Bitcoin Cash is a virtual asset that has become highly popular due to its faster transaction time. Built on the same consensus protocol as the premier digital asset Bitcoin, BCH is a fork with a more elaborate plan to increase block sizes, enabling faster block finality. If you are searching for a comprehensive guide on what Bitcoin Cash is all about and what platforms you can buy Bitcoin Cash through, you have come to the right place.

On this Page:

Best Places to Buy Bitcoin Cash in May 2024

Before we go ahead, let’s explore some of the best places to buy Bitcoin Cash this year. Our top choices include:

While this list is not exhaustive, these platforms have been carefully reviewed and selected and are the best brokers you can buy Bitcoin Cash through. Some of the considerations we put in our review are user-friendliness, reasonable fee structure, payment options, security, and customer support.

How to Buy Bitcoin Cash – Guide to the Best Brokers for Buying BCH in May 2024

If you are looking for a short guide to buy Bitcoin Cash immediately, the following steps should get you started in no time. Follow the steps below to buy Bitcoin Cash in less than five minutes.

- Open an account: You’ll first need to open an account with a trusted cryptocurrency broker. We recommend Capital.com.

- Upload ID: As a regulated brokerage site, Capital.com will ask you to upload a copy of your government-issued ID.

- Deposit: You can now deposit funds with a debit/credit card, Paypal, Neteller, Skrill, or a bank wire.

- Buy Bitcoin Cash: Search for ‘BCH’ and click the ‘Trade’ button. Enter the amount of Bitcoin Cash you wish to buy and confirm the order.

You will now have Bitcoin Cash in your portfolio. Most investors will keep their Bitcoin Cash funds on the platform until it’s time to cash out. You can also withdraw your crypto funds to the crypto wallet.

Where to Buy Bitcoin Cash

Several platforms offer support for Bitcoin Cash trading. However, you should look for some factors like safety, fees, payment option, support, and if the platform is regulated. This section covers our top reviewed brokers to buy Bitcoin Cash through, with our recommended broker coming up first.

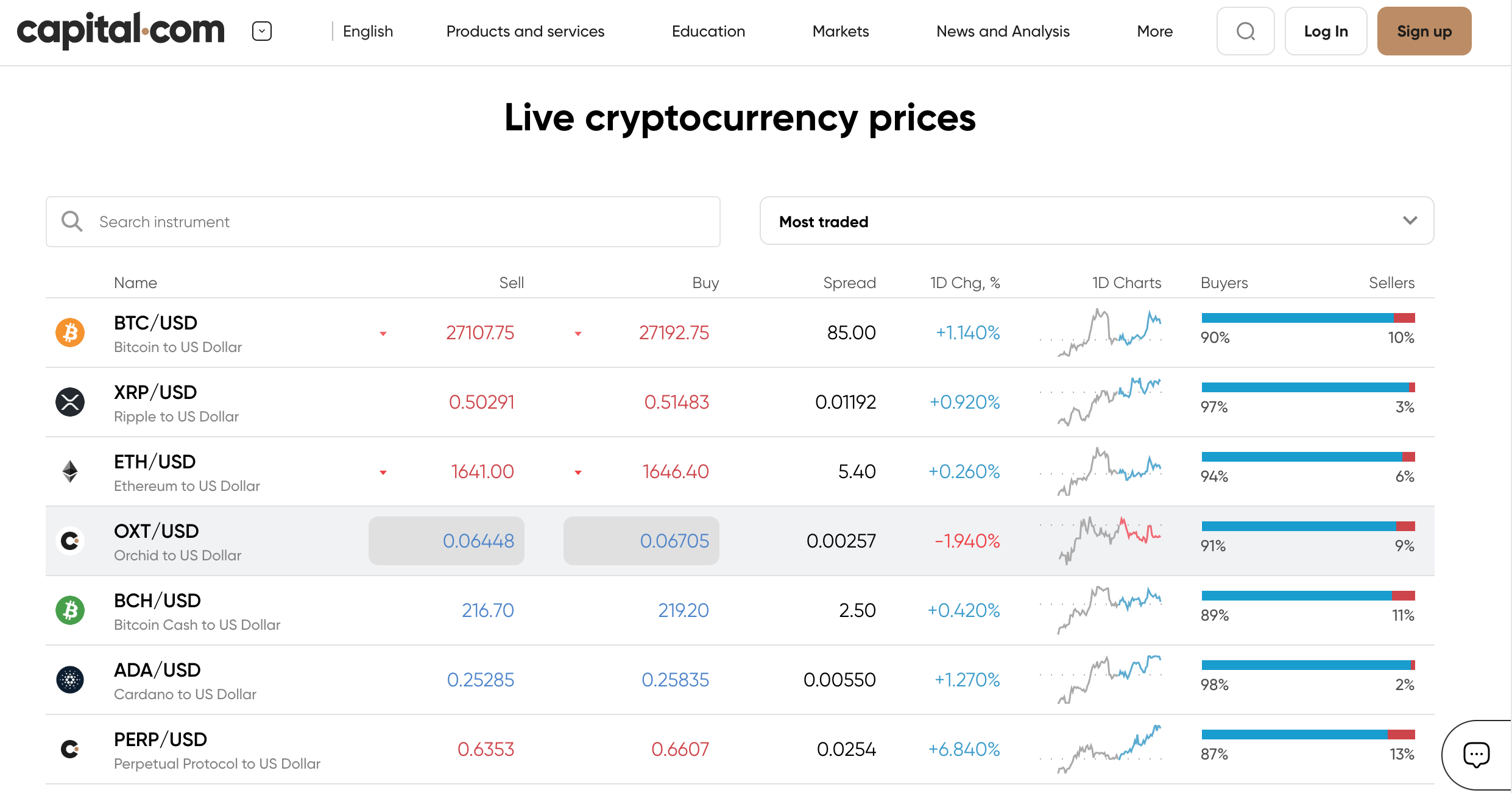

1. Capital.com – Trade Bitcoin Cash Commission-Free

Capital.com is a top crypto broker that allows users to purchase Bitcoin Cash with no hefty fees. Capital.com is regulated by global bodies like the CySEC, the FCA, and ASIC. It also offers commission-free trades, thereby significantly boosting your purchasing power.

Aside from cryptocurrencies, Capital.com caters to traders interested in commodities, ETFs, CFDs, stocks, bonds, and FX currency pairs, enabling them to enjoy low FX and stock CFD trades.

However, Capital.com offers only CFD trading meaning you only trade the price movement of an underlying asset without worrying about storing the asset itself. In the aspect of user experience, Capital.com is one of the top performers and uses patented artificial technology to make the experience both smooth and easy for an array of investor types.

You can choose a web-based trading platform or the popular Meta Trader 4 (MT4) option. This furnishes you with various technical indicators, charting tools, and support for automated trading via expert advisors.

Capital.com offers maximum leverage of 1:20, which should be used sparingly given the financial losses a bad trade may incur. The platform is also rich in beginner-friendly materials, as newbies can go through financial articles, glossaries, and industry-specific content to better understand the financial space. Demo accounts are also on offer.

Pros

- Low FX and stock fees

- Rich educational resources

- Multiple trading platforms

- 0% commission trades

- Heavily regulated by tier-1 bodies

- Tight spreads

Cons

- Only CFD trades on offer

- Does not support custom investment strategies

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

2. Binance – World’s Largest Crypto Exchange

Founded in 2017, Binance is a popular crypto exchange and processes over $40 billion on average in daily transaction volume. Of Chinese descent, the Bitcoin exchange has become a popular destination for virtual asset enthusiasts, given its low fees and easy-to-use platform.

Solely interested in virtual assets, Binance has quickly established itself as a top crypto exchange, given the rapid pace at which it lists top-performing digital assets. In addition, Binance has also introduced more traditional financial services through its Binance Earn platform.

Here, users can generate passive income from their crypto holdings through flexible and locked savings. Also, its decentralized finance (DeFi) staking is a popular choice due to its high-interest rate. Split into ‘Guaranteed’ and ‘High-yield,’ users can earn between 4.23% to 45% on their holdings.

Binance operates like a traditional brokerage firm, making it more familiar to traders. You can trade crypto assets like Bitcoin and Bitcoin Cash on margin trading, futures trading, and different zones. The cryptocurrency exchange sports one of the largest repositories of cryptocurrency trading, and its web and mobile trading platform is user-friendly and suitable for various skill levels.

To crown it all, Binance operates one of the lowest fee structures in the crypto industry, charging a 0.10% commission for every trade on the platform. Large trades can also be slashed down to 0.06%, depending on the user’s account.

Pros

- High liquidity for all listed virtual assets

- Low commission fees and drops even further

- Supports multiple payment methods, including P2P

- Beginner-friendly and also useful for experienced traders

Cons

- Not regulated by recognized global brand

- Largely in private hands

Your Capital is at risk.

3. Coinbase – Top-Listed US Crypto Exchange

Coinbase is a big crypto wig in its own right. The US-based Bitcoin exchange is the only cryptocurrency trading platform publicly listed on Nasdaq’s trading floor.

Coinbase has made a name solely due to its user-centric approach to cryptocurrency trading. The Coinbase app is highly intuitive and user-friendly and is a destination point for most US crypto investors.

Aside from facilitating trades for retail investors, Coinbase also services large institutional investors seeking exposure to cryptocurrencies as it helps them store their digital holdings in offline cold storage demographically distributed.

Coinbase also operates a Pro variant of its platform, a favorite destination for experienced traders. Benefits are lower fees and more charting and analytical tools. However, the Bitcoin exchange has always been criticized for its high trading fees and other charges.

Coinbase charges a whopping 4% commission on deposits and 25% on other varying charges. Meanwhile, the exchange hosts several large and small-cap cryptocurrencies and is the second most tradable exchange behind only Binance.

Pros

- Highly intuitive and user-friendly interface

- Multiple platforms for different users

- Large repository of digital assets

- Low minimum balance

- High liquidity

Cons

- Expensive trading platform

- Complex fee structure

Your Capital is at risk.

4. Libertex – Popular Choice For Stocks and CFDs

Libertex is a CySEC-regulated trading platform that allows you to trade stocks, cryptocurrencies like Bitcoin Cash, ETFs, and commodities. The CFD trading platform was launched in 1997. It now has more than 2 million clients spread across 110 countries. Unlike other platforms, Libertex specializes in a few niche asset classes.

It covers only 213 markets. Every financial market on Libertex can be traded with leverage. Libertex leverage is capped at 1:30 for UK traders. That means if you have a £100 account balance, the broker will give you access to £3000 in trading capital.

One standout feature of Libertex is the zero spread offering. This feature is quite rare for CFD brokers, and it ensures traders can earn more profits when trading. However, there are still some complications around the platform’s commission charges. Libertex is not overly transparent on its charges, and you might find yourself digging deep to find the required information.

Pros

- No deposit fees

- Trade Bitcoin Cash on low commissions

- Regulated broker

Cons

- Commissions not transparent

- Limited markets offered

Your Capital is at risk.

5. Plus500 – Regulated Platform Offering Different Asset Classes

Plus500 is a top brokerage platform that started as a means for people to trade contracts for difference (CFDs). Listed on the London Stock Exchange, the platform has been available since 2008. Today, Plus500 operates in over 100 countries and offers access to various asset classes – including cryptocurrencies.

One of the many benefits of Plus500 is that it’s regulated. The platform operates under licenses from several tier-1 regulators, including the U.K.’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Like the stock exchange, it discloses information and has a relatively healthy relationship with regulators.

Account opening on Plus500 is relatively seamless. The process is entirely digital, and you should be able to get everything ready in a few minutes. With Plus50, you can pay no withdrawals, deposits, and account maintenance fees. But you should know that the platform charges $10 per quarter after three months of inactivity.

Plus500 also offers impressive research and analysis tools, allowing you to make more informed trades. Generally, this is a very good platform for trading Bitcoin Cash.

Pros

- Regulated platform

- Quick account opening process

- Low minimum deposit

Cons

- Not available in the United States and Canada

- Charges an inactivity fee

Your Capital is at risk.

6. AvaTrade – Legacy Crypto Trading Platform for Investors

While it might not be famous in crypto investor circles, AvaTrade is a top option for anyone looking to trade the broader stock market.

Founded in 2006, AvaTrade is regulated by several top regulators – including the ASIC and Japan’s Financial Services Authority (FSA). So, as far as regulation goes, the platform checks huge boxes.

AvaTrade offers access to several asset classes. While it offers crypto trading, too, you should note that this is only available through CFDs. The fact that CFDs aren’t available to retail traders in some jurisdictions means that you might not be able to access AvaTarde’s Bitcoin Cash offering.

Once you can get past the CFD restrictions, however, AvaTrade is a great platform. Its commissions on trades are comparatively lower than many other trading platforms, and it offers a proprietary AvaaTrade Web trader service to its users – reviews for that have been stellar. You also get impressive research tools, with in-house materials and third-party options available on AvaTrade. So, if you need the information to guide your trades, you can get them here.

Pros

- Impressive research tools

- Free deposits and withdrawals

- Proprietary trading software

Cons

- Limited range of tradable assets

- High inactivity fees

Your Capital is at risk.

7. Revolut – Personal Finance Service With Crypto Support

Revolut is an innovative digital banking and currency exchange service that has been making waves over the past few years.

The service is based in the United Kingdom and was launched in 2015. Revolut is one of the world’s fastest-growing digital banks with many features.

Unlike the other platforms on this list, Revolut doesn’t offer crypto trading. Instead, the service focuses more on currency conversion. With Revolut, you can convert cash to crypto quickly and seamlessly.

Revolut offers an in-platform wallet for coin custody. However, there are restrictions. Users of the Revolut Standard service tier won’t be able to receive coins or send them outside of the platform. Revolut also adds a 2.5 percent markup to its volume-weighted average price (VWAP), meaning you will have to pay even more if you want to trade.

Pros

- Seamless account opening

- Easy-to-use interface

- A broad range of cryptocurrencies

Cons

- Restrictions for Revolut Standard users

- Higher service fees

Your Capital is at risk.

8. CryptoRocket – Newbie Crypto Trading and Exchange Platform

CryptoRocket is an online brokerage service. Launched in 2018, it has become quite prominent among crypto traders.

The company is based in St. Vincent and the Grenadines and is not regulated in any top jurisdiction. Besides cryptocurrencies, CryptoRocket offers access to stocks, currencies, and more.

The service offers a low minimum deposit of $10, but its deposit channels are limited. Users can only deposit money using Bitcoin, bank transfers, and cards. However, CryptoRocket offers same-day withdrawals for credit card transactions – an attractive quality for traders.

Another area where CryptoRocket does really well is with leverage. The platform offers up to 500:1 margins for traders, allowing you to maximize your returns on trades. CryptoRocket also allows you to trade institutional liquidity sourced from global investment banks to access top rates and trade on tight spreads.

Trading and educational tools are also abundant on CryptoRocket, so feel free to peruse the platform to see what you’d like.

Pros

- Impressive research tools

- Same-day credit card withdrawals

- High-leverage trading margins

Cons

- Limited deposit channels

- Non-regulated platform

Your Capital is at risk.

9. Changelly – Nifty Exchange for Instant Bitcoin Purchases

Changelly is a cryptocurrency exchange and trading platform that was launched in 2015. The service is owned and run by Fintechvision Ltd. – a company registered in Hong Kong and based in Malta. Changelly’s objective is to make it easier for people to exchange between different cryptocurrencies.

The platform offers access to over 150 assets, allowing exchanges in just a few clicks. Its main feature is an instant exchange, which offers swift exchanges in just a few minutes. Besides this feature, Changelly offers leveraged trading with up to 10x margins on coins.

But this feature isn’t available to everyone. Changelly also has a competitive fee structure, charging a flat fee of 0.25% on crypto-to-crypto trades.

These fees are automatically factored into its rates, so you don’t need to worry about manual accounting. If you want to purchase or sell crypto for fiat, Changelly charges a 5 percent fee. The fee is also flat, so it doesn’t depend on your currency or residence. As expected, deposits and withdrawals are free, and Changelly offers different transaction channels.

Pros

- A flat crypto exchange fee

- Impressive security features

- Broad deposit and withdrawal channels

Cons

- High fees for fiat trading

- Slow customer service

Your Capital is at risk.

What is Bitcoin Cash?

This section aims to demystify the value proposition of this popular crypto asset and what it seeks to achieve.

So, what is Bitcoin Cash?

Bitcoin Cash is similar to other crypto projects. Let’s look at the project and what it stands for.

- Known by the acronym BCH, the digital asset is a Bitcoin fork

- It is a digital currency and is also virtually tradable

- Bitcoin Cash uses a proof-of-work (PoW) consensus algorithm like Bitcoin

- The split blockchain network aims to solve the scalability issue surrounding the older blockchain

Before we dig deep into Bitcoin Cash, we need to understand the back story behind the crypto project. Originally founded in a 2008 whitepaper by an anonymous group or individual named Satoshi Nakamoto, Bitcoin heralded the beginning of the virtual currency era.

The Bitcoin network enables decentralized value transfer, eliminating central authorities like banks or governments, and is censorship-free. Given the digital asset’s deflationary tendencies, Bitcoin is considered a form of ‘digital gold’ and a better store of value than commodities like gold.

However, there is a core component the original founder(s) did not factor in – scalability. With interests in blockchain technology and cryptocurrencies kicking in, more users have joined the Bitcoin network.

Still, the PoW consensus algorithm has been hard tasked to meet up with the demand. This has seen transactions on the network slow, although security has remained top-notch. Also, new blockchain concepts like interoperability (where several blockchains communicate with one another) are missing in the Bitcoin network.

Bitcoin Cash aims to solve one of these problems: scalability. It gets a bit technical here but stay with us. The original Bitcoin block size is meant to require 1 MB of storage space, but there have been talks to increase this output. Adding more information to a transaction or data could increase the block size, thereby addressing scalability.

Scalability is how long it takes to validate transactions on the Bitcoin network. The Bitcoin block size increased momentarily, spiking to 1.305 MB in February 2019. This enabled the Bitcoin network to average more than the seven transactions per second (TPS) it currently boasts of. This saw development teams develop the idea of Segwit2x, which will see them incorporate Segwit technology alongside a higher block size.

The fail-points of this concept led to the formation of Bitcoin Cash in 2017. It operates on a separate blockchain platform, and the hard fork occurred on block number 478,559. Bitcoin Cash operates on the same consensus algorithm as the Bitcoin network and uses the PoW mining protocol.

The difference between both lies in the block size. While the older blockchain uses a fixed 1MB storage size for data, BCH uses a whopping 8MB as part of its massive on-chain scaling approach.

However, this approach has not really differentiated it from the Bitcoin network, as it still averages a transaction speed of 10 minutes. However, while Bitcoin averages 7 TPS due to the larger network traffic, BCH averages 116 TPS.

The failed vision of Bitcoin Cash led to a further split or hard fork in 2018, and the new project was named Bitcoin Satoshi Vision (BSV) in homage to the original idea of Nakamoto. Bitcoin Cash has not stopped increasing its block size and has a maximum storage size of 32 MB.

According to BitInfo Charts, BCH had an average block size of 4.7105 MB in 2018. This astronomical figure has since tapered down, and the forked network currently has an average block size of 297 KB as of August this year.

From its humble beginnings, Bitcoin Cash sought to enable a faster peer-to-peer (P2P) electronic cash system with low fees and permissionless spending as its foundation. But the split protocol has not been able to displace the much older network. Currently, it sits on the fourteenth position on the most valuable crypto asset chart with over $14.8 billion in market cap.

It is tradable on several crypto exchanges globally and is popularly traded against US Dollars. You can also trade it against the British Pound, Euro, Korean Won, and Japanese Yen.

Why Buy Bitcoin Cash? Bitcoin Cash Analysis

Bitcoin Cash may still be an underdog, but the digital asset has many things going for it. We itemize a few of those and explain why you should buy Bitcoin Cash.

Bitcoin Cash Is Deflationary By Design

Aside from the scalability issue the Bitcoin Cash blockchain aims to address, the protocol is another bit of Bitcoin. This means it has a hard cap limit of only 21 million BCH coins that will ever be mined. The basic economic concept points out that a scarce commodity or asset is expected to rise with time, and with only 10% remaining, Bitcoin Cash could see its value triple in the future.

So if you are searching for a store of value that is not too pricey, Bitcoin Cash should fit the billing.

Another form of ‘Digital Gold’

Following the deflationary mechanism of Bitcoin Cash is the store of value concept. Bitcoin gained crypto prominence because it is a better store of value than traditional commodities like gold. This has primarily driven institutional crypto investment and garnered adoption for the benchmark crypto asset.

Since Bitcoin Cash operates under the same premise, it is also a great store of value in the long term, and this can be something you can hedge your funds against fiat devaluation. With national banks printing billions to stem the economic impact of the global pandemic, buying Bitcoin Cash can be a smart way to retain a large chunk of value with the upside of increasing with time.

Fractional Ownership

Small-cap cryptocurrencies are largely snapped up more easily than large-cap digital assets. With Bitcoin Cash reaching $800, several investors are priced out of owning the digital asset. However, there is still a means of owning Bitcoin Cash without coughing up the whole sum.

With fractional investment, you can own a part of the digital asset without breaking the bank. Only a few online brokers offer this service.

Is it Worth Buying Bitcoin Cash in 2024?

Bitcoin Cash was once one of the standout performers in the crypto space. From late 2021 to mid-2022, the token traded at $200 on average. However, much of the token’s traction was vaporized after 2022’s bear market arrived.

What also didn’t help this token is Bitcoin’s detractors increased. People have gotten increasingly wary about the state of the most volatile cryptocurrency. As a result, Bitcoin’s sell-offs were reflected in the increasing number of Bitcoin Cash sellers. That resulted in a further drop in the BCH price to the sub $100 level.

That said, Bitcoin Cash’s tendency to mirror Bitcoin’s price movements also has major upsides. While BCH suffered from a major downturn till the end of 2022. The arrival of 2023 saw it increase in value alongside Bitcoin, which gained more support from the community vying to shrug off the effects of the FTX crash.

After closing the year with a price of slightly below $100, Bitcoin Cash significantly recovered during the first months of 2023. The broader crypto market was showing songs of recovery, so major cryptocurrencies followed it. In January, Bitcoin Cash was already traded at above $100, and in February, it also managed to peak at $144.

While this was followed by a short decrease, BCH never went below $100 after that. Moreover, in June, Bitcoin Cash started a revival, and on June 1, it hit its all-time high of the year, crossing the $300 mark. The cryptocurrency experienced a correction after this and is currently traded at a price of $208.

One of the main factors to consider if you want to invest in this crypto is the price performance of the Bitcoin itself. Though these two cryptocurrencies don’t have any connection to each other, Bitcoin Cash is significantly affected by the ups and downs of Bitcoin. So the broader market performance is one thing that can tell about the future price of Bitcoin Cash.

Another thing to consider is the fundamental analysis of the Bitcoin Cash project, including its future updates and institutional interest in it. One of the latest news about this crypto is the announcement that BCH will be one of the few cryptocurrencies listed on the crypto exchange EDX Markets.

Ways of Buying Bitcoin Cash

Bitcoin Cash’s value proposition is attractive to several investors, and with the digital token making significant gains in the past weeks, interests in the secondary store of value are at an all-time high (ATH). If you want to buy Bitcoin Cash, we highlight some of the ways you can go about doing this effortlessly:

Buy Bitcoin Cash with PayPal

PayPal is recognized globally as the world’s top remittance and digital payment company. With the e-wallet provider recently allowing crypto purchases through its service, several investors are now picking interest in the nascent industry. You can easily buy Bitcoin with PayPal directly but can’t purchase Bitcoin Cash on the platform now.

Buy Bitcoin Cash with a Credit Card

Since you can buy Bitcoin with a credit card, buying BCH will not be much of an issue. This payment method is available on a few brokerage websites. Due to the underlying risk, most brokers and exchanges do not offer credit card support.

However, you will need to consider the categorization of your crypto transaction on a credit card. Most credit card issuers group crypto purchases as a “cash advance,” which attracts a transaction fee between 3 and 5%. If you are only left with this option, ensure you know how much you may be billed before proceeding.

Buy Bitcoin Cash with a Debit Card

The third and most popular option is to buy Bitcoin Cash with your debit card. Several investors favor this due to the ease of payment processing and the low fees it attracts. However, you must consider a broker’s processing fee to buy Bitcoin Cash with a debit card. Some brokers charge between 4 to 5% of the total transaction, which can eat into your capital.

What to Remember Before Buying Bitcoin Cash

If you want to buy Bitcoin Cash, there are a few things to be wary of before taking the plunge:

Price Swings

Your friends may have told you that cryptocurrencies are generally unstable in their prices, and they are right. Digital assets are known to change course overnight, which could positively or negatively impact your portfolio. Volatility is an issue the emerging industry is grappling with, and sometimes you may see a 30% in a daily chart and a subsequent dip the next day.

If you are up to the task and are not risk-averse, you should buy Bitcoin Cash. The digital asset is making a major recovery, and forecast websites like Wallet Investor put its Bitcoin Cash prediction at $1,005.840 by the year’s end. A five-year forecast will see BCH trade at $2,072.520.

Blockchain Tech Is Publicly Viewable

Unlike your traditional financial transaction between you and the bank, crypto purchases are viewable by anyone. Cryptocurrencies use distributed ledger technology (DLT) or blockchain, which records all transactions on a network. These activities are done in the open, meaning anyone can query the data to verify a transaction.

If you are more comfortable with the conventional system of transacting business, then crypto assets like Bitcoin Cash may not be what you need.

Transacting Parties Are Unknown

Even though we mentioned in the previous post that blockchain tech is transparent, transactions are done on a wallet-to-wallet basis. Both transacting parties use wallet addresses which usually comprise several strings of numbers and letters and are generally unreadable. Also, personal details are excluded as funds are transferred and received through these addresses. Although cryptocurrencies are transparent, they are also pseudonymous.

Choosing the Right Broker

Deciding on the broker, you want to buy Bitcoin Cash through is crucial as purchasing the asset. Given the importance of this step, we have itemized some key features you should look out for in a broker before settling for one:

Fees

A broker’s fee structure is essential as it will help you know how much you will have to trade after paying fees. You can find broker information on certain review websites like Inside Bitcoins, where we cover broker’s deposit, withdrawal, and trading fees. This will help you know the ones that are retail-driven and economical.

Safety

It would help to use only a crypto exchange or broker with robust security protocols. Some of the things you should check out are two-way authentication and a whitelist for funds withdrawal. If these are missing, then there is a high probability that the platform is unsafe.

Customer Support

Most crypto exchanges are user-friendly, and you should be able to find your way around quickly. However, there are occasions when you run into difficulty completing a transaction. Great customer support will put you right in no time. Check out an exchange’s customer resolution time before signing up.

Payment Methods

Equally as important are an exchange’s supported payment options. You must know what platforms you can fund your account with and the accompanying charges. This will help you find the right payment channel to maximize capital utility.

Liquidity level

Check the broker’s trading volume for that particular asset before proceeding. A high liquidity pool shows that you can withdraw your funds anytime.

Bitcoin Cash Price

As we stated earlier, Bitcoin Cash is volatile, which means it is constantly rising and falling. The crypto market is driven mainly by market supply and demand, and the scarcity of an asset shows it would rise with time. This would see people:

- But if they believe the price will increase, this sentiment would propel it upwards.

- Sell if they feel that the price is set for a significant correction.

These factors have contributed to Bitcoin Cash’s fall to sub $100 levels during 2022’s crypto winter. The token has closely followed the Bitcoin price, which was in an uptrend at the beginning of 2023. Bitcoin Cash followed the trend and was traded at above $120-140 during the second month of the year.

After correcting at $110, Bitcoin Cash started another rally in May, reaching as high as $130 before another drop. This time the token’s value did not decrease below the $100 mark. Bitcoin Cash experienced a significant uptrend in June and peaked at $301. The price changes continued for the next few months, with BCH first dropping to $186, which was followed by an increase of $224 and then followed by another drop to $183.

But Bitcoin Cash has started another positive trend in the last few days and again has crossed the $200 mark. The current price of the cryptocurrency is $209, and with a market cap of over $ billion, it is currently the 18th largest cryptocurrency. BCH has a YTD return rate of 116%, which is significantly high compared to other cryptocurrencies.

Bitcoin Cash Price Prediction

Like most old-school cryptos, Bitcoin Cash relies on its value as a tradable asset. While that lack of use case can be counted as a negative in the long run, Bitcoin Cash’s close relationship with the advent of crypto – Bitcoin – has many upsides.

For one, one has to look at only the technical indicators to predict the future course that this token can take. And since the token is largely inactive on Twitter, we can’t think of any other social or developmental indicators to assess where the BCH price would go.

The crypto market remains volatile, but developments may advance Bitcoin and Bitcoin Cash. One important development is the Bitcoin Cash Halving Countdown, which is expected to happen on April 4, 2023. This will reduce the number of Bitcoin Cash coins that each miner gets for creating a new block on the blockchain.

Bitcoin Cash had its first halving event on April 8, 2020, due to a different mining algorithm employed at its launch. The halving reduces mining profits for BCH miners. The halving dates for Bitcoin and Bitcoin Cash depend on block height, occurring every 210,000 blocks. While Bitcoin’s final halving is expected in 2140, BCH’s last halving may happen around 2148.

After a month of fluctuations, Bitcoin Cash’s value is very close to its price of the same period in the last month. It has experienced a drop of 1.62% in the last seven days and slightly increased by 0.38% in the last 24 hours. Bitcoin Cash has a Fear and Greed Index of 49, which is considered Neutral. However, technical indicators are bearish, indicating a Sell.

As for the price predictions in the long-term, Bitcoin Cash is expected to have a maximum price of $285 in 2023 with an average price of $259. In 2024 its average price can increase up to $399 with a possibility of hitting as high as $430. According to the bullish predictions, Bitcoin Cash is expected to hit $500 by 2025 and even reach $675 as its highest price. In 2030 Bitcoin Cash is expected to hit $4200.

Still, these predictions should not be taken as the only source to invest in Bitcoin Cash as they don’t consider many other factors that can affect the price of the cryptocurrency. Hence, before you invest in this coin, do your own research, follow the trends and news in the market, and always take into account the volatility of the crypto market.

Investing in Bitcoin Cash vs. Trading Bitcoin Cash

Trading in the crypto market will require you to adopt a strategy. But which one should you go for? We dissect both in this section:

Investing in Bitcoin Cash

Investing should be your beginning step if you are starting in the crypto space or have a limited idea of how the crypto market works. This would require you to buy and hold for upwards of a year. Once you are satisfied with the growth of your portfolio, you can decide to sell and cash in your profits.

Trading Bitcoin Cash For Quick Returns

This second option is ideal for experienced traders who understand complex concepts like futures trading, margin trading, leverage trading, and the accompanying risks and gains. If you have the expertise to detect major price movements and enter into profitable trades, you can quickly multiply your returns in a short period.

So, Which is Better?

Deciding on if to hold and compound your gains for an extended period or trade to make quick gains solely lies with you. However, we list a few criteria you should consider before choosing between the two strategies.

Your Schedule

If you are very busy, you know that time is invaluable and cannot afford to waste it. Trading Bitcoin Cash requires spending time to do background research and monitor market sentiment. If you do not have the time to do the needed research, buying and holding may be what you should consider.

Reason For Buying Bitcoin Cash

Your ‘why?’ will determine whether you should invest or trade Bitcoin Cash. If you support the project’s value proposition, you may likely want to buy and hold until the market is favorable. However, if you generate quick returns on your investment, trading Bitcoin Cash may be the best route.

Risk Appetite

Cryptocurrencies are risky; volatility could wipe off your investment in real time. If you are risk-averse, investing in Bitcoin Cash for the long term guarantees you will get something in return. However, if you are more open to risky investments, you can trade the price swings of Bitcoin Cash for quick returns.

Taxation on Bitcoin Cash Earnings

The crypto market has largely been unregulated in the last twelve years. However, federal regulators are already creating a framework to curtail the excesses of the emerging space.

Your tax obligations on your Bitcoin Cash earnings fall under the Internal Revenue Service (IRS) definition of “property.” This means you will pay the same tax as your capital gains for your asset.

In addition, crypto earnings can be taxed under the income tax bracket in some situations. This section explores those instances and how to maximize savings from long-term capital gains tax.

Taxable events that qualify for capital gains tax in the United States include:

- Swapping crypto for fiat

- Making a payment with crypto

- Exchanging one crypto for another on an exchange or peer-to-peer (P2P) platform

Events that qualify for income tax are:

- Receiving crypto from an airdrop

- Interests earned from lending to DeFi platforms

- Block earnings from crypto mining

- Accepting crypto for services rendered

- Newly minted digital coins earned from staking and providing liquidity

Although this seems like the IRS has its hands in every available spot, you can still write off a large sum of your tax obligations up to $3,000.

Calculating Your Capital Gains Tax

Capital gains tax is pegged between 0 and 20% in the United States. Income tax ranges between 10% to 37% and will also determine how much of your crypto earnings you must remit as taxes in your annual report. Having this at the back of your mind, you should be able to estimate your:

Short-term Capital Gains

This comes into consideration if you have only traded cryptocurrencies for less than a year. In this instance, your tax obligation will fall under your regular income tax bracket.

However, you can reduce the impact on your taxable income up to $3,000 with an option to post-date your losses until the following year. We have prepared a comprehensive list in a separate guide. You can access that by clicking the highlighted link.

Long-term Capital Gains

If you have been a long-term crypto hodler, you can substantially save a lot as you will only be taxed up to 20% of your income tax bracket. Holding crypto long-term can be a great way to reduce your tax payments.

Bitcoin Cash Trading Robots

Making massive yields from crypto goes beyond investing or trading the market yourself. You can make good returns on your investment without exerting too much effort.

Automated trading robots are sophisticated software programmed to scour the market for the best trades. They set stop-limit orders, take profits, and conduct technical and fundamental analyses.

Utilizing cutting-edge technologies, they can get a ‘full picture’ of the market while eliminating emotions. This helps set loss margins and enables you to make maximum returns in winning trades. However, there is only a handful of genuine trading software as the sector is largely unregulated. Below, we list some of the best trading bots in the market at the moment:

FAQs

How do you buy Bitcoin Cash?

There are over 400 crypto exchanges and hundreds more traditional exchanges that offer support for digital assets like Bitcoin Cash.

Should I Buy Bitcoin Cash?

Bitcoin Cash has remained one of the top performers in the crypto space despite making few fundamental changes. However, you can still generate returns from these price swings but make sure you only invest what you can afford to lose.

How does Bitcoin Cash work?

Bitcoin Cash operates much like Bitcoin and facilitates the trustless transfer of value between transacting parties. It is built on blockchain technology, which ensures that all transactions are immutable and permanently stored on the network.

Is it Safe to Buy Bitcoin Cash? Bitc

Bitcoin Cash is volatile, much like Bitcoin and Ether. However, the digital asset’s long stay in the public eye shows it is a safe investment. While several other cryptocurrencies have gone into oblivion, Bitcoin Cash has continued to rise in value. It is one of the top 20 cryptocurrencies by market cap.

How do I Make Money with Bitcoin Cash?

There are three ways you can earn Bitcoin Cash or make money from it. One way is to build a validation center where you compete to solve the complex mathematical puzzles needed to unlock block rewards. Another is investing or buying Bitcoin Cash and holding for the long term. Holding for the long term means you plan on selling when the profit threshold is acceptable. The last way is to actively trade Bitcoin Cash on an exchange.

What are the Benefits of Buying Bitcoin Cash?

Bitcoin Cash's sporadic growth this year has seen it retain its position on the most valuable crypto ranking. However, if you are keen to hedge your funds against fiat inflation, Bitcoin Cash can be a suitable option. It's deflationary like Bitcoin and operates under the same consensus algorithm.

What are the Best Payment Methods to Buy Bitcoin Cash with?

We suggest using debit cards due to the ease and low costs they generally incur.

What are the Best Bitcoin Cash Brokers?

There are numerous brokers that allow you to buy Bitcoin Cash.

How can I Buy Bitcoin Cash Instantly?

To buy Bitcoin Cash instantly; first you need to open an account with a regulated broker. Once your account is verified, you will be able to invest or trade Bitcoin Cash.

How can I Buy Bitcoin Cash with USD?

The best way to buy Bitcoin Cash with US dollars is through a reputable broker or crypto exchange. The greenback is the most recognized currency brand in the world, and most platforms support it.

What are the Taxes for Trading Bitcoin Cash?

Tax rates vary depending on the jurisdiction where you are residing. The only way to know your tax obligation is by perusing relevant government websites.

How much is Bitcoin Cash worth?

Bitcoin Cash is fluid, meaning the price changes often. Meanwhile, as of early October 2023, Bitcoin Cash is currently trading at $206.

How Do You Mine Bitcoin Cash?

Bitcoin Cash is intrinsically the same as Bitcoin at its core. This means you can only gain block rewards and profit from the exercise by utilizing application-specific integrated circuits (ASIC) miners. This increases your chances of gaining BCH from mining.

Can somebody buy bitcoin cash anonymously ?

Hello Broady545, with all the negative attention cryptocurrencies have received recently, it is getting harder and harder to buy BCH anonymously. However, as you can see in this FAQ, there are ways to buy cryptocurrencies without revealing sensitive information to the brokers.

How have you chosen the best broker to buy your Bitcoin from? What are the things you have thought about before choosing the perfect and most reliable one for that purpose?

Hello Ann, we assess a number of factors before choosing our top digital currency broker. These factors include security, licensing, authenticity, operating regions, availability, and ease of use among many others. By our evaluation, eToro has earned its place on the top of our list. You can learn more about the digital assets broker in oureToro review here.

Awesome comparisons.

Great, this was really helpful.

Wow… Thanks for the information.

But is this not Bitcoin, I am well aware of how to buy and sell bitcoin and I will love to know more about bitcoin cash as well if it is different.

Can you help with the best place where I can buy bitcoin cash with ease?

Hello Roland, yes, buying Bitcoin Cash is a very easy process if you have bought and/or traded cryptocurrencies before. Our recommendation for the best place to buy Bitcoin Cash is eToro – a top-class digital assets broker that operates on a global scale.

Buying bitcoin using credit cards carry the risk of charge backs or not? Either buy online or not?

Hello Charles, using credit cards to buy cryptocurrency does have a very small risk of chargebacks depending on the bank you are using. To protect yourself from chargebacks, make sure that you use a highly-authentic platform or broker like eToro.