The passion for an alternative source of income has people diving into stock trading. However, not everyone has the propensity or skill to do that, which is why stock trading signals have gotten a lot of traction lately.

But which stock trading signals are the most viable? This guide will provide the best stock trading signals provider of 2024. It will dive into its competencies and how well it is equipped to help people.

Best Stock Trading Signals Providers – Top 10 List

- Benzinga Pro: Leading Stock Trading Signals Provider Offering Holistic Insights about Stocks

- eToro – High-Profile Trading Platform Offering Robust Trading Signals

- PepperStone – Stock Trading Platform Relying on MetaTrader4 to Offer Trading Signals

- AvaTrade – Offering Actionable Trading Signals Covering a Wide Array of Instruments

- XTB – Trading Signals Provider Offering Free Access to Bank Recommendations

- Trade Nation – Stock Trading Signals Provider Offering Precise Signals Using TN Trader

- AltIndex – Offers Alternative Data Using ML and AI and Uses Social Sentiment to Offer Stock Signals

- Danelfin – AI-Driven Trading Signals for Long-Term Investing

- MindFul Trader – Stock Trading Signal Provider That Uses Quantitative Signal Analysis

- Seeking Alpha – Trading Signal Provider Suitable for Long-Term Investors

Visit the Best Stock Trading Signals Provider

Review of the Top Stock Trading Signals Provider on the Market

There are many stock trading signals providers on the market. Some are unsuccessful, some are fake, and only a few are worth an investor’s time and attention. This complete list covers the leading signal providers that have proven their mettle as optimal tools for investment. This section offers a mini-review of them, highlighting their functionality and the types of signals they deliver.

Benzinga Pro: Leading Stock Trading Signals Provider Offering Holistic Insights about Stocks

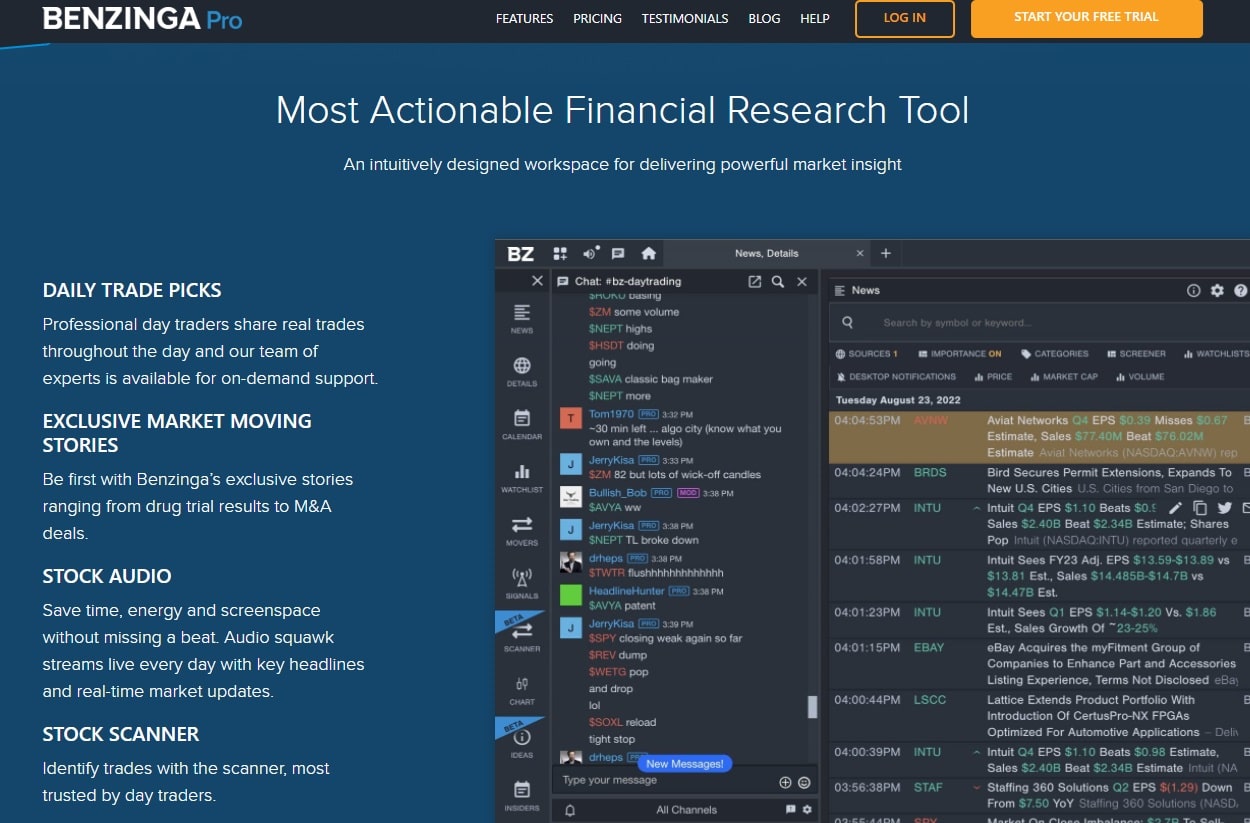

At the top of the list is Benzinga Pro. Referred to by the website as the best investment software with breaking stock market news, this stock signals provider offers highly precise signals backed by fundamental and technical analysis.

Describing itself as the most actionable financial research tool, this application offers everything from daily trade picks to stock scanners. With daily trade picks, professional day traders will receive on-demand support from real-time experts.

There is also stock audio information, offering real-time market updates through audio streams. Furthermore, those who want to fine-tune the signals can do so using stock scanners, which is helpful in identifying trades for day traders. Furthermore, it also offers stock alerts through its in-house mobile application.

Essentially, this particular signals platform covers more than just one area when offering alerts. While standard chart patterns are analyzed, news articles and overall market sentiments aren’t ignored either. The platform also watches out for special circumstances that could alter a stock’s price.

These features are supported by an excellent UI that focuses on accessibility. It is not difficult to understand the signals either, for Benzinga Pro gives complete rationale of the signals it generates.

Signals also cover things like Option Activity, Price Spikes, Opening Bell, Halt/Resume, Highs/Lows, and Block Trade. These signals can also be fine-tuned using multiple variables such as outstanding shares, average volume, price change, share float, and more.

With the custom notifications, users can also decide how they will receive signals.

There are three types of subscription models for Benzinga Pro. Basic, which costs $37 a month, offers basic signals and services. Essential provides a real-time scanner and bonuses. For the highest-grade professionals, the streamlined version also offers Audio Squawk and an advanced newsfeed.

- Real-time audio market updates stream

- Customizable stock scanning tools available

- Multi-factor signal analysis approach

- User-friendly interface design

- Flexible notification delivery options

- Most advanced features require premium

- Basic plan is quite limited

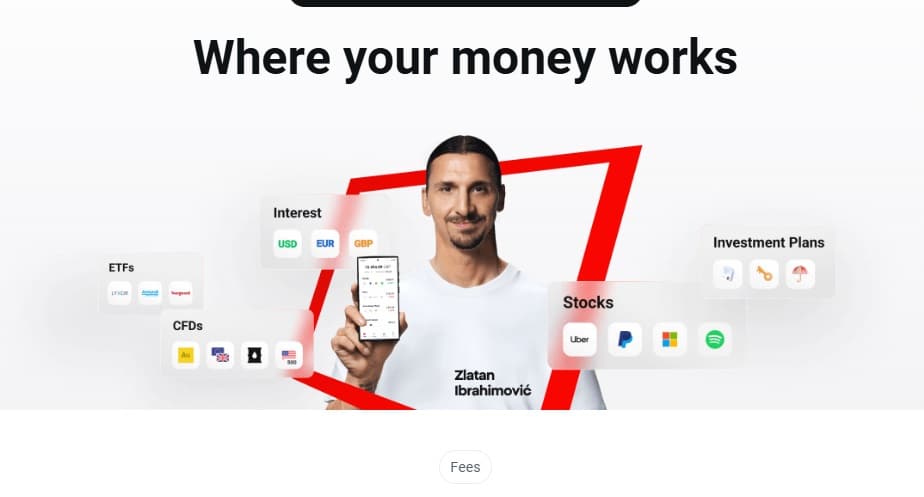

eToro – High-Profile Trading Platform Offering Robust Trading Signals

Another high-ranking stock signals provider is eToro. This trading platform offers trading signals through an embedded signal system known as TipRanks. This attribute offers trading signals based on multiple variables, everything from analyst ratings and price targets to financial forecasts.

The focus is also on analyzing each asset separately and offering a page to buy or sell these assets depending on the suitable audience. This platform also offers hedge fund and insider transactions.

However, perhaps the biggest feature this platform has is social trading. Users can copy the trades of leading investors, which significantly reduces the time to research each asset. Furthermore, the trading terminal is equipped with top-of-the-line charting tools, allowing users to perform market analysis, sentimental analysis, and technical analysis.

Because everything is tied to social trading, users can also post, comment or even tag existing signals.

When it comes to how these alerts are provided, eToro gives three options – mobile, desktop or email notifications. That said, it does not provide recurring time frame of how long and how often users will get it. That said, eToro also offers periodic news and industry updates, factors essential to keep an eye on the market’s pulse and making an investment decision.

- Social trading with expert copying

- Comprehensive TipRanks analysis integration

- Multiple notification delivery methods

- Advanced charting tools available

- Access to insider trading data

- Unclear signal frequency timing

- Limited customization of alerts

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Crypto assets are highly volatile and unregulated. No consumer protection. Tax on profits may apply

PepperStone – Stock Trading Platform Relying on MetaTrader4 to Offer Trading Signals

Pepperstone is a trading platform that offers CFDs and commodities trading services. However, its signal-providing skills have come to light thanks to MetaTrader 4. MetaTrader 4 signals help reduce all kinds of human-related errors.

The signals generated through this platform can be leveraged for several strategies. Furthermore, MetaTrader 4 relies on providing signals from multiple providers, ensuring that users aren’t beholden to a single provider, which can often create issues.

Pepperstone is a highly rated platform, having received more than 4.5 out of 5 stars from over 2.5K reviewers on TrustPilot. Furthermore, in addition to CFDs and commodities trading, Pepperstone has also started to dive into Crypto CFDs trading.

Additionally, Pepperstone offers access to a wide array of trading platforms, including cTrader, MetaTrader 5, TradingView, Ready to Trade, etc.

Overall, Pepperstone is a suitable platform to pick up great stock trading signals. While it primarily relies on MetaTrader 4 to provide these signals, the other investment options of this platform are also unique, making it suitable for most investors.

- Multiple signal provider integration

- High TrustPilot user ratings

- Wide platform compatibility options

- Diverse trading instrument selection

- Minimizes human trading errors

- Heavily dependent on MetaTrader 4

- Limited customization of alerts

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.8% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

AvaTrade – Offering Actionable Trading Signals Covering a Wide Array of Instruments

Those looking for highly actionable trading signals will also like what AvaTrade has to offer. This platform promises to elevate the trading experience using a user-friendly tool that reportedly everyone can use.

The key element providing signs are tools integrated with traditional signals. Here, the trading signals are simple “buy” and “sell” suggestions which AvaTrade claims to generate through technical and fundamental analysis. The usability of these signals becomes apparent as the signals can seamlessly blend with WebTrader and AvaTradeGo platform.

Covering a wide range of instruments, this stock signals provider also focuses on commodities and indices. Each signal is simple. However, they all come with a rational explanation, which is a suitable element for those who want to confirm whether the signals provided are effective or not.

In addition to signals, AvaTrade also offers trading education to further make traders knowledgeable about how to use the signals.

These factors have led to AvaTrade being highly rated on TrustPilot, and perhaps one of the few sites with a full star score. International Business Magazine has also offered it a crypto trading platform of the year award in 2024, which further consolidates its position as a strong signals provider.

- Simple buy/sell signal format

- Comprehensive educational resources available

- Multi-platform signal integration

- Strong TrustPilot ratings

- Clear signal reasoning provided

- Relatively basic signal complexity

- Limited customization options

XTB – Trading Signals Provider Offering Free Access to Bank Recommendations

XTB is another trading platform that offers stock signals services. However, unlike other platforms that ask for payment, its signals are free of charge. Professionals and institutions pick signals on this platform.

The buy and sell signals that XTB generates are based on the recommendations of leading banks such as JP Morgan, Merrill Lynch, Deutsche Bank, Morgan Stanley, and other entities.

When it comes to professional trading ideas, forecasters on Reuters and FX Week offer daily insights via this platform, as well as through Twitter feeds. Other signals forecasters who have joined with XTB include Ashraf Laidi.

The analyses are divided into three tiers to ensure that investors get the best signals possible. Furthermore, when it comes to how the alerts are provided, the application relies on mobile trade alerts from expert analysts. Mobile alerts also consist of joining an exclusive WhatsApp Group.

Overall, XTB is a good signals provider for those looking for trading opportunities backed by some of the biggest entities on the platform. While the services it delivers aren’t AI enabled, the focus on precision is high, which is one of the reasons why over 1 million users use this platform.

- Free trading signals service

- Major bank recommendations included

- Multi-tier analysis system available

- WhatsApp group alert options

- Professional analyst insights provided

- No AI-powered signal generation

- Limited advanced technical features

Trade Nation – Stock Trading Signals Provider Offering Precise Signals Using TN Trader

Another pick for the best stock signals provider for this year is Trade Nation. A simple platform offering diverse investment opportunities, this application offers signals through TN Trader, which offers signals with the help of a signals center.

Signals Center offers an expert look at the stocks, with professionals focusing on using technical and fundamental analysis to understand patterns and generate signals. TN Trader itself offers high-profile charting tools comprised of 95 indicators and 35 drawing tools, all powered by ChartIQ.

Order placement is also simplified on this platform, and the user-friendly interface also gives users access to low-cost spreads. Furthermore, Trade Nation also gives users access to news articles related to business and finance to help them better gauge market conditions and decide their investments.

Overall, users who prefer a high degree of simplicity when they are using trading signals should focus on Trade Nation. The signals center and the robust charting tools can help beginners understand the ebb and flow of the market, and veterans will also prefer how this platform focuses on making users trade-ready.

- Extensive chart analysis tools

- User-friendly signal interface design

- Professional technical analysis provided

- Low-cost trading spreads

- Comprehensive market news access

- Limited advanced trading features

- Basic signal delivery system

AltIndex – Offers Alternative Data Using ML and AI and Uses Social Sentiment to Offer Stock Signals

Since the introduction of certain unique investment entities – such as crypto – have challenged traditional market fundamentals, there is a need to look for alternate data to gauge a price of an asset. AltIndex is such a stock signals provider that focuses on alternative data providers to understand the market’s flow and generate signals accordingly.

The primary crux of this website is to use artificial intelligence. As such, it does not have to look at a simple earnings reports or fundamental news. Instead, it focuses on social sentiment, which is a much bigger driver in a stock price’s rise and fall.

The platform makes use of natural language processing to extract data from social media and other platforms. This information is then analyzed by artificial intelligence to provide actionable intelligence.

AltIndex also makes use of social media metrics to assess whether a product has a successful launch. To gauge social sentiments, it collects unconventional data like website visits, downloads, and other information. Based on that information, AltIndex scores an asset from 1 to hundreds. High-scoring stocks get a “strong buy” signal from AltIndex.

Notifications provided by this platform are in real-time, and the signals are sent directly to a user’s email.

This unconventional approach has had a lot of success, and AltIndex’s win rate is 75%.

This approach has led AltIndex to outperform stock benchmarks such as S&P500, and others. When it comes to pricing, there are three plans involved, with the pro version offering 100 stock alerts and costing $499 a month.

The only negative part is that there is no money-back guarantee. While it could be a major issue for most, it could be considered a positive in AltIndex’s case, since it is less likely to fail at providing profits to users.

- AI-powered sentiment analysis

- Real-time email notifications provided

- High reported success rate

- Alternative data signal generation

- Social media metrics integration

- No money-back guarantee offered

- Limited signals in lower tiers

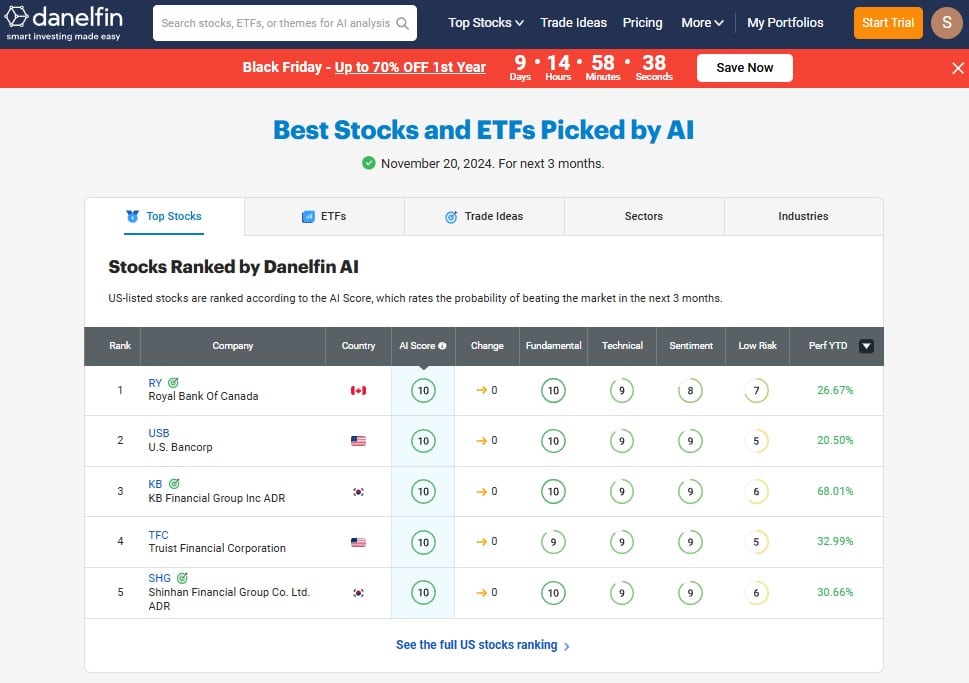

Danelfin – AI-Driven Trading Signals for Long-Term Investing

Another stock signals provider that is essentially fit for everyone is Danelfin. This platform uses explainable artificial intelligence to provide signals and, since 2017, has been responsible for nearly 191% of the market gains. Danelfin is a platform whose signals depend on the AI score it gives to assets. The higher the score is for a stock, the stronger its buy signal is.

One of the best features of this particular platform is how the stocks are ranked. The table provided on the homepage makes even non-users aware of the state of the market. For instance, at the time of writing, the Royal Bank of Canada is considered the best stock, with a YTD performance of 26.6% and a risk score of only 7. The highest-performing stock, however, has been KB Financial Group Inc ADR, whose YTD performance is around 68%.

However, signals are not only generated on the basis of stocks. Danelfin also keeps a sharp eye on the themes and sectors of a particular stock, often highlighting which ones have a higher chance to trade in the green.

Two types of stocks are covered by this stock signals provider – from the US market and the Europe market. The US market stocks get more information about them, and even investment themes are covered. For the European markets, the focus is only on sectors and industries.

The core crux of the AI score is the probability of beating the market in the next three months, which makes Danelfin suitable for long-term investors as well. To give an AI score, it analyzes over 10,000 features, which adds more robustness to how it analyzes each asset.

- Explainable AI scoring system

- Strong historical performance record

- Comprehensive market theme analysis

- Long-term prediction capabilities

- Multi-region stock coverage offered

- Limited European market details

- US market bias in analysis

Mindful Trader – Stock Trading Signal Provider That Uses Quantitative Signal Analysis

Mindful Trader is another highly suitable stock signals service, fit for those who want a more human touch on their stock signals. Provided by Eric, a Stanford graduate who got a perfect score on his SATs, Mindful Trader focuses on the fundamentals when generating signals about which stocks to pick.

Eric has backtested each signal provided by this platform, which gives it long-term wealth potential. The data-driven approach to picking stocks focuses on analyzing historical probabilities and price movement tendencies. Those who follow Eric will get stock picks and option stock picks in real time.

By his own admission, Eric relies on swing trades. However, this niche approach also means that this site is more suitable for those intra-day traders who want to exit and enter the markets quickly. It also means stocks that Eric suggests are mostly penny assets, affordable for everyone.

In addition to providing signals, Eric also offers lessons via Mindful Trader. These lessons comprise of a watch list showing the exact swing trade strategy used to determine a stock’s price.

This old-school approach of getting signals for stocks has been well-received by the investing community. However, the lack of focus on news could be an issue for some investors.

- Data-driven historical analysis approach

- Real-time swing trade signals

- Personal expert trading guidance

- Affordable stock recommendations provided

- Educational resources included

- No news integration offered

- Focused only on swing trading

Seeking Alpha – Trading Signal Provider Suitable for Long-Term Investors

Investors looking for stock signals that could be viable for a long term should look at Seeking Alpha. Offering an average of 2 stock signals a month, this is a platform suitable for those who invest semi-passively, removing the need to actively place trades. Furthermore, the signals exist at the same time for six months and often a few years.

Another reason why most investors prefer Seeking Alpha is due to the plethora of information it provides. Along with the signals, it offers a full-time analysis of why it has recommended a particular stock. Fundamental data is the core aspect behind the generation of these signals, with a slight focus also put towards factors like earnings and momentum.

Updates on outstanding positions are also available through this platform, including the updated stock rating about previous picks. It is a crucial feature since some investments may not be viable for an extended period of time.

Seeking Alpha is also very academically inclined, offering regular webinars to its members and giving them a complete analysis of market insights and projected trends.

While this platform has outperformed even the S&P500 every year since its launch, it does not provide enough information about average returns, which is one of the key reasons it is at the bottom of our list. That said, users are free to check out the free trial before committing funds to this platform.

- Detailed fundamental analysis provided

- Regular position update notifications

- Educational webinars offered regularly

- Long-term investment focus

- Free trial available

- Limited monthly signal quantity

- Unclear average return metrics

What are Stock Trading Signals?

Stock trading signals are referred to as signals or indicators that suggest whether a particular stock is worth investing in. These signals are generated through the following different analyses.

Technical Analysis

This approach involves deriving signals through historical price patterns, volume, and other market data using charts and tools such as Moving Averages, RSI, and MACD.

Fundamental Analysis

The overall financial health of the company to which the stock belongs is subject to this analysis. Here, the metrics considered include earnings reports, P/L statements, the current chair’s performance history, and news about the company’s operations.

AI-Generated Signals

Because of a wide range of factors that could influence an asset’s price, artificial intelligence is also used to derive trading signals. These models capture large data sets and analyze them quickly to generate trading signals. The data sets include everything from historical price performance to social metrics.

Market Sentiment

With the arrival of crypto assets, market sentiment has become another key indicator in determining an asset’s potential to generate profit. Sentimental analysis of a particular stock is done through news and social media assessment, as well as looking at the fear and greed index. Crypto trading signals hinge heavily on this.

Economic Indicators

Broader economic data is another key point for generating trading signals. Here, the parameters considered include employment figures, GDP growth, internet rates, etc.

News Events

News events analysis focuses on newsworthy events that trigger the rise and fall of a particular asset’s price. For instance, Tesla’s stock went from $170 at the beginning of 2024 to over $360 after Donald Trump was elected as the 47th president of the United States.

What are the Different Types of Stock Trading Signals?

There are three basic types of stock trading signals: buy signal, sell signal, and hold signal.

Buy Signals

Buy signals indicate the right time to invest in a particular token. Multiple triggers could generate a buy signal, such as breakouts from a key resistance level, oversold conditions, positive news from the market, fundamental strength of an asset, and even a Golden Cross, a signal that emerges when a short-term moving average intersects a long-term moving average.

Sell Signal

The sell signal shows that the time is now to lock the profits by selling a particular stick. Overbought conditions in which the RSI is above 70, a downtrend breaks support, negative news, a death cross on the price chart, and fundamental weaknesses within a project shoot off the sell signals.

Sell signals aren’t only about generating profits but also about protecting oneself from losses.

Hold Signals

Hold signals say that buyers should maintain their current position on a particular asset and not buy or sell it. It is suitable for stocks that don’t show any immediate movement.

Triggers that could flare a hold signal include stable indicators showing stock trading inside a well-defined range. Unclear market conditions also mean an asset should be held. If the stock has long-term potential, then it is better to keep the asset held.

How We Created Our List of the Stock Trading Signals Providers?

While many claim to provide high-quality stock trading signals, few platforms offer precise ones. With that in mind, here are aspects we looked at when creating our list of the best stock trading signals providers.

Evaluating the Track Record of a Provider

The first factor we looked at was the track record of a signals provider. They should have a document of how their previous signals performed. It is important to assess their success rate.

Our track record evaluation also focused on how transparent they are about publishing their past performance. Wins matter, but losses do, too, which their past performance should portray properly.

Another important factor to assess is how customers perceive them. Positive reviews are good, but they should be natural. Furthermore, we recommend going outside the website to platforms like TrustPilot to get the real picture of how a stock signals provider performs.

Assessing How the Signals are Generated

The second factor we analyzed was how the signals were generated. We dove into the articles on the website to see if the platform offers signal generation through technical, fundamental, or sentimental analysis. We also looked into whether AI is involved with signal generation.

Trading robots often rely on AI-generated signals. However, understanding them is only possible after seeing the types of data they analyze. While we prefer AI-generated signals in most cases, we have covered some human-driven signals on this page. These signals are mostly back-tested, which gives them more of that trust factor.

Quality of Signal Services

The focus should also be on the quality of signals available. The first factor to analyze in this situation should be the frequency of signals being provided. Day traders need signals nearly daily to act on them quickly to make the trade. Long-term profit-seekers can wait for a long time. We also assessed whether users were notified when long-term signals were changed.

Quality also has to do with simplicity. The signals provided by these stock signal providers should be properly understood without any issues. Therefore, our experts also looked at the in-depth analysis reports coupled with the signals, which helps determine the viability of the signals these platforms deliver.

Accuracy is another crucial factor in these signals. A 70-60% accuracy rate for stock trading is considered good. However, we also avoided providers claiming to provide outlandish accuracy rates, almost 95 to 99%.

Testing the Services

The signals provided should have a proper backtesting facility accompanying them. There are two forms of backtesting that we generally prefer – trial account and paper trading.

Platforms like Benzinga Pro offer a trial account. In the case of Benzinga Pro, the trial account exists for 14 days. This is enough time to assess the stock signal quality and make real gains through the site.

The other facility is paper trading. Paper trading is a pseudo-trading methodology in which assets are bought and sold in a simulated environment. These also provide a good view of whether a platform is good at delivering suitable signals.

Evaluation of Compatibility

Signals providing platforms should be compatible with other brokers and platforms, which is the only way the signals generated could mean anything. A sub-factor to compatibility is also how the signals are delivered. Some offer them through the app, others through mobile alerts, and some provide email alerts. Most provide in-app notifications as well.

It is also important that these notifications don’t become annoying. Timely notifications are always better since they can prepare traders before they act on the signals received.

How Stock Trading Signals Provider Work?

Here are the three steps through which stock trading signals provider offer their services.

Market Analysis

The first task is market analysis. It involves using sentimental, technical, or fundamental indicators to determine how an asset moves on the market. Platforms leverage expert insights or even AI to identify patterns from the price charts and the indicators to generate buy, sell, or hold signals.

Signal Generation

The signal generation process involves creating structured recommendations for the buyers to access the rationale behind these signals instead of just the hint of whether to buy, sell, or hold an asset.

Signal Delivery

Once a signal is generated, it is delivered to the customer through several means. They could be through apps, emails, or even real-time dashboards. These signals offer actionable details like the entry price, target price, and stop-loss levels. Signals are also bundled with market analysis reports, which essentially contain why a particular signal was recommended.

Conclusion

This guide has highlighted the top stock trading signals providers in the industry. Each has its own strength, and all of them leverage different indicators to generate highly precise signals that could help investors create profits in the long or short term.

We have also clarified the parameters we used to rank these platforms while discussing how these providers offer stock trading signals.

According to our findings, the best one among them is Benzinga Pro. It is simple to use and uses multiple parameters to generate signals. It is also cheap, which makes it more inclusive than most stock trading signals providers on the market.

FAQs

Are stock signals reliable?

The reliability of stock signals depend on the track record of the provider. Therefore, investors should assess the historical returns of a stock signals provider before making a choice. Furthermore, it also helps to not blindly follow any signal, since the best stock trading signals have a 60-70% accuracy rate.

Do veteran traders use stock signals?

Veteran traders often rely on their own expertise and use technical, fundamental, and sentimental indicators to analyze a stock's value. Therefore, stock signals are mostly meant for casual traders or traders who cannot put a lot of effort into research.

Are AI-derived stock signals better than human-generated signals?

Both AI-derived signals and human-generated signals are valuable. While artificial intelligence can leverage multiple data points and indicators to generate a signal, human-generated signals are mostly offered by a professional trader who has done in-depth research into the fundamental and technical indicators of that stock.

What is the best stock trading signals provider of this year?

The best stock trading signals provider of this year is Benzinga Pro. It is a sleek stock trading signals provider with a simple UI featuring a lot of customizable options. Furthermore, it has a high accuracy rate while being affordable.