Join Our Telegram channel to stay up to date on breaking news coverage

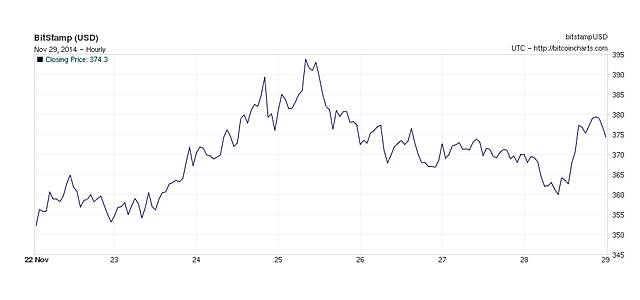

NEW YORK (InsideBitcoins) — The bitcoin price flirted with a double-digit weekly gain of nearly 12% before settling back to end the week up about 6% to the mid $370s. The cryptocurrency began the weekend following Black Friday by gaining 5% to the mid-$380s by early Saturday morning.

- San Francisco-based bitcoin exchange Kraken was tapped to assist in the bankruptcy proceedings of Mt. Gox. In a directive issued by the Tokyo District Court Wednesday, Kraken was selected to “support the investigation of missing bitcoin and the distribution of remaining assets to the creditors.”

- The American Red Cross began accepting bitcoin donations on a temporary basis, thanks to the efforts of Bitpay, the Atlanta-based bitcoin payment processor, who established a hosted donation webpage for the well-known U.S. charity. Cryptocurrency contributions will be accepted through “Giving Tuesday.”

- The Chamber of Digital Commerce tapped Matthew Taylor Mellon, heir to the noted Mellon-Drexel families, to serve as executive committee chairman. The volunteer position will see Mellon serve as a liason between the bitcoin advocacy organization and the financial services industry.

- Bitcoin Black Friday saw some 1000 merchants across the nation promote bitcoin payments to holiday shoppers, via special digital currency discounts.

For other events of the week, check the Inside Bitcoins news summary. And as always, for breaking news, follow us on Twitter @InsideBitcoins and join the conversation on Facebook.

Hal M. Bundrick is the Editor-in-Chief of Inside Bitcoins. Editor@InsideBitcoins.com. Follow him on Twitter @HalMBundrick

Join Our Telegram channel to stay up to date on breaking news coverage