It can be said that Songbird is to Flare what Kusama is to Polkadot. The Flare Network will have its own token, Spark (FLR), which will function as a governance tool. Whereas, Songbird will have its own token (SGB), which will be distributed once only and in the same ratio to all the same recipients of the FFLR distribution. The starting supply of SGB will be 15 billion and the initial inflation will be 10% p.a. through FTSO and the validator reward system.

One phase is prior to the launch of Flare, in which Songbird will improve the security, stability, and credibility for the ultimate launch of Flare by continuing testing of the Flare Time Series Oracle, StateConnector, and F-Asset systems along with the network architecture. The second phase will begin post-Flare launch, in which Songbird will be used as a long-term network for testing governance-led changes to the Flare main net, including changes to FTSO & F-Assets or any other changes in the network, and the incorporation of new F-Asses.

There are two core uses for Songbird – to provide advanced testing and community building for applications that wish to launch on Flare, and to make FLR token holders familiar with key Flare protocols such as delegation to FTSO, minting of F-Assets, and applications that build on Flare without putting their FLR tokens at risk.

On this Page:

How to Buy Songbird

- Choose a Songbird exchange – we recommend eToro as it’s FCA, ASIC and CySEC regulated

- Create an account

- Deposit funds into your account

- Search ‘Songbird’ in the drop-down menu – eToro expect to list SGB soon

- Click ‘Open Trade’ and select an amount of Songbird to buy

Best Places to Buy Songbird in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Cryptocurrency Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

We recommend eToro as it’s the easiest exchange to buy Bitcoin on, which can then be used to buy Songbird (SGB) when it is listed.

Alternatively you can buy Ethereum on there and stake it to earn passive income while you’re waiting for the announcement of the Songbird listing.

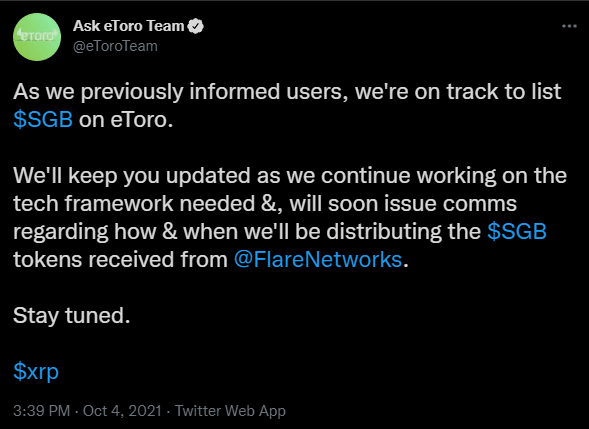

eToro will list Songbird ($SGB)

Songbird (SGB) is expected to be listed on eToro soon in 2024. They are continuously listing new popular altcoins as they come onto the cryptocurrency markets. As per their recent tweet, eToro is all set to list SGB soon.

Step 1: Open an Account

You can follow the link’s to the eToro website using Windows or Mac and click ‘get started on the homepage to set up a free account. You’ll be asked to choose a username, email address and create a secure password. You can also sign up with Facebook or Google Plus.

If you’d instead use the eToro mobile app for iOS or Android, check out our screenshot-filled guide to the eToro app.

eToro website homepage

Your capital is at risk.

Step 2: Upload ID

eToro will then require you to verify the provided identity with a copy of your driver’s license or passport to comply with government regulations. A copy of the utility bill or bank account statement will also be required to verify the provided address.

Once the documents are uploaded, eToro will automatically complete the verification.

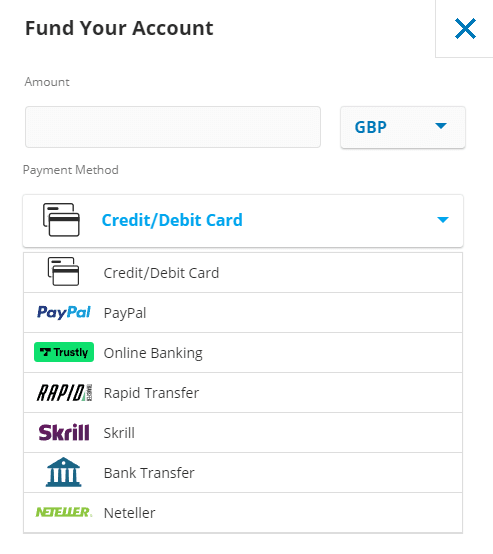

Step 3: Make a Deposit

The minimum requirement for opening an account with eToro is $50, which can be deposited through various methods, including:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

eToro charges no deposit fees. This is less expensive than some of its biggest competitors, such as Coinbase, which charges 3.99 percent when using a debit card to purchase Bitcoin.

Deposit methods on eToro

Furthermore, there is no transaction cost if you are a US resident depositing funds through a USD-backed payment method. The minimum deposit is $50 for residents of the United States and $200 for most other countries.

eToro doesn’t offer direct Songbird (SGB) purchases – meaning that you will first need to deposit some funds and buy Bitcoin. Apart from a bank transfer, all deposit method instantly credits your funds into your account.

Step 4: Search for Bitcoin

At this stage of our step-by-step guide, you should now have an eToro account that is funded. Now it’s time to buy Songbird (SGB). Since eToro doesn’t have Songbird (SGB) at this stage, you can now buy Bitcoin simply by typing the amount you want to invest in the ‘Amount’ box ($25 minimum trade).

Then via Bitcoin, you can buy Songbird (SGB) on eToro, Binance, Coinbase etc once it’s listed at the major exchanges. Or using ETH, which can be easily staked on eToro to earn staking rewards.

Hopefully, the Songbird (SGB) token will be available on eToro very soon.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Best Broker to Buy Songbird (SGB) in the UK

eToro founded in 2007 and based in the United Kingdom, had more than 20 million members in around 100 countries, including millions of registered users in 43 US states and Washington, DC. eToro began as a graphics-intensive forex platform, and it has repurposed those tools for cryptocurrency trading.

Customers from outside the United States can trade additional asset classes such as contracts for difference (CFDs) and stocks on various exchanges. This assessment compares eToro’s capabilities for US citizens versus non-US clients.

Songbird (SGB) on eToro – Songbird (SGB) should be listed on eToro soon in 2024. They are continuously listing new popular altcoins as they come onto the cryptocurrency markets.

Initial Deposit

The minimum deposit on eToro is $50.

Traders can use various payment methods through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, VISA, or Neteller.

Regulation

eToro is regulated in the United Kingdom (UK) and worldwide, holding licenses from the ASIC, FCA, and CySEC. In addition to this, eToro is a member of the Financial Services Compensation Scheme (FSCS) that protects the first £85,000 of investors’ funds in case of the broker’s bankruptcy.

Buying and selling on eToro can be done online through their mobile app. The opening process of an eToro account is straightforward and takes about a couple of minutes.

Pros & Cons of the eToro platform:

- eToro provides copy & social trading

- Supports 120+ cryptocurrencies

- ASIC, FCA, and CySEC regulated

- Commission free stock trading

- User-friendly GUI (graphical user interface) stockbroker.

- Mobile app for Android and iOS

- Accept Skrill, VISA, Neteller, and PayPal

- Performing advanced technical analysis can be challenging for pro-traders – not many chart indicators

- Buy/sell spread is high on some altcoins

- Some low marketcap coins take time to be listed

2 – Binance

Binance is without a doubt the greatest eToro alternative. Binance is the world’s largest cryptocurrency exchange in terms of daily transaction volume, with over $20 billion in transactions each day. It provides you with access to hundreds of assets as well as a smooth trading service that makes it easy to generate money.

The benefits of Binance are quite remarkable. The trading commission is a one-time fee of 0.1 percent, which is relatively minimal. Expert traders can employ complex tools such as futures and margin trading, and the exchange provides a number of deposit and withdrawal options. When this is combined with Binance’s high liquidity, it is easy to see why it is so popular.

Binance, on the other hand, is a cryptocurrency-only trading platform. The exchange also has significant credit card transaction fees, and the main portal isn’t very user-friendly. Furthermore, for newbies, the Binance UI is not particularly user-friendly. For first-time crypto investors, the charts and menu selections may be perplexing.

Since Songbird (SGB) is a relatively new coin, gaining popularity recently, it’s not yet listed on big exchanges like Binance. However, we can buy BTC, and ETH which be exchanged for Songbird (SGB) on smaller exchanges.

Pros & Cons of the Binance platform:

- Excellent liquidity.

- Outstanding security features.

- Professional traders have access to a wide range of sophisticated items.

- High fees for credit card deposits.

- No copy trading.

3 – Coinbase

Coinbase is among the most well-known cryptocurrency exchanges in the United States, and it’s one of the world’s largest. Nonetheless, keep in mind the risks of trading these speculative currencies. Coinbase, the largest cryptocurrency trading platform in the United States, was founded in 2012 in San Francisco.

Coinbase became the first crypto trading company in the United States to be listed on a US exchange in April, with an IPO priced at roughly $86 billion. While bitcoin brokerages are not covered by the Securities Investor Protection Corporation or SIPC, Coinbase covers its site for any losses incurred due to theft or hacking.

Songbird is currently not accessible for trading, but you can add it to your watchlist, read news, and do other things with a Coinbase account.

Pros & Cons of the Coinbase platform:

- It provides access to over 60 cryptocurrencies.

- A low minimum is required to fund an account.

- In the event that a website is hacked, cryptocurrency is protected.

- Higher maker / taker fee than Binance unless your trading volume is very high

- Less customer support

4 – Bitfinex

Bitfinex, Bitfinex, launched in 2012, is one of the older cryptocurrency exchanges. Since its inception, the exchange has remained a market leader in cryptocurrency trading, currently ranking eighth among the world’s largest cryptocurrency exchanges by volume. The New York Attorney General concluded that Bitfinex and Tether deceived clients and markets by overstating Tether reserves and concealing losses. Bitfinex has also been fined in the past for running an unregistered exchange and enabling illegal off-exchange trades. This raises serious concerns about the integrity of this cryptocurrency exchange.

Bitfinex’s active trading platform offers 150 cryptocurrencies, including Bitcoin, Ethereum, Terra, Tether, Solana, Litecoin, Ripple, and many others. There are far too many to mention here, but Bitfinex does an excellent job supporting popular currencies on its platform. Bitfinex has relatively cheap trading costs, with most trades costing less than 0.20 percent. On the surface, this exchange appears to be suitable for a wide range of users, but it has a shady history, including several fines and accusations of cryptocurrency market manipulation.

As previously stated, Bitfinex has a close association with Tether, a stablecoin that is always worth $1. However, previous instances of reserve dishonesty may cause you to reconsider holding too much Tether in your account, assuming you’re willing to hold it at all. Tether maintains that the currency is completely backed, but it is up to you to determine whether or not you believe them.

Fees – The majority trades either a 0.10 percent maker fee or a 0.20 percent taker fee. This rate applies to crypto, stablecoin, and fiat transactions.

Pros & Cons of the Bitfinex platform:

- Established since 2012

- Suited for advanced traders

- Low trading fees

- Over 100 supported coins.

- Margin trading, derivatives, and advanced order types supported

- Accepts bank wire deposits and withdrawals

- U.S. citizens not accepted

- Not regulated

- Hacked on more than one occasion

5 – KuCoin

KuCoin is a secure and simple-to-use cryptocurrency exchange platform where users worldwide may trade crypto assets. Furthermore, the platform is situated in Seychelles, and the founding members have previous expertise running businesses like Ant Financial and iBox PAY.

Kucoin is often referred to as “The People’s Exchange.” The platform includes a trading bot, margin trading, futures trading, loans, and other services. Furthermore, according to the platform, one out of every four HODLers in the world uses KuCoin.

Kucoin has its cryptocurrency, known as Kucoin Shares (KSC). If you hold KSC coins, you will save trading costs and gain more cryptocurrency. KuCoin is also one of the top ten cryptocurrency exchanges in the world, according to CoinMarketCap.

Trading Fees – Kucoin’s trading fee structure is pretty straightforward. The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. If you own the platform’s native Kucoin Shares tokens, you can further minimize your fees.

Pros & Cons of the KuCoin platform:

- Users can trade using Arwen without having to transfer funds into a third-party wallet.

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- User-friendly exchange

- Due to KuCoin’s commitment to rapidly launching new, innovative crypto assets, customers have access to a huge variety of trading pairs.

- Low trading and withdrawal fees

- KuCoin Shares allow users to invest in the success of KuCoin.

- Users can choose from a vast number of trade pairs.

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilise.

- Lacks the trading volumes found on some of the more established platforms.

- No fiat trading pairs

6 – Bybit

Bybit, founded in 2018, is a forward-thinking, rapidly expanding cryptocurrency derivatives exchange. A team of individuals with experience in investment banking and the forex sector formed the organization. Bybit’s headquarters are in Singapore, and the company is registered in the British Virgin Islands. It promises a worldwide economy and offers a trading system that appears to be fast, secure, and transparent. It has set out on a quest to create the next-generation financial ecosystem, which will be powered by innovative and powerful blockchain technology. With over 1.6 million Bybit users worldwide, whether retail or professional clients, Bybit stays customer-focused and strives to give the greatest user experience possible.

Bybit exchange, a crypto derivatives exchange, offers a fair trading environment in which to trade futures contracts with good leverage in BTC/USD, ETH/USD, XRP/USD, EOS/USD, and BTC/USDT everlasting contracts. According to our Bybit review, this cryptocurrency exchange operates and delivers a safe, secure, fair, transparent, and efficient futures trading platform. Market takers pay 0.075 percent, while market makers pay -0.025 percent. As a result, they will be compensated when a market maker opens a transaction. This low cost encourages market makers to stay active and fill the order book.

Where is Bybit regulated?

Bybit Fintech Limited operates a regulated cryptocurrency trading platform called Bybit. The corporation is based in Singapore and is registered in the British Virgin Islands. Users do not need to obtain KYC to trade on Bybit because the bitcoin exchange is not yet regulated in any country.

- USDT everlasting BTC, ETH, EOS, and LTC pairs

- Trading costs range from 0.025 to 0.075 percent for leverage of up to 100 times.

- Order book with high liquidity and low spreads

- Bybit is a mobile trading app.

- 4.9 out of 5 stars based on over 50,000 reviews

- Affiliate and referral programme (30% commission)

Pros & Cons of the Bybit platform:

- Trustworthy and reputable trading platform

- 4th largest derivatives exchange in the world by volume

- Variety of markets including spot, perpetuals and Futures

- Advanced and feature-rich trading platform

- Intuitive and responsive mobile app

- Difficult for beginners to navigate

- Limited number of spot trading pairs against BTC

What is Songbird?

According to its website, Songbird is the Canary network for Flare. First, let us introduce the Canary network. It is an operational blockchain with a defined token supply intended to be used to test features for a related main net. The concept of the Canary Network was originated by Polkadot with its Kusama Network. It is a way to reduce risk and validate new software by releasing a small percentage of software to users before the actual launch, with the aim of testing the software’s functioning.

Songbird is expected to play an important role in continuing testing of various products that will be using the platform, including F-Asset systems, State Connector, FTSO, and the network infrastructure. It will be a test site for possible updates to Flare, which means that various dApp launches and innovations will take place on the Songbird blockchain before they are introduced on Flare after testing. This feature of prior testing of applications makes Songbird a unique network.

Songbird was launched on 16th September 2021. Before it can be used to test and harden the underlying protocols comprising the eventual launch of the Flare network, it will follow three preset phases. The first phase was the initial 10-day “Observation Mode”, which concluded on September 27th, 2021. This first stage was key in deploying and testing both the FTSO and the network. The second phase will be the “State Connector” and the third will be the “F-Asset”. After the completion of all three phases, the contracts will subsequently be deployed on Songbird for testing prior to the launch of the Flare Network.

The combined protocols will allow the tokens that do not have native smart contract functionality to directly access and be scalably used on Flare in decentralized applications like fast and complex payments, metaverses, NFTs, DeFi, and gaming. The launch of the initial observation stage was completed without any unexpected issues. The Flare updates will be tested on Songbird and more than 340 validators and over 40 data providers applied for whitelisting.

Many DeFi projects, data providers, exchanges, wallets, and custodians have expressed their support and plan to launch and test their applications on songbird. Some of the main names include Gala Games, 888 TNW, Trustline, Global Esports Federation, Delchain, Lena Instruments, Flare Finance, Ola Finance, Flare Metrics, and more.

Is it worth buying SGB in 2021?

The Songbird token, SGB, was unveiled for trading on Sept. 29, and since then it has shown great prospects for appreciation. In just 24-hours after its launch, the token SGB surged by more than 40%. It was first listed on the XRP-centric exchange Bitrue (BTR). The listing price of SGB was as low as $0.27.

Recently, the SGB token has been trading at $0.40. On September 30th, the price of SGB reached an all-time high of over $0.71. Apart from Birtue, Songbird is listed on two other exchanges, including GoPax and EXMO.

Flare Network has already secured connections with four blockchains that will be using it to bring smart contract functionality to their networks. The four blockchains include Dogecoin, Ripple, Stellar, and Litecoin. Adding smart contract functionality to already billion-dollar blockchains will have a significant impact on all of them, and these prospects hold great promise for the SGB token’s growth. It is because all these processes will go through the Songbird platform before the actual launch on the Flare network.

Four Blockchains – XRP holders received 30% of the total initial supply of 100 billion SGB tokens. Another 22% will be distributed via liquidity mining over the next 7-8 years to those who move assets from compatible chains onto Songbird. The collective market cap of the four blockchains that will connect to the Flare network will be over $150 billion. And if somehow they merge, it would instantly become the world’s number three blockchain.

Many analysts believe that the final launch will be similar to the launch of decentralized finance for Ethereum, which is behind 90% of the rally in ETH prices. It is assumed that when the Flare network becomes capable of enabling other blockchains with the functionality of smart contracts, it would bring massive capital to the Flare team.

Before its launch, four blockchains have shown support for the project, and for the time being, there are chances that more blockchains will use the Flare Network to add smart contract functionality to their networks, which will ultimately add to the value of the SGB token.

Will the Price of Songbird Go Up in 2021?

Yes, it seems like the platform Flare Network and its Canary Network, Songbird, will be very beneficial for tokens without the capability of smart contract functionality, and providing this feature to them will definitely accelerate the price of SGB in the future.

As per our in-depth technical analysis of previous SGB price data, the price of Songbird is expected to reach a low of $0.42 in 2021. With an average selling price of $0.44, the SGB price can reach a maximum of $0.45.

- In 2022, the price of Songbird is expected to fall to a low of $0.59. Throughout 2022, Songbird price can reach a maximum of $0.75 with an average price of $0.61.

- According to the forecast price and technical analysis, the price of Songbird is expected to reach a low of $0.88 in 2023. With an average selling price of $0.91, the SGB price can reach a maximum of $1.05.

- In 2024, the price of one Songbird is predicted to fall to a low of $1.22. Throughout 2024, the SGB price can reach a maximum of $1.49 with an average price of $1.27.

- Songbird prices are expected to fall to as low as $1.83 in 2025. According to our estimates, the SGB price might reach a high of $2.17, with an average forecast price of $1.88.

Digital Coin Price: The price of SGB is expected to target $0.699 by the end of December 2021. The predicted highest price is $1.96, while the expected minimum price is $1.62 for the future. The price of SGB is expected to surpass the $1 benchmark in 3 years.

Price Prediction – The SGB price outlook provides hope for stable trends, implying that there is hope for the SGB price, which may display a bullish bias. The average price for 2021 is predicted as $0.44. The average is expected to surpass $1 by 2024.

When you’re considering an investment, follow these things:

Every cryptocurrency comes with risks, and this is especially true in the case of Songbird (SGB). So, whenever you invest, it is important that you don’t get drawn into FOMO. Apart from following others, you must conduct your own research before investing in any digital asset.

1 – Research, research, research: Before investing your money, good and comprehensive research about the product must be done to avoid risks associated with them.

Here are the different methods we looked into:

- Exploring social media platforms

- Analyzing upcoming events

- Research the fundamentals

- Discover trending topics

- Utilize the power of niche forums

- Go to crypto meetups

- Observe the transaction volume

Watch the market: The second stage in discovering more regarding your chosen product or digital asset is to monitor the market. The market may move in a route that varies from your forecasts, and keeping cool when the market moves in a different direction is evenly essential. The easiest approach to keep up with the market is to read through review sites and recommendations. Excellent liquidity.

Buying Songbird as a CFD Product

Contracts for differences (CFDs) are derivatives that allow you to speculate on multiple financial markets without owning the underlying asset. It is widely used in established markets such as foreign exchange currency pairings, stocks, bonds, indices, and commodities.

Trading CFDs entails more than simply buying and selling; it also entails agreeing to swap the difference in an asset’s price when the contract is opened and expires.

CFD trading has made its way into the cryptocurrency industry, and Songbird (SGB) should be available as a CFD product soon.

Songbird (SGB) CFD isn’t available yet, but if it ever is, it will be on CryptoRocket and Binance.

Taxation on Songbird Earnings:

As the cryptocurrency market is still new and finding its ground, regulatory agencies, including the SEC, are looking to regulate this industry. Furthermore, the Internal Revenue Services have been trying to set up a tax regime for cryptocurrencies. Currently, cryptocurrencies and digital assets are treated as properties and fall under the capital gain tax bracket.

However, in certain situations, some earnings from cryptocurrencies are also considered income and fall under the income tax bracket. The following are the taxable events that qualify for capital gains and income taxes when trading digital assets.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21, IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals who have bitcoin as a capital asset but are not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Taxable events that are considered property gains tax in the US:

- Exchanging your cryptocurrency for fiat money

- Making purchases with crypto.

- Swapping one cryptocurrency for another – whether through an exchange or a peer-to-peer (P2P) channel – is common.

Taxable events that are considered income taxes:

- Block rewards from cryptocurrency mining

- Crypto assets are earned from liquidity pools (LPs) or staking.

- Receiving crypto for services rendered

- Getting crypto from an airdrop

- Earning interest from lending to decentralized finance (DeFi) platforms

Be aware that you can write off your capital gains tax through losses incurred from trading. You can also save up to $3,000 of your income taxes, depending on how long you have held on to an asset.

Calculating Your Capital Gains Tax

The crypto market has seen exponential growth in the past year, and government agencies are trying to take knowledge of it. Given the recent spike in the non-fungible token (NFT) sub-sector, the IRS is also looking to get a piece of the crypto pie. Two things largely decide the number of capital gains tax rates for cryptocurrencies, first, your income tax bracket, and second, how long you have held on to your crypto asset. This will help you calculate your:

1. Capital Gains on Short-Term Investments

The short-term capital gains tax is heavily influenced by the time you have been trading or holding cryptocurrency. If you have made gains or losses by trading or keeping cryptocurrency for less than a year, you will be taxed at your regular tax rate. Losses incurred during the trading year may be valuable. You can deduct up to $3,000 in taxes by using a tax-loss harvesting approach. You also have the option of deferring your taxes until the following year.

2. Capital Gains on Long-Term Investments

If you have been trading cryptocurrencies for more than a year, you are eligible for long-term capital gains. Depending on your income, you will pay taxes ranging from 0% to 20%. On this page, we’ve broken down the income tax brackets. The second stage in discovering more regarding your chosen product or digital asset is to monitor the market. The market may move in a route that varies from your forecasts, and keeping cool when the market moves in a different direction is evenly essential. The easiest approach to keep up with the market is to read through review sites and recommendations.

Automated Trading With Robots

A trading robot is a computer programme that performs all of the operations of a professional trader on an exchange on a computerised basis. The computer software is a completely automated version of time-tested trading strategies. During instances of significant market volatility, robots tend to outperform humans regardless of the direction in which asset values are moving. This is due to the fact that they rely on trading tactics designed to create profits even when the market is down.

Furthermore, the world’s most successful Bitcoin bots are noted for their lightning-fast research and execution. As a result, they can conduct a large number of transactions each day, allowing them to capitalise on any trading chances that emerge.

Trading Songbird (SGB) may be a challenging career for anyone, and there is no guarantee that your market analysis will provide a profit. To get past this obstacle, there are other surefire ways to build your capital with little to no effort. Ideally, the bots benefit, and that profit is greater in risk-adjusted terms than if you had simply purchased and held the same coins throughout.

SGB Mining: Can You Mine SGB?

The supply of SGB tokens will remain with the Flare Foundation. It means if investors claim their FLR through an exchange, they will receive SGB on their behalf. Investors need to ask the Flare Foundation to distribute the tokens to them.

SGB vs. Other Cryptocurrencies

Songbird (SGB) vs. Kusama (KSM)

The easiest live comparison for Songbird Network would be Kusama Network for Polkadot. Kusama was launched 8 months before the highly successful launch of Polkadot. However, after the launch of Polkadot, Kusama took on a life of its own over time. Just like Kusama, all major applications must run through Songbird before making their way over to Flare Network. Just like Kusama, assets on Songbird will be real and tradeable.

However, the blockchain of Kusama uses a para-chain mechanism which is more well-defined than the beta-chain mechanism used in Songbird Network. The beta-chain mechanism is somewhat riskier than the para-chain network, which prompted the founder of the Flare network, Hugo Philion, to warn developers to use the network slowly and with small amounts.

Songbird (SGB) vs. Ethereum (ETH)

SGB has been listed on a variety of cryptocurrency exchanges, but unlike other major cryptocurrencies, it cannot be purchased directly with fiat money. However, you may still simply purchase this currency by first purchasing USDT from any fiat-to-crypto exchange and then transferring to an exchange that trades this coin. In this tutorial article, we will walk you through the procedures to purchase SGB in detail.

The Ethereum network’s programs and services all require computational power to function (and that computing power is not free). Besides, Ether is a payment method used by network users to pay for the services they want from the network.

Songbird (SGB) vs. Bitcoin (BTC)

Songbird (SGB) is the native cryptocurrency of the Songbird blockchain, which serves as a testnet for the Flare blockchain. For those who are unfamiliar with the term “canary network,” it is an operating blockchain network with a defined but limited token supply that is used to test the functionalities of the mainnet, which in this instance is Flare.

On the flip side, Bitcoin uses peer-to-peer technology to manage transactions and issue new bitcoins without a central authority or banks. The network as a whole is in charge of these tasks. Anyone can participate in Bitcoin because it’s open-source and nobody owns or controls it. Several Bitcoin’s unique qualities enable it to be used in ways no other payment system has been able to.

Songbird (SGB) Chaos

The development team of Flare Network has made no promises to maintain the liveliness of Songbird Network as it will fall on Flare Foundation and governance of the two networks. Furthermore, they warned that chaos on Songbird should be expected and it is much riskier than the flagship protocol, Flare Network. Over time, it is possible that the Songbird Network fades away from memory or could evolve into its own independent blockchain like Kusama.

SGB Price Predictions: Where Does SGB Go From Here?

The current price of Songbird is $0.3870, and SGB is ranked #2843 in the crypto ecosystem. Songbird has a circulating supply of 0 and a market capitalization of $0. The cryptocurrency’s current value has dropped by -4.11 percent in the last 24 hours. When we compare the current market cap of the SGB to the previous day’s market cap, we can see that the market cap is likewise down.

Songbird is having difficulty gaining traction with other crypto coins. In the last seven days, the SGB has dropped to around -25.64 percent. The currency has been demonstrating risky framing segments for the previous few days; the coin may have excellent fundamentals, but we do not believe it will be a successful asset in the short run. Thus, it’s crucial to note that a Songbird (SGB) price increase is almost certain in the next five years.

Songbird Price Prediction for 2021 – As per our in-depth technical analysis of previous SGB price data, the price of Songbird is expected to reach a low of $0.42 in 2021. With an average selling price of $0.44, the SGB price could reach a peak of $0.45.

Songbird Price Prediction for 2022 – In 2022, the price of Songbird is expected to fall to a low of $0.59. Throughout 2022, Songbird value can reach a maximum of $0.75 with an average price of $0.61.

Price Predictions for SGB in 2023-2024 – According to the projected price and technical analysis, the price of Songbird is expected to reach a low of $0.88 in 2023. With an average selling price of $0.91, the SGB price can reach a peak of $1.05.

In 2024, the price of one Songbird is predicted to fall to a low of $1.22. Throughout 2024, the SGB price could reach a peak of $1.49 with an average price of $1.27.

Songbird Price Prediction for 2025 – Songbird prices are expected to fall to as low as $1.83 in 2025. According to our estimates, the SGB price might reach a high of $2.17, with an average forecast price of $1.88.

Price Prediction for Songbirds in 2026 – According to our in-depth technical analysis of SGB price history, the price of Songbird in 2026 is expected to be around $2.74. Songbird price can reach a maximum of $3.16 in USD, with an average trading value of $2.82.

Songbird (SGB) Price Prediction for 2027 – In 2027, the price of Songbird is expected to fall to a low of $3.86. Throughout 2027, Songbird price might reach a high of $4.74 with an average trading price of $3.97.

Summary

Songbird is the Canary network for Flare. Speaking about the Canary network, it’s is an operational blockchain with a defined token supply intended to be used to test features for a related main net. The concept of the Canary Network was originated by Polkadot with its Kusama Network. It is a way to reduce risk and validate new software by releasing a small percentage of software to users before the actual launch, with the aim of testing the software’s functioning.

Songbird is expected to play an important role in continuing testing of various products that will be using the platform, including F-Asset systems, State Connector, FTSO, and the network infrastructure. It will be a test site for possible updates to Flare, which means that various dApp launches and innovations will take place on the Songbird blockchain before they are introduced on Flare after testing. This feature of prior testing of applications makes Songbird a unique network.

If you’re ready to invest in SGB, our recommended cryptocurrency broker is eToro, which has announced that they expect to list Songbird for trading soon. It only takes three minutes to get your account set up and get ready to purchase Songbird (SGB) using USD, GBP, EUR, Bitcoin or Ethereum. Keep an eye on the eToro Twitter account for more SGB news.

You should also remember the following:

- Songbird (SGB) investing and trading requires substantial research and commitment.

- SGB (Songbird) is a high-risk investment.

- Invest just what you can bear to lose.

- Only use registered brokers and exchanges when trading or investing.

- You should also seek the opinions of review sites and web specialists about Songbird.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

Read more:

FAQs

Any risks in buying Songbird (SGB) now?

There are always risks in buying digital assets. However, it's worth risk-taking as eToro has announced an SGB airdrop, and its merits can trigger a sharp bounce-off.

Should I buy Songbird (SGB)?

Yes, it seems like the platform Flare Network and its Canary Network, Songbird, will be very beneficial for tokens without the capability of smart contract functionality, and providing this feature to them will definitely accelerate the price of SGB in the future. As per our in-depth technical analysis of previous SGB price data, the price of Songbird is expected to reach a low of $0.42 in 2021. With an average selling price of $0.44, the SGB price can reach a maximum of $0.45. In 2022, the price of Songbird is expected to fall to a low of $0.59. Throughout 2022, Songbird price can reach a maximum of $0.75 with an average price of $0.61.

Where can I spend my Songbird (SGB)?

Songbird (SGB) is still not as widely used as Bitcoin. However, there is an increasing number of stores that are now accepting it. In any case, you can always convert Songbird (SGB) into other cryptocurrencies like Bitcoin, Ethererum, or Tether to make payments online.

Is it safe to buy Songbird (SGB)?

Songbird is the test platform for the Flare Network, an Ethereum-like blockchain that seeks to bring smart contract capability to other blockchains, including Ripple, Litecoin, and Dogecoin. It will enable developers to build apps that can run on these blockchains. However, developers will be able to start building on the Flare network after they test their work on Songbird. Thus, it's safe to invest in it. However, we recommend not to put all your investment in one basket.

Will Songbird (SGB) ever hit $1?

The SGB price outlook provides hope for stable trends, implying that there is hope for the SGB price, which may display a bullish bias. The average price for 2021 is predicted as $0.44. The average is expected to surpass $1 by 2024.

Bitcoin

Bitcoin