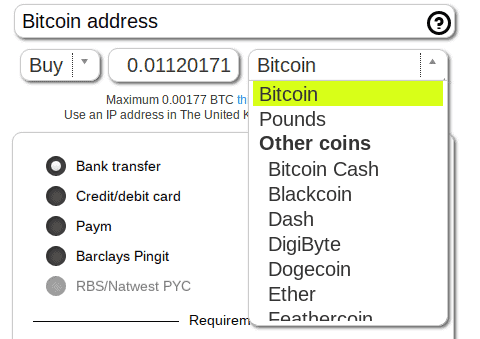

What cryptocurrencies does Bittylicious support?

In total, Bittylicious supports 16 different cryptocurrencies. As you will see from the list below, the platform’s choice of supported coins is rather strange. For example, apart from Bitcoin, Bitcoin Cash, Litecoin and Ether, none of the remaining coins are top 10 cryptocurrencies. This means that you can’t buy Ripple, Stellar Lumens or EOS at Bittylicious. Nevertheless, here’s the full list of supported coins.

- Bitcoin

- Bitcoin Cash

- Blackcoin

- Dash

- DigiBite

- Dogecoin

- Ether

- Featercoin

- Groestlcoin

- Litecoin

- Monetory Unit

- Peercoin

- Peercoin

- Stratis

- Syscoin

- Vertcoi

Which countries does Bittylicious support?

Although Bittylicious is fully committed to the UK market, they actually accept users from the vast majority of nation-states. However, seven countries, in particular, are prohibited from using Bittylicious, which we have listed below.

- Iraq

- Iran

- North Korea

- Sudan

- Syria

- Turkmenistan

Your specific location might also mean that you are prohibited from using certain payment methods. For example, only those based in Europe can use fiat currency to buy coins. As such, if you’re based in the U.S. then you should consider a more inclusive exchange like Coinbase.

Bittylicious Payment Methods and Fees

It is important to note that payment methods available on Bittylicious will depend on where you are based. Most importantly, if you want to use fiat money to deposit funds, you will need to be based in Europe.

- SEPA bank transfer (E.U only)

- UK Faster Payments

- Debit/Credit Card (Europe only)

- iDeal (the Netherlands only)

- Mister Cash / Bancontact (Belgium only)

Trading fees

Trading fees are a bit complex at Bittylicious. The platform claims that no fees are charged when you buy bitcoin with a debit card, and that the price that you see is the ‘all-in’ price. However, this is actually very misleading. The reason for this is that the crypto exchange rates charged on the exchange are really bad.

Let’s take a look at the following example.

As you’ll see from the above screenshot, there is just under a 50% variance in the price that you pay, depending on the payment method. As such, if you’re in the UK and want to use Barclays Pingit, you’ll pay more than £2,000 above the market price.

This makes Bittylicious a really expensive crypto exchange to use. Other exchanges such as Coinbase do not mislead customers by offering different prices for different payment methods. Instead, all deposits and free, and you only pay fees in the form of the spread.

How to sign up and trade on Bittylicious

Although we cannot endorse Bittylicious, insofar that fees are high, only Europeans can use fiat currency, and the fact that the platform is not regulated, if you do want to get started with the exchange, we’ve provided a simple step-by-step guide below.

Step 1. Open an account with Bittylicious

First, you will need to visit the official Bittylicious homepage, and then click on the ‘REGISTER’ button at the top of the page. Next, you’ll then need to enter your email address, full legal name, and choose a password. Read and accept the terms and conditions, before clicking on the yellow ‘REGISTER’ button.

You will then receive an email from Bittylicious, which you need to confirm by clicking the link contained within the email.

Step 2. Verify your identity

If you are planning to buy cryptocurrencies with real-world money, then you will need to verify your identity. As soon as you are logged in, you will see a banner that asks you to upload some ID – click it.

You will now see a long list of personal information that you need to provide. This will include your full legal name, address, nationality, and date of birth.

As you will see from the above screenshot, you need to provide quite a lot of documents before you can get started at Bittylicious. Take a look at the breakdown below.

- To prove your name, you’ll need to upload government issued ID. This can be a passport, driving license, or a national ID card.

- To prove your address, you need to upload a recent document that contains both your name and address on it. This can include a utility bill, bank statement, council tax bill, mortgage statement or rental bill.

- If you are planning to do a bank transfer, then this also needs to be proved. You’ll need to upload a recent bank statement, which can be no older than three months.

- You also need to confirm your mobile phone number, which is done by confirming a unique PIN number that is sent to your device.

- Once you’ve submitted all of the above, you will then need to wait for the team at Bittylicious to check your documents. You’ll receive an email once your account is ready to use.

Step 3. Place order

Once your account is verified, you can then place an order. Go to the homepage and select the cryptocurrency that you want to buy from the drop-down list.

You then need to select whether you want to buy or sell your chosen cryptocurrency, alongside the amount. Next, enter the cryptocurrency waller address that you want the coins deposited to. Finally, you need to select your preferred payment methods from the list that is presented to you.

Step 4. Transfer funds

On the next screen of the purchase process, you will be shown the account details that you need to transfer the money to. Alternatively, if you are paying with a debit/credit card, you’ll be taken through the payment process.

At this point of the transaction, the broker that you are indirectly buying from will have deposited the coins into the escrow account of Bittylicious.

Step 4. Wait for the broker to confirm receipt of funds

As soon as the brokers confirm that the funds have been received, they will notify Bittylicious. Finally, Bittylicious will transfer the coins to the wallet address that you entered at the first point of the order process.

Is Bittylicious regulated?

Bittylicious is not regulated, which is a major concern. Although they are based in the UK, this doesn’t force the exchange to obtain a regulatory license. On the other hand, Bittylicious do need to comply with UK and E.U. anti-money laundering laws (AML), which means that they need to identify customers before they can buy or sell coins.

We much prefer cryptocurrency exchanges that are heavily regulated. Coinbase, for example, holds regulatory licenses from the UK’s FCA, as well as CySEC in Cyprus.

Is Bittylicious safe?

Although Bittylicious have not experienced a hack (that we know of) since their inception in 2013, it is still a major concern that the platform is not regulated. As the platform operates more like a peer-to-peer escrow service, Bittylicious only holds customer funds for a small amount of time.

As such, the main concern that you will have is if Bittylicious does not forward the coins onto you once they have been released by the seller. Moreover, customer funds are always held online (as opposed to cold storage), which is again a major risk.

In order to keep customer funds safe, Bittylicious offers the following security features.

- Two-factor authentication (not enforced)

- Customers identified when using fiat currency

- SSL Encryption

The aforementioned lack of security features, alongside a non-regulated status, means that we are unable to endorse Bittylicious as a go-to cryptocurrency exchange. We instead feel more comfortable recommending regulated platforms such as Coinbase, who ensure customer funds are kept safe.

Does Bittylicious have a wallet?

Due to the nature of the Bittylicious model, the platform does not offer a wallet. In fact, the exchange does not even offer an online wallet. Instead, as soon as the seller confirms they have received your funds, the coins are sent directly to your third-party wallet.

Does Bittylicious have an app?

On top of not having a wallet, Bittylicious does not provide its users with a dedicated mobile app. Instead, you will need to access the Bittylicious platform via your mobile web browser. When we tested it out ourselves, we found the mobile version of the website a bit difficult to navigate across.

This was especially true when it came to entering the cryptocurrency wallet address that we wanted the funds sent to. As there is no QR code facility, you need to manually paste the code into the mobile web browser.

If you want a dedicated mobile app that will allow you to trade cryptocurrencies seamlessly, then we would suggest looking at Coinbase.

Bittylicious customer service

If you need to contact the support team at Bittylicious, then there are a couple of notable options available to you. Take note, although Bittylicious list a telephone number (UK toll) on their support page, they state that this cannot be used for account support. As such, it remains to be seen what the number is actually for.

- Phone Number: +44 870 2955078 (no support)

- Live Chat

Bittylicious pros and cons

Pros:

Cons:

- Really bad exchange rates

- Huge difference in price depending on the payment method

- Fiat currency purchases only for Europeans

- Not regulated

- No trading floor

- No mobile app or wallet

- Lack of security features

Conclusion

In summary, it’s really difficult to make a strong case for Bittylicious. In fact, the platform doesn’t offer anything notable at all. Firstly, although the platform claims to support the vast majority of countries, you can only deposit funds with real-world money if you are based in Europe.

Furthermore, the actual buying process is really inefficient. You need to place an order, transfer the funds to the broker that Bittylicious matches you with, and then you need to wait for the broker to confirm that they received your transfer. On top of this, Bittylicious does not actually allow you to trade crypto. Instead, as soon as your payment is confirmed, the coins are instantly sent to your private wallet.

Finally, it is a major concern that the platform is not regulated in any way, nor do they offer a mobile app or online wallet.

This is why we think that you are best off using a heavily regulated exchange like Coinbase. The platform accepts most nations (including the U.S.), supports multiple payment methods, deposits are free, fees are super low, and you can also trade on-the-go via the native mobile app. Even better, you can trade 24/7, apply leverage, and short crypto.

How many coins do Bittylicious list?

Bittylicious supports 16 different cryptocurrencies.

Can you 'short' Bitcoin on Bittylicious?

You can't short coins on Bittylicious. You'll need to use a more comprehensive platform like Coinbase for this.

How do I contact Bittylicious via live chat?

Once you are logged in to your account, head over to the support page and click on 'LIVE CHAT'.

How much are Bittylicious trading fees?

Trading fees are included in the price that you are offered by the broker. You'll need to calculate the exchange rate against the official spot rate to find out how much you are paying.

Can I buy crypto with a debit/credit card at Bittylicious?

You can use a debit/credit to buy crypto at Bittylicious only if you are based in Europe.