You might find the number of options available confounding. No matter what your level of experience is, TD Ameritrade claims to offer a compelling working model. Founded in 1978, TD Ameritrade is one of the largest US-based stock brokerage firms. It came into existence as a result of multiple mergers and acquisitions.

Read on to learn more about TD Ameritrade, its pros and cons as well as how it works.

On this Page:

Our Recommended Broker

We’ve analysed TD Ametritrade’s platform, fees and usability and found that we cannot recommend this broker. The platform below offers a much more intuitive platform that is beginner-friendly and well-regulated. Try our recommended broker by clicking on the link below or read on to find out more about TD Ametrade.

What is TD Ameritrade?

Among the subsidiaries and operations that constitute TD Ameritrade are TD Waterhouse, Ameritrade, First Omaha Securities and Scottrade which was the most recent. With each merger, it has expanded its features and grown its user base into its current state. For instance, the Scottrade acquisition brought on board over 3.5 million customers.

Based in Omaha, Nebraska, TD Ameritrade offers an impressive array of investment options for all levels of traders. It operates over 360 branch offices across the US and in each of these, there are professional investment consultants.

Each day, when the market is open, its clients place over 860,000 trades. TD Ameritrade holds total client assets worth over $1 trillion and more than 11 million broker accounts.

As of November 25, 2019, Charles Schwab announced that it would buy out TD Ameritrade and integrate the two companies upon finalization of the deal. They will carry out the transaction during the second half of 2020. At present, the two will continue to function autonomously.

Once the transaction is finalized, the merger is expected to take place within a span of 3 years. In the meantime, it still continues to accept new accounts and will move these over to Charles Schwab following the acquisition.

Tradable Securities

You may trade the following securities on TD Ameritrade:

Traders get access to the following stocks:

Stocks Offered

Special Features

Wide range of investment options

Among the outstanding features of its services is its vast investment selection, as it covers the full spectrum including forex and futures. Notably approved clients can also trade bitcoin futures here.

Commission-free trades

Another area in which it shines is its commission-free trades, which it announced on October 3, 2019. Prior to that, it had been charging $6.95 per trade which was relatively high.

Presently, online options, ETF and stock trading are free. Options trading, however, still have the typical $0.65 per-contract fee.

Vast library of educational tools

It also excels in the educational resources category with abundant offerings in every category and format. These range from quizzes and slideshows to articles and videos as well as in-branch presentations and live seminars conducted online.

The “Ask Ted” feature is particularly handy as the chatbot offers guidance on specific requests.

Mock trading account

TD Ameritrade is among the few online stock brokers to offer mock trading accounts. Providing $100,000 in practice money, the PaperMoney Virtual Simulator targets advanced traders. The trading platform even has access to a margin account. It is accessible on desktop as well as the Mobile Trader app.

Trading technology

The order routing algorithms on this site are always seeking out price improvement so as to offset the price of placing trades. Traders also have access to real-time data streaming on all trading platforms.

Account Fees, Commissions and Limits

On this brokerage site, account holders enjoy relatively low account fees. Below is the breakdown.

Account Minimum

TD Ameritrade stands out for, among other things, its $0 account minimum.

When you open an account and fund it, you can qualify for a bonus of up to $600. The offer applies to a new joint, individual or IRA account funded within 60 days of opening. Here is how it works: On TD Ameritrade, you will find just about any type of account. Some of the most popular ones include:Promotions

Account Types

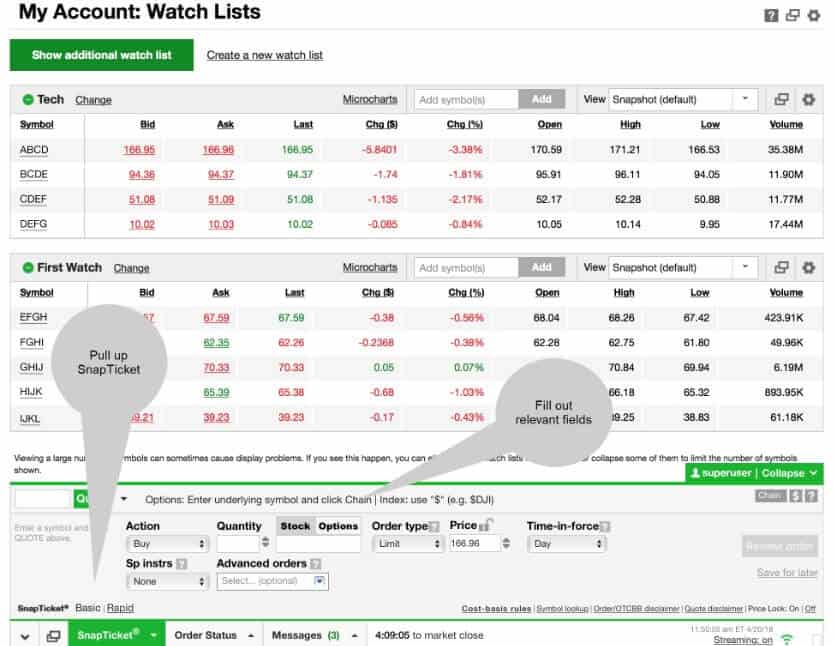

Trading Platform and Technical Features

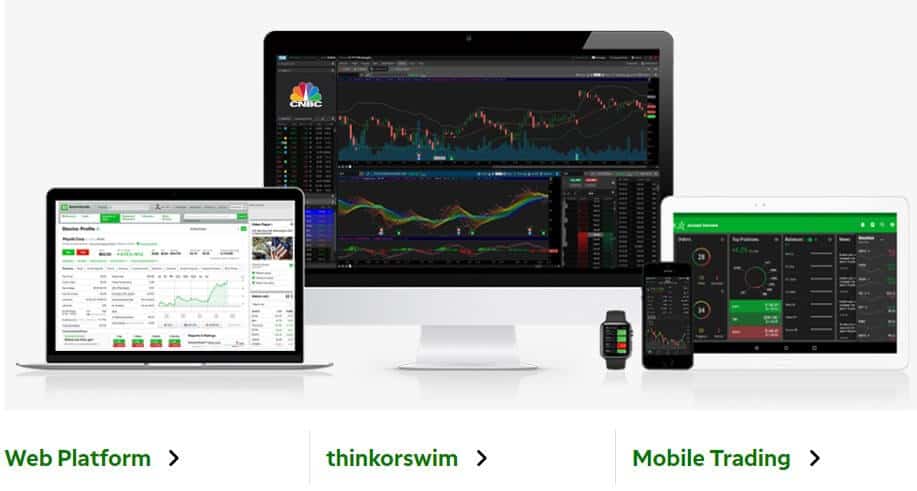

Account holders on TD Ameritrade get access to two main trading platforms, each of which has a corresponding mobile app. These are:

Experienced traders will enjoy access to plenty of elite-grade tools for analysis and to test out strategies. They also get tools for monitoring potential risk/reward and scanning markets. Traders using this downloadable option can customize the interface remarkably, setting preferred trading defaults, layouts and color schemes. TD Ameritrade is also a market leader when it comes to technical features, which dominate thinkorswim. Have a look at some of its technical trading tools:

Research and Data

Whether you are a newbie to investing or a seasoned pro, you will likely find that the learning process never ends. On TD Ameritrade, you get plenty of handy tools for this purpose. The comprehensive set of research resources lets traders plan and evaluate strategies and analyze market conditions and investment performance.

Some of the tools for this purpose include:

Cashier Options

There are 5 main ways to fund your account. These are:

Withdrawal options, on the other hand, include wire transfer and cheque.

How to Trade on TD Ameritrade

Here is how to start trading on Ameritrade:

Step 1: Open an account.

The process is straightforward but unfortunately, is not fully online. To get started, click on “Open New Account” on the site’s homepage and complete the online form.

Once you have done so, print out the form and mail or fax it together with a copy of the required ID. The process may take up to 3 days.

Step 2: Fund your account.

Select the desired funding method and follow the prompts to make a deposit.

Step 3: Start trading

You can start trading using your laptop or smartphone.

Ease of Use

One of the highlights of the site is that it has something for traders and investors of all levels. There are handy tools for everyone from the passive trader to the seasoned active trader.

The website interface is intuitive and clutter-free, making it easy to find what you are looking for.

Customer Service

Yet another highlight of this brokerage site is its customer support team. Not only are they reachable on multiple avenues, but they also are fast as well as highly responsive to customer needs.

Here is how you may reach them:

Security & Regulation

TD Ameritrade makes use of advanced firewalls and 128-bit SSL encryption to keep user data and communication secure.

It is also a member of the Securities Investor Protection Corporation which protects members against losses of up to $500,000. Each of the brokerage firm’s clients also has $149.5 million worth of securities’ protection and $2 million cash protection.

TD Ameritrade is regulated and certified by multiple top-tier authorities. These include the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) and the Financial Industry Regulatory Authority (FINRA).

Additionally, the institution has a long-standing track record as a reputable industry player. It is also known to disclose its financials.

Supported Countries and Languages

TD Ameritrade specifically targets users in the United States. However, there are a number of other countries where the service is accessible. These are:

It supports 3 languages, namely English, Chinese (Traditional) and Chinese (Simplified).

Education and Resources

On its site, TD Ameritrade claims to offer an “education experience that customizes to fit your investment interest and goals.” And it strives to deliver impressively in this regard. Here are some of its educational resources:

Mobile Trading

Both of the site’s trading platforms are accessible on both desktop and mobile device operating systems. Its mobile trading app is available for Android and iOS and even work on Apple Watch.

TD Ameritrade app is the mobile alternative to the web platform while the TD Ameritrade Mobile Trader is the companion of thinkorswim.

Pros and Cons

- Low trading fees

- Regulated by top-tier authorities

- Great desktop trading platform

- Fast and responsive customer support team

- Impressive array of research and educational tools

- Offers a wide selection of no-fee trading options

- Users can only trade in a limited number of markets

- Slow account opening which is partly digital and partly manual

- Does not offer electronic wallets or credit and debit cards for easy cash transfer

- Charges a $75 transfer-out fee

Conclusion

TD Ameritrade is impressive in all the areas that matter most and has over the years sought to streamline its users’ pain points. For instance, in the past, it would charge a $49.99 broker-assisted trading fee but it has now come down to the industry average.

It also introduced worthwhile features like tax-loss harvesting. And its site is a lot more harmonious and intuitive than it once was.

Overall, it is a highly competitive brokerage firm that is constantly improving its offerings. Its faults are few and far between, and as such, it is a worthwhile choice for traders and investors at every level.

FAQs

Can I trade margins on TD Ameritrade?

Yes. During the application process, select the option and the service provider will assess your suitability.

Will my account earn interest?

Yes. The service is, however, subject to its rates and policies which change from time to time so it is best to keep checking for updates.

What is the minimum amount needed to open an account?

There is no minimum required for account opening. But to be considered for margins and options trading, you need a $2,000 minimum.

Are there any restrictions for deposits made into my account?

Yes. Trading some securities and making withdrawals is restricted until your deposit clears, which could take 1-6 business days depending on the deposit method.

Can I endorse stock certificates over to TD Ameritrade in order to open an account?

Yes. To do so, designate TD Ameritrade Inc. as the attorney on the back of the certificate to transfer the stock.