Join Our Telegram channel to stay up to date on breaking news coverage

BCH Price Prediction – October 17

Bitcoin Cash (BCH) is seen to be caught between the bull and the bear, while the price of the cryptocurrency fluctuates sideways.

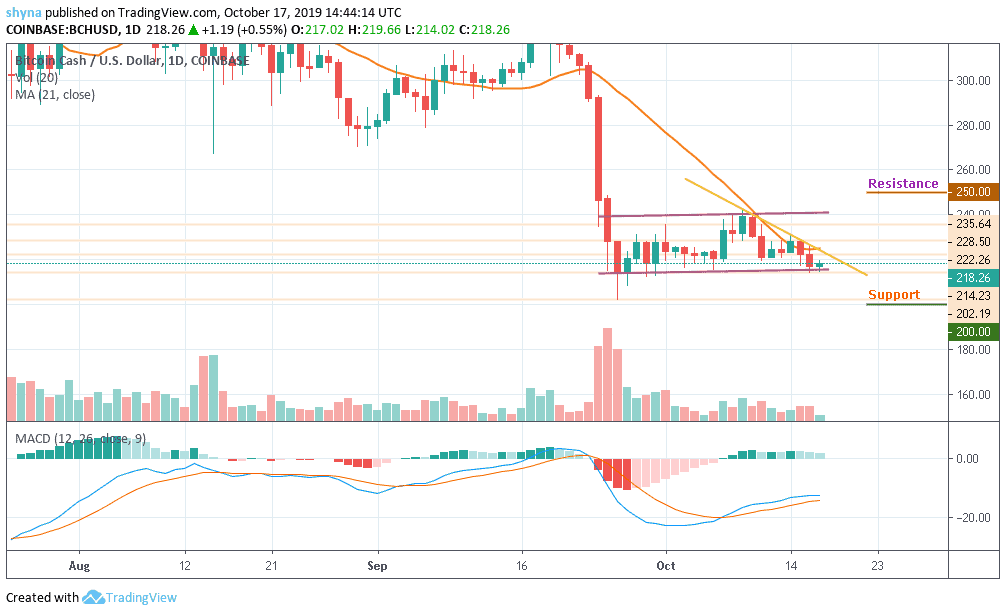

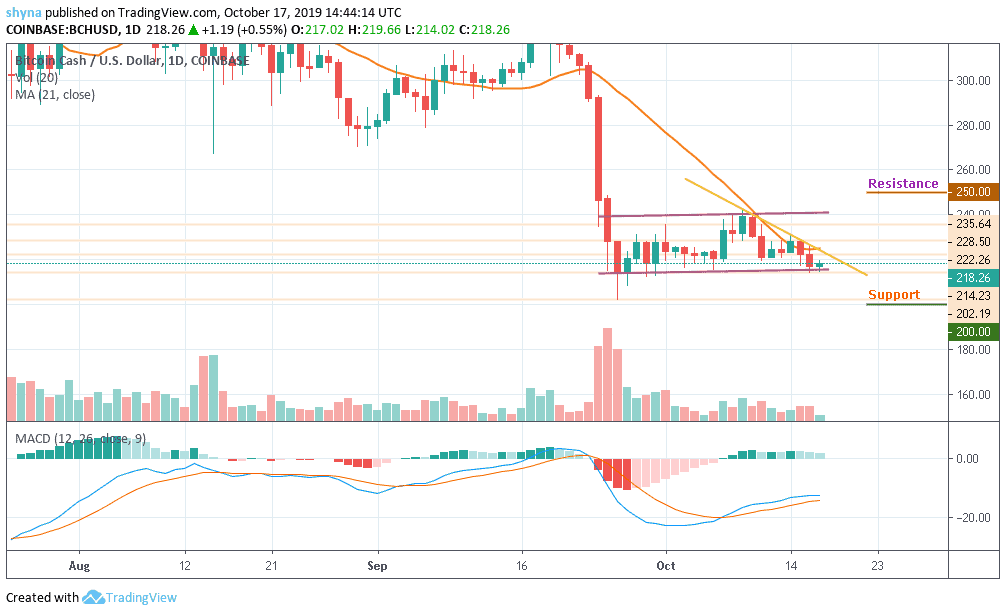

BCH/USD Market

Key Levels:

Resistance levels: $250, $260, $270

Support levels: $200, $190, $180

Looking at the daily chart, Bitcoin Cash could no longer defend the support level of $220 again as the price hovers around $218. The coin is now moving below the moving average, with a period of 21 indicating a bearish trend. For the time being, the market price is moving towards the lower boundary of the channel and the MACD indicator has been issuing some signals.

Taking a look at the market, the BCH coin is yet to show a strong bear dominance in the long-term. But the short-term outlook looks bearishly strong. However, a bullish interception may set the next key resistance at $250, $260, and $270, crossing the upper boundary. Nevertheless, we can expect a little rise before the rally continues.

Following the on-going movement, the price of BCH has recently plunged to $214 before a small rise to where it’s currently changing hands at $218. A further rally is likely at $200, $190 with a possible new monthly low at $180. As we can see on the daily price chart, BCH volume has been drastically low over the past days, which shows the bears are gaining moment.

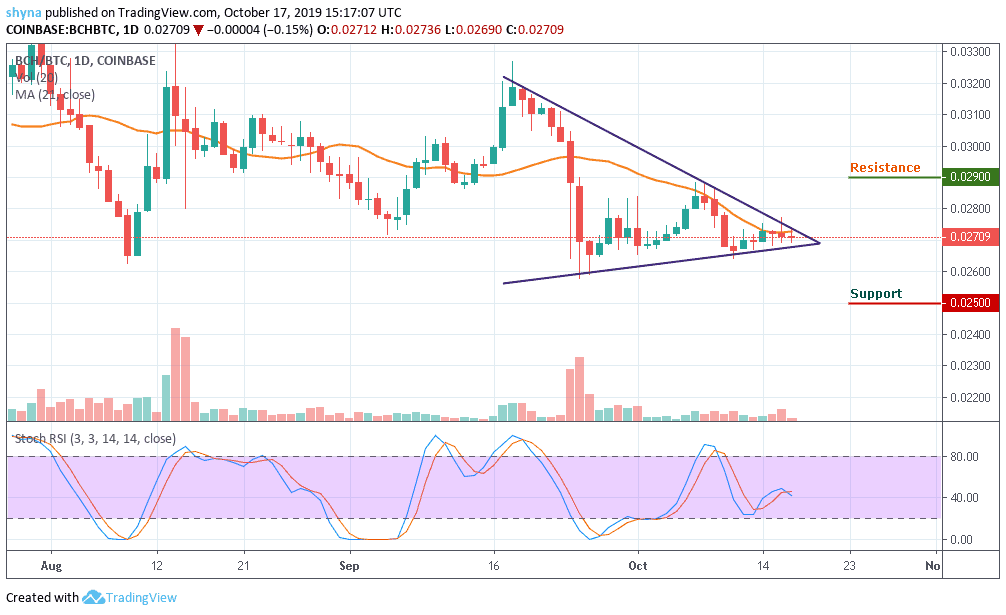

With Bitcoin comparisons, the market has evolved for a while in a very different way. But currently, sellers and buyers are trying to decide who will control the market but currently the moving under the 21-day MA and towards the lower boundary of the channel while the stochastic RSI is maintaining the level 45.

However, the downtrend is seen giving the sellers the confidence to increase their entries. More so, if the bears succeeded in the broken price, one would expect the market to fall to the support level of 0.025 BTC and 0.040 BTC. Meanwhile, a rebound could increase it to the 0.029 BTC and 0.030 BTC resistance levels.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage