Donald Trump’s historic return to the White House has unleashed a risk-on frenzy in the global stock market, with many investors turning to penny assets that can possibly bring high returns. Usually, penny stocks, otherwise known as “micro-cap” or “nano-cap” stocks are often priced under $5 per share, making them more accessible to even casual investors.

While they may be highly speculative and susceptible to dramatic price swings, investing in the right penny stock can potentially deliver substantial returns. As such, it is important that investors have a deep insight into what they are investing in to avoid losing their capital in the long run. To help you make an informed investment decision, we combed the market and identified some of the best penny stocks with high-growth potential.

Read on to discover which penny stocks demonstrate huge potential for growth and where to get them in 2024. We will also highlight best stock tipping service providers that can help you identify high-potential market investments.

9 Best Penny Stocks To Buy In 2024 – Quick List

Below is a short list of the top penny stocks to consider right now:

- Grab Holdings Limited (GRAB) – Southeast Asia’s Superapp

- Archer Aviation Inc (ACHR) – Developer of eVTOL Aircraft

- SoundHoundAI (SOUN) – An Independent Voice AI Company

- So-Young International (SY) – Medical Aesthetic Services

- Planet Lab PBC (PL) – San Francisco-Based Earth Imaging Firm

- Sintz Technologies (SINT) – Advanced Ceramics Company

- Bitfarms (BITF) – Global Bitcoin Mining Firm

- LuxUrban Hotels (LUXH) – Top-Tier Hotel Operator

- Agilon health Inc (AGL) – Long-Term Solution For Leading Physician Groups

Visit Benzinga Pro For Tips On Penny Stocks

Best Penny Stocks To Buy In 2024 – Fully Reviewed

In this section, we will dive deep into each of the penny stocks featured in the quick list.

Grab Holdings Limited (GRAB) – Southeast Asia’s Superapp

Grab Holdings Limited has managed to capture the attention of investors looking for under $5 stocks to add to their long-term portfolio. Founded in 2012, Grab Holdings Limited offers a broad suite of services, spanning enterprise solutions, financial services, deliveries, and mobility.

With a lofty mission to empower Southeast Asia’s economy, Grab maintains a leading market share in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

One of the core services provided by Grab Holdings Limited is food and grocery delivery, ensuring that users can have their essentials delivered to their doorstep with just a few taps. With a host of options spanning hawker fare to Michelin-starred restaurants, Grab ensures there is something for everyone.

For those seeking to navigate through the busy Southeast Asia cities, the company has provided a comfortable taxi transport system through its Grab Ride app, connecting millions of passengers with private hire and even coach drivers without upfront pricing. Through the user-friendly app, users can track their trip history, get vehicle or driver updates, and stay in control of their taxi experience.

In addition to this, Grab Holdings Limited is also a household name in the financial service industry, offering a host of payment solutions, consumer loans, and insurance. The company’s industry-standard solutions are utilized by clients spread across the region.

In terms of its financial performance, Grab Holdings Limited has achieved a strong benchmark in the third quarter of 2024, recording a substantial 17% year-over-year increase to $716 million. Its monthly transacting users also reached 42 million while a profit of $15 million was reported. This impressive performance, according to reports, raises Grab’s full-year revenue guidance to $2.76 billion. With more growth still on the horizon, market analysts believe GRAB will be a good addition to investors’ portfolios.

Archer Aviation Inc (ACHR) – Developer of eVTOL Aircraft

Archer Aviation Inc is yet another compelling pick for the best penny stocks to buy this year. At its core, the company focuses on providing safe, sustainable, and low-noise electric aircraft, delivering the future of what air travel can be.

In late 2022, Archer made major headlines after it launched Midnight, an electric vertical aircraft (eVTO) that’s fully optimized for back-to-back 20-mile trips, offering a world-class experience. The Midnight aircraft is configured to operate with a pilot, a maximum of four passengers, and carry-on luggage, making it a suitable option for urban air mobility.

Since its launch, the battery-powered landing aircraft has gained widespread adoption, with Archer recently selling at least 100 to Soracle in a deal valued at approximately $500 million. In a statement, Archer revealed Soracle’s plan to deploy the aircraft to cities where ground transportation is restrained by traffic or geographical barriers.

Meanwhile, at the time of writing, Archer is collaborating with the Federal Aviation Administration (FAA) in the United States and other globally-recognized aviation authorities to safely integrate its aircraft into the airspace. The firm is already in the final stages of the approval process, with expectations that it will start the electric air taxi trial next year in New York.

After its debut in the United States, Archer plans to move to India in 2026, leveraging its partnership with InterGlobe to bring an all-electric air taxi to the world’s most populous country. More so, there is an ongoing discussion to enter the Dubai and Japan markets. Given its robust plans for global expansion, there is a growing optimism that Archer’s stock will see substantial growth in the coming years.

Archer completed the third quarter of 2024 on a strong note, reporting over $500 million of cash and cash equivalent and an indicative order book worth $6 billion.

SoundHoundAI (SOUN) – An Independent Voice AI Company

SoundHoundAI stands out as an autonomous voice AI platform, with a focus on delivering high-quality conversational experiences to customer service industries. With an ambitious plan to bring value and delight to every business, SoundHoundAI has developed a voice recognition tool that helps machines detect, understand, and analyze human speech.

The firm opens its doors to businesses across automobile, IoT, TV, and more, helping them create a completely unique voice that reflects their brands so that they can build harmonious relationships with their customers. According to its website, top brands including Mercedes Benz, Hyundai, Honda, Pandora, Mastercard, VIZIO, Netflix, Square, and Snapchat rely on its conversational technologies.

Beyond its voice recognition tool, SoundHoundAI is planning to launch a solution that will comprehend speech prompts and give a voice reply. This powerful tool will be useful in restaurants for taking food orders.

That being said, one of the biggest investors in SoundHoundAI’s stock market is Nvidia, holding over 1.7 million shares, equivalent to $7 million at press time. Meanwhile, the company’s performance in the 3rd quarter of 2024 surpassed expectations, hitting the $25 million mark in revenue.

While the stock has been the subject of extreme volatility over the past couple of months, SoundHoundAI’s high revenue growth potential makes it an appealing investment option for stock enthusiasts.

So-Young International (SY) – Medical Aesthetic Services

So-Young International describes itself as the largest and most vibrant social community in China for consumers, providers, and experts in the medical aesthetics industry. Led by Xing Jin, the company is specially designed to help consumers discover, evaluate, and reserve medical aesthetic services.

The platform is home to a host of trustworthy and data-driven information that can assist users in discovering the latest aesthetic treatment trends. The lineup of medical experts covered has been carefully vetted to foster standard treatment for all users.

Also, thanks to its vast audience reach, users will be able to learn from the personal experiences of those who had undergone similar treatments, further strengthening the trust for those willing to follow the same route. Beyond aesthetics, So-Young is diversifying into other medical lines such as dermatology, dental, gynecology, ophthalmology, and many more.

By leveraging its diverse social community, data-driven insights, and strong branding, So-Young is poised to bite deep into the bustling consumption healthcare service market in the Asian country.

Over the past couple of years, the firm has recorded noticeable growth, with sales topping $52 million in the second quarter of 2024. Given the relevance of its offerings to the Chinese healthcare market, analysts believe SO-Young will see more profits next year. If this is anything to go by, its share price might hit $2 soon.

Planet Lab PBC (PL) – San Francisco-Based Earth Imaging Firm

Planet Lab PBC is one of the best low-penny stocks that every investor seeking to explore the aerospace market should consider buying. The company has earned recognition for its innovative approach to satellite-based earth imaging and analytics.

Integral to its operations are the 3U-CubeSat miniature satellites known as Doves. Each of the Doves constantly scan the earth surface to give up-to-date data on climate monitoring, disaster management, urban planning, and many more.

The company has an active contract to supply satellite images to various U.S government organizations including the National Aeronautics and Space Administration (NASA) and the Bureau of Reclamation. Recently, Planet Lab has signed a contract extension with its long-term partner, Abelio a French technology company.

Through the strategic collaboration, Abelio will leverage insights and data provided by Planet Labs to enhance their digital agricultural solution. As the firm continues to solidify its market position, investors are watching and eager to increase their exposure to its shares.

Over the past couple of months, PL has been on an impressive run, outperforming other penny stocks. Moreover, since the beginning of the fourth quarter of 2024,, the market cap of Planet Lab has increased from $738.56 million to $895.89 million, reflecting the increasing confidence of investors in the stock.

SINTX Technologies (SINT) – Advanced Ceramics Company

Among all penny stock classes, SINTX Technologies has gained significant traction due to its overlapping presence across various market sectors. The firm is a well-known manufacturer of silicon nitride and various advanced ceramics.

Since its establishment in 1996, SINTX Technologies has designed various ways to use silicon nitride for biomedical, technical and antipathogenic applications in the United States. While its headquarters is situated in Salt Lake City Utah, spinal implants made from SINTX’s silicon nitride have been successfully infused in humans in Europe, Brazil, and Taiwan.

On November 18, 2024, the company’s Board of Directors approved a stock repurchase program to buy back up to $500,000 of the company’s outstanding common stock over the next quarters. This strategic effort reflects the company’s commitment to enhancing shareholder’s value.

SINTX plans to use the stock repurchasing program to effectively reduce the number of outstanding shares, which in the long run will increase the value of stakes held by the remaining holders. That said, for investors, the move is designed to help enhance earnings per share, earning SINT a place on our list of profitable penny stocks.

Meanwhile, SINT has been struggling to gain traction since the start of the year, losing up to 97% of its value from January to November. However, recent market data shows that the stock is gradually gaining momentum – all thanks to the ongoing stock repurchasing initiative.

BitFarms (BITF) – Global Bitcoin Mining Firm

BitFarms (BITF), worth over $1 billion, is a good option for investors aiming to gain investment exposure to tech and cryptocurrency. The company is widely regarded as one of the biggest cryptocurrency mining firms in the world, with 10 mining sites across Canada, US, Argentina, and Paraguay.

Unlike most crypto mining companies, BitFarms depends on renewable energy, covering about 75% of its electricity usage. Similarly, the company revealed that it has signed strategic contracts to ensure that all its mining centers remain afloat for a long period.

To further expand its operations in the United States, BitFarms recently acquired Stronghold Digital Mining. With this acquisition, BitFarms intends to increase its energy portfolio by more than 950 MW by the end of 2025.

More so, as part of its effort to enhance its mining operations and increase revenue, BitFarms is working to upgrade its T21 miners provided by Bitmain. The upgrade, according to the mining company, will help improve its energy efficiency and hash rate by 20%.

Apart from its mining exploration, Bitfarms has an electrical engineering, installation services and various on-site technical repair centers. In the third quarter of 2024, the company reported a revenue of $45 million, amounting to a significant 8% Q/Q increase for the cryptocurrency miner.

LuxUrban Hotels (LUXH) – Top-Tier Hotel Operator

LuxUrban Hotels (LUXH) leverages the Master Lease Agreements (MLA) to secure long-term operating licenses for hotels. The company is committed to building a portfolio of hotels with the aim of renting out the rooms to corporations and vacation travelers.

Through its business model, LuxUrban Hotels is giving hotel owners an opportunity to hold on to their properties and retain equity value, while the company owns the cash flow. More so, with the focus on expanding its presence across international cities, LuxUrban is taking advantage of the difference in hotel prices across these regions to net profit.

LuxUrban Hotels recently announced plans to implement a reverse stock split, with the aim of supporting its position on Nasdaq Capital Markets. This development will see the number of shares of common stock issued drop from 151.85 million to 2.17 million shares.

LUXH has a market cap of $6.02 million, making it a more riskier and volatile stock to buy. However, considering the various upsides that come with its business template, high-risk investors may consider diving into it.

In the last six months, LUXH has endured a massive dip in price. Nonetheless, with the reverse stock split set to take effect by November 20, 2024, LUXH is showing recovery signs, jumping up 3% a day before the implementation day.

Agilon Health (AGL) – Long-Term Solution For Leading Physician Groups

Agilon Health, which has a market cap of $650 million, is a company that empowers physicians to transform healthcare in their communities. The firm, through its extensive partnerships, provides an enabling environment for primary care physicians to focus on value-based care and treatment.

With a robust care model that’s accessible to a peer network of more than 2,700 PCPs, Agilon presents itself as an ideal solution for leading local physician groups looking to improve their practices and provide better care experiences for patients. In essence, the company brings the real value of care to the local healthcare system.

Over the past year, Agilon has recorded noticeable growth, raising investors’ optimism in its stock. The company, in its Q3, 2024 report, revealed that its Medicare Advantage membership grew by 35% YoY to 525,000 members.

Also, the company disclosed that its revenue during the quarter increased by 28% YoY to hit $1.45 billion. This healthy report pushed the full-year revenue guidance from $6.025 billion to $6.057 billion.

Agilon Health is set to take more strategic action by exiting unprofitable collaborations and contracts. The move, according to experts, will definitely enhance the business venture of the company and bring more profit.

What Are Penny Stocks?

Before diving into any penny stocks, it is important to have enough understanding of what they actually represent. According to the Securities and Exchange Commission (SEC), penny stocks are shares of small companies that trade for less than $5. Since these shares are low-priced, they cater to retail investors who do not have too much capital to spend on trading or those looking to build a diversified portfolio at cheap costs.

For newcomers seeking to start their investing career, penny stock trading can be one of the most reasonable ways to go. In most cases, investors can begin with as low as $20 to $100. Moreover, apart from being affordable, penny stocks have the potential for exponential growth. Being cheap amplifies their potential to deliver extremely high returns to investors.

However, penny stocks are high-risk investments and can easily witness heavy downtrend, especially if the company fails to meet expectations or retain market presence. As such, investors must conduct their due diligence before diving in and only invest the amount they can afford to lose.

Where Can I Buy Penny Stocks?

For beginners and seasoned investors looking for the best spots to buy stocks, here are some of the top options available.

eToro

eToro is a renowned multi-asset mobile trading platform that supports users to securely buy and sell stocks, ETFs, and cryptocurrencies. In addition to the afore-listed penny stocks, investors can buy more than 3,250 different stocks on eToro.

The all-round platform appeals to seasoned traders and newbies with its intuitive user interface and host of trading tools. Since its establishment in 2007, eToro has swiftly grown to a trading platform of international repute with more than 25 million users across 140 countries.

Meanwhile, the platform has a flagship “Copy Trading” tool that supports new beginners to search and copy trades of successful traders on the trading outlet. Furthermore, the platform has a News Feed that underlines the eToro social trading network segment where users share their opinions about market trends.

Similarly, eToro also provides live data and real-time signals and market insights, ensuring that users remain updated about market activities. Thanks to these features, investors have the opportunity to get first-hand information and market insights from other users, giving them an edge over others.

Also, eToro has a “Watchlist” section that allows investors to monitor their investment portfolio. Despite its vast functionalities, eToro offers a few order types like market order, limit order, stop-loss order, and take-profit order.

Platform charges on the network vary based on membership level, type of trading assets, and transaction volume. Nevertheless, network fees on the platform are market competitive, giving eToro an edge over its competitors.

AvaTrade

AvaTrade is another one-time spot to trade penny stocks. The exchange is a regulated forex and CFD broker based in Dublin and has satellite offices across Europe, South Africa, Colombia, and Asia.

However, the company is registered with various global regulators which makes it one of the most reliable trading outlets. The trading platform supports a wide range of assets, providing investors with an array of investment opportunities.

At its core, AvaTrade provides a pathway to commodity and index markets through its contract for difference (CFD) investment instruments. In addition, investors can also trade stocks, spot forex, cryptocurrencies and vanilla forex options.

The platform is designed to meet the various demands of investors by providing them with numerous market entry points through pathways like WebTrader (website) and the AvaTrade (mobile app). As a result of its flexibility, AvaTrade has extended its entry point to other sources like MetaTrader 4 and 5 implementations, AvaOptions, AvaSocial, and Dupiltrade.

While offering various entry pathways, the AvaTrade platform has an engaging interface that gives room for easy exploration of all market opportunities. More so, the trading outlet offer educational materials through AvaAcademy, providing traders with quality contents

Upon successful registration, users can access a vast collection of tutorials, webinars, videos, articles, and quizzes that will help improve their trading expertise. To further aid new traders in finding their feet, AvaTrade has put in place a copy trading tool, helping beginners to replicate the strategies of successful traders.

PepperStone

With its headquarters in Melbourne, Australia, Pepperstone has grown into a globally recognized broker with offices in popular cities like London, Cyprus, Dubai, Kenya and Düsseldorf.

Pepperstone leaves no stone unturned in providing users with reliable and legitimate trading services. It has the regulatory backing of top regulators like the U.K Financial Conduct Authority, the Australian Securities and Investment Commission, and the Dubai Financial Services Authority.

At its core, Pepperstone offers more than 1,200 CFDs across forex, indices, commodities, shares, and cryptocurrencies. To ensure maximum access to charting tools and a variety of features that can help investors make informed decisions, Pepperstone has integrated with a wide range of third-party platforms like TradingView, MetaTrader 4, MetaTrader 5, and many more.

Pepperstone has a demo account trading feature that allows all categories of traders to master their trading strategy before implementing it.

How We Select the Best Penny Stocks

Below are some of the factors we considered while selecting the best penny stock to buy:

Diversity

Portfolio diversification is crucial for investors to minimize risks and strengthen their potential returns. With this in mind, we combed the market for a wide range of stock industries spanning crypto mining, hotel, aerospace, healthcare, automobile, and many others suitable for days traders.

Market Capitalization

Since well-established, big assets often offer lower returns at higher costs, many high-risk traders are turning to micro-cap stocks with high-growth potential. Therefore, we gave more priority to assets in this category.

While they are very risky and vulnerable to extreme market volatility, they serve as exciting opportunities for investors, especially beginners who want to get a feel of the market at reasonable costs.

News & Market Trends

Penny stocks easily react to hype, rumors, and emerging developments in the socio-political landscape. News of market expansion or regulatory approval can push stocks to rise or fall. Most of the selected penny stocks are gaining significant traction at the moment.

Earning Reports

Before selecting these stocks, we carefully examined their earnings reports to evaluate the financial well-being of their companies. By analyzing the financial performance of the companies, investors will be able to know if the stocks will post long-term growth for backers or not.

Strategies For Trading Penny Stocks

When diving into the realm of penny stocks, either as a beginner or existing trader, here are some of the tips to consider:

- Do your due diligence, investigating every aspect of the company’s including its financial strength.

- Keep your stakes to a minimum and have an exit plan in sight.

- Manage your expectations.

- Endeavor to diversify your investments.

- Subscribe to top stock picking platforms to keep tab with market trends.

- Use a reliable broker while trading stocks.

- Keep learning.

Where Can I Get Accurate Penny Stock Alerts & Tips?

In this segment of our guide, we will walk you through the top two platforms where you can get insightful penny stock alerts and tips in 2024:

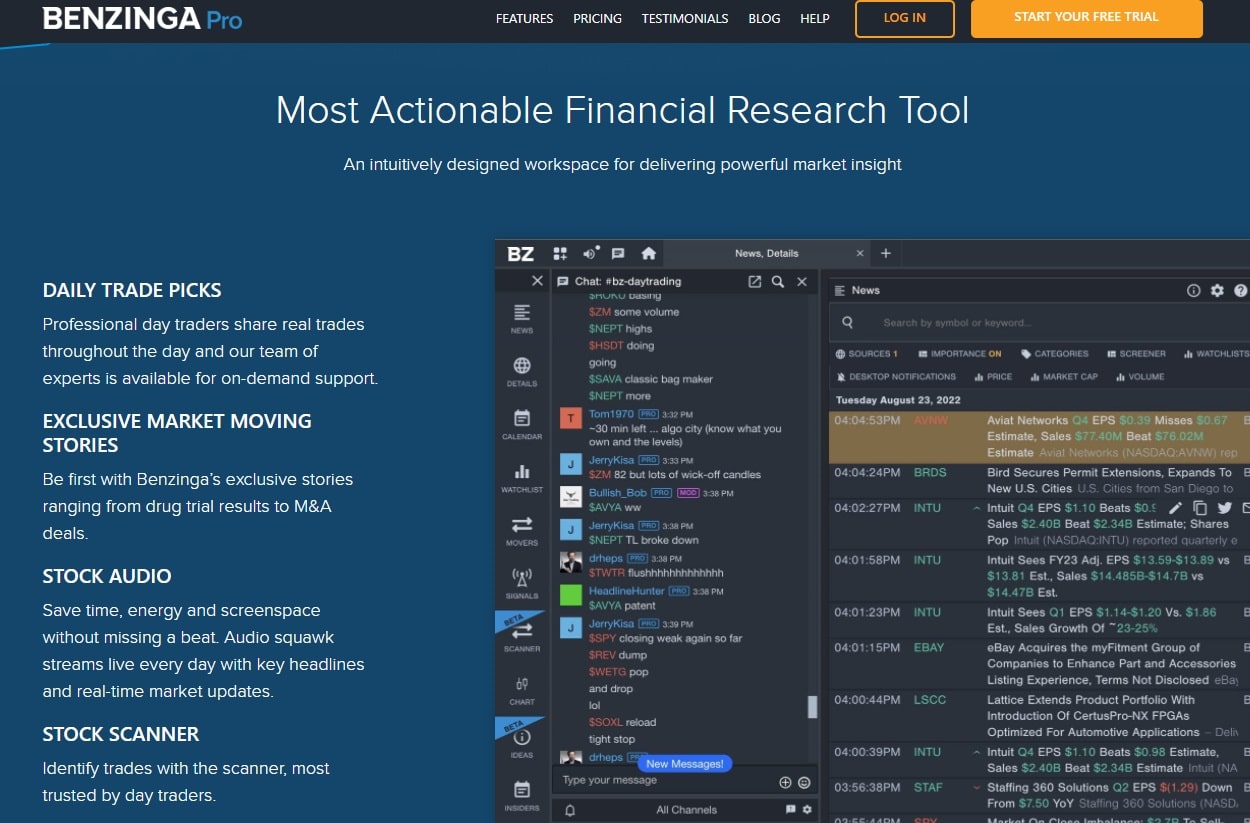

Benzinga Pro

Benzinga Pro stands out as one of the best platform to get reliable penny stock alerts and tips. With its “Alerts” feature, the platform avails customizable real-time market news to users’ desktop or email, ensuring that they do not miss out on potential opportunities in the market. For those aiming to stay abreast of specific stock events, the Benzinga Pro’s calendar feature handles it.

There is also a stock scanner which helps users scan stocks, filtering them based on market cap, volume and other important attribute. Social traders will also have the opportunity of interacting with like-minded individuals through the platform’s community chat room.

More so, considering its intuitive and easy-to-use interface, Benzinga Pro appeals to both experienced traders and beginners alike. Its pricing structure is not expensive, offering a basic subscription of just $37 per month.

AltIndex

AltIndex comes next on our list of the best places to get correct penny stock alerts. It leverages aggregated data from multiple sources to help users make better investment decisions. Also, through the aid of its AI infrastructure, AltIndex studies general sentiment on stocks, using pointers like trends, expansion efforts, recruitment effort, layoffs, followers, and more.

For instance, if the general sentiment of a stock is positive, AltIndex will rate it high. Otherwise, it will rate it low. After coming up with ratings on the investment potential of a given stock, AltIndex will convey its recommendations to users through their email.

AltIndex has a “Trending Stocks” segment where users can get first-hand information about stocks that are making waves and keep up with market trends. There is also Unique AI Stock picks which reportedly come with an 80% win rate. The combination of these impressive features makes AltIndex an ideal stock alert and tipping service provider.

Our Verdict

In this comprehensive guide, we extensively explore some of the best penny stocks that investors may try out 2024, analyzing their fundamentals and growth potential. Penny stocks are open to newbies who want to get a feel of the market with a small amount of money as well as veterans who are looking to buy higher volumes of shares for a low price.

However, since investing in penny stocks requires in-depth research, we recommend that investors subscribe to Benzinga Pro and AitIndex for reliable insights and strategies that can help build a versatile portfolio.

Get Real-Time Tips On Penny Stocks

FAQs

What are penny stocks?

According to the Securities and Exchange Commission, penny stocks are low-priced shares, probably trading below the $5 level.

Which penny stock is the best to buy now?

While there are hundreds of penny stocks available, the best among them include Grab Holdings Limited (GRAB), Archer Aviation Inc (ACHR), SoundHoundAI (SOUN), So-Young International (SY), and many more.

Where can I get reliable penny stock trading tips?

The two top platforms to get real-time and accurate stock trading tips are Benzinga Pro and AitIndex. Both platforms come with a rich tapestry of features that help elevate the trading experience of users.