Binance Coin (BNB) was launched in July 2017 as the native token for the popular Binance exchange for discounted trading fees. The demand for BNB is linked to the popularity of the Binance exchange – its valuation has risen from under $1 to over $600 at its all-time high in mid-2021. BNB opened in 2022 at around $500 before retracing to a large degree, thanks to the bear market. The token opened in 2023 at $246 and is slowly making a comeback thanks to the renewed faith in cryptocurrencies.

This guide explains how to buy Binance Coin and what the future holds for the cryptocurrency.

On this Page:

Where to Buy BNB – Quick Guide

- Choose a cryptocurrency exchange – we recommend Binance

- Create and verify your account

- Deposit funds into your account

- Search ‘Binance Coin’ in the drop-down menu

- Click ‘Trade,’ select an amount of BNB to buy, and open the trade

Best Places to Buy Binance Coin in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

This section highlights some of the best platforms to buy Binance Coin this year. They are:

The brokers listed above were chosen as the best brokers available to buy BNB because of their unique features. These platforms provide a combination of low fees, quick transactions, and easy-to-use processes. These platforms make it easy to buy and sell BNB. They are also very safe and secure platforms as they are regulated brokers. All conduct proper checks to comply with anti-money laundering (AML) and know-your-customer (KYC) policies.

How to Buy BNB – Quick Guide to the Best Brokers for Buying BNB

Do you want to buy Binance Coin right now? If yes, follow the four quickfire steps outlined below to get started.

- Open an account: You’ll first need to open an account with a trusted cryptocurrency broker. We recommend Binance as it is the largest crypto exchange.

- Upload ID: Binance requires users to upload a photo ID and verify their email address and phone number.

- Deposit: You can now deposit funds with a debit/credit card, Paypal, Neteller, Skrill, or a bank wire.

- Buy BNB: Search for ‘BNB’ and click the ‘Trade’ button. Enter the amount of Binance Coin you wish to buy ($50 minimum) and confirm the order.

Where To Buy BNB

To buy BNB, you’ll need a cryptocurrency exchange. It’s essential to pick a trustworthy exchange that makes it easy to go from fiat to digital currency. The cryptocurrency exchanges below offer cutting-edge trading tools and a wide selection of tokens.

With that in mind, let’s look at where to buy BNB.

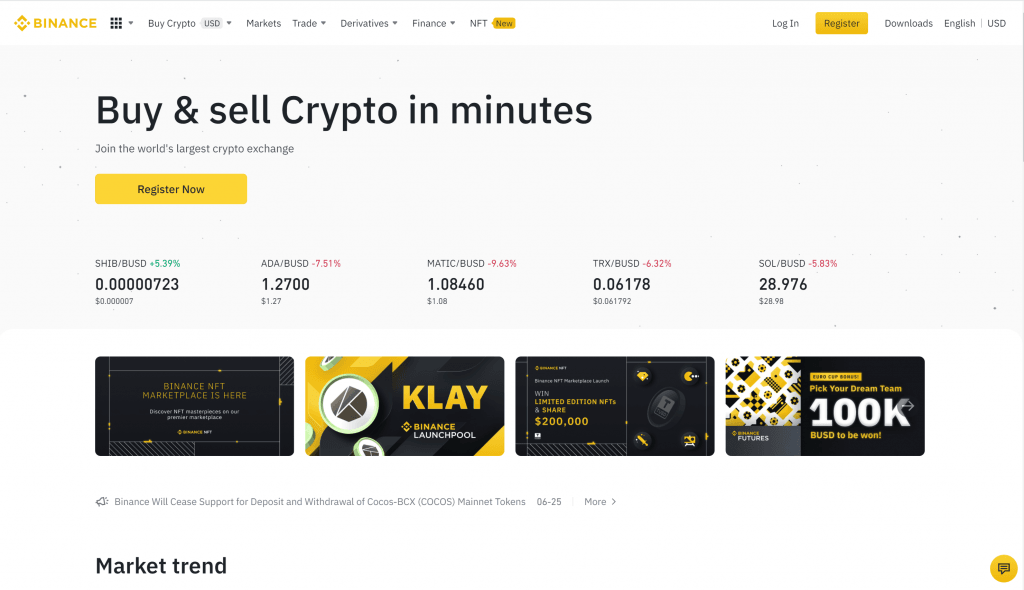

1. Binance – Top-Rated Crypto Exchange to Buy BNB

Binance is the world’s largest online cryptocurrency exchange by trading volume. BNB is the cryptocurrency coin that powers the entire Binance ecosystem, including the exchange. Therefore investors can buy BNB from the Binance exchange directly.

The Binance exchange offers over 150 cryptocurrencies for investors and traders to buy and sell on its platform.

Trading commissions on Binance start from about 0.1 percent, and the platform also offers leveraged trading and access to crypto futures. This enables traders to buy cryptos bigger than their wallet balances. You can also buy BNB with fiat currency on Binance.

The Binance exchange is easy to navigate, making it suitable for beginners and advanced traders. The Binance platform is available on both the mobile app and web browser. Users on the Binance exchange can earn rewards by depositing or staking cryptos, getting instant loans secured by crypto assets and more. The exchange is also safe and secure. Binance uses two-factor authentication for its security alongside anti-Phishing measures.

Pros

- More than 150 cryptos are available

- Supports deposits and withdrawals of fiat money

- Strong emphasis on security

- Low trading fees

- Multiple trading types for different trader experience levels.

- Beginner-friendly offers tutorials.

Cons

- A demo account is only available for the Binance Futures platform.

Your Capital is at risk.

2. MEXC – Emerging Crypto Broker With High-Security Features

Despite its relatively recent entry into the decade-old crypto industry, the platform gained momentum during the preceding bullish market, offering investors an exceptional avenue to accumulate cryptos like BNB. With an expansive range of cryptocurrencies, surpassing 1700 tokens, it caters to users interested in consolidating multiple cryptos in a single location.

With a user base exceeding 10 million across 170 countries, MEXC has forged a global network. This global outreach allows users from virtually any corner of the world to find their community through the platform’s social media channels. Additionally, its low fee structure stands as a significant draw for individuals seeking reduced transactional costs.

MEXC has adeptly positioned itself as an investor-friendly platform for acquiring cryptocurrencies, owing to its user-friendly interface and ease of navigation. For those considering investment in BNB, MEXC undoubtedly presents itself as a viable option to explore.

Pros

- Supports more than 1700 cryptocurrencies

- No deposit fee

- Highly secure platform

- Offers advanced features

- More than 180 trading pairs

Cons

- Limited promotional events

- Restricted in multiple countries

Your Capital is at risk.

3. Capital.com – Trade BNB CFDs Commission-Free

Capital.com is one of the best brokers for traders to buy and sell stocks, commodities, indices, forex, and cryptocurrencies. What sets Capital.com apart is that it specializes in CFDs (contracts-for-differences).

The platform offers dozens of cryptocurrency pairs that contain BNB. CFDs allow you to trade the future value of cryptos like BNB against major currencies like the US dollar, British pound, euro, and Japanese yen.

This broker is very beginner-friendly; this can be seen from its commitment to zero fees, customer service, and easy-to-use website and mobile apps. The browser and mobile apps are easy to navigate thanks to their intuitive interface. This CFD broker also offers advanced research tools for analysis. Capital.com does not charge fees such as trade commissions, withdrawal fees, and inactivity fees. The required Capital.com minimum deposit is $20 if the funds are transferred via credit/debit card or Apple Pay. For bank transfers, the minimum deposit is $250.

Capital.com offers three account types called Standard, Plus, and Premier. These accounts differ in the services available and change according to your account balance. If your balance goes up, you can ‘unlock’ additional services.

Pros

- Zero fees

- Trade Stocks & Crypto In A Single Place

- Dedicated account manager for every user

- Demo account

- Intuitive Interface Across All Platforms

- Good customer support

- Advanced Research Tools For Analysis

Cons

- Only CFD and real stock are available.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

4. KuCoin – Access to BNB And Many Other Altcoins In One Place

Founded in 2017 prior to the major crypto bull market, KuCoin was initiated by a team of seasoned professionals. Its swift traction in the market can be attributed to its intuitive interface and robust security features. Notably, its unique selling proposition was its prompt listing of emerging yet lesser-known cryptocurrencies, propelling its growth at an exceptional rate. Since its inception, KuCoin has expanded its reach to 200 countries, currently serving a user base exceeding 30 million globally.

Presently helmed by Johnny Lyu, the exchange has established offices in various locations including Hong Kong and Singapore. Accumulating a lifetime trading volume of 1.2 trillion and offering an array of tech-driven products, the KuCoin ecosystem presents an enticing prospect for investors seeking to acquire BNB tokens or diversify their crypto portfolio.

Pros

- A vast array of advanced investment tools

- High-quality security elements

- Licensed entity

- No major legal issues

- Variety of cryptocurrencies

- Low fees

Cons

- Unavailable in some locations

Your Capital is at risk.

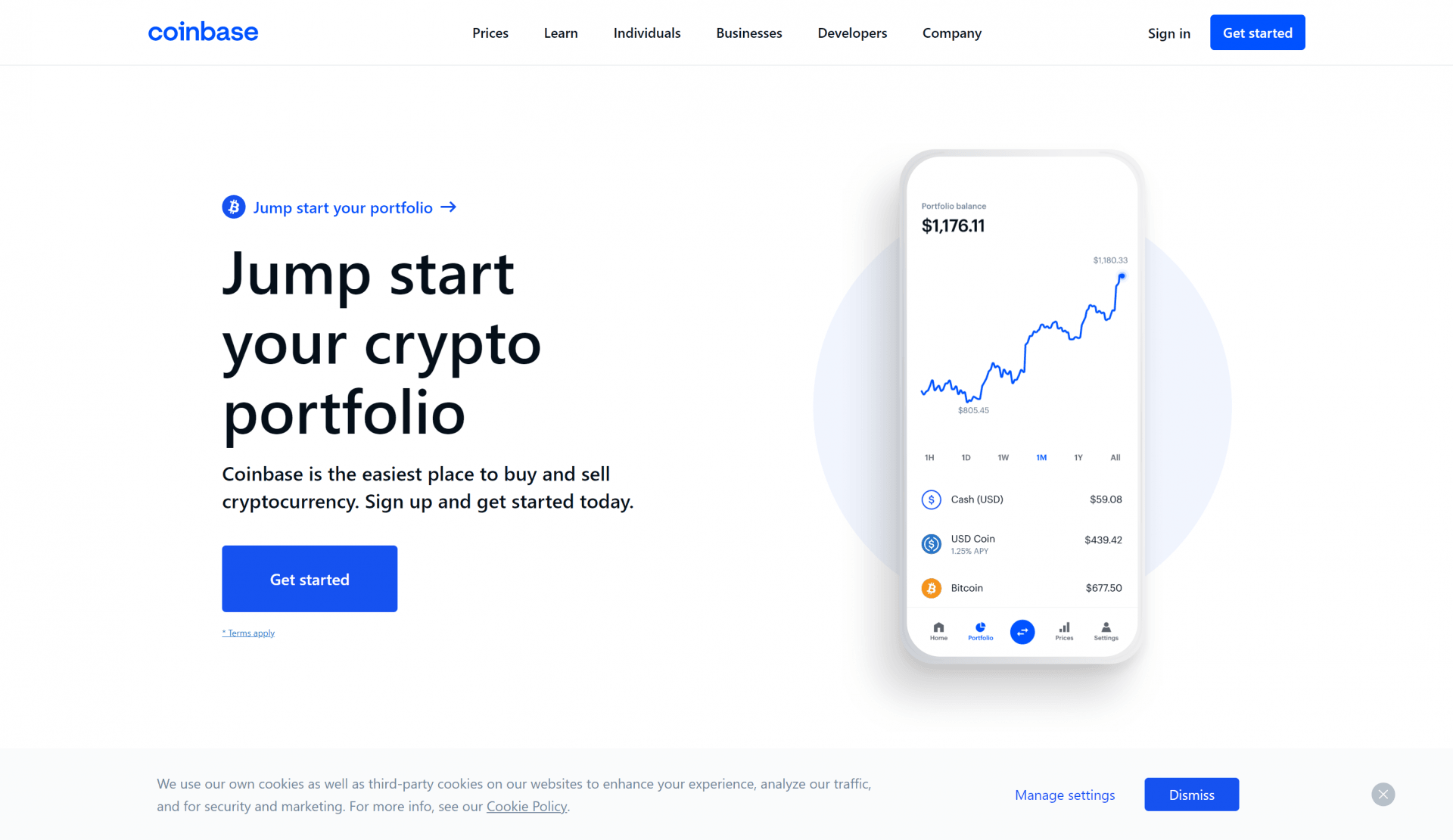

5. Coinbase – Largest Crypto Exchange in the United States

Coinbase is one of the most popular, easy-to-use cryptocurrency exchanges out there. The firm allows users to trade, sell and buy BNB alongside other cryptocurrencies exclusively. The exchange offers several benefits, such as a straightforward interface and many customer trading pairs.

The main attraction of Coinbase is that the platform is set up in such a simple way that it makes it super easy for beginners to use. Experienced traders can use Coinbase’s professional platform, Coinbase Pro.

Coinbase is heavily regulated with licenses from US financial regulators and is safe and secure to use. Coinbase offers several additional products and services, such as a fully-fledged cryptocurrency wallet, one of the best ripple wallets available. This can be downloaded onto your iOS or Android phone via a mobile app. You can also apply for a Coinbase debit card – which allows you to easily spend your cryptocurrency holdings in the real world – as Visa backs it. Like Binance, users can earn cryptocurrency rewards through Coinbase’s unique Coinbase Earn feature.

Pros

- Easy-to-operate platform

- The comprehensive mobile app mirrors desktop functionality

- Large crypto options

- Coinbase Earn feature rewards users with crypto for learning about available coins

Cons

- Higher fees than competitors

Your Capital is at risk.

6. Libertex – Industry-Leading Broker for Stocks and CFDs

Libertex has been an online financial trading platform and multi-asset broker for over 20 years. Libertex offers investors a wide range of assets for trading, including Forex, Indices, Stocks, Commodities, ETFs, and CFDs.

Users on the Libertex platform also get access to trading cryptocurrencies like BNB and over 50 more. Libertex requires users to have at least a minimum deposit of $100. Although the platform charges withdrawal fees depending on the payment method, it does not charge a fee for inactive accounts or deposit fees.

Available deposit channels include Neteller, Skrill, credit and debit cards, bank transfers, Multibanco, Sofort, Trustly, and more. The platform is known for its zero spreads pricing structure, which is unique in the CFD trading space. It offers two web trading platforms for traders: the MT4 and the Libertex Web Trader.

With a good mobile app and a desktop trading interface, Libertex provides flexibility and seamless trading. You can sign up for a demo account to acquaint yourself with the Libertex platform.

Pros

- Demo account available

- User-friendly trading platform

- Offers the MT4, including an automated trading

- Flexible payment and withdrawal methods

- Easy technical analysis for research and testing

Cons

- Charges for some of the withdrawal channels

Your Capital is at risk.

7. Plus500 – Regulated Platform Offering Different Asset Classes

Plus500 is one of the top-rated brokers for investors willing to buy BNB. The broker is a leading trading platform that provides CFD markets in forex, indices, commodities, stocks, and ETFs.

Plus500 also offers easy and seamless trading for cryptocurrencies. The broker is based in London and regulated by the Financial Conduct Authority (FCA). It is also registered in Cyprus and so is regulated by the Cyprus Securities and Exchange Commission—or CySEC.

Plus500 offers trading on two account types; the standard accounting for all users and the Professional Trading account for experienced traders. This account offers more leverage. Plus500 also has a free Demo account option.

The broker requires a minimum deposit of £100 on standard and professional accounts, while the leverage on standard accounts is capped at an industry-standard 1:30.

Plus500 interface is integrated with WebTrader 4 trading platform, perfect for advanced traders. The broker also offers an additional layer of security thanks to its two-step logins.

Pros

- Over 2,000 financial instruments, including cryptocurrencies

- Simple trading interface

- Competitive trading fees across all trading pairs.

Cons

- Plus500 doesn’t accept customers in the United States

- Charges inactivity fees

Your Capital is at risk.

8. AvaTrade – Legacy Crypto Trading Platform for Investors

AvaTrade is a popular broker that offers trading on various assets through contracts for difference (CFDs). This broker enables traders to access international shares, forex, commodities, cryptocurrencies, etc.

The broker, a subsidiary of AVA Group of Companies, is one of the oldest online brokerage platforms.

AvaTrade offers 0% commission on all trades and tight spreads for most transactions. Plus, it’s suitable for more advanced traders since it integrates with MetaTrader 4 and 5 and offers its trading platform. AvaTrade also incorporates other trading interfaces like Webtrader, AvaOptions, and AvaTradeGo, a mobile-friendly charting and trading platform.

AvaTrade is safe and secure as it is regulated by Abu Dhabi’s Financial Services Regulatory Authority. AvaTrade offers standard and professional account options like so many brokers. To have a professional account on AvaTrade, you must apply, and to be approved, you would need a portfolio of over $500,000 on the AvaTrade platform.

Pros

- Copy trading feature

- Demo account available

- Research and analysis tools available

- Good customer support available in different languages

Cons

- Withdrawal requests could take up to 5 days to process

Your Capital is at risk.

9. Revolut – Personal Finance Service With Crypto Support

Revolut is a FinTech firm mainly known for its banking and payment services. The company offers its clients access to investing in stocks, cryptocurrencies, and ETFs listed on exchanges.

Revolut was originally founded to enable users to receive, send easily, and exchange currencies. However, it has grown beyond just giving users access to basic transactions wherever they are. Revolut launched its trading feature in 2019.

Like many brokers, the Revolut platform can be accessed via a web browser or mobile app. The app is user-friendly and intuitive. It has useful features to follow the latest news, get essential stock data, check top movers, and evaluate your trading results. One of the exciting aspects of Revolut is that it does not require any minimum deposit. Revolut has three account types, namely Standard, Premium, and Metal. All three account types offer commission-free trading; the difference among them lies mainly in the amount of monthly free stock trades they offer

The Standard account allows one free stock trade monthly, while the Premium account offers 5 free stock trades. On the other hand, the Metal account doesn’t have a limit on the number of free trades.

Pros

- Free stock trading

- Expansive support for crypto

- The fast and easy account process

- Great mobile trading platform

- Quick transactions and asset conversions

Cons

- Limited product portfolio

- Poor customer service.

Your Capital is at risk.

10. CryptoRocket – Newbie Crypto Trading and Exchange Platform

CryptoRocket is a leading cryptocurrency broker that provides users access to various cryptocurrencies, like BNB and Bitcoin. The platform also offers trading in forex, Commodities, Energies, Metals, Indices, Stocks, and CFDs.

CryptoRocket offers its clients the chance to trade on institutional liquidity sourced from central investment banks and fully transparent liquidity execution providers. This means that traders on the platform can have access to excellent rates and the ability to trade on tight spreads.

CryptoRocket accepts a minimum deposit of only $10. However, it has limited deposit methods compared to other services. On CryptoRocket, you are limited to depositing with wire transfers, Bitcoin, and cards.

CryptoRocket offers leverage of up to 1:500, access to deep liquidity, and excellent 24/7 customer support. CryptoRocket is an online broker that was launched in 2018. It is based in St. Vincent and the Grenadines. The platform offers traders access to advanced charting and analysis tools and the latest news to help with their strategies. It uses the MetaTrader4 trading platform and offers one major account type: the standard account. CryptoRocket also has a demo account available.

Pros

- Diverse assets available for trading

- Same-day withdrawals for credit card transactions

- Low minimum deposit threshold

- No withdrawal or deposit fees

- 24/7 customer support

- Intuitive and user-friendly MT4 platform

Cons

- Limited deposit channels

- No MetaTrader 5 platform

Your Capital is at risk.

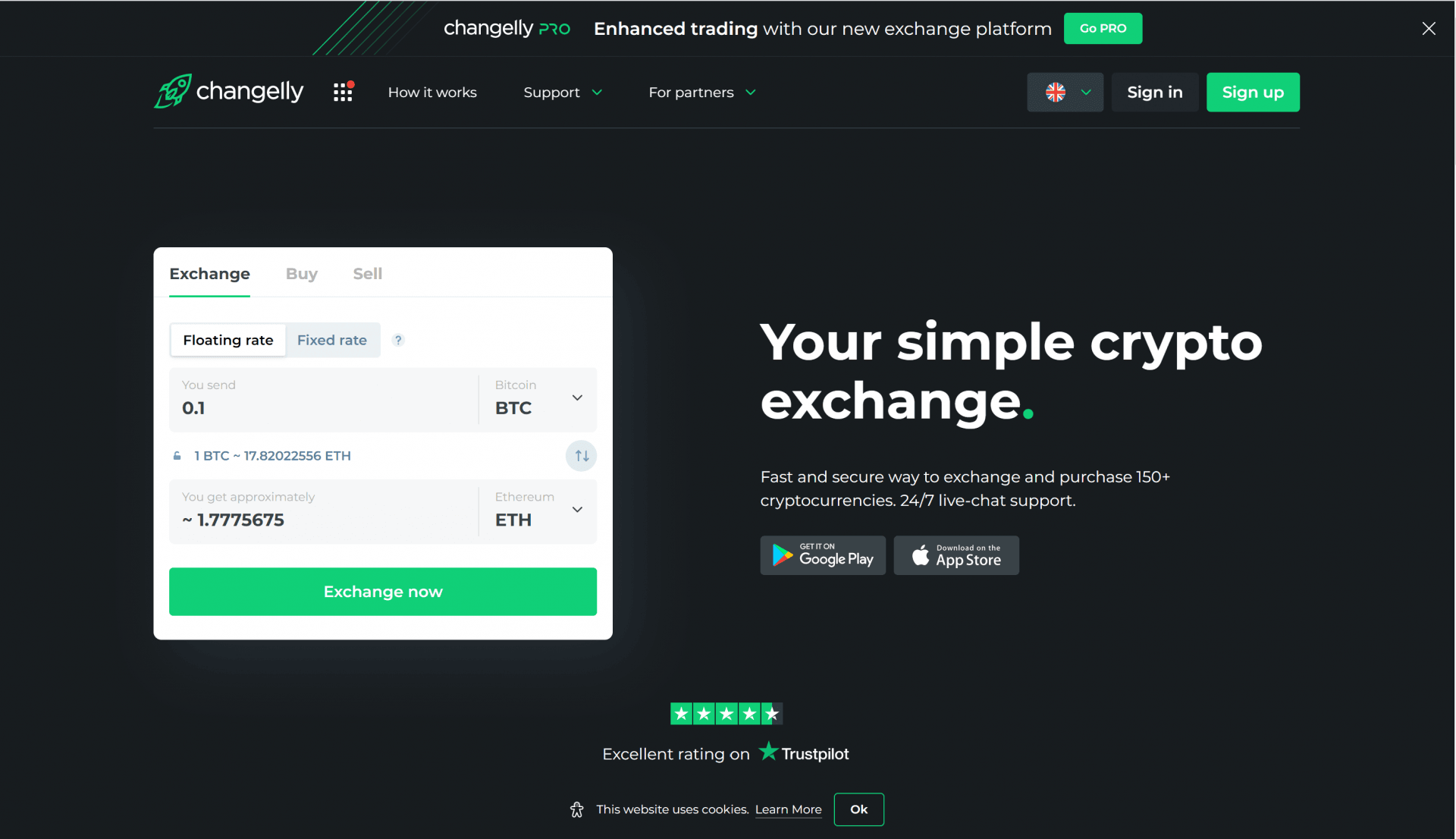

11. Changelly – Nifty Exchange for Instant Purchases

Changelly is a non-custodial exchange that is known for its privacy features. The platform, which allows users to buy and sell cryptocurrencies like BNB, has operated since 2015.

Changelly charges traders a flat rate of 0.25% on all crypto-to-crypto trades. These fees are automatically factored into the exchange rate when creating an order. There are no specific deposit fees on the platform, but you must factor in transaction fees when exchanging.

One of Changelly’s unique features is the service allowing quick conversions. Users can easily exchange between more than 150 different cryptocurrencies with just a few clicks. The exchange also allows customers to purchase cryptocurrencies directly using their debit or credit card.

Changelly also provides trading through its subsidiary, Changelly Pro, for professional traders. Changelly is a safe and secure exchange. Although it does not ask users to pass any KYC or AML checks, it allows users to enable two-factor authentication to their accounts to add an additional security layer.

Pros

- Easily exchange over 150 cryptocurrencies.

- Non-custodial exchange does not hold customer funds

- Integrated with popular wallets and exchanges

- 24/7 live customer support for all users

Cons

- Cryptocurrency prices set by Changelly

- High fees for crypto-to-fiat conversion

Your Capital is at risk.

What is Binance Coin?

You may have come across Binance Coin or, more popularly, BNB and wondered what it is. This section breaks down this digital asset’s mystique and shows its various use cases.

So, what is Binance Coin?

- Binance Coin is a digital currency of the world’s largest crypto exchange by trading volume Binance

- It started as an ERC-20 token on the Ethereum blockchain before transitioning to BEP-20 when Binance launched its standalone blockchain network.

- Binance Coin is originally meant to be a discount token for network fees on the Binance crypto exchange.

- However, the virtual currency has seen its use case grow as the parent exchange has built a thriving crypto ecosystem.

- Binance Coin is utilized in decentralized exchange platforms like PancakeSwap and is the de facto native currency for Binance Smart Chain.

- The digital asset is also used in Binance Launchpad alongside the exchange’s stablecoin BUSD to stake in upcoming projects.

Before we move into the fine details on Binance Coin and the various ways you can trade and utilize the virtual asset, we need to bring you up to speed on the parent exchange Binance.

Binance started life as a small-cap Bitcoin exchange in 2017 in Mainland China and became an instant success. It launched on the Ethereum blockchain, releasing its utility token Binance Coin. From inception, the Chinese exchange intended to transition from a centralized to a decentralized one – a feat they achieved two years later.

With the Chinese government cracking down on crypto exchanges in the territory, Binance was forced to shut down its operations in the Chinese region. However, this seemingly bad turn of events served as a beacon for Binance to expand its reach. Losing its Chinese patronage, Binance extended its operations globally, and this began to pay dividends, with the exchange becoming the largest Bitcoin exchange in just two years.

To much acclaim, Binance continued growing its ecosystem and launched its Binance decentralized exchange (Binance DEX) in 2019. The exchange recorded its first $1 billion trading volume surpassing previous record holders like the defunct Mt. Gox exchange.

A year later, Binance also officially launched its Binance Smart Chain (BSC), a platform that facilitates building decentralized applications (apps). Binance Coin’s initial use as a discount token began to expand with the digital asset featured in several of the exchange’s plans.

During this period, Binance Coin subsequently transitioned Binance Coin from an ERC-20 token operating solely on the Ethereum network to a BEP-20 token. Binance Coin now features a lot in the premier Bitcoin exchange’s plans. It is used in staking on the Binance Launchpad – a platform that enables new projects to receive funding, and users get the protocol’s token in return. Popular DEX platform PancakeSwap also leverages the popularity of Binance Coin and uses the digital token as its de facto token.

In addition, development teams use Binance Coin on BSC to settle network fees and build apps. More mundane use cases include a payment tool for online and in-store purchases, booking hotels and flights on the travel website Travala.com, and providing liquidity on the Binance Liquid Swap.

More details surrounding Binance Coin show why it is so popular among crypto traders and investors. Like the top digital asset Bitcoin, Binance Coin is deflationary and has a hard-cap limit of 200 million tokens. This has boosted the token value as scarcity generally leads to an increase in value over time.

Another unique characteristic of Binance Coin is that the Binance crypto exchange adopted a token burn mechanism. This means a particular percentage of all circulating BNB tokens will be taken out of circulation via Binance, buying them at market value and removing them permanently from circulation. This technique has paid dividends, as our data shows.

For instance, the December 2017 Binance Coin burn of 986,000 tokens led to the surge of BNB from $3.34 to $21.48 in January 2018. Even though the price would usually drop soon after, Binance Coin has never dipped to its pre-rally prices. Several other exchanges have adopted this token burn mechanism for their native tokens.

Why Buy Binance Coin? Binance Coin Analysis

Binance Coin is a highly coveted digital asset in the blockchain ecosystem, and its 800% increase from year-to-date (YTD) has seen several crypto investors scramble to lay their hands on the virtual currency. However, if you still do not see a reason to buy or trade Binance Coin, we have listed a few reasons you should buy Binance Coin below.

Binance Is Not Slowing Down

Since seizing the highly coveted number one spot of the largest Bitcoin exchange by trading volume in 2017, the Binance exchange has not relinquished its position in the last four years. Instead, the gap between the former China-based exchange and other Bitcoin service providers has widened, with digital currencies going more mainstream.

And while Binance coin was affected by the broader bearish sentiments of the cryptocurrency market, it has managed to stay above the $200 mark throughout 2022. Factors like eco-friendliness and providing a launchpad for fan tokens are just some of the reasons that Binance Cion was able to weather the cold winds of crypto winter.

With such a broad ecosystem, Binance Coin will always be a top digital asset, and the token has proven itself to be one of the best-performing crypto assets after securing the third position for more than a year. Binance’s continued dominance of the crypto scene will only see Binance Coin continue to enjoy market demand.

Continued Rollout of Services And Growing Use Cases

Binance has stayed ahead of the pack due to its quick rollout of crypto services. One of the exchange’s most popular services is the Binance Launchpad is a fledgling community where users can earn interest in any project they are interested in without buying the token directly. The platform’s high-yield savings plan enables users to easily generate passive income from their crypto holdings.

Also, it launched tokenized securities in the middle of the year and saw a significant uptick in user traffic before bringing it down due to regulatory issues. Binance is always the first to the market with innovative products, and this approach has paid dividends. Binance Coin’s growing feature in several Binance financial products and the high yields attached to them will only see the digital asset continue to rise with time, as witnessed in April this year.

There has also been a rising trend of gambling platforms that accept BNB.

Binance’s Popularity Is Lending Binance Coin Cred

Everyone knows we only associate with what we know. It is core human nature. Even though several discount tokens are circulating on the crypto market, crypto enthusiasts are more familiar with Binance Coin. With the large uptick and the number of transactions Binance processes by the day, you would be better off adding Binance Coin to your portfolio if you are an active trader.

Huobi Token (HT) and OKEx Token (OKB) are popular choices, but Binance Coin leads the pack and is the premier discount token in the crypto scene.

Binance Coin’s Meteoric Rise

We’ve dwelt a lot on the Binance exchange, so let’s turn our attention to the price performance of Binance Coin. Launched initially at $0.1077 following a successful initial coin offering (ICO) in 2017, Binance Coin has grown more than 50,000% from inception. The digital asset’s potential began to reflect in July 2019, when it surged to $36.73 despite being in a bear market.

Market pressure saw it lose momentum, dropping $15.76 in early December of that same year. However, Binance Coin has primarily outperformed the general crypto market, and it showed its potential when it surged from $38 in January 2021 to a record value of $650 in four months.

Although the virtual currency has dropped, Binance Coin is still one of the top five largest crypto assets by market cap.

Is it Worth Buying Binance Coin in 2024?

In a year marked by regulatory turbulence and price fluctuations, Binance Coin (BNB), the native cryptocurrency of the Binance exchange, finds itself at a critical juncture. BNB has traversed a tumultuous path, experiencing both meteoric rises and significant setbacks in its value.

The year 2021 witnessed BNB riding the wave of a booming crypto market, surging to all-time highs. However, the subsequent crypto winter of 2022 eroded much of these gains, highlighting the inherent volatility of the cryptocurrency market.

In January 2023, BNB experienced a resurgence with renewed support for Bitcoin. It led to a substantial price surge for BNB, positioning it as one of the prominent contenders in the digital asset arena. Yet, this upward momentum was met with challenges, particularly on the regulatory front.

Amidst an ongoing backdrop of regulatory scrutiny, Binance Coin continued to be at the center of attention. In April, the cryptocurrency remained locked within a narrow price range. Notably, this period coincided with regulatory pressure from a complaint the U.S. Commodity Futures Trading Commission (CFTC) lodged against Binance and its CEO Changpeng Zhao (CZ). The CFTC alleged that Binance had offered crypto derivatives with leverage to U.S. customers without the necessary registration, highlighting the global reach of regulatory oversight.

The regulatory turbulence intensified in June as the U.S. Securities and Exchange Commission (SEC) brought legal charges against Binance and another major exchange, Coinbase. These charges were twofold, targeting the trading and listing of tokens deemed unregistered securities, as well as asserting that earning and staking services violated securities laws. The SEC’s allegations against Binance extended further, encompassing accusations of wash trading and improper commingling of customer funds.

The impact of these charges was palpable in the market. Following the news of the SEC charges on June 5th, the price of Binance Coin experienced a sharp decline from above $310 to below $300. This downward trajectory persisted throughout the week, culminating in a price drop to just over $220 – the lowest point in half a year.

Despite these challenges, Binance Coin has maintained its allure within the crypto community. The current price analysis places BNB within a flat channel, indicative of a consolidation phase that may eventually lead to a decisive breakout. The cryptocurrency faces significant support at $230 and resistance at $260, with market participants grappling with breaching these key levels. As the bears test the resilience of these support levels, there remains a possibility of BNB revisiting the $200 mark by August.

As of the latest data, the price of Binance Coin stands at $243.27, reflecting a 0.67% increase over the last 24 hours. The 24-hour trading volume amounts to $404 million, underlining the ongoing activity in BNB trading. Binance Coin currently occupies the fourth position on CoinMarketCap, boasting a market capitalization of $37 billion.

Ways of Buying Binance Coin

With all you have learned about the discount token, you must be curious about how to buy Binance Coin. The most straightforward approach would be to head down to the Binance crypto exchange and make the purchase. However, there are other options that you can explore if you are not currently signed up on Binance and do not want to, as Binance Coin is available on several other exchanges. A few means you can use to buy Binance Coin are:

Buy Binance Coin with PayPal

If you have a PayPal account, you can easily buy Binance Coin. You only need to research the best online brokers or platforms supporting this payment method. Several platforms support paying with PayPal.

Buy Binance Coin with a Credit Card

You can also explore adding Binance Coin to your portfolio through your credit card. However, this option is not rampant for crypto, so you must ensure your broker offers it. Another condition you should take cognizance of is that credit card payments are generally restricted in some regions based on the operating laws guiding those areas.

Also, some credit card issuers view cryptocurrencies like Binance Coin as a “cash advance,” which means you will need to pay a fee for using this payment option. This could range between 3 to 5% depending on the card issuer.

Buy Binance Coin with a Debit Card

Debit cards are one of the most popular means of online transactions due to the relative ease and speed of processing transactions. It is also cheaper than other options as you can pay as low as 0.5% of the total transactions depending on the broker you choose to buy Binance Coin through.

However, this does not mean you should blindly choose a broker without considering their processing fee. Look out for top online platforms with low fees before making any purchase. This will save you many fees and substantially increase your purchasing power.

What to Remember Before Buying Binance Coin

Even though cryptocurrencies are the new hot financial investments, there are a few things you need to keep in mind before investing in them. Binance Coin is a crypto asset that also falls under this industry’s purview. We list a few for you to consider:

1. Binance Coin Is Centralized

Blockchain and, subsequently, cryptocurrencies, as promulgated by Bitcoin creator Satoshi Nakamoto, are decentralized, indicating the absence of a central controlling authority. Even though Binance Coin is built on blockchain technology, it is not decentralized as it is controlled solely by the Binance crypto exchange. If the crypto exchange loses its charm and falls down the pecking order, Binance Coin may not be valuable again.

If you are a diehard Nakamoto fan of the decentralized medium of exchange, Binance Coin may likely not fit into your profile.

2. Binance Coin Has Little Utility Outside Binance

The use cases of Binance Coin are very attractive, and many people are drawn in also by its value propositions. However, Binance Coin mostly thrives in the Binance exchange, meaning it is a one-exchange token like others operated by similar centralized exchanges. Even though you can use it to pay for online purchases and book hotels and flights, it does not have the wide adoption that cryptocurrencies like Bitcoin and Ethereum have. This single reason means Binance Coin’s future growth is intrinsically tied to the success of the Binance exchange.

3. Binance Coin Is Volatile

Volatility is a popular topic in the crypto industry, and all virtual currencies starting from Bitcoin to joke cryptocurrency Dogecoin, have to deal with wild price swings as well. Binance Coin is not left out, and its meteoric rise and sudden nosedives show that you should be wary when investing in digital assets.

A case in point is how it surged to $675 in four months and lost more than 45% of its value during the May crypto market crash. If you invested during its peak, your portfolio might be red if you still hold on.

However, Binance Coin is one of a few digital assets that withstood the severity of the three months bearish trend pretty well. While BTC slumped over 50%, shaving off over $1 trillion from the market, Binance Coin fell just 45% and still traded above half of the record value.

Choosing the Right Binance Coin Broker

If you have decided to buy Binance Coin, you should consider selecting a suitable broker. There are a few things you should consider before leaping:

1. Fees

Always look out for the fees. High trading fees mean it will reduce your profit and your purchasing power. Only choose a broker with reasonable deposit, withdrawal, and trading fees.

2. Platform Safety

If the broker is not regulated, do not use it. Regulated brokers will ensure the safety of your funds and personal details from bad actors.

3. Customer Support

Trading cryptocurrencies can sometimes be more tedious if you are not experienced. Choose a broker with a highly-rated customer experience. This will help you in times when you are in a fix.

4. Multiple Payment Methods

A broker with various payment options means you can make deposits and withdrawals easily and cheaply. The best platforms usually support bank transfers and debit cards. You can also check for e-Wallet payment options like PayPal and Skrill.

5. Trading Volume

Last but not least, select a broker with high trading volume and liquidity for the digital asset you want to trade. This will make it easy to withdraw your funds anytime you need them.

Binance Coin Price

Binance Coin price has posted massive upsides and significant lows, which is how the crypto market operates. Volatility is a major issue here and is something you should take cognizance of if you intend to buy Binance Coin. BNB is known to experience wild price swings, and its rise and fall largely depend on market forces.

- Essentially, Binance Coin rallies the more people use it on the Binance exchange.

- It dips when large-cap assets like Bitcoin enter the red zone

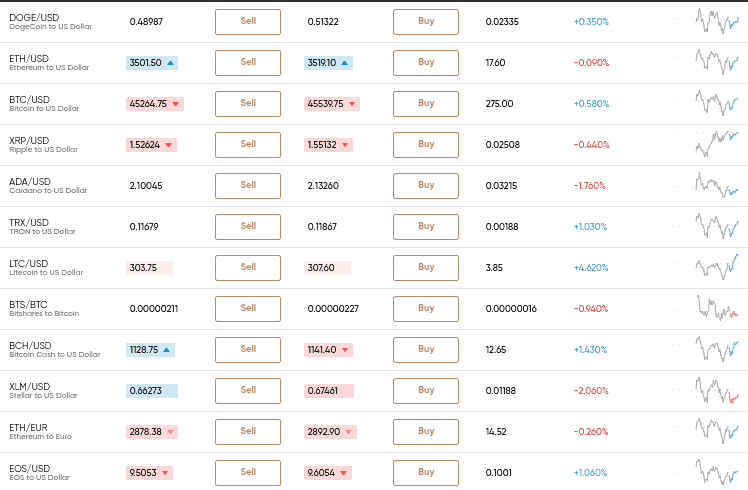

Like several crypto assets, Binance Coin is also traded against other currencies aside from the dollar. This makes it easy for traders and investors to monitor BNB’s real-time price performance. You can also trade it against the British Pound, Euro, Brazilian Real, and others.

Binance Coin, much like various other crypto protocols, has been grappling with volatility issues. However, it partially managed to recuperate in 2023, achieving noteworthy milestones in the company’s journey. In a recent Twitter Ask-Me-Anything (AMA) session held on July 31st, 2023, Changpeng Zhao (CZ), the CEO of Binance, provided insights into several key aspects of the company’s operations and vision.

Missed our Twitter Space with @cz_binance?

Not to worry, we've summed up the highlights for you 🤝

Read on to find out what CZ had to say about Launchpads, #Binance merch, and more!https://t.co/WC65H8lYR5

— Binance (@binance) August 2, 2023

Regarding Binance’s license in Dubai, CZ highlighted the substantial effort in securing the Operational Minimum Viable Product (MVP) license. He emphasized the challenging yet collaborative process with Dubai’s regulators, allowing users to access Binance’s crypto exchange and fiat gateways, positioning Dubai as a significant player in the crypto world.

CZ delved into the significance of Binance Launchpad, established in 2019 to aid crypto projects in raising funds during bear markets. He underlined the rigorous vetting process, lasting approximately nine months or more, to ensure dedication and execution capability among selected projects. CZ also outlined the company’s stance on Binance merchandise, noting its exclusivity and limited availability to devoted community supporters.

In response to inquiries about team management, CZ outlined Binance’s diverse teams focused on various sectors like blockchain, DeFi, and NFTs. He stressed the importance of swiftly adapting to emerging trends and the challenge of assembling the right team to execute these trends effectively. CZ affirmed Binance’s reputation as an industry influencer, facilitating collaborations with numerous projects due to its brand strength, and emphasized the crucial role of execution in the company’s strategy.

In a significant milestone recently, Binance has announced the official launch of Binance Japan, a dedicated platform tailored to serve the Japanese market. This development marks an important juncture in Japan’s venture into Web3 technology, as Binance aims to provide unparalleled cryptocurrency experiences to its user base within the country.

We’re proud to announce that #Binance has officially launched in Japan as Binance Japan K.K.

Users in the country now have access to more tradable tokens than any other exchange, with Spot and Earn products available.

Find more details below.https://t.co/grxPYSsp84

— Binance (@binance) August 1, 2023

Previously operating under the name SAKURA Exchange BitCoin, Inc. (SEBC), Binance’s acquisition of the licensed local cryptocurrency exchange service provider in November 2022 has prompted a strategic rebranding. The entity is now recognized as Binance Japan Inc., reflecting its alignment with the Binance brand and ethos.

Binance Japan extends a comprehensive array of offerings to its freshly onboarded users. Among the variety of services available, individuals in Japan can engage in spot trading and capitalize on Earn products. Notably, the platform boasts a diversified selection of 34 tokens available for spot trading, including Binance Coin (BNB), marking its debut within the Japanese market.

The recent strategic move by Binance is poised to propel Binance Coin (BNB) to unprecedented heights in the foreseeable future. Short-term projections indicate a promising trajectory, with an anticipated 8.39% surge in price, potentially reaching $265.08 by August 10th, 2023. This forecast is underpinned by a blend of technical indicators, revealing a current sentiment categorized as Neutral, while the Fear & Greed Index stands at 49, also reflecting a Neutral stance.

Examining recent trends, Binance Coin has displayed notable resilience, recording 19 out of 30 (63%) green days within the last month. This performance is characterized by a relatively modest price volatility of 1.72% over the same period. Considering these factors, the prevailing forecast suggests that the present juncture may offer a favorable entry point for those considering investing in Binance Coin.

Looking further ahead, the long-term outlook for Binance Coin in 2023 paints a picture of potential growth. Projected figures propose a range of performance, with projected minimum and maximum prices of approximately $287 and $698, respectively. This range signifies the potential for substantial value appreciation over the year, indicating opportunities for investors seeking sustained growth.

Investing in BNB vs Trading BNB

Investing strategies are key to turning a profit in your investing. Many are caught between the two ends, with some favoring just holding on to a project even though it depletes their funds and others selecting trading for instant gains. This section covers both choices and decides which strategy best suits your personality.

Investing in Binance Coin

Deciding to invest in Binance Coin points to a few details about the sort of investor you are. The most likely reason why you would consider taking this route will likely be if you are new to the crypto scene. An asset’s performance over time draws you in and you believe it may surpass its previous high in the coming year. That would be a great time to sell it off for a profit.

Another reason may be tied to your schedule. If you do not have the time, you should consider buying and holding for long periods. This would save you headaches on the asset’s repeat price swings during trading. Also, if you do not have the technical know-how to make correct price forecasts, investing in Binance Coin could be a great idea.

Trading Binance Coin

If you decide to trade Binance Coin, it only means one thing – you have the technical knowledge to cash on the asset’s price swings. This would require studying an asset’s historical pricing data and creating a successful trading pattern. It also means you need to have enough funds to continue, as the market frequently makes detours.

Trading Binance Coin will likely require you to open a long position (or buy) where you forecast that an asset will rise above your mark price (or the price you purchased it). You can also short (or sell), which means you are forecasting that the price will drop below your entry price.

You can substantially increase your return on investment (ROI) by utilizing leverage. This will allow you to trade with more money than you have.

So, which one should you go for?

A few factors should guide your decision, and you should look out for the following:

1. Time

The number one question you should ask yourself is, do you have the time? If you are super-busy and don’t have the time to learn how the crypto market works, we recommend identifying a few top-performing virtual currencies and holding them for the long term. Imagine the wealth those who stored their Binance Coin for a long time have made since the bull run.

If you do not have the time, don’t waste your funds trying to make quick bucks. Buy and hold.

2. Risk Appetite

If you are a conservative investor and risk-averse, you should only invest in Binance Coin. However, if you are more driven by taking on challenges and have technical knowledge, trading may best suit your style. Know what your strengths are and leverage them.

Buying Binance Coin as a CFD Product

Binance Coin can also be purchased as a Contract for difference (CFD). These derivative products have also filtered into the crypto space, and several digital assets can now be traded as CFD products. A CFD is simply an agreement between a buyer and a seller showing that the buyer must pay the seller the difference between the current value of an asset and its value when the contract expires. Buying a CFD allows you to profit off Binance Coin’s price movement without owning the asset.

Taxation on Binance Coin Earnings

The booming crypto market has attracted regulatory bodies, including the Internal Revenue Service (IRS). Even though there is no legal oversight for the emerging industry, the IRS defines crypto as “property,” which falls under the capital gains tax bracket.

Meanwhile, situations may warrant the tax agency to treat your crypto earnings under the income tax bracket. This section breaks down circumstances that may warrant you to pay taxes on your Binance Coin earnings.

Taxable events considered capital gains tax:

- Selling your crypto for fiat currency

- Making purchases with your crypto

- Exchanging one crypto for another – be it on an exchange or a peer-to-peer (P2P) network

Taxable events that fall under the income tax bracket:

· Earning interest from lending to DeFi protocols

· Receiving crypto for work done

· Earning crypto from liquidity pools (LPs) or staking

· Receiving crypto from an airdrop

· Rewards from mining crypto

However, you can write off some of your taxes if you incur losses from trading crypto. The maximum cap is $3,000 of your income tax, dependent on the length of time.

Calculating Your Capital Gains Tax

Taxes are a civil obligation, and crypto investors must pay a particular percentage of their gains. This depends on your income tax bracket and how long you have held on to your crypto asset in the United States. This will help you work out how much you will pay in:

Short-term Capital Gains Tax

Short-term capital gains are taxed like your ordinary income. Short-term capital gain means you have held the asset for a year or less. This can surge up to 37%, depending on your tax bracket. Short-term taxes are more heavily taxed than long-term gains tax, which means your profits can be eroded if you fall into a higher income tax bracket.

However, there is a way you can still turn this situation around. Losses that you may have incurred in your twelve months of trading Binance Coin or any other digital asset may be useful if you leverage a tax-loss harvesting strategy. This will enable you to write off $3,000 of your taxes as losses helping you save more. You can also post-date your taxes to the next year with this technique.

Long-term Capital Gains Tax

As mentioned earlier, long-term capital gains are taxed more favorably than short-term gains. Long-term capital gains apply if you have held your asset for over a year before selling it. This asset will fall under the taxable income bracket starting at 0%, 15%, or 20%. The rate for those who report gains after a year can drop from 15% or lower.

The Need For Responsible Binance Coin Investment

The crypto market is saturated with a lot of “get-rich-quick” syndrome. However, it would be best to be careful when investing in any asset, including Binance Coin. Behind the tall tales and gains are people who have lost their savings on a bad trade or investment.

However, the use case and Binance’s prominent position in crypto indicate that Binance Coin is not yet done. This means it would likely continue rallying even as the crypto market matures with the years. Notwithstanding, we have highlighted two key ideas you should have if you intend to buy Binance Coin or trade any other virtual currency.

1. Invest what you can afford to lose

The gains are there, and so are the losses. Take it from us that a mistimed or ill-informed investment can wipe off your holdings in minutes. Cryptocurrencies are largely speculative and volatile, as they can rise 20% in a day and dump even more the next.

We recommend starting with a little sum to find your feet and know how the market reacts to industry news (good and bad). Make sure you only invest what you can afford to lose.

2. Research is Important

Investing in cryptocurrencies is not for the faint-hearted. If you want to turn a profit, you must be committed to research before taking any step. Likely sources that will provide you with standard and up-to-date info are social media channels, expert review websites like Inside Bitcoins, and crypto-specific news outlets. These sources will give you all the details on how a crypto asset has performed over time and the market’s reactions.

Can you Mine Binance Coin?

Unlike Bitcoin and several other crypto assets, Binance Coin cannot be mined as it is only controlled and issued by the Binance exchange. You can only get BNB if you buy or trade the asset. The alternative is to use a cloud mining service to mine Bitcoin and then convert the Bitcoin to BNB. That’s another way, but you can’t directly mine Binance Coin.

Minimizing Your Risk with Crypto Investment

Two important points we believe you should know by now are:

- Binance Coin has growth potential

- It is also risky

Given this, we have a few tips for ensuring a minimal risk-to-return ratio.

1. Conduct Independent Research

The crypto market has been defined as a Wild West, which means many things are mainly unregulated. This comes with a few advantages and several demerits. Hence, we advise that you always look into a project’s fundamentals and value proposition to determine whether it is here for the long term.

Check out the project’s authoritative reviews to better understand what it aims to do. This will help you dodge many crypto scams that permeate the nascent industry.

2. Think Long-term

The apt subhead for this is to avoid get-rich-quick schemes, which should also do. Fraudsters have saturated the crypto space with get-rich-quick strategies. Some have gone as far as hiring popular Hollywood celebrities to promote their scam projects. Do not invest because someone you admire is saying you should. Make your own decision and ensure you do not get suckered in by the sweet words. Trust the data more than your emotions.

3. Start with Little

The exponential growth or upside of investment can make you wish you invested more than you did. Do not let this happen to you. Remember the principle of compound investing.

Only invest what you can afford to lose at any given time. Remember that the crypto market is unregulated, and any crypto project can pack up anytime. Do not pump your life savings into cryptocurrencies with the hope that it will give you financial freedom. It may not work out that way.

4. Emotions

You may find it hard to believe, but there is a syndrome called FOMO, or fear of missing out, and it is confirmed in the crypto space. Always resist the urge to invest in a project with high hype. It may just drop in the next turn.

Always conduct your research before investing, and never assume a position if you do not feel confident about the expected ROI.

Automated Trading Robots

You can further reduce the risk of trading Binance Coin by leveraging sophisticated software called automated trading robots. This software will help you set limit orders, take profits, and stop losses for you with minimal effort.

One key benefit of using automated trading bots is removing the human factor. These trading bots look at the data in setting a buy or sell signal. This removes the human element and allows you always to pick winning trades. Some of the best-automated trading bots have success rates of 99.4%, meaning nine out of ten trades are expected to profit.

We have reviewed some of the best trading bots that allow you to invest with little setup in a few minutes.

Binance Coin vs. Other Cryptocurrencies

Although Binance Coin is a top digital asset, how does it compare to others in the crypto space?

Binance Coin vs. Bitcoin

Binance Coin has an enviable market cap but pales compared to Bitcoin’s. The benchmark crypto leads the emerging industry and dictates every move of the crypto market. Also, Bitcoin is decentralized and has more adoption, with several countries considering adding it as a medium of exchange.

Bitcoin has seen the most institutional adoption, with several investments pouring into the premier digital asset from tech companies and finance houses.

Binance Coin vs. Ethereum

Binance Coin is also behind Ethereum in adoption. The Ethereum network plays a crucial role in the developing DeFi space, and ETH is seen as the digital currency for the expanding DeFi and NFT landscape. This has lent ETH much credence, with more and more investments pouring in. Also, Ethereum has a strong and vibrant community, and its successful shift to the PoS mining protocol is expected to catapult the protocol to the next level.

Binance Coin vs. Cardano

Cardano is another top crypto protocol and is generating much buzz recently. Although the blockchain platform is not yet live, Cardano has shown exponential growth and recently displaced Binance Coin for the third position on the global crypto ranking. The network’s focus on DeFi and NFTs means it will continue to have real-world use cases as the future of finance evolves.

Binance Coin vs. Dogecoin

Dogecoin does not have a real-world use case, but it is one of the top crypto protocols in the world. Started as a comic take on the crypto industry, the parody coin has garnered the support of several public figures, including Tesla and Space X boss Elon Musk and billionaire investor Mark Cuban. This has helped it join the world’s top ten largest crypto assets.

With a vibrant community, Dogecoin has stayed in the public’s eyes and could continue doing so in the future.

Binance Coin vs. Solana

Solana is another protocol that is interested in DeFi and NFT. The network’s higher and faster throughput of 50,000 TPS has recently joined the top ten largest crypto assets ranks. Growing adoption and integrations have also helped out. With the project gaining steam in the last few months, Solana could well and truly replace Binance Coin in the fourth position in the coming weeks.

Future Price Prediction of Binance Coin

The crypto market is still in its early stages so you will witness many wild price swings. However, this should not deter you from tapping into the future of finance.

As per Binance Coin’s performance, it will likely continue rising as time goes by. Binance Coin has shown resilience in the last six months, which should be a good indicator. Even though it may dip with the broader market, it would rally with time.

Best Place to Buy Binance Coin

Binance Coin has been one of the top-performing digital assets in the crypto market for the last eight months. Starting the year at $38, the virtual asset has surged over 800% YTD, which shows great fundamental growth for long-term investment.

If you are ready to buy Binance Coin, we recommend using Binance itself, although all the exchanges features on this list have strong features.

You should also remember the following:

- Investing and trading Bitcoin requires a lot of research and work

- Bitcoin is inherently risky, so it is essential to watch it spruce every now and then

- When trading or investing, do so with only registered brokers and exchanges

- You should also check out review sites and online experts to get their opinions about Bitcoin

- Resist FOMO. Only invest if you’re sure of it

Bitcoin

Bitcoin