The cryptocurrency NuCypher aims to provide a layer of security and anonymity for decentralized apps built on public blockchains such as Ethereum, and allows developers to store, exchange, and manage sensitive information and private data cross-chain.

The NU platform provides two primary services:

- Secrets Management – saves sensitive information such as passwords and private keys

- Dynamic Access Control – provides and rescinds access to information on a case-by-case basis.

NU, the network’s native cryptocurrency, rewards nodes that provide encryption services to users. Still have questions about how NuCypher works? Read on for our ‘What is NuCypher?’ in-depth guide.

On this Page:

How to Buy NuCypher

- Choose a NuCypher exchange – its currently listed at Coinbase and Binance

- Create and verify your account with your government issued ID

- Deposit funds into your account

- Open a Coinbase Pro account using the same credentials and transfer funds across

- Search ‘NU’ in the menu and choose e.g. the NU/USD trading pair, or NU/USDT on Binance

- Set a limit order at the price in USD you’d like to buy Nucypher for

Best Places to Buy Cryptocurrency in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Cryptocurrency Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

If you’re looking for an alternative exchange to Binance and Coinbase, we recommend eToro as it’s the easiest to buy Bitcoin on, which can then be used to buy NuCypher once eToro list NU.

Step 1: Open an Account

The first step is to open the eToro website and then register for a trading account by clicking on the “Join Now” button at the center of the screen. You’ll be asked to enter the following details to create an account.

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

If you’d prefer to use the mobile app for iOS and Android, read our guide to the eToro app with screenshots.

eToro website homepage

Your capital is at risk.

Step 2: Upload ID

eToro will then require you to verify the provided identity with a copy of your driver’s license or passport to comply with government regulations. A copy of the utility bill or bank account statement will also be required to verify the provided address. The verification will then automatically happen once the documents are uploaded.

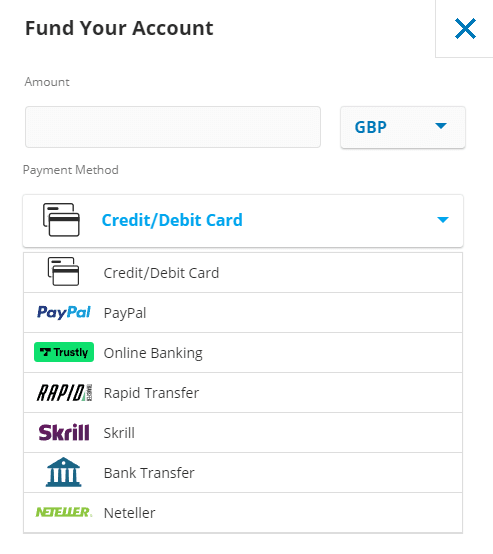

Step 3: Make a Deposit

The minimum requirement for opening an account with eToro is $50, which can be deposited through various methods, including:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

eToro imposes a flat fee of 0.5 percent on all deposits, regardless of payment method. This is far less expensive than some of its key competitors, such as Coinbase, which charges 3.99 percent to buy Bitcoin with a debit card.

Different deposit methods on eToro

Furthermore, there is no transaction cost if you are a US resident depositing funds through a USD-backed payment method. The minimum deposit is $50 for residents of the United States and $200 for most other countries.

eToro doesn’t offer direct NuCypher purchases – meaning that you will first need to deposit some funds and buy Bitcoin. Apart from a bank transfer, all deposit method instantly credits your funds into your account.

Step 4: Search for Bitcoin

At this stage of our step-by-step guide, you should now have an eToro account that is funded. Now it’s time to buy NuCypher.

Since eToro doesn’t have NU at this stage, you can now buy Bitcoin simply by typing the amount you want to invest in the ‘Amount’ box ($25 minimum).

Then using your Bitcoin, you can currently buy NuCypher on Coinbase and Binance which have NU/BTC trading pairs. Given its popularity the NuCypher token should be listed on eToro shortly.

Read more about how to buy cryptocurrency in 2024 here.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

1. eToro – Best Cryptocurrency Exchange

eToro is a regulated cryptocurrency broker with its main office in the United Kingdom. It was founded in 2007, and since then, it has expanded globally and has offices around the world. It reached a milestone of over 20 million registered users in 2021.

NuCypher on eToro – Unfortunately, eToro doesn’t have NuCypher at this stage. However, you can buy Bitcoin on eToro, then transfer that to Coinbase or Binance to buy NU with.

Hopefully as NU is a popular altcoin, it will be available on eToro soon.

Initial Deposit

The minimum deposit on eToro is $50 and traders can fund their accounts through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, VISA, or Neteller.

Regulation

eToro is regulated in the United Kingdom (UK) and worldwide, holding licenses from the ASIC, FCA, and CySEC. In addition to this, eToro is a member of the FSCS which protects the first £85,000 of investors’ funds in case of hacking.

Buying and selling on eToro can be done on desktop via Windows or Mac or on the mobile app for iOS and Android. The opening process of an eToro account is beginner-friendly and takes just a few minutes.

Pros & Cons of the eToro platform:

- eToro provides copy and social trading.

- Regulated by ASIC, FCA, and CySEC.

- Share trading with no commissions.

- User-friendly graphical user interface (graphical user interface) stockbroker.

- A well-known mobile trading app.

- Skrill, VISA, Neteller, and PayPal are all accepted at eToro.

- On some altcoins, the buy/sell spread is wide.

- Some low market capitalization coins need time to be listed.

- Performing advanced technical analysis can be challenging for pro-traders.

2 – Binance

Binance is the world’s largest cryptocurrency exchange by daily transaction volume, with over $20 billion in deals per day. It gives you access to hundreds of assets and a smooth trading service that makes it simple to make money.

The advantages of Binance are pretty astounding. The trading commission is a flat 0.1 percent, which is low – or 0.075% if you hold BNB and opt to use it to pay for fees.

Expert traders can use sophisticated tools, including futures and margin trading, and the exchange offers a variety of deposit and withdrawal methods. When you combine this with Binance’s high liquidity, it’s easy to see why it’s so popular.

At July 04, 2021, the Binance exchange listed NU/BTC, NU/BNB, NU/BUSD, and NU/USDT trading pairs.

- Users can now begin depositing NU in anticipation of trading.

- Withdrawals for NU were opened at 02:00 PM on 2021-06-04. (UTC)

Pros & Cons of the Binance platform:

- Very good liquidity

- Users can now begin depositing NU

- Exceptional security features

- Withdrawals for NU are opened

- Professional traders have access to sophisticated products.

- High fees for credit card deposits.

- Copy trading isn’t available.

3 – Coinbase

Coinbase is one of the most well-known cryptocurrency exchanges in the United States, as well as one of the largest in the world. Coinbase was launched in San Francisco in 2012.

Coinbase became the first crypto trading company in the United States to be listed on the stock exchange in April, with an IPO valued at roughly $86 billion. While bitcoin brokerages are not covered by the Securities Investor Protection Corporation or SIPC, Coinbase covers its site for any losses incurred due to theft or hacking.

Coinbase listed NuCypher in Dec 2020, therefore, it’s supported by Coinbase on the web, android, and iOS applications. Customers of Coinbase can now buy, sell, convert, transmit, receive, or store NU.

Fees – Coinbase provides a free USD Wallet and Hosted Cryptocurrency Wallet Service. This means that Coinbase will store your USD and cryptocurrencies for free. Transferring cryptocurrency from one Coinbase wallet to another is free of charge.

Spending USDC with a Coinbase Card is free, however, Coinbase charges a flat 2.49 percent transaction fee on all purchases, including ATM withdrawals, done with other cryptocurrencies.

Pros & Cons of the Coinbase platform:

- It provides access to over 50 cryptocurrencies.

- A low minimum is required to fund an account.

- In the event that a website is hacked, cryptocurrency is protected.

- Higher fees than other cryptocurrency exchanges.

4 – Bitfinex

Bitfinex was founded by Giancarlo Devansini and Raphael Nicolle in the British Virgin Islands in 2012. It’s headquartered in Hong Kong. Initially, the company operated solely as a peer-to-peer margin lending platform for Bitcoin. Some iFinex inc founders and management are also connected to Tether, the US-pegged Stablecoin.

The cryptocurrency exchange has evolved to be one of the largest, with operations in the UK (GBP), Europe (EUR), Japan (JPY), and others. Its services are best suited for traders with a certain level of experience or expertise. Additionally, the platform provides margin trading, staking, and lending options for cryptocurrencies.

Fee – Taker costs range between 0.2 and 0.055 percent, whereas Maker fees range between 0.1 and 0.0 percent. There is no trading cost for big orders placed through the OTC desk. Bank wire transfers incur a 0.1 percent deposit and withdrawal fee. For foreign withdrawals, this can be increased to 1%.

Pros & Cons of the Bitfinex platform:

- Established since 2012

- Suited for advanced traders

- Over 100 supported coins.

- Accepts bank wire deposits and withdrawals

- U.S. citizens not accepted

- Not regulated

- High trading fees

- Hacked on more than one occasion

5 – KuCoin

KuCoin, which debuted in 2017, is a cryptocurrency exchange that provides third-party brokerage services. KuCoin is a secure and simple-to-use cryptocurrency exchange platform where users worldwide may trade crypto assets. Furthermore, the platform is situated in Seychelles, and the founding members have previous expertise running businesses like Ant Financial and iBox PAY.

Kucoin is often referred to as “The People’s Exchange.” The platform includes a trading bot, margin trading, futures trading, loans, and other services. Furthermore, according to the platform, one out of every four HODLers in the world uses KuCoin.

Kucoin has its cryptocurrency, known as Kucoin Shares (KSC). If you hold KSC coins, you will save trading costs and gain more cryptocurrency. KuCoin is also one of the top ten cryptocurrency exchanges in the world, according to CoinMarketCap.

KuCoin listed NuCypher (NU) back on November 30, 2021, and supported trading pair include NU/USDT and NU/BTC.

Pros & Cons of the KuCoin platform:

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- KuCoin Shares allow users to invest in the success of KuCoin.

- User-friendly exchange

- Low trading and withdrawal fees

- Users can trade using Arwen without having to transfer funds into a third-party wallet.

- A vast number of pairs are available to trade.

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilise.

- Lacks the trading volumes found on some of the more established platforms.

- No fiat trading pairs

6 – Bybit

Bybit is a relatively new trading platform that launched in March 2018. It offers an industry-leading leverage trading exchange that focuses on cryptocurrency derivatives, trading important coins including Bitcoin,

Takers are charged a fee of 0.075 percent on each order, which is a pretty standard market rate. Makers, on the other hand, pay a 0.025 percent fee – so if you are the maker in a $1000 trade, you would only pay $997.50, which we thought was a fair price. Regardless of the currency used in the transaction, the fees are the same. There is also a 0.0005 Bitcoin fee for BTC transfers, which is lower than the global industry standard.

- Bybit is a mobile trading app.

- 4.9 out of 5 stars based on over 50,000 reviews

- USDT everlasting BTC, ETH, EOS, and LTC pairs

- Trading costs range from 0.025 to 0.075 percent for leverage of up to 100 times.

- Order book with high liquidity and low spreads

- Affiliate and referral program (30% commission)

Pros & Cons of the Bybit platform

- Dependable and respectable trading platform.

- By volume, it is the world’s fourth-largest derivatives exchange.

- A variety of markets are available, including spot, perpetual, and futures.

- A sophisticated and feature-rich trading platform

- Mobile app that is simple to use and responsive

- Difficult for newcomers to navigate.

- Limited number of spot trading pairs against BTC.

What is NuCypher?

The NuCypher Network is a security layer for blockchain as well as Ethereum applications that provides decentralized access controls and key management through proxy re-encryption. Simply said, NuCypher is a decentralized Key Management System (KMS) that employs blockchain technology to enable data owners to securely exchange sensitive data with a large number of users. It is used as security infrastructure for sharing data. From a centralized health care system to a decentralized content marketplace, anyone can use this platform.

The three primary use cases of the NuCypher Network are Secret Management, Dynamic Access Control, and Secure Computation. Any decentralized application (dApp), system, or protocol that is engaged with non-public user or organizational data can enjoy the security provided by NuCypher. Unlike centralized KMS as a service solution, NuCypher does not require trusting a service provider.

Maclane Wikison and Micheal Egorov launched NuCypher in 2015 with the goal of offering data security and encryption that allows users to securely migrate information and computations to the cloud. Initially, the business’s team was focused on dealing with industries that handle huge volumes of sensitive data, such as finance and healthcare, and the company also offered lab environments to many large banks at one point.

However, in 2017, the company decided to adapt its product to smart contracts, which would provide dApp developers with the same secure storage guarantee as before. This decision led the company to adopt a token-based model featuring a decentralized infrastructure layer to further reduce the platform risk.

Wikison and Egorov participated in the US startup accelerator Y Combinator in the summer of 2016. Next year, the company NuCypher published its whitepaper and launched its private testnet. Major stake infrastructure participated in the launch of private treatment, including Bison Trails, Figment, InfStones, and Staked.us. In October 2019, the company began its public testnet, and the incentivized public tesnet was launched in January 2020. However, the mainnet of NuCypher was launched in October 2020.

The team behind the creation of NuCypher includes MacLane Wilkison, Michael Egorov, John Pacific, and David Nunez. MacLane Wilkison is the co-founder and CEO of the company. He is a former investment banker at Morgan Stanley. Moreover, he is a Certified Information Systems Security Professional (CISSP), a Chartered Financial Analyst (CFA), a Software Engineer, and a Certified Financial Risk Manager.

Michael Egorov is also a co-founder and CTO at NuCypher. He worked on infrastructure tools at LinkedIn. He also has experience as a scientist and physicist in work related to quantum computing and cryptography. John Pacific was a founding engineer of the NuCypher project. Furthermore, he works on Proxy Re-encryption and Fully Homomorphic Encryption research. Davud Nunez is in charge of cryptography research and development at NuCypher.

Performance of NuCypher (NU)

NuCypher coin (NU) runs on the Ethereum Network, which means it is an ERC-20 token. A NU token can be staked to run a node on the NuCypher network. The NU token was initially released in October 2020, with an initial price of $0.2. NuCypher distributed approximately 222.5 million NU tokens to node operators in proportion to the amount of ETH they had locked with the launch of the mainnet. The total supply of NuCypher coins is 1,311,422,168 NU, whereas the circulating supply is 687,500,00 NU.

NuCypher was funded through a private seed round, where they raised $750 thousand, and a Simple Agreement for Future Token (SAFT) pre-sale, where they raised over $15 million over two sales. The token is used for staking by node providers and for governance purposes. The community voted in June 2021 to integrate infrastructure with Keep, another crypto security project. The union is called KEaNU. However, the principal products will stay separate. The merger is anticipated to happen by the end of July 2021, which will launch a new token, T, issued to NuCypher and Keep holders.

The NU token is used for holding, sending, or staking and plays a crucial role in maintaining and operating NuCypher’s network. Users can gain the ability to perform a NuCypher Ursula node and participate in the DAO. They can vote on protocol upgrades, fee rate changes, and the DAO’s adjustments by owning and staking NU tokens. Furthermore, the NU token can also be exchanged for other Ethereum network tokens and can also be used within Ethereum-based applications built on the Ethereum blockchain.

The coin NU/USDT dropped during the initial days of its launch and dropped to as low as 0.1739, then started moving upward with the Coinbase listing in December 2020. However, the price started declining steadily in June due to a combination of the general market downturn and the news of the upcoming merger with Keep, which added a great deal of skepticism into the fate of the NuCypher token.

However, many investors had more optimistic views about the coin as they had faith in the project, pointing out that NuCypher was a young project with solid fundamentals and many potentials, which started driving its prices to the upside. The coin kept its bullish momentum and reached 0.5095, its all-time high, in September 2021. After this, NU/USDT started declining, facing a correction, and dropped to as low as 0.2500. Since then, the coin has been moving in a range between 0.2500 and 0.3400. The current price of NU/USDT is 0.2945.

Is it Worth Buying NuCypher in 2024?

NuCypher price surges day by day, and the coin is rocketing to new heights with gains of over 400% and a new all-time high. It is assumed that the work-in-progress related to the long-awaited merger with another crypto network has been pushing NU prices higher lately.

A merger on a blockchain is a unique and new thing, and investors are excited to see what this merger will do to the networks. Just three days back, NU prices reached an all-time high of $3.58, with the token seeing an 1100% increase in value, given the increased interest of investors in the coin.

The coin is experiencing massive transaction volumes as they have increased about 20,000% in just 24 hours and have ended up doubling the market capitalization of the NuCypher token to over $2 billion.

Will the Price of NuCypher Go Up in 2021?

Cryptocurrencies have made a strong comeback after a few months of weakness owing to China’s crackdown. While Bitcoin and Ethereum are hitting all-time highs, numerous altcoins are soaring as well. NuCypher was one of the lesser-known cryptocurrencies that drew everyone’s attention on October 15.

The altcoin climbed more than 1,100% during the day at one point, and it concluded with about 400% gains during the day at a new all-time peak. Following this spike, crypto investors are asking how NuCypher would fare in the long run. What is the pricing forecast for NU in 2025?

Surprisingly, the network celebrated its one anniversary on October 15, and the markets gave it even more reason to celebrate. The anticipated merging of NuCypher with another crypto network, Keep, has been a significant cause of its rise. Although the merger was announced in June, the developers hosted a Q&A session on October 15, which may have sparked the interest of traders. Both networks will be merged into a single system called Threshold, supported by a token called “T.”

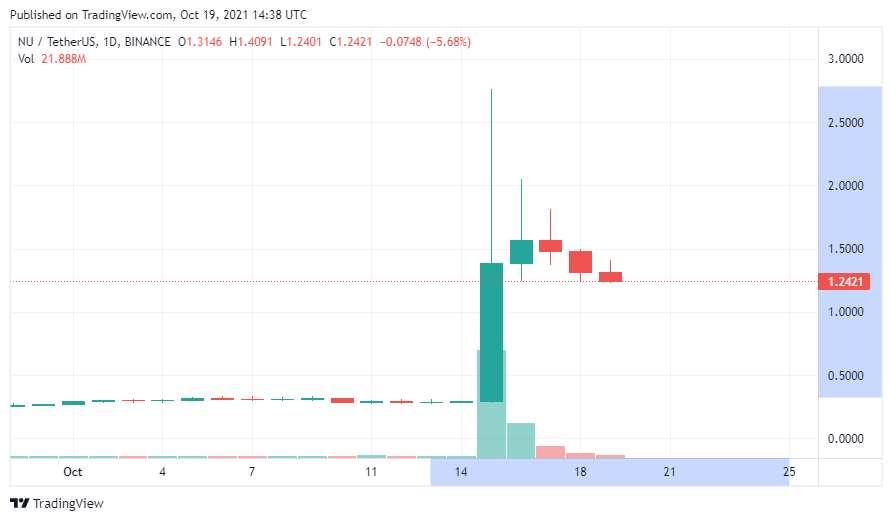

NuCypher Daily Chart

The increased transaction volume and the upcoming merger with Keep hold impressive potential for NU coin. Furthermore, given such exceptional growth in a short history, the outlook for the coin has become very promising. It is expected that the upcoming merger with Keep will push the NuCypher token’s price upward in 2021.

The network offers security for sensitive data transfer and, due to its unique services, there are good chances of increased adoption of the NuCypher network by organizations. Furthermore, the relatively low circulating supply of NU tokens also makes it worth buying in 2021. NU has a circulating supply of 687 M, whereas the maximum supply is 3.9 billion NU coins.

Gov. Capital – The price of NuCypher is expected to drop as low as $1.632 in December 2021, and it could rise as high as $1.8768.

Cryptopolitan – NuCypher price outlook suggests that the average price in 2021 will remain $0.32. The minimum price level for NU should be $0.30 by the end of this year, and the maximum price level should be $0.33.

Coin data flow – NuCypher price seems to reach $1.78 by the end of 2021 and the start of 2022.

How to Choose the Right Crypto Broker

Given the wide variety of brokers from which to purchase NuCypher, you must make the best option possible. Consider the following aspects while looking for the best broker for you:

1. Charges

What is the relevance of selecting a low-cost broker while trading cryptocurrencies like NU? Because costs can easily add up. Before choosing a trading platform, get a breakdown of the broker’s fee structure. Withdrawal and deposit fees, transaction fees, and trading fees should all be mentioned.

2 – Security

To prevent unauthorized access to your money, the right broker should have suitable safety and security measures in place.

3. Assistance

A reputable broker will also have a robust customer service staff to help you with all of your needs.

4. Deposit Alternatives

You want to be able to deposit as many funds as possible. There are always numerous options, ranging from bank transfers to credit cards to payment processors. Just keep in mind that each one has its own set of costs.

When you’re considering an investment, follow these things:

Every cryptocurrency carries hazards, and this is especially true for NU. So, whenever you invest, make sure you don’t get caught up in FOMO. Before investing in any digital asset, you should do your own study in addition to following others.

1 – Research, research, research: Before investing your money, conduct thorough research on the product to avoid hazards related to it.

Here are the several ways we investigated:

- Investigating social media platforms

- Considering forthcoming events

- Investigate the fundamentals

- Discover popular subjects.

- Make use of the potential of specialist forums.

- Attend crypto meetups.

- Take note of the transaction volume.

- Keep track of the market:

The second stage in learning more about your chosen product or digital asset is to monitor the market. The market may move in a path that differs from your expectations, and remaining cool when the market moves in a different direction is equally important. The easiest approach to keep up with the market is to read through review sites and recommendations.

Buying NuCypher as a CFD Product

Contracts for difference (CFDs) are financial derivatives that enable you to speculate on numerous financial markets without owning the underlying asset. It is commonly utilized in established markets such as currency pairs, stocks, bonds, indexes, and commodities.

CFD trading requires more than just buying and selling; it also entails agreeing to exchange the difference in the price of an asset when the contract is opened and when it expires.

CFD trading has entered the cryptocurrency market, and NuCypher is now available as a CFD product. If you’re having problems understanding bitcoin trading and where to keep your crypto funds, you can earn from NuCypher by using CFDs.

We recommend trading NuCypher CFDs on Binance as it’s a well-established exchange with margin trading. NU/USDT can be traded with isolated 3x leverage on Binance.

Another popular leverage trading platform for altcoins is CryptoRocket. They don’t currently support NU but so support ETH, DOGE, XRP, LUNA and more so we could expect them to list NU soon.

Taxation on NuCypher Earnings:

As the cryptocurrency market is still new and finding its ground, regulatory agencies, including the SEC, are looking to regulate this industry. Furthermore, the Internal Revenue Services have been trying to set up a tax regime for cryptocurrencies. Currently, cryptocurrencies and digital assets are treated as properties and fall under the capital gain tax bracket. However, in certain situations, some earnings from cryptocurrencies are also considered income and fall under the income tax bracket. The following are the taxable events that qualify for capital gains and income taxes when trading digital assets.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21, IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals who have bitcoin as a capital asset but are not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Taxable events that are considered property gains tax in the US:

- Exchanging your cryptocurrency for fiat money

- Making purchases with crypto.

- Swapping one cryptocurrency for another – whether through an exchange or a peer-to-peer (P2P) channel – is common.

Taxable events that are considered income taxes:

- Block rewards from cryptocurrency mining

- Crypto assets are earned from liquidity pools (LPs) or staking.

- Receiving crypto for services rendered

- Getting crypto from an airdrop

- Earning interest from lending to decentralized finance (DeFi) platforms

Be aware that you can write off your capital gains tax through losses incurred from trading. You can also save up to $3,000 of your income taxes, depending on how long you have held on to an asset.

Calculating Your Capital Gains Tax

The crypto market has seen exponential growth in the past year, and government agencies are trying to take knowledge of it. Given the recent spike in the non-fungible token (NFT) sub-sector, the IRS is also looking to get a piece of the crypto pie. Two things largely decide the number of capital gains tax rates for cryptocurrencies, first, your income tax bracket, and second, how long you have held on to your crypto asset. This will help you calculate your:

i) Capital Gains on Short-Term Investments

The short-term capital gains tax largely depends on how long you have been trading or holding cryptocurrencies. If you have made gains or losses from trading or holding crypto for less than a year, you will be taxed under your normal tax bracket. Losses you incur for that trading year can prove useful. Leveraging on a tax-loss harvesting strategy, you can write off up to $3,000 of your taxes. You also enjoy the privilege of post-dating your taxes to the next year.

ii) Capital Gains on Long-Term Investments

Long-term capital gains apply if you have been trading cryptocurrencies for upwards of a year. You will pay taxes between the range of 0 to 20% depending on your income. We have itemized the income tax brackets on this link.

Automated Trading With Robots

A trading robot is a computer program that, on a computerized basis, executes all of the activities of a professional trader on an exchange. The computer software is a fully automated version of tried-and-true trading techniques. Regardless of the direction in which asset values are moving, robots tend to outperform humans during periods of substantial market volatility. This is because they rely on trading strategies that are meant to generate profits even when the market is down.

In addition, the most successful bitcoin bots in the world are known for their lightning-fast research and execution. As a result, they can complete a huge number of transactions every day and thereby take advantage of any trading opportunities that arise.

Trading NuCypher can be a difficult profession for anyone, and there is no assurance that your market analysis will result in a profit. There are other sure ways to grow your capital with little to no effort to get around this problem. Ideally, the bots make a profit, and that profit is bigger in risk-adjusted terms than if you had just bought and held the same coins throughout.

NuCypher Mining: Can You Mine NU?

No, NU cannot be mined as it is based on a proof-of-stake mechanism and not a proof-of-work mechanism like Bitcoin and ETH.

Decreasing Risk in NuCypher Investment:

Every investor needs to find ways to protect themselves from any big loss. If you want to cap your risks, then follow these rules:

Hedge your risks: You should always have a well-balanced portfolio of investments. Use financial instruments strategically to mitigate the risk of adverse price movements. On the other hand, the investors hedge one investment by making a trade-in another.

Use a stop loss: A stop-loss order is used to restrict an investor’s loss on an adverse move in a security position. You don’t have to monitor your holdings on a daily basis if you use a stop-loss order. An investor’s ally is a stop loss. Be a note of it and make sure you stick to it. When things don’t go as planned when investing, you’ll want to know when to take your money out.

Set a target: Short-term traders who want to manage their risk should employ take-profit orders. This is because they can exit a transaction as soon as their predetermined profit target is met, avoiding the risk of a market decline. Traders that follow a long-term strategy dislike such orders since they reduce their profits.

Use multiple exchanges: To reduce risk in crypto trading, I use a variety of exchanges, employ hardware wallets, and invest in a variety of narratives (Oracles, Defi, or insurance). To reduce risk when trading, trade only when truly strong patterns form or when a coin has reached its bottom.

Fundamental & Technical analysis: When it comes to investing, I prefer to focus on coins with strong fundamentals. I only invest on rare occasions in response to news or other events. If I decide to invest, I will also do technical analysis. I consider things like where the currency is in its life cycle.

Are there any trading patterns? For the coin, there is support and resistance, recent price history, news, and forthcoming events. If I invest in fundamentally sound coins, I can stay calm even if the price changes a lot because I know the price will eventually rise.

NuCypher vs. Other Cryptocurrencies

NuCypher (NU) vs. Cardano (ADA)

NuCypher is an Ethereum based token that can be staked to run a node on its network. The company describes itself as a threshold cryptocurrency network that provides data privacy and key management for dApps and protocols.

On the other hand, Cardano is a blockchain and cryptocurrency organization with a core mission to standardize, protect, and promote the Cardano Protocol technology.

NuCypher (NU) vs. Ethereum (ETH)

NuCypher is an Ethereum token that may be staked to run a NuCypher network node. NuCypher describes itself as a network of threshold cryptography that provides data privacy and key management for decentralized apps and protocols. While Ethereum is both a money and a platform for decentralized computing. Developers may use the platform to build decentralized apps and create new crypto assets known as Ethereum tokens.

NuCypher Price Predictions: Where Does NU Go From Here?

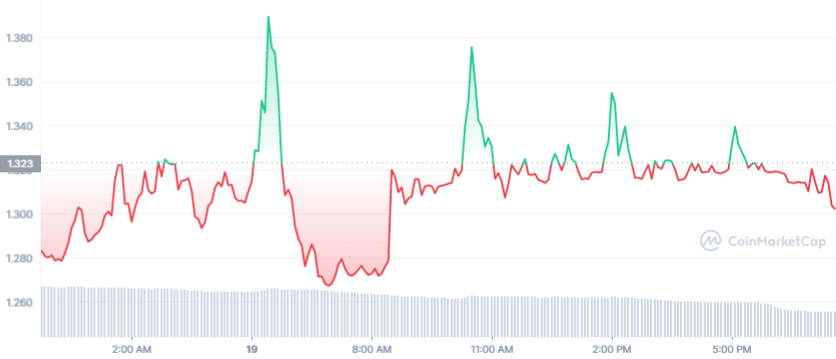

According to the most recent data, the current price of NuCypher is $1.35, and NU is ranked #100 in the entire crypto ecosystem. NuCypher has a circulation supply of 687,500,000 and a market capitalization of $930,406,384. When we compare the NU’s current market value to yesterday’s, we can notice that the market cap is likewise down. The NU has been on a nice rising trend over the last 7 days, increasing by 378.55 percent. NuCypher has recently demonstrated very high potential, and now could be a fantastic time to get in and invest.

NuCypher Weekly Line Chart – CoinMarketCap

However, when the present price is compared to the previous 30 days price history, it is shown that NuCypher’s worth has climbed by 82.628 percent. The month’s average minimum price was $0.21, while the maximum average price was $0.24. This means that this coin is a suitable asset and fresh addition to your long-term coin portfolio. The 90-day price change is around 71.47 percent, with the price fluctuating between a minimum average price of $0.38 and a maximum average price of $0.42 in the previous 90 days.

NuCypher has demonstrated a rising trend over the last four months. As a result, we believe that similar segments of the market were extremely popular at the time. According to the most recent data, the trading volume of NuCypher has grown in the last four months. The trading volume has a significant impact on the price.

In the last four months, the coin has increased by 57.70 percent, with a maximum average price of around $0.56 and a minimum average price of around $0.49.

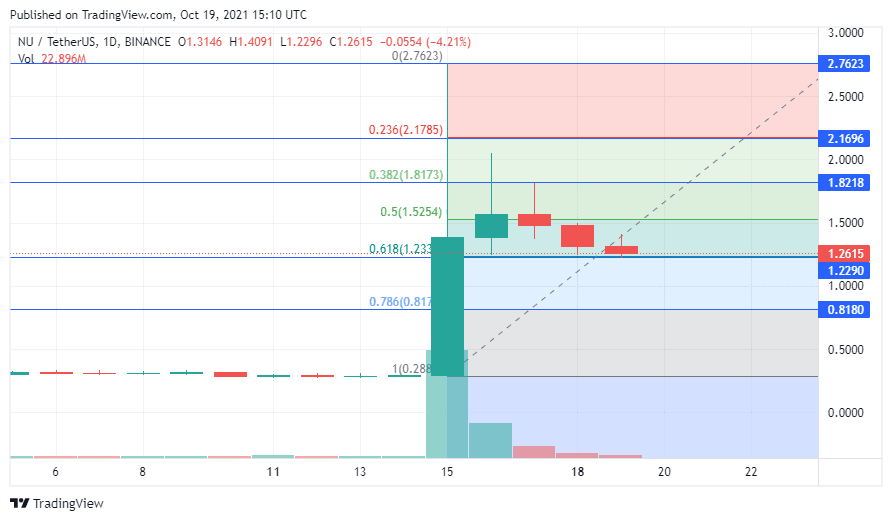

NuCypher Daily Chart – 61.8% Fibonacci Correction

NuCypher Price Prediction 2021 – According to our in-depth technical analysis of NU price history, the price of NuCypher is expected to reach a low of $1.41 in 2021. With an average trading price of $1.48, the NU price can reach a maximum of $1.52.

NuCypher Price Prediction 2022 – In 2022, the price of NuCypher is expected to fall to a minimum of $2.09. Throughout 2022, NuCypher price can reach a maximum of $2.46 with an average price of $2.15.

NuCypher Price Forecast for 2023 – According to the forecast price and technical analysis, the price of NuCypher is expected to reach a low of $2.92 in 2023. With an average trading price of $3.00, the NU price can reach a maximum of $3.63.

NuCypher Price Forecast for 2024 – In 2024, the price of one NuCypher is predicted to fall to a minimum of $4.07. Throughout 2024, the NU price can reach a maximum of $5.04, with an average price of $4.19.

NuCypher Price Prediction 2025 – The price of NuCypher is expected to fall as low as $5.93 in 2025. According to our estimates, the NU price might reach a high of $7.14, with an average predicted price of $6.09.

Summary

NuCypher secures private data on public blockchains to provide cryptographic services to multiple protocols. Through Umbral, its encryption technique, and Ursula, a network of running nodes, the platform provides a nodes management system and dynamic access control services. Umbral is NuCypher’s encryption method, which enables users to keep data private while yet securely sharing information.

If you’re ready to take the plunge to get in on the action, you can complete your crypto journey using our recommended broker, eToro. It only takes three minutes to get your account set up and ready to purchase NU using Bitcoin you buy on eToro and then transfer to Binance, which allows you to margin trade NuCypher.

If you’re ready to invest in NU, we recommend regulated and user-friendly exchange eToro.

You should also remember the following:

- Do your own research (DYOR) when investing in and trading NuCypher.

- NU is a high-reward, but also high-risk investment.

- Invest only what you can afford to lose.

- Only use regulated brokers and exchanges when trading or investing.

- Consult review sites for an overview on the cryptocurrency markets.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risks in buying NuCypher now?

There's always risks in buying digital assets. The major risk is in the possibility of NuCypher price falling off the cliff or the asset becoming totally worthless.

Should I buy NuCypher?

The fact that this cryptocurrency has a fairly low circulating supply makes it worth considering. NuCypher has a total quantity of 3.9 billion coins and 687.5 million coins in circulation. The use cases for cryptocurrency appear to be strong, with a promising future. Furthermore, NuCypher's low cap makes it even more appealing to crypto traders seeking for tokens that are just starting started on their way to highs. Mergers in the cryptocurrency world are unusual, and the forthcoming merger between NuCypher and Keep could be the next trigger that propels it to new heights.

Where can I spend my NuCypher?

NuCypher is still not as widely used as Bitcoin. However, there are an increasing number of stores that are now accepting it. In any case, you can always convert NuCypher into other cryptocurrencies like Bitcoin, Ethererum, or Tether to make payments online.

Is it safe to buy NU?

NuCypher focuses on privacy and assists other blockchains in running smoothly. It can optionally grant and remove access to sensitive information on the network, in addition to providing privacy architecture to the decentralised web. It could be a suitable solution for firms that prioritise security because of its high security focus. Therefore, NU is a safe buy, however, we recommend not to put all your investment in one basket.

Will NU ever hit $7?

The price of NuCypher is expected to fall as low as $5.93 in 2025. According to our estimates, the NU price might reach a high of $7.14, with an average predicted price of $6.09.

Bitcoin

Bitcoin