TraderOr is a new online brokerage firm that is offering investors access to a wide range of financial products that include cryptocurrency pairs, FX currency pairs, stocks, indices, commodities, and ETFs. If you’re looking for a CFD platform that makes the trading process super easy, alongside a full range of features and market analysis innovative tools, then we would suggest exploring TradeOr.

In this review, we cover the ins and outs of this innovative broker. We’ll explore the range of assets on this platform, the features and trading tools, fees and commission, payment methods, trading platform, regulation and safety tools and more.

On this Page:

What is TradeOr?

TradeOr is an online trading platform that connects users to financial markets via top liquidity providers. With this platform, investors get access to leverage trading on more than 120 assets across various markets with zero commission on any trade and very competitive spreads.

The platform’s main attractions for clients is the ability to use bitcoin as the primary payment option, the range of security features the broker provides, and the smooth and extremely easy-to-use proprietary trading platform offered by TraderOr.

What Shares Can You Buy on TraderOr?

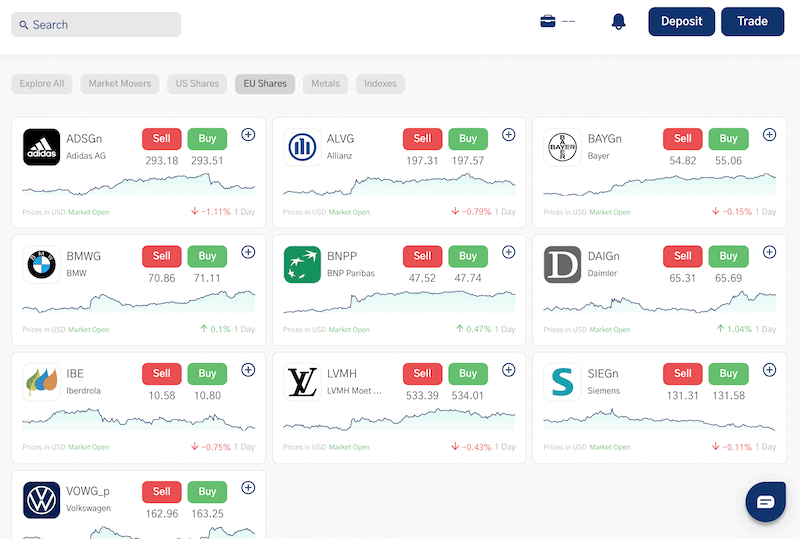

Generally, TradeOr offers a decent selection of shares to trade on. This includes popular and highly liquid shares from US stock market as well an extensive list of shares from European stock markets.

Overall, TraderOr offers shares of 27 companies from US stock markets that include Tesla, Amazon, Apple, Ford, Facebook, Google, Microsoft, Intel, Netflix, and more. From European share markets, the broker offers the following stocks: Adidas, Allianz, Bayer, BMW, BNP Paribas, Daimler, Iberdrola, LVMH, Siemens, and Volkswagen.

What CFDs Does TradeOr Offer?

In addition to shares from the United States and Europe, TraderOr also offers access to a range of CFD products from different markets that include FX currency pairs, cryptocurrencies, indices, stocks, ETFs, and commodities (energy and metals). In general, the selection of products with TraderOr is currently fairly limited, however, it is clear that the broker will increase the range of products available to be traded in the near future.

TradeOr Fees & Commissions

Unlike traditional commodity and stockbrokers operating in the market, TraderOr has a different pricing structure. Overall, TraderOr is considered a low-cost brokerage firm though it does not yet provide a detailed list of all charges and commission on its website.

Simply put, when you buy and sell assets with TraderOr, you do not have to pay any trading fees besides the spread. There are no account management fees and we could not find ant hidden fees the broker charges. Nonetheless, below you will find the fees and charges you need to find out about before you start trading with this broker.

Deposit and Withdrawal Fee

TradeOr does not charge any deposit and withdrawal fees as it uses bitcoin as the primary payment method on its platform. The broker mentions on the website that it may charge a fee if the payment method used charges them a fee. This basically means that you’ll only have to pay the exchange/wallet fee and the blockchain fee for transferring funds into TradeOr’s network.

Rollover/Overnight Fees

Much like any other CFD brokerage firm in the market, TradeOr charges rollover/overnight interest rate for positions held open overnight. If you are not familiar with the term, a rollover fee is an interest rate that the broker charges if you hold a position overnight.

Inactivity Fee

TradeOr discloses on its official website that the company may charge an inactivity fee in case there has been no trading activity on the client’s TradeOr account.

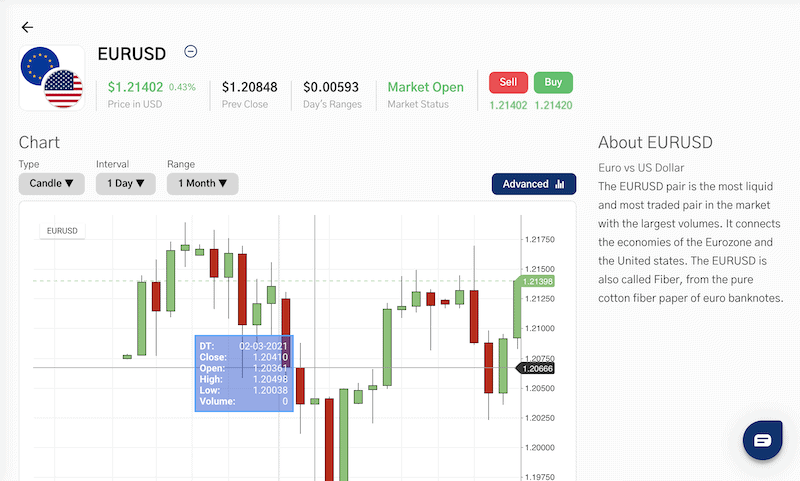

TradeOr Spreads

TradeOr promises CFD trading with zero commissions and tight spreads. And indeed, the broker offers very competitive spreads. TradeOr offers variable spreads, meaning that they fluctuate in times of high volatility. For example, the spread for the EUR/USD ranges between 0.8 to 2 pips. All in all, TradeOr partners with top liquidity providers so you get low spreads and fast trading execution.

TradeOr Leverage and Short-Sell Requirements

One of the main reasons to choose to trade with TraderOr is the high leverage it offers. As we mentioned previously, TradeOr is not yet regulated by any financial agency and as such, it is able to provide leverage of 100:1 or even more. This essentially means that an investor has the potential to control a $1,000,000 position with just $10,000 in the account balance. This is above the average in the industry which typically ranges around a leverage ratio of 2:1 to a maximum of 30:1.

Having said that, you should also take into account that leverage trading is risky and may not be suitable for everyone.

TradeOr Trading Platform

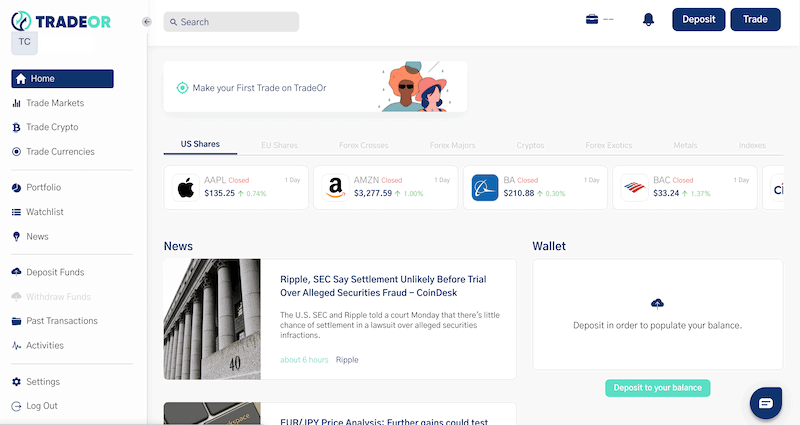

TradeOr has an excellent web platform and powerful tools to ensure investors are getting a successful trading experience. In general, this platform was designed for simplicity and functionality, making it an ideal solution for beginner traders. On this platform, you have a left-side navigation menu where you get access to any feature you need in order to manage your investment account and place orders in the market.

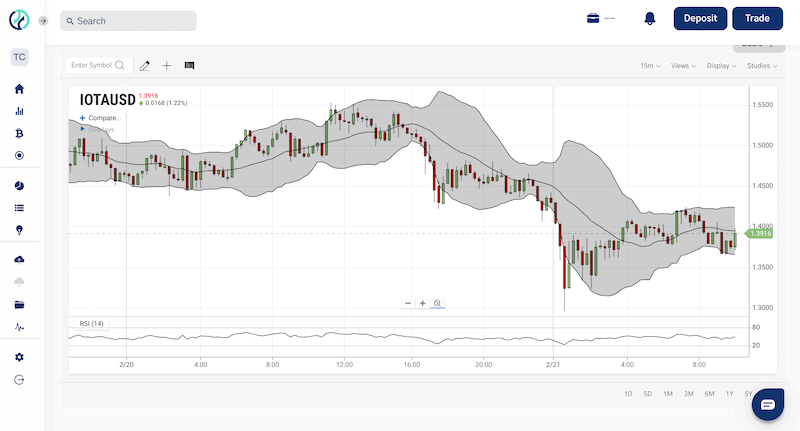

The TradeOr web platform comes with the ChartIQ, which is the most powerful HTML5 charting library and is among the best charting packages available on web browser platforms. It has 125 built-in technical indicators, a nice range of timeframes, and two different layout modes.

TradeOr Mobile App

At present, TradeOr does not have a mobile trading app. While this is a major flaw for some investors, the TradeOr platform runs on any web browser so you’ll be able to access your account from your mobile device.

TradeOr Account Types

TradeOr only has one account type for live trading, which means all traders on this platform are getting the same leverage, trading fees, and spreads. As such, the minimum deposit requirement for all levels of traders to opening an account with TradeOr is just $10.

While the option to trade on a demo account is currently unavailable, the broker does mention on its terms and condition page that simulated conditions might be different than real live accounts. This means that TradeOr is expected to offer a demo practice account in the near future.

Research, Analysis and Education at TradeOr

To be honest, this is one of the main areas where the broker needs to improve. First, there’s no access to a demo account, which is one of the most important features for new traders who are looking to get familiar with the platform as well as the brokerage firm. Then, the broker does not provide educational materials and a variety of unique research and analysis tools.

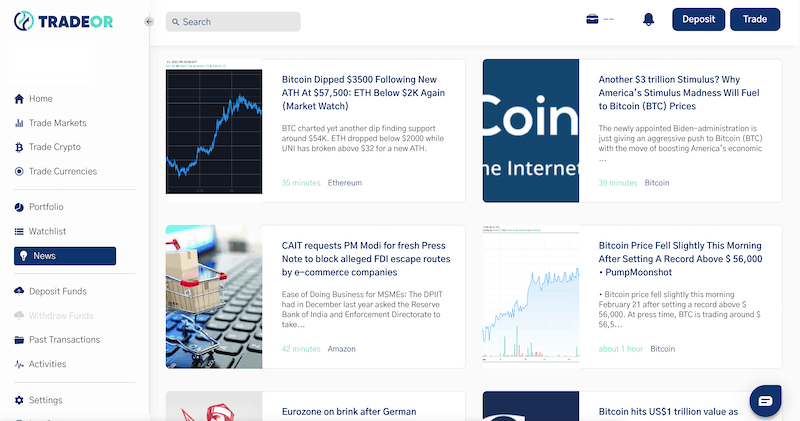

On the other hand, TradeOr makes things simple by offering two main research and analysis tools on its platform – the ChartQI charting package for technical analysis research, and the excellent news section it offers on its platform.

Payment Methods at TradeOr

As we previously mentioned, TradeOr offers only one payment method – bitcoin. This means that all transactions are safe and executed instantly.

TradeOr Minimum Deposit

The minimum deposit requirement at TraderOr is just $10 or equivalent. In the UK, the minimum deposit stands at £10. Notably, the broker does not mention any restrictions about the maximum amount that can be deposited into a trading account.

Customer Service at TradeOr

Clients can reach the TradeOr customer support team 24/7 via a submit a ticket form, email address, or live chat support. Overall, the TradeOr support team is very responsive to questions and you can get answers to your queries immediately via the live chat box that is available directly on the trading platform as well as on the broker’s homepage.

Is TradeOr Safe?

TradeOr is a new broker that has not yet obtained regulatory approval. But this does not come as a surprise as getting authorities and licenses from financial agencies often takes several years. Nevertheless, TradeOr is not the conventional brokerage firm. Instead, it offers an innovative platform where investors get security by enabling top security tools such as the 2FA authentication factor.

In addition, TradeOr supports bitcoin as the only payment option, which removes the involvement of third parties like banks and payment providers. As such, TradeOr’s payment system is safe and secure as bitcoin is encrypted and backed by the blockchain network.

Join TradeOr – Steps Required

If you are ready to open an online trading account with TradeOr, below we are now going to show you the full sign up and deposit process. Bear in mind that the registration process with TraderOr is very simple and requires you to pay close attention to security and safety features.

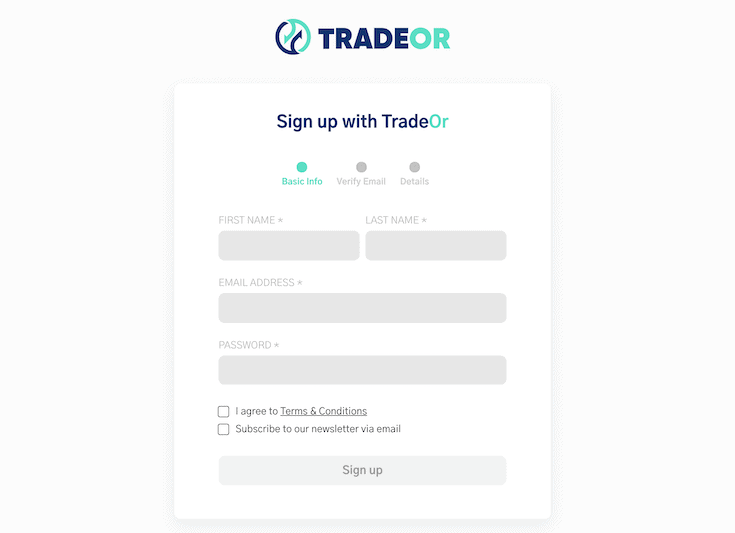

Step 1: Open an Account

TradeOr makes it easy to start trading on its platform.You do not have to upload documentation and wait for several days before you account is getting approved.

To get started, all you need to do is to sign up for an online trading account with TradeOr – simply visit the broker’s site and click on the Sign-Up button at the top of the page.

As you can see in the image above, you’ll have to submit your first and last name, email address, and then create a password. You’ll then have to verify your email address and complete a short questionnaire where you have to enter more personal information.

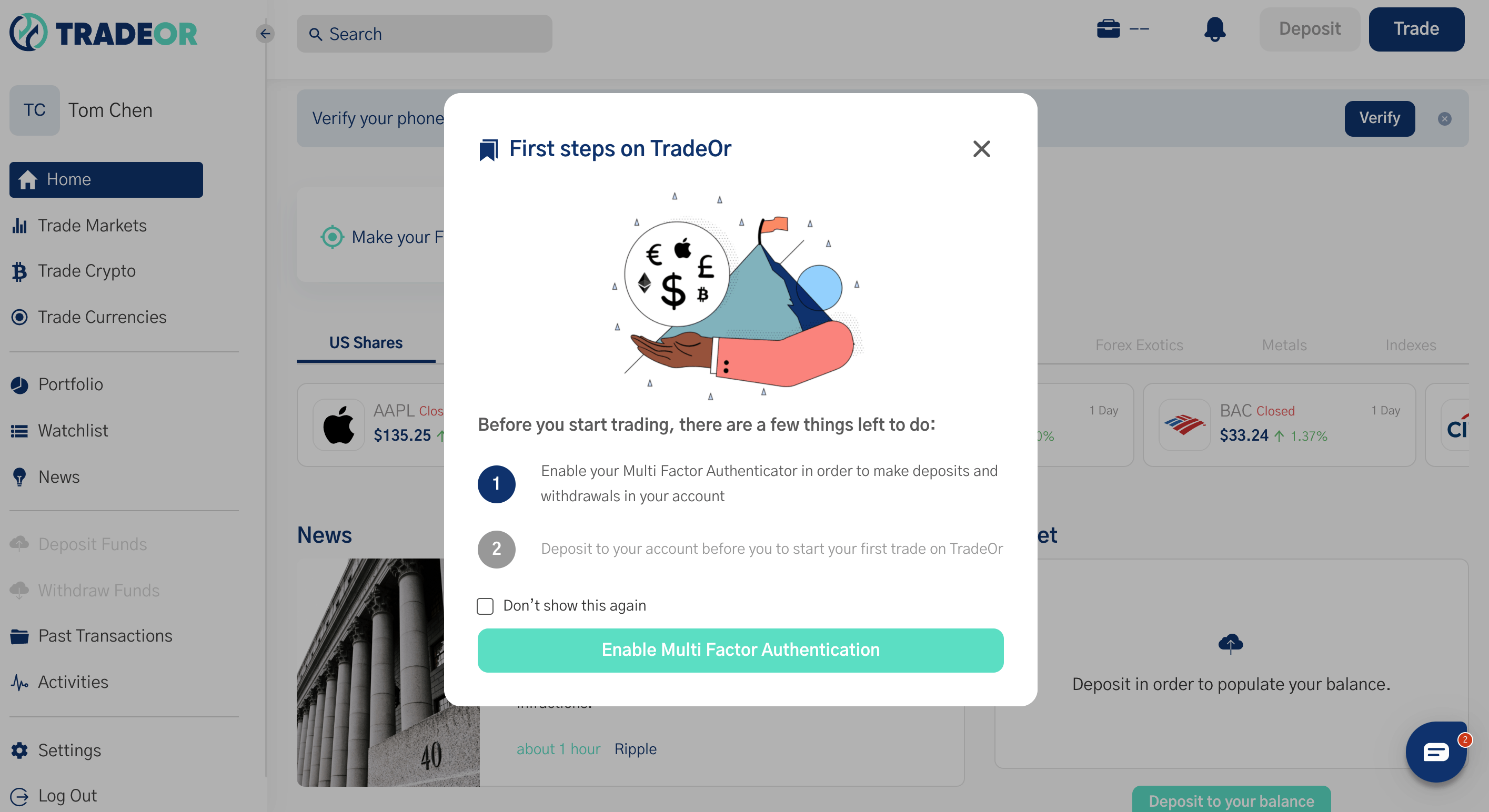

Step 2: Enable the 2FA in Your Account and Verify Your Mobile Phone

TradeOr takes another approach to ensure clients’ data and funds are well protected on its platform. The broker requires every investor to enable the 2FA factor authentication tool before you can enter the platform. For those unaware, the 2FA is one of the best ways to secure any online trading network.

This means you’ll have to enable the 2FA tool and then download the google authenticator app, scan the QR code and insert the number you’ll see in the app. To complete the verification process, TradeOr also requires you to verify your mobile phone number by sending an SMS code to your mobile device.

Step 3: Make a Deposit

Now you can add funds to your new trading account. As we mentioned above, TradeOr maintains a minimum deposit requirement of just $10 (or equivalent). The broker supports bitcoin as its primary and only payment method, meaning you’ll have to transfer funds via your electronic wallet to TraderOr’s wallet.

Step 4: Start Trading

Deposit funds at TradeOr is instant so you’ll be able to see the funds in your account immediately. At this point, you can start trading. In order to make your first trade, you need to choose the asset you wish to buy or short sell, set the amount, and the order type, and place an order. Then, insert a stop loss and take profit order to mitigate your risk.

TradeOr Pros and Cons

- Zero commission policy

- Enables users to deposit and withdraw funds using bitcoin

- Useful news section included in the platform

- Customers support is available 24/7

- Top security features including the 2FA

- Up to 500:1 leverage

- Low minimum deposit requirement of just £10

- No demo account

- Charges inactivity fee

- Not regulated

- Supports one account type

TraderOr Review – The Verdict

From the above in-depth review, TradeOr is a new trading platform that offers users several benefits, including the use of bitcoin as a payment method, high leverage ratio, and zero commission pricing structure. On top of that, the platform appears to be completely reliable and safe as the broker ensures data is protected and clients’ funds are safe and secured.

Compared to other online platforms, the selection of assets at TradeOr is fairly decent. However, this new innovative broker has made an interesting selection of products that includes the popular VIX index, US and EU shares, and some of the most exotic altcoins in the market. Moreover, TradeOr maintains an extremely low minimum deposit requirement and a quick and hassle-free registration process.

TradeOr – Top CFD Broker with Low Fees

74% of retail traders lose money when trading CFDs.

FAQs

What is TradeOr?

TradeOr is a new online trading platform that allow investors to trade CFD products via its own innovative trading platform.

Is TradeOr a regulated broker?

No, at the time of writing, TradeOr is not regulated by any regulator. However, it complies with all laws and regulations in the areas it provide online trading services.

Is TradeOr available in my country?

Overall, TradeOr is available in most countries around the world. But in order to find out if TradeOr is available in your country, you'll have to start the registration process or contact the broker's support team.

Does TradeOr have a mobile app?

No, TradeOr currently does not support a mobile trading app.

What is the minimum deposit at TradeOr?

TradeOr has a minimum deposit requirement of just $10 or equivalent.